Buy now, pay later services have become increasingly popular in recent years, making it easier for customers to purchase products without having to pay for them upfront and letting business owners expand the range of payment options available at their stores.

Afterpay and Affirm are two of the most popular buy now, pay later services on the market today. Both offer customers the option to purchase items online and pay for them in installments, but they have some key differences that both customers and business owners should be aware of.

Looking into adding BNPL to your store? Want to know which of them offers more financing options suited particularly for your needs? In this article, we’ll compare Affirm vs Afterpay, explore pros and cons of these platforms, so you can make an informed decision efficiently.

Key takeaways:

- Buy now, pay later is a payment option which allows customers to purchase products without an obligation to pay for them in full at once.

- Affirm and Afterpay are BNPL services cooperating with a large number of retailers and ecommerce giants, such as Shopify.

- Affirm offers its customers both a physical and virtual card, offers a credit line up to $2,500 per person, doesn’t charge late fees, but performs a credit check.

- Afterpay offers a credit line of up to $500 per person on a virtual card, doesn’t charge late fees and conducts a softer credit check in contrast to its competitor.

What are the buy now, pay later services?

Buy now, pay later services, or deferred-presentment credit, allow customers to purchase items and pay for them later in smaller, more manageable monthly installments.

These services have become increasingly popular over the past few years because they make it easier for people to purchase online, where many retailers require a credit card as a form of payment. For example the Federal Reserve Bank of New York conducted a survey, which showed that approximately 20% of respondents use BNPL apps in the last quarter of 2023.

What does this mean for businesses?

Buy now, pay later services are embraced by a diverse array of businesses, with ecommerce retailers in particular leveraging them to boost conversion rates, elevate average order value, and expand their customer base.

Typically, these financing options grant customers the capability to promptly finance their purchases and repay them in predetermined installments over time (weeks or months). Merchants receive the entire payment for the item upfront, with any applicable fees already deducted (similar to a credit card transaction), and are relieved of the responsibility of handling financing. The BNPL providers take over customer underwriting, installment management, and payment collection tasks, allowing merchants to concentrate on expanding their business. Not bad, right?

But with so many BNPL platforms out there, how do you make the right choice when the time comes to add this method for your business? How will they affect your bottom line?

How to choose the right BNPL option for your business

When it comes to choosing the right BNPL option to add to your store, consider what’s best in your situation. That’s why there are two questions that you need to ask yourself:

1. What’s the most appealing option for your target market?

When you’re looking at different BNPL providers, take a close look at the credit limits they offer. Make sure they match up with what your customers typically spend and the average order value of your products. It’s also a good idea to check if they have both minimum and maximum credit limits to cater to different spending habits.

But wait, there’s more. Think about where your customers are located. You’ll want to pick BNPL providers that are popular in those regions to make sure you’re offering options that they’re familiar with and likely to use. This way, you can cover more ground and appeal to a wider audience.

2. Does this option work for you from the point of view of repayment terms?

Pay attention to the installment plans and how long they last. If your business usually sees higher average order values, you might want to go for a provider that offers longer repayment periods. That way, customers can spread out their payments over several months, like paying monthly installments over six months. But if your average order values are on the lower side, you might be able to get away with fewer installments over a shorter time frame, like four payments spread over six weeks.

To answer these questions, you need a thorough comparison of the BNPL options available. Let’s have a look at two of the most popular providers to answer the question “What’s better for your business – Affirm or Afterpay?”.

Overview of Afterpay

Afterpay, which is a subsidiary of the parent company After Group, is a buy now, pay later service that lets customers purchase items now and then make interest-free repayments over the course of four weeks.

It has become one of the most popular buy now, pay later services in Australia, and it’s available in the United States, Canada, UK, and New Zealand, and is partnered with multiple ecommerce retailers, including Shopify, Macy’s and Walmart, where it’s listed as under each retailer’s payment options. The provider currently has an A+ rating from the BBB, and it has processed more than $1 billion in payments since launching in 2017. The platform is backed by Sequoia Capital, Floodgate, and GIC, and it has raised more than $150 million in funding.

Overview of Affirm

Affirm, just like the previous option, is a service that enables customers to buy items immediately and then repay the cost in either 4 interest-free payments every two weeks (with Affirm Pay in 4) or monthly installments. Note that the platform may charge interest.

Affirm operates in the USA as well as US territories, and collaborates with a broad spectrum of retailers, including Amazon, Shopify, Best Buy, Gap, J. Crew, Macy’s, and Walmart, offering its services to customers. Founded in 2014, Affirm was acquired by PayPal in 2016. It holds an almost similar A- rating from the BBB and has facilitated over $12 billion in payments since it was launched. Affirm has secured more than $250 million in funding and is supported by investors such as Sequoia Capital, Founders Fund, and Thrive Capital as well.

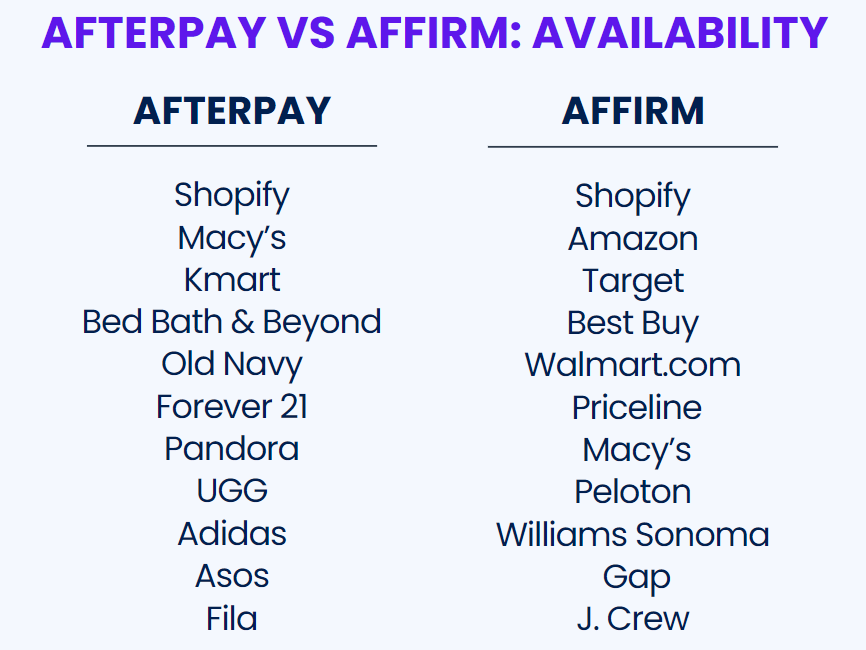

Affirm vs Afterpay: Availability and integrations

One of the first things both customers and merchants typically consider is the availability of the provider in stores. Here’s a general split for Affirm vs Afterpay:

However, as a merchant, you’re probably more interested in platform integrations with major ecommerce platforms.

Afterpay currently integrates with Shopify, Magento, WooCommerce, BigCommerce, Wix, Squarespace, Salesforce, Adyen, Ecwid, PrestoShop, etc.

Affirm boasts the following integrations: Shopify, BigCommerce, Lightspeed, Magento, WooCommerce, Wix, Cardinal Commerce, CoreCommerce, Salesforce, Ultracart, etc.

See your platforms on this list? Want to simplify your accounting for these platforms and get rid of manual data entry? We’ve got you covered!

Connect your platforms (including Afterpay and Affirm) to accounting software via Synder

Synder Sync is a smart accounting software that allows merchants to automate their online sales bookkeeping.

The software features 30+ integrations at no additional cost, including Affirm and Afterpay services. What does this mean? You can connect all the platforms in use to your accounting system (QuickBooks Online/Desktop, Xero, Sage Intacct ) and enjoy peace of mind with automation of the repetitive bookkeeping tasks.

Here’s how Synder can help you streamline your activities:

- Synchronization of all payment transactions and payoffs in one place to reflect the actual money flow;

- Auto-matching of transactions for easy one-click reconciliation across multiple platforms;

- Payments categorization on accounts, classes and more;

- Great customization opportunities in case of specific flows.

Join Synder’s 15-day free trial or register for our Weekly Public Demo to view the tool in action with a specialist. Discover the power of accounting automation!

Want to know more about connecting your BNPL providers to Synder before the trial? Have a look at our guides on Afterpay and Affirm for additional info.

Affirm vs Afterpay: Key differences between the platforms

The two providers have a couple of major differences:

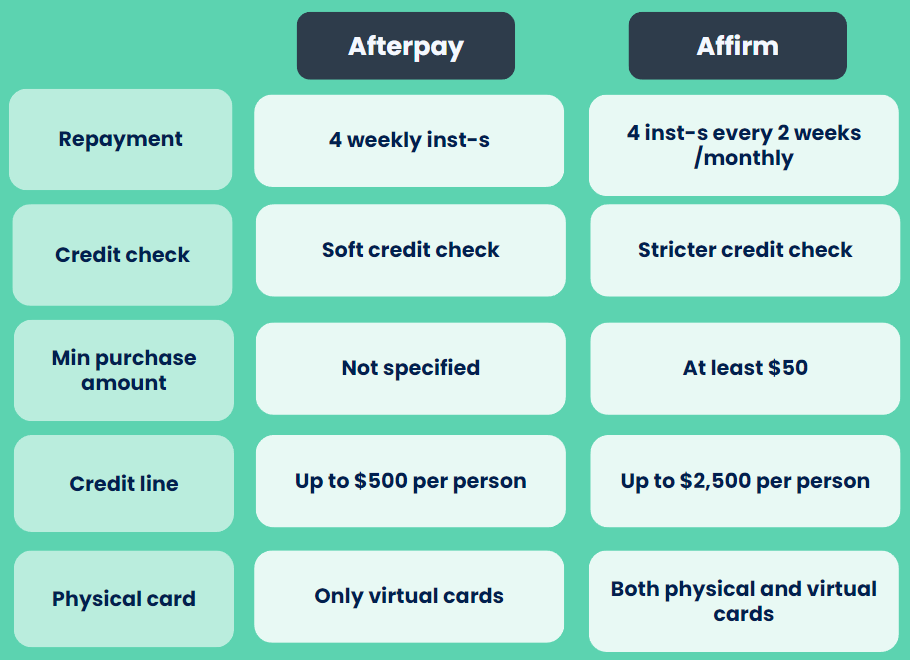

1. Repayment

With Afterpay, customers will pay off the full amount in four weekly installments, whereas with Affirm, customers will pay the full amount of their purchase in four installments every two weeks or monthly installments depending on the plan. From this point of view, Affirm offers more flexibility.

2. Credit check

Afterpay requires a soft check when they first sign up for their mobile app, and doesn’t require an income verification, making it easier for customers with limited credit to access its services.

Affirm does require customers to submit their names, Social Security numbers, and incomes to initiate the check, so it’ll be harder for customers with limited credit to get approved for Affirm.

Note that both providers may perform a hard credit check when certain actions are taken by the borrower, such as selecting specific payment options or making purchases.

What customers are usually worried about is whether the providers report them to credit bureaus. If a customer violates the terms of use, Afirm is more likely to report this information to credit bureaus and it will definitely affect their credit score.

3. Minimum purchase amount

Afterpay itself doesn’t specify a minimum purchase amount, but these requirements may be set by the retailer a customer makes a purchase from.

Affirm requires customers to purchase items that are at least $50.

4. Credit line

Afterpay offers customers a credit line of up to $500 per person, and it’s $15 per week for every $100 borrowed.

Affirm offers customers a credit line of up to $2,500 per person, and it charges $10 per month for every $100 borrowed.

5. Physical card

Afterpay offers only virtual cards in their mobile app, which customers can use at stores, but the choice is limited to the options where Google Pay or Apple Pay are accepted.

Affirm, in its turn, issues physical debit cards in addition to a virtual card in the mobile app, which is accepted by any shop.

As a merchant, you can view and evaluate these points and decide which platform satisfies your needs.

Read some additional information on using Affirm on Amazon.

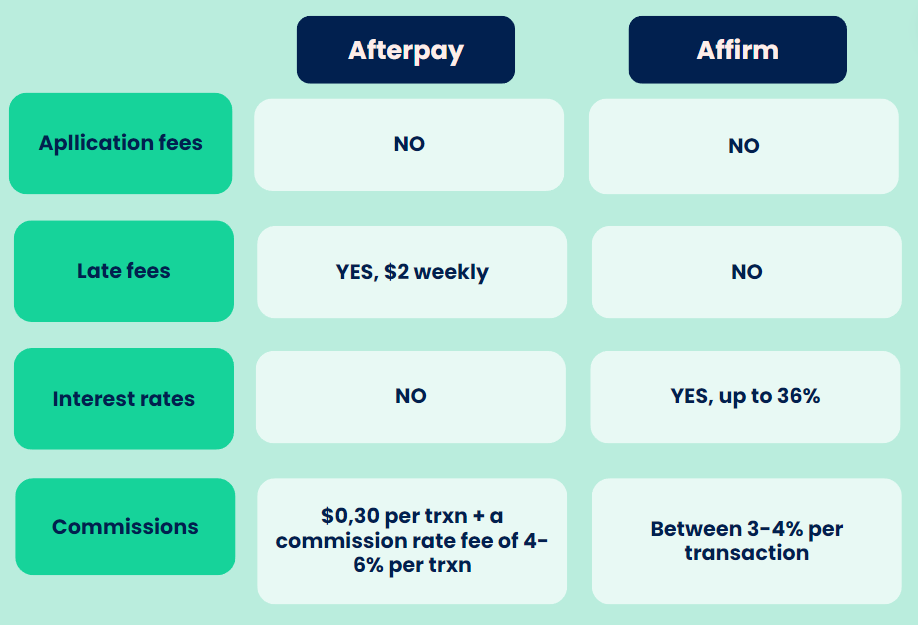

Affirm vs Afterpay: Associated fees for customers

When a customer makes a decision to use or not to use a service, they often rely on how much they’ll have to pay in fees – application fees, late fees, etc. As customer preferences directly affect how merchants select financing options for their businesses, it’s time to find out how much customers need to shell out.

- Application fees

Both platforms don’t charge an application fee. - Late fees

Afterpay charges late fees from their customers. For example, if a customer doesn’t make their payment by the due date, the platform will charge the late fees amount of $2 weekly. Affirm, in its turn, doesn’t charge any late fees at all. - Interest rates

Afterpay doesn’t charge interest, while Affirm charges interest up to 36%. - Commissions

Afterpay charges a 30-cent fee per transaction plus a commission rate fee of 4-6% per transaction, depending on the plan selected by a merchant. Affirm charges between 3-4% per transaction.

Affirm vs Afterpay: What’s best for your business?

Overall, Afterpay and Affirm are two of the most popular buy now, pay later services on the market today. Both of these services make it easier for people with less than stellar credit to purchase items online, where many retailers require a credit card as a form of payment.

As a merchant, first and foremost you need to take into account direct integrations with major ecommerce platforms. Once you make sure the BNPL provider works well with your store, you can proceed to other criteria.

While both providers offer great terms, users are more likely to go with Affirm. That’s why you should keep it in mind when choosing the BNPL option for your business. However, as we’ve already discussed, customer choice isn’t the only point of consideration for those financing options. If you feel that Afterpay’s repayment terms are more suitable, go with this provider.

Additional reads:

How to Use Afterpay on Amazon

Does Walmart Take Afterpay?

Affirm vs Afterpay: BNPL FAQs

1. What are the types of BNPL financial arrangements?

While some buy now, pay later services ask shoppers to put down a security deposit, others go without any upfront investments. Let’s look at various buy now, pay later options in more detail:

- After-sale financing

Retailers offer post-purchase financing, allowing customers to obtain a loan or credit to cover the cost of their purchase, often with fixed or promotional interest rates. It’s ideal for customers who lack immediate funds but want to acquire a product instantly and pay over time. - Installment plans

Total purchase costs are divided into fixed monthly payments over a set period, typically ranging from months to years. Retailers may offer interest-free or interest-bearing installment options, depending on the plan terms. Note that late fees often apply. - Layaway

Customers choose items for purchase but instead of taking them home immediately, they put them on hold at the store and make periodic payments until the full cost is covered. Layaway is usually interest-free, making it budget-friendly for gradual payments. - Rent-to-own

Customers lease products for a defined period with an option to buy at the lease end. Regular rental payments, with a portion going toward the purchase price, provide flexibility for owning items without a large upfront payment, popular for big-ticket items. - Deferred interest plans

Offered with credit cards or store financing, customers can delay interest payments for a promotional period. However, if the balance isn’t paid in full by the end of the promotion, interest applies from the purchase date. Clear understanding of terms and deadlines is crucial to avoid unexpected charges.

2. How can businesses benefit from offering BNPL options?

From the point of view of businesses, they might benefit from buy now, pay later financing options in several ways:

1. Receiving immediate revenue

BNPL allows businesses to receive the full payment upfront, mitigating the risk of non-payment or fraud. This immediate revenue stream can improve cash flow and financial stability. In today’s turbulent economy, that’s something lots of businesses might appreciate.

2. Reduced risk

By transferring repayment risk and fraud liability to the BNPL provider, businesses are protected from potential losses associated with customer defaults or disputes.

3. Expanded customer base

Offering BNPL options attracts a wider range of customers, including those who prefer installment payments or lack access to traditional credit cards. This inclusivity can lead to increased sales and market share.

4. Higher conversion rates

BNPL services reduce financial barriers to purchase by offering flexible payment options. This can result in higher conversion rates, as customers are more likely to complete transactions when presented with installment payment choices.

5. Increased Average Order Value

Breaking down payments into smaller installments encourages customers to make larger purchases than they might otherwise. This can lead to higher Average Order Value and increased revenue per transaction.

6. Improved customer experience

BNPL services offer a convenient and seamless checkout experience, enhancing customer satisfaction and loyalty. The streamlined payment process can contribute to positive brand perception and repeat business.

3. How does the usage of buy now, pay later services affect customer’s credit score?

Afterpay doesn’t report payment information to credit bureaus, therefore the usage of the platform won’t affect the customer’s credit score. Affirm, however, unconditionally reports the information about their first loan to Experian, and may report to other credit bureaus in the future and it may affect their customers’ credit score.

4. How do these buy now, pay later platforms perform credit checks?

Afterpay may conduct a soft credit check when a customer signs up for the first time. The platform may also conduct a hard credit check, especially if a borrower selects the Pay Monthly option when checking out. Such checks aren’t visible to other lenders. Affirm also performs soft credit checks when a borrower creates an account, but when a borrower makes a purchase, this is a reason for the platform to initiate a hard credit check. As you can see, both platforms may resort to a hard credit check. The information about the customer’s credit history may be reported to credit bureaus and may make an impact on the customers’ credit score.

5. Is it easier for a customer to get approved for a BNPL loan in comparison with a credit card?

Typically yes, it’s easier to gain a BNPL loan due to more loyal requirements and simplified customer verification process.

6. Is it possible to offer these BNPL options to customers outside the US?

Afterpay enables customers to shop online from stores in New Zealand, Canada and UK, but the merchants must participate in the “Global Shopping” program. Affirm operates with US and Canadian merchants only.

7. Can customers get refunds if they paid with Affirm or Afterpay?

Yes, both financing options can issue refunds to their customers but only if there’s a confirmation from the store. After a refund request is processed, the refund takes approximately 3-10 business days according to Affirm and Afterpay. As Affirm charges an interest rate, it’s also subject to refund.

8. Is there any fee if a customer wants to pay off their loans earlier?

Both providers allow their customers to make their payments before the scheduled due dates, and don’t charge any fees for it. Moreover, since Affirm charges interest rates, you have a chance to save money on interest by early repayment.

Share your opinion

What’s your point of view on popular BNPL options? What’s your experience of adding them to your store? Did it affect your revenue? Did it help you build strong customer relationships? Did it have additional benefits? Share your experience in the comments section below!

.png)