Finance and accounting form the bedrock of any business, regardless of its size or scale. That’s why tailoring your operations to your business is so important.

In this article, we’re going to delve into the world of finance and accounting outsourcing (FAO), with a special focus on how it can be a game-changer for small and medium-sized businesses. Additionally, we’ll explore how accounting software can streamline and optimize your business operations.

Looking for a perfect match? Find an accounting professional or CPA in Synder’s directory.

Contents:

1. Why should a business outsource accounting?

2. Benefits of finance and accounting outsourcing

3. When should a business consider accounting outsourcing and bookkeeping services?

4. What accounting services can a business outsource?

5. How to make outsourced finance and accounting work for your business

6. Managing finance and accounting: In-house or outsourcing?

Why should a business outsource accounting?

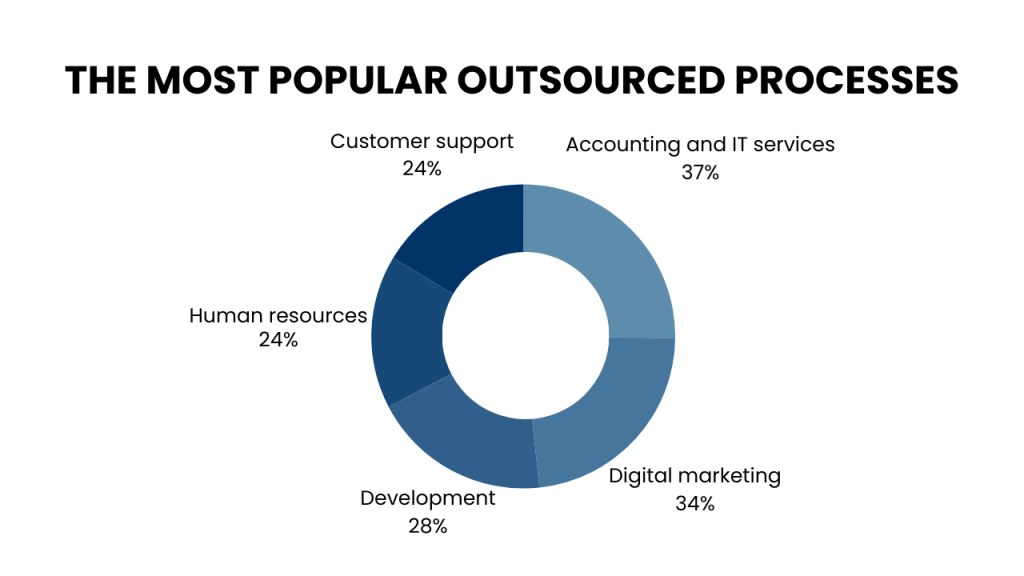

Outsourcing accounting refers to the practice where a business hires an external company or service provider to handle its accounting and financial tasks. According to Capterra, 71% of business owners choose to hire external companies for their finance and bookkeeping needs. Accounting and IT processes are the services most frequently outsourced by businesses.

Outsourcing accounting is a strategic decision that allows a business to reduce its operational costs significantly. By doing so, a business doesn’t have to bear the expenses related to hiring, training, and maintaining an in-house accounting team, which includes salaries, benefits, and other overheads.

It also gives businesses access to a team of accounting experts who are up-to-date with the latest financial regulations and practices. This expertise ensures high-quality financial management and compliance without the need for the business to invest in extensive training or expensive software.

Benefits of finance and accounting outsourcing

1. Get access to the team of financial and accounting professionals

When working with an outsourced accounting firm, you can rely on qualified professionals who provide bookkeeping and accounting services to manage your finances for you. By finding an accounting practice that suits you, you can rest assured that financial reporting will be done accurately and in compliance with the latest regulations. They can also provide you with financial planning and other advanced financial services that require a higher level of knowledge and skills.

You don’t need to invest money to find and keep key talent in your company, as through outsourcing, you always have access to experts both in terms of their work and helpful advice. Moreover, those companies have many specialists on their teams, which also gives you a unique chance to lean on their expertise that you otherwise couldn’t achieve with the in-house employees.

2. Grow your business and increase productivity

It’s important to ask: “What’s your and your employees’ key function in your business? How does each one of you add to the growth of your enterprise?”

For you, as a business owner, it’s important to prioritize your own time so that you can focus on developing and managing business activities that are vital.

Some of the top benefits were related to better use of time as well as increased productivity and efficiency. Outsourcing finance and accounting can provide you with those advantages, which in turn contributes to the growth and development of your starting business with no money.

3. Optimize accounting functions with process automation

Let everyone do what they do best. Accounting professionals know how to make their work easier by streamlining the business process and relying on digital finance technology. But, there are other industry secrets that make accounting tasks more efficient and accurate. Outsourcing can give you that edge.

Even if you choose to outsource finance and accounting tasks for a limited period of time, optimization is certainly an invaluable advantage that can be implemented even if you decide to discontinue the services. At later stages, process outsourcing can be transferred to your team to further their efficiency and productivity.

4. Ensure financial compliance and reduce risk

Outsourcing your accounting and finance tasks to professionals brings accuracy and ensures compliance with the latest financial regulations and tax laws. This compliance is crucial for any business to avoid legal complications and financial penalties.

The outsourced team’s expertise in handling complex regulatory requirements significantly reduces the risk of non-compliance. They stay abreast of changes in laws and regulations, which is especially beneficial for businesses operating in multiple jurisdictions or those that lack the internal resources to keep up with these changes.

5. Achieve cost-effective scalability

As your business grows, its financial needs become more complex and demanding. Outsourcing accounting functions provides scalability, allowing you to adjust the level of service as your business expands or contracts. This flexibility means you don’t have to worry about hiring additional staff during peak times or scaling back during slower periods. It’s a cost-effective solution that aligns with your business’s growth trajectory, ensuring that you have the right level of accounting support at every stage of your business journey.

6. Strategic financial insights and advisory

Beyond just handling day-to-day accounting tasks, outsourced accounting firms can provide strategic financial insights and advisory services. They can offer guidance on financial strategy, cash flow management, investment decisions, and long-term financial planning. This level of insight and advice can be invaluable for businesses looking to navigate financial challenges and capitalize on growth opportunities.

When should a business consider accounting outsourcing and bookkeeping services?

Not every business needs outsourcing. But some situations should certainly encourage you to consider it.

- When you have a small business and no need for a full-time employee, you can benefit from an advisory specialist with accounting and bookkeeping expertise.

- When you urgently need help with reports or reconciliation due to the looming IRS audit, tax season, or your previous bookkeeper is unavailable.

- When you’ve been looking for a staff accountant for too long and haven’t been able to find one because of the related costs.

- When accounting has become a general pain point in your workflow, and you’re looking for accounting services with expert assistance.

Learn about basic accounting for a small business: bookkeeping and accounting basics.

What accounting services can a business outsource?

Businesses can outsource a wide range of accounting services, depending on their needs and the complexity of their financial operations. Such services can include:

- Accounts Receivable management;

- Accounts Payable management;

- Bookkeeping;

- Account reconciliation;

- Payroll;

- Expense reports;

- Tax preparation and planning;

- Chief Financial Officer (CFO) services;

- Financial reporting and analysis;

- Financial forecasting;

- Dashboarding service, etc.

Let’s go into more detail about some of these services.

#1. Accounts Payable and Receivable

Managing accounts payable involves processing and paying invoices owed to suppliers, while accounts receivable focuses on issuing invoices to customers and ensuring the timely collection of payments.

#2. Bookkeeping

This includes managing day-to-day financial records, tracking income and expenses, and ensuring accurate financial documentation. Bookkeeping is fundamental for maintaining orderly financial records and is often one of the first services businesses choose to outsource.

#3. Payroll

Outsourced accounting firms can handle payroll processing, including calculating wages, withholding taxes, processing payments to employees, and submitting the necessary payroll tax forms.

#4. Tax preparation and planning

This involves preparing and filing tax returns in compliance with local, state, and federal regulations. Tax professionals also provide tax planning advice to minimize tax liabilities and ensure compliance with tax laws.

#5. Financial reporting and analysis

Outsourced accounting services can prepare periodic financial reports such as balance sheets, income statements, and cash flow statements. They also offer financial analysis to help businesses understand their financial health and make informed decisions.

#6. Chief Financial Officer (CFO) services

Some outsourcing firms provide part-time CFO services, offering high-level financial strategy, advice, and management. This can be particularly beneficial for small and medium-sized enterprises that need strategic financial leadership but don’t require a full-time CFO.

How to make outsourced finance and accounting work for your business

Outsourcing isn’t a one-size-fits-all type of process. Hence before you dive into it, it’s best to check how outsourcing can be tailored to your unique business needs.

#1. Evaluate your finance and accounting operations

Make a list of different aspects of your business accounting that you’re currently tapping into. Consider any changes that you’re planning to implement within the next year or so and the effect they’ll have on your finance and accounting operations.

This provides you with clear data on the type of services you might need.

#2. Perform a cost-benefit analysis

Stack the pricing of outsourcing financial services against the cost you’re currently incurring. Cutting costs will surely be a great benefit for your company.

Compare offers from different outsourcing companies. Auxis or Deloitte are some of the large providers, but there are a host of smaller companies, too. Keep in mind that there’s a shift in the pricing model being made now: since technology allows for much faster processing of data, companies are updating the way they charge clients for their services.

Remember the intangible benefits of outsourcing, like higher flexibility, increased efficiency, or access to specialized knowledge.

#3. Take stock of finance and accounting services you want to outsource

Since you can outsource finance and accounting tasks, it doesn’t necessarily mean that you should. You can pick and choose which services you want to outsource and which you’d rather handle in-house.

With the help of good software, many of your finance and accounting duties can be automated and will require a minimum of your time at a subscription cost only. This is certainly a solution worth considering, as it provides you with a middle ground between completely relinquishing your involvement and full in-house accounting.

Extra option for accounting management: Accounting software solution

Integrating process automation through cloud accounting software is an excellent strategy for business owners who prefer to maintain some level of in-house accounting management. Accounting software for large businesses streamlines financial management and saves considerable time, ensuring accurate financial reporting. This approach effectively balances the need for personal oversight with the efficiency of modern technology.

Accounting systems have a wide-ranging functionality that lets you record entries in your books and produce financial statements and other reports in a couple of clicks. Synder is a great example of such smart cloud accounting.

- Accurate data for all your transactions. Synder records the data from the connected payment and sales channels right into your accounting system (QBO, QBD, Xero). The software syncs all the transactions with such details as taxes, locations, discounts, shipping information, etc., while ensuring there are no duplicates.

- Smart reconciliation. With Synder, payouts are instantly matched with the records from your real bank account. The software helps minimize discrepancies, aiming for a zero difference between the accounts during the actual reconciliation process.

- Automated categorization to personalize your accounting operations. In Synder, you can create personalized rules. These rules aim to automate various tasks such as categorizing products, giving classes, adding locations for particular records and filling out missing data.

- High level of data security. By utilizing sophisticated encryption and secure connections, Synder guarantees the privacy and security of data transferred between platforms and accounting software.

Test Synder’s abilities by creating a trial account and getting a full month of free reconciliation!

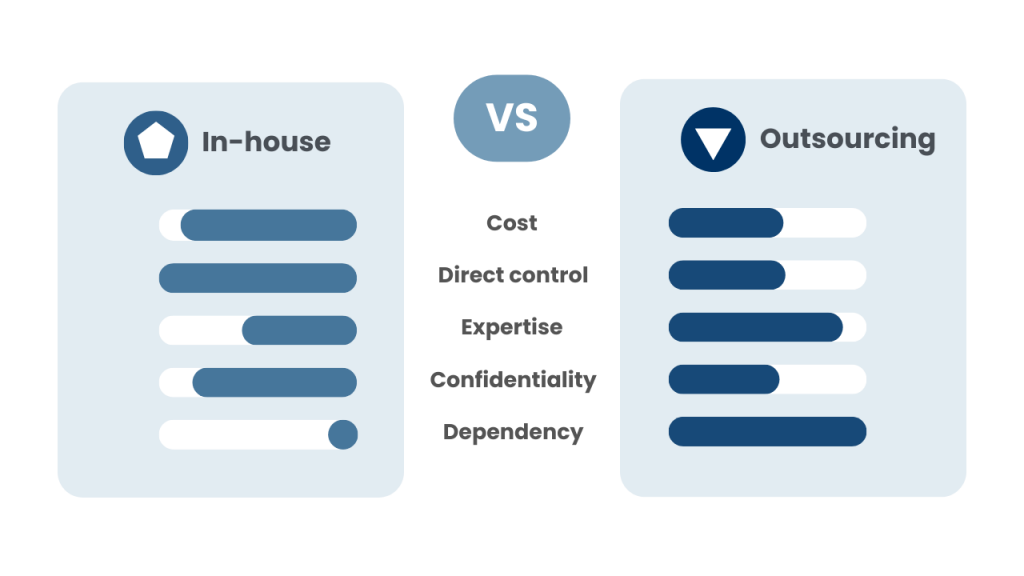

Managing finance and accounting: In-house or outsourcing?

Large companies are in a different position than small and medium-sized businesses when it comes to managing finance and accounting. While for those corporate giants having elaborate departments is somewhat typical, for SMBs the situation looks rather different.

Many small business owners choose to initially manage their finances by themselves, sometimes with the help of only Excel spreadsheets. But as the business grows, so do the needs. Payroll tax, invoicing, and leger management are becoming more complex and are beginning to take much more time than initially anticipated.

In-house accounting

The next natural step is to employ an accountant or a bookkeeper in-house. This clearly can unburden the already busy business owners or other employees. Accounting professionals can easily take care of their assigned tasks. However, it incurs the following costs:

- Hiring process;

- Salary plus payroll taxes, insurance, health care benefits, etc.;

- Continuous training costs;

- Office space (not applicable for remote work);

- Office supplies;

- Accounting technology.

Outsourcing for SMBs

Now, let’s look at outsourcing and what it’s like for small business owners. Here, there’s usually a single cost associated with outsourcing, which is service charges.

While, on the whole, outsourcing is supposed to give you a financial advantage, it’s best to compare expenses associated with both types of management of your accounting needs (i.e. in-house vs. outsourcing).

Currently, there’s a shift in pricing models as more and more work is being done through smart technology and automation, which changes how much time is devoted to taking care of clients’ operations. Amidst the ever-changing world of financial technology consulting, small and medium-sized businesses can uncover new opportunities by considering the top benefits of outsourcing their accounting processes.

While costs should definitely play a part in choosing the right model of handling your business finance and accounting, we shouldn’t discount other aspects.

Conclusion

For small and medium-sized businesses, outsourcing finance and accounting can be highly appealing. Particularly because it’s challenging for a single in-house employee to match the diverse range of services offered by an outsourced team. Outsourcing not only brings a wealth of expert knowledge to the table but also serves an advisory role, adding significant value to the business.

The market for outsourced services is highly adaptable, allowing these services to be customized to meet the unique requirements of your business. This flexibility enables you to leverage the benefits that outsourced accounting has to offer fully.

%20(1).png)

Synder’s blog never disappoints! 🌟 Exploring the top 3 benefits of outsourcing accounting for SMBs, and I’m eager to learn more about their Fintech skills.

Thank you for your feedback! We’re doing our best to provide you with comprehensive pieces.

Outsourcing accounting reduces costs, provides access to expertise, and ensures scalability. It guarantees financial compliance, risk reduction, and strategic financial insights. For businesses, it’s a tailored solution that balances efficiency, cost-effectiveness, and personal oversight through integration with accounting software. Small and medium-sized enterprises benefit from the diverse services and advisory roles outsourcing offers.

Thank you for sharing!

Thanks for sharing this insightful guide on a crucial aspect of business management. This comprehensive overview highlights the numerous advantages of outsourcing finance and accounting, emphasizing cost savings, scalability, and access to specialized expertise. The breakdown of outsourced services and practical tips on evaluating and implementing outsourcing add practical value.

You’re welcome, and thank you for your thoughtful comment! It’s great to see that you found the guide on outsourcing finance and accounting both insightful and practical. Highlighting the benefits such as cost savings, scalability, and access to specialized expertise is crucial for understanding the full potential of outsourcing in these critical areas. We’re glad that the breakdown and tips provided could add value to your understanding of how to approach outsourcing effectively. If there are any more aspects of outsourcing or business management you’re curious about, feel free to share your questions!

Outsourcing for accountants UK involves delegating specific financial tasks or processes to external service providers or specialized firms. This could encompass functions like bookkeeping, tax preparation, auditing, or financial analysis. Such outsourcing helps accountants focus on high-value tasks, enhances efficiency, and ensures comprehensive support within the framework of UK financial regulations.

Thank you for sharing .I’m researching the top three benefits of outsourcing accounting for SMBs and interested in learning more about their Financial abilities.

Thank you! We’re glad that you found our article helpful and informative.

It really becomes difficult to find a good outsourcing accounting company near you. You need to research well on every aspect before assigning your business data