This article delves into the seamless connection between the bustling marketplace Etsy and the robust accounting platform QuickBooks, offering a comprehensive solution for financial management and operational efficiency. As we navigate through the nuances of this integration, we’ll also explore the Etsy integration with QuickBooks via Synder, a tool designed to optimize and enhance this synergy.

Synder’s unique capabilities in automating and streamlining financial processes not only simplify the complexities of ecommerce transactions but also provide invaluable insights, making this integration a game-changer for Etsy sellers. Join us as we unravel the benefits and practical applications of the Etsy integration with QuickBooks via Synder, showcasing how Etsy businesses can leverage these tools for maximum impact in the competitive world of online selling.

Contents:

1. Reasons to implement Etsy + QuickBooks Online integration via Synder

2. How to set up the QuickBooks Etsy integration

3. Key features of the QuickBooks Etsy integration

4. Etsy QuickBooks integration FAQ

Reasons to implement Etsy + QuickBooks Online integration via Synder

Searching for effective ways to connect Etsy and QuickBooks? Then the features provided by Synder deserve your consideration. Here’s a look at some of the advantages that Synder offers to its users.

Withheld tax tracking

Facilitator Tax generally refers to taxes collected and remitted by a marketplace facilitator on behalf of sellers using their platform. Since Etsy is one of the marketplaces that withholds this tax, it should be tracked on the expense account, or you should reduce your tax liability.

Synder simplifies this process for Etsy and QuickBooks Online integration. The software takes the tax amounts from the Etsy record and stores them in both the income part of a transaction (Sales Receipt/Invoice) and the expense part, along with the Etsy fees, effectively canceling them out. Such a tracking option eases the whole bookkeeping process and the final reconciliation since all the expenses are recorded in the right QuickBooks accounts.

Learn more about Etsy seller fees – check our ultimate Etsy fees guide.

Connection of additional sales channels and/or payment platforms

When selling on Etsy, it’s important to track all your sales and transactions accurately so the final accounting software has all the necessary records to generate a detailed report of your Etsy business. With Synder, you can connect PayPal as your payment platform to the software so it can sync all the stored data right into your QuickBooks account. Also, you have an opportunity to connect additional online marketplaces on which you’re selling to track the business performance across all channels in use, including Etsy.

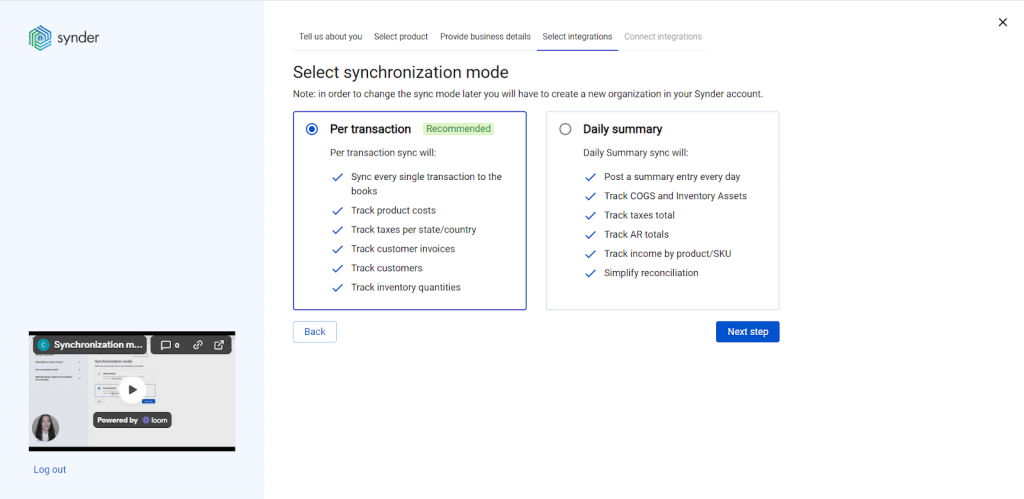

Per transaction or Daily summary sync options

Synder offers two options for syncing your transactions: per each transaction from all the connected platforms or on a daily basis, where all the transactions from this day are grouped in one summary or entry. If comparing both modes, the Per transaction syncing mode is more detailed than the Daily summary sync, which is more suitable for recording a large number of transactions.

If you connect Etsy with PayPal as your payment platform, you’ll get 2 journal entries reflecting the records from Etsy itself and the connected payment gateway.

Note: No customer data from Etsy is transferred to your QuickBooks when choosing the Daily Summary sync.

Data security

Synder holds a SOC 2 Type 2 Certification, ensuring top-tier security and compliance for your financial data. Utilizing sophisticated encryption and a secure connection, it guarantees the confidentiality and protection of data transferred between platforms, such as Etsy and QuickBooks, ensuring your information remains safe and private.

Detailed reporting

Synder captures essential accounting and bookkeeping data, making it possible for you to produce comprehensive and precise P&L and Balance Sheet reports for your Etsy business. The software records all income and expense details sourced from Etsy, Etsy Payments, or any other linked payment gateway. This also includes data from an additional sales channel connected to Synder as well.

24/7 support

Synder support team is accessible around the clock through chat and email, always prepared to assist you throughout the entire Etsy and QuickBooks integration setup process. For a hands-on view of the actual workflow, Synder’s specialists conduct Weekly Product Demo sessions, providing an in-depth look at how the software functions internally.

How to set up the QuickBooks Etsy integration via Synder

Now let’s create your account by following these step by step instructions below.

1. Create an account

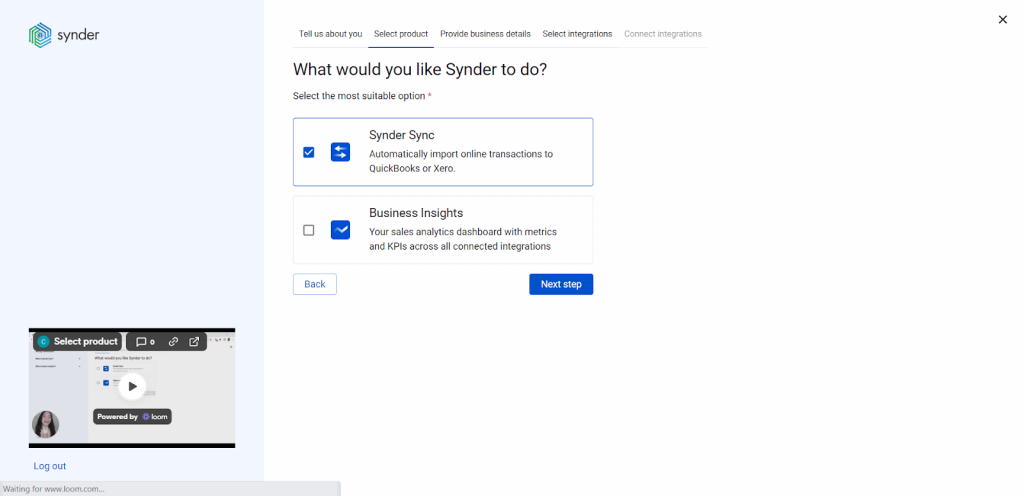

First, choose the main product you want to utilize for your Etsy and QuickBooks integration: Synder Sync or Synder Insights.

- Synder Sync – an actual connector between your sales channels (Etsy) and QuickBooks through which you can sync transactions right into the accounting software;

- Synder Insights – an analytical tool with which you can track the most important metrics for your Etsy business.

Note: You can select either one or both products.

2. Set up the organization

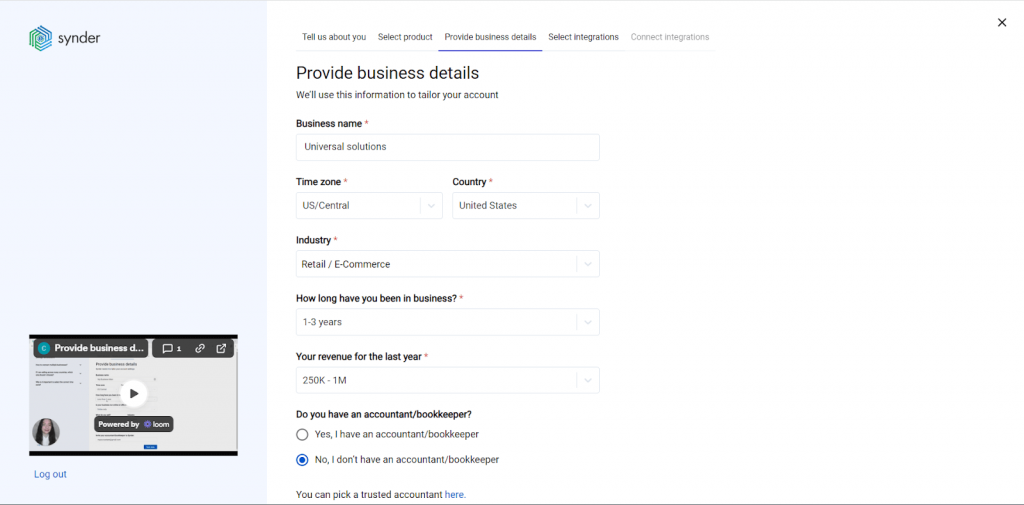

Fill out the information about your Etsy business:

- The name of the organization;

- Time zone;

- Country;

- Industry;

- How long the business has been on the market.

This information will help us understand your requirements better, allowing us to offer you tailored assistance and support regarding Etsy and QuickBooks connection.

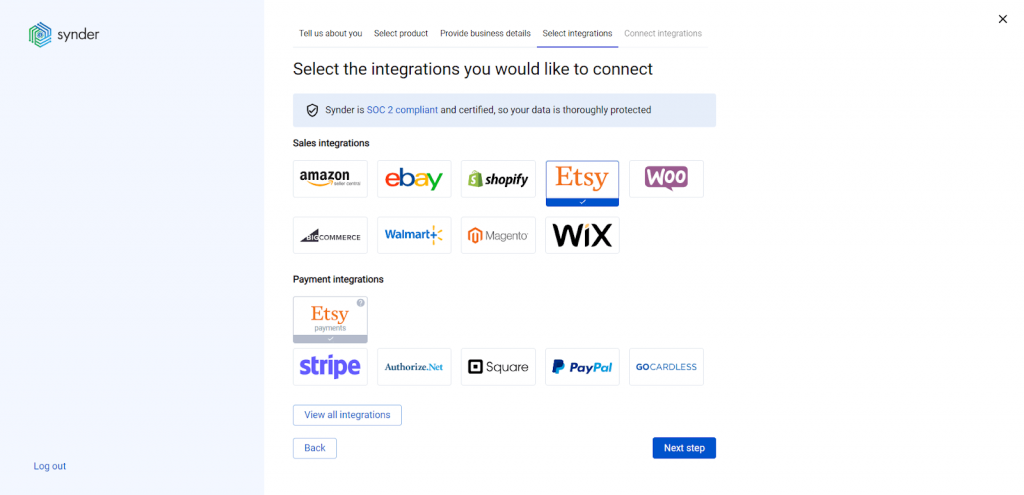

3. Select Etsy as your platform

Choose Etsy for the sales integration.

For Etsy stores that process payments through gateways other than Etsy Payments, it’s highly recommended to link these additional payment platforms to Synder. Such connection ensures precise recording of sales, fees, refunds, and payouts from the connected payment gateway(s), complemented with extra information from Etsy orders.

Note: Click ‘View all integrations’ to see all the platforms available for integration.

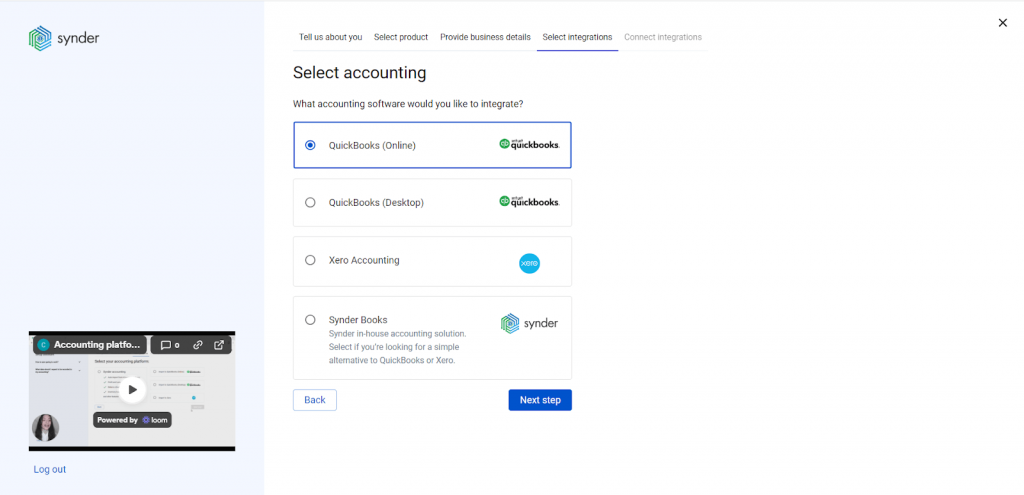

4. Select QuickBooks Online among accounting software

Choose QuickBooks Online among the provided options.

Synder is also available for integrations with QuickBooks Desktop, Xero and its own accounting software – Synder Books.

5. Choose the sync mode

In this step, you’ll need to choose a sync option for your QuickBooks Etsy integration. Synder provides Per transaction and Daily summary modes.

Don’t know which one to choose? Check out our guide to learn more about the workflow and benefits of both modes.

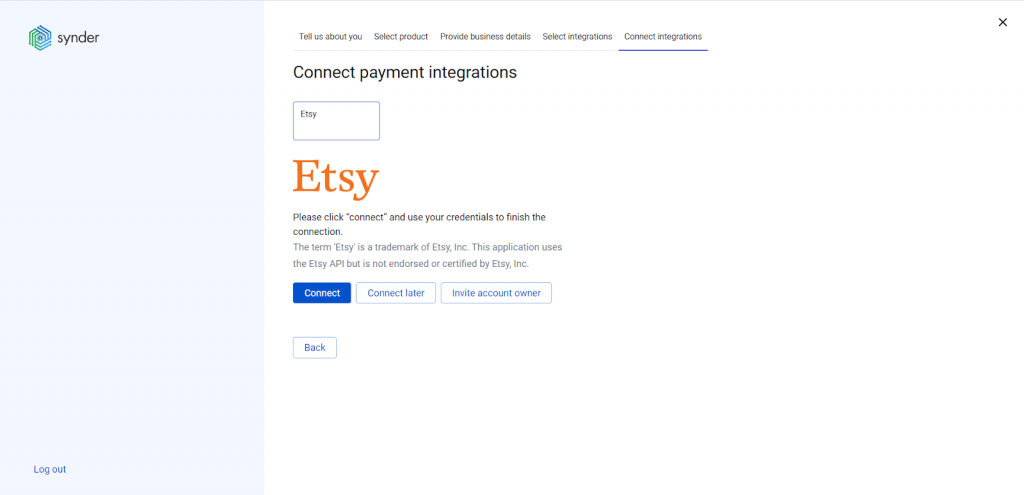

6. Connect platforms

You’re almost done! Simply click the “Connect” button (if you’re an admin) or “Invite” to send the link to the Etsy business owner (if you’re an accountant or a bookkeeper).

To complete the Etsy and QuickBooks integration setup, choose a payout account (usually your Checking account) that’ll prepare your books for the reconciliation process.

Once both Etsy and QuickBooks accounts are connected, Synder will complete the setup and begin syncing the latest orders and transactions from Etsy to your accounting records.

If you already have a Synder account and want to add Etsy, check out Synder’s integration guide on how to connect Etsy to an already existing account.

Your Synder account is now set up to synchronize your Etsy data. Remember, it’s important to customize your Synder account to fit your specific requirements, so ensure that all crucial accounting and bookkeeping features are activated in the settings.

Key features of the QuickBooks Etsy integration via Synder

Instant synchronization and historical data import

Receive immediate records of your ongoing Etsy sales directly in QuickBooks as they occur, ensuring a real-time overview of your financial situation. Synder captures every detail relevant to your bookkeeping and accounting, ensuring that final reports include all income and expense transaction details except for customer emails (due to Etsy API). Etsy’s data recording in QuickBooks is based on the synchronization mode you select during the onboarding process: Per Transaction or Daily Summary.

For capturing extra financial details from transactions processed through a payment platform other than Etsy Payments, you need to link each specific payment platform with Synder. This connection enables Synder to identify and accurately record all the transactions relevant to your Etsy business.

Note: Synder records fees and VAT details from Etsy as separate transactions in your QuickBooks account, so they’ll show up as separate transactions.

Error-free multi-channel reconciliation

Review all transactions recorded in QuickBooks from every platform connected to Synder, including sales channels (Etsy or any other) and payment gateways. This step simplifies the upcoming reconciliation process. Whenever a payout from a payment platform is recorded, it’s automatically reflected in your QuickBooks account under the ‘Bank feeds‘ tab. By matching payouts with actual transactions, Synder helps minimize discrepancies, aiming for a zero balance difference during the actual reconciliation process.

FYI: Payouts won’t duplicate your bank feed records.

Automated categorization and classification

For QuickBooks and Etsy integration, Synder offers a feature to create custom rules for streamlining tasks like categorizing Etsy products, assigning classes and locations, sending reminders, and filling out missing data. The software will automatically apply these rules to new transactions after setting up and activating them. All you need to do is to select a particular trigger that initiates an action set during the setup.

Such rules will be helpful for product classification by name or for income/expense tracking per platform. Synder also provides pre-designed templates for the Etsy and QuickBooks connection, which you can use as they are or modify them to create your own.

Inventory tracking

Reduce the risk of overstocking or running out of inventory by integrating Etsy and QuickBooks. Synder pulls product details and their corresponding SKUs from the Etsy store and logs them in QuickBooks Online. With the correct setup, the software categorizes revenue according to the product income accounts specified in your records. Items with identical SKUs in both Etsy and QuickBooks are automatically recognized as the same product, ensuring accurate inventory management. If the SKUs differ, you can optimize the recording process with the help of the product mapping feature.

Multicurrency management

Integrate Etsy with QuickBooks via Synder Sync to ensure all payments are synchronized with precise exchange rates. Synder records transactions from the connected platforms in their original currency right into your QuickBooks Online account. These amounts are then converted into your preferred home currency using the exchange rates from Etsy or the payment platform through which the payment was made.

It’s recommended to link all your active business channels together with Etsy to Synder to achieve thorough and accurate financial reporting.

Sync rollback

If you’re not satisfied with the synchronization results in your QuickBooks Online account, you can undo the syncs without causing any harm to your accounting data. Once the Etsy record is removed, you can update the settings or implement an automated categorization rule before resyncing the corrected data back into your QuickBooks Online account. The rollback can be performed either on a per transaction or in bulk, depending on your needs.

Note: Rollback doesn’t reinstate the number of syncs available.

Wrapping up

The integration of Etsy with QuickBooks Online, facilitated by Synder, streamlines the process of accounting and financial management, making it more efficient and less prone to errors. Synder’s role in this ecosystem is invaluable, offering tools for real-time transaction recording, comprehensive Etsy data capture, and easy reconciliation. Its features cater to diverse business needs, ensuring a tailored and effective financial management experience. With the robust security and compliance measures in place, Synder further assures the safety and integrity of your financial data.

This synergy of Etsy, QuickBooks Online, and Synder creates a powerful trio for ecommerce businesses, enabling sellers to focus more on business development and spend less time on trying to comprehend the intricacies of accounting.

Etsy QuickBooks integration FAQ

Is it possible to get an instant low-stock alert?

Synder can do that. To enable this action, you’ll need to utilize the Automated Categorization feature. The rule you’ll create for the Etsy integration will monitor the quantity on hand for your products in the QuickBooks account and notify you via email once the levels are below your specified inventory threshold.

Two options are available:

Option 1

Go to Categorization Rules → Rules → Create Rule → (choosing the trigger) Sales Receipt: Created → (choosing the condition) IF: Line Product or Service → less (enter the amount you need) → Yes → (choosing the action) THEN: Email → Inventory for [product name] went down → [Product name] went down. Please, repurchase.

This will tell Synder that an email should be sent to the company owner with any text you specify in your condition.

Note: The Rule will be activated once a sales receipt is created.

Option 2

You can use a Synder template and edit it so it suits your needs.

Go to Categorization Rules → Templates → Inventory → Alert inventory goes down in Sales Receipt → Try it out.

Check out a detailed Synder guide to learn more – How To Get Instant Low Stock Alerts.

Can I add more platforms to Synder?

Yes. In addition to an Etsy account, you can also connect other ecommerce platforms, such as eBay, Shopify, Amazon, etc, to Synder. Keep in mind that it’s recommended to connect both ecommerce platforms and payment gateways so Synder Sync is able to recognize all transactions and record them into your QuickBooks account.