Steady cash flow is what supports your business in a very literal sense. Driving those numbers upwards should be applied not only at the sales and marketing level but the accounting level too.

Improving your cash flow metrics with a smart accounting feature like a recurring invoice is a great example of how accounting software can become a reliable partner in your business venture. That’s especially useful if you’re running a subscription-based business and your products or services require regular billing of the same amounts.

In this article, we’ll take a closer look at the benefits of recurring invoicing and technical solutions that can automate the invoicing process. Moreover, we’ll show how to implement recurring invoices easily with the added advantage of automation to close the paid invoices.

Contents:

1. What is a recurring invoice?

2. Benefits of automated recurring invoices

3. How to automate recurring invoices

4. Do recurring invoices have any drawbacks?

What is a recurring invoice?

In a nutshell, a recurring invoice is a payment invoice for your products or services that you send to your customer regularly – weekly, monthly, or yearly – so that you only change the invoice date while all other data remains exactly the same.

It works pretty straightforwardly: you assign a frequency with which you’ll bill a certain customer and send an invoice using this chosen schedule.

As you’ve probably noticed, recurring invoicing is a simple process. Moreover, it’s perfectly suited for businesses with subscription-based pricing models. Though of course, any other business that needs to regularly bill customers can profit from recurring invoices too, for example, a business providing regular support and maintenance for the products you sell.

But there’s more to a recurring invoice than meets the eye, so let’s explore it.

Benefits of automated recurring invoices

A recurring invoice is an ideal candidate for automation since once you set up the first invoice and choose the corresponding starting date and an interval, the whole process will manage itself.

This simple feature can provide a host of advantages to the business owner, in terms of financial stability, better cash flow, saved time, cybersecurity and much more.

Cutting down on late payments

Late payments can hamper your cash inflows and endanger your ability to pay your bills on time, letting down your suppliers, employees, or partners.

Where do late payments come from? As with any relationship, there are two parts to the story – here, it’s the business and the customer. While you can try to diminish customer-related issues with late payments, it’s your own practices that you have 100% control over. Hence, ensuring that your automated invoicing is the right thing to start with.

Increasing payment compliance

Recurring invoices are usually sent on a strict billing schedule, making your customers lock into the same payment routine. When your customers know that every month, on the same date they’ll receive an invoice, it’s much easier for them to align their finances with the payments towards your business.

Check our essential guide to receiving payments: top payment gateways for your business.

Reducing invoice errors

Errors in accounting can contribute to almost half of the financial challenges that small businesses face, which is astonishing! That fact alone should highlight the importance of reducing such errors as much as possible. And a recurring invoice system can certainly help since it automatically pulls the data from your accounting system and the only work you need to do is select the time frame.

Saving time and effort processing invoices

Automating accounting processes is an operational baseline for any business. For small business owners that’s even more important as they usually can’t delegate as many tasks to other professionals. Nonetheless, they want to devote as much time to the most crucial aspects of their own business. Automating accounting processes like recurring invoices can take you just one step closer, freeing more of your time.

Increasing cash flow

Cash flow is the fuel for business existence and growth. Having a steady flow of monthly income ensures that a business continues to operate, meets obligations to employees and partners, and above all – that it grows.

At the same time, one of the main reasons why small businesses go bankrupt worldwide is poor cash flow. And automating those invoices helps you manage your cash flow better.

Having predictable revenue estimates

This point ties in with the above one. Being able to predict your revenue makes every aspect of your business much simpler. You can set up sending invoices on a billing schedule that’ll allow you to have a steady cash inflow throughout the month. It’ll help you plan your expenses more accurately, make informed growth decisions, and plan for marketing activities or investments with less risk of overspending.

Increasing sales with payment schedules

One-time pricing for a product or a service, especially when we talk about large purchases, can sometimes be too high for a customer to pay. So it can scare people away from what you offer, even though the initial buying intent was high.

You can drive more sales by simply dividing the one-time payment into smaller chunks. Even if customers may pay a larger amount over a long period of time, they can get immediate access to the product. And seeing their credit card balance diminish only a little every month in exchange for your offer keeps everyone happy.

Hence, reviewing your payment structure and applying recurring invoices can help you make your product or service more affordable for a larger number of customers.

Learn more about basic accounting for small businesses.

How to automate recurring invoices

Now that we’ve seen that automating invoices can be very beneficial for many areas of your business, we’ll learn exactly how to set it up step by step.

Creating recurring payments can be done in accounting software such as QuickBooks or Synder, depending on your preferences. However, it’s the combination of Synder, QuickBooks, and payment gateways integration that can be the most beneficial as it allows you not only to send recurring invoices to your customers but also automatically close those invoices in QuickBooks with payments received.

If you choose to create invoices in Synder to make them recurring, they’ll be visible in QuickBooks and vice versa, as the programs are fully integrated and really easy to use.

How to set up invoices in accounting software

When approaching recurring invoices you have 2 options: you can either create a new recurring invoice from scratch or turn an existing invoice into a recurring one. Both are very straightforward.

Create a new recurring invoice

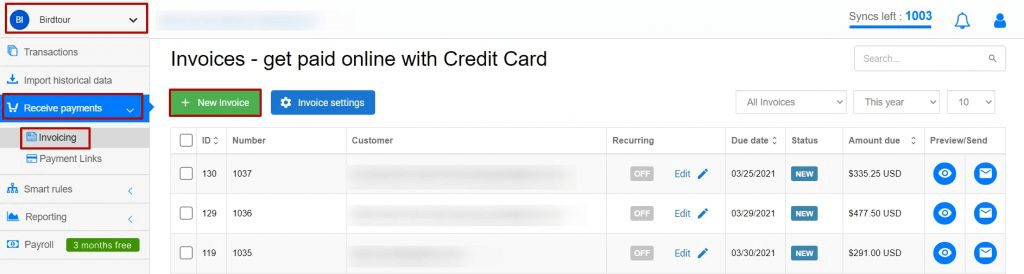

When creating a brand new recurring invoice in Synder, first select the Organization, then go to the Receive Payments tab in the left-side menu and choose Invoicing.

Click the New Invoice button to enter the workspace for creating invoices.

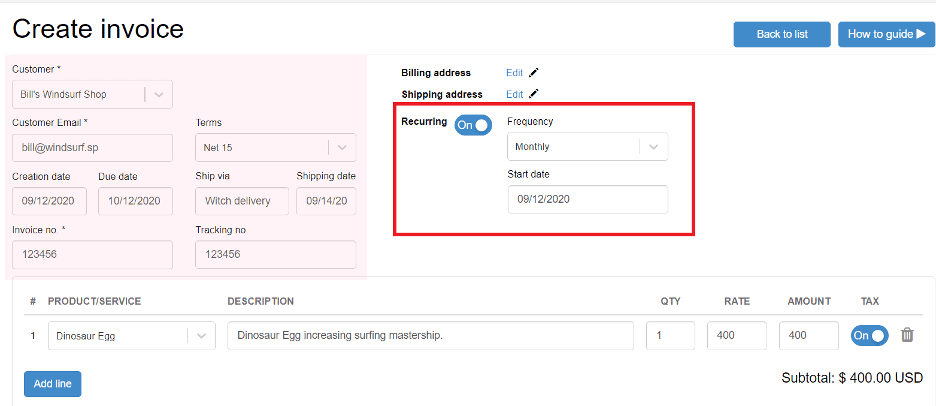

Fill out all the necessary invoice fields. Switch the Recurring option to On and set up the start date and interval for the invoice. Click the Create invoice button at the bottom of the page and that’s it.

Turn an existing invoice into a recurring one

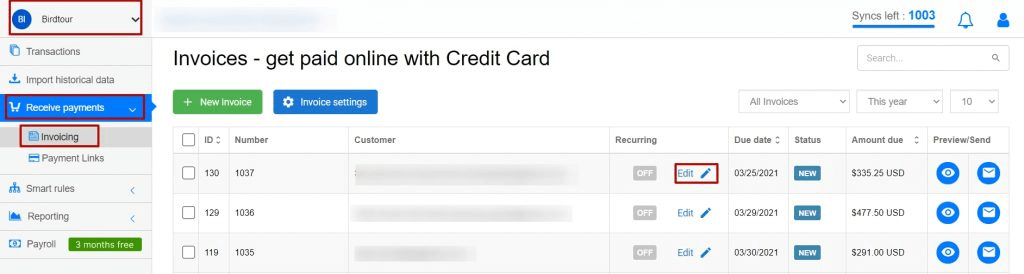

If you’d like to turn an existing one-time invoice into a recurring one, choose an Organization, then Receive payments > Invoicing – these steps are the same as the above.

And now, select the needed invoice from the list, and click Edit in the Recurring column.

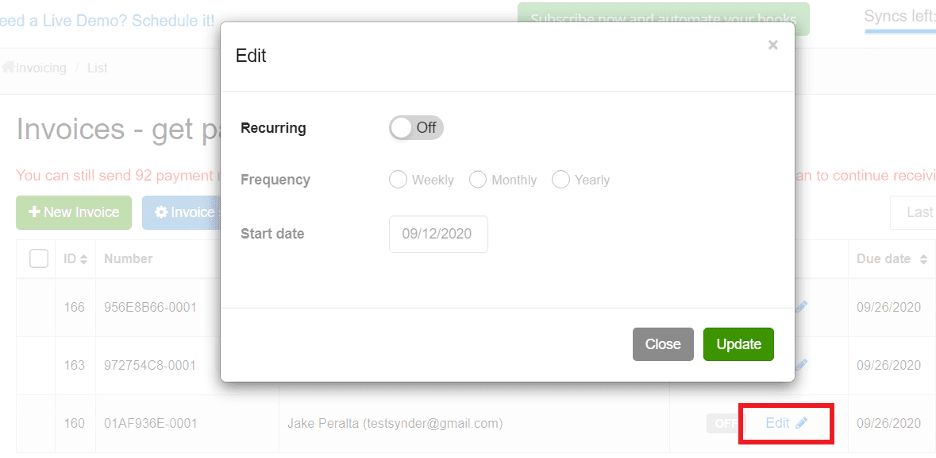

In the pop-up window, change the Recurring toggle to the ON position and specify the start date and frequency. Afterwards, just click Update and you’re done.

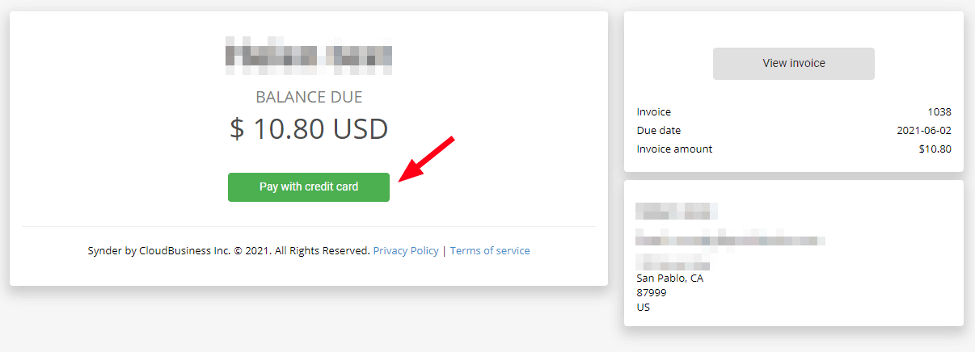

Once a customer receives an invoice, it’ll contain a link that’ll take them to the secure pop-up window for credit card payment with an invoice overview.

How to automatically close invoices

Now that the invoice is created, it’ll be sent to the customer on the scheduled date. While you can forget about sending those invoices as long as the data remains the same, you still need to close them once the payment comes through.

That’s a really tedious task of combing through your bank account in search of new payments and then trying to find the corresponding invoices in your accounting system to match them and mark them as paid.

And here is where Synder really shines. Since this software seamlessly integrates with various payment gateways, like Stripe or Square (for a full list of integrations, click here) it’ll automatically close your open invoices upon receiving the payment. The same process is for Windows, Linux and Mac accounting software.

Once you connect all your payment gateways and QuickBooks Online upon initial setup of Synder, and switch on Apply payments to unpaid Invoice/Bill transactions, you don’t have to do anything else. The whole process will be fully automated.

Due to the seamless integration, your end-of-the-month reconciliation will be even smoother. And with smart features like skip duplicates and reconciliation troubleshooting, you can be sure that closing your books will be a breeze.

Find out about 5 tips for invoicing – how to add value without adding time.

Do recurring invoices have any drawbacks?

We don’t think that recurring invoices have drawbacks as such, but there are definitely things to bear in mind when using them.

Not every business needs recurring invoices. If your customers pay one time for a product or service they buy from you and there are no other regular payments, then the recurring invoice system is simply redundant in your business model.

For those who benefit from recurring invoices, there are a few caveats they need to remember to not turn this time-saver into a troublemaker.

Error in invoice data

An error in a recurring invoice is a recurring error. And to make things worse, both you and your customer may be overlooking the error for quite a long time. As a result, it can lead to a disgruntled customer and lengthy refunds. To prevent this, it’s always best to double-check the initial invoice upon setup before sending it to a customer.

Change in invoicing details

If you decide to make changes to your pricing or your client choses to upscale or downscale the service you provide, the subscription will change and so will the invoice amount. When that happens, you need to remember to make necessary amends to the invoice itself to avoid errors in accounting.

Recurring invoicing means commitment

Recurring invoicing implies a long-term relationship with your business and not all customers will feel comfortable with that. That’s why it’s important to communicate pricing models and billing schedules to your customers and possibly give several payment options like credit card or a simple payment link for example.

Closing thoughts

We hope that we’ve made a strong case for the use of automated recurring invoices in your accounting system, especially for those businesses that operate within the subscription model.

Recurring invoices are simple, yet powerful as they save your time, diminish errors, and streamline your cash flow. However, the real gem with automated invoices with Synder is the hands-free closing of the open invoices upon payment.

But that’s just one of many Synder’s features that can benefit your business. If you’re curious about how else Synder can help your business, sign up for a free trial or book a demo.