Ensuring that the company’s internal statements align with external statements provided by the bank is key. That’s why bank reconciliation stands as a core process, offering a thorough examination of transactions to uncover discrepancies.

This article delves into the peculiarities of reconciliation, comparing the conventional manual approach using Excel with the time-saving benefits of using automated tools such as Synder. From the fundamental steps of reconciliation to the challenges faced by practitioners, we explore the transformative potential of Synder in streamlining ecommerce accounting.

We asked Rachel Dauchy to delve into the intricacies of ecommerce bookkeeping, seeking her insights to share with our readers. Join us on a journey through the complexities of manual reconciliation in Excel and the seamless synchronization facilitated by Synder.

Rachel Dauchy, an ecommerce bookkeeping expert

Rachel Dauchy is an ecommerce bookkeeping expert based in Southeast Michigan. She is also a Shopify Affiliate and helps many sellers with their inventory needs, consults to determine which cloud-based inventory app to use, and helps them navigate sales tax compliance. Rachel is also a cohost of “Ecomm As You Are Roundtable” from Roundtable Labs. Her firm NetDeposited also owns and operates an ecommerce store on the Shopify platform called “Two Hands One Mind”, which sells educational toys for children.

Key takeaways:

- Challenges of manual reconciliation: Excel’s manual approach presents risks like data errors, version control issues, lack of automation, and security concerns.

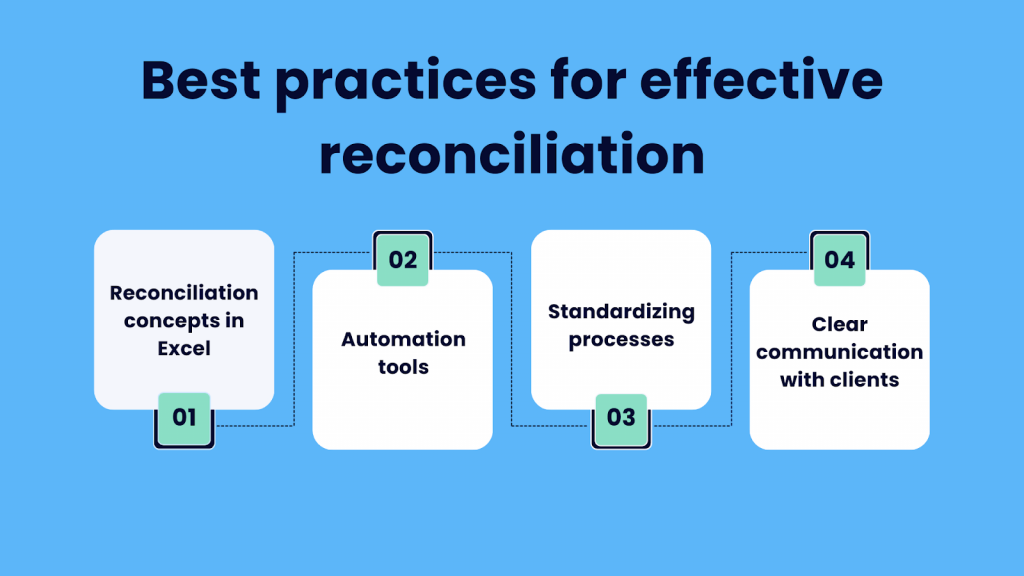

- Best practices for effective automatic reconciliation: Embracing automation for high volumes, standardizing processes, and maintaining transparent communication with clients.

- Synder’s automation advantages to eliminating manual reconciliation: Autosynchronization into accounting systems, rollback of erroneous data, enhanced customization with Smart Rules, advanced security measures, and much more.

Contents:

1. Understanding the reconciliation process in general

2. Manual vs automated reconciliation: What is the difference?

3. Manual reconciliation: Common challenges

4. Meet Rachel from NetDeposited: What are some of the challenges Rachel has faced in her practice?

5. How to avoid this? Rachel’s best practices for effective reconciliation

6. Automated reconciliation: What is Synder, and how does it automate ecommerce accounting?

- Why is ecommerce accounting challenging without Synder?

- Why do accountants trust Synder?

- Security measures in Synder: Is Synder safe?

Understanding the reconciliation process in general

Reconciliation is a crucial aspect of financial management that ensures the match between a company’s internal financial records and its external financial statements, particularly those provided by the bank. The process involves comparing and matching transactions recorded in the company’s records with the entries in its bank statements. The primary goal is to identify any discrepancies, errors, or omissions that might have occurred during the recording or processing of financial transactions.

What is reconciliation?

The reconciliation process typically includes the following key steps:

1) Matching transactions

At its core, reconciliation involves comparing individual transactions between the company’s statement and the bank statement. This step is fundamental to identifying any disparities in amounts, dates, or transaction details.

2) Identifying discrepancies

Once transactions are matched, the next step is to scrutinize the internal statement and the bank statement for any discrepancies. These disparities can arise due to timing differences, errors in data entry, or issues with bank processing.

3) Resolving discrepancies

Upon identifying discrepancies, the bank reconciliation process requires resolving these issues. This may involve contacting the bank, rectifying errors in the accounting system, or providing additional documentation to reconcile the discrepancies.

4) Updating records

After resolving discrepancies, it’s essential to update the company’s financial statement to reflect the accurate and reconciled financial position. This ensures that the internal financial statement aligns with the external statement provided by the bank.

5) Monitoring & reporting

Continuous monitoring is crucial for maintaining the accuracy of financial statements. Regular reconciliation not only helps identify discrepancies promptly but also facilitates the generation of an accurate financial report for stakeholders.

Overall, the reconciliation process is dynamic and requires attention to detail, precision, and, increasingly, the integration of technology to streamline and enhance efficiency.

Learn more on this topic: What Is Reconciliation in Accounting: The Basics of Reconciling Accounts.

Manual vs automated reconciliation: What is the difference?

Traditionally, manual reconciliation, often executed within the familiar Excel spreadsheets, has been the common method. However, with the advent of technology, automated reconciliation tools have emerged, simplifying the way businesses manage their financial data set.

In this section, we delve into the fundamental distinctions between manual reconciliation in Excel spreadsheets and the automated efficiency offered by tools.

Manual reconciliation in Excel format

Manual Excel bank reconciliation involves the thorough & complex review & comparison of financial transactions recorded in a company’s statement with the corresponding entries in its bank statements.

Automated reconciliation: Sync your data with Synder

Automated reconciliation, exemplified by third-party apps like Synder, utilizes technology to streamline the bank reconciliation process by proactively verifying all transactions in your accounting company, let’s say QuickBooks Online, through Synder. This method is a hallmark of effective account reconciliation software, offering a significant advantage in accuracy and efficiency. Curious about how it works? Let’s explore.

Imagine your Shopify store is linked to QuickBooks Online, and Synder replicates your money flow within the QuickBooks environment. When customers make purchases, transactions first go through your payment processor, and subsequently, the payment processor transfers the funds to your designated bank account (‘Checking’) in QuickBooks.

Synder efficiently syncs both sales and expense transactions to the ‘Clearing’ account in QuickBooks, labeled as the ‘Shopify Bank Account.’ When the payout occurs in the actual bank, the app synchronizes and generates a transfer from the ‘Clearing’ account to your ‘Checking’ account, accurately reflecting the actual money flow. You can simplify the bank reconciliation process in just a few clicks in the ‘Banking’ section, where the information automatically synced by Synder seamlessly aligns with your real money transfers.

Manual reconciliation: Common challenges

We have to admit that manual bank reconciliation via Excel is still a common practice in many organizations nowadays, allowing finance professionals to ensure the accuracy of financial statements by comparing and adjusting discrepancies. However, this process has its fair share of challenges.

Below, you’ll find an account of the common challenges associated with manual bank reconciliation. Also, we’ll explore some common obstacles faced during manual reconciliation and offer insights into overcoming them.

1. Error-prone data entry

Manually entering large volumes of data into an Excel worksheet increases the risk of typographical errors and data entry mistakes.

Impact: Inaccuracies in data entry can lead to misinterpretation of financial information, affecting the overall reconciliation process.

2. Version control

Excel files are often shared among team members, and maintaining version control can be challenging. Multiple versions of the same sheet may exist, making it difficult to track changes and updates accurately.

Impact: Version control issues can result in confusion, as team members may be working with different datasets or reconciling against outdated information.

3. Lack of automation

Manual bank reconciliation lacks automation, requiring individuals to perform repetitive tasks, such as matching transactions and updating spreadsheets. Even utilizing a ready-made bank reconciliation template in Excel won’t simplify your life the way automatization applications can do.

Impact: Increased workload, slower reconciliation processes, and a higher likelihood of errors due to the absence of automated checks.

4. Audit trail challenges

Maintaining a clear audit trail can be challenging in an Excel worksheet, especially when there are multiple contributors and changes over time.

Impact: Difficulty in tracing back changes may hinder the ability to identify the source of discrepancies and may pose challenges during audits.

5. Data security concerns

Excel files may not offer the same level of security as dedicated accounting software, and sharing sensitive financial information through spreadsheets can pose security risks.

Impact: Unauthorized access or data breaches can lead to the exposure of confidential financial data, potentially compromising the integrity of the reconciliation process.

6. Time-consuming reconciliation

Manual bank reconciliation can be time-consuming, especially when dealing with a large number of transactions and a complex financial data set.

Impact: Delays in the reconciliation process can affect timely decision-making and financial reporting, impacting the overall efficiency of financial operations.

Meet Rachel from NetDeposited: What are some of the challenges Rachel has faced in her practice?

We asked Rachel Dauchy from NetDeposited to shed light on common challenges faced by online sellers, and she provided a comprehensive overview. In this section, we’ll start by considering the problems connected with accounting for Shopify & PayPal and then proceed to problems associated with WooCommerce and Stripe accounting.

Accounting for Shopify & PayPal transaction data

Here’s how Rachel reflects on her experience in managing clients and outlines key considerations when taking on new ones:

1. What info do you need to find out first

From Rachel’s experience, the first thing you need to do is understand whether the client has PayPal connected to multiple banks, debit cards, or credit cards.

“When taking on a potential new client, these are the things I need to ask: Are they using PayPal? If so, is it connected to more than one banking, more than one debit card, or more than one credit card?”

2. Three Shopify stores = 3 separate PayPal accounts

Rachel shared with us an example of a high-volume client with a complex PayPal setup connected to three Shopify stores and various checking accounts. The complexity of the situation made her choose the approach where you have a separate PayPal account linked to each Shopify store, which simplifies payment processing and reconciliation, ensures clear accounting, and minimizes confusion, especially when dealing with transactions in multiple currencies.

“I learned my lesson the hard way. I had a high-volume client with one PayPal connected to three Shopify stores and linked to numerous Checking accounts. It was insane, so I’ve changed the way they handle PayPal.”

Rachel had to navigate the complexities of managing a high-volume client with one PayPal connected to three Shopify stores and linked to numerous checking accounts, leading her to change the way they handle PayPal. Considering her experience, here’s what she has to say to anyone facing a similar problem:

“I advise having a separate PayPal account for each Shopify store if there’s more than one. This strategy leads to the creation of three distinct PayPal Clearing accounts. While it might seem like an extra step, it’s a deliberate choice to prevent the complexities of reconciling a single PayPal clearing account with payouts from three different stores. Dealing with troubleshooting in such a scenario can be quite cumbersome.”

3. PayPal as an operating account: Separate money in and out processes

Rachel stresses that it’s very important to keep things simple by only using PayPal for payments and keeping money coming in separate from money going out. This makes things clearer and easier to fix, especially when dealing with lots of stores and transactions.

“The most important thing is, if you’re receiving payments through PayPal, are you making purchases too? I prefer clients to use PayPal solely as a payment gateway, separating money in and out processes for clarity.”

Though she does recommend her clients to use PayPal as an operating account, she leaves the choice to make such decisions for their business to them.

“Despite my preference against using PayPal as an operating account, I understand it’s their business. I’ve trained my staff to manage these nuances systematically, addressing one aspect at a time for smoother financial handling.”

4. Multicurrency

Rachel also talked about her experience with clients using PayPal and the difficulties they face when dealing with multiple currencies. She emphasized how important it is to know how PayPal and Shopify work together, especially when handling transactions in multiple currencies.

Rachel points out that turning on multicurrency in PayPal can cause problems with managing different currency amounts. Some of her clients choose to activate multicurrency in PayPal because Shopify has PayPal express checkout available. This means that certain items show up on PayPal statements in different currencies. Rachel says that in these cases, you have to manually change everything to US dollars each time to sort it out. Dealing with this problem is not easy:

“If they go through the cart or use Shopify payments, multicurrency in Shopify works seamlessly. However, if they choose to ‘buy it now’ with PayPal, it bypasses the cart, and with Multicurrency on, it can lead to a balance in different currencies.”

5. Expenses

Rachel also highlights some other issues that come with using different third-party connectors. One of the examples she shared was when a summary from a third-party system got into the Clearing account, including the money for PayPal payments. The big problem was when the client had lots of daily expenses because the system couldn’t break them down. That’s why it’s really important to tell the difference between different expenses that come from, let’s say, stamps.com, UPS shipping, and other things. Otherwise, your financial records might not make sense.

“I often explain to clients the complications arising from connectors. In the past, we encountered issues with a system bringing over a journal summary that lacked detailed breakdowns. The system used to bring over an amount for PayPal payments into the Clearing, but the challenge was when there were multiple expenses throughout the day. It couldn’t break them down individually; it was just a lump sum categorized as an expense.”

6. Recurring subscriptions

Rachel is also talking about the difficulties she deals with when clients have recurring subscriptions linked to their PayPal accounts.

“It’s hard to put all these expenses into one group because you have to break down the details in a journal entry, which makes a lot more work.”

Learn more about bookkeeping for small business by reading our Use Case about Restaurant bookkeeping.

WooCommerce & Stripe accounting

1. Refunds

Sometimes, refunds were made in Stripe but didn’t show up in WooCommerce, causing inconsistencies. One of Rachel’s clients wanted her to check their transactions in Stripe and WooCommerce. What complicates the issue is that the client doesn’t use QuickBooks or any other automatic software. They handle everything with Excel files and put all the data from the bank, Stripe, and WooCommerce into tables manually.

Naturally, when Rachel started looking for errors, she was overwhelmed by the process of matching information using pivot Excel tables from Stripe and WooCommerce and the tedious work of reconciling the data side by side: sales transactions, payouts, expenses, and refunds.

“Okay. First, consider the fees, and then take a look at the refunds. In this case, the refunds were slightly off because someone processed a refund in Stripe instead of WooCommerce. Now we recognize what caused the discrepancy… I could see three orders missing in WooCommerce, and there was also a refund processed in Stripe but not in the other system. This points to an operational problem that needs fixing.”

2. Staggered payouts

Getting money from payment processors like Stripe doesn’t always happen right away. Rachel points out that payouts can happen at different times, which makes it hard to match up sales with specific dates. She explains that the time it takes to get paid for sales doesn’t always match up with when customers place their orders. So, when you get a payout, it might not just be for sales from one day but for sales from several days put together.

It’s tricky because payouts can cover a lot of days and even spill over into different months, which means you have to be really careful when you’re looking at them and trying to match things up. It can be tough to reconcile old data, especially when you’re dealing with orders and payouts from months ago.

“Here’s the essence of what I convey to people: You’ll invariably encounter a staggered payout time. In a single payout, it’s not about sales from just one day; it encapsulates sales from a multitude of days. It’s that simple.”

Take a moment to learn more by exploring our in-depth guide Syncing Historical Data: A Feature Overview.

3. Individual order tracking

Rachel emphasized the importance of accurate reconciliation, especially in the context of expense management, and highlighted the significance of monitoring individual orders, going beyond a general summary, and examining the specific details of each transaction.

“When dealing with expenses, the capability to trace individual orders offers a detailed perspective, allowing businesses to accurately link each cost to its respective transaction.”

This method not only guarantees precision but also helps identify inconsistencies in expense data. By diligently tracking individual orders, businesses acquire valuable insights into spending patterns, pinpoint areas for potential cost optimization, and uphold a transparent record for audit purposes.

How to avoid this? Rachel’s best practices for effective reconciliation

Confronting the challenges outlined above prompted Rachel to actively seek ways to avoid such problems, and she was kind enough to share her best practices with our readers. Now, let’s delve into the practical tips she offered to overcome these hurdles and enhance overall success.

1. Understand/familiarize yourself with the reconciliation concepts in Excel

Being an experienced accountant, Rachel emphasizes the importance of understanding reconciliation concepts in Excel before utilizing automated connectors or software.

According to her, before jumping into using automation tools for ecommerce reconciliation, it’s crucial to get the basics right in Excel.

“Understanding how to match transactions, tackle discrepancies, and handle financial data manually in Excel is like building a strong foundation. It’s like learning the ABCs before moving on to sophisticated tools. This basic knowledge not only helps you make sense of your finances but also equips you to troubleshoot problems effectively.”

Mastering Excel reconciliation concepts is the key to smoothly transitioning to and fully benefiting from automated solutions like Synder.

2. Implement automation tools

When dealing with a large number of transactions in ecommerce, attention to detail during reconciliation is key. The sheer volume can make this process overwhelming. Rachel underscores the significance of automation tools like Synder – they play a key role in simplifying and efficiently handling these large volumes.

She points out that Synder’s strength lies in its ability to automate tasks, reduce manual work, cut down the chances of errors, and speed up the reconciliation process. This not only ensures accuracy but also frees up time and resources for businesses.

“Synder is an invaluable solution for those dealing with the task of reconciling a large number of transactions. She thinks it helps streamline the process and ensures financial accuracy. I started using Synder, and this far, it’s been amazing. Like from the moment of login, it’s just been working out perfectly. I love it. I have found the mapping is really great. I love the rollback function. So, for me, it’s worked really well.”

Take advantage of the opportunity to optimize your business processes and explore Synder features with a free trial. To gain more insights and tips, book your seat on the informative Weekly Public Demo offered by Synder. Elevate your financial management with Synder – where simplicity meets effective financial operations.

3. Standardize processes

Rachel emphasizes the importance of training staff to troubleshoot and reconcile transactions effectively. She says that transaction reconciliation can be complex, and ensuring that all team members have the necessary skills is crucial to ensure that financial processes run smoothly.

Establishing standardized processes for data reconciliation throughout the team is a matter of utmost importance. Implementing consistent procedures is crucial for maintaining uniformity and coherence in reconciliation efforts, thus avoiding discrepancies that could result from using different approaches.

“I have my processes standardized. I’m aware that someone might prefer a different approach, and that’s valid and fine. I’m sure others have great ways of doing it too. However, for me, standardizing is a big part of it.”

When every team member follows the same standardized procedures, it not only promotes efficiency but also minimizes the likelihood of errors. This consistency is particularly valuable in troubleshooting, as a standardized approach makes it easier for team members to collectively identify and address issues.

4. Stick to clear communication with clients

Trust in financial management is not just about discussing technical aspects like payment platforms and accounting details upfront. Establishing a strong relationship founded on trust and collaboration is essential, extending beyond mere understanding of the details.

“Balance reconciliation goes beyond mere professional advice; it’s about fostering a collaborative partnership. Building trust is a mutual effort that requires professional expertise from the accountant and a willingness to listen from the client. The relationship between the accountant and the client hinges on this mutual understanding, where both parties should be receptive and responsive.”

For instance, Rachel always takes a while to explain to her clients running several Shopify stores that, based on her experience, it’s really essential to set up several separate PayPal accounts. And while some of them may have initially been hesitant, they willingly open extra PayPal accounts after realizing the advantages.

“I’ve had clients agree without hesitation that I’ve said ‘I really need you to just open up two more PayPals’. And they’re like, ‘No problem. I totally get it. Okay.’ We need to be on the same page.“

Automated reconciliation: What is Synder, and how does it automate ecommerce accounting?

Synder is a third-party app for automated reconciliation. It serves as a transformative solution to streamline and enhance ecommerce reconciliation processes. Synder acts as an intermediary between various data sources, such as payment gateways, accounting systems, and bank statements.

Its core functionality lies in automating the synchronization of transactions in real-time, alleviating the need for manual data entry, and reducing the risk of human error.

Utilizing advanced algorithms, the app not only streamlines reconciliation and categorizes transactions accurately, providing a comprehensive and up-to-date overview of financial transactions, but also ensures precision in updating your ledger, providing a real-time reflection of your financial transactions.

Why is ecommerce accounting challenging without Synder?

Ecommerce accounting can be complex due to:

- Data entry errors: Manual data entry, when you have a high volume of transactions, increases the likelihood of errors in recording transactions. An automated sync app like Synder helps reduce data entry mistakes and ensures the accuracy of financial records.

- Multicurrency: Ecommerce businesses often deal with international customers, leading to transactions in multiple currencies. Handling currency conversions and ensuring accurate recording of these transactions can be challenging without automated tools.

- Platforms integration: Ecommerce sellers may operate on various platforms (e.g., Shopify, Amazon, eBay), and managing accounting across different platforms can be time-consuming and error-prone without an integrated solution.

- Payment gateway reconciliation: Reconciling payments received through different payment gateways with corresponding sales can be a manual and complex task. An automated sync app helps streamline this process.

- Refunds recording: Processing refunds in ecommerce impacts financial records. Tracking these transactions accurately is crucial for maintaining a clear and up-to-date financial picture.

- Tax compliance and reporting: Adhering to tax regulations and generating accurate financial reports is crucial for ecommerce businesses. An integrated solution can ensure that tax calculations are accurate and simplify the reporting process.

- Inventory tracking: Automated systems provide real-time updates on inventory levels, helping businesses avoid stockouts and overstocks and ensuring accurate product availability.

Learn more in this article: How To Get Instant Low Stock Alerts.

Discover our guide: Inventory Management: QuickBooks Online and Desktop Inventory Tracking Solutions.

- Bank reconciliation: Matching transactions recorded in the accounting system with those in the bank statement is a critical task. An efficient sync app helps automate bank reconciliation, reducing the chances of errors.

- Fees recording: Utilizing automated systems facilitates precise calculation and recording of various fees associated with online sales, including platform fees, payment gateway charges, shipping costs, and taxes, ensuring accurate financial reporting.

Why do accountants trust Synder?

A lot of accountants trust Synder for a multitude of reasons. First and foremost, it significantly streamlines the reconciliation process compared to manual methods in Excel. Synder’s advanced automation capabilities eliminate the time-consuming and error-prone nature of manual reconciliation.

1. Autosync

Synder’s real-time syncing feature provides up-to-the-hour financial insights, reducing the risk of discrepancies and allowing accountants to make informed decisions promptly.

2. Customization

The app’s user-friendly interface and customizable settings cater to the unique needs of each business, enhancing efficiency and saving valuable time. Its intelligent algorithms effortlessly match transactions, categorize expenses, and synchronize data with precision, ensuring a high level of accuracy.

Customize your flows with Smart Rules

If you feel that your business needs even more advanced customization, Synder allows you to create Smart Rules. You can add to the synchronization flow any data that’s crucial for you but missing in the standard process. You can apply or edit classes/locations/tax/payment methods/product names, etc., in your books for synchronized transactions based on customer/product names/descriptions/amounts, etc. Or you can build a flow to trigger any necessary action like sending a notification email (thank you emails/reminders), a text message, etc.

As a result, you’ll be able to automate various aspects, including income/expense categorization, assignment of classes and locations, or even sending reminders. These personalized rules can be tailored to your specific requirements based on the ‘if-then’ conditions, and once the Rules are activated, Synder will automatically apply them to new transactions. You have the flexibility to choose specific triggers to modify only particular transaction types or select particular conditions for actions, such as classifying.

Additionally, you can use Synder’s pre-made templates as a starting point and customize them to align with your business processes.

Dive into our insightful article Smart Rules: Make small business accounting answer your specific needs.

Code modification

And if you need even more tailor-made flows than Smart Rules, Synder’s dev team can try to create a special solution for you! Just contact Synder’s dedicated support specialists, who are available 24/7 ready to provide expert guidance and assistance.

3. Rollback

Keep the records from all the connected platforms in your books clean. If, for any reason, you’re not satisfied with the sync results, you can easily roll back the transaction and restore the books to their original state. No trace is left in your accounting. After the record is deleted, you can edit the configurations or apply an automated categorization rule and then resync the accurate data back into your books. The rollback may be done per transaction or in bulk.

Explore our in-depth feature overview article Rollback of Sync: A Feature Overview.

Security measures in Synder: Is Synder safe?

The syncing process through Synder is highly secure. Data is encrypted both at rest and during transmission, ensuring comprehensive protection. The integration employs an encryption code, utilizing Amazon VPC and CloudFlare DNS for enhanced security measures. Our data processing facilities are hosted on AWS servers, and the network infrastructure is restricted to CloudFlare, reinforcing the security posture.

Furthermore, Synder conducts annual penetration testing to identify and address potential vulnerabilities and we’re SOC 2 compliant. Alongside that, Vanta monitors Synder’s security, providing real-time insights. This multifaceted approach guarantees a robust and reliable security framework for the seamless transfer of data between platforms.

Check out What Does SOC 2 Stand For: A Quick Guide To The Concept for more info.

Wrapping up: Should we use a bank reconciliation spreadsheet or reconcile with Synder?

Exploring the challenges of manual bank reconciliation processes and the benefits of automated solutions like Synder, it’s obvious that automation of ecommerce accounting streamlines the process manifold. Synder’s integration of automation, real-time insights, and robust security framework makes it a trusted solution for accountants navigating the complexities of ecommerce finance.

The choice between manual reconciliation and Synder is not just about tools; it’s a decision that influences the accuracy, speed, and security of financial operations. In this fast-paced digital era, utilizing automated solutions becomes not just a preference but a strategic imperative for businesses aiming to enhance efficiency and accuracy in their financial reconciliation processes. Sounds like a formula for accounting success, doesn’t it?

Share your experience in a spreadsheet and automated reconciliation

We believe in the power of shared experiences and learning from one another. Are you using bank reconciliation in Excel? Or maybe you’ve already tried Synder to automate your reconciliation process? Share your thoughts in the comments below. Your experience could be an inspiration to other entrepreneurs. Don’t hesitate to share your thoughts and insights! 🚀

FAQs

1. Is there a limit to the number of transactions that Synder can import in one go?

You can schedule the import of as many transactions as needed, and these transactions will be processed gradually in the background, ensuring a smooth and efficient workflow.

2. How does Synder handle discrepancies between internal financial records and a bank statement during the syncing process?

Synder ensures accuracy through:

- Autosync: Info is updated within an hour with autosync.

- Duplicate protection: Synder boasts the feature ‘Skip synchronization for duplicated transactions’ To ensure that the transactions that already exist in your accounting company won’t be synced again.

- Rollback feature: It clears your cash book in one click without data harm.

- Import historical data: The feature reimports data for accuracy.

- Dedicated support team: Our team is always ready to assist.

3. Are there specific features within Synder that allow data syncing from an accounting sheet?

Yes, there are. If you have any unsupported providers you’d like to sync to your accounting system, you’ll find the Excel import feature very helpful. It allows you to import any data from an Excel spreadsheet to Synder and then operate with the uploaded data, just like with regular transactions, by syncing them to your accounting company. We recommend you download and use our ready-made template and fill it out with the data you export from the unsupported payment processor.

Learn more in this article: How to Import Data from Excel to QuickBooks, Xero and Synder accounting.

4. Is QuickBooks paid or free?

QuickBooks offers both paid versions and a limited free trial. The free trial allows testing the software before committing to a subscription. For ongoing access to all features, a paid subscription is necessary. Different pricing plans are available, catering to various business sizes and needs, including options for self-employed individuals, small businesses, and larger enterprises.

Excellent articles! Was helpful info about excel.

Thank you David!