As a business owner, you might know how selecting the right accounting software can impact your business’s management process. The right solution can be a real asset and a financial management partner, while the wrong choice might lead to accounting inefficiencies and overpayments. The decision between industry leaders like Xero and QuickBooks requires a thorough understanding of features, benefits, and potential drawbacks.

Let’s compare Xero and QuickBooks (QuickBooks Online) accounting platforms and explore how they help businesses manage finances more efficiently.

Xero vs QuickBooks: general Overview of Xero and QuickBooks (QuickBooks Online) accounting

Of many accounting software on the market, two titans stand out for their global influence and innovative approach: Xero and QuickBooks Online. Let’s start with a quick overview of both platforms to explore their histories, unique selling points, and the diverse features that have solidified their positions in the industry.

Xero accounting – pioneering cloud-based accounting

Founded in 2006, Xero swiftly became a pioneer in cloud-based accounting solutions. The company’s vision was clear: democratize accounting by providing accessible and powerful tools to businesses of all sizes. Over the years, Xero has become synonymous with innovation and adaptability, catering specifically to the needs of small to medium-sized enterprises (SMEs).

User-friendly interface and accessibility

Xero’s commitment to user-friendliness is evident from the moment users log in. The platform boasts an intuitively designed interface, allowing even those without extensive accounting backgrounds to navigate seamlessly. This emphasis on accessibility aligns with Xero’s mission to empower businesses, regardless of their scale or financial expertise.

Feature-rich offerings

Xero’s feature set is comprehensive and tailored to meet the multifaceted needs of modern businesses. Core Xero functionalities include:

- Invoicing

Create professional invoices effortlessly, streamlining the billing process. - Expense tracking

Effectively monitor and manage business expenses, providing real-time insights into financial health. - Bank reconciliation

Automate the reconciliation of bank transactions, reducing the risk of errors and enhancing accuracy.

Flexibility and scalability

Xero stands out with its adaptability to various industries. Whether you’re a service-based business, a retailer, or a consultancy firm, Xero’s flexibility ensures that its features can be tailored to your specific needs. Furthermore, Xero’s cloud-based nature facilitates scalability, allowing businesses to grow without the constraints of traditional on-premise solutions.

Related:

Learn how to automate data entry from 25+ online platforms to Xero and managage Xero clients more efficiently.

QuickBooks Online – the evolution of accounting excellence

Established in the 1980s by Intuit, QuickBooks has been a stalwart in the accounting software realm for decades. The platform’s genesis was rooted in a commitment to simplifying financial management for businesses of all sizes. What started as a desktop-based solution evolved into a comprehensive suite of tools catering to freelancers, small enterprises, and large corporations. While desktop is one of QuickBooks’s available options, it is safe to say that QuickBooks Online is the brand’s flagship and the most widely used accounting solution in the US.

Searching for a medium to large enterprise-level accounting solution? You might want to read the comparison of QuickBooks Enterprise vs NetSuite.

Audience diversity and industry-specific solutions

QuickBooks’ broad appeal is evident in its ability to cater to a diverse audience. From freelancers managing their finances to small businesses navigating growth and larger enterprises with complex financial structures, QuickBooks utilizes all the possibilities to meet a spectrum of needs.

Extensive feature set

QuickBooks’ reputation as a powerhouse accounting solution is built on its rich feature set, addressing the nuanced requirements of businesses across industries. Key features include:

- Inventory management

Ideal for companies dealing with physical products, QuickBooks Online inventory management feature facilitates inventory tracking and optimization. - Job costing

A boon for ventures with project-based revenue, QuickBooks’ job costing feature aids in accurate project budgeting. - Industry-specific solutions

QuickBooks Online offers tailored solutions for industries such as construction, healthcare, and nonprofit organizations.

Robust reporting capabilities

A standout feature of QuickBooks Online is its commitment to providing businesses with actionable insights through robust financial reporting tools. These include customizable templates and advanced analytics, allowing for deep dives into financial data. Such capabilities not only empower users to make informed decisions about their financial health but also streamline future strategic planning

Related:

Learn how to migrate from QuickBooks Desktop to QuickBooks Online with ease.

A detailed view of Xero business accounting features, tools, and benefits

Now, it’s time to look at both platforms in more detail. And we’ll start by looking at what Xero can offer.

Xero user interface and ease of use

Xero’s interface is super easy to use. The menus and features are set up logically, so you can easily find your way around, saving you time and making the software simple to work with. Xero’s interface is adaptable, meaning it caters to users with different levels of expertise. They also listen to user feedback and keep updating the interface to stay modern and helpful for businesses in a changing financial world.

Xero ensures that anyone, from an experienced accountant to a new business owner, can use the software without too much effort. The platform is constantly improving, considering user opinions and adjusting to the needs of businesses as they evolve. Xero’s user-friendly interface transforms accounting from something complicated into a smooth and productive experience.

Automatic bank reconciliations

Xero’s automatic bank reconciliation feature is a transformative solution, liberating businesses from the cumbersome and time-consuming manual reconciliation.

Traditionally, reconciling bank statements with internal financial records was laborious, demanding attention to detail and consuming valuable hours. Xero’s automation lifts this burden. The platform utilizes advanced algorithms to seamlessly match transactions between bank statements and accounting records, ensuring real-time accuracy. Discrepancies are flagged for user attention, minimizing the risk of oversight and errors.

The benefits of Xero’s automatic bank reconciliation are profound. First and foremost, it saves businesses significant time, allowing financial professionals to redirect their efforts toward more strategic tasks. Minimization of errors is another advantage, lowering the risk of inaccuracies that often accompany manual reconciliation. The automation also translates into enhanced financial visibility, providing businesses with accurate and up-to-date information for faster decision-making.

Xero customizable invoicing

Xero’s customizable invoicing feature simplifies infusing brand identity into financial documents. Users can seamlessly integrate company logos, select brand-appropriate colors, and choose fonts that resonate with their brand personality. Regardless of their design skills, users can create professional and visually appealing invoices.

Available customizations:

- Logo integration

- Users can prominently display their company logo for brand consistency.

- Color palette selection

- One can choose from a palette of brand-appropriate colors for a cohesive look.

- Font customization

- One can select fonts that align with the brand personality.

- Layout adjustments

- You can tailor the arrangement of key elements to suit your business’s specific needs.

Customizable invoicing goes beyond aesthetics, helping build positive client relationships, instilling confidence, and setting your business apart.

Xero’s VAT calculator

Xero’s VAT calculator is a handy tool that makes calculating Value Added Tax (VAT) easier for businesses. It helps users quickly figure out the correct VAT amounts for their transactions, ensuring accurate tax calculations. With the Xero VAT calculator, you don’t need to worry about applying the right VAT rates—it does it for you. This feature saves time and reduces the chances of mistakes in VAT calculations, making financial management smoother and more precise for Xero users.

Real-time collaboration

In the heartbeat of Xero’s functionality lies the power of real-time collaboration, transforming how teams engage with financial data. With simultaneous access and work capabilities, multiple users can contribute seamlessly, accelerating workflow and eliminating bottlenecks.

Key benefits:

- Simultaneous access and work

Team members can engage concurrently, reducing delays and accelerating financial processes. - Enhanced transparency

Real-time tracking of changes fosters transparency, accountability, and informed decision-making. - Collaboration beyond teams

Xero’s reach extends beyond internal teams to external stakeholders, enabling seamless collaboration with accountants, advisors, and consultants.

Reporting and analytics

Xero empowers businesses with its robust reporting and analytics capabilities. The platform offers an array of customizable reports, allowing users to tailor insights to their specific needs. This adaptability extends to key metrics, enabling users to focus on the data that matters most. Real-time accessibility ensures both historical reports and a current snapshot of the business’s financial health.

Complementing its reporting prowess, Xero’s analytics tools delve into trends and patterns within financial data. Through trend analysis, businesses can identify and understand the trajectory of crucial metrics over time, facilitating proactive decision-making. Comparative performance assessments offer a holistic view of business evolution, while forecasting and predictive insights empower users to anticipate future financial scenarios, contributing to strategic planning.

A break down of QuickBooks features, tools, and benefits

Now, let’s look at what QuickBooks Online has under the hood to empower business accounting and business management.

User interface and ease of use

QuickBooks Online is an impressive financial management platform that offers a harmonious blend of sophistication and user-friendliness. Its intuitive interface allows users to easily navigate through its impressive feature set. QuickBooks’ design is logical and easy to understand, making it accessible to everyone, from seasoned accountants to small business owners, regardless of their accounting expertise.

It helps QuickBooks provide a great user experience and ensures users can perform complex financial tasks efficiently. The platform is accessible across different devices, catering to users on the go.

Inventory management

QuickBooks’ inventory management feature is a boon for businesses immersed in physical product transactions. The platform enables businesses to accurately track and optimize stock levels, providing real-time inventory status.

- Real-time tracking

QuickBooks Online enables businesses to track inventory movements in real-time, from product purchases to sales. This real-time visibility minimizes the risk of stockouts or overstocking, optimizing inventory levels for operational efficiency. - Customizable alerts

To further enhance inventory control, QuickBooks Online offers customizable alerts for low stock levels or impending reorder points. Businesses can set thresholds based on their specific needs, receiving timely notifications to replenish stock as needed. - Integration

QuickBooks’ inventory management seamlessly integrates with other financial features, creating a unified ecosystem. This interconnected approach ensures that inventory data is seamlessly incorporated into financial reports, providing a holistic view of a business’s financial health.

Job costing

For businesses reliant on project-based revenue streams, QuickBooks’ job costing feature becomes an invaluable tool for precise project budgeting and financial success. It offers a nuanced approach to project management and financial tracking.

- Detailed expense tracking

QuickBooks Online allows businesses to track expenses associated with specific projects in granular detail. These include labor costs, material expenses, and any other project-related expenditures, providing a comprehensive overview of project financials. - Revenue allocation

Job costing in QuickBooks Online not only tracks expenses but also allocates revenue to specific projects, enabling businesses to determine the profitability of each project and aiding in strategic decision-making for future endeavors. - Budget vs. actual analysis

The platform facilitates a thorough analysis of budgeted versus actual costs for each project. This feature empowers businesses to identify areas where they may have exceeded or come under budget, contributing to improved financial forecasting and project management.

Industry-specific solutions

QuickBooks Online recognizes the diverse needs of businesses across various industries and goes beyond a one-size-fits-all approach by providing industry-specific solutions. Let’s take a closer look at how QuickBooks Online caters to specific sectors.

Construction industry

- Job costing enhancements

QuickBooks Online offers specialized features for construction businesses, enhancing job costing capabilities to accommodate the unique financial intricacies of construction projects. - Project profitability analysis

The platform enables construction businesses to analyze project profitability, considering labor costs, materials, and overhead expenses.

Healthcare industry

- Medical expense tracking

QuickBooks Onlinefor healthcare allows detailed tracking of medical expenses, ensuring accurate financial records for healthcare providers. - Billing and invoicing

The platform streamlines billing processes, providing healthcare organizations with efficient invoicing tools tailored to their specific billing needs.

Nonprofit organizations

- Donation tracking

QuickBooks Online offers features for nonprofits to track donations, ensuring transparent and accurate recording of financial contributions. - Fund accounting

The platform supports fund accounting, allowing nonprofits to manage restricted and unrestricted funds separately, meeting the unique financial reporting requirements of the nonprofit sector.

QuickBooks’ commitment to industry-specific solutions showcases its adaptability to the nuanced financial requirements of diverse sectors, further solidifying its position as a comprehensive and tailored financial management solution.

Integration capabilities

QuickBooks Online integration capabilities help transform business operations, streamlining processes, enhancing accuracy, and promoting financial management efficiency. It’s a reliable companion for businesses that use various business tools, ensuring financial management remains at the core of a thriving ecosystem.

- Flexibility across applications

QuickBooks’ integration capabilities offer a spectrum of flexibility, allowing businesses to connect with a diverse range of applications. This adaptability is crucial in a modern business environment where diverse tools are employed for various operational needs. - Point-of-sale systems integration

For businesses utilizing point-of-sale systems, QuickBooks Online ensures a seamless integration process. Sales data, transactions with credit cards, and financial from point-of-sale systems, effortlessly synchronize with QuickBooks Online, eliminating the need for manual data entry and reducing the risk of errors. - Ecommerce platform harmony

QuickBooks Online harmonizes with e-commerce platforms, streamlining the management of online sales, inventory, and financial data. The integration ensures that businesses engaged in e-commerce can seamlessly reconcile their online transactions with their financial records in QuickBooks Online. - CRM software connectivity

Customer Relationship Management (CRM) is a cornerstone of modern business, and QuickBooks Online recognizes its importance. The platform seamlessly connects with CRM software, ensuring that customer data, sales interactions, and financial transactions are intricately linked. This integration fosters a holistic view of customer relationships and financial performance.

QuickBooks integration streamlines workflow, reducing manual data entry burdens and enhancing accuracy in financial data. The automation minimizes time and effort spent on repetitive tasks while facilitating the automated exchange of information between applications.

Reporting and analytics

QuickBooks Online goes beyond just showing data but helps businesses make smart decisions. The platform provides detailed financial reports, offering a clear view of a company’s financial health. With tools for analyzing trends, users can navigate business performance wisely. QuickBooks Online acts as a guide, offering more than just numbers — it provides the strategic insights businesses need to succeed in the ever-changing financial world, especially when it comes to understanding complex financial structures through advanced reporting like the multi-step income statement.

- Comprehensive financial health

QuickBooks Online empowers users to generate detailed financial reports that offer a 360-degree view of the business’s fiscal health. These reports encompass a wide array of financial metrics, including profit and loss statements, balance sheets, and cash flow reports. The depth and breadth of the information presented enable users to gain a nuanced understanding of their financial standing. - Customizable insights

The platform’s commitment to detailed financial reporting extends to customization. Users can tailor reports to focus on specific metrics and key performance indicators relevant to their industry or business goals. This customization in QuickBooks Online ensures that the insights derived are not only comprehensive but also directly applicable to the unique needs of each business. - Real-time accessibility

QuickBooks Onlinegoes beyond static reporting by offering real-time accessibility to financial information. This feature ensures businesses can access their latest data, facilitating agile decision-making in response to market changes and business dynamics. - Analyzing trends

QuickBooks’ analytics tools empower users to delve into trend analysis, providing a nuanced perspective on the trajectory of key financial metrics over time. This feature is instrumental in identifying patterns, fluctuations, and emerging trends within the financial data, offering businesses a strategic advantage in anticipating market shifts. - Informed decision-making

Armed with trend analysis insights, users can make informed decisions that positively impact business performance. Whether it’s adjusting marketing strategies, revising budget allocations, or optimizing inventory management, QuickBooks’ analytics tools provide the data-driven foundation for strategic choices. - Deep understanding of financial data

QuickBooks’ commitment to trend analysis is not just about surface-level observations; it involves gaining a deep understanding of financial data. By leveraging analytics tools, users can navigate through complex datasets, uncovering valuable insights that might remain hidden in traditional reporting methods.

Let’s compare QuickBooks vs Xero for potential drawbacks

Like everything else, accounting solutions have benefits and flaws – QuickBooks Online and Xero are no exception. Understanding and addressing potential drawbacks is crucial for businesses to make the right decision.

Let’s explore the potential cons associated with Xero and QuickBooks Online, acknowledging that these considerations are integral to choosing the platform that best aligns with your business needs.

Xero – a versatile platform with learning curve considerations

Xero’s commitment to user-friendliness and extensive accounting and finance management functionality are undeniable. However, some aspects can hamper the software adoption or even make businesses look for an alternative. Let’s break them down.

The learning curve for new users

The platform may present a learning curve for new users, particularly those transitioning from different accounting systems. While the interface is intuitive, it may require some adjustment, especially if you got used to another platform. Moreover, one might need time to learn all the features and how to apply them to a particular business needs.

Adequate training and support are essential components for a smooth onboarding process. Investing time to familiarize users with Xero’s features and functionalities can accelerate the learning curve, ensuring the platform is leveraged to its full potential.

Limited industry-specific features

While Xero prides itself on versatility, businesses with highly specialized needs may find that QuickBooks Online possesses more industry-specific features. This way, it can be a significant factor when deciding which option to choose.

Businesses might want to thoroughly assess their industry-specific requirements and evaluate whether Xero can fully accommodate them. Customization options and third-party integrations can mitigate some of these limitations, but businesses should weigh the trade-offs carefully.

QuickBooks – overcoming complexities for a seamless experience

Now, let’s explore what can potentially scare users away from

Pricing structure complexities

QuickBooks Online, with its extensive range of plans and add-ons, can pose challenges for users when navigating its pricing structure. Some businesses may find the array of options overwhelming.

Understanding the nuances of each plan and add-on is essential to avoid unexpected costs. Businesses should take the time to engage with QuickBooks Online customer support or explore available resources, gain clarity on the pricing structure, and select a plan that aligns seamlessly with their financial objectives.

Feature-rich and overwhelming

QuickBooks’ rich feature set, while being a strength, can also be overwhelming for smaller businesses or those with simple accounting needs.

The platform’s extensive functionalities may extend beyond certain users’ requirements, leading to a potential risk of underutilization. Adequate training and customization are critical to optimizing the platform for specific use cases.

By tailoring QuickBooks Online to meet the specific needs of a business, whether through personalized training or selective feature activation, businesses can navigate the richness of the platform more effectively.

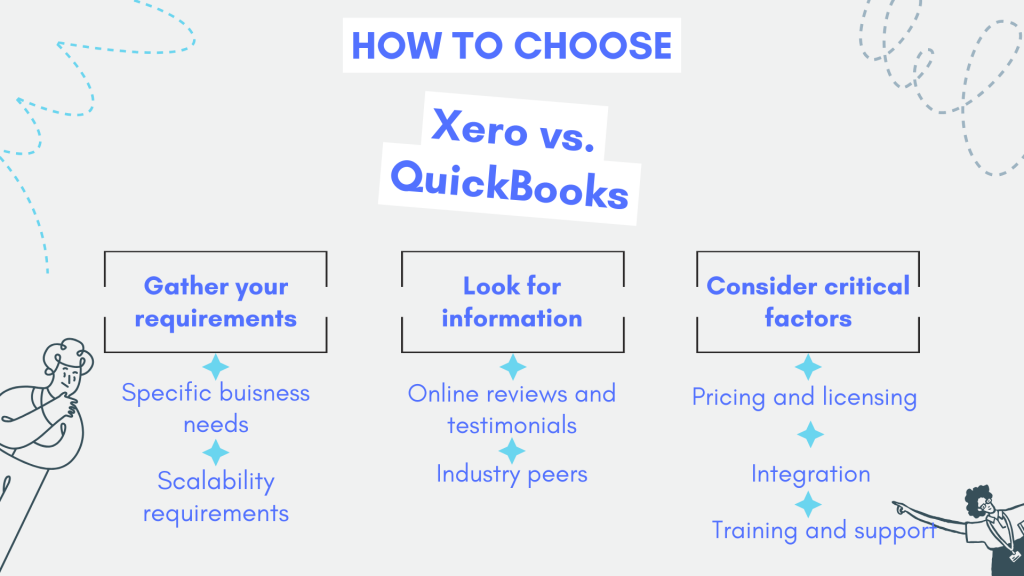

Xero or QuickBooks: best practices for choosing accounting software

As you can see in the example of Xero and QuickBooks Online, selecting the right accounting software might not be that easy. Meanwhile, this choice is like choosing a strategic partner for financial management (if you think of your business as your home, accounting software might be like homeowners insurance, covering your back). So you might want to approach it wisely and thoroughly compare the two solutions agains your requirements. That means careful consideration, planning, and a deep understanding of the unique needs of your business. Some best practices for choosing accounting software might also help, providing a roadmap for businesses to make informed decisions.

Let’s look at them in more detail.

A quick guide on gathering requirements

A big and one of the most critical steps to start your selection journey is to understand what you need now and might need in the future. Here’s what you can do at this point.

Identifying specific business needs

The foundation of choosing the right accounting software lies in understanding your business’s specific requirements. Define the key areas that demand attention, such as:

- Invoicing: Consider the intricacies of your invoicing process and whether the software accommodates customization to reflect your brand.

- Expense Tracking: Evaluate your business’s approach to expense tracking and choose software that streamlines this process, offering real-time insights into financial health.

- Inventory Management: For businesses dealing with physical products, assess the importance of inventory management features for accurate tracking and optimization.

- Reporting: Gauge the significance of reporting in your decision-making process. Determine whether customizable reports and analytics tools are essential for your business.

Assessing scalability requirements

Consider your business’s growth trajectory as a factor in your software selection process. Opt for accounting software that can seamlessly scale alongside your expanding operations. A solution that adapts to increased data volumes, user demands, and evolving financial complexities ensures that your financial management remains agile and efficient.

Where to look for information (think of TechRepublic Premium, etc.)

You need to start your search with something to find out about available options and form your opinion on what might potentially fit your bill. So here’s a couple of actionable ideas.

Online reviews and testimonials

Harness the power of the digital age by exploring online reviews and testimonials from businesses that share similarities with yours. Real-world experiences provide invaluable insights into the practical use and performance of accounting software. Platforms like Capterra, G2, or the accounting software provider’s website often feature user reviews that offer a candid perspective on the software’s strengths and potential drawbacks.

Consultation with industry peers

Tap into the wealth of knowledge within your industry by reaching out to industry peers or business associations for recommendations. Hearing about the firsthand experiences of others in your field can guide you toward a solution that aligns precisely with your industry’s specific needs. Peer insights can uncover nuances that might not be apparent from online reviews, offering a more holistic understanding of the software’s performance in a particular business context.

Factors to consider

Last but not least, you might want to consider a row of various factors before you make a final decision. Let’s look at the most critical ones.

- Pricing and licensing models

Evaluate pricing structure and licensing options of accounting software with a discerning eye. Ensure that the chosen plan aligns seamlessly with your budget while offering the necessary features for your business. Consider whether the pricing model is scalable and flexible to accommodate your business’s changing needs over time.

- Integration capabilities

Smooth integration with other business tools and applications is paramount in the modern business landscape. Assess the compatibility of the accounting software with the tools your business relies on. Whether it’s customer relationship management (CRM) software, ecommerce platforms, or point-of-sale systems, seamless integration enhances workflow efficiency and prevents data silos.

- Customer support and training options

The journey with accounting software doesn’t end at implementation; ongoing support and training are vital for sustained success. Assess the quality of customer support and the availability of training resources offered by the software provider (you might find out whether users are satisfied with the support QuickBooks offers, etc.). Responsive support and comprehensive training contribute significantly to a successful implementation, ensuring that your team can navigate the software with confidence.

Final word: the divergence and convergence of Xero and QuickBooks

As you can see, while both Xero and QuickBooks offer robust features, they also differ in many aspects.

For example, Xero’s accounting functions use a very structured setup process, providing a seamless experience for users. One notable advantage is that Xero allows for two tracking categories with many subcategories, allowing businesses to categorize and analyze their financial data with precision.

Affordability and scalability are paramount considerations, and here, Xero is more affordable and scalable than QuickBooks. With Xero’s low starting price, businesses can access a comprehensive feature set without breaking the bank. Additionally, the platform’s aesthetic appeal cannot be overlooked—it looks better, providing a user-friendly interface that enhances the overall experience for users.

While QuickBooks offers more reports than Xero, including the specialized QuickBooks Advanced and QuickBooks Self-Employed plans, Xero’s accounting functions still stand out for their efficiency and adaptability. For businesses seeking tailored solutions, Xero inventory management and the Xero VAT feature are invaluable tools.

Both platforms excel in integration capabilities. Integrations QuickBooks offers are extensive, including QuickBooks Payroll, while Xero’s accounting functions seamlessly connect with various third-party apps, contributing to a customized and efficient workflow.

At the end of the day, the choice of QuickBooks vs Xero ultimately boils down to specific business needs and preferences. Whether opting for the live support offered by QuickBooks Live, leveraging the extensive reports or appreciating the affordability and scalability of an appropriate pricing plan Xero offers, businesses have the flexibility to choose the solution that best aligns with their unique requirements. Don’t forget that both solutions provide a free trial. So, you can always check them in action to see whether they fit your bill befor making any commitment.

%20(1).png)