Due diligence is akin to a comprehensive health check of a potential investment or product. It is a systematic process, going beyond just a cursory glance, to dive deep into the details, uncovering all relevant facts and figures. This crucial practice incorporates an exhaustive review of all financial records, an assessment of every material aspect, and a thorough analysis of any additional elements considered pertinent to the situation.

In its essence, due diligence is a safety net woven by prospective buyers, investors, or partners to ensure they fully understand the opportunities and risks associated with a potential agreement or financial transaction. This process not only enlightens them about the current status and health of the entity in question but also unveils its history, future prospects, and any hidden aspects that may impact its value or viability.

Think of due diligence as detective work that aims to safeguard your interests by providing a solid foundation for informed decision-making. By conducting this in-depth exploration, you can negotiate from a position of strength, uncover potential red flags, and ultimately, mitigate financial and legal risks.

In this article, we’ll traverse the wide terrain of due diligence, exploring its different aspects and nuances. We’ll delve into various types of due diligence, and uncover the steps involved in the process and due diligence check list businesses have to follow. We’ll also look at common mistakes to avoid during due diligence and tools and resources that can assist in carrying out an effective investigation. This comprehensive exploration aims to equip you with the knowledge and insights to protect your investments and make confident, well-informed decisions. Let’s embark on this journey of discovery.

Understanding due diligence

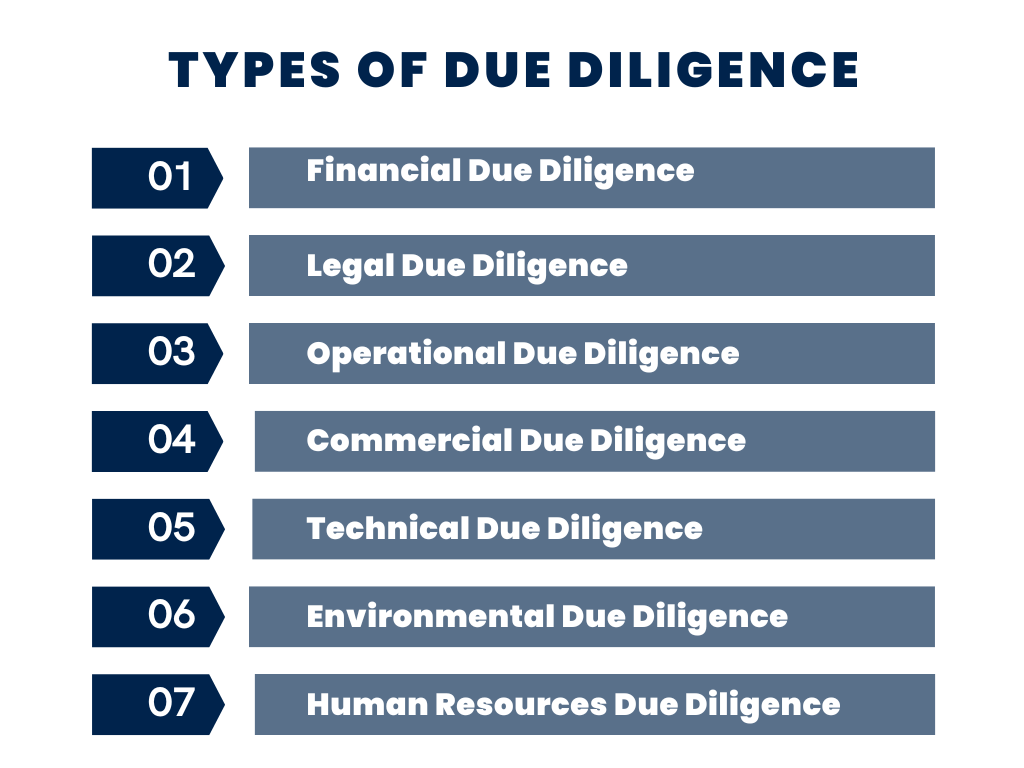

Due diligence comes in several forms, each of which is applied in different contexts and serve different purposes. Here are the main types.

Financial due diligence

This form of due diligence involves a thorough review of a company’s financials, including assets, liabilities, revenue streams, and expenses. Financial due diligence seeks to validate the financial health and stability of a business or investment.

Legal due diligence

This involves an examination of all legal matters pertaining to a company. This includes things like the verification of business licenses and permits, analysis of contractual obligations and rights, verification of intellectual property rights, and checks for ongoing or potential legal disputes.

Operational due diligence

This type focuses on the operational aspects of a business, including day-to-day operations, resources, client relationships, suppliers, and production processes.

Commercial due diligence

This involves examining a company’s position within its industry and market. It includes things like analysis of competition, assessment of market trends, and scrutiny of the target company’s business model and strategic plans.

Technical due diligence

In industries like technology or manufacturing, technical due diligence can be crucial. This process involves reviewing the technological capabilities and capacities of a company. It could include validation of proprietary technology, examination of research and development processes, and assessment of IT systems.

Environmental due diligence

Particularly important in sectors like manufacturing, oil and gas, or chemicals, environmental due diligence involves investigating a company’s environmental compliance. This can involve checking adherence to environmental laws and regulations, assessment of potential environmental risks and liabilities, and inspection of waste disposal and management practices.

Human resources due diligence

This form of due diligence reviews aspects related to a company’s workforce. It covers areas such as employment contracts, employee benefits, labor disputes, and organizational structure.

The type of due diligence performed will depend on the nature of the transaction and the industry in which the business operates. In many cases, multiple forms of due diligence will be conducted in concert to ensure a comprehensive review.

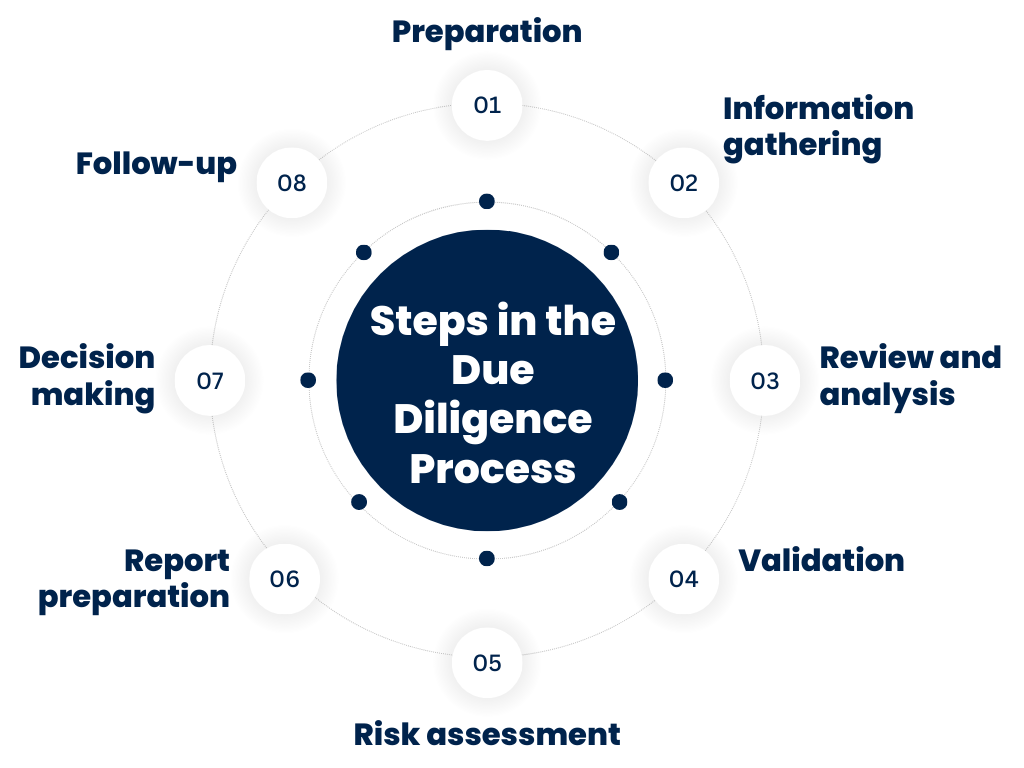

Steps in the due diligence process

The process of due diligence can be broken down into several key steps. These steps can vary depending on the specific context and type of due diligence being conducted, but the general framework often includes the following:

Step 1. Preparation

Before the due diligence process begins, it is important to clearly define the purpose and scope of the investigation. This involves determining which areas of the business will be examined, what information will be needed, and what resources will be required.

Step 2. Information gathering

The next step is to gather all relevant information. This typically involves requesting documents from the company being examined and conducting independent research. The information gathered will usually cover areas such as the company’s financials, legal status, operations, and market position.

Step 3. Review and analysis

Once the necessary information has been gathered, it is time to review and analyze it. This can involve looking for inconsistencies in financial reports, checking for potential legal issues, evaluating the company’s performance and strategy, and assessing its position within the market.

Step 4. Validation

This step involves verifying the information that has been gathered and analyzed. This can be achieved by cross-referencing documents, conducting interviews, or using third-party resources to corroborate the findings.

Step 5. Risk assessment

After the validation, a risk assessment is carried out. This step identifies potential risks that could impact the investment or transaction, whether they are financial, legal, operational, or market-related.

Step 6. Report preparation

The findings from the due diligence process are then compiled into a comprehensive report. This report should clearly outline the findings, including any potential risks, and provide an objective analysis of the company’s situation.

Step 7. Decision making

Once the report is complete, it can be used to inform the decision-making process. This could involve deciding whether to proceed with a transaction, negotiating the terms of a deal, or identifying areas where the company could improve its performance.

Step 8. Follow-up

In some cases, due diligence doesn’t end with a decision. Follow-up actions might be necessary, such as ongoing monitoring or additional investigations if new information comes to light.

By following these steps, businesses and investors can ensure they have a thorough understanding of a company’s situation before they make any significant decisions.

The due diligence checklist

For simplicity, we’ll focus on three major types of due diligence: legal, financial and operational. The specific elements of a due diligence checklist may vary depending on the nature of the transaction. However, they generally fall into three categories:

Legal due diligence checklist

Legal due diligence is a comprehensive appraisal of a business from the legal perspective. It’s done primarily when a business transaction is being contemplated like mergers and acquisitions. Here is a broad checklist that covers most of the legal aspects that need to be considered:

1. Corporate records

- Review the Certificate of Incorporation and Articles of Association.

- Review the minute books, bylaws, and shareholder agreements.

- Check the history of corporate filings and ensure they are up to date.

2. Intellectual property

- Identify and review all owned or licensed intellectual property including patents, trademarks, trade names, copyrights, and proprietary technology.

- Confirm the business owns or has the rights to use all intellectual property necessary for its operations.

3. Material contracts

- Review all material contracts of the company such as leases, supply agreements, distribution agreements, and customer contracts.

- Check for any potential breach of contracts.

4. Legal compliance

- Confirm compliance with all local, state, and federal laws and regulations applicable to the company.

- Review any documentation related to regulatory compliance, inspections, or audits.

5. Litigation and disputes

- Determine whether the company is involved in any ongoing or potential litigation or disputes.

- Review the details, status, and potential implications of any such matters.

6. Employment agreements and policies

- Review employment agreements, employee handbooks, and company policies.

- Check compliance with employment laws, including wage and hour laws, and health and safety regulations.

7. Real estate and property

- If applicable, review any owned or leased real estate and related agreements.

- Check the status of the title deeds and any encumbrances on the property.

8. Environmental issues

- If applicable, assess compliance with environmental regulations.

- Determine if the company holds any liabilities for environmental issues.

9. Taxes

- Review the company’s tax filings and payments to ensure compliance with all applicable tax laws.

- Identify any ongoing or potential tax disputes or issues.

Remember, the exact nature of legal due diligence will depend on the specific transaction and jurisdiction, so this list may not be exhaustive and should be adapted as needed. It’s always recommended to engage a legal professional to assist in the due diligence process to ensure that all relevant legal aspects are adequately covered.

Financial due diligence checklist

Financial due diligence involves a thorough examination of the financial health of a company. Once again, this is particularly crucial during a merger, acquisition, or investment scenario. Here’s a basic checklist:

1. Financial statements

- Review the past three to five years of income statements, balance sheets, and cash flow statements.

- Check consistency and accuracy of the financial reports.

2. Audit and internal control reports

- Review any audited financial statements and auditor’s reports.

- Evaluate the company’s internal control systems.

3. Revenue and expenses

- Review the sources of revenue and the major expenses.

- Look for trends, fluctuations, and any inconsistencies over the years.

4. Profit margins

- Review the profit margins over the years.

- Analyze gross, operating, and net margins for consistency and trends.

5. Tax returns and liabilities

- Review tax returns from the past few years.

- Confirm the company is in good standing with tax authorities and has no outstanding tax liabilities.

6. Accounts receivable and payable

- Analyze your receivables and payables.

- Evaluate the company’s credit control policies and its effectiveness.

7. Inventory

- If applicable, assess the value of inventory and the inventory turnover rate.

- Check for any obsolete or slow-moving inventory.

8. Debt and equity structure

- Understand the company’s capital structure – its mix of debt and equity.

- Review all outstanding loans, interest rates, repayment schedules, and covenants.

9. Financial projections

- Review the company’s financial forecasts and the assumptions used.

- Understand the company’s growth plan and evaluate its feasibility.

10. Investments and assets

- Review the valuation of significant assets and investments.

- Understand the depreciation and amortization methods used.

It’s important to note that while this checklist provides a comprehensive overview of what financial due diligence might entail, each company’s situation is unique, and the scope of the review may vary accordingly. Professional advice from accountants or financial advisors is often invaluable during this process.

Read our article about financial due diligence and customer due diligence to learn more details.

Operational due diligence checklist

Operational due diligence involves an in-depth examination of the day-to-day operations of a company. This process helps identify potential operational risks and inefficiencies. Here’s a basic checklist for operational due diligence:

1. Business model

- Understand and evaluate the company’s business model.

- Identify the key drivers of the business and assess their viability.

2. Management and employees

- Evaluate the experience and competence of the management team.

- Review the company’s organizational structure.

- Understand the company’s employee dynamics, including turnover rates, compensation, and benefits.

3. Operations and production

- Review the company’s operational processes and efficiency.

- If applicable, evaluate the production processes, capacity, and any potential bottlenecks.

4. Supply chain

- Assess the company’s procurement process and relationships with suppliers.

- Understand any dependencies on key suppliers and the associated risks.

5. Customer analysis

- Identify the company’s key customers and understand their relationship.

- Evaluate the customer acquisition and retention strategies.

6. Product and services

- Review the company’s products or services for quality and marketability.

- Understand the process of product development and lifecycle.

7. Market position and competition

- Understand the company’s position in the market.

- Analyze the competitive landscape and the company’s competitive advantages.

8. Facilities and equipment

- Evaluate the condition of the company’s physical assets, including buildings, facilities, and equipment.

- Understand the maintenance and replacement schedules and related costs.

9. IT systems

- Evaluate the company’s information technology infrastructure.

- Understand the company’s data management systems and their reliability.

10. Regulatory compliance

- Check the company’s compliance with relevant industry-specific regulations.

- Evaluate the company’s health and safety record and procedures.

As always, this checklist should be customized to suit the specific needs and nature of the business being investigated. This operational due diligence is often best conducted with the assistance of professionals who have experience in the industry.

Due diligence tools and resources a business might consider

Due diligence can be streamlined and made more effective by leveraging a host of contemporary tools and resources. These instrumental aids range from virtual data rooms to social media monitoring tools. Let’s explore some of these essential tools and resources that can enhance your due diligence process.

Virtual data rooms

In the digital age, Virtual Data Rooms (VDRs) have become an indispensable tool for secure and organized data sharing. During transactions like mergers or acquisitions, a VDR provides a secure platform where sensitive documents can be systematically shared and accessed, ensuring smooth, secure, and efficient communication between parties.

Financial analysis tools

When it comes to the assessment of financial health, financial analysis tools are pivotal. Software like Excel or QuickBooks can simplify data analysis and generate comprehensive financial reports. For more complex data sets, advanced tools like Tableau or Looker can be used to develop detailed and interactive financial reports.

If you want to make sure the bookkeeping side of your or your client’s business is ready for due diligence, you’d want to have a reliable accounting solution like Synder.

Synder is a powerful accounting tool designed for ecommerce and SaaS businesses that simplifies the due diligence process by ensuring accurate financial records from the start. It serves as a comprehensive solution for businesses and accounting professionals, regardless of whether they’re starting from scratch or improving existing books.

The platform offers Synder Sync, which records all data from sales channels and payment gateways in the accounting system, with no cap on historical data import. The Roll Back function allows safe deletion and resynchronization of faulty transactions.

Synder provides two modes for data synchronization to suit different business needs: the Per Transaction Sync for detailed transaction records and the Daily Summary Sync for summarized transactions. These modes ensure a balance between data detail and system efficiency.

The tool also guarantees accurate P&L statements and Balance Sheets, reflecting the true financial health of a business. With all transactions duly recorded, including fees, financial reports remain up-to-date, and the accrual-based accounting system is ready for due diligence.

Want to give Synder a try? Check out the tool’s functionality by signing up for a 15-day free trial, or book a seat at our webinar. Streamline your accounting processess and enable businesses to tackle due diligence with readiness and confidence.

Project management software

Efficient management of due diligence can be ensured by using project management tools. Platforms like Trello, Asana, or Jira, with their issue tracking and story points, help keep track of tasks, progress, and deadlines, facilitating streamlined project management and enhancing collaboration among teams.

Legal research platforms

Legal research is an integral part of due diligence, and resources like Westlaw or LexisNexis offer invaluable help. These platforms provide comprehensive access to case law, statutes, regulations, and other legal resources, facilitating a thorough legal review.

Industry research databases

Insight into the industry landscape can be obtained using databases like Statista, IBISWorld, or Bloomberg. These resources provide crucial industry data, market research, and insights that can inform the due diligence process.

Public records and government databases

Public records and government databases are essential resources for various aspects of due diligence. These include patent databases, corporate registries, property records, and court records, all of which can provide valuable information about the company under review.

Company’s internal resources

The internal resources of the company undergoing due diligence, including financial statements, HR records, contracts, corporate bylaws, and more, form the backbone of the due diligence process. These documents provide a detailed insight into the company’s status and performance.

Customer relationship management systems

CRM tools like Salesforce or HubSpot offer valuable insights into a company’s customer base and sales operations. These can shed light on the company’s market presence, customer relationships, and revenue streams.

Social media monitoring tools

In the era of digital reputation, social media monitoring tools like Hootsuite or Sprout Social play a crucial role. These platforms can provide insights into the company’s social media presence, customer engagement, and overall reputation.

Professional services

Last but not least, professionals like consultants, lawyers, and accountants bring their invaluable expertise to the table. Their assistance in the due diligence process can provide a more comprehensive review, ensuring a well-informed decision-making process.

All in all, the process of due diligence, while complex, can be made more efficient and effective by using the right mix of tools and resources. By leveraging these resources, businesses can ensure they have a thorough understanding of the situation before making significant decisions. For entrepreneurs looking for financial resources and support, PayPal offers a range of funding options and guidance, called PayPal funding.

Mistakes to avoid in the due diligence process

Conducting due diligence is a critical step in any business transaction, but the process can be fraught with potential pitfalls. When carried out correctly, due diligence can illuminate valuable insights into a company’s operations, financial health, and market position. However, errors made during this process can lead to missed opportunities, or worse, unanticipated challenges down the line. Let’s dive into our list of some common mistakes and explore how to avoid them.

The pitfall of poor planning

Every successful due diligence process begins with a robust plan. Jumping into the process without a clear strategy, timeline, and allocation of resources can lead to an ineffective review and missed key details. Therefore, meticulous planning should be your first step towards efficient due diligence.

The misstep of a homogeneous team

Assembling a team with diverse skills and expertise is crucial in achieving a comprehensive understanding of the situation. An effective due diligence team needs members with varied backgrounds, including legal, financial, and operational expertise. Neglecting this diversity can result in an incomplete and skewed assessment.

The error of overlooking small details

In the world of due diligence, no detail is too small. Focusing solely on high-level information and ignoring the fine print can potentially lead to overlooking significant issues. Remember, devil’s often in the details!

The slip-up of ignoring non-financial factors

While financial health is a key component of any due diligence process, it shouldn’t overshadow non-financial factors. Aspects like company culture, customer satisfaction, and environmental impact play a critical role in assessing a company’s overall health and long-term sustainability.

The blunder of unverified information

Accepting information at face value is a cardinal sin in due diligence. Every piece of data, claim, or statement should be meticulously verified using multiple sources to ensure its authenticity and accuracy.

The oversight of overemphasis on the past

Historical data, while important, is only one part of the picture. The due diligence process should also account for the company’s future prospects by examining its strategic plans, emerging market trends, and potential future risks and opportunities.

The folly of rushing through

Due diligence is a time-consuming process and rushing it can result in missed information or incorrect conclusions. It’s essential to take the time needed to ensure a thorough review.

The snare of neglecting post-agreement due diligence

The end of an agreement does not signify the end of due diligence. Conducting post-agreement due diligence can ensure a smooth transition and help identify any issues that may arise during the integration process.

The trap of ignoring red flags

Ignoring red flags during due diligence can be a costly mistake. Any potential warning signs or anomalies should be investigated thoroughly, as they may signal significant underlying issues.

Avoiding these common mistakes can significantly enhance the effectiveness of the due diligence process, helping businesses make informed decisions and avoid potential pitfalls. Remember, due diligence, when done right, can be the key to unlocking a successful business transaction.

Conclusion

As we come to the conclusion of our exploration into due diligence, it is abundantly clear that due diligence isn’t merely an optional step, but rather a fundamental requirement in any business transaction or investment decision. It forms the sturdy bedrock on which robust business decisions are grounded, and its significance can never be overstated.

Conducting a meticulous due diligence process empowers businesses to probe every element of a potential investment. This investigation extends into examining the financial stability, operational efficiency, legal standing, and future opportunities and risks associated with the investment. Through this exhaustive review, businesses can create a holistic image of the current state of affairs and forecast the future.

In turn, this process not only serves as a safeguard against potential risks but also equips businesses with the power to make well-informed decisions. It aids them in accurately determining the true worth of the opportunity at hand, enhancing their negotiating power, and formulating robust future strategies. All these factors contribute to protecting their investments, maximizing their potential returns, and securing their long-term success.

One key tool that should be underscored here is the due diligence checklist. This instrument is invaluable in organizing and ensuring a comprehensive due diligence process. It provides a systematic way to cover all necessary bases, preventing any crucial aspect from being overlooked. It’s much more than a simple to-do list; it’s a roadmap that guides the due diligence process, ensuring every potential risk and opportunity is thoroughly examined.

.png)