If you’re still manually reconciling your Square transactions in QuickBooks Online, now might be the right time to switch to a simpler approach. Integration tools, such as Synder, can automate the process by syncing your Square sales, fees, tips, and refunds directly into QuickBooks Online.

Using this approach, about 50% of businesses have shortened their month-end close by 3–5 days, and nearly one-third save as much as 6–10 days. Here’s a step-by-step guide to help you reconcile Square transactions more efficiently.

How to reconcile Square deposits in QuickBooks Online using Synder

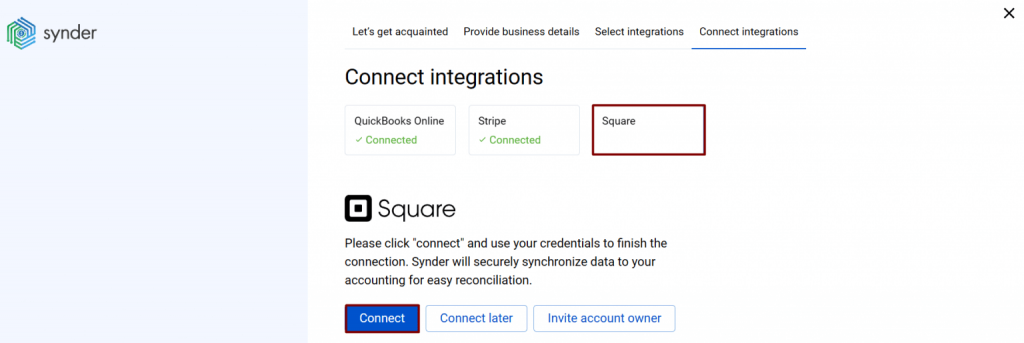

Step 1: Set up your Synder integration

- Go to Settings in Synder.

- In the Integration dropdown, select Square.

- Make sure all accounts are correctly selected.

- If you want to choose between separate cash vs. card Square sales in QuickBooks, make sure you configure the correct income accounts during setup.

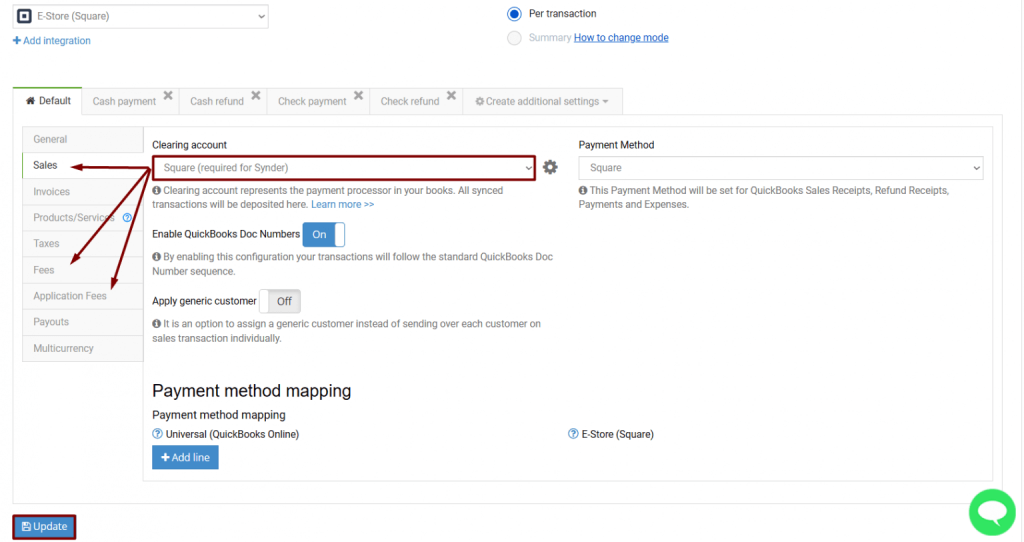

Step 2: Configure the clearing account

- Double-check that this account is set as the Bank account in the same tabs.

- Ensure that you have a Square (required for Synder) account in your QuickBooks Chart of Accounts.

- In Synder settings, select this account as the Clearing account under the Sales, Fees, and Application fees tabs.

- If you don’t have a Square account created, Synder will automatically create one.

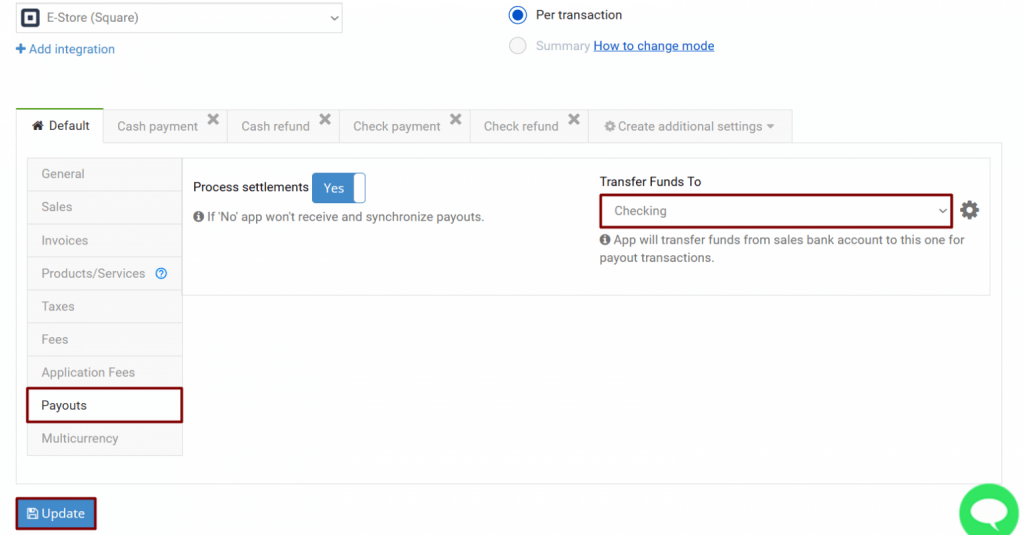

Step 3: Enable payouts processing

- This enables automatic matching of Square payouts with your checking account withdrawals.

- In Synder, go to the Payouts tab.

- Turn on the payouts feature.

- Under Transfer Funds To, select the Checking account where your Square deposits are sent.

Step 4: Synchronize Square transactions

- Choose between two modes:

- Automatic sync – new Square transactions will be synced with QuickBooks automatically.

- Manual sync – you control when transactions are pushed to QuickBooks.

- For historical transactions, you must import them manually if you want to reconcile them.

Step 5: Reconcile in QuickBooks

- Keep in mind that Square usually transfers real funds into your checking account 3–7 days after the payment occurs.

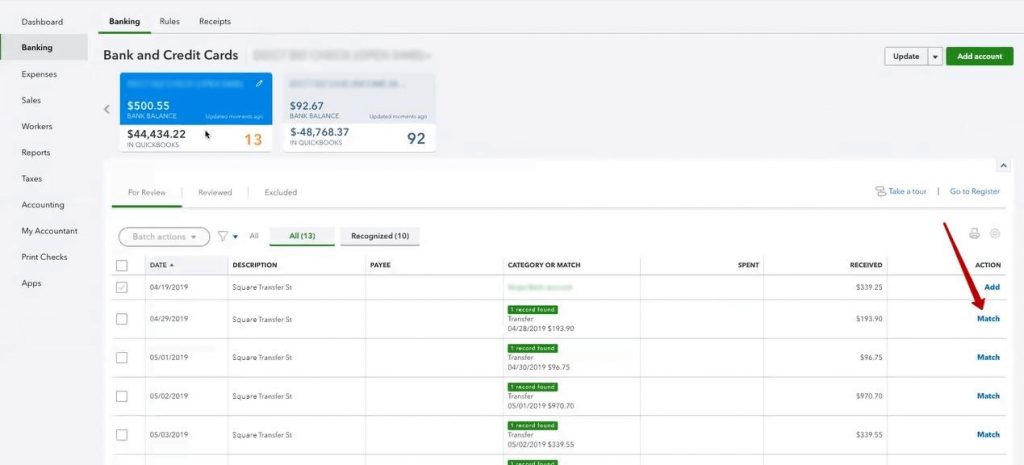

- Open the Banking section in QuickBooks.

- Go to the For Review list.

- Find Square withdrawals and click Match.

Step 6: Confirm reconciliation

- Once you’ve matched transactions, your QuickBooks checking account will be fully reconciled.

- All sales, fees, refunds and expenses from Square will now be recorded automatically, avoiding manual data entry.

Manual methods for reconciling Square transactions in QuickBooks Online

Not every business uses automation to reconcile Square transactions in QuickBooks Online, and some still rely on manual methods. From matching deposits and fees in the bank feed to using spreadsheets or journal entries, these approaches can get the job done. The challenge is that they’re often time-consuming and prone to errors, especially for high-volume transactions.

Here’s a list of manual methods to reconcile Square deposits in QuickBooks Online:

- Bank feed matching: You can manually match deposits from your checking account to individual Square sales, fees, and refunds in QuickBooks Online’s Banking tab. This requires reviewing each transaction and ensuring it lines up with your statements.

- Spreadsheet import: Download your Square reports (CSV or Excel) and compare them line by line with your QuickBooks transactions. You’ll have to manually adjust sales, fees, and refunds to make everything accurate.

- Journal entries: Manually record Square sales, fees, and refunds as separate journal entries in QuickBooks, then reconcile them with your bank deposits. This method requires careful calculation to avoid errors.

- Clearing account method: Create a clearing account in QuickBooks for Square transactions. Record all sales and fees into this account, then reconcile the total deposits with your bank statement manually.

Benefits of automation in Square QuickBooks Online reconciliation

Manually syncing data between platforms can quickly eat up both time and resources. That’s why many business leaders turn to automated tools to seamlessly connect their systems. Here are some key advantages reported by companies that have made the switch:

- Error-free reconciliation: Synder automatically matches your Square data with actual bank statements in QuickBooks Online, reducing manual work and costly errors while speeding up the reconciliation process.

- Consolidated cash flow tracking: Track your Square cash flow with detailed insights into income and expenses, giving you a clear financial overview and allowing faster, more informed decisions that can save operational costs.

- Historical data import: Synder allows you to backfill historical Square transactions into QuickBooks without creating duplicates, saving time on manual data entry and ensuring your past records are accurate and complete.

- Accurate financial reporting: Quickly create detailed P&L and balance sheet reports from invoices, receipts, and bills, with the option to customize date ranges for more insightful analysis.

Want to make reconciling Square deposits in QuickBooks Online faster and easier? Join a free Synder demo and see how much time you can save.

FAQ

Where should Square tips and fees be posted in QuickBooks?

Square tips and fees should be posted to the Square (required for Synder) account in your QuickBooks Chart of Accounts. This acts as a clearing account, ensuring that all Square-related transactions are accurately recorded before being transferred to your actual bank account.

Should I use daily summary or per‑transaction import?

Synder offers both daily summary and per-transaction import options. The choice depends on your preference for detail and the volume of transactions. Per Transaction Sync provides a more granular view, recording each sale individually, which can be beneficial for detailed reporting and reconciliation. Summary Sync consolidates all transactions into a single entry per day, simplifying the reconciliation process but offering less detail.

Does the integration support multi-location and multicurrency?

Yes, Synder’s integration supports both multi-location and multicurrency setups in QuickBooks. This allows businesses with multiple locations or those dealing with transactions in different currencies to accurately record and reconcile their Square sales in QuickBooks.

Can I backfill historical Square data into QuickBooks Online without duplicates?

Yes, you can backfill historical Square data into QuickBooks Online using Synder. To avoid duplicates, it’s crucial to set the correct start date for the import and ensure that transactions are not already present in QuickBooks. Synder’s system is designed to prevent duplicate entries by checking for existing records before importing new data. Included for free on the Premium plan, 3 months free on Pro, and available for a fee on Basic and Essential.