Direct deposit forms are helpful tools, allowing businesses to efficiently pay their employees electronically. QuickBooks accounting software, a widely used business accounting option, offers a streamlined process for managing direct deposit forms, ensuring accuracy and convenience for businesses of all sizes.

Today, we’re looking at the fundamentals of QuickBooks direct deposit forms to grasp their significance and functionality.

Key takeaways

- Direct deposit forms allow businesses to efficiently pay employees electronically, eliminating the need for physical checks and reducing administrative overhead.

- QuickBooks simplifies the setup and management of direct deposits with its user-friendly interface, comprehensive payroll functionality, and robust security measures.

- Using QuickBooks for direct deposits enhances payroll efficiency, ensures timely and secure employee payments, and improves overall employee satisfaction.

Level up your QuickBooks experience with smart automation! Integrate financial data from all your sales channels in QuickBooks to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What is the purpose of direct deposit forms for businesses?

First thing, let’s go through some basics and see what is a direct deposit, a direct deposit form and why you need them.

What’s direct deposit?

Direct deposit is when your paycheck goes directly into your bank account without you having to take a physical check to the bank. It’s like an employer electronically sending your money straight to your account. This way, you don’t have to worry about losing a check or waiting in line at the bank to cash it. Direct deposit is a common way for companies to pay their employees because it’s convenient and secure.

What’s a direct deposit form?

By definition, a direct deposit form is a paper or electronic document that an employee fills out to give the employer the information they need to deposit paychecks directly into the employee’s bank account.

It includes details like the bank account number, the bank’s routing number, and the type of the employee’s account. So basically, it’s permission to send money directly to the bank that an employee grants to the business they work with.

A business needs to provide an employee with the form to fill out when they start their work or if an employee wants to change where their paycheck gets deposited.

What’s the purpose of a direct deposit form?

The primary purpose of these forms is to streamline the payment process, eliminating the need for physical checks and reducing administrative overhead. By automating payroll through direct deposit, businesses can improve efficiency, accuracy, and timeliness in compensating their workforce.

Moreover, direct deposit forms enhance employee satisfaction by providing a convenient and reliable method of receiving payment. Employees no longer need to make trips to the bank to deposit paper checks, reducing potential delays and the risk of loss or theft. This convenience contributes to higher morale and productivity among employees, as they can access their funds promptly and securely.

In other words, the purpose of direct deposit forms for businesses is to modernize payroll operations, enhance financial efficiency, and improve the overall employee experience.

How does a direct deposit form benefit employees?

Direct deposit forms offer numerous benefits to employees, making receiving payment more convenient, secure, and efficient. Let’s break down these benefits.

#3 – No physical check deposits

One of the primary advantages is the elimination of the need to physically deposit paper checks. With direct deposit, employees no longer have to wait in line at the bank or worry about misplacing their checks.

#2 – Timely access to funds

Direct deposit ensures timely access to funds, as payments are deposited directly into employees’ bank accounts on scheduled paydays. This reliability allows employees to plan and manage their finances efficiently, whether for paying bills, budgeting, or saving for the future.

#3 – Fraud prevention

From a security standpoint, direct deposit reduces the risk of check fraud and theft associated with paper checks. Electronic transfers are encrypted and transmitted securely, minimizing the likelihood of unauthorized access to sensitive financial information.

As you can see, direct deposit can benefit both businesses and empoyees, making it a win-win situation. Now, let’s procede to how you can handle direct deposit forms with QuickBooks.

Why is QuickBooks a popular choice for managing direct deposit forms?

It’s worth to note that QuickBooks is one of the most popular accounting software thanks to its accessibility to businesses of all sizes, from small startups to large enterprises.

One of the helpful features it provides is the possibility to manage direct deposit forms due in a user-friendly environment with seamless integration with payroll systems. And it;s a big advantage. Let’s look at some more.

- Easy set up

The software’s intuitive design makes it easy for users to navigate the process of setting up and managing direct deposit for employees. With step-by-step guidance and prompts, businesses can quickly enter banking information, specify payment amounts, and schedule payments with confidence.

- Extended payroll functionality

QuickBooks offers comprehensive payroll functionality beyond direct deposit, allowing businesses to handle various aspects of payroll management, including tax calculations, compliance reporting, and employee benefits administration. This versatility streamlines administrative tasks and reduces the likelihood of errors in payroll processing.

- Security measures

QuickBooks prioritizes data security and compliance, implementing stringent measures to protect sensitive financial information and ensure regulatory adherence. This commitment to security gives businesses peace of mind when entrusting their payroll operations to the platform.

With all the above in mind, it becomes clear what makes QuickBooks a top choice for businesses seeking efficient and reliable payroll management, including the handling of direct deposit forms.

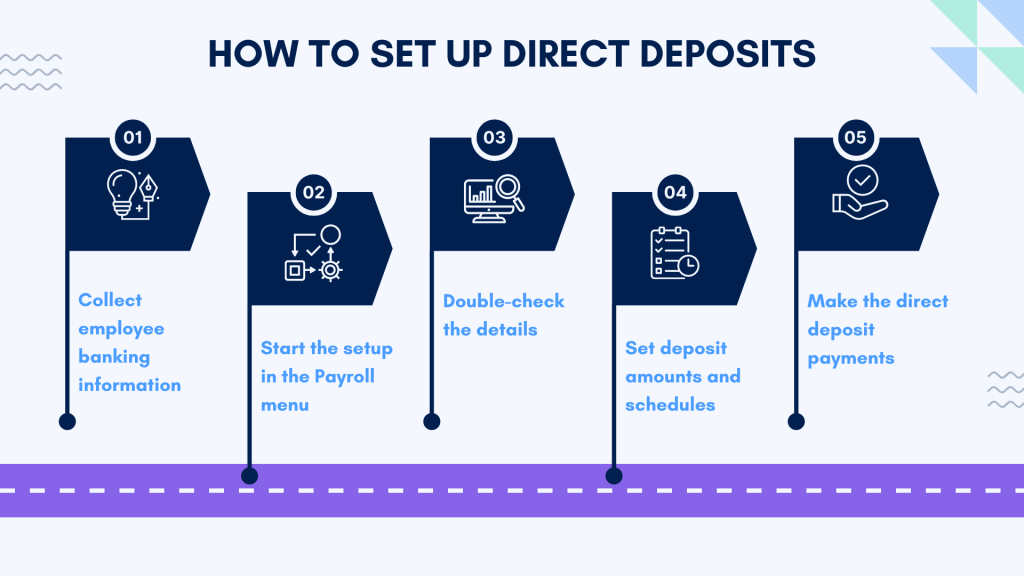

How to set up direct deposit for employees using QuickBooks?

Setting up direct deposit for employees using QuickBooks involves several key steps to ensure accuracy and compliance with banking regulations.

- Collecting employee banking information

The process begins with gathering relevant banking information from employees, including their bank name, account number, and routing number. - Starting the setup in the Payroll menu

Once the necessary information is collected, businesses can navigate to the Employees tab within the Payroll menu in QuickBooks to initiate the setup process. From there, businesses can select individual employees and input their banking details into the designated fields. - Double-checking the details

It’s essential for businesses to verify the accuracy of the information entered, as any discrepancies could result in failed or delayed payments. QuickBooks provides validation checks to help identify potential errors before initiating direct deposit payments. - Setting deposit amounts and schedules

After confirming the accuracy of the banking information, businesses can specify the amount to be deposited into each employee’s account and set up any recurring payment schedules as needed. QuickBooks offers flexibility in payment options, allowing businesses to tailor direct deposit settings to align with their payroll practices. - Making the direct deposit payments

Once the setup process is complete, businesses can initiate direct deposit payments directly from QuickBooks on scheduled paydays. The software automates the transfer process, ensuring timely and accurate payments while minimizing manual intervention.

Throughout the setup process, QuickBooks provides guidance and support to help businesses navigate any challenges or questions that may arise. By following these steps diligently, businesses can establish and maintain a reliable direct deposit system for their employees, enhancing payroll efficiency and employee satisfaction.

How does QuickBooks ensure the security and confidentiality of direct deposit information?

QuickBooks prioritizes the security and confidentiality of direct deposit information, employing robust measures to protect sensitive financial data from unauthorized access and cyber threats. One of the key security features is encryption, which encrypts data transmitted between QuickBooks and its servers, as well as between users’ devices and the software.

Additionally, QuickBooks implements multi-factor authentication protocols to verify the identity of users accessing the platform, adding an extra layer of security against unauthorized access. Users may be required to enter a one-time code sent to their registered email or mobile device to authenticate their login attempts.

Furthermore, QuickBooks adheres to industry standards and best practices for data security, including compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS). This ensures that the software meets stringent requirements for protecting sensitive financial information and maintaining the integrity of payment transactions.

Moreover, QuickBooks provides regular updates and patches to address known security vulnerabilities and mitigate emerging threats. By staying vigilant and proactive in addressing potential risks, QuickBooks helps safeguard users’ direct deposit information.

Bottom line

Direct deposits offer significant advantages for both businesses and employees. For businesses, direct deposits streamline payroll processes, reducing the time and resources needed to issue payments. They also enhance security by eliminating the risks associated with paper checks. Employees benefit from the convenience of direct deposits, as they no longer need to visit banks to cash or deposit checks, ensuring timely access to their earnings. Additionally, direct deposits provide a reliable and efficient payment method, contributing to overall employee satisfaction and morale.

Using QuickBooks for filling out direct deposit forms adds further convenience and efficiency to the payroll process. QuickBooks offers a user-friendly interface that simplifies the task of collecting and managing employee banking information. Its integration with payroll systems streamlines the setup and execution of direct deposits, saving businesses time and reducing the potential for errors. QuickBooks’ robust security features also ensure the confidentiality and integrity of sensitive financial data, instilling trust and confidence in users. Overall, QuickBooks stands out as a preferred choice for businesses seeking a reliable and convenient solution for managing direct deposits, enhancing payroll management efficiency while meeting the needs of both employers and employees.

Continue reading: How to set up an accounting system?

Share your thoughts

Do you know what QuickBooks direct deposit forms are? Have you ever used them? Leave your comment in the section below, and let’s discuss!

.png)