Cryptocurrency is revolutionizing how we think about and manage finances. In this article, we delve into the world where accounting meets cryptocurrency. We’ll explore the complexities, opportunities, and challenges this modern financial marvel presents to the realm of accounting.

Buckle up because this isn’t just any financial evolution – it’s a digital finance revolution!

Contents:

1. Understanding assets and cryptocurrency’s role as one

2. Defining assets in the financial world

3. Digital asset types described

4. How cryptocurrency fits into the asset category

5. Cryptocurrency’s unique asset characteristics

6. Accounting for cryptocurrency on the balance sheet

7. Cryptocurrency and Tax Implications

9. FAQ section

Understanding assets and cryptocurrency’s role as one

The concept of assets is foundational in both accounting and finance. Assets are resources owned or controlled by a business or individual that are expected to produce economic value or future benefits.

Traditionally, assets include cash, real estate, inventory, and investments. However, the advent of digital currencies like cryptocurrencies has expanded this definition.

Defining assets in the financial world

Assets are typically categorized based on their liquidity, usage, or purpose within an organization or individual’s portfolio. Common types of assets include:

- Current assets: Cash and other resources that are expected to be converted into cash, sold, or consumed within one year or a normal operating cycle.

- Long-term assets: These include fixed assets like property, plant, and equipment and intangible assets like patents and copyrights, which provide benefits over a longer period.

Digital asset types described

Digital assets have grown significantly in variety and complexity over recent years, driven by technological advancements and increasing digitalization. Each digital asset type has its own characteristics, uses, and regulatory considerations.

Here’s an overview of some key types of digital assets.

Cryptocurrencies

The most well-known type of digital asset. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin operate on blockchain technology and are used primarily as mediums of exchange or for investment purposes. They are decentralized and usually operate independently of traditional financial systems.

→ Learn how to account for cryptocurrency and what the regulations for cryptocurrency are.

Tokens

Tokens are a type of digital asset that are often issued on existing blockchains. Unlike cryptocurrencies, which are intended to be used as digital money, tokens can represent various assets or utilities. There are several types of tokens, including:

- Utility tokens. Provide access to a product or service within a specific network or platform.

- Security tokens. Represent investment contracts and are subject to federal securities regulations. They often represent shares in a company, a portion of earnings, or other financial instruments.

- Non-fungible tokens (NFTs). Unique digital assets that represent ownership or proof of authenticity of a specific item or piece of content often associated with digital art, collectibles, and digital rights.

Stablecoins

A type of cryptocurrency designed to minimize price volatility. Stablecoins are typically pegged to a stable asset like gold or fiat currencies such as the US dollar. This pegging mechanism offers the advantages of cryptocurrencies without the typical price fluctuations.

Digital collectibles

Similar to NFTs, these are unique digital items collected for their rarity or personal value. They can include digital art, virtual cards, and other collectibles whose ownership and authenticity are verified on a blockchain.

How cryptocurrency fits into the asset category

Crypto fits into the asset category in accounting, but it introduces unique characteristics that set it apart from traditional assets. In accounting terms, an asset is something of value that an individual or a business owns or controls with the expectation that it will provide future benefits. Cryptocurrencies, like Bitcoin or Ethereum, are considered intangible assets because they do not have a physical form but still hold value.

Cryptocurrency’s unique asset characteristics

Cryptocurrencies, as a relatively new asset class, exhibit a range of unique characteristics that set them apart from traditional financial assets. These features are deeply rooted in their technological underpinnings, market dynamics, and the evolving regulatory landscape.

Here’s an expanded look at these characteristics.

1. Digital and intangible nature

Cryptocurrencies are purely digital, existing only in electronic form. This intangibility poses unique challenges in storage and security, as they require digital wallets and robust encryption methods to prevent theft, loss, or hacking. Unlike physical assets that can be stored in a safe or a bank, the safety of cryptocurrencies depends on digital security measures and the vigilance of their holders.

2. Decentralization and blockchain technology

One of the most revolutionary aspects of cryptocurrencies is their decentralized nature, made possible by blockchain technology. This means that they operate on a network of computers rather than a centralized server or institution. This decentralization provides a level of autonomy resistance to censorship, and reduces reliance on traditional financial intermediaries.

3. High volatility

The prices of cryptocurrencies can be extremely volatile, often much more so than traditional assets like stocks or commodities. This volatility is driven by various factors, including speculative trading, regulatory news, technological advancements, and changes in market sentiment. While this can offer opportunities for high returns, it also introduces significant risk.

4. Liquidity variations

Cryptocurrencies can be highly liquid, but this liquidity can vary greatly between different coins and tokens. Popular cryptocurrencies like Bitcoin and Ethereum generally have high liquidity due to their large market capitalizations and active trading communities. However, smaller or less known cryptocurrencies may lack sufficient trading volume, making them less liquid.

5. Security risks and cybersecurity measures

Given their digital nature, cryptocurrencies are susceptible to risks such as hacking and digital fraud. Securing these assets requires sophisticated cybersecurity measures, including the use of secure wallets, two-factor authentication, and maintaining operational best practices to safeguard digital keys.

6. Anonymity and transparency paradox

Cryptocurrencies offer a degree of anonymity since transactions do not require personal information to be directly attached. However, the blockchain ledger is transparent and publicly accessible, meaning that all transactions are traceable and permanently recorded. This duality offers privacy in transactions but also ensures a level of accountability and traceability.

7. Limited but growing acceptance

While the acceptance of cryptocurrencies for everyday transactions is growing, it remains limited compared to traditional currencies. This limited acceptance impacts their practical use as a medium of exchange and can contribute to their volatility. However, as more businesses and financial institutions adopt cryptocurrencies, their acceptance and stability are likely to increase.

8. Regulatory uncertainty and compliance

The regulatory framework for cryptocurrencies is still in its infancy and varies widely by jurisdiction. This uncertainty can affect their legal status, how they are taxed, and their overall market stability. Investors and users must navigate an evolving regulatory landscape, which can pose challenges for compliance and risk management.

9. Influence of technology and innovation

The value and utility of cryptocurrencies are closely tied to technological innovation in the blockchain and fintech sectors. Developments such as improved blockchain protocols, enhanced security features, and new financial products based on cryptocurrencies can significantly impact their market dynamics.

10. Investment potential and high returns

Despite their risks, cryptocurrencies have attracted investors due to their potential for high returns. The rapid growth and market interest in certain cryptocurrencies have yielded substantial returns for early adopters, though this comes with a high risk of volatility and potential loss.

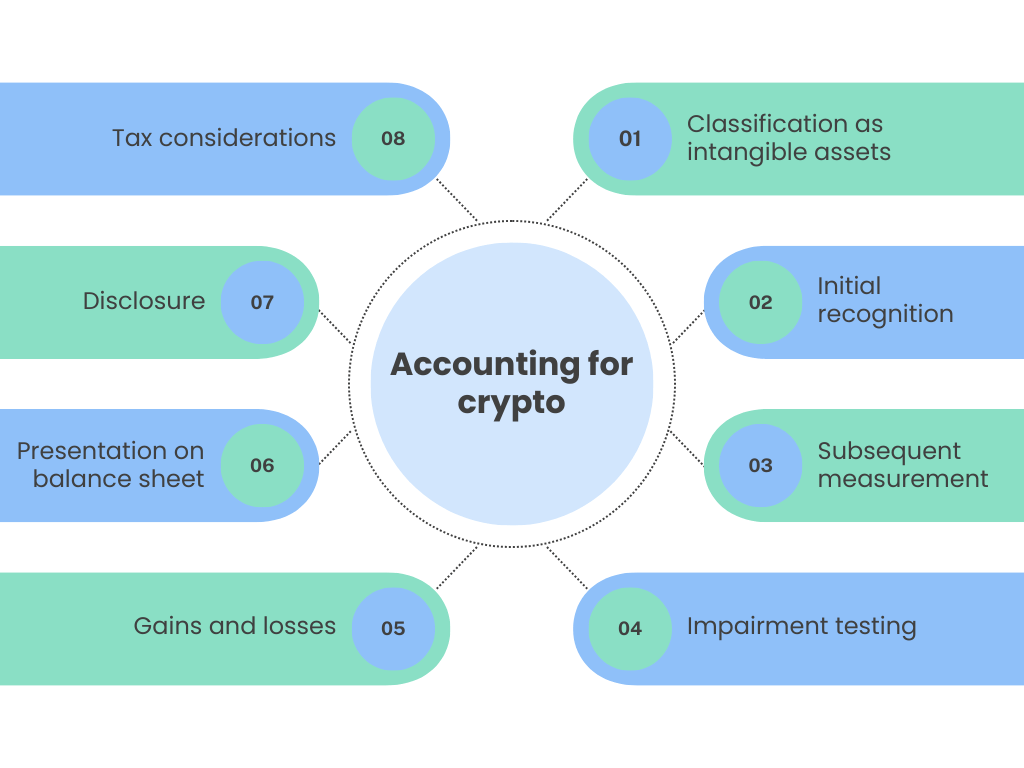

Accounting for cryptocurrency on the balance sheet

Accounting for crypto on the balance sheet is a nuanced process that requires careful consideration of various accounting standards and principles.

Step #1. Classification as intangible assets

As was said above, cryptocurrencies are classified as intangible assets because they lack physical form but are identifiable (each has a unique digital identifier) and are controllable (through private keys).

This classification impacts how cryptocurrencies are accounted for in terms of amortization (generally, cryptocurrencies are not amortized), impairment, and disclosure requirements.

Step #2. Initial recognition

The initial cost of a crypto includes its purchase price (the amount of cash or the fair value of other consideration given) and any directly attributable costs, such as transaction fees or brokerage costs.

When cryptocurrencies are acquired through an exchange transaction, their initial cost is determined based on the fair value of the asset given up or the fair value of the crypto received, whichever is more clearly evident.

Step #3. Subsequent measurement

Under IFRS, after initial recognition, an entity can choose either the cost model (carrying the asset at cost less any accumulated impairment losses) or the revaluation model (revaluing the asset to fair market value at each reporting date), provided there is an active market for the crypto. The latter is uncommon due to the rarity of an active market for many cryptocurrencies.

Under GAAP, cryptocurrencies are measured at cost less impairment. Unlike IFRS, GAAP does not allow for the revaluation of intangible assets.

Step #4. Impairment testing

Cryptocurrencies are tested for impairment when there are indicators that the asset might be impaired (e.g., significant decline in market value, adverse changes in the technological, market, economic, or legal environment).

If the carrying amount of the crypto exceeds its recoverable amount, an impairment loss is recognized. This loss is recorded in the income statement and reduces the carrying value of the crypto on the balance sheet.

Step #5. Gains and losses

Gains and losses are realized when the crypto is sold or transferred in another way.

The gain or loss is the difference between the sale proceeds and the crypto carrying amount at the time of the transaction.

Step #6. Presentation on the balance sheet

The classification depends on the purpose of holding the crypto. If intended for long-term investment, it’s classified as a non-current asset. If held for trading or sale in the ordinary course of business, it’s a current asset.

Due to the unique nature of crypto, they are often presented as a separate line item on the balance sheet to enhance the clarity of financial statements.

Step #7. Disclosure

Entities must disclose the accounting policies for crypto, including the methods used for determining the carrying amount.

- Disclosures about the nature of the crypto held, the risks associated with holding them, and any restrictions on their sale or use.

- Disclosure of the amount and nature of impairment losses, if any, and the circumstances leading to such impairments.

Step #8. Tax considerations

The tax treatment of crypto can differ from their accounting treatment. Entities need to consider how crypto transactions and holdings are taxed in their jurisdiction.

Maintaining compliance with tax regulations may include capital gains tax, income tax, or other forms of taxation, depending on the jurisdiction and the nature of transactions.

Cryptocurrency and Tax Implications

Cryptocurrency and its tax implications are a complex and evolving area of tax law, varying significantly by jurisdiction. However, there are some common principles and considerations that often apply.

1. Classification as property or asset

In many jurisdictions, cryptocurrencies are treated as property or assets for tax purposes, not as a currency. This means that standard property tax rules apply to transactions involving cryptocurrencies.

2. Capital gains tax

When you sell crypto for more than you purchased it for, you typically incur a capital gain, which is subject to capital gains tax. Conversely, selling for less than the purchase price results in a capital loss, which may be used to offset other capital gains.

3. Income tax

If you receive cryptocurrencies as payment for goods or services, it’s usually considered income and is taxable at the fair market value of the cryptocurrency at the time of receipt. Similarly, if you mine cryptocurrency, any earnings are typically treated as taxable income.

4. Record-keeping

It’s essential to keep detailed records of all cryptocurrency transactions. This includes dates of transactions, the value of the crypto in fiat currency at the time of the transaction, and the purpose of the transaction (e.g., whether it was for personal use or investment).

5. Tax on exchanges

Exchanging one crypto for another is often a taxable event, where you may realize a capital gain or loss. The gain or loss is calculated based on the difference in value between the cryptocurrency received and the adjusted basis of the crypto given up.

6. Taxation of ICOs and tokens

Participating in Initial Coin Offerings (ICOs) or receiving tokens can also have tax implications, depending on how the tokens are classified (e.g., as securities, commodities, or something else) and the jurisdiction’s tax laws.

7. Reporting requirements

In many jurisdictions, you may be required to report crypto holdings and transactions in tax filings, especially if they exceed certain thresholds or if you have realized significant gains or losses.

Risk management

Risk management with cryptocurrency in accounting involves identifying, assessing, and addressing the various risks associated with holding, transacting, or investing in cryptocurrencies as part of business operations or financial portfolios. Given the unique nature of cryptocurrencies, this process requires a different approach compared to traditional assets.

1. Market volatility

Cryptocurrencies are known for their high price volatility. Risk management strategies must account for rapid and significant fluctuations in value, which can impact balance sheets and investment portfolios. Hedging strategies, like using futures contracts or diversifying holdings, can be employed to mitigate these risks.

2. Cybersecurity risks

The digital nature of cryptocurrencies makes them susceptible to cyber threats such as hacking, phishing, and fraud. Implementing robust cybersecurity measures, including secure wallets, multi-factor authentication, and regular security audits, is critical for protecting these assets. In the realm of cryptocurrency security, it’s worth asking, “Do I need a VPN?” A VPN adds an extra layer of protection by encrypting your online activities, enhancing defense against cyber threats such as hacking and phishing. Assessing the need for a VPN is a crucial step in fortifying your digital asset protection measures.

3. Operational risks

Managing cryptocurrencies requires specific operational knowledge and infrastructure, such as secure transaction processes, reliable wallet management, and effective backup systems to prevent loss of private keys.

4. Liquidity risk

Some cryptocurrencies may have limited liquidity, making buying or selling large amounts difficult without affecting the market price. Understanding and managing liquidity needs is essential, especially for businesses that might require quick access to cash or are engaged in frequent trading.

5. Accounting challenges

The lack of specific accounting standards for cryptocurrencies can lead to challenges in accurately valuing these assets, assessing impairment, and determining their impact on financial statements. Regularly reviewing and updating accounting practices in line with the latest guidance from accounting bodies is necessary.

6. Taxation risks

Uncertainties and complexities in the tax treatment of cryptocurrencies can lead to compliance risks. Businesses need to ensure accurate reporting of crypto transactions for tax purposes and stay informed about changes in tax regulations.

Conclusion: Cryptocurrency in financial reporting

In summary, the emergence of crypto in accounting is reshaping how we handle financial information. However, while cryptocurrency integration offers promise, it also demands careful risk management and compliance efforts. As regulations evolve, cryptocurrencies have the potential to bring transparency and efficiency to financial reporting.

Learn more about IFRS 15 and its five-step model.

FAQ section

What are the implications of holding cryptocurrency for a long period?

Holding cryptocurrency for a long time can lead to significant capital gains or losses, impacting tax liabilities. It can also cause balance sheet fluctuations due to the volatile nature of crypto values and may present impairment risks if the market value significantly declines. Long-term holding should align with the company’s overall investment strategy and risk tolerance.

How does crypto affect a company’s working capital?

Cryptocurrency can enhance a company’s working capital due to its liquidity but also brings challenges due to its volatility. The impact on working capital depends on how quickly the crypto can be converted to cash and used for short-term obligations.

Are there industry-specific considerations for cryptocurrency accounting?

Yes, industries like technology, FinTech, retail, ecommerce, banking, and financial services have unique considerations for cryptocurrency accounting—these range from the frequency of crypto transactions to stringent regulatory and risk management requirements.

How do changes in cryptocurrency valuation affect financial ratios?

Changes in cryptocurrency valuation can significantly affect financial ratios. Fluctuations in value can impact asset-to-liability ratios, profitability ratios, and return on assets, especially if crypto forms a significant part of a company’s total assets.

Can cryptocurrency be considered a hedge against inflation in accounting?

While some view cryptocurrencies like Bitcoin as a potential hedge against inflation, their high volatility and uncertain regulatory environment make them a risky choice. In traditional accounting terms, hedging usually involves more stable and predictable assets, making cryptocurrencies a less conventional choice for inflation hedging.

.png)