One of the typical scenarios in business is when a company orders products or services to be paid for later. Even though they’re yet unpaid, a company reflects these expenses in the books. This process, known as accruing expenses, is vital for maintaining accurate financial records and ensuring transparency in the company’s financial obligations.

Today, we’ll explore accrued expenses and their role in effective financial management.

Key takeaways

- Accruing expenses involves recording costs when incurred, even if payment is made later, to ensure accurate and transparent financial records.

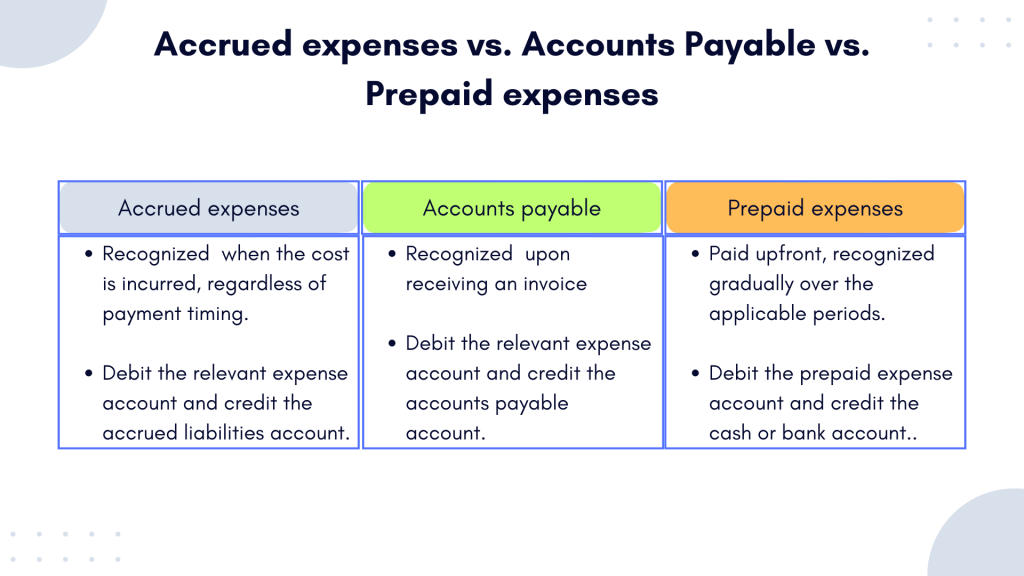

- Accrued expenses, accounts payable, and prepaid expenses differ mainly in their timing of recognition, with accrued expenses reflecting immediate financial obligations.

- Effective management of accrued expenses through systematic tracking and clear policies helps businesses maintain financial stability and transparency.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What are accrued expenses (accrued liabilities)?

Let’s start with how accounting defines accrued expenses.

Accrued expenses in business finance, often referred to as accrued liabilities, are, by definition, costs a company has incurred but not yet paid for. Despite the postponed payment, these expenses are recorded in the financial records, aiding the company in accurately reflecting its financial obligations and providing a comprehensive view of its current financial status. The term accrued liabilities is used because these represent obligations a business accumulated over time but have not yet settled.

Here’s an example.

Imagine a business that hires a cleaning service in January for the entire month but receives the bill in February. Even though they haven’t paid yet, the company records the cleaning expenses for January in its books during January itself (as they’re using the service in January). It’s an accrued expense – recognizing the cost when it occurs but not necessarily when you make the payment.

Accruing expenses aligns with the principle of accrual accounting, which emphasizes recognizing revenue and expenses when they are earned or incurred, irrespective of the actual cash transactions

A quick look at accrual accounting

Accrual accounting is a way of keeping financial records that focuses on when transactions occur, not just when money changes hands. In simple terms, it recognizes revenues and expenses when they are earned or incurred, rather than when the actual cash is received or paid.

This method provides a more accurate and comprehensive view of a company’s financial health by reflecting its ongoing activities in a timely manner. Accrual accounting helps businesses make informed decisions, plan for future expenses, and present a clearer picture of their overall financial position.

How do accrued expenses differ from other types of business expenses?

Businesses should distinguish accrued expenses from other business expense types. Sometimes, it’s pretty easy, as the difference is straightforward. But in other cases, the difference is not that visible. Meanwhile, different expenses play distinct roles in financial recognition and recording.

Let’s explore the key differences between accrued, accounts payable, and prepaid expenses.

Related:

Accounts Payable Process: The Ultimate Guide to AP

What are accounts payable?

Accounts payable represent amounts a company owes to its suppliers or vendors for goods or services received on credit. Unlike accrued expenses, the recognition of accounts payable happens when the invoice is received.

For instance, if a business purchases office supplies on credit, the corresponding accounts payable entry is recorded upon receipt of the supplier’s invoice.

What are prepaid expenses?

In contrast, prepaid expenses involve payments made in advance for goods or services that a business will utilize in the future.

For example, a company pays the annual rent at the beginning of the year. They record the entire amount as a prepaid expense. In other words, they recognize the expenses before they actually happen and gradually expense the costs in the applicable periods (i.e., each month).

Key difference of the accrued expense type in timing and recognition

As you can see, both accrued expenses and accounts payable pertain to the unpaid costs. Still, we distinguish between them. With prepaid expenses, the situation is more understandable. So, what’s the key difference between those expense types?

The answer is the timing of recognition.

Accrued expenses capture costs when incurred, providing a more immediate representation of the company’s financial standing. Accounts payable, however, hinge on the receipt of invoices, delaying recognition until the bill is received. Prepaid expenses, conversely, involve upfront payments, allowing companies to recognize costs before they are incurred. This method offers a different perspective, reflecting future financial obligations that have already been settled.

Understanding these distinctions is pivotal for businesses to maintain accurate financial records and gain insights into their current and future financial commitments.

What are the pros and cons associated with the practice of accruing expenses?

Accruing expenses in business finance comes with its set of advantages and drawbacks.

On the positive side, accruing expenses allows a company to reflect its financial obligations promptly, providing a more accurate snapshot of its current financial state. This practice aligns with the accrual accounting method, offering a comprehensive overview of a company’s financial health. Additionally, accounting for anticipated costs enables businesses to plan and budget more effectively.

However, there are cons to consider.

Accruing expenses may lead to overestimating current liabilities if not done judiciously, potentially impacting financial decision-making. Inaccurately calculated accrued expense estimates can result in misrepresentation in financial reports, affecting the company’s credibility. Striking a balance and implementing careful management practices are crucial to harnessing the benefits of accruing expenses while mitigating potential drawbacks.

Related:

What Is Accrual Accounting: How Does It Work and Why Should You Use It?

Shifting to Accrual Accounting: How Small E-commerce Businesses Can Streamline Bookkeeping Across Multiple Platforms

How does a business decide when to defer payments for products or services?

The decision to defer payments for products or services, thereby creating planned expenses, involves a strategic evaluation of a company’s cash flow and financial objectives. Businesses often opt for deferred payments to optimize their cash position, ensuring they have the liquidity to cover operational needs. This decision hinges on factors such as vendor terms, cash flow projections, and the overall company’s financial strategy.

Understanding the implications of deferred payments is critical. While it aids short-term cash management, it also introduces the need to accurately record and manage accrued expenses.

Why is accruing expenses important for ensuring transparency in a business’s financial position?

Accruing expenses affects transparency in a company’s financial position. As a company recognizes and records anticipated costs when they are incurred, regardless of payment timing, it provides stakeholders with a more accurate depiction of the current financial obligations. This transparency is essential for building trust among investors, creditors, and other stakeholders.

Failure to accrue expenses promptly can lead to current liabilities understatement, giving a misleading impression of a company’s financial health. Accurate and transparent financial reporting facilitates informed decision-making, fosters confidence among stakeholders, and contributes to the overall financial integrity of the business.

Therefore, accruing expenses is not just an accounting practice. It’s more of a fundamental aspect of responsible financial management.

What measures can businesses implement to effectively track and manage accrued expenses?

Effectively tracking and managing accrued expenses requires a systematic approach within a business.

Implementing clear policies and procedures for expense recognition and running regular reviews and reconciliations ensure accuracy. Companies can employ accounting software to streamline the process and minimize errors associated with manual record-keeping.

Regular communication and coordination between departments, especially finance and operations, are crucial to capturing all relevant expenses. Training and educating staff on timely and accurate expense reporting contribute to a culture of financial responsibility.

Adopting these measures can help businesses enhance their ability to track and manage accrued expenses effectively, promoting financial stability and transparency.

Bottom line

As you can see, accrued expenses are key to managing a company’s finances effectively. By recording costs when incurred, even if payment is due later, businesses provide a more transparent view of their financial position.

This practice, aligned with accrual accounting, aids in budgeting, decision-making, and fostering trust with stakeholders. Striking a balance between the benefits and potential drawbacks is crucial for responsible financial management. Overall, accurate recording of accrued expenses contributes to the long-term financial health and integrity of a business.

Continue reading: How long does a wire transfer take?

Share your thoughts

Do you understand accruals? Share your questions and experiences in the comments section below.. We’d love to hear from you!

.png)