Understanding online payment systems has become paramount in the ever-evolving world of digital transactions. One key player that has emerged in recent years is Stripe. But exactly what is a Stripe account? This article aims to demystify the concept and highlight its significance in today’s online commerce landscape.

What is Stripe?

Stripe is an online service that allows businesses to accept payments from customers over the internet. Think of it like a virtual cash register for websites and apps. Here’s a breakdown of what Stripe provides:

- Payment processing. Stripe enables businesses to accept payments online. This includes payments from credit cards, debit cards, and various other payment methods, depending on the region.

- Stripe Connect. This product is designed for marketplaces, platforms, and payment facilitators. It allows them to accept money, make payouts, and manage the money movement for their business models.

- Stripe Atlas. A toolkit for startups to incorporate in the U.S., set up a U.S. bank account, and start accepting payments with Stripe. This is particularly useful for international entrepreneurs.

- Stripe Radar. A suite of modern, machine-learning based tools for detecting and preventing fraud.

And that’s not all the services Stripe provides its users with! Stripe has distinguished itself with its developer-first approach. Their documentation, APIs, and developer tools are considered by many to be top-notch, which has made them particularly popular among tech startups and online businesses.

How does Stripe work?

At a high level, Stripe acts as a bridge between businesses and banking systems, ensuring that online transactions are processed securely and efficiently. Over the years, they’ve expanded their services to accommodate a wide range of business needs, from straightforward payment processing to more complex financial operations. Here’s a general overview of how Stripe works.

1. Integration with business platforms

- Direct Integration. Developers can integrate Stripe directly into their websites or mobile apps using Stripe’s API.

- Plugins & Extensions. For non-developers or those using popular platforms like WordPress, Shopify, WooCommerce, and others, Stripe offers plugins or extensions. These allow for easier integration of Stripe’s payment processing capabilities.

2. Transaction process

First of all, a customer chooses to make a purchase from a Stripe-integrated business, so they enter their credit card or other payment details into a secure payment form. This can be a Stripe-hosted form or a custom form built by the business.

Stripe handles the secure transmission of this payment data, interacting with the credit card networks and the customer’s bank. After that the transaction is either approved or declined, and the outcome is communicated back to the merchant’s website or app. If approved, the funds are captured and later settled into the merchant’s bank account, usually within a few days.

3. Payouts

After processing the transaction, Stripe deducts its fees and transfers the net amount to the business’s linked bank account. This is done based on a schedule (e.g., daily, weekly) that the business can set in its Stripe Dashboard.

4. Dashboard & Management tools

Stripe provides users with a dashboard where they can view transactions, manage refunds, handle disputes or chargebacks, and access various reports and analytics.

5. Global operations

Stripe supports multiple currencies and payment methods, making it suitable for businesses that operate internationally. The platform can automatically handle currency conversion for businesses.

What is a Stripe account?

A Stripe account refers to the account a business or individual sets up with Stripe to make use of its services. When someone signs up with Stripe to accept payments, manage transactions, or utilize any of its other offerings, they create a Stripe account.

There are different types of Stripe accounts, tailored to different needs:

- Standard account. This is the most common type of account. Businesses or individuals can easily sign up to accept payments, and Stripe handles everything from storing cards to direct payouts to the bank. The account holder uses Stripe’s dashboard to manage transactions, refunds, and other necessary actions.

- Express account. Designed primarily for platforms and marketplaces, this type of account provides a UI for users to onboard, a dashboard for them to see their earnings, and handle payouts. A Stripe Express account offers more control to the platform compared to a Standard account but is more streamlined than a Custom account.

- Custom account. This is the most flexible type of Stripe account, designed for platforms and marketplaces that need a fully customized user experience. With Custom accounts, the platform handles the user experience and is responsible for ensuring all necessary information is collected.

- Connected account. This refers to an account that’s connected to a platform using Stripe Connect. It could be any of the above types (Standard, Express, Custom) but is linked to a primary platform or marketplace that manages the flow of funds. For example, if you’re a seller on a marketplace that uses Stripe to process payments, your individual seller account with that marketplace might be a “Connected Account” on Stripe.

When you have a Stripe account, you can access the Stripe Dashboard, a centralized place where you can see and manage your payments, refunds, customers, and other data related to your Stripe services. The type and depth of features you’ll have in the dashboard can vary based on the type of account and the permissions granted to it.

Setting up a Stripe account

Setting up a Stripe account is a straightforward process. Here’s a step-by-step guide to help you establish your account:

1. Visit Stripe’s Website.

2. Click on the “Start now” or “Sign up” button.

3. Provide your email, create a password, and confirm the password. You might also be asked to complete a captcha to verify you’re human.

4. After logging in, look for an “Activate your account” or similar section. Here, you’ll be required to provide more detailed information:

- Business details. Type of business (individual, corporation, non-profit, etc.), business address, official website, and description of products or services.

- Personal details. Your full name, address, date of birth, and the last 4 digits of your Social Security Number (or relevant ID number, depending on your country). Stripe uses this to verify your identity.

- Bank details. The account where Stripe will transfer (or “settle”) the funds you receive. This will typically include your bank’s routing number and your account number.

5. For added security, consider setting up two-step verification. This will require you to enter a code from your phone or an authenticator app when logging in.

6. Set Up Your Payment Acceptance Methods. Configure how you want to accept payments. With Stripe, you can accept payments via your website, mobile apps, invoices, or in person.

- For online payments, you’ll likely integrate Stripe’s API or use one of their pre-built integrations or plugins for popular platforms like WordPress, Shopify, etc.

- For in-person payments, you can use Stripe Terminal to accept card-present transactions.

7. Test Before Going Live. Stripe provides a testing environment where you can make dummy transactions to ensure everything works as expected. Use the “View test data” toggle in the dashboard to switch between live and test modes.

8. Once you’re confident everything is set up correctly, you can switch from test mode to live mode and start accepting real payments.

Note: Ensure that your business complies with all relevant regulations. For instance, if you’re dealing with customers in the European Economic Area (EEA), you’ll need to be aware of and compliant with the General Data Protection Regulation (GDPR).

9. Monitor and Manage Your Account. Regularly check your Stripe Dashboard to oversee transactions, manage disputes, and view analytics.

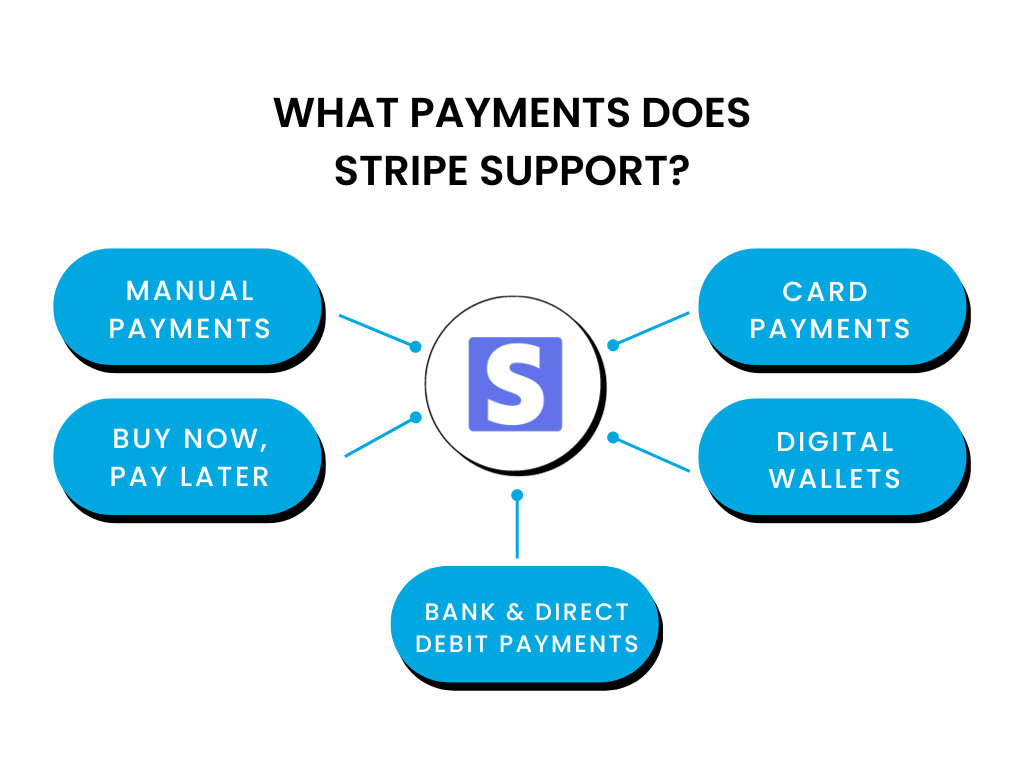

What payments does Stripe support?

Stripe supports a wide variety of payment methods to accommodate businesses and customers worldwide. Here are the payment methods supported by Stripe:

Card payments

Stripe accepts all major debit and credit cards from customers in every country. This includes:

- Visa

- Mastercard

- American Express

- Discover

- JCB

- Diners Club

- UnionPay (certain countries)

Digital wallets

Stripe supports various digital and mobile wallets, such as:

- Apple Pay

- Google Pay

- Microsoft Pay

- Alipay

- WeChat Pay

- Click to Pay (Visa, Mastercard, American Express, and Discover’s unified payment method)

Bank and direct debit payments

Depending on the region, Stripe supports several bank and direct debit payment methods:

- ACH Debit (in the U.S.)

- SEPA Direct Debit (in the European Union)

- Bacs Direct Debit (in the UK)

- BECS Direct Debit (in Australia)

- FPX (in Malaysia)

- iDEAL (in the Netherlands)

- giropay (in Germany)

- EPS (in Austria)

- P24 (in Poland)

- Bancontact (in Belgium)

- Sofort (used in several European countries)

Buy Now, Pay Later

Some deferred payment and installment options include:

- Afterpay / Clearpay

- Klarna Payments

- Stripe’s own installment payment service (availability can vary by region)

Manual payments

Checks and money orders, although these are processed outside of Stripe. Stripe provides tools for recording and reconciling these payments within your account.

Note 1: Remember, the availability of certain payment methods can vary based on your business’s location and the location of your customers. Stripe’s platform detects and offers appropriate payment methods dynamically based on the customer’s location, ensuring a smoother checkout experience.

Note 2: It’s also worth noting that Stripe continuously evaluates and adds new payment methods. Therefore, for the most up-to-date list and detailed information about specific payment methods, it’s best to check Stripe’s official documentation or website.

Do Stripe payments go straight to bank account?

No, Stripe payments do not go directly to your bank account immediately after a transaction. In summary, while Stripe handles the payment processing and makes the process of accepting online payments much smoother, there’s still a delay between when a transaction occurs and when the funds are settled in your bank account. This delay accounts for the payout schedule and any potential issues like refunds or disputes.

There’s a settlement process that Stripe follows:

1. Payment processing

When a customer makes a payment, Stripe handles the transaction and keeps a record of the funds to be transferred to you.

2. Holding in Stripe account

After a successful transaction, the funds are first held in your Stripe account. This hold allows Stripe to manage potential refunds, chargebacks, or disputes.

Read about Stripe chargeback protection.

3. Payout schedule

Stripe has a predefined payout schedule, which is often based on the country and type of business. For many businesses in countries like the U.S., there’s a 2-day rolling payout schedule. This means that payments received on a given day are sent to your bank account two days later. However, in some other countries or for certain types of businesses, the payout schedule can be longer, such as 7 days.

For example, if you receive a payment on a Monday (and you’re on a 2-day rolling payout schedule), that payment would be settled in your bank account on Wednesday.

4. Initial waiting period

New Stripe accounts might have an initial waiting period (typically 7-10 days) before the first payout is made. This waiting period helps Stripe mitigate risks. After this period, payouts will follow the regular schedule.

5. Manual payouts

Stripe also allows users to set manual payouts, meaning you can decide when to transfer funds from your Stripe account to your bank account, rather than having it done automatically.

Note: If, for some reason, a payout fails (e.g., bank account details are incorrect, the bank rejects the transfer, etc.), the funds will be returned to your Stripe balance. Stripe will notify you of this, and you’ll need to address the issue before the funds can be re-sent.

Are Stripe payments safe?

Yes, Stripe payments are considered safe for both merchants and customers.

While no system can claim to be 100% secure against all potential threats, Stripe is among the industry leaders in terms of payment security and has a strong track record in this area.

Stripe has invested heavily in security infrastructure and follows industry best practices to protect the data and transactions that flow through its system. Here are some reasons why Stripe payments are secure:

- PCI DSS Compliance. Stripe is certified as a PCI Level 1 Service Provider, which is the highest level of certification available in the payments industry. The Payment Card Industry Data Security Standard (PCI DSS) sets the security standards for organizations that handle credit card transactions.

- Encryption. Stripe uses strong encryption methods to protect sensitive data. Card numbers are encrypted at rest with AES-256, and decryption keys are stored on separate machines.

- Stripe Radar. This is Stripe’s machine learning-driven fraud detection system. It analyzes transactions in real-time to block fraudulent charges and helps merchants identify and prevent potential fraud.

- Two-Factor Authentication. Stripe offers two-factor authentication (2FA) for accounts, adding an extra layer of security. With 2FA, users need to provide a second piece of information, aside from just their password, to access their account.

- Secure payment forms. Stripe provides merchants with payment forms that are embedded directly into their websites but hosted on Stripe’s servers. This ensures that the data entered by customers is sent directly to Stripe, bypassing the merchant’s servers entirely.

- Regular audits and monitoring. Stripe undergoes regular security audits and assessments to ensure its infrastructure and practices remain secure.

What are the advantages of using Stripe?

Stripe offers several advantages as a payment processing platform for both large enterprises and small businesses. Here are some of the notable benefits:

Ease of integration

Stripe provides developers with well-documented APIs that allow for easy integration into websites, mobile apps, and other platforms. Additionally, for non-developers or those using popular CMS platforms like WordPress, there are pre-built plugins and extensions available.

Transparent pricing

Stripe’s pricing structure is straightforward, with no hidden fees. This transparency makes it easier for businesses to understand costs and plan accordingly.

Global reach

Stripe supports over 135 currencies and multiple payment methods, including credit/debit cards, bank transfers, and popular e-wallets. This extensive support makes it suitable for businesses that operate internationally.

Customizable checkout experience

Businesses can customize the look and feel of their checkout process, whether using Stripe’s pre-built payment forms or creating their own for a seamless brand experience.

Security

Stripe uses state-of-the-art security measures, including encryption, tokenization, and machine learning-driven fraud detection (Stripe Radar). They also handle most of the PCI DSS compliance requirements, reducing the burden on merchants.

Dashboard and reporting

Stripe provides an intuitive dashboard that allows merchants to monitor transactions, manage disputes, and gain insights into their sales and customers. The platform also offers detailed reporting and analytics tools.

Expandable with extensions

The platform’s functionality can be expanded with various third-party apps and integrations, allowing businesses to tailor Stripe to their specific needs.

Note: While these advantages make Stripe an appealing choice for many businesses, it’s essential to consider the specific needs of your business, potential processing fees, and any regional limitations. It’s also beneficial to compare Stripe with other payment processors to determine the best fit for your situation.

What are the potential drawbacks and limitations of Stripe?

In conclusion, while Stripe offers a lot of advantages, it’s essential for businesses to evaluate their specific needs, transaction patterns, and technical capabilities when considering Stripe as their payment processor. It’s also essential to understand its potential drawbacks and limitations:

Account freezing or termination

Like many payment processors, Stripe uses algorithms to detect suspicious activities. Sometimes, legitimate businesses can be flagged, leading to account holds, freezes, or even terminations. This can disrupt cash flow and can be challenging, especially for new businesses.

Not always the cheapest option

Depending on the transaction volume and size, some businesses might find other processors to offer more competitive rates, especially when considering international or cross-border transaction fees.

Limited Physical Point of Sale (POS) options

While Stripe does offer Terminal for in-person payments, Stripe POS options might not be as comprehensive or diverse as those from other providers that have a longer history in brick-and-mortar payment solutions.

Delayed funds

Although Stripe’s payout schedule is standard for the industry, some businesses might prefer a processor that offers more immediate access to funds.

Foreign exchange fees

If your business deals with multiple currencies, Stripe charges a conversion fee, which might be higher than some other payment processors or banks.

Conclusion

As the world leans more toward digital commerce, tools like Stripe have become indispensable. By understanding what a Stripe account offers and how it functions, businesses can unlock a world of possibilities and simplify their online transactions.

.png)