If you’re an e-commerce store owner in the food and beverage industry, you might have thought about how you can help your customers with payment-related issues.

So can you buy groceries with Afterpay? Yes. With a proper integration, the payments will even be accurately recorded in Xero.

A common question when it comes to payments is whether users can use the buy now, pay later service Afterpay to purchase groceries. In this article, we’ll give much-needed answers to this question so that both business owners and users can use Afterpay to their advantage.

Contents:

1. What is Afterpay, and how does it work?

2. What is Afterpay financing commonly used for?

3. How do food prices influence customers’ shop and pay habits?

4. Can customers order groceries online and pay with Afterpay?

5. Can you buy groceries with Afterpay at Walmart?

6. Is there a limited number of payments you can split your purchase into?

7. Is there an app available for making a purchase with Afterpay?

8. What happens when you miss a payment with Afterpay?

9. What other apps offer the option to shop now and pay later?

What is Afterpay, and how does it work?

Afterpay is a service that allows shoppers to make purchases and pay for them in four equal installments, interest-free. This service is available at select online retailers, and it can be used for both one-time purchases and recurring payments.

When users check out with Afterpay, they’re usually given the option to pay in four installments. The first installment is due at the time of purchase, and the remaining three installments are automatically deducted from the user’s bank account every two weeks.

If you’re an e-commerce store owner, you can offer Afterpay as a payment option to your customers. Doing so can increase your conversion rate, as it provides a more flexible payment option for your customers. It can also boost your average order selling price as Afterpay payments are only applicable on orders over $35. Just make sure you have the right method of reconciling Afterpay in Xero so all your Afterpay purchases can be properly accounted for.

What is Afterpay financing commonly used for?

As mentioned before, Afterpay financing is used for making purchases and splitting the payment into multiple interest-free installments.

As such, it’s often used for all sorts of retail transactions, allowing customers to buy goods or services immediately and pay for them over time without incurring traditional interest charges.

Afterpay is popular in industries such as fashion, beauty, electronics, home goods, and more. It provides consumers with a flexible and convenient payment option while helping merchants increase sales and customer satisfaction.

However, food & beverage stores have also started including Afterpay as a payment option, as we’ll further elaborate in the next section.

How do food prices influence customers’ shop and pay habits?

Unfortunately, we’re witnesses to stark food inflation and rising costs of living in general. As a result of increasing food prices and inflation, a growing number of buyers would like to have an option to buy now and pay later for their groceries.

Here are some of the benefits of getting the opportunity of splitting your payment into several installments:

1. Affordability

High food prices may make it difficult for some individuals or families to afford immediate purchases. By utilizing buy now, pay later options like Afterpay, they can spread the cost of groceries or meals over time, making them more affordable in the short term.

2. Budget management

Fluctuating food prices can disrupt budget planning. When prices are high, some people may prefer to use buy now, pay later services to manage their finances more effectively. By breaking down food expenses into smaller, manageable installments, they can better align their budget with their immediate needs.

3. Timing of purchases

Consumers may choose to defer food purchases when prices are high, especially for non-perishable items. However, if they require immediate access to food but are hesitant to pay the full amount upfront, using a deferred payment option can provide a solution. This allows them to obtain the necessary groceries or meals without straining their immediate finances.

4. Convenience and flexibility

Shop now, pay later services offer convenience and flexibility, allowing consumers to obtain food items or meals immediately without having to worry about the immediate payment. This convenience can be particularly appealing during periods of high food prices, as it provides individuals with the flexibility to manage their cash flow more efficiently.

Can customers order groceries online and pay with Afterpay?

Yes – customers can buy groceries with Afterpay. As it was mentioned before, sellers can add Afterpay to their Shopify store to provide this payment option to their customers. That way, if you sell groceries in your online store, your customers will be able to buy them with Afterpay.

To add Afterpay to your Shopify store, you need to sign up for a merchant account. You’ll get a merchant ID and a secret key that you’ll need further, so note these down somewhere.

Next, log in to your Shopify store, go to Settings, and click on ‘Payments.’ Scroll down to the ‘Alternative Payments’ heading and click on ‘Choose alternative payment.’ Next, type “Afterpay” in the search bar that pops up and click on it.

You’ll now be prompted to enter your merchant ID and secret key. Once done, click on ‘Activate.’ Now, Afterpay will be listed as one of the payment options on your Shopify store. Your customers can spend a total of $150 the first time they use Afterpay, but the maximum Afterpay account limit increases over time.

It’s important to note that if your customers want to buy groceries with Afterpay at an online retailer like Coles or Woolworths, they may not be able to do so directly. This is because these stores don’t offer Afterpay as a direct method for payment. However, users can buy Woolworths or Coles gift cards through the Afterpay app — the cost of the gift card will be split into four payments like regular Afterpay payments. Users can then use this gift card at Coles or Woolworths like normal gift cards. This is an indirect way of buying groceries with Afterpay and may restrict user options to only a few retailers.

Finally, users can check out the official Afterpay page that lists all food and beverage companies offering Afterpay as a payment method, providing clarity on what stores accept Afterpay. Customers can use their Afterpay Mastercard to pay at each of the retailers listed on this page if they’re shopping in-store.

Keen on adding Afterpay to your e-store? Synder enables seamless integration of all your e-commerce platforms and payment gateways with your accounting system. Book a demo and see Synder in action today.

Can you buy groceries with Afterpay at Walmart?

This is one of the most frequently asked questions, as Walmart is one of the largest retailers in the USA, so here’s the answer you’ve been looking for.

In short, yes, you can buy groceries with Afterpay at this supermarket.

Afterpay has partnered with Walmart to offer its buy now, pay later service for online purchases, including groceries. This means that when shopping on Walmart’s website or mobile app, you have the option to select Afterpay as a payment method during checkout.

It’s important to note that Afterpay availability may vary depending on your location and specific Walmart store. Additionally, not all items or categories may be eligible for Afterpay. During the checkout process, Afterpay will inform you of the specific payment schedule and any associated fees or terms that may apply to your purchase.

Is there a limited number of payments you can split your purchase into?

As mentioned earlier, Afterpay allows you to divide your total purchase amount into four equal payments. These payments are made every two weeks over a period of eight weeks.

However, a specific retailer might have a different set of terms and conditions for grocery shopping with Affirm, so it’s best to check it firsthand with the vendor in question.

Is there an app available for making a purchase with Afterpay?

Yes, Afterpay provides a mobile app that allows users to make purchases with participating retailers. The Afterpay app is available for download on iOS and Android devices.

With the Afterpay app, you can browse and shop from various online and in-store retailers that offer Afterpay as a payment option. The app provides a convenient and streamlined way to make purchases using Afterpay’s buy now, pay later service.

In addition to making purchases, the app also allows you to manage your Afterpay account, view your payment schedule, make payments, and track your spending. It provides a comprehensive overview of your current and upcoming payments, helping you stay on top of your finances.

To use the Afterpay app, you’ll need to create an Afterpay account, link a payment method, and undergo a verification process. Once set up, you can start using the app to shop and make payments with Afterpay at participating retailers.

What happens when you miss a payment with Afterpay?

If you have turned off your automatic Afterpay payments, it might happen that you miss a payment.

In this case, Afterpay will charge you a $10 penalty. If you fail to make the payment within seven days, you’ll be charged an additional $7.

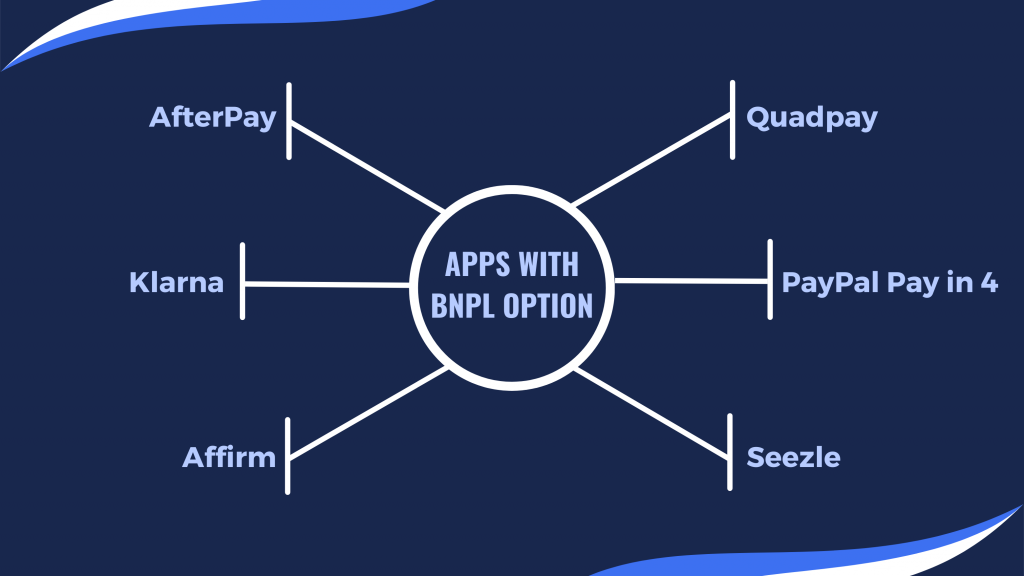

What other apps offer the option to shop now and pay later?

If you don’t want to use credit cards or Afterpay, but still want to enjoy the benefits of buying now and paying later for groceries, there are several other BNPL apps and services that offer the option to buy now, pay later. Some popular ones include:

1. Klarna. Klarna allows users to split their purchases into four equal payments, similar to Afterpay. It also offers a “Pay in 30 days” option, where users can make the full payment within 30 days without any interest or fees.

2. Affirm. Affirm offers installment plans for online purchases, allowing users to split the cost into fixed monthly payments over a specified period. Interest rates may apply depending on the purchase amount and repayment terms.

3. Quadpay. Quadpay allows users to split their purchases into four interest-free payments over six weeks. It offers both online and in-store payment options.

4. PayPal Pay in 4. PayPal’s Pay in 4 feature enables users to split eligible purchases into four equal payments over six weeks, with no interest or fees.

5. Sezzle. Sezzle offers interest-free installment plans, allowing users to split their purchases into four payments over six weeks. It conducts a soft check of your credit during the sign-up process.

These are just a few examples of apps providing the option to buy now, pay later, and the availability of these services may vary depending on your location and the specific retailers you are shopping with, so always have that in mind.

Using Afterpay to shop for groceries: Final thoughts

Buying groceries online with Afterpay can be a bit difficult because not all grocery retailers have partnered up with Afterpay. Those that have partnered up can be found on the official Afterpay website, and customers can use their Afterpay Mastercard to pay at these retailers if they’re shopping in-person.

If users want to buy groceries at other retailers using Afterpay, they can do this indirectly by first buying a gift card through the Afterpay app. This gift card can then be used like any other gift card.

Finally, if you’re an e-commerce store owner operating in the food and beverage industry, make sure to add Afterpay to your Shopify store so that your customers can have one more option available when it comes to buying groceries with Afterpay.