Unraveling the layers of a company’s financial health involves navigating through several interconnected metrics and financial statements. One such crucial yet often undervalued metric is operating cash flow (OCF). This financial parameter speaks volumes about a company’s ability to generate cash from its core business operations and its consequent ability to maintain solvency and growth.

In the following sections, we will break down the concept of cash flow, distinguish between different types, and delve deeper into the specifics of operating cash flow. Join us on this journey into the world of business finance, as we demystify the concept of operating cash flow and highlight its importance in assessing a company’s operational health and financial prowess.

Cash flow: understanding key financial concepts

1. Cash flow: the basics

Cash flow is the crucial movement of cash or cash-equivalents in and out of a business, acting as a vital indicator of its financial strength and liquidity. The term ‘flow’ emphasizes its ongoing nature, reflecting the constant motion of cash within the organization.

Cash flow serves as a financial lifeline, sustaining the day-to-day operations of a business. It paints a comprehensive picture of the company’s financial stability and liquidity by tracking the inflow and outflow of funds. This continuous cycle encompasses various elements such as sales revenue, investments, loans, expenses, and debt payments. Analyzing these cash movements provides valuable insights into the company’s financial health.

Similar to the rhythmic ebb and flow of tides, cash flow captures the dynamic nature of funds as they enter and exit the business. It represents a continuous process that fuels growth, innovation, and adaptability. With positive cash flow, businesses have the resources to pay suppliers, compensate employees, invest in research and development, and expand operations. On the other hand, negative cash flow can indicate liquidity challenges and the need for prompt action.

Maintaining a healthy cash flow requires a careful balance of financial management and strategic decision-making. Accurate cash flow forecasting and prudent financial policies enable businesses to optimize their resources, ensure liquidity, and plan for the future. By effectively managing cash flow, organizations can weather economic uncertainties, seize growth opportunities, and foster long-term sustainability. To do so, you need to make sure operates just like an orchestral ensemble.

2. Profit vs. cash flow

Profit vs. cash flow: the symphony of business finance

In the orchestral ensemble that is business finance, two instruments often play the leading roles: Profit and Cash Flow. Each instrument has its own unique sound and tone, playing different yet integral parts in the overall composition.

Profit: the grand piano

In this financial symphony, profit is a lot like the grand piano, taking the center stage. It’s calculated by subtracting all costs, expenses, and taxes from a company’s revenue. When a company announces a significant profit, it’s akin to a beautiful melody playing out, captivating everyone’s attention and creating an atmosphere of success and achievement.

However, the grand piano, while essential to the symphony, does not perform alone. It needs to be complemented and supported by other instruments to create a balanced composition. That’s where our second instrument comes in.

Cash flow: the double bass

Operating cash flow, in this symphony, can be likened to the double bass. It may not garner as much spotlight, but it provides the harmony and rhythm that keep everything on track. Cash flow signifies the actual inflow and outflow of cash within a business. It supports the company’s day-to-day operations, similar to how the steady rhythm of the double bass underpins the entire symphony.

A business might hit all the right notes on profit, but without positive cash flow — a steady rhythm of cash inflows exceeding outflows — the company may struggle to maintain its operations. Like a symphony without a double bass, the lack of sufficient cash flow could throw the business off balance.

The harmony: profit and cash flow together

Profit and cash flow are not competing against each other. Rather, they’re playing together, each contributing its unique sound to the overall performance. Profit indicates a successful performance and the potential for future compositions. On the other hand, cash flow sustains the performance and allows the ensemble to keep playing.

Understanding the distinct yet interrelated roles of profit and cash flow in the financial symphony helps us to appreciate and interpret a company’s financial performance accurately. To truly comprehend it, one must listen to both the melody and the rhythm.

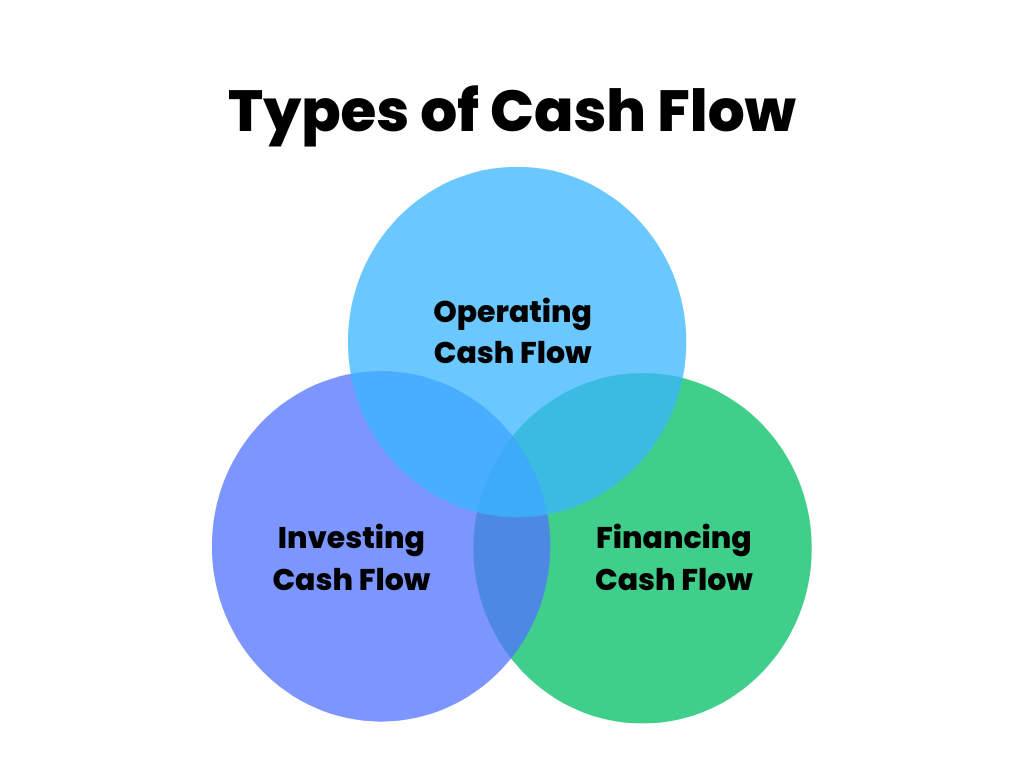

3. The three types of cash flow: the financial trifecta

In the financial arena of business, cash flow reigns supreme. However, it doesn’t stand as a singular entity; instead, it manifests as a trifecta of distinct types:

Each type of cash flow has its unique characteristics and roles, and together, they provide a comprehensive view of a company’s financial health.

Operating cash flow: the pulse of business operations

Operating cash flow is the lifeblood of a company’s daily business operations. It reflects the cash generated from the company’s core business activities such as selling goods, providing services, and other transactions related to its operations. OCF gives a clear picture of whether a company can generate enough positive cash flow to maintain and grow its operations.

Investing сash аlow: the yardstick of growth

Investing cash flow provides insight into a company’s growth and expansion activities. This cash flow represents the cash used for investing in the business, such as buying property, plant, and equipment, and the cash received from selling these assets. It’s a yardstick that measures how much a company is investing in its future growth and how much it’s gaining or losing from its past investments.

Financing cash flow: the mirror of capital transactions

Financing cash flow reflects a company’s transactions with its investors and creditors. This involves issuing and repurchasing of company’s shares, borrowing and repayment of debt, or paying out dividends. It mirrors the company’s strategy for raising capital, returning profits to shareholders, and managing its financial structure.

Understanding these three types of cash flows can give us a 360-degree view of a company’s financial health. They serve as the financial trifecta, offering valuable insights into a company’s operational efficiency, investment activities, and financial strategy.

Understanding operating cash flow: breaking down the elements

1. Operating Income

Operating Income is the profit a company makes after subtracting operating expenses — such as wages, depreciation, and cost of goods sold (COGS) — from its gross income. Essentially, it represents the profit earned from a company’s core business operations before interest and taxes.

This operating profit then forms the starting point for calculating the operating cash flow. Adjustments are made to the operating income for non-cash items like depreciation and changes in working capital (current assets and current liabilities) to arrive at the OCF. This process essentially converts the accrual accounting profit (operating income) into cash basis profit (operating cash flow), which reflects the actual cash that a company generates from its operations.

Thus, operating income is a key ingredient in the recipe of operating cash flow. It sets the stage, providing the initial estimate of a company’s profitability from its core operations, which is then refined further to understand the actual cash flow scenario.

2. Working capital

Working capital represents a company’s operational liquidity, calculated as current assets minus current liabilities. Changes in working capital reflect shifts in a company’s short-term assets and liabilities. Working capital is the fuel that keeps the engine of a company’s daily operations running smoothly.

Working capital is calculated as current assets minus current liabilities. Current assets are short-term resources that a company expects to convert into cash within a year, such as accounts receivables and inventory. On the other hand, current liabilities are the company’s short-term obligations that need to be paid within a year, such as accounts payable and accrued expenses.

In the context of OCF, changes in working capital are considered. An increase in current assets, like accounts receivables or inventory, would reduce the OCF as it implies that more cash is tied up in assets. Conversely, an increase in current liabilities, like accounts payable, would increase the OCF as it means the company is holding onto its cash longer.

By examining changes in working capital in the calculation of OCF, we are essentially adjusting the operating income to reflect how the company’s day-to-day operations affect its cash position. Therefore, working capital is not just an element but a dynamic component in the equation of operating cash flow, highlighting the liquidity position of the business.

3. Non-cash expenses

Non-cash expenses are costs that do not involve actual cash outflows and are added back when calculating the OCF. They are the silent adjusters, subtly influencing the OCF without directly involving any cash movement.

Non-cash expenses are costs that reduce a company’s earnings but do not involve a direct cash outlay. The most common example of a non-cash expense is depreciation, the gradual wear-and-tear of long-term assets like machinery and buildings. Another example is amortization, which is similar to depreciation but applied to intangible assets such as patents or trademarks.

While these expenses reduce the company’s net income on the income statement, they do not represent an actual cash outflow. Therefore, when calculating OCF, these non-cash expenses need to be added back to the net income.

In essence, non-cash expenses act as a sort of invisible hand in the calculation of operating cash flow. They do not directly impact the cash position of the company, but they significantly influence the portrayal of the company’s cash generation capability. As such, they are a silent but vital element of the operating cash flow calculation.

Calculate operating cash flow: step-by-step guide and operating cash flow formula

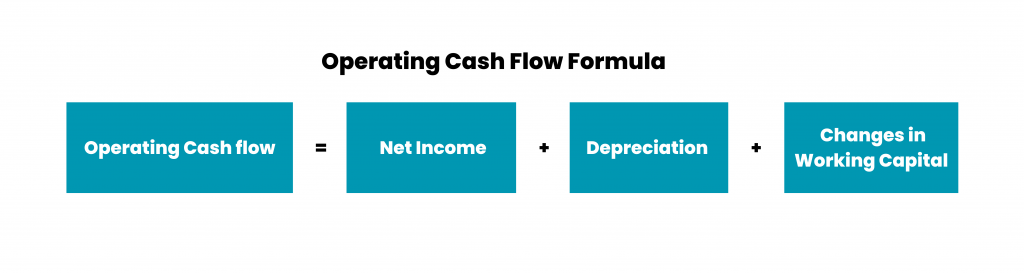

Operating cash flow formula

Calculating operating cash flow can provide valuable insights into a company’s financial health. The formula looks as follows:

Step-by step guide to using the formula

Here’s a simple, step-by-step guide to help you calculate OCF:

Step 1: Start with net income

Find the company’s net income, which is often at the bottom of the income statement. This figure represents the company’s total revenue minus its cost of goods sold, operating expenses, interest, taxes, and other expenses.

Step 2: Add back non-cash expenses

Non-cash expenses like depreciation and amortization reduce net income but do not involve an actual cash outflow. Therefore, they need to be added back to the net income. You can find these details in the depreciation/amortization line item on the income statement or the notes to the financial statements.

Step 3: Account for changes in working capital

The next step is to account for changes in working capital, which is the difference between current assets and current liabilities. An increase in current assets consumes cash, and so, you subtract it. Conversely, an increase in current liabilities generates cash, and so, you add it.

Step 4: Adjust for interest and taxes (if necessary)

Some companies choose to adjust their OCF for interest and taxes paid, although this is not always the case. If your company does this, you’ll need to add back the amount of interest and taxes paid.

Once you’ve made all these adjustments to the net income, you’ll arrive at the operating cash flow. This figure provides a more accurate picture of the cash a company generates from its core business operations. It’s a key indicator of a company’s financial health and can be a valuable tool for investors, creditors, and other stakeholders.

Common mistakes and pitfalls in calculating OCF

Calculating operating cash flow seems straightforward, but it can sometimes be a tricky endeavor. Various pitfalls and common mistakes can throw off your calculation and lead to an inaccurate representation of a company’s financial health.

1. Neglecting non-cash expenses

One common mistake is forgetting to add back non-cash expenses like depreciation and amortization to net income. These expenses reduce net income on the income statement, but they do not represent actual cash outflows. Therefore, they need to be added back when calculating OCF.

2. Misunderstanding changes in working capital

Another potential pitfall is misunderstanding the changes in working capital. An increase in current assets (like accounts receivable or inventory) consumes cash, reducing OCF. Conversely, an increase in current liabilities (like accounts payable) preserves cash, increasing OCF. Some people mistakenly believe that an increase in current assets increases OCF, and vice versa.

3. Overlooking one-time items

It’s important to account for any one-time gains or expenses when calculating OCF. Failure to do so can inflate or deflate OCF, providing a skewed view of a company’s cash generation capability.

4. Ignoring interest and taxes

Some businesses choose to include interest paid and taxes in their calculation of OCF, while others do not. It’s essential to be consistent and understand how including or excluding these items can affect your OCF calculation.

All in all, calculating Operating Cash Flow requires careful attention to detail and a deep understanding of the company’s financial activities. By avoiding these common mistakes and pitfalls, you can ensure a more accurate calculation that truly reflects a company’s financial health.

How to monitor and control operating cash flow with Synder

Being an innovative financial management platform, Synder offers a range of tools and features that can greatly assist businesses in monitoring and controlling their operating cash flow. With its creative approach, Synder provides a host of benefits.

Integration with accounting systems

Synder seamlessly integrates with popular accounting systems, such as QuickBooks and Xero. This integration allows businesses to sync their cash flow data with their accounting software, ensuring accurate financial records and providing a holistic view of their financial health.

Real-time tracking

The tool enables businesses to track their cash flow in real-time. It automatically syncs with various financial accounts, such as bank accounts and payment platforms, to gather transaction data. This allows businesses to have an up-to-date and accurate view of their cash inflows and outflows.

Automated data entry

Synder eases the process of recording financial transactions by automating data entry. It automatically categorizes and reconciles transactions, reducing the need for manual data input and the risk of human error. You can go with either detailed per transaction sync to keep track of all the details in your accounting, or choose summarized daily journal entries per connected platform to see only the most important financial information. These two types of syncing transactional data streamline the monitoring of operating cash flow, saving time and improving accuracy.

Expense management

Synder simplifies expense management by integrating with expense tracking tools and credit card platforms. It automatically captures and categorizes expenses, ensuring that all expenditures are accurately accounted for in the cash flow analysis. This way, businesses can have a clear overview of their expenses and identify opportunities to reduce costs and improve cash flow.

Invoice management

Efficient invoicing is crucial for maintaining a healthy cash flow. Synder offers robust invoicing features, including automated invoice matching, tracking, and reminders. By streamlining the invoicing process, businesses can ensure timely payments, reduce accounts receivable, and enhance cash flow predictability.

Synder provides businesses with a range of innovative tools and features to effectively monitor and control their operating cash flow. Check out Synder by signing up for a 15-day free trial, or book office hours to see everything with a specialist.

The role of operating cash flow in investment decisions

When it comes to making investment decisions, operating cash flow serves as an essential navigational tool. It provides crucial insights about a company’s financial health that can guide investors in determining whether a particular investment could be a worthwhile venture.

1. Evaluating company’s financial health

OCF is a key indicator of a company’s financial health. It shows whether a company can generate sufficient cash through its operations to sustain its business. A consistent positive OCF suggests that a company is financially healthy and capable of maintaining its operations without relying heavily on external financing.

2. Comparing Companies

OCF can be used to compare companies within the same industry. While net income can be influenced by various accounting practices, OCF is a more direct measure of the cash a company is generating. Therefore, it allows investors to make a more apples-to-apples comparison between companies.

3. Assessing dividend sustainability

For investors interested in dividend-paying stocks, OCF can provide insights into a company’s ability to sustain or grow its dividend payments. If a company’s OCF comfortably covers its dividend payments, it is more likely to maintain or increase its dividend in the future.

4. Identifying red flags

A significant discrepancy between a company’s net income and OCF could be a red flag. For instance, if a company shows high net income but its OCF is negative or considerably lower, it suggests that the company’s profits are not being converted into cash. This could indicate potential accounting issues or other financial problems.

Conclusion

As we conclude this extensive exploration of operating cash flow, it becomes evident just how crucial understanding and calculating this financial metric can be for various stakeholders. From business owners and managers strategizing for their company’s growth, to investors searching for the next promising venture, or financial analysts comparing industry benchmarks, the ability to accurately calculate and interpret operating cash flow can be a game-changer.

OCF’s true strength lies in its potential to provide an unbiased, clear-cut view of a company’s ability to generate cash from its core business operations. While other financial metrics may offer an embellished view of a company’s financial health, often influenced by accounting practices, the OCF delivers an undiluted perspective on the operational efficiency and the sustainability of a business.

Moreover, it’s vital to remember that while a positive OCF generally indicates strong financial health, a negative OCF is not always a harbinger of doom. There may be periods of high growth investments when a company might have a negative OCF. Hence, it is essential to view this metric in the larger context of a company’s strategic goals, industry norms, and economic environment.

In the end, the value of understanding and calculating OCF cannot be overstated. The knowledge of how to calculate OCF and the insights derived from this exercise equip you to make informed decisions and evaluations. It can help business leaders in maintaining the financial health of their organization, guide investors towards lucrative investments, and aid analysts in accurately comparing businesses within the same industry.

Read our comparison about Temporary vs Permanent accounts.

.png)