Since the world has gone digital, money transfer apps like PayPal and Cash App have become lifelines for managing our finances efficiently and securely. They offer unparalleled convenience for handling transactions on the go.

But have you ever found yourself in a situation when you need to move funds between these platforms? While we do know that direct transfers aren’t supported, there are effective workarounds that enable you to seamlessly and quickly move your money from one account to another.

In this article, we’ll guide you through the steps to move money from your PayPal to Cash App using your bank account or Cash Card. Are you ready to simplify your financial transactions? Let’s get started!

Contents:

1. Can money from PayPal be transferred to Cash App?

2. How to transfer money from PayPal to Cash App?

3. Wrapping up

Can money from PayPal be transferred to Cash App?

There isn’t a direct way to transfer your PayPal balance to Cash App. But there’s a workaround! Actually, two:

- You can send the money from PayPal to your linked bank account, then to your Cash App.

- You can order a Cash App Cash Card and link it to your PayPal.

Find out more about the Cash App Business account.

How to transfer money from PayPal to Cash App?

Method 1. Transfer via a bank account

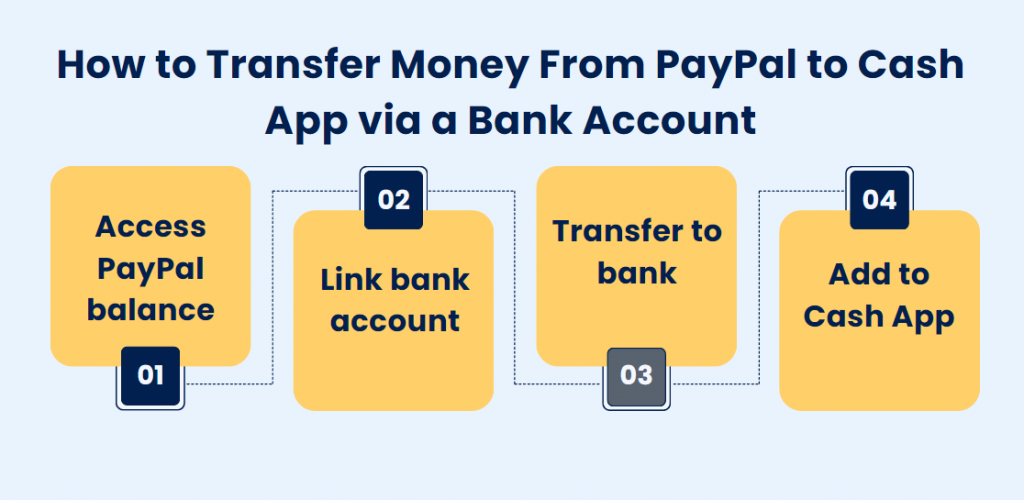

If you want to move money from PayPal to Cash App using a bank account, just follow these four simple steps:

- Access PayPal balance: Open the PayPal app on your mobile device and tap on your balance on the home screen. If you’re using a desktop, sign in to your PayPal account and proceed to the “Wallet” section to view your balance.

- Link bank account: If not already linked, link your bank account to PayPal using your account information.

- Transfer to bank: Tap “Transfer” and then select “Transfer to bank”. Choose between an instant transfer or a standard transfer.

- Add to Cash App: Open Cash App, tap the money icon, select “Add Cash”, enter the desired amount, and confirm.

Note: An instant transfer incurs a fee, whereas a standard transfer is free but typically takes 1-3 days to process.

Learn more about how PayPal works.

Method 2. Transfer with a Cash Card

If you choose to transfer via Cash Card, here’s your three step guide:

- Get Cash Card: In your Cash App account, go to the Cash Card tab on your home screen and follow the prompts to order your Cash Card.

- Link Cash Card to PayPal: In the PayPal app, navigate to “Wallet”, add a debit or credit card, and use your Cash Card details.

- Transfer funds: Once linked, transfer money directly from PayPal to Cash App using your Cash Card details.

Note: Once you’ve completed the order, your Cash Card is ready to use right away. You can find the card details in the Cash Card tab. You can expect the physical Cash Card to arrive within approximately 10 business days.

Find out how to cancel a pending PayPal transaction.

Does your business need help with PayPal accounting? Try Synder for free and discover how it can enhance your bookkeeping processes. Also, join our informative Weekly Public Demo for extra insights and advice.

Wrapping up

While there isn’t a direct way to transfer money from PayPal to Cash App, there are practical methods to effectively move your funds between these platforms. Whether opting for a bank account transfer or utilizing Cash App’s Cash Card, each method offers a straightforward solution tailored to your preferences for speed and convenience. By following these steps outlined in this article, you can navigate financial transactions between these popular online money transfer apps seamlessly, ensuring your money moves where you need it, when you need it. Simplify your financial management today with these reliable transfer options.

PayPal to Cash App FAQs

Can a PayPal card work on Cash App?

No, a PayPal card cannot be directly used on Cash App. Cash App works seamlessly with the following debit and credit cards: Visa, MasterCard, Discover, American Express, along with most prepaid cards. However, specific cards issued directly by PayPal, such as the PayPal debit card or business debit cards, are not currently supported on Cash App. If you want to add funds from a PayPal account to Cash App, you would typically need to transfer the money to a linked bank account first and then add it to Cash App from there.

How to send money to Cash App?

Here’s how you can add money to your Cash App balance:

- Open Cash App account and tap on the “Money” tab which you can find at the bottom left corner of the screen.

- Select “Add money”.

- Choose the amount you want to add.

- Tap “Add”.

- Confirm the transaction by using Touch ID or entering your PIN.

Can I send money to someone’s Cash App without Cash App?

No, you cannot directly send money to someone’s Cash App without having the Cash App yourself. Cash App requires both the sender and the recipient to have accounts on the platform in order to facilitate transactions between them. If you need to send money to someone who uses Cash App and you don’t have an account, you would need to use indirect methods like asking a friend with Cash App to assist or using alternative payment methods like bank transfers or other peer-to-peer (P2P) payment services.

What’s a Cash App Card?

The Cash App Card is a free, customizable debit card that directly links to your Cash App balance. The Cash App Cash Card works just like any other traditional debit card and can be utilized anywhere Visa is accepted, both online and in physical stores. However, it is not connected to your personal bank account or personal debit card.

When you use the Cash App Cash Card for transactions, the funds are deducted directly from your Cash App balance. If you need to withdraw money from your Cash App balance to your personal bank account, you would need to initiate a “Cashing Out” process within the Cash App to transfer funds from your Cash App balance to your linked bank account or personal debit card.

Can I transfer money from PayPal to Venmo?

Yes, you can! Visa+ enables seamless money transfers between PayPal and Venmo. With Visa+, you’re able to send money from your PayPal balance to a Venmo account, or receive money from a Venmo account into your PayPal account.

There are no transfer fees for moving money between PayPal and Venmo. Transfers typically complete within up to 30 minutes.

How long does it take to transfer money from PayPal to Cash App?

The time it takes to move money from your PayPal to Cash App depends on the method you choose:

- Instant transfer: This option usually takes just a few minutes to complete, but it incurs a fee.

- Standard transfer: This method is free but typically takes 1-3 business days to process.

The actual timing can vary based on the specific transaction and processing times between PayPal and your bank account linked to Cash App.

How can I use a balance with PayPal?

If you’ve got a PayPal Balance account, you can use it to send money to family and friends or buy things online.

To check how much you’ve got available, just head to your Dashboard on the PayPal website. On the PayPal app, tap on “PayPal balance” to see your funds in your main currency.

Your available balance on the balance account shows how much money you can use right away, not counting pending payments or any ongoing transactions. For a detailed breakdown of your balances in different currencies, go to the Wallet section in the PayPal app.

If you’ve got a PayPal Balance account, you can also acquire the PayPal debit card. With the PayPal Debit Card, you can instantly use your PayPal funds to shop online or in stores where Mastercard is accepted, withdraw cash from ATMs worldwide, and add cash to your PayPal account at supported stores across the country.

Have you ever transferred money from your PayPal account to Cash App? Share your experience in the comments below!