Any company’s financial stability highly depends on its cash flow, which is determined largely by the timely collection of dues. Mismanagement of accounts receivable, either through manual processes or ineffective automation, can lead to human errors, inaccuracies, and delays, resulting in a backlog of collections.

Correctly implemented automation for accounts receivable can be a game-changer at this point. So, let’s examine why automation is necessary and how you can implement it with accounts receivable automation software.

Key takeaways

- Efficient accounts receivable management helps maintain a stable cash flow, as errors or delays in collecting dues can put a company’s financial health at risk.

- Implementing automation for accounts receivable offers significant benefits by streamlining tasks like invoicing, payment tracking, and reporting, thereby enhancing operational efficiency and financial control.

- You can leverage various software (like Synder, Sage Intacct, Zoho Books, QuickBooks, Xero, and more) to automate these tasks effectively.

Contents:

1. A look at accounts receivable

2. Automated accounts receivable: what it is and why you might need it to up your game

3. Accounts receivable automation software you might want to consider

4. How does AR work – an example of Synder

- Creating and sending invoices

- Payment collection: Applying payments to invoices

- Sending payment reminders

- Beyond automating AR: What else can Synder do?

5. The future of accounts receivable automation

6. Final words on AR automation

A look at accounts receivable

Accounts receivable (AR) are money customers owe a company for things they bought on credit. These play a significant role in keeping a company’s cash flow stable.

In simple terms, AR promises future cash – they’re a kind of IOUs waiting to be paid. A business must handle these IOUs well, ensuring they turn into actual cash on time.

As you can see, managing AR is all about finding the right balance.

On the one hand, giving customers credit can boost sales. But on the other hand, the company needs to collect that cash to keep things running smoothly. So, handling AR to preserve the balance between the two helps a company manage its short-term money needs and keep its finances healthy.

Maintaining this balance might include setting clear credit terms to specify how much credit is extended and when payments are expected. Keeping an eye on customers’ ability to pay is very important to avoid potential problems. Sending out invoices promptly and following up on overdue payments also help keep accounts receivable in check. There are more, and we’ll tackle some further.

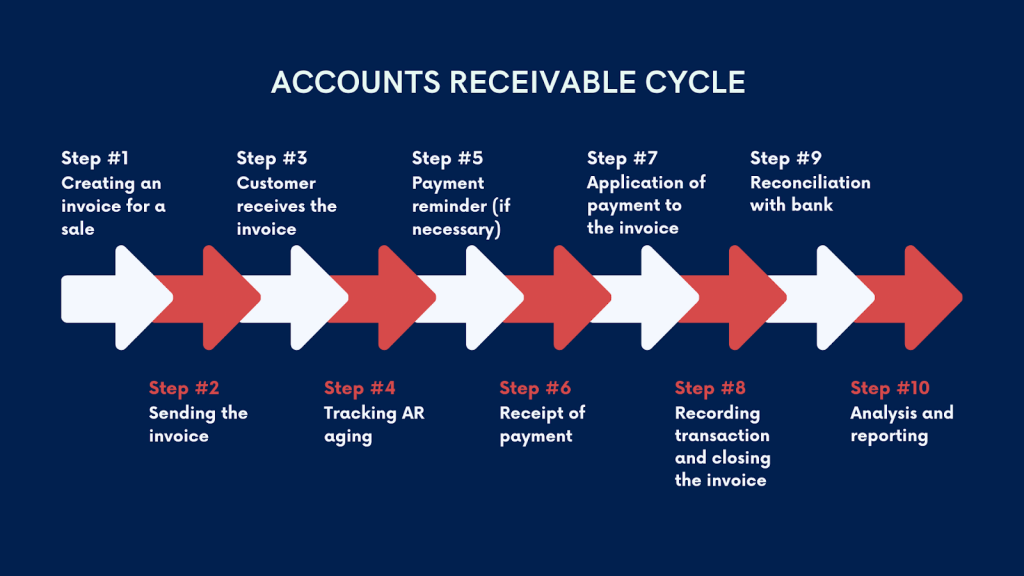

How does the accounting cycle work?

- The accounts receivable cycle begins when a company sells goods or services and issues an invoice detailing what to pay for and when it’s due.

- The customer receives the invoice, and as time passes, the company monitors the accounts receivable aging, ensuring not to miss the due date. If you don’t get payment by the due date, you can send a payment reminder to the customer. When payment is received, it’s applied to the corresponding invoice in the company’s records, thus closing it.

- Next, you reconcile with bank statements and generate reports to analyze collection performance and outstanding balances.

This way, a company can avoid the risks of late payments or customers who can’t pay and is more likely to have a steady cash flow, run smoothly, and stay successful in the long run.

Read more on accounts receivable:

What Is Accounts Receivable: Understanding Your AR Accounts

Automated accounts receivable: what it is and why you might need it to up your game

As mentioned, managing AR puts a lot on your plate. The good news is that today technology can help you take a substantial portion out of it.

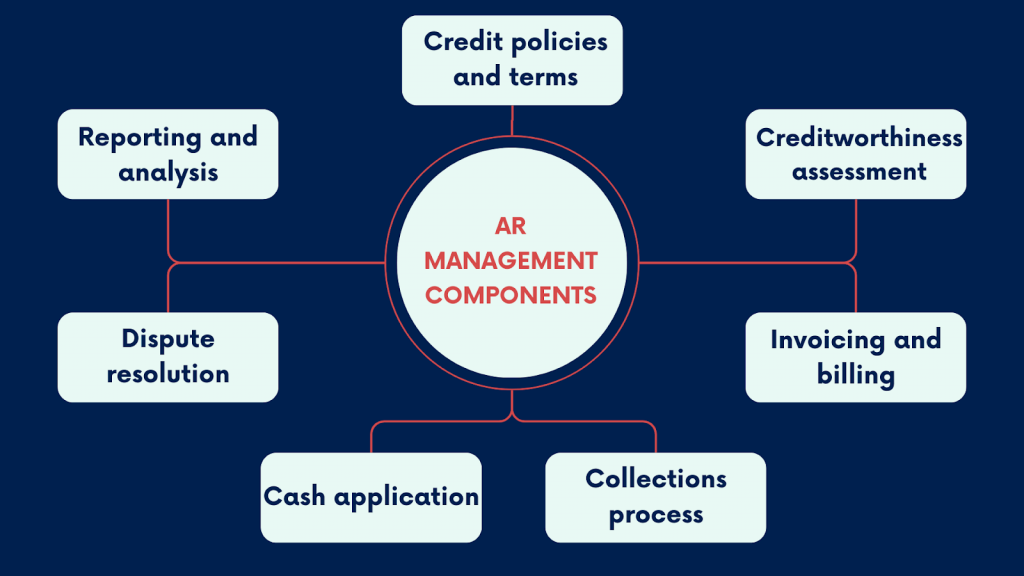

What does AR management take?

But let’s take a moment to break down the major components of managing accounts receivable.

Credit policies and terms

Establishing clear credit policies and terms, including credit limits and late payment interest rates, enables effective risk management. It helps in the future assessment of customer creditworthiness, sets repayment expectations, and ensures consistency in decision-making. Customer-wise, it outlines clear conditions for getting products or services on credit, the scope and term of repayments, reducing the likelihood of disputes or misunderstandings.

Customer creditworthiness assessment

Assessing customers’ creditworthiness might involve looking at how reliably they’ve paid in the past, their credit score, and how financially stable they are. This helps lower the chances of them not paying on time or not paying at all. Understanding these factors allows the company to make better decisions about who to extend credit to, ensuring smoother transactions and reducing the risk of financial losses due to late or missed payments.

Invoicing and billing

Timely and accurate invoicing is critical for effective management of accounts receivable. It’s essential to send out invoices quickly after delivering goods or services. They should list the delivered items or services, their corresponding costs, the payment due date, and other important payment terms. This way, the company ensures customers understand what they need to pay for and by when. It can speed up the payment process and reduce the risk of payment delays.

Collections process

A solid collection process ensures that customers pay their invoices on time. This process involves a few key steps. The company might send reminders for overdue payments to prompt customers to pay. If reminders don’t work, they might follow up by phone and discuss payment arrangements. Sometimes, they might even negotiate with customers a plan for paying off what they owe in smaller chunks. All this allows you to get the owed money this or that way and keep your cash flow healthy.

Cash application

Matching customer payments with the corresponding invoices allows you to keep things in order with accounts receivable. This way, you have proper AR reconciliation, which means all the owed money is accounted for correctly. So, when a customer pays, you need to update the records to show which invoices have been paid and how much. You also have financial reports accurately reflecting this money, which is essential for understanding your financial position.

Dispute resolution

Dealing with any problems or disagreements customers might have about invoices quickly is a part of managing accounts receivable. By sorting out these issues fast, the company shows that it cares about its customers and their concerns. Plus, it helps keep the payment process moving smoothly, and this is positive for everyone involved.

Reporting and analysis

You might want to carefully monitor accounts receivable, checking things like aging reports. They show how long invoices have been outstanding and days sales outstanding (DSO), which measures how quickly customers pay their bills. Another wise approach is having and controlling your bad debt reserves set aside for payments that might not get collected. This monitoring, reporting, and analysis help you understand how well you manage your AR and pinpoint areas where things could be done better.

As you can see, there’s a lot to do.

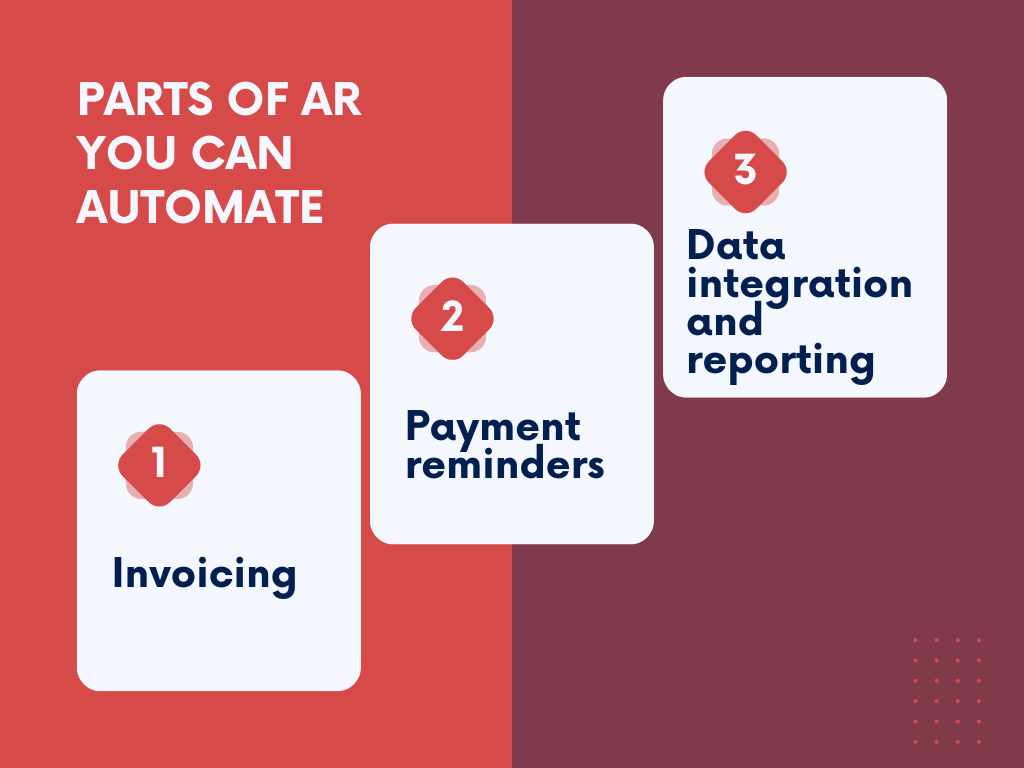

What part of accounts receivable can you automate?

Accounts receivable automation involves the integration of technology and software solutions to automate various tasks associated with managing outstanding dues from customers. These tasks encompass the entire AR lifecycle, including generating invoices, sending reminders, tracking payments, and generating reports.

Automation can put on autopilot many of what you used to do manually. But that’s not only about saving time. There’s more value in enabling businesses to significantly enhance their operational efficiency and achieve better financial control.

Now, let’s look at what automation can handle for you in a bit more detail.

1. Invoicing automation

Invoicing automation is probably the most significant aspect of automating accounts receivable (AR) processes, impacting the creation, sending, and processing of invoices using digital technologies. Digital invoicing replaces traditional paper-based invoicing with electronic methods.

Technically, digital invoicing involves using software or online platforms to generate invoices. These invoices can be customized to include company branding and specific details about the products or services provided, prices, and payment terms. Once created, they can be sent directly to the customer’s email or accessible through an online portal. Customers can then review the invoice, make payments electronically, and, if needed, even set up automated recurring payments. Sometimes, automated invoicing includes applying payments to the corresponded invoices, facilitating the process for you even more.

What are the benefits of digital invoicing? Here’s your answer:

- The biggest value of digital invoicing lies in its efficiency, accuracy, and convenience. Invoicing automation saves businesses time and resources that would otherwise be spent on manual tasks such as printing, mailing, and processing paper invoices. This improves operational efficiency and reduces the risk of errors or delays associated with manual data entry.

- On top of that, automated invoicing speeds up payment processing, as customers can receive invoices instantly and make payments electronically (often via the payment link included in the invoice).

- In addition to accelerating the cash flow for businesses, digital invoicing is environmentally friendly. It reduces paper usage and contributes to sustainability efforts.

Read more about invoicing:

- Handling Invoice Management With Small Business Accounting Software

- Invoicing Software for Small Business

2. Automated payment reminders

Payment reminders help optimize the collections process and ensure customers pay on time. You can leverage technology to streamline this communication and reduce late payments by gently prompting customers with outstanding balances to settle their invoices promptly.

Automating payment reminders involves using software to send notifications to customers at predetermined intervals. You can personalize them with invoice details and relevant account information, which enhances the customer experience and conveys professionalism. Automation ensures consistency in sending reminders, regardless of staff availability.

You can deliver these reminders through various channels, such as email, SMS, or automated voice calls, catering to customer preferences and increasing the chances of timely responses. Often, you can customize reminder schedules based on customer behavior, adjusting timing according to payment patterns.

Automated payment reminders help businesses improve collections efficiency, strengthen cash flow, and enhance customer relationships.

3. Automated data integration and reporting

Data integration and reporting are significant for accounts receivable automation, empowering businesses to efficiently manage financial processes and gain valuable insights into their receivables.

Connecting financial data across diverse systems and generating comprehensive reports can enhance financial visibility, inform decision-making, and drive improved outcomes.

Automated data integration involves synchronizing payment information with accounting software. It eliminates manual data entry and reduces errors. This integration provides accurate record-keeping, granting access to up-to-date financial data. It’s worth noting that many integration solutions allow for extracting payment and transaction data directly from various sources, minimizing the synchronization time and improving efficiency, allowing businesses to track key metrics such as receivables performance, payment trends, and aging analysis.

These are key components of AR automation, integrating which into your business strategy empowers businesses to streamline their receivables processes, enhance customer interactions, and gain valuable insights for informed financial decision-making.

Accounts receivable automation software you might want to consider

Now, let’s look at the tools to help you automate your AR. It’s absolutely worth mentioning that there are many available. However, we’ll look more at accounting software that comprises AR automation functionality alongside other accounting features.

#1 – Synder

Synder is an accounting automation software designed to streamline financial processes for online businesses.

It offers integration with 30+ systems, including ecommerce, payment, and accounting platforms, automated bank feeds, expense categorization, and reconciliation, helping maintain accurate financial records efficiently.

With Synder, users can create and sync invoices with accounting, automatically close them upon payment, accurately categorize payments (including processing fees and taxes), and reconcile them with bank transactions. Also, you can set up overdue payment reminders and automated email notifications to customers (together with other custom workflows) using the Smart Rules functionality.

Altogether, it helps businesses have a clear and up-to-date view of their accounts receivable, allowing them to track and manage cash flow effectively.

Get hands-on experience of using Synder during a 15-day free trial and book a seat at our Weekly Public Demo for a guided tour by our support team.

#2 – Sage Intacct

Sage provides comprehensive accounting solutions for businesses of all sizes. With Sage Intacct, users can manage various financial tasks, including accounts receivable.

Sage Intacct offers features such as creating and sending invoices, tracking payments, and automating reminders for overdue invoices. Additionally, Sage Intacct provides robust reporting and analytics capabilities, allowing businesses to monitor AR performance and identify areas for improvement. Sage Intacct’s AR management tools help streamline invoicing processes, track payments accurately, and ensure timely collections, ultimately improving cash flow management and financial visibility.

#3 – Zoho Books

Zoho Books is a cloud-based accounting software offering a range of features for businesses, including accounts receivable (AR) management.

With Zoho Books, users can create professional invoices, track payments, and send automated reminders for overdue invoices. Zoho Books integrates with various payment gateways, making it easy for customers to pay invoices online and facilitating faster payment processing.

Besides, it provides customizable invoice templates and reporting tools to help businesses analyze AR performance and make informed decisions. Zoho Books also offers automated reminders for overdue invoices, reducing the risk of late payments. The software tracks payments in real time, providing businesses with accurate information on their AR status.

#4 – QuickBooks

QuickBooks is a widely used accounting software with robust accounts receivable (AR) management features. You can create customized invoices, track payments, and set up automated reminders for overdue invoices.

QuickBooks integrates with various third-party apps, allowing businesses to streamline invoicing processes and improve efficiency. Additionally, QuickBooks offers reporting tools to help businesses analyze AR performance and identify trends. With QuickBooks, businesses can efficiently manage AR processes, track payments accurately, and improve cash flow management.

Read more about how Accounts Receivable in QuickBooks.

#5 – Xero

Xero is a cloud-based accounting software known for its powerful accounts receivable (AR) automation capabilities. It allows users to create and send invoices, track payments in real time, and automate overdue invoice reminders.

Xero integrates with various payment gateways, making it easy for customers to pay invoices online and facilitating faster payment processing. It also offers advanced reporting and analytics features for AR management, allowing businesses to analyze performance and make data-driven decisions. Xero’s AR management tools help improve invoicing processes, ultimately supporting better financial management decisions and cash flow management.

How does AR work – an example of Synder

Now, shall we look at how accounts receivable automation functions, using the example of sending invoices and receiving payments in Synder? Each invoice represents an account receivable, as it signifies the money owed to you by your clients.

Let’s imagine you manage your accounting in QuickBooks and utilize multiple payment systems to receive payments. What would the process look like?

Creating and sending invoices

You initiate the process by creating invoices for your clients. Whether for goods sold or services rendered, you can generate these invoices within QuickBooks or do it in Synder, and they’ll automatically sync with your QuickBooks. So, either way, you’ll instantly see the created invoices in both Synder and QuickBooks.

Creating an invoice in Synder is simple, involving several steps.

Step #1

You log into Synder.

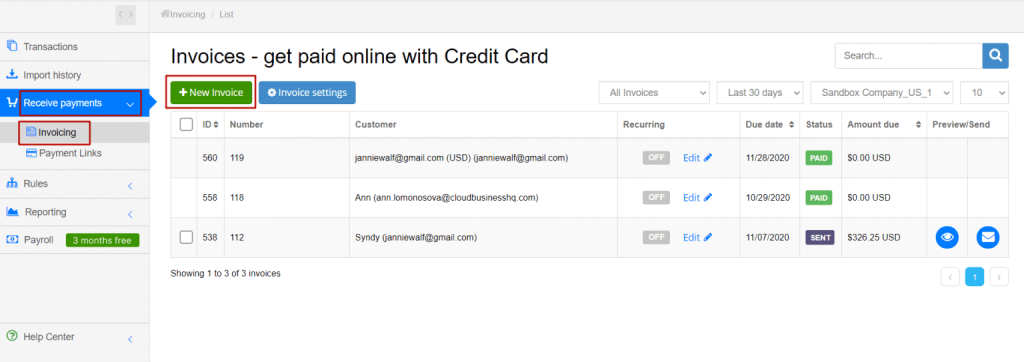

Then, you click on Invoicing in the left side menu under the Receive payments section and press the New Invoice button.

Step #2

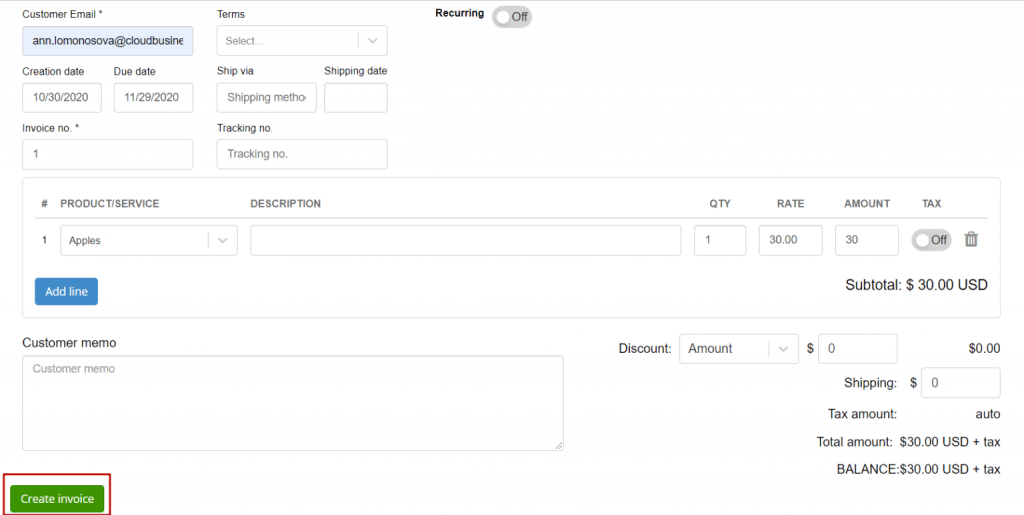

It’ll bring you to the invoice template where you fill out with the necessary details. You need to click the Create invoice button to complete the creation.

Step #3

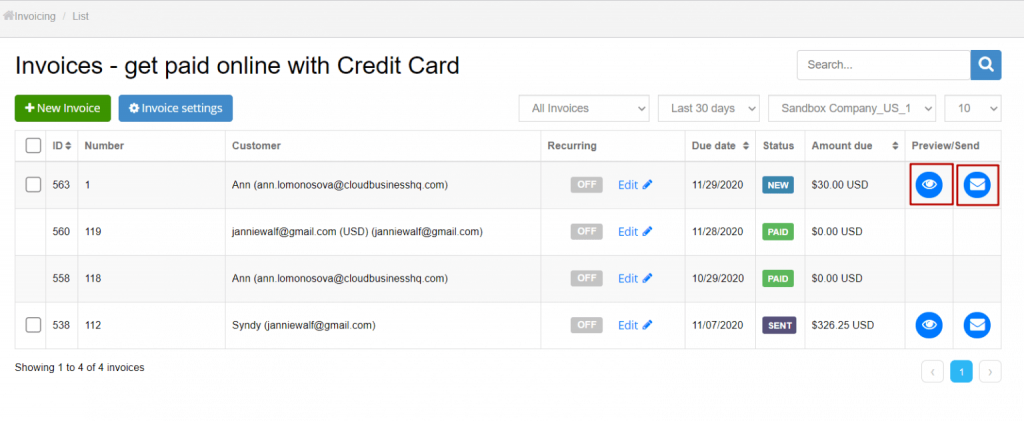

Now, you need to verify your invoice is in the list of your invoices. Press the Back to list button at the top right corner of the page to get to the list of all your invoices.

You should see the created invoice at the top of the list. Now, you can use the Preview and Send buttons in the right column of the invoices list to send the invoice to your client.

Once sent, the invoice will appear in your QuickBooks.

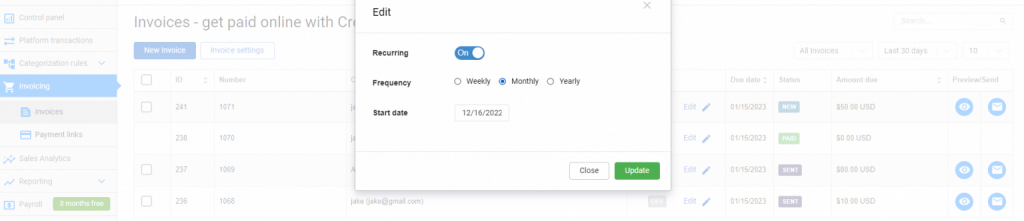

Making the invoice recurring

If the invoice is for a recurring payment, like a subscription, you might want to make it recurring. You can do it at the creation step by turning on the Recurring setting in the template.

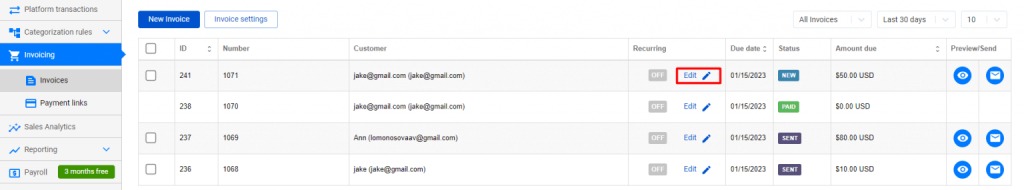

You can also do it from the invoice list. You might want to click the Edit button under the Recurring column next to your invoice in the list, switch on the recurring feature, and choose the payment frequency (weekly, monthly, or yearly).

Payment collection: Applying payments to invoices

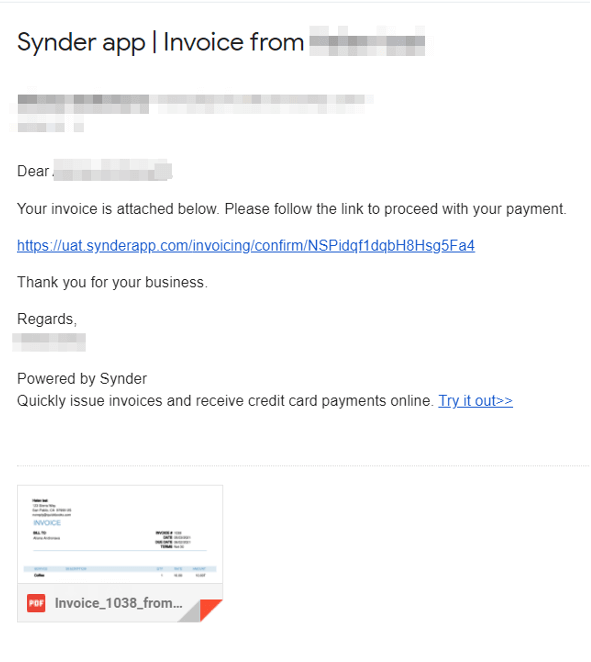

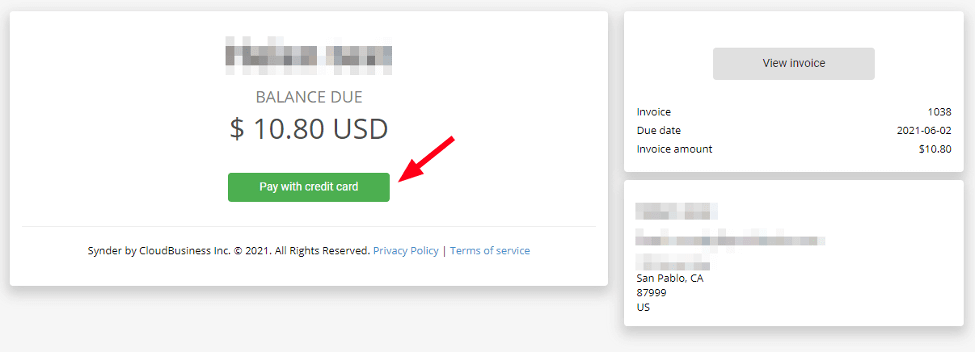

Once you send the invoice, your customer will get an email with the invoice (and PDF attachment) and the payment link for it.

Clicking on the link will bring them to a simple checkout page (super protected, no worries), where they can pay with the credit card.

There’ll be all the invoice details, so the customer might see what they’re paying for.

Now, as the customer pays the invoice, what’s next? Traditionally, you’ll look for the correct payment and apply it to your invoice manually. And you know how much time and effort it might take.

Synder can put this process on auto-pilot. You only need to click a couple of buttons to set it up.

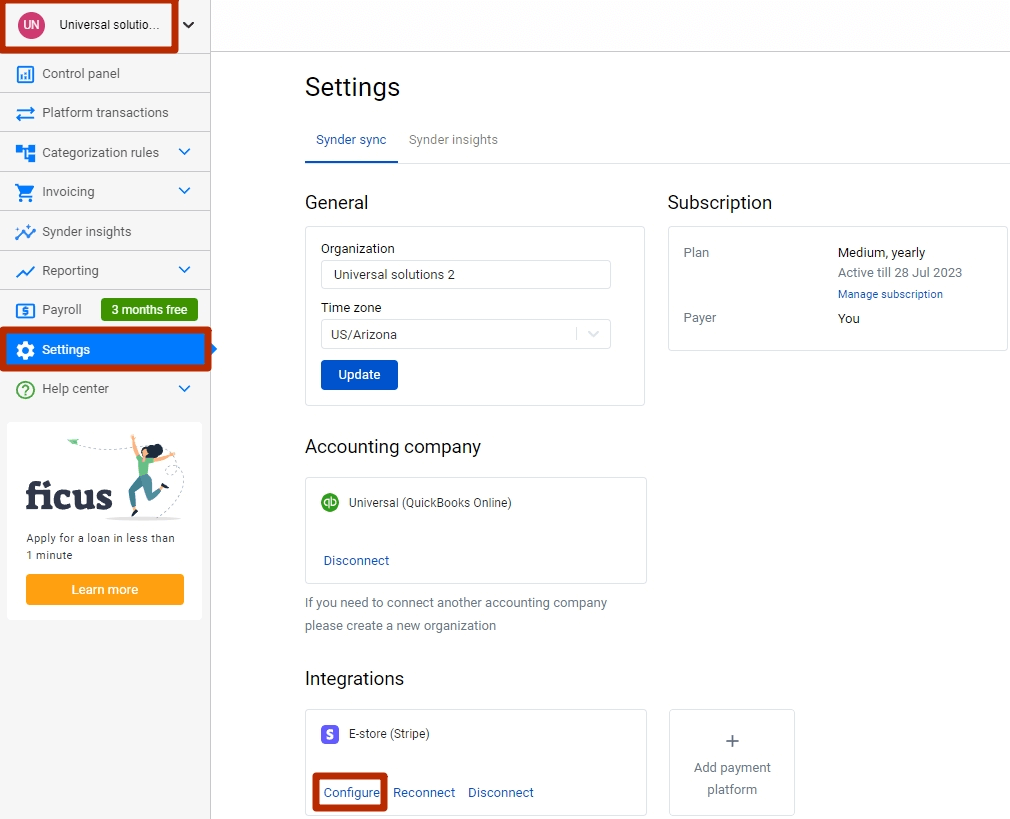

Step #1

At this point, you go to Settings in the general dashboard menu, which is on the left.

Click on it and choose Configure under the needed payment system integration.

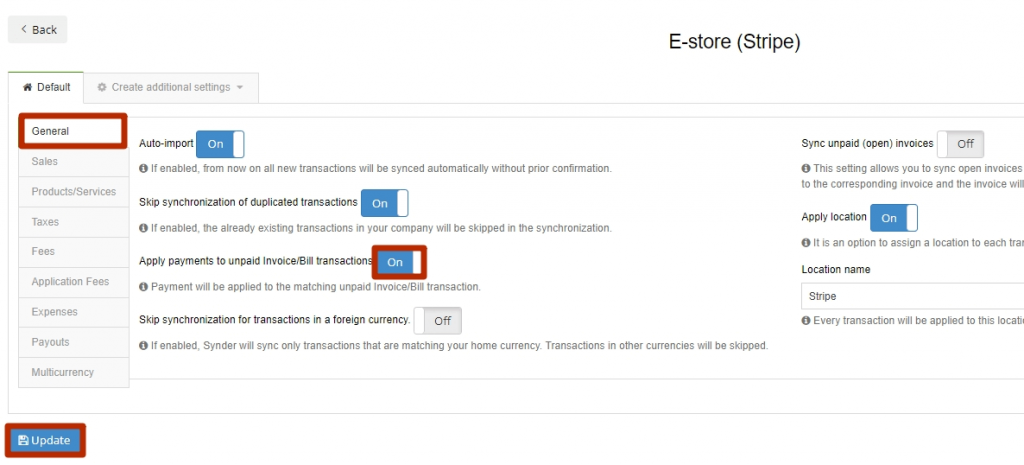

Step #2

Here, in the General tab, turn the Apply payments to unpaid Invoice/Bill transactions setting on and hit the Update button to save the changes.

From now on, your Stripe, Square, PayPal, Braintree, etc. payments will be automatically applied to open invoices in your books.

Sending payment reminders

As mentioned, you can use the Smart Rules feature in Synder to set up payment notifications before and after the due date to remind the customers of their outstanding or overdue payments, ensuring they don’t forget to pay you.

These notifications are convenient as they contain the invoice attached, so the customer knows what payment you mean.

The rules work on the if-then principle, allowing you to create various workflows, dragging and dropping condition and result boxes. You can set each box up to better serve your particular needs. This way, you can create simple and more complex notification workflows.

So, that was an example of how accounts receivable automation works in Synder.

The process might slightly differ from solution to solution. Still, you can see the general idea and how it can help you with AR management.

Beyond automating AR: What else can Synder do?

It’s worth mentioning that invoicing is just an aspect of managing your online business that Synder can make more efficient for you. The bigger value is Synder’s capability to gather all your sales channels under one roof and integrate them with accounting.

This move can turn your books into the ultimate source of truth about your sales, products, and customers, providing a better view of your business performance.

It comes with advantages.

- First, you have all your transactions from all your sales channels (ecommerce platforms and payment systems) gathered in one place. Integrating each channel through a separate app might lead to having duplicates in your books. The integration apps that don’t communicate with each other might not recognize the same transaction from two different systems (think of a Shopify store with Stripe added as another payment option).

Synder fetches transaction data from various sources, recognizing and eliminating duplicates, leaving you with neat books and accurate data.

- Another advantage is having a 360-degree view of your finances, product, and customer data in a single dashboard. It gives you a huge opportunity for analysis. There’s no need to switch between multiple apps and systems to see how this or that your channel works. You can compare those against one another to see which is more efficient and where you might fancy more effort.

- Your financial reports and statements only benefit from having all financial data in one place. You can generate accurate and informative statements for further analysis or taxation matters.

- Last but not least, you ditch the manual work from a big deal of bookkeeping tasks. Synder takes them upon itself, leaving you with what you meant to do as a business owner – analyze and grow your business.

The future of accounts receivable automation

Looking ahead, the future of AR automation is more about efficiency, insights, and strategic advantages.

Two key technologies are making waves – artificial intelligence (AI) and machine learning (ML). These tools are changing how businesses handle their receivables by predicting customer payments, optimizing payment schedules, and automating responses based on past data. In simple terms, they’re getting smarter over time.

Blockchain is another technology that can change the usual AR management ways. It offers much better security and transparency by creating an unchangeable record of transactions. This way, it reduces fraud and disputes and builds trust with customers.

Predictive analytics, powered by intelligent algorithms, will help businesses forecast payment trends and identify risky customers. So they could manage cash flow better and tackle potential issues before they become problems.

The role of AR professionals seems to transform, influenced by technology development. As automation takes over routine tasks like sending invoices and reminders, AR professionals might have more time to focus on analyzing financial data and crafting better strategies for managing receivables.

Final words on AR automation

Let’s wrap it up. Handling accounts receivable is vital for keeping a company’s finances in good shape as it provides better cash flow visibility. Automating this process can make it easier and more efficient. It means setting clear rules for giving credit to customers, checking if they can pay, sending invoices on time, and keeping track of payments. By automating these tasks, businesses can spend less time on paperwork and more time on important decisions. As technology improves, the future of accounts receivable automation holds even more potential for helping businesses thrive.

Learn about Quickbooks ecommerce integration and Wave alternatives.

Share your thoughts

Sharing is caring! Please share your thoughts and opinions in the comments section below. We love a good discussion.

Excellent article!