As an accounting firm, you know how important keeping your clients’ books up-to-date and accurate is. The data sync mode plays a big role here as it determines the level of detail available in the books. With lots of accounting software on the market, it might be challenging to pick the one that suits both low- and high-transaction volume clients, and, ideally, you’d like to have both at your disposal.

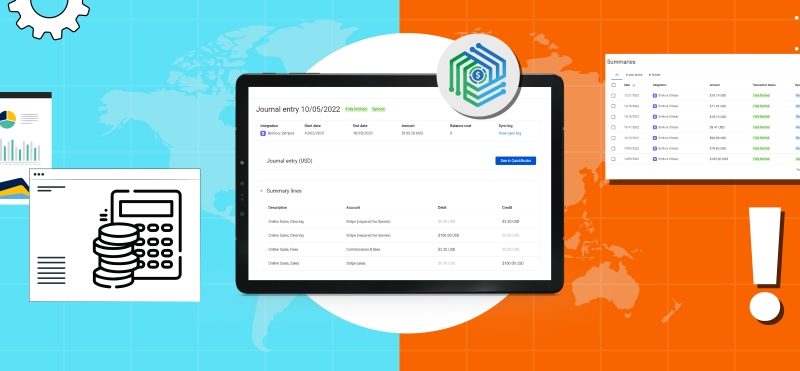

Synder has had detailed per transaction sync available for years, however, many accounting firms prefer to do books with summarized entries for some clients. This is where Synder’s new Daily Summary tool can come in handy: it can help you achieve that goal with its powerful automation capabilities. Today we’d like to showcase some key benefits of using Synder Daily Summary, along with examples tailored to accounting firms.

Here’s what you’ll discover in our overview:

1. Features and capabilities of the Daily Summary sync

2. What sets Synder ahead of the competition?

Features and capabilities of the Daily Summary sync

Seamless connection to 25+ payment processors and e-commerce platforms

One of the main benefits is that Synder’s Daily Summary tool provides a simple way to connect with over 25 payment processors and e-commerce platforms. All in one tool! This enables you to easily import all transactions from these platforms into one central location, eliminating the need for manual data entry.

For instance, if you have a client who runs online stores on Shopify, Amazon, and Etsy, you can import all transactions from these platforms into Synder Daily Summary and ensure that their books are accurate and up-to-date.

Unlimited historical import and bulk rollback

With Synder Daily Summary, you can take your bookkeeping processes to the next level. Our tool offers unlimited historical import and bulk operations, making it easy to quickly import all historical data for a new client and bring their accounts up to speed.

Synder can bulk import, sync or undo sync in one click, which is very convenient once you realize you need to correct some entries and redo them. With Synder, the whole process takes minutes. The cool thing about bulk actions is that Synder natively protects you from duplicates, so your clients’ books are 100% accurate and clean. And don’t worry about transaction dates – they’ll all be gathered from the connected integrations, and your books will contain accrual-based reports for added convenience.

Reconciliation based on clearing accounts

Synder’s Daily Summary tool uses clearing accounts to simplify the reconciliation process, ensuring that all transactions are recorded correctly and without discrepancies.

Just imagine the peace of mind that comes with knowing that all transactions from your clients’ e-commerce stores, linked to multiple platforms and payment processors, are accurately recorded and matched to bank statements. With Synder, you can connect to all platforms and import the data to separate clearing accounts for each connected integration. And when the payment processor transfers money to the bank (after charging its commission), Synder records a transfer from the clearing to the checking account for the exact amount coming from the processor. This means that the clearing account balance goes down to zero, and the checking account has a perfect match to the bank feed.

But that’s not all – if there are any cash transactions recorded (from Shopify POS, Square POS, etc.), Synder will post them to a separate account you specify, so that cash doesn’t interfere with the clearing process, and you can reconcile it separately.

COGS and inventory asset tracking

We understand the importance of accurate tracking and reporting of inventory assets and cost of goods sold (COGS). That’s why our Daily Summary tool provides seamless COGS and inventory asset tracking, as well as inventory turnover ratio, making it easy to import your client’s inventory cost list and calculate COGS automatically.

With Synder, your client’s COGS and inventory assets are being accurately tracked and reflected in their financial statements. Whether your client runs a retail store or any other business that deals with inventory, Synder Daily Summary can help you import the list of costs associated with their inventory and automatically calculate COGS based on the number of items sold throughout the day. And with synced Journal Entries that increase COGS and decrease inventory assets on an accrual basis, you can rest assured that your client’s financial statements accurately reflect their business operations.

Mapping by products for detailed P&L

At Synder, we believe that flexibility is key when it comes to the bookkeeping processes. That’s why our Daily Summary tool provides flexible mapping capabilities, allowing you to map accounts based on products, SKUs, product options, and variations from the connected integration(s).

How does it work? If you have a client who runs an e-commerce business with multiple revenue streams, you’ll be able to map their accounts to specific SKUs and track each revenue stream (product/product group) separately. This will give you greater control over their financial statements and deeper understanding of their standing to help them make informed business decisions.

Mapping of fees, refunds, taxes, discounts, tips, loans, and gift cards

Separating financial transactions into different categories is essential for accurate bookkeeping and a clear understanding of a business’s financial situation. That’s why our Daily Summary tool allows for the separation of fees, fee types, refunds, taxes, discounts, tips, gift cards, loan paybacks, and more, giving you mapping flexibility and greater visibility and control over your client’s financial transactions.

Should your client run a restaurant or any other business that deals with various types of financial transactions, Synder Daily Summary can help you easily separate fees, refunds, taxes, discounts, tips, and loan paybacks, gift cards, etc., ensuring that not a single transaction is missing from their books.

Mapping taxes by states/countries to reflect correct tax liability in a balance sheet

Synder’s mapping functionality doesn’t end with fees and refunds, as the tool allows you to track your client’s global tax obligations. With Daily Summary, you can break down taxes by state or country, ensuring that your client’s tax liability in the balance sheet is accurate.

Suppose you have a client who sells products to local and overseas clients. In this case, you can use Synder Daily Summary to easily separate taxes by country or state based on shipping address country, ensuring that their tax liability is accurately reflected in their balance sheet.

Multi-currency mapping to cover any multi-currency flow

There are many challenges associated with managing transactions in different currencies and accurately reflecting your client’s international operations in their financial statements. Our Daily Summary tool eliminates those issues by providing multi-currency processing capabilities and customizability of mappings by currency, ensuring that you can cover any multi-currency flow for your client.

What it means is that you can easily manage transactions in different currencies and customize mappings by currency, guaranteeing that your client’s financial statements accurately reflect their international operations. For example, if your client operates in multiple countries or transacts in different currencies, Synder Daily Summary can help you create a separate journal entry for each currency. And if you want to have one combined journal entry in your home currency, this is also possible once you change your mapping accordingly.

Assigning classes to journal entries to track detailed sales results

We know how important detailed sales tracking is to make informed business decisions. That’s why our Daily Summary tool allows you to assign classes to journal entry lines, providing you with greater visibility into the performance of different products or services within your client’s business.

With Synder Daily Summary, you’ll track how these products or services sold across different platforms perform, giving you and your client a better understanding of which products are selling best and which platforms are driving the most revenue. For example, if a client of yours runs a retail company or any other business that deals with different products or services across multiple platforms, you can use the tool to easily create mapping by product groups and assign classes to journal entries, providing detailed sales results tracking by platform. Thus you and your client will have better visibility of how products are sold throughout different sales channels (Amazon, Shopify, eBay, etc.).

What sets Synder ahead of the competition?

Synder is proud to be regarded as one of the best accounting solutions in 2023, boasting thousands of positive reviews across major marketplaces – Trustpilot, Capterra, GetApp, G2, etc. Our journey to create a technically advanced solution backed by accounting expertise has been a long and challenging one, but we’re thrilled with the results.

What makes Synder stand out from other alternatives on the market? It’s simple – our commitment to providing the best possible solutions for accounting firms. We’ve tailored Synder specifically to meet the needs of accountants, ensuring that our tool provides the necessary functionality and flexibility to streamline their workflow and improve their clients’ financial management.

Here’s a quick breakdown of what gives Synder the competitive advantage over similar solutions on the market:

1. Synder integrates with the biggest number of platforms

Synder offers support for over 25 processors, including a wide range of e-commerce marketplaces (Amazon, Etsy, eBay, etc.), storefronts (Shopify, Wix, BigCommerce, Woocommerce, etc.), payment processors (Stripe, PayPal, Square, Authorize.net, Afterpay, etc.), and POS systems (Shopify POS, Square POS, Clover, etc.). We also offer Excel import for missing integrations, ensuring that you can easily import data from any platform, even if it’s not directly supported by Synder. See the complete list of integrations here.

2. Synder posts summaries daily to the books

Synder gives timely financial information for both accounting firms and their clients. Our tool provides quick results in your client’s books, giving you instant access to the information you need to make informed business decisions. That’s a striking difference from many other solutions that use synchronization based on the payout, which means you may have to wait up to two weeks to see the information in your books.

3. Synder is tailored to e-commerce and syncs payment processor fees

Synder is designed to connect to both sales channels and their native and non-native payment processors, and accurately grabs all the details with a smart skip duplicates feature, providing complete and accurate financial data. Many of our competitors neglect non-native payment processors and only connect to e-commerce channels to avoid duplicates between systems, which means that payment processing fees can be missing because there’s no information about them in e-commerce channels.

4. Synder provides rollback

Synder provides a rollback feature, which is highly appreciated by accountants for its ability to bulk delete any synced info from the books. This feature is particularly useful in situations where incorrect settings have caused data to be synced wrongly – you can easily fix any errors and resync data back to the books properly, saving you valuable time and ensuring that your clients’ financial data is accurate. Unfortunately, many alternative software options lack a rollback feature, which can result in days of cleaning up the books from the mess caused by blind automation.

5. The integration is stable and backed by top-rated support and development teams

Synder offers unrivaled support. We understand that behind every great tool is a team of dedicated professionals who are committed to providing exceptional service and support. That’s why we offer 24/7 support through a variety of channels, including Zoom, in-app chat, and email. Our team of developers is constantly analyzing feedback from accounting firms to ensure that our tool is always evolving to meet the needs of our clients. With Synder, you can trust that you have a partner who is invested in your success and is always ready to help you tackle any challenges that may arise.

Wrapping up

At Synder, we’re dedicated to providing accounting firms with a powerful tool that streamlines their bookkeeping processes and ensures accurate financial data for their clients. With features like seamless integration with over 25 payment processors and e-commerce platforms, COGS tracking, flexible mapping, and simple reconciliation, Synder Daily Summary has everything your accounting firm needs to easily manage your clients’ finances and improve their financial visibility.

Gone are the days of manual data entry from online platforms or low-quality integrations with no bulk functionality or low customizability. With Synder, you can enjoy complete and accurate automation, giving you more time to focus on expanding and growing your practice and providing exceptional service to your clients.

Are you ready to take your accounting firm to the next level? Try Synder on a 15-day free trial and explore a host of benefits the real smart automation tool has to offer.

.png)