When it comes to accounting software, Intuit QuickBooks stands out as one of the most widely embraced options. Numerous businesses utilize QuickBooks for bookkeeping, inventory management, payroll, and various other financial responsibilities. You can opt for either QuickBooks Online or QuickBooks Desktop, each with its unique plans and advantages.

It can be challenging to determine which version is the best fit for your business. In this article, we’ll compare & explore which one suits collaborative work on the go and which offers enhanced speed and advanced features.

Let’s delve into all the essential aspects of the two versions. We’ll provide you with comprehensive information to aid in choosing the optimal accounting solution for your business.

Key takeaways:

- QuickBooks Online prioritizes cloud-based accessibility and real-time collaboration, ideal for businesses needing flexibility.

- QuickBooks Desktop suits those who don’t require constant collaboration, seeking comprehensive features with offline access.

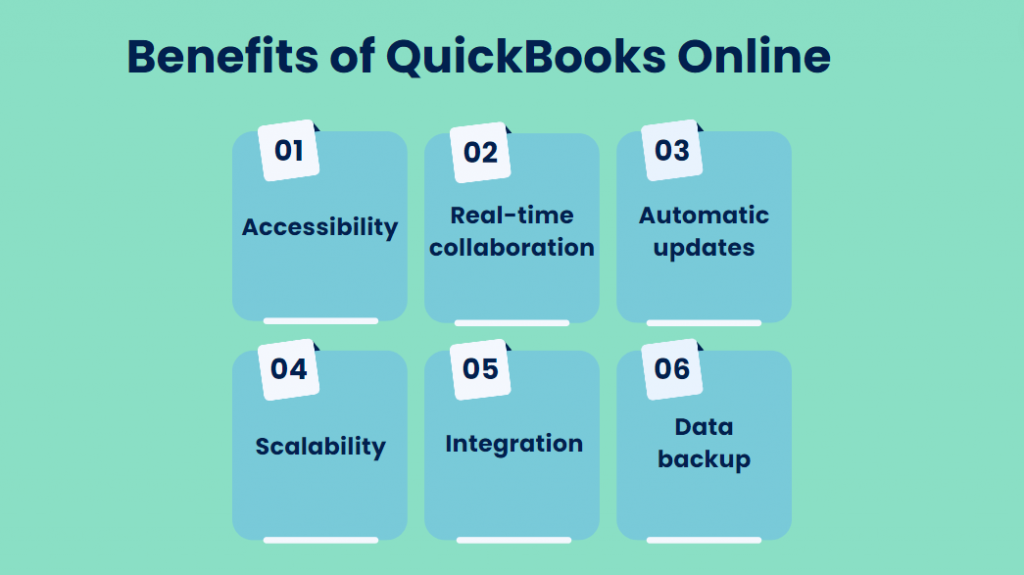

- QuickBooks Online offers accessibility from any device, real-time collaboration, automatic updates, scalability, and seamless integration with third-party applications.

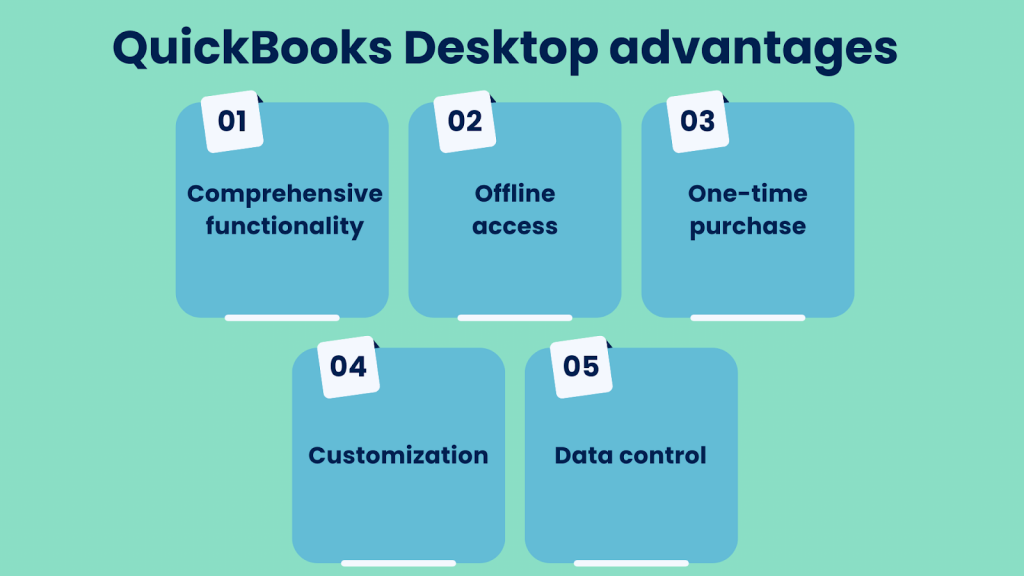

- QuickBooks Desktop provides comprehensive functionality, offline access, a one-time purchase model, extensive customization options, and direct control over data storage and security.

- When choosing between QuickBooks Online and Desktop, consider pricing models, integration needs, customer support, security measures, ease of use across platforms, and reporting options.

Contents:

1. QuickBooks Online vs Desktop: A super quick overview

- What are the advantages of QuickBooks Online?

- What are the disadvantages of QuickBooks Online?

- Who should choose QuickBooks Online?

3. What is QuickBooks Desktop?

- What are the advantages of QuickBooks Desktop?

- What are the disadvantages of QuickBooks Desktop?

- Who should choose QuickBooks Desktop?

6. QuickBooks Online vs Desktop: FAQs

QuickBooks Online vs Desktop: A super quick overview

When evaluating Intuit’s top two products, QuickBooks Online and Desktop, you’ll find both are exceptional business accounting software systems equipped with robust features.

The primary difference between the two lies in their accessibility and pricing models. QuickBooks Desktop is a conventional accounting software that requires downloading and installation on your computer and follows an annual license pricing structure. Conversely, QuickBooks Online is a cloud-based software with a monthly subscription, accessible via the Internet.

For businesses adept at accounting and not in need of real-time collaboration, QuickBooks Desktop is the preferred choice. On the other hand, QuickBooks Online is ideal for businesses requiring real-time collaboration and access to their QuickBooks files from any device.

Note: These two versions operate independently, meaning data entered on the Desktop doesn’t sync with the Online version and vice versa.

What is QuickBooks Online?

QuickBooks Online is a cloud-based accounting software developed by Intuit, designed to streamline and simplify financial management for businesses of varying sizes. This flexibility is especially valuable for entrepreneurs figuring out how to start a business with no money, providing them with a cost-effective tool to manage their emerging financial needs. It operates on a subscription-based model, with several different pricing plans available depending on the level of functionality you require.

Unlike traditional desktop accounting software, QuickBooks Online operates entirely in the cloud, allowing users to manage their finances, track expenses, and generate financial reports from any device with internet access. The online platform offers the flexibility of real-time collaboration and automatic updates, making it ideal for businesses with remote teams or those on the go.

However, QuickBooks Online does have some limitations compared to Desktop. It has fewer features and functionality, particularly in the areas of inventory management and job costing. It also has slower processing speeds than Desktop, which can be an issue if you have a large volume of transactions.

Overall, QuickBooks Online is best suited for small businesses with basic accounting needs. If you require a more robust set of features, you may want to consider QuickBooks Desktop.

What are the advantages of QuickBooks Online?

1. Accessibility

QuickBooks Online enables the management of finances from any device with internet access, providing convenience and flexibility.

2. Real-time collaboration

The cloud-based nature facilitates real-time collaboration among team members, allowing seamless sharing of financial data and task collaboration.

3. Automatic updates

You’ll benefit from automatic updates, ensuring access to the latest features, improvements, and security patches without requiring manual intervention.

4. Scalability

Different subscription plans are available, allowing businesses to scale their usage based on specific needs and growth.

5. Integration

The software seamlessly integrates with various third-party applications, enhancing functionality and adaptability to different business processes.

6. Data backup

QuickBooks Online automatically backs up data in the cloud, reducing the risk of data loss and ensuring up-to-date financial information availability.

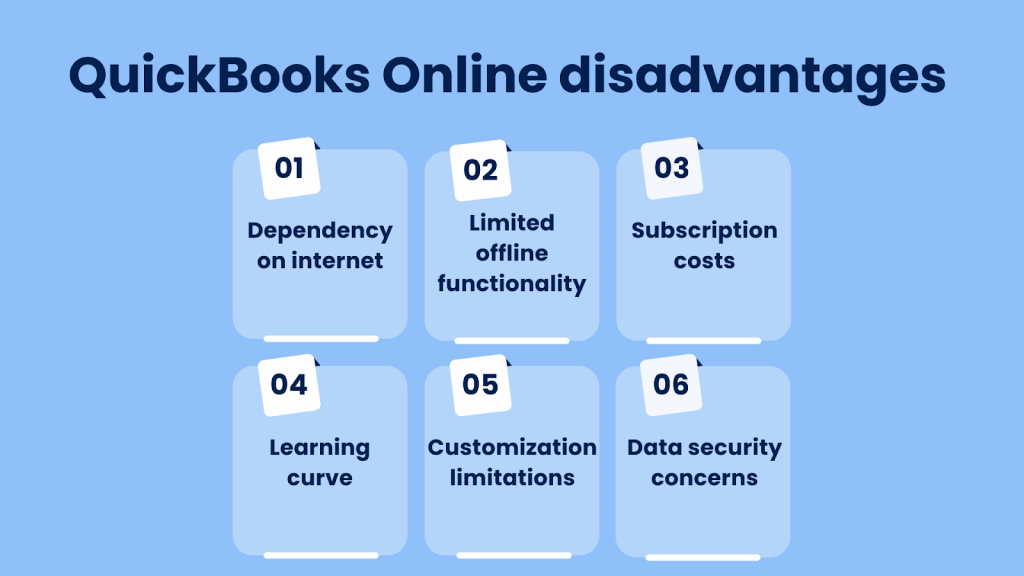

What are the disadvantages of QuickBooks Online?

1. Dependency on the internet

The full functionality of QuickBooks Online requires a reliable internet connection, posing challenges in areas with limited or unreliable internet access.

2. Limited offline functionality

While some features are available offline, the full functionality is best experienced with a continuous internet connection.

3. Subscription costs

The subscription-based model may result in cumulative costs over time, potentially exceeding the one-time purchase model of desktop versions.

4. Learning curve

Users transitioning from traditional desktop accounting may face a learning curve in adapting to the online interface and workflow.

5. Customization limitations

Some users may find certain customization options limited compared to the desktop version, especially for advanced reporting and specific industry needs.

6. Data security concerns

Despite robust security measures, businesses with sensitive data may harbor concerns about storing financial information in the cloud.

Note: QuickBooks Online is best suited for small businesses with basic accounting needs. If you need a more robust set of features, you may want to consider QuickBooks Desktop.

Who should choose QuickBooks Online?

1. Service-based businesses

QuickBooks Online is ideal for businesses offering services rather than physical products. It streamlines financial management for consultants, freelancers, and professionals who prioritize real-time collaboration and easy access from any location with an internet connection.

2. Startups & small enterprises

For businesses in their early stages or with limited financial complexity, QuickBooks Online provides a cost-effective solution. Its scalability allows startups to adapt as they grow without the need for extensive features offered by QuickBooks Desktop.

3. Businesses with real-time collaboration needs

QuickBooks Online is the go-to choice for businesses emphasizing collaboration among team members, as it facilitates seamless sharing of financial data and task collaboration without the limitations of a physical location.

What is QuickBooks Desktop?

QuickBooks Desktop is a traditional accounting software developed by Intuit, designed to provide comprehensive financial management solutions for businesses. It requires a one-time purchase, with the option to upgrade to newer versions.

Unlike cloud-based counterparts, QuickBooks Desktop is installed directly on a computer, offering a locally hosted approach to accounting. It offers a more comprehensive set of features, including advanced inventory management, job costing, and more.

What are the advantages of QuickBooks Desktop?

1. Comprehensive functionality

QuickBooks Desktop is known for its extensive range of features, offering robust solutions for accounting, inventory management, and payroll.

2. Offline access

Users can access and work on their financial data without the need for a continuous internet connection, ensuring functionality even in areas with limited internet access.

3. One-time purchase

QuickBooks Desktop operates on a one-time purchase model, which may be more cost-effective for some businesses in the long run compared to subscription-based models.

4. Customization

Desktop versions often provide more extensive customization options, allowing businesses to tailor the software to meet specific industry needs and reporting requirements.

5. Data control

With QuickBooks Desktop, businesses have direct control over their data storage and security, eliminating concerns associated with cloud-based storage.

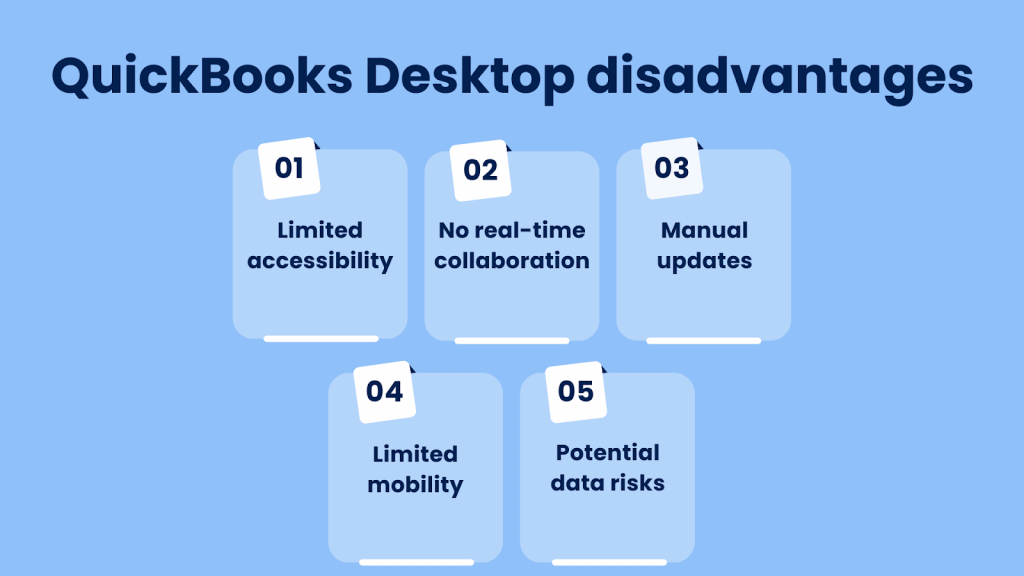

What are the disadvantages of QuickBooks Desktop?

1. Limited accessibility

Unlike cloud-based solutions, QuickBooks Desktop doesn’t offer the same level of accessibility. Users are confined to the device where the software is installed.

2. No real-time collaboration

Collaboration among team members may be challenging, as QuickBooks Desktop lacks real-time collaboration features present in cloud-based alternatives.

3. Manual updates

Users are responsible for manually installing updates, which may require additional time and effort compared to the automatic updates provided by cloud-based software.

4. Limited mobility

QuickBooks Desktop ties users to a specific device, limiting the ability to manage finances on the go or work remotely, which is a significant drawback in today’s mobile business environment.

5. Potential data risks

While users have control over their data, the risk of data loss due to hardware issues or lack of proper backups may pose a threat.

Who should choose QuickBooks Desktop?

1. Manufacturing and production businesses

QuickBooks Desktop caters to businesses involved in intensive inventory management and production processes. It provides a robust accounting and inventory management package essential for businesses with intricate product lines.

2. Specialized professional services

QuickBooks Desktop suits industries with specific needs, such as engineering or architecture firms, which require detailed customization and advanced reporting options not extensively available in QuickBooks Online.

3. Large corporations with dedicated accounting teams

QuickBooks Desktop is preferable for established companies with dedicated accounting teams, offering comprehensive features and customization options. It’s suitable for businesses that require intricate financial reporting and analysis across multiple departments. That is why it counts as one of the ost popular accounting software for large businesses.

QuickBooks Online vs Desktop comparison: What is the main difference between QuickBooks Online and Desktop?

Choosing between QuickBooks Online and Desktop is a decision that hinges on your business’s unique requirements and preferences. By carefully evaluating factors such as pricing, integrations, customer support, security, ease of use, and reporting options, you can make an informed choice that aligns with your organization’s financial management needs.

Pricing & tiers

One of the most important considerations when choosing between QuickBooks Online and Desktop is pricing. QuickBooks Online and Desktop follow different pricing structures.

QuickBooks Online typically offers a subscription-based model with different tiers catering to varying business needs. On the other hand, QuickBooks Desktop requires a one-time purchase, with the option to upgrade to newer versions as they’re released.

QuickBooks Online plans range from $90 to $170 per month (or from $45 to $85 if you subscribe for 3 months) and include various features and functionality.

The cost of QuickBooks Desktop ranges from $1,922 to $4,668, depending on the version you choose.

Consider the scale of your business, budget, and preferences when deciding between the two. While QuickBooks Online may seem more expensive at first glance, it’s important to consider the long-term costs and savings. With QuickBooks Online, you don’t have to worry about purchasing new versions or maintaining the software, as automatic updates are included in your subscription. Additionally, with online access, you can save time and money on travel expenses and in-person meetings.

With QuickBooks Desktop, you’ll need to purchase new versions as they’re released and may need to pay for technical support or upgrades. However, if you plan to use the software for an extended period, you may find that a one-time purchase is more cost-effective than a monthly subscription.

Integrations

Integration capabilities can significantly impact your workflow efficiency.

QuickBooks Online, being cloud-based, offers seamless integration with a wide range of third-party apps and services, such as BigCommerce, promoting a connected ecosystem that enhances ecommerce functionality and streamlines accounting processes for online businesses. QuickBooks Online makes connecting with other business tools easy and straightforward, with over 750 integrations available. This simplifies and automates various accounting tasks, offering a hassle-free online experience for users. The connection process is simple, allowing direct use of third-party applications online.

On the other hand, QuickBooks Desktop, while robust, may require additional software or plugins for certain integrations, and these may not be as extensive as QuickBooks Online’s offerings. QuickBooks Desktop focuses more on ecommerce integrations, offering over 200 third-party applications. While it has fewer options than QuickBooks Online, it remains one of the most interconnected desktop solutions. However, its limited payment channels may pose challenges for modern merchants looking to accept online invoice payments.

Evaluate your business’s specific integration needs to determine the most suitable option.

Customer support

When it comes to customer support, both QuickBooks Online and Desktop offer extensive resources to help you get the most out of the software. QuickBooks Online provides support via phone, chat, and email, as well as a comprehensive knowledge base and community forum. Additionally, depending on your subscription level, you may have access to dedicated account managers and training resources.

QuickBooks Desktop also provides support via phone and chat, as well as a knowledge base and community forum. However, it’s important to note that support for Desktop is only available for the current version and one version prior. This means that if you’re using an older version of Desktop, you may not be able to receive assistance.

Overall, both versions of QuickBooks offer extensive customer support resources. However, QuickBooks Online may be a better fit if you need dedicated account managers or training resources.

Security

Security is paramount when handling financial data. QuickBooks Online employs robust security measures, including encryption and multi-factor authentication, to safeguard your data stored in the cloud. Additionally, with automatic software updates, you can rest assured that you always have the most secure version of the software.

QuickBooks Desktop also offers bank-level security and encryption, but it’s important to note that you’re responsible for maintaining your data backups and keeping your software up-to-date. Additionally, when the Desktop is installed on a local computer, there’s a higher risk of data loss or theft if the computer is lost or stolen.

Assess your comfort level with cloud security versus local security to determine which version aligns better with your security preferences.

Ease of use

Distinguishing itself from QuickBooks Desktop, QuickBooks Online offers unparalleled accessibility. You can conveniently access your financial data from any device with an internet connection, granting the freedom to manage finances on the go or from various locations. This cloud-based solution isn’t bound by the limitations of device-specific installations.

QuickBooks Online ensures compatibility with an array of browsers, such as Google Chrome, Microsoft Edge, and Mozilla Firefox. Moreover, it provides a dedicated mobile app catering to both iOS and Android users. This flexibility allows seamless navigation and functionality across diverse platforms.

In contrast, QuickBooks Desktop necessitates installation on a designated computer, restricting access to that specific device. However, if you’re seeking flexibility, the option of utilizing a hosting provider enables access to the desktop software from a cloud server. By utilizing a simple username and password, you can remotely log in and manage your financial data, replicating the experience of working on a local desktop.

Can you get QuickBooks Desktop on a Mac?

Check the minimum system requirements for your Mac to make sure you can install QuickBooks.

Reporting options

Both QuickBooks Online and Desktop offer robust reporting capabilities, but the methods differ. QuickBooks Desktop allows for real-time access to reports from anywhere, while QuickBooks Online provides powerful reporting tools that might require manual updates.

Consider the importance of real-time reporting, customization options, and the level of detail required for your financial analysis.

Ultimately, whether you opt for the cloud-based convenience of QuickBooks Online or the robust capabilities of QuickBooks Desktop, both versions strive to empower businesses with effective tools for financial success.

QuickBooks Online vs. Desktop: Recap of key differences

| Aspect | QuickBooks Online | QuickBooks Desktop |

| Pricing & tiers | Subscription-based, ranging from $90 to $170/month | One-time purchases, ranging from $1,922 to $4,668 |

| Integrations | Cloud-based, 750+ integrations | Desktop-based, 200+ integrations (focused on ecommerce) |

| Customer support | Phone, chat, email, knowledge base, community forum | Phone, chat, knowledge base, community forum (limited support for older versions) |

| Security | Cloud-based, encryption, multi-factor authentication | Desktop-based, bank-level security, responsibility for backups and updates |

| Ease of use | Accessible from any device with internet, dedicated mobile app | Requires installation on a designated computer, option for cloud hosting |

| Reporting options | Powerful reporting tools, potential manual updates | Real-time access to reports from anywhere |

Synder & QuickBooks

Synder is an ecommerce accounting tool crafted to aid businesses of all sizes in saving time, ensuring accuracy, and making informed decisions for enhanced growth.

Synder is great for both business owners looking for efficient financial management and accounting professionals aiming for precise record-keeping. The software can help you synchronize your ecommerce transactions seamlessly with your accounting company.

No more manual data entry and discrepancies – Synder ensures that your financial records are consistently accurate and up-to-date.

Synder & QuickBooks Online

The connection of QuickBooks Online and Synder streamlines your online selling tasks. It seamlessly integrates your sales and expense transactions into QuickBooks Online by linking all your sales channels and payment platforms to the app, making bookkeeping easier.

Synder helps maintain consistency across different platforms, handling details like customer info, sales tax, inventory, and shipping costs.

By using the Synder app, you avoid entering data manually, simplify accounting reconciliation, and enhance your overall online selling process. It also allows easy collaboration, enabling you to share your account with your accounting expert.

If you’re looking for a visual walkthrough of the Synder and QuickBooks Online integration, we have a video demonstration ready for you to watch.

Moreover, you have the option to post transactions individually as sales receipts or choose a straightforward journal entry posting. Synder lets you allocate expenses and income to their respective accounts in QuickBooks as per your preference.

Take advantage of the opportunity to optimize your business processes and explore Synder features with a free trial. To gain more insights and tips, book your seat on the informative Weekly Public Demo offered by Synder.

Synder & QuickBooks Desktop

Synder is a simple, quick, and secure way to sync your ecommerce data smoothly between your online sales channels and payment platforms and your QuickBooks Desktop. It allows automatic synchronization of your online sales and expenses and a one-click reconciliation of the synced data.

Note: Synder integrates with QuickBooks Desktop versions 12.0+.

For those seeking a visual demonstration of the Synder and QuickBooks Desktop integration in action, a video is available. This resource provides a step-by-step overview of how the integration works, allowing businesses to see the seamless synchronization in practice and understand the value it brings to their financial operations.

Take a look at the nuances of account reconciliations in QuickBooks Online and QuickBooks Desktop in our article How to Reconcile in QuickBooks Online and QuickBooks Desktop: Account Reconciliations in QuickBooks.

QuickBooks Online vs Desktop: Bottom line

In the accounting business, the choice between QuickBooks Online and Desktop boils down to your business’s unique needs and priorities. Each version has its advantages and drawbacks, and understanding these distinctions is crucial in making an informed decision.

While QuickBooks Online offers the convenience of real-time collaboration, accessibility from any device, and automatic updates, it may not be the best fit for businesses with complex inventory management or those operating in areas with limited internet access. On the other hand, QuickBooks Desktop provides robust features, offline access, and extensive customization options, but it lacks the flexibility of cloud-based collaboration.

The comparison also explored the role of automation tools like Synder, emphasizing its significance in streamlining ecommerce accounting processes. Synder’s integration with both QuickBooks Online and QuickBooks Desktop provides businesses with a seamless way to synchronize online sales and expenses, reducing manual data entry and ensuring accuracy.

Ultimately, the decision hinges on factors like the scale of your business, budget considerations, and the level of functionality required. Both versions aim to empower businesses with effective financial tools, but the choice depends on which features align better with your organization’s goals and preferences.

If you’re interested in a broader perspective on accounting software options, consider checking out our article Xero vs QuickBooks / QuickBooks Online: Ultimate QuickBooks vs Xero (QuickBooks alternative) Faceoff

QuickBooks Online vs Desktop: FAQs

1. Do accountants prefer QuickBooks Desktop or QuickBooks Online?

Accountant preferences between QuickBooks Desktop and QuickBooks Online vary based on specific needs. QuickBooks Desktop offers robust features for complex needs and offline work, while QuickBooks Online prioritizes accessibility, real-time collaboration, and automatic updates. The choice depends on factors like business nature and mobility requirements, with some accountants using a combination of both.

2. Can QuickBooks Online be used offline?

No, QuickBooks Online is a cloud-based accounting software, and it requires an internet connection to access and use its features. Unlike QuickBooks Desktop, which can be used offline after the initial setup, QuickBooks Online relies on real-time data synchronization with the cloud. QuickBooks Desktop may be a more suitable option if you need offline access to your accounting software.

3. Can I start fresh in QuickBooks Online?

Yes, you can start fresh in QuickBooks Online by creating a new company. Follow these steps to set up a new company:

- Log in to your QuickBooks Online account.

- Click on ‘+ New’ or ‘Create.’

- Select ‘Company → New Company.’

- Follow the prompts to enter your new company details.

- Set up accounts and complete the process.

Starting fresh in QuickBooks Online allows you to create a new company file and set up your accounting records from scratch, providing a clean slate for your financial data. Keep in mind that each new company you create will have its own subscription and billing, separate from any existing companies you may have in QuickBooks Online.

4. Can you lock months in QuickBooks Online?

You can set a closing date in QuickBooks Online, which can serve a similar purpose. Here’s how you can set a closing date:

- Log in to your QuickBooks Online account.

- Go to ‘Settings’ (gear icon) in the upper right corner.

- Select ‘Account and Settings’ or ‘Company Settings.’

- Choose ‘Advanced’ from the left menu.

- In the ‘Accounting’ section, find ‘Close the books.’

- Click ‘Set date/Close the books.’

- Set a closing date and specify whether changes are allowed after the closing date.

5. Do QuickBooks Online and QuickBooks Desktop have mobile apps?

Yes, both QuickBooks Online and QuickBooks Desktop offer mobile apps that allow users to access key features on the go.

QuickBooks Online has a mobile app for iOS and Android, offering on-the-go access to key financial features. QuickBooks Desktop has the ‘QuickBooks Desktop Companion’ app, allowing limited remote access to customer and vendor information, invoicing, and expenses.

6. Can I switch from QuickBooks Desktop to Online or vice versa?

Yes, you can switch from QuickBooks Desktop to QuickBooks Online or vice versa. To switch from QuickBooks Desktop to Online, export your data from Desktop and import it into QuickBooks Online. For the reverse switch, export data from QuickBooks Online and import it into QuickBooks Desktop. Keep in mind that manual adjustments may be needed, and subscription plans may differ.

Related reading:

QuickBooks Migration Failed Unexpectedly: How to Fix and Prevent?