Have you ever found something amazing on Amazon but hesitated to make a big purchase, wishing you could spread the cost over time because paying all at once seems too much? Well, it’s high time to get yourself acquainted with Buy Now, Pay Later services like Afterpay that are revolutionizing the way people shop online.

With Afterpay’s growing popularity, many people are asking, “Does Amazon accept Afterpay?” And for merchants, a key concern is, “How can I track Amazon and Afterpay cash flow together?“

In this comprehensive guide, we’ll delve deeper to answer the above questions and explore how Afterpay’s service integrates with stores like Amazon.

Key takeaways:

- Afterpay is an app that lets customers buy now and pay later by splitting the total cost into four equal payments.

- Customers have two ways: use Afterpay’s single-use payment option or buy an Amazon gift card with Afterpay.

- Accounting software solutions such as Synder Sync help merchants easily manage and synchronize their Amazon and Afterpay financial data.

Contents:

1. Afterpay overview for both customers and sellers

2. How to use Afterpay on Amazon: Is it possible?

3. Merchants’ corner: How to integrate your Amazon and Afterpay’s data

4. FAQs

Afterpay overview for both customers and sellers

Before diving deeper into the topic, let’s quickly explore Afterpay to understand the fuss around it.

Afterpay is an innovative Buy Now, Pay Later service, meaning the customer can purchase something immediately and pay for it over time in four equal installments. No interest, additional fees, or the full amount upfront.

The first installment is paid right away when you make the purchase. The next three payments are spread out over the next six weeks (i.e. the customer makes a payment every two weeks). This way, customers don’t have to pay for everything at once.

For example, if a customer wants to buy a mattress that costs $432, Afterpay will split the payments into four installments, so the customer will need to pay $144 every two weeks.

Note: For now, Afterpay is available in the U.S., Canada, the U.K., Australia, and New Zealand only.

What are the benefits of Afterpay?

The possibility of splitting the total price into four equal installments already sounds tempting to customers, but that’s just the beginning of the Afterpay benefits. In fact, this payment platform provides advantages to both buyers and sellers.

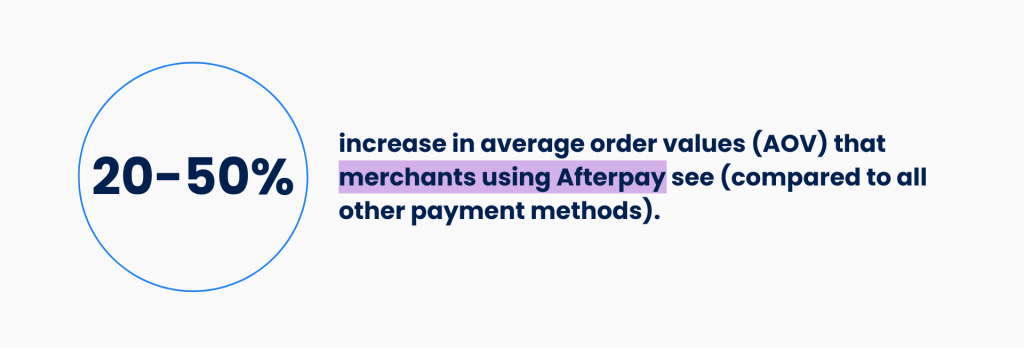

Source: Afterpay

Even though it’s obvious that higher customer satisfaction increases the likelihood of repeat purchases from an online store, let’s explore more reasons why sellers should consider adding Afterpay to their payment options across their sales channels.

| Afterpay benefits for customers | Afterpay benefits for sellers |

| The possibility of paying for the order in 4 smaller installments over time | Increased purchases since customers don’t pay upfront |

| Instant approval process* | Attracting younger shoppers due to Afterpay’s flexibility |

| Automatic deductions from a bank account on the days the payments are due | Reducing cart abandonment |

| Afterpay doesn’t charge any interest | Getting the full payment right away |

*When you, as a customer, choose Afterpay, the system quickly checks your eligibility by reviewing your past payments with Afterpay and your current spending. This isn’t a traditional credit check but a soft inquiry performed by top ecommerce shopping cart software, which won’t affect your credit score.

Note: If, for some reason, a payment doesn’t go through, Afterpay won’t immediately charge you any extra fees. There’s a grace period provided, and if the payment is still not made after that, a late fee may be applied.

How to use Afterpay on Amazon: Is it possible?

If the question is “Does Amazon accept Afterpay?“, then the quick answer is NO. Amazon doesn’t take Afterpay as a direct payment method, nor does it allow the use of Afterpay for purchases made on its website.

However, if we rephrase the question a little, making it “Is it possible to pay with Afterpay on Amazon?” – then the answer will be YES. There’s a workaround – it’s possible to pay with Afterpay when shopping on Amazon through the Afterpay app.

Simply saying, you can’t pay with Afterpay on Amazon, but you can shop on Amazon with the Afterpay app.

You’ve got two options here:

While the first option means paying for the Amazon products cart directly, the second one, obviously, means buying a gift card, which can then be used to purchase on Amazon. Now, it’s time to discover how both of them work.

1. Single-use payment option: Using Afterpay’s single-use virtual card

⭐️ Note that for this option, the shopping and purchase should be processed through the Afterpay app platform, not through Amazon. If you go directly to Amazon, you won’t be able to avail of this Buy Now, Pay Later option with Afterpay.

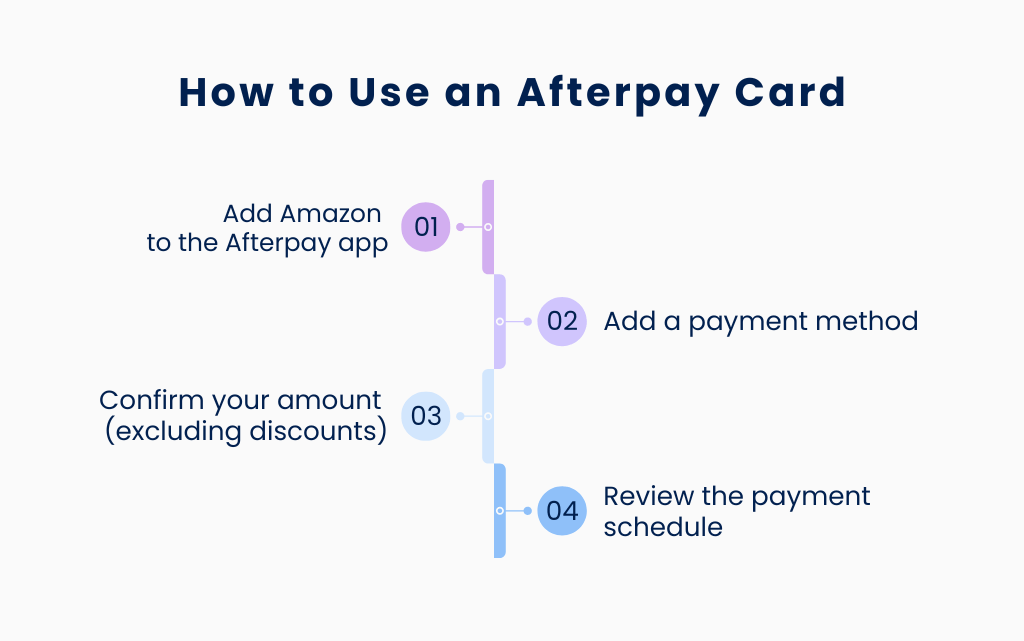

Afterpay offers a single-use virtual card that can be utilized just like a regular debit or credit card to make your purchase on Amazon. The process is quite simple, and Amazon accepts this Afterpay card without any issues. Want to know the steps?

Step 1. Add Amazon to the Afterpay app

Open your Afterpay app and navigate to “My accounts” → “Link new account.” Choose Amazon from the list of available retailers and enter your Amazon login details. Once your Amazon account is connected, you can browse through the available products and add your chosen items to cart.

Step 2. Add a payment method

When you reach the checkout page, click on “Add a payment method” and pick “Add a credit or debit card.” Afterpay will automatically fill out the credit card fields, allowing you to place your order.

After that, you can click “Buy now. Pay later” button and proceed with your payment.

Note: Make sure to untick the “Set as default payment method” box as this is a single-use payment option. If you don’t, Amazon will attempt to charge future orders to the same card, which will be declined since it’s an Afterpay single-use card.

Step 3. Confirm your amount (excluding discounts)

In this step, Afterpay will show you the final amount, including shipping fees and tax. The hardest steps are completed, so there’ll be nothing extra from now on.

Step 4. Review the payment schedule and complete your order

Afterpay will automatically split the payment into 4 installments, showing you the amounts together with the due dates for each. If everything is ok, you can confirm. After that, the first amount will be withdrawn from the Afterpay card.

And that’ll be it. Now you’ll only need to stick to the schedule Afterpay created.

2. Gift card option: Buying a gift card from the Afterpay website

Another excellent payment opportunity and a workaround to use Afterpay on Amazon is a gift card. Amazon allows customers to pay with gift cards, which can be purchased using Afterpay.

This is how to do this:

- Visit the Afterpay website and navigate to the dedicated Amazon page. There, you can select an Amazon gift card worth between $5 and $500 (by the way, you can purchase multiple cards if needed).

- Head to Amazon and proceed to shop as usual.

- At the checkout page, choose “Enter a gift card or promotional code” under the payment method and use your gift card’s details to pay.

As you can see, although the Afterpay payment process isn’t offered on the Amazon website or at the checkout, these clever workarounds still allow you to use the Afterpay service and get the products you need without paying a substantial sum upfront.

→ Learn how to redeem Amazon gift cards.

Merchants’ corner: How to integrate your Amazon and Afterpay’s data

If you’re a seller operating on one or many marketplaces and want to give your customers wider payment options, handling such complex data manually using Excel can become an issue. So why not automate the process of recording your sales and transactions with a smart accounting software solution – Synder Sync?

With Synder Sync, you can manage sales and payments across all platforms, whether it’s Afterpay, Amazon, or any of the 30+ platforms Synder supports, in a single source of truth. Simply connect all your business units, including your accounting software, to Synder and start recording.

Good news: On a 15-day free trial, Synder offers a 1-month historical data import, allowing you to test the workflow with real sales data without waiting for new sales.

Wondering how this integration can benefit your business? Here are some of the key advantages of using Synder:

- Automated synchronization to the accounting software (QuickBooks, Xero, or Sage Intacct);

- Withheld tax tracking;

- Detailed transactions breakdown;

- Preparation for an error-free reconciliation;

- Multi-currency support;

- Categorization, product mapping, and more.

Most importantly, Synder can save 40+ hours on your monthly bookkeeping tasks!

Book a seat at our Weekly Public Demo to learn more about the possibilities of Amazon and Afterpay integration, or sign up for a 15-day free trial to explore all the features first-hand.

Shopping with Afterpay: Conclusion

While Amazon doesn’t directly integrate with Afterpay, the workarounds discussed in this guide allow customers to enjoy the flexibility and convenience that Afterpay offers. Additionally, sellers can boost their sales by providing Afterpay as a payment option. For now, two options are available: customers can either use a virtual Afterpay card for a single payment or purchase an Amazon gift card with Afterpay.

More and more people prefer this payment option, which allows them to split their payments into more manageable pieces. As a result, numerous retailers and big brands are striving to offer Afterpay as one of the supported payment methods for their customers. So, next time you shop on Amazon, remember these handy tips and make the most of your Afterpay experience.

Share your experience

Have you tried using a single-use Afterpay card when shopping on Amazon? Or are you an Amazon seller searching for a way to track Afterpay purchases alongside Amazon sales in your accounting system? Share your story and experience with Afterpay and Amazon in the comments below!

FAQs

How long does it take to pay the total cost with Afterpay?

Afterpay splits the Amazon purchase into four equal payments, due every two weeks. Before confirming the order, Afterpay will show the exact amount for each payment and their due dates. The first payment is withdrawn from the Afterpay card immediately.

→ Learn what will happen if you don’t pay Afterpay at all.

Will I be charged interest?

No. If paid on time, Afterpay doesn’t charge any interest, fees, or upfront costs on Amazon purchases. You only pay the total purchase cost of your Amazon order.

How do returns and refunds work with Afterpay?

If you need to return an Amazon’s order purchased with an Afterpay card, simply follow the standard Amazon return process. Once Amazon processes your return, it’ll refund Afterpay the total amount of the order, and your remaining Afterpay payments will be canceled.

Can I purchase with an Afterpay single-use card on other platforms?

Yes. Just like with Amazon, you can use an Afterpay single-use card on other sales channels. Simply browse through the available merchants in the “In-App Only” section of the Afterpay app. Once you find something you like, you can proceed with the purchase just as you would with an Amazon’s order. Afterpay will generate a single-use payment card for that specific transaction and schedule the split payments.

Does Amazon accept Affirm?

Yes. Amazon does accept Affirm as a payment option. Through the partnership between Amazon and Affirm, customers can split the total cost of their purchases into manageable monthly payments for orders of $50 or more.

However, you can only use Amazon Pay with Affirm to pay for purchases shipped to a U.S. address.

Why doesn’t Amazon accept Afterpay?

Amazon doesn’t provide Afterpay as a payment method because they have their own payment options and partnerships in place. Additionally, integrating a BNPL service like Afterpay may not align with Amazon’s current business model or payment processing systems.

%20(1).png)

How to get a one time after pay card?

Hi Ellen, Afterpay Single-Use Payment allows you to shop at specific online stores via the Afterpay app, so once you have your app open, you can shop from there and pay with this method at the checkout. The app will automatically fill in the payment details. After confirming, the down payment will be issued, and the rest will be split into payments over 6 weeks which you can manage directly in your Afterpay account. If you would like to learn more about the eligibility or other aspects related to this payment method, it’s best to contact the Afterpay support team.

Afterpay took the first initial payment but Amazon is showing revision needed . When I call amazon they say they haven’t been able to get they payment they ran the one time card 7 times declined every time. After pay had no problem taking the money and setting up payment dates but has not paid Amazon. I have no products I ordered yet after pay has my money .

We’re saddened to hear about your experience, we hope that both Amazon and Afterpay support teams will be able to resolve the matter quickly. Thank you so much for sharing.

This is a cool workaround if you could actually get to Amazon through the afterpay app but you can’t as far as I can find. Do you have links to the Amazon store through the afterpay app?

Hi Clarissa! When you open your Afterpay app, go straight to the Shop tab, and from there, select Amazon. Best of luck!

I made a purchase on amazon using the single pay card on afterpay and it shows when my order will get delivered but I’ve gotten no first payment taken out, so I’m a little confused.. will the first payment come out once the itmes have shipped?

Hi Deziree, typically, with Afterpay, the first payment is often due at the time of purchase or shortly thereafter. To get the most accurate information, I recommend checking your Afterpay account for payment details and schedules. It should give you a clear picture of when your payments are due. If there’s still confusion or if the payment details aren’t clear, reaching out to Afterpay’s customer service would be the best course of action. They can provide specific details about your transaction and clarify when your first payment will be deducted.

I have made a purchase with Afterpay on Amazon and purchased multiple items it ended up being 4 different orders and 2 of the orders didn’t process but Afterpay charged me the full amount for everything in my cart who do I get to fix this Afterpay or Amazon since it was a one time use card from Afterpay

Hi Kevin, as Synder, we’re unable to directly assist with transaction-specific issues between Afterpay and Amazon. However, in your situation, where you’ve been charged for items that weren’t processed in your order, the best course of action is to first contact Afterpay. Since the charge was made through an Afterpay one-time use card, they should be able to review the transaction details and clarify the charges. Best of luck!

All this on here works however, I see that the product I’m ordering from Amazon does not charge you shipping yet. Afterpay is charge me shipping. Why is that?

Afterpay may sometimes include an additional amount as a buffer to cover any potential tax or shipping costs that may not have been factored in at the time of checkout. Once your order is confirmed and the actual cost is determined, Afterpay will adjust the amount you’re charged, ensuring you only pay for the actual cost of your order. If you notice a discrepancy, it’s worth waiting up to 24 hours for the merchant to make any adjustments. If the issue isn’t resolved, or if you’re still being charged for shipping when you shouldn’t be, contacting Afterpay’s customer service should help clear up any confusion.

Why when checking out the Amazon total and the after pay payment total were totally different. The products purchased were on sale on Amazon but after pay made me pay full price. A difference of $60. Then they split that full price into four payments and automatically deducted the first payment out of my checking account. Once after pay paid the full amount they said that the difference of the sale price would be applied after…I don’t get how that works ? Do I have to pay all of the 4 payments then get credited the difference? Will my payment amount change? Do they keep the first payment and then apply the deduction ? IDK?? Can you answer those questions.?

Hi Michael, it seems there was a discrepancy between the sale price on Amazon and the amount Afterpay charged. Typically, Afterpay adjusts future payments if there’s a price difference after the transaction. You might not need to pay the full amount before seeing a credit; adjustments could lower your remaining payments. For the most accurate resolution, it’s best to directly contact Afterpay’s customer service. They can explain how the adjustment will be applied, whether it affects future payments or results in a refund for overpayments. Keep an eye on your account for any changes to your payment schedule.