I won’t be the first to say that managing accounting is a tremendously important part of business management that can be challenging. Even small businesses can struggle with accounting tasks, but larger companies face even greater complexities. Enterprises face unique challenges in the financial realm, and the list of pain points can seem never-ending: from keeping track of massive financial transactions to multiple subsidiaries to global operations. Add here complying with many regulations that sometimes change faster than you’re getting used to them, and you get an accurate idea of why enterprise accounting gives any seasoned accountant sleepless nights.

No wonder large companies invest in business software, including accounting software. And in this article, we’ll look at enterprise accounting software and how it helps beat finance management pains for large companies.

Enterprise business: what to consider a large company?

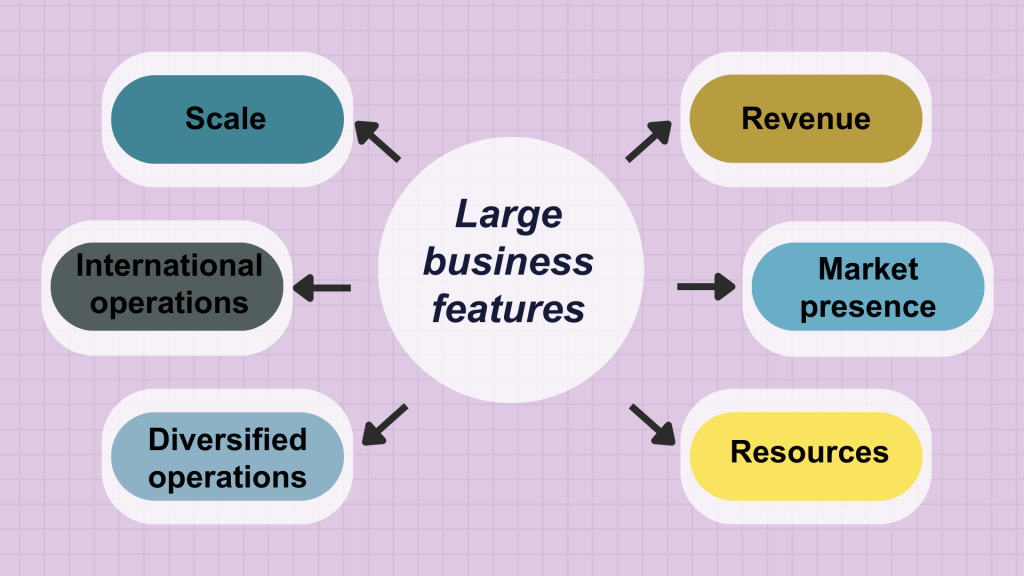

To begin, let’s explore what distinguishes large businesses from other organizations.

A large business or enterprise usually is a company that operates on a significant scale, often with a substantial workforce, high revenue, and a notable market presence. Although there are no strict frames of what constitutes a large business, they typically possess several distinctive characteristics.

Let’s look at them in more detail.

- Scale

Big companies run on a large scale, meaning they have many employees, multiple locations or branches, and serve a wide range of customers. - Revenue

Smaller enterprises generate less annual revenue compared to larger businesses. Large businesses are commonly ranked as top companies in their respective industries based on revenue. - Market presence

Large corporations typically hold a substantial portion of the market and are often viewed as key players in their respective industries. - Resources

They have substantial financial assets that allow them to invest in research and development, marketing, and expansion. - Diversified operations

Many large businesses have diversified operations, spanning multiple product lines or services. - International operations

Many big corporations have expanded their reach worldwide, running business activities in numerous countries.

An interesting fact is that – according to the SBA – the number of large businesses in the US only slightly exceeds 21K, which is less than 1% of all firms in the US, with small businesses making the vast majority.

Peculiarities of accounting for enterprise businesses

As mentioned, enterprise businesses have a global reach, employ many individuals, and generate massive revenues, operating at an impressive scale. But great size means more complexity in operations and, consequently, accounting. Thus, in finance management, large businesses have unique peculiarities and challenges. Let’s see how enterprise accounting differs from small and mid-size business accounting.

What’s small business or basic accounting?

Small businesses are privately owned enterprises, usually with no or few employees and smaller operations. Simple as they are, they still play a vital role in the economy, fostering entrepreneurship and creating job opportunities. Basic accounting for small businesses involves recording financial transactions, preparing financial statements, and ensuring tax compliance. These three basic practices help manage the company’s financial health, make informed decisions, and meet legal requirements.

What’s midsize business accounting?

The bridge between small and large, midsize businesses balance growth aspirations with resource constraints. These companies are more resourceful and have a broader reach than small businesses, yet they retain their agility and adaptability.

Midsize business accounting, at this point, involves systematically recording, summarizing, and analyzing financial transactions for accurate reporting, regulatory compliance, and informed decision-making. Key components include bookkeeping, financial statements, budgeting, tax compliance, payroll management, internal controls, financial analysis, audit preparation, technology integration, and financial strategy. The complexity of accounting increases in midsize businesses due to higher transaction volumes, a larger workforce, and expanded operations. And thus, many midsize businesses have dedicated accounting teams or outsource finance and accounting services to ensure efficient financial management.

What does an accountant face working with large companies and enterprises?

Large business owners, obviously, can’t handle accounting on their own, heavily relying on their accounting teams to manage their financials. So, enterprise accountants play a critical role in the decision-making processes of large organizations. Their responsibilities encompass a broad spectrum, ranging from financial reporting and compliance to budgeting and strategic planning. However, as the backbone of a company’s financial health, enterprise accountants encounter several complex challenges in their day-to-day operations. We’ve briefly highlighted some of them at the beginning of this article, so let’s look at those in more detail now.

Managing voluminous data

One of the foremost challenges for enterprise accountants is dealing with the massive influx of financial data. Large corporations generate volumes of financial transactions, invoices, and other financial records. And it’s essential to handle and interpret this data accurately and expediently. Analyzing and processing this extensive data manually can be overwhelming, leading to the risk of errors and inefficiencies.

Ensuring compliance and regulation adherence

The fluid landscape of financial regulations and accounting standards poses a significant challenge for enterprise accountants. Staying up-to-date with the latest laws and compliance requirements can be demanding, especially in a global business environment. Non-compliance can result in severe penalties and reputational damage for the company. Thus, enterprise accountants must continuously educate themselves and establish robust internal control systems to ensure adherence to the relevant regulatory frameworks.

Data security and cyber threats

Enterprise accountants deal with sensitive financial information that is a prime target for cybercriminals. Data breaches and security lapses can have catastrophic consequences, including financial losses and loss of trust from stakeholders. To mitigate these risks, accountants must employ robust cybersecurity measures, such as encryption, secure cloud storage, and employee training to recognize and prevent phishing attacks.

Collaboration and communication

Large enterprises typically have multidisciplinary teams working across different departments and locations. Effective collaboration and communication become challenging, especially when dealing with financial data that affects various stakeholders. Accountants must bridge the gap between finance and other departments, ensuring clear communication and a shared understanding of financial goals and objectives.

How can accounting software facilitate finance management for big companies?

As you can see, accounting for large companies is not a piece of cake. All things manual can’t work efficiently here. At this point, accounting software is a powerful tool to facilitate finance management for these enterprises, offering benefits that streamline processes, enhance accuracy, and provide valuable insights.

Speaking of the benefits, let’s take a sneak peek at what cloud accounting software has under the hood for big companies.

- Automation and efficiency

Accounting software automates routine financial tasks, such as data entry, invoice processing, and payroll calculations. This automation minimizes human errors, accelerates processes, and frees up valuable time for more strategic financial analysis and decision-making. - Real-time financial tracking

Large companies deal with vast amounts of financial data. Accounting software enables real-time tracking of transactions, expenses, and revenue streams, ensuring that financial data is up-to-date and readily available, allowing management to make informed decisions promptly. - Data accuracy and compliance

The software’s built-in validation checks and compliance features help maintain accurate financial records, which is crucial for large enterprises that should adhere to complex regulatory requirements and standards. Mistakes can lead to costly legal issues and reputational damage, making data accuracy a top priority. - Customized reporting

Accounting software enables the creation of customizable financial reports and dashboards, empowering decision-makers with a comprehensive overview of the company’s financial health, performance, and trends. Thus, it helps identify areas for improvement and capitalize on growth opportunities. - Integration with other systems

Large companies often utilize various software systems for different departments. Modern accounting software can integrate with these systems, enabling seamless data flow across the organization. This integration eliminates data silos and provides a holistic view of the company’s operations. - Scalability and growth

As companies expand, their financial management needs become more complex. Accounting software can scale for the company’s growth, accommodating increased transaction volumes, multiple locations, and diverse business units. - Cost savings

While the initial investment in accounting software might seem substantial, the long-term cost savings are significant. Manual labor reduction, fewer errors, and improved efficiency translate to improved financial performance. - Forecasting and planning

Accurate data forms the foundation for effective forecasting and strategic planning. With robust accounting software for medium business, large companies can create accurate financial models, perform scenario analysis, and develop sound growth and risk mitigation strategies. - Audit preparedness

Large enterprises are subject to audits from regulatory bodies and external auditors. Accounting software helps maintain organized and accessible financial records, simplifying the audit process and ensuring compliance.

Factors to pay attention to when choosing software for a big company

Sizable corporations usually feature a notably more intricate and protracted process of selecting business software due to their complex operations. The ramifications of a misjudged decision in this regard can reverberate through the corridors of time, costing not only financial resources but also precious time and effort. Transitioning to a new software system can exact a toll that extends far beyond monetary expenses, often challenging the very core of the organization’s functionality. At this point, it’s critical to approach software selection wisely.

The implications of an unsuitable choice can range from diminished operational efficiency and compromised competitiveness to outright business setbacks. Disrupted workflows, data discrepancies, and compliance breaches are some of the potential minefields awaiting those who hastily embark on software decisions.

The enterprise accounting solutions market is narrower than that of small business accounting. Still, the variety of options can be bewildering. At this point, businesses might want to consider some factors to introduce a semblance of order to their software selection process, making it more efficient.

- Scalability and flexibility

A software solution must be capable of accommodating the company’s current demands while also scaling to accommodate future growth. It should be flexible enough to adapt to evolving business requirements, ensuring that the investment remains valuable over time.

- Integration capabilities

Seamless integration with existing systems and software is essential to maintain workflow continuity. The chosen software should be able to integrate with a company’s current tech stack to prevent data silos and enable efficient data sharing and process automation.

- Customization options

Large enterprises often have unique processes and needs. The software should offer customization options that allow tailoring the solution to match the company’s specific workflows, rather than forcing the organization to adjust its processes to fit the software.

- Security and compliance

Data breaches and non-compliance can have severe repercussions. The software must adhere to the highest security standards, including data encryption, multi-factor authentication, and regular security updates. It should also comply with relevant industry regulations and standards.

- Vendor reputation and support

Opting for software from reputable vendors ensures reliability, ongoing updates, and quality support services. Research the vendor’s track record, customer reviews, and responsiveness to gauge their commitment to customer satisfaction.

- Total cost of ownership (TCO)

Beyond the initial purchase cost, evaluate the software’s TCO, including licensing, maintenance, support, and potential training expenses. Calculating the long-term financial impact provides a more accurate picture of the investment’s value.

- User experience and training

A user-friendly interface reduces the learning curve and enhances user adoption. Ensure the software offers intuitive navigation and provides training resources to help employees master the tool quickly.

- Performance and reliability

Downtime and sluggish performance can disrupt operations. Prioritize software solutions with a proven track record of high performance and reliability to minimize disruptions.

- Future-proofing and innovation

Technology evolves rapidly, and the software should be equipped to embrace new trends and innovations. Consider the vendor’s commitment to ongoing development and the incorporation of emerging technologies.

- Collaboration and communication tools

Effective collaboration is vital for large companies. Look for software that offers robust communication and collaboration features, such as real-time messaging, document sharing, and project management capabilities.

- Ease of migration

If migrating from existing software, assess the ease and potential challenges of transitioning data and processes to the new solution. A smooth migration process minimizes disruptions.

- Feedback from stakeholders

Involve key stakeholders from various departments in the decision-making process. Their input can provide valuable insights into the software’s compatibility with different business functions.

Enterprise accounting software you might want to look at

When you know what to look at when choosing enterprise accounting software, you can better evaluate whether this or that solution might fit your business. As for where to look, we gathered a list of popular accounting software catering to large companies’ needs.

Synder

Synder, a robust accounting solution for online businesses featuring large volumes of transactions, offers scalability that caters to businesses of diverse sizes, making it a versatile option for both small-scale enterprises and large corporations. This software’s user-centric approach addresses the needs of businesses at every growth stage, providing an encompassing array of features that ensure effective financial management.

- Synder’s adaptability is its hallmark, serving the requirements of businesses regardless of their scale. Startups and small businesses appreciate its user-friendly interface and straightforward setup, facilitating quick integration. For large corporations, Synder’s scalability manages augmented transaction volumes and intricacies without compromising precision.

- Particularly for businesses dealing with substantial transaction loads, Synder’s advanced automation mechanisms streamline financial operations. Features such as automatic bank feeds and simplified expense categorization alleviate manual work, boosting efficiency and allocating resources for strategic endeavors.

- Synder’s customizable reporting empowers both small and large businesses with insights essential for informed decision-making. Whether monitoring expenses, tracking sales trends, or analyzing cash flow, the software generates in-depth reports customized to unique needs. This empowers businesses to pinpoint avenues for growth and optimize financial strategies.

- Synder’s seamless integration with 25+ ecommerce, payment, and accounting platforms ensures consistency and precision in financial data management for large corporations employing interconnected software systems. Additionally, Synder’s multi-currency support and automated tax calculations make it adept for global operations, assisting large companies in navigating complex international financial landscapes.

In essence, Synder’s scalable accounting solution suits businesses ranging from startups to expansive corporations, accommodating their specific requirements. Its adaptability, streamlined processes, tailored reporting, integration capabilities, and global competence collectively position it as an invaluable tool for enterprises seeking optimal financial management solutions aligned with their growth trajectories.

Should you believe Synder can be the solution you’re looking for, don’t hesitate to book a seat at our webinar or sign up for a free trial to learn more about how it can help your particular business.

QuickBooks Enterprise

QuickBooks Enterprise is an accounting software tool tailored to meet the dynamic demands of growing businesses. What sets this software apart is its commitment to simplicity and accessibility. Renowned for its user-friendly interface, QuickBooks Enterprise doesn’t require a steep learning curve, making it a favorite among businesses that prioritize efficiency without compromising accuracy.

- One of the standout features of QuickBooks Enterprise is its advanced inventory tracking system. For businesses dealing with physical products, efficient inventory management can mean the difference between profit and loss. QuickBooks Enterprise empowers organizations with tools to monitor inventory levels, track stock movement, and optimize reordering processes. This translates into reduced carrying costs, minimized stockouts, and improved customer satisfaction—a boon for industries like retail, manufacturing, and distribution.

- Furthermore, the software’s prowess extends beyond inventory management. Its customizable reporting capabilities allow businesses to generate tailored financial reports that distill complex data into clear, actionable insights. Decision-makers can thus analyze financial performance, monitor key metrics, and make informed choices that drive the organization forward. What’s more, QuickBooks Enterprise fosters cohesion by seamlessly integrating with other essential business applications, creating a unified ecosystem that streamlines operations and enhances overall productivity.

In other words, as businesses evolve and diversify, their financial needs transform accordingly, and QuickBooks can grow alongside them, accommodating increasing complexities and requirements.

Oracle NetSuite

Oracle NetSuite emerges as a formidable cloud-based solution that seamlessly integrates financial management, Enterprise Resource Planning (ERP), and Customer Relationship Management (CRM) into a unified platform.

- One of its most notable attributes is its comprehensive suite of functionalities that cover a wide spectrum of financial needs. From intricate financial planning to accurate revenue recognition and even addressing the complexities of global tax compliance, Oracle NetSuite stands out for its ability to provide an all-encompassing financial management experience.

- What truly sets Oracle NetSuite apart is its emphasis on real-time data accessibility. In today’s fast-paced business environment, having up-to-the-minute insights is paramount. NetSuite delivers on this front by allowing businesses to access their financial data in real time. This capability equips decision-makers with the necessary information to make well-informed choices promptly. Moreover, the agility this real-time access offers enables companies to swiftly adapt to ever-changing market conditions, giving them a competitive edge in navigating uncertainties.

- Oracle NetSuite’s cloud-based architecture adds another layer of appeal. By being hosted in the cloud, the software minimizes the complexities of on-premises installation and maintenance. This not only reduces the burden on IT departments but also facilitates easy scalability as businesses grow. The cloud-based approach also enhances collaboration, as teams can access the software and its data from anywhere with an internet connection. This proves particularly valuable in today’s era of remote work and global operations.

Long story short, Oracle NetSuite is a comprehensive financial management solution that empowers businesses with real-time insights, robust functionalities, and the flexibility of cloud-based accessibility. For organizations seeking an integrated platform to harmonize financial processes and adapt swiftly to changing circumstances, Oracle NetSuite remains a compelling option.

Sage Intacct

Sage Intacct is an accounting solution, garnering praise for its robust financial management capabilities. Designed to cater specifically to businesses grappling with complex accounting requirements, Sage Intacct offers a comprehensive suite of features that streamline various financial processes.

- Notably, its automation functionalities play a pivotal role in enhancing efficiency by simplifying tasks like accounts payable and receivable. By automating these processes, organizations can reduce manual errors, mitigate the risk of discrepancies, and optimize resource allocation.

- One of Sage Intacct’s key strengths lies in its reporting tools, which provide a profound understanding of an organization’s financial performance. These tools go beyond basic financial statements, offering detailed insights into critical metrics and key performance indicators. This level of granularity empowers financial teams and decision-makers to make informed choices, identify trends, and proactively address challenges. Whether it’s monitoring cash flow, tracking expenses, or assessing revenue streams, Sage Intacct’s reporting capabilities are integral to driving strategic financial decisions.

- Another noteworthy feature of Sage Intacct is its multi-entity support, a vital asset for organizations with diverse operations or multiple subsidiaries. Managing finances across various entities can be intricate, often involving intricate intercompany transactions and regulatory compliance. Sage Intacct simplifies this complexity by allowing seamless consolidation of financial data from multiple entities. This functionality not only streamlines reporting but also ensures accuracy and compliance, ultimately fostering a cohesive financial overview for the entire organization.

As companies continue to evolve and expand, the comprehensive capabilities of Sage Intacct position it as a dependable ally in the pursuit of accurate, streamlined, and strategically informed financial operations.

SAP S/4HANA Finance

SAP’s S/4HANA Finance is an all-encompassing enterprise resource planning (ERP) solution renowned for its capacity to seamlessly integrate financial operations with various other pivotal facets of business functionality.

- Central to S/4HANA Finance’s distinction is its revolutionary in-memory database, a technological marvel that shatters the constraints of traditional data processing. By storing and retrieving data in real-time, this database redefines the landscape of reporting and analysis. Organizations can harness this dynamic feature to promptly generate insights, enabling them to respond promptly to market shifts and evolving trends. In doing so, businesses can enhance their agility and maintain a competitive edge in an ever-dynamic corporate environment. This instantaneous access to financial data doesn’t just empower financial teams; it extends its benefits across departments, promoting synergy and informed collaboration throughout the organization.

- The forward-looking capabilities of S/4HANA Finance extend beyond conventional financial management. Predictive accounting, a hallmark feature of this solution, ushers in a new era of proactive financial planning. Through intricate algorithms and historical data analysis, the system forecasts potential financial outcomes, enabling businesses to strategize for various scenarios. This proactive approach aids in risk mitigation, resource optimization, and the cultivation of a resilient financial strategy. Likewise, the cash management feature optimizes liquidity by providing insights into cash flows and suggesting strategies to enhance working capital management. Such comprehensive functionalities demonstrate S/4HANA Finance’s commitment to holistically addressing the multifaceted needs of modern enterprises, allowing them to navigate complexities with precision and confidence.

S/4HANA Finance is essential for large enterprises, seamlessly integrating financial data with broader functions, breaking down silos, and fostering synchronization. Its predictive accounting and cash management features add strategic value, elevating it beyond routine tasks. This solution empowers organizations to streamline workflows, adopt a forward-looking financial approach, harness data as a strategic asset, and drive growth.

Microsoft Dynamics 365 Finance

Within the comprehensive array of tools that constitute the Microsoft Dynamics suite, Dynamics 365 Finance emerges as a powerhouse, offering an extensive range of end-to-end financial management capabilities that cater to the diverse needs of modern businesses. At its core, Dynamics 365 Finance goes beyond the mundane aspects of financial management; it becomes a strategic partner in an organization’s financial journey. The suite integrates various features, seamlessly navigating the intricate landscape of budgeting, financial planning, and vendor collaboration. This integration paves the way for holistic decision-making regarding various financial facets.

- What sets Dynamics 365 Finance apart from conventional financial management tools is its incorporation of advanced AI capabilities that bring automation and predictive insights to the forefront. This infusion of artificial intelligence not only accelerates routine financial tasks but also empowers organizations with data-driven foresight. By harnessing historical data patterns and trends, the AI-driven functionalities enable businesses to make informed decisions, anticipate market shifts, and adapt strategies accordingly. In this fast-paced and dynamic business environment, such predictive prowess can often mean the difference between seizing opportunities and being left behind.

- Organizations today are continually striving to stay ahead in an ever-evolving landscape, and Dynamics 365 Finance emerges as an invaluable asset in this pursuit. It caters to businesses seeking to embrace cutting-edge technology to enhance their financial operations. This platform offers a comprehensive suite of tools that not only address immediate financial needs but also lay the foundation for sustainable growth. Its user-friendly interface and intuitive design make it accessible to financial professionals across various proficiency levels, further democratizing the realm of financial management. Whether it’s orchestrating intricate budgeting processes, orchestrating financial planning, or nurturing vendor relationships, Dynamics 365 Finance provides a unified platform for organizations to navigate their financial landscape with confidence.

Dynamics 365 Finance transcends software – it’s a strategic enabler aligning financial endeavors with business goals. Seamlessly integrating financial features with AI insights, it fuels innovation and growth. As businesses optimize operations and make informed decisions, Dynamics 365 Finance showcases technology’s potential to reshape financial management and drive prosperity.

Bottom line

Enterprise accounting’s complexity arises from the intricate challenges faced by large businesses, spanning data management, compliance, and cybersecurity. Accounting software offers a remedy, delivering automation, real-time tracking, and data precision. However, the pivotal choice of software demands a deep comprehension of business needs. Factors such as scalability, integration, customization, security, vendor credibility, and costs must all be carefully evaluated. Collaborating with stakeholders and integrating their feedback is essential.

In this landscape replete with software options, selecting the optimal fit is paramount. The chosen solution can redefine financial management, streamline processes, and foster expansion. By aligning software capabilities with your specific business demands, you can adeptly navigate the complexities of enterprise accounting, ultimately steering your organization toward sustained prosperity.

Read more about Desktop accounting software.