In the modern era of commerce, the ability to facilitate seamless financial transactions can make or break a business. As digital economies grow and physical cash usage declines, businesses of all sizes are compelled to adapt. It’s in this milieu that Square Payments has made its mark, radically transforming the landscape of payment processing with innovative, user-friendly solutions.

Today, Square Payments goes beyond traditional payment processing, offering an array of tools that include point-of-sale systems, business software, and even financing services. This article explores the game-changing influence of Square Payments in the digital payments sector, detailing its features, advantages, and the role it plays in the evolving world of digital transactions.

Square: Overview of the Square payments system

Square Payments has been a game-changer in the realm of financial transactions, offering a versatile, comprehensive solution designed to cater to diverse business needs. Central to this system is the Square Reader, a compact device that transforms your smartphone or tablet into a portable point-of-sale (POS) system when connected to the headphone jack. This device allows businesses to accept card payments on the go, making it ideal for mobile and pop-up businesses and those wishing to offer customers an additional payment method.

However, Square Payments’ offerings extend beyond physical card transactions. The platform encompasses a wide array of digital solutions, including digital invoices, online payments, virtual terminals, and fully-fledged ecommerce solutions. These features make it a complete payment platform capable of catering to businesses operating exclusively online, those with brick-and-mortar locations, and everything in between.

The Square Payments system also integrates seamlessly with a variety of popular third-party business applications, allowing businesses to create an end-to-end solution tailored to their specific needs. From managing inventory to analyzing sales data and tracking customer behavior, Square Payments offers a comprehensive set of tools that simplify the process of running a business in today’s digital world.

Payments: A deep dive into Square features

Square Payments’ platform is distinguished by a multitude of features designed to streamline payment processing for businesses.

Option for payments #1. Point of Sale (POS) systems

A Point of Sale (POS) system is where your customer makes a payment for products or services at your store. It’s a crucial part of every retail business and serves as the central component of your business, where everything—like sales, inventory, and customer management—merges.

Square’s Point of Sale (POS) system offers a comprehensive and user-friendly suite of services that can handle all these aspects. Below are some key aspects of Square’s POS system.

Transaction management

Square’s POS enables businesses to process sales effectively, whether it’s cash, cards, checks, or gift cards. It can handle discounts, taxes, and tips, making the transaction process seamless and efficient.

Inventory management

With Square’s POS system, businesses can keep a real-time track of their inventory. The system can send alerts when stock levels are low, manage vendor lists, and generate purchase orders, all contributing to an efficient inventory management process.

Customer Relationship Management (CRM)

Square’s POS offers built-in customer relationship management tools. Businesses can create customer profiles, track their purchase history, and gather valuable data for personalized marketing.

Reporting and analytics

The POS system by Square is equipped with robust reporting and analytics features. It can provide real-time sales data, identify top-selling products, and track the performance of sales staff. These insights can help businesses make informed decisions and strategize their growth.

Customizability

The POS system can be customized to cater to the specific needs of a business. Be it setting up a digital menu for a restaurant or categorizing merchandise in a retail store, Square’s POS system is flexible and adaptive.

Integration

Square POS seamlessly integrates with other Square services and popular third-party business software, forming an end-to-end business management solution.

Offline mode

One of the standout features of Square’s POS system is its ability to operate even without an internet connection. The Offline Mode ensures that businesses can continue to accept swipe payments, ensuring uninterrupted service.

Option for payments #2. Invoice

Square’s invoicing software provides businesses with a straightforward, quick way to send professional, customizable invoices via email or directly through the Square app. It simplifies the billing process by allowing businesses to:

Send digital invoices

Create and send invoices directly from your phone or computer, and allow customers to pay online instantly.

Customize invoices

Square allows businesses to personalize their invoices, add their logo and business details, and specify terms and conditions.

Schedule recurring invoices

This feature is especially useful for businesses with subscription services or recurring billing. You can automate the invoicing process, saving time and ensuring timely payments.

Track and manage invoices

The system lets you track the status of your invoices, sending you notifications when an invoice is viewed, paid, or nearing its due date.

Option for payments #3. Mobile payment processing

As the world goes increasingly mobile, businesses need to adapt to stay competitive. Mobile payment processing refers to the ability to accept credit and debit card payments via a mobile device, such as a smartphone or tablet. This approach has become critical, especially for businesses that operate outside a traditional brick-and-mortar setup, such as food trucks, pop-up shops, or businesses that operate at multiple locations.

Square Payments revolutionized mobile payments with its Square Reader. This compact device plugs into the headphone jack or lightning port of a smartphone or tablet, effectively turning it into a mobile point-of-sale (POS) terminal. Here are the key aspects of Square’s mobile payment processing.

Square Reader for Magstripe

This tiny, portable card reader plugs into your smartphone or tablet, allowing you to swipe credit or debit cards anywhere. The reader works in tandem with the free Square Point of Sale app to handle transactions.

Square Reader for contactless and chip

This device allows businesses to accept EMV chip cards, Apple Pay, and other contactless payments. It pairs wirelessly to your device and processes payments quickly and securely.

Speed and convenience

With Square’s mobile payment processing, businesses can accept payments anywhere, whether at a pop-up event, on a delivery route, or at a customer’s home. This gives businesses the flexibility to sell wherever their customers are while offering a fast, convenient payment method for customers.

Integrated system

All transactions made via mobile payment processing are integrated into the broader Square ecosystem. This means they automatically sync with the Square POS system, keeping track of sales, inventory, and customer data.

Security

Square complies with the highest security standards. It encrypts card information at the moment of swipe, dip, or tap and doesn’t store card data on the device, ensuring every transaction is secure.

Option for payments #4. Virtual terminal and Card on File

A virtual terminal is a software application that allows businesses to accept payments without the need for a physical credit card terminal or Point-of-Sale (POS) system. Essentially, it’s an online version of a credit card terminal. This is especially useful for businesses that handle orders over the phone, through mail, or in situations where the customer is not physically present.

Square’s virtual terminal is a feature that allows businesses to manually enter credit or debit card information into a secure web page on their computer, thus processing the payment. Here’s an in-depth look at Square’s virtual terminal:

Easy setup and use

To use Square’s virtual terminal, all you need is a Square account and an internet-connected device. There is no need for additional hardware or software. Simply log in to your Square Dashboard, navigate to the Virtual Terminal, and start processing payments.

Process payments anywhere

A virtual terminal allows you to accept payments without the customer being present. This is beneficial for businesses that take orders over the phone, by mail or provide services where the customer isn’t physically present at the point of sale.

Card-on-file

With the virtual terminal, you can securely store customer card details for future payments. This is particularly useful for repeat customers or businesses offering subscription-based services.

Invoicing

Square’s virtual terminal also allows businesses to send invoices directly from the dashboard, providing an additional option for requesting and receiving payments.

Security

Square adheres to PCI-DSS standards and implements advanced encryption methods, ensuring that the payment data you process through the virtual terminal is secure.

Integrated reporting

Payments processed through the virtual terminal are automatically recorded and integrated into your Square sales reports, making it easy to track and manage all transactions.

Affordable

The fees for using the virtual terminal are simple and transparent. There’s no monthly fee; you pay a flat rate for each transaction.

The Card on File feature enables businesses to securely store customer card information for future transactions, offering an added level of convenience for repeat customers.

Square integration capabilities

In today’s digital age, businesses often rely on various software and platforms to run their operations. Therefore, the ability to integrate different systems seamlessly is a critical factor in choosing any business software, including payment processing systems. Square Payments excels in this regard, offering robust integration capabilities with a wide range of popular business software and platforms.

Accounting software

Square Payments integrates seamlessly with leading accounting software like QuickBooks and Xero. This means all your transaction data can be automatically synced with your accounting software, reducing manual entry and errors, simplifying your bookkeeping, and giving you a real-time view of your financial situation.

Ecommerce platforms

Square Payments integrates with popular ecommerce platforms like WooCommerce, Shopify, and BigCommerce, among others. This means businesses can use Square to process all payments on their online store, providing a consistent, secure checkout experience for customers.

Inventory management software

Square’s POS system comes with built-in inventory management features. However, if your business has more complex inventory needs, Square also integrates with advanced inventory systems.

Customer Relationship Management (CRM) systems

Square integrates with CRM systems such as Zoho and HubSpot, allowing businesses to sync customer data and transaction histories. This provides valuable insights to personalize marketing efforts and improve customer service.

Restaurant management systems

For businesses in the food service industry, Square offers integration with platforms like Chowly, which syncs your POS system with food delivery platforms, and Fresh KDS, a kitchen display system.

Employee management and scheduling software

Square integrates with solutions like Homebase and Deputy, allowing businesses to manage employee schedules, track time, and sync sales data for labor cost reporting.

APIs for custom integrations

In addition to all these pre-built integrations, Square also provides APIs (Application Programming Interfaces) that developers can use to build custom integrations. This means that virtually any software your business uses can be made to work seamlessly with Square, given the right technical expertise.

Payment cards

Payment cards represent one of the most common forms of non-cash payment methods in today’s business environment. They include credit cards, debit cards, prepaid cards, and increasingly, mobile and contactless payment methods. Each card type has its unique features, and understanding them can help businesses cater to a wide range of customers.

- Credit cards. They are issued by financial institutions, allowing cardholders to borrow funds to pay for goods and services. Cardholders are required to pay back the credit borrowed, along with the interest accrued. The widespread use of credit cards presents a need for businesses to accept online and in-store payments.

- Debit cards. Unlike credit cards, debit cards draw money directly from the cardholder’s checking account when a transaction is made. It’s equivalent to paying with cash or a check, without the need for either. The key advantage for businesses is that payments are received instantly, without the risk of a check bouncing due to insufficient funds.

- Prepaid cards. Prepaid cards, also known as stored-value cards, are loaded with funds before using. They can be reloaded, reloaded and reused. Businesses can attract customers who prefer to pay upfront.

- Contactless payments. Contactless payment methods, such as NFC (Near Field Communication) technology, allow customers to pay by tapping their card, smartphone, or smartwatch onto a reader. Contactless payments are fast, convenient, and reduce physical contact.

- Mobile payments. Mobile payment technologies, such as Apple Pay, Google Pay, and Samsung Pay, allow customers to store card information on their mobile devices and make payments using the device. They provide an extra layer of security, as they use tokenization technology, replacing card details with a unique code (or “token”) for each transaction.

Square Payments is designed to accept all these types of payment cards. Both the Square Reader for magstripe and the Square Reader for contactless and chip are able to process credit, debit, and prepaid cards. The Square Terminal and Square Register also support these payment methods. Furthermore, the Square system is designed to handle contactless payments and mobile payments, ensuring businesses can cater to all customer payment preferences.

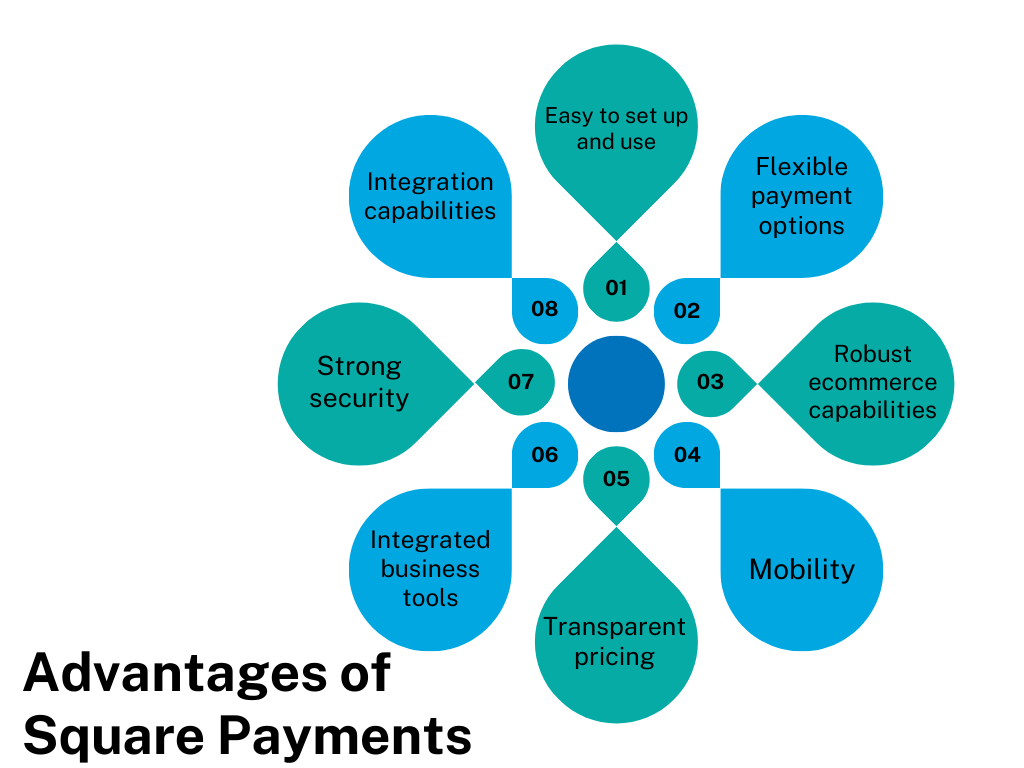

Advantages of the payments with Square

Square payments have revolutionized the way small businesses process transactions by providing a suite of hardware and software solutions that are affordable, user-friendly, and rich with features. Here are some of the main advantages that Square payments offer to businesses:

square payments

Easy to set up and use

Square is designed to be intuitive and user-friendly, both for business owners and their customers. It’s easy to set up an account, and the Square dashboard is straightforward to navigate, making it simple to track sales, refunds, and customer data.

Flexible payment options

Square accepts all major credit and debit cards, as well as contactless payments and mobile wallets like Apple Pay and Google Pay. This flexibility can help businesses cater to a wider range of customers.

Robust ecommerce capabilities

With Square, businesses can easily set up an online store, send invoices digitally, and integrate payment processing with their existing ecommerce platforms. This provides a seamless shopping experience for customers and helps businesses adapt to the growth of online commerce.

Mobility

With Square’s mobile card readers, businesses aren’t tethered to a physical location. They can accept payments anywhere, whether they’re at a farmer’s market, pop-up shop, or client’s home.

Transparent pricing

Square uses a flat-rate pricing model for transactions, with no hidden fees. This makes it easier for businesses to understand exactly what they’re paying for.

Learn more about Square fees and specifically Square credit card fee.

Integrated business tools

From digital receipts and inventory management to sales reports and analytics, Square offers a range of tools that help businesses manage their operations more effectively.

Strong security

Square adheres to PCI-DSS standards and uses encryption and tokenization technologies to keep transaction data secure, helping to protect businesses and their customers from fraud.

Integration capabilities

Square can be integrated with a wide array of business applications, from accounting and CRM software to ecommerce platforms and inventory management systems. This makes it easier for businesses to streamline their operations.

Square conclusion: The role of payments with Square in the evolving digital economy

With digital transactions becoming more prevalent, Square Payments is well-positioned to play a significant role in shaping the future of the digital economy. Its innovative approach and adaptability make it a key player in the fintech space.

Square Payments should be a serious consideration for businesses seeking a dynamic, reliable payment processing solution. As we delve deeper into the digital age, these solutions will become increasingly critical to business success. Therefore, thorough research and consideration of your specific business needs are essential when choosing a payment processing solution.