Cloud accounting software has revolutionized the way businesses, including small businesses, manage their financial operations in today’s digital era. With its numerous benefits and increasing popularity, it’s become a game-changer for businesses of all sizes, enabling even a small business to compete on a level playing field. Providing enhanced accessibility, real-time collaboration, scalability, cost-effectiveness, and robust security, cloud accounting and bookkeeping software offers unparalleled efficiency and convenience for a business.

In this article, we’ll explore the features, examples, advantages and challenges of cloud accounting software, empowering businesses to make informed decisions about adopting this transformative financial management tool.

Contents:

1. What is cloud computing and cloud accounting?

2. Examples of popular cloud software solutions for accounting purposes

3. Key features of cloud accounting software for business

4. What to take into account when choosing cloud accounting software

5. Advantages of cloud accounting software

6. Challenges and risks of cloud accounting software

What is cloud computing and cloud accounting?

Cloud computing, in the context of accounting, refers to the use of remote servers hosted on the internet to store, manage, and process financial data. Instead of relying on local infrastructure like a colocation data center, cloud accounting software allows businesses to access their accounting software and data through a web browser or app. It means that cloud accounting software refers to a web-based application that allows organizations to store, process, and manage their accounting and financial data on remote servers accessed via the internet.

The role of cloud computing in accounting is transformative due to several reasons. It eliminates the need for businesses to invest in expensive hardware and IT infrastructure, reducing upfront costs and maintenance requirements. With cloud accounting software, businesses can leverage the power of remote servers to handle complex calculations, store large volumes of data securely, and enable seamless collaboration among multiple users.

Examples of popular cloud software solutions for accounting purposes

1. Synder

Synder is an innovative cloud-based accounting software specifically tailored for small and medium-sized businesses (SMBs). With its user-friendly interface and robust features, Synder aims to simplify the financial management process for SMBs while providing them with the tools they need to effectively run their business.

One of the key features of Synder accounting software is its ability to generate professional invoices. Customers of this accounting software can easily create customized invoices, including their company logo and branding, and send them directly to clients. This streamlines the invoicing process, saving time and effort for a business. Synder also allows for automated recurring invoices, reducing the manual workload and ensuring timely and accurate billing.

Automation is a strong part of Synder. The accounting software automates bookkeeping tasks by automatically capturing financial transactions from various sources. It integrates seamlessly with popular e-commerce platforms and payment gateways such as Shopify, WooCommerce, Amazon, PayPal, Stripe, and more. This integration enables Synder accounting software to sync sales, fees, refunds, and other transactional data, eliminating the need for manual data entry and reducing the chance of errors. This automation saves significant time and improves accuracy in financial record-keeping.

Synder accounting software offers integration with bank accounts, enabling real-time bank feeds. This feature allows users to automatically import bank transactions into Synder, providing an up-to-date view of their financial position. With real-time bank feeds, businesses can quickly reconcile transactions and ensure their financial records are accurate and complete. The automatic reconciliation feature matches imported transactions with existing records, further reducing manual effort and ensuring accuracy.

To help a business gain insights into its financial performance, Synder accounting software provides detailed business performance reports. Customers of the accounting software can generate reports that showcase key metrics such as revenue, expenses, profit margins, and more. These reports provide valuable information for analyzing business performance, identifying trends, and making informed decisions.

Synder also prioritizes data security. The accounting software employs industry-standard encryption and data protection measures to ensure the confidentiality and integrity of user data. Regular backups are performed to safeguard against data loss, providing peace of mind to users.

Furthermore, Synder’s customer support team is readily available to assist customers with any inquiries or technical issues. They provide prompt responses and guidance, ensuring a smooth user experience.

Test Synder during a 15-day free trial (no credit card required!) or book office hours to learn more about its powerful functionality via live chat.

2. NetSuite

NetSuite is a widely recognized cloud-based accounting software that offers a comprehensive suite of financial management tools and services. It’s designed to streamline and automate various accounting processes, providing businesses with a centralized platform for managing their financial operations.

As a cloud-based solution, NetSuite eliminates the need for on-premises servers and software installations. Users can access the platform securely from any device with an internet connection, enabling remote collaboration and real-time data visibility.

One of the key features of NetSuite is its robust financial management capabilities. It allows a business to handle essential accounting tasks such as general ledger management, accounts payable and receivable, fixed asset management, cash flow management, and financial reporting. NetSuite supports multi-currency transactions and global consolidation, making it suitable for businesses operating across multiple countries and regions.

In addition to core accounting functions, NetSuite offers its customers modules for inventory management, order management, purchasing, and supply chain management. These integrated modules allow businesses to seamlessly connect their financial data with their operational processes, providing a holistic view of their business performance.

NetSuite’s reporting and analytics capabilities enable users to generate customized financial reports, perform in-depth analysis, and gain insights into their financial data. The platform provides real-time dashboards, key performance indicators (KPIs), and customizable workflows to help customers monitor and manage their financial health effectively.

Another notable aspect of NetSuite is its scalability. The accounting software caters to the needs of small and medium-sized businesses as well as large enterprises. It can handle high transaction volumes and support complex financial processes, making it suitable for businesses with growing operations and evolving accounting requirements.

NetSuite accounting software also offers integration capabilities with other business systems, including customer relationship management (CRM), e-commerce platforms, human resources management systems (HRMS), and more. This integration facilitates seamless data flow and enhances the efficiency of business processes.

Moreover, NetSuite’s cloud-based architecture ensures automatic updates and maintenance, eliminating the need for manual software updates. This ensures that users always have access to the latest features and security enhancements without the hassle of manual upgrades.

3. QuickBooks Online

QuickBooks Online is a highly popular cloud-based accounting software that caters to the needs of small and medium-sized businesses (SMBs). It offers its customers a comprehensive suite of features and tools designed to streamline financial management processes and provide businesses with accurate and up-to-date financial information.

One of the key functionalities of this accounting software is its invoicing feature. Customers can easily create and customize professional-looking invoices, including company logos and branding. The accounting software allows for easy tracking of invoiced amounts, payment status, and due dates. QuickBooks’s customers can send invoices directly to clients via email and even enable online payment options to facilitate faster and more convenient transactions.

Expense tracking is another important aspect of QuickBooks Online. This accounting software enables customers to record and categorize business expenses efficiently. Its customers are able capture receipts and attach them to expense entries, making it easier to keep track of expenses and maintain accurate records. QuickBooks accounting software allows for integration with bank accounts and credit cards, automating the process of importing and categorizing transactions, thereby reducing manual data entry and saving time.

QuickBooks Online accounting software offers robust bank reconciliation capabilities. It syncs with users’ bank accounts, allowing for automatic bank feeds that import transactions in real-time. This feature simplifies the process of reconciling bank statements with financial records, ensuring accuracy and reducing the chances of errors. Customers of QuickBooks Online can easily match imported transactions with existing records, flag discrepancies, and resolve any discrepancies promptly.

The reporting capabilities of QuickBooks Online accounting software are extensive and customizable. Its customers are able to generate various financial reports, including profit and loss statements, balance sheets, cash flow statements, and more. These reports provide valuable insights into business performance, allowing QuickBooks customers to analyze revenue, expenses, and profitability. QuickBooks Online also offers built-in templates and pre-configured reports, simplifying the reporting process for users.

Additionally, QuickBooks Online provides its customers with features like inventory management, time tracking, and project management, allowing businesses to track and manage their inventory, billable hours, and project-related expenses. QuickBooks Online accounting software also supports integration with other business tools and applications, such as customer relationship management (CRM) systems and payroll software, to streamline data flow and enhance overall operational efficiency.

Being cloud-based, QuickBooks Online has some more beneficial features like access to financial data from anywhere, anytime, using any device with an internet connection. This enables remote collaboration and real-time visibility into financial information. QuickBooks Online accounting software also ensures automatic updates and backups, eliminating the need for manual software installations and reducing the risk of data loss.

QuickBooks Online provides excellent customer support through various channels, including live chat, phone, and email. QuickBooks users can seek assistance for any technical issues or queries, ensuring a smooth user experience and prompt resolution of any problems.

4. Xero

Another highly regarded example of cloud-based accounting software is Xero, which has gained popularity for such features as its user-friendly interface and extensive integrations with various business tools. This accounting software is designed for small and medium-sized businesses (SMBs) and offers a package of feature to streamline financial management processes as accounting software for medium businesses.

One of the standout features of Xero accounting software is its invoicing capabilities. Its customers create professional invoices, customize them with their company branding, and send them to clients directly from the software. Xero supports automated recurring invoicing, making it convenient for businesses that have regular billing cycles. This accounting software also offers the feature of online payment options, allowing customers to make payments directly from the invoices, which can help speed up cash flow.

Bank reconciliation is another core functionality of Xero accounting software. It integrates with banks and financial institutions to import transactions automatically, providing customers with real-time data. This feature simplifies the process of matching imported transactions with existing records, ensuring accurate and up-to-date financial information. Xero’s customers are able to reconcile bank statements and identify any discrepancies, improving accuracy and reducing manual effort.

Expense tracking is also made efficient in Xero accounting software, which allows for easily capturing and categorizing business expenses, attaching receipts, and recording reimbursement claims. The accounting software supports multi-currency transactions, which is especially useful for businesses operating internationally. Xero also offers features for managing purchase orders, bills, and vendor payments, providing a comprehensive solution for expense management.

Xero’s inventory management capabilities enable businesses to keep track of their stock levels, track sales, and manage purchase orders. Customers of this acccounting software can set up inventory items, track costs, and receive alerts for low stock levels. Integration with e-commerce platforms allows for seamless synchronization of inventory data, ensuring accurate stock tracking across various sales channels.

Xero’s extensive integration options make it a powerful accounting software. The accounting software integrates with a wide range of business tools, including customer relationship management (CRM) systems, payment gateways, project management software, and more. These integrations facilitate data flow and streamline business processes, eliminating the need for manual data entry and enhancing overall efficiency.

The accounting software provides robust reporting capabilities, offering a variety of financial reports such as profit and loss statements, balance sheets, and cash flow statements. Its users have a possibility to generate customized reports and dashboards, allowing for in-depth analysis of financial data. Xero’s reporting features provide businesses with valuable insights into their financial performance and aid in decision-making.

Xero places a strong emphasis on data security and privacy. The accounting software employs multiple layers of encryption and secure authentication protocols to protect user data. Regular backups are performed to ensure data integrity and provide peace of mind to users.

Customer support is an important aspect of Xero’s service. The accounting software makes it opens to its users access to support resources, including guides, videos, and online forums. Xero accounting software also offers email and live chat support to assist users with any technical issues or inquiries.

These examples represent just a small fraction of the cloud-based accounting software solutions available in the market and it’s essential for businesses to carefully evaluate their specific accounting needs, scalability requirements, and budgetary constraints when choosing a cloud accounting software solution.

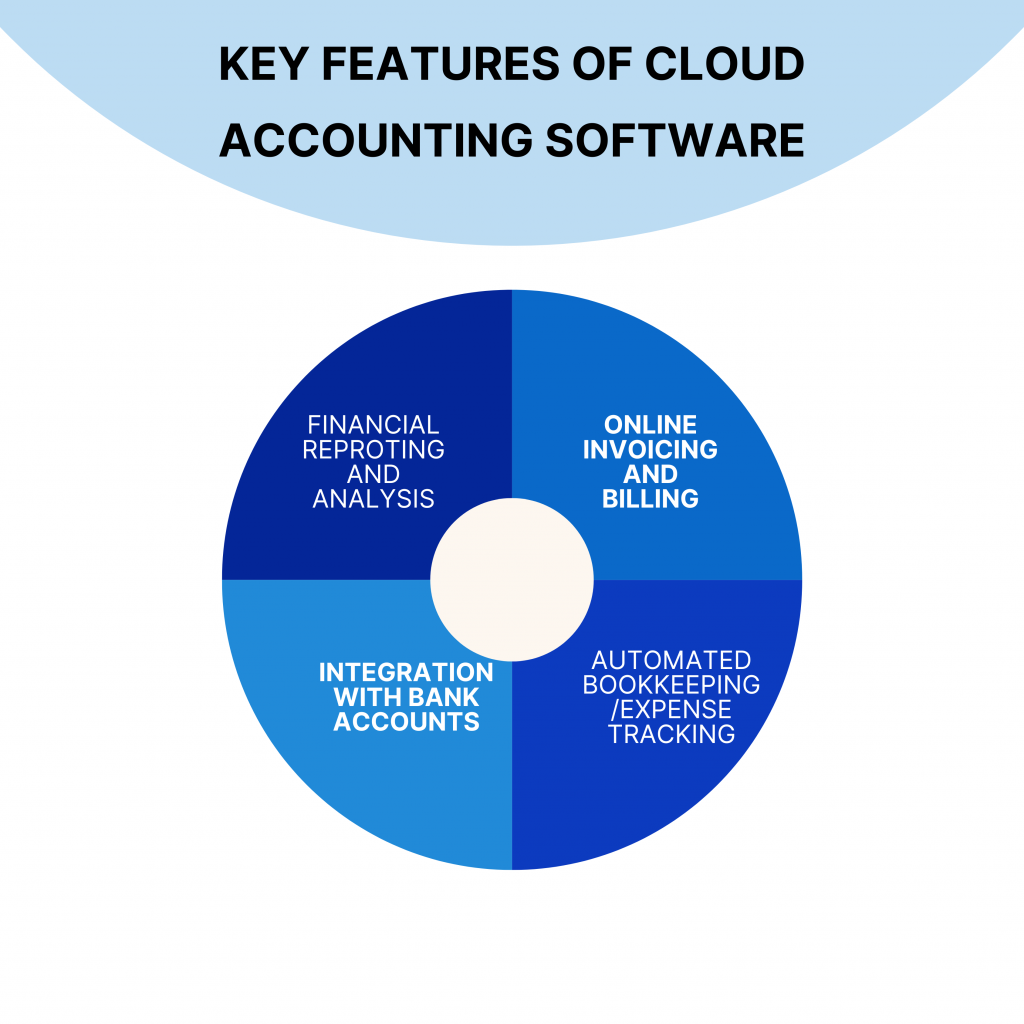

Key features of cloud accounting software for business

Cloud accounting software offers a wide range of key features that simplify accounting processes, improve accuracy, and provide valuable insights into a business’s financial health. Let’s explore some of these key features in detail:

Online invoicing and billing

One of the primary features of cloud accounting management software is online invoicing and billing. This feature allows businesses to create professional-looking invoices, customize templates with their branding, and send them to clients electronically. Online invoicing streamlines the billing process by eliminating the need for manual paperwork and mailing invoices.

Cloud accounting software enables a business to generate invoices quickly, add line items, specify payment terms, and calculate taxes automatically. It also allows for easy customization, such as adding company logos and payment instructions. Some software solutions even offer the option to set up recurring invoices for regular clients, saving time and effort in generating repetitive invoices.

Online invoicing provides businesses with several advantages. It accelerates the payment collection process by allowing clients to pay invoices electronically through integrated payment gateways. This improves cash flow and reduces the time and cost associated with manual payment processing.

Automated bookkeeping and expense tracking

Cloud software for accounting automates bookkeeping tasks, making them more efficient and accurate. It eliminates the need for manual data entry by automatically capturing and categorizing transactions. By linking bank accounts or integrating with financial institutions, cloud accounting software can directly import and reconcile transactions, saving time and reducing the risk of errors.

Automated bookkeeping ensures that financial records are up to date and eliminates the tedious manual tasks traditionally associated with recording transactions. This feature also allows businesses to track expenses more effectively. Users can scan or photograph receipts, which can be uploaded directly into the software for automatic expense categorization and tracking. This not only simplifies expense management but also improves accuracy and facilitates expense reporting for tax purposes.

Integration with bank accounts and financial institutions

Cloud accounting software often provides seamless integration with bank accounts and financial institutions. This integration enables direct bank feeds, where transactions from linked bank accounts are automatically imported into the software in real-time. This eliminates the need for manual data entry, reduces errors, and ensures accurate and up-to-date financial information.

By integrating with bank accounts and financial institutions, cloud accounting software simplifies bank reconciliation. Reconciling accounts becomes a streamlined process as users can match imported transactions with corresponding records in the accounting software. This improves accuracy, reduces the time spent on manual reconciliation, and provides a clear overview of the company’s cash flow position.

Financial reporting and analysis tools

Cloud accounting software offers robust financial reporting and analysis tools that provide valuable insights into a business’s financial performance. These tools enable users to generate a variety of reports, such as profit and loss statements, balance sheets, cash flow statements, and customizable financial dashboards.

Financial reports provide a comprehensive overview of the business’s financial health and performance. They help users track revenue, expenses, profitability, and cash flow. By analyzing these reports, businesses can identify trends, assess the effectiveness of their financial strategies, and make informed decisions.

Cloud accounting software often allows users to customize reports to meet their specific needs. They can select specific time periods, choose relevant data fields, and apply filters to generate tailored reports. This flexibility empowers a business to focus on the key financial metrics and gain deeper insights into its financial data.

Additionally, some cloud accounting software solutions offer advanced analysis tools, such as key performance indicators (KPIs) and benchmarking. These tools allow businesses to compare their financial performance against industry standards or set targets, facilitating performance evaluation and strategic decision-making.

By leveraging these key features of cloud accounting software, businesses can streamline their financial processes, improve accuracy, and make informed decisions. Whether it’s generating professional invoices, automating bookkeeping tasks, reconciling bank transactions, or analyzing financial data, cloud accounting software provides the necessary tools for efficient financial management. It empowers a business to focus on strategic decision-making, optimize cash flow, and drive overall financial success.

What to take into account when choosing cloud accounting software

When selecting a cloud accounting software solution, a business must consider various factors to ensure it meets its specific needs and requirements. Let’s explore some key factors to consider when choosing cloud accounting software:

Pricing and subscription plans of accounting software

Subscription and price plans are critical factors to evaluate when choosing cloud accounting software. Consider the following aspects:

1. Cost structure: Understand the pricing model of the software, whether it is based on a monthly or annual subscription, or a usage-based pricing model. Evaluate if the pricing aligns with your budget and the value the software provides.

2. Scalability: Consider the software’s flexibility in scaling up or down as your business grows or changes. Ensure that the pricing structure accommodates your future needs and expansion plans.

3. Additional fees: Take note of any additional fees, such as for add-ons, integrations, or customer support. Factor in these costs to get a comprehensive understanding of the total cost of ownership.

Ease of use and user interface of accounting software

The ease of use and user interface of cloud accounting software play a crucial role in ensuring user adoption and efficiency. Consider the following aspects:

- Intuitiveness. Evaluate how intuitive and user-friendly the software’s interface is. Look for features like a clean design, logical navigation, and easily accessible functionalities that enable users to quickly learn and navigate the system.

- Training and support. Assess the availability of training resources, such as user guides, video tutorials, and customer support, to help users familiarize themselves with the software. A responsive and knowledgeable support team can also make a significant difference in the software’s usability.

- Mobile access Determine if the software provides a mobile application or mobile-responsive interface, allowing users to access and perform accounting tasks on-the-go. This feature can be beneficial for businesses with remote teams or those requiring flexibility in accessing financial data.

Integration capabilities with other software

Consider the integration capabilities of the cloud accounting software with other business systems and applications, for example, third-party integrations. You should evaluate the software’s ability to integrate with other essential business applications, such as

- customer relationship management (CRM)

- e-commerce platforms, payment gateways

- project management tools.

Integration capabilities can streamline data exchange, reduce duplicate data entry, and improve overall workflow efficiency.

Dive into our detailed article about procurement to unlock the secrets of smart purchasing and strategic supplier relationships that can propel your business forward!

Data security and privacy measures of accounting software

Data security and privacy are paramount considerations when choosing cloud accounting software. Ensure the software provides robust security measures and protects sensitive financial data. Look for the following:

- Data encryption. Check if the software employs strong encryption protocols to protect data during transmission and storage. Encryption ensures that data remains secure even in the event of unauthorized access.

- Data backup and recovery. Assess the software’s data backup and recovery processes. Regular automated backups and reliable recovery mechanisms safeguard against data loss due to hardware failure.

- Compliance and certifications. Consider if the software complies with industry-standard security certifications, such as ISO 27001 or SOC 2. These certifications demonstrate that the software provider follows best practices in data security and privacy.

- Access controls and permissions. Evaluate the software’s access control features, such as user permissions and role-based access, to ensure that sensitive financial data is accessible only to authorized personnel within your organization.

Advantages of cloud accounting software

Accessibility and convenience

One of the significant advantages of cloud accounting software is its accessibility and convenience. Traditional accounting systems often require users to be physically present in the office or connected to a specific network to access financial data. In contrast, cloud accounting software allows users to access their accounting systems from anywhere, at any time, as long as they have an internet connection.

This accessibility enables business owners, accountants, and bookkeepers to work remotely, collaborate with team members, or access financial data while on the go. Users can log in to their cloud accounting software using a web browser or mobile application, providing them with real-time access to critical financial information. This flexibility allows for faster decision-making, timely responses to financial queries, and seamless coordination among team members, regardless of their physical location.

Real-time data updates and collaboration

Cloud accounting software offers real-time data updates and collaboration features that significantly enhance productivity and efficiency. Multiple users can access and update financial data simultaneously, eliminating the need for manual data consolidation and reducing the risk of data duplication or errors.

Real-time data updates ensure that several users can have access to the most up-to-date financial information. When, for example, a new transaction is recorded or an invoice is issued, it reflects immediately in the system, allowing users to view and analyze the latest data. This real-time visibility into financial data enables quicker decision-making, as users can assess the current financial status of the business without delay.

Cloud accounting software also facilitates seamless collaboration among team members. Multiple users can work on the same financial records simultaneously, making it easier to share information, discuss financial matters, and ensure everyone is on the same page.

Scalability and cost-effectiveness

With cloud accounting software, businesses can easily scale their operations without the need for expensive hardware upgrades or additional IT resources. Cloud accounting software providers typically offer flexible subscription plans that can be adjusted as the business’s needs evolve. As the organization grows or experiences fluctuations in accounting requirements, users can upgrade or downgrade their subscription plans accordingly. This scalability ensures that businesses only pay for the resources and features they need, optimizing cost-effectiveness.

Furthermore, cloud accounting software eliminates the costs associated with maintaining on-premises infrastructure, such as server maintenance, software updates, and data backup. The responsibility for maintaining and securing the servers and infrastructure lies with the software provider, reducing the burden on businesses. This cost-effective approach allows organizations to allocate their resources towards other critical areas of their operations.

Enhanced security and data backup

Data security and backup are paramount concerns for businesses, especially when it comes to financial information. Cloud accounting software addresses these concerns by offering enhanced security measures and robust data backup capabilities.

Cloud accounting software providers employ advanced security protocols, such as encryption, firewalls, and intrusion detection systems, to protect sensitive financial data. These measures help safeguard against unauthorized access, data breaches, and cyber threats. Additionally, cloud solutions often have dedicated security teams that monitor and address potential vulnerabilities, ensuring the highest level of data security.

Furthermore, cloud accounting software automates data backup processes, ensuring that financial data is regularly and securely saved. In the event of hardware failure, natural disasters, or other unforeseen circumstances, businesses can quickly restore their financial data from backups maintained by the cloud provider. This data redundancy and backup system provide peace of mind, reducing the risk of data loss and ensuring the availability of financial information when needed.

Challenges and risks of cloud accounting software

Cloud accounting software offers numerous benefits, but it’s important to be aware of potential challenges and risks associated with its implementation. By understanding and addressing these challenges, businesses can mitigate risks and maximize the advantages of cloud accounting software. Let’s explore some key challenges and risks:

Internet connectivity and downtime issues

One of the primary challenges of using cloud accounting software is its reliance on internet connectivity. Without a stable and reliable internet connection, users may face difficulties accessing their financial data or performing accounting tasks. Internet outages or slow connections can disrupt operations and hinder productivity.

To address this challenge, businesses should ensure they have a robust internet infrastructure and consider having backup internet options in place. Additionally, monitoring and addressing any potential issues promptly can help minimize downtime and prevent significant disruptions to accounting processes.

Data privacy and security concerns

Data privacy and security are crucial considerations when using cloud accounting software. Storing financial data on remote servers may raise concerns about the safety and confidentiality of sensitive information. It’s necessary to carefully evaluate the data privacy and security measures implemented by the cloud accounting software provider.

To mitigate data privacy and security risks, businesses should prioritize the selection of reputable cloud accounting software providers that adhere to industry-standard security protocols. As mentioned above, look for providers that offer encryption, data access controls, regular security updates, and compliance with relevant regulations.

Furthermore, businesses should educate employees about best practices for data security, such as using strong passwords, enabling two-factor authentication, and being cautious about phishing attempts. Regularly updating software and promptly addressing any security vulnerabilities or issues that arise is also crucial.

Potential limitations in customization

While cloud accounting software offers a range of features and functionalities, there may be limitations in terms of customization. Some software solutions may not fully align with specific business processes or industry requirements. This can pose challenges if the software cannot be tailored to meet unique accounting needs.

To address customization limitations, businesses should carefully evaluate the software’s flexibility and customization options during the selection process. Engaging with the software provider and understanding the extent to which the software can be tailored to match specific requirements is essential. Additionally, businesses can consider if the software offers integration capabilities with other applications.

It’s crucial to strike a balance between customization needs and the benefits of using a standardized cloud accounting software solution. Businesses should carefully assess their customization requirements and determine if the software’s out-of-the-box features meet their core accounting needs, while still allowing for scalability and adaptability as the business grows.

Advanced testing capabilities

One great advantage of such accounting software is its ability to streamline testing processes. With cloud-based solutions, businesses can easily test and experiment with different accounting approaches and strategies without the need for extensive manual intervention. This allows for quick iterations and the ability to fine-tune financial processes, ensuring accurate and efficient accounting practices.

Overall, cloud accounting software presents significant advantages and opportunities for businesses of all sizes, including small businesses. With its testing capabilities, extensive services, cost-effectiveness, and robust security, it offers a great deal for businesses looking to streamline their financial management processes and stay ahead in today’s competitive landscape. By embracing cloud accounting software, businesses can access the tools and insights they need to make informed decisions and drive their success forward.

Wrapping up: How to choose suitable cloud software for accounting

In conclusion, cloud software for accounting offers numerous benefits that can revolutionize the way businesses, bookkeeping and accounting professionals manage financial processes. The popularity and adoption of cloud-based solutions have been steadily increasing, driven by the desire for flexibility, efficiency, and streamlined financial management. Cloud accounting solutions have become a preferred choice for businesses of all sizes, ranging from startups to large enterprises. Its ability to provide anytime, anywhere access to financial data, and offer powerful reporting and analysis tools has transformed the way accounting tasks are performed.

When considering a cloud accounting solution, it’s important for businesses to assess their specific needs, evaluate pricing and subscription plans, ensure ease of use and user interface, explore integration capabilities, and prioritize data security and privacy measures. We hope that by following our tips, you’ll be able to unlock the full potential of cloud-based financial management software and choose the right cloud accounting solution.

You might also find it interesting to read about best accounting software for dropshipping in 2023 and best accounting software for Mac.

.png)