When it comes to managing your finances, understanding the difference between fixed and variable expenses is crucial. Fixed expenses, such as rent or mortgage payments, remain constant from month to month. However, variable expenses can fluctuate and impact your budget significantly.

In this article, we’ll focus on one such expense – variable expenses – and explore what they are and how they can affect your budget. We’ll delve into the different types of variable expenses, how to track them, and some tips on how to manage them effectively.

Definition of Variable Expenses

Variable expenses are expenses that fluctuate each month. Unlike fixed expenses, variable expenses can change depending on a variety of factors, such as usage or consumption. Examples of variable expenses include groceries, utility bills, entertainment, and clothing.

In business, variable expenses are costs that change depending on how much you produce, sell, or operate. Fixed costs, like rent or salaries, stay the same month to month, while variable expenses fluctuate.

Think of things like raw materials, packaging, and shipping costs. If your business produces more products, you’ll likely spend more on these things; if you produce less, these costs go down. For example, a bakery would spend more on flour, sugar, and other ingredients when making more cakes, making these costs variable.

This way, variable expenses move up and down with your business activity. Tracking them helps businesses adjust prices, forecast profits, and understand how costs might change with different levels of sales or production.

Examples of Variable Expenses

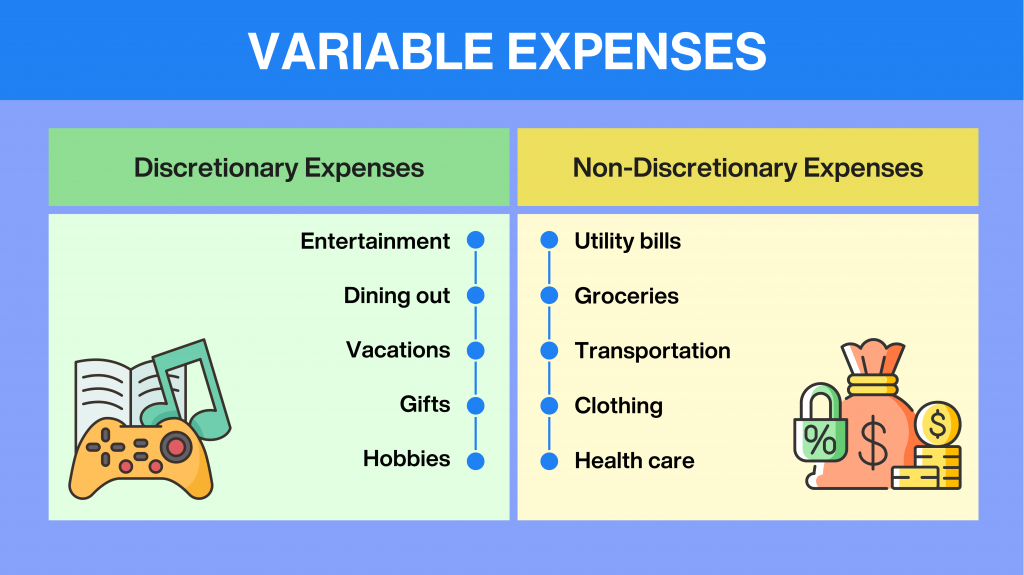

Variable expenses can be divided into two categories: discretionary and non-discretionary expenses. Discretionary expenses are those that are not necessary for survival, while non-discretionary expenses are essential for our daily lives. Here are some examples of each type of variable expense:

Discretionary Expenses

- Entertainment

- Dining out

- Vacations

- Gifts

- Hobbies

Non-Discretionary Expenses

- Groceries

- Utility bills

- Transportation costs

- Clothing

- Health care costs

It’s important to note that some expenses can fall into both categories. For example, groceries are a non-discretionary expense, but the type of food purchased can be a discretionary expense.

How to Track Variable Expenses

- Use a budgeting app: There are several budgeting apps available that can help you track your spending. These apps allow you to categorize your expenses and monitor your spending habits.

- Keep a spending journal: Writing down your expenses in a journal can help you see where your money is going and identify areas where you may be overspending.

- Use a spreadsheet: If you prefer to use a computer, you can create a spreadsheet to track your expenses. This will allow you to see your spending patterns and identify areas where you can cut back.

The Importance of Tracking Your Variable Expenses

Tracking your variable expenses is an essential part of budgeting. You can identify areas where you may be overspending by monitoring your spending. Keeping track of your variable expenses is important as they can add up quickly and impact your overall financial health.

Firstly, it allows you to identify areas where you may be overspending and find ways to reduce your expenses. Secondly, it provides a clear picture of your spending habits and helps you make informed financial decisions. Finally, tracking your variable expenses can help you set realistic financial goals and create a budget that works for you.

Strategies for Managing Variable Expenses

Managing your variable expenses can be challenging, but there are several strategies you can use to keep them under control. Here are some tips for managing your variable expenses effectively:

- Set a budget: Setting a budget for your variable expenses can help you stay on track and avoid overspending.

- Cut back on discretionary expenses: Identify areas where you may be overspending on discretionary expenses and find ways to cut back.

- Shop around for the best deals: When it comes to non-discretionary expenses, such as groceries or utility bills, shop around for the best deals.

- Use cash: If you overspend on variable expenses, try using cash instead of credit or debit cards.

Variable Expense: Conclusion

In conclusion, variable expenses play a significant role in determining the effectiveness of a budget. By understanding what variable expenses are and how they can impact one’s finances, individuals can make informed decisions about their spending habits and ensure that they are able to live within their means.

While it may be tempting to overspend on variable expenses, it’s important to remember that these expenses can add up quickly and have a significant impact on one’s overall financial health. By creating a budget that accounts for variable expenses and setting realistic goals, individuals can take control of their finances and make smart decisions about their spending.