Invoices stand as the bedrock of financial transactions for businesses of all sizes. Invoice management is essential for maintaining healthy cash flows and building strong client relationships. Stripe is the popular payment platform that facilitates business transactions and streamlines the invoicing journey.

In this article, we speak of sending Stripe invoices and offer insights for efficiently managing business invoices, particularly for enterprises navigating the complexities of multi-channel operations.

What is Stripe?

In a nutshell, Stripe is a super-smooth payment platform, bridging the gap between a business’s customers and bank account and making online payments safe and easy. Apart from payments, Stripe offers many other helpful tools, including integration with accounting software and a nifty feature to help you deal with invoices without the headache.

So, let’s break it down.

Stripe is serious about security, so you can sleep easy knowing no sneaky data breaches are likely to happen on their watch.

Stripe works like your personal payment butler, taking care of all sorts of ways your customers want to pay. Credit cards, debit cards, even those funky new methods, such as Apple Pay or Samsung Pay. And – what’s no less important – it’s a breeze to set up on your website or app.

But where things get interesting are invoices. Stripe makes creating and managing them as easy as pie. You can use templates and automatic stuff, so you don’t have to do all the boring bits, and you can keep tabs on who’s paid up and who still owes you that coffee money.

Stripe also handles subscriptions like a pro. And you know that part where people abandon their shopping carts? Stripe jazzes up your checkout page, so they’re more likely to seal the deal. Oh, and it’s got brainy analytics to help you make smarter choices for your business.

Let’s talk about the benefits. Signing up is a breeze. The interface is user-friendly and intuitive. You can easily track your sales and overall financial performance thanks to comprehensive Stripe reporting. Plus, it’s a globetrotter, handling payments in multiple currencies – perfect for expanding your business worldwide. Ultimately, Stripe grows with you, so as your business gets bigger, Stripe’s got your back.

Still, I can’t let you go without putting a little fly into the ointment. Stripe, being super developer-friendly (which means you can set it up to cater to your specific needs), also requires a good deal of technical skills when you need to customize it. It can be a drawback if you’re not a tech-savvy business owner or don’t have a developer on-site. Which means extra expenses for you (in time and money) to make Stripe perfectly work for you.

What is an invoice?

As we speak about invoicing, I want to briefly go through why it is important to businesses.

An invoice, as we all know, is a formal document issued by a seller to a buyer. It details the products or services you sell along with their costs, serving as a written payment request and outlining the terms and conditions of the interaction between you and your customers.

Looking at invoices in more detail, they’re more than encouraging payments – they help keep track of sales, inventory, and how well we’re doing. And they’re not just for math. Invoices set the rules for getting paid, like when and how. This makes everyone happy and trust each other, like a good team.

Managing invoices right is like having the secret sauce. If we fail, it’s like dropping the sauce everywhere. Late payments and confused terms can mess up our cash flow and put us in a tough spot. Plus, it’s like telling people we’re not so great at this game, which isn’t cool. It might even stop new players from joining us and block our path to growth.

So, invoices are like the captain of our business game. Giving them the right attention and playing by the rules helps businesses win on and off the field.

Types of invoices: exploring customer payment documents

Invoices generally fall into two main types: manual invoices and digital invoices. These are like the old-school classics and the modern tech wonders of the invoicing world.

Manual invoices

Imagine the traditional way of doing business – paper invoices physically handed out or mailed to clients. They’re like the vintage vinyl records of invoicing. They might work for smaller companies with a few monthly transactions. However, they come with a catch — someone needs to manually type in all that data, which can be a bit of a drag. And, being real, errors can sneak in while moving info from paper to screen.

Digital invoices

Now, let’s fast-forward to the tech-savvy present. Digital invoices are the rockstars here. Instead of paper, these are electronic documents that can be made, sent, and tracked online. What’s the big deal? Say goodbye to manual data entry woes. These invoices play nice with accounting software and online platforms, cutting down on mistakes and saving time. You can keep tabs on things in real time, get automatic reminders, and access everything with a click.

So, in a nutshell, it’s all about finding the right groove for your business. Old-school manual invoices have their charm but can be a bit clunky. On the other hand, digital invoices are the sleek, streamlined future. The choice is yours – a bit of nostalgia or a whole lot of efficiency – in the end, it’s all about keeping the invoicing beat. (Still, I can’t imagine someone being super fond of manual data entry these days.)

How to create and send invoices in Stripe

Now, let’s put all the above together. We looked at invoicing, its role in managing a business, and how one needs to approach it right. Meanwhile, Stripe allows for this right approach to invoicing, facilitating the creation and sending of invoices and receiving payments. Here’s a quick step-by-step guide to sending invoices with Stripe.

1. Set up your invoice’s default look

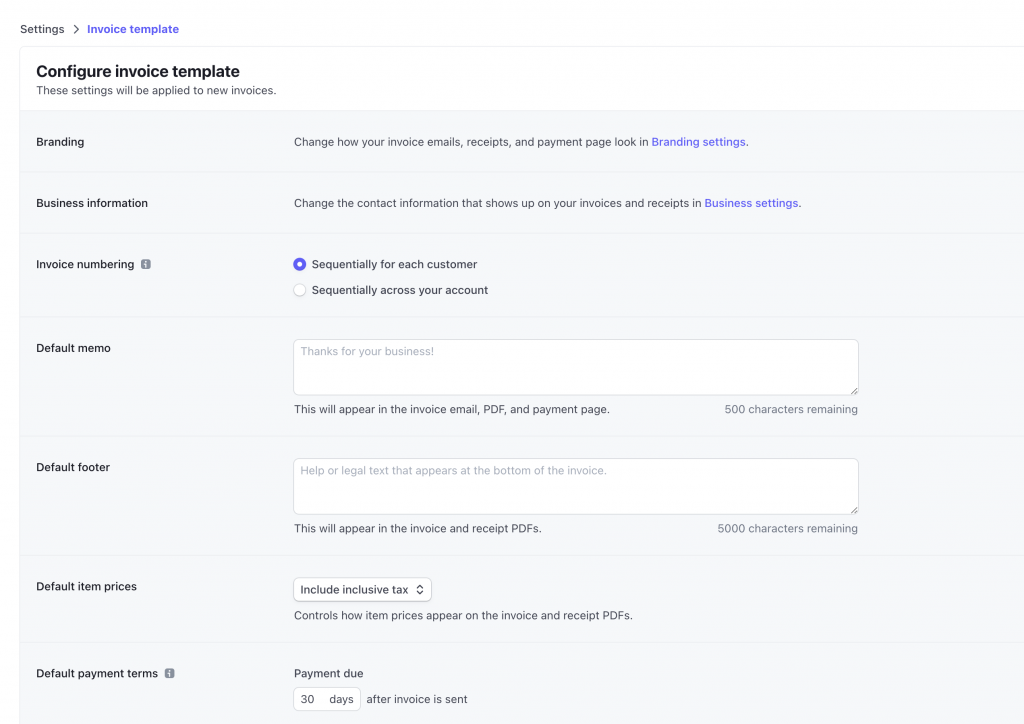

Before you start sending invoices, you might want them to be recognizable and associated with your business. So, while this is pretty much optional, you might want to brand your invoices, so that they look familiar to your customers, and then don’t wonder where the invoice comes from (saves time).

At this point you might want to configure the template for your invoices, customizing it with your brand logo and color and setting up default fields like memo and footer. Memos often serve as a notes section. They can express gratitude for the customer’s business or provide additional context about the invoice. The footer field typically includes contractual or legally mandated text. You might also add custom fields like Tax compliance or Purchase order (PO) numbers, etc., and provide your public business information

You can handle the creation of invoice templates under your Stripe’s Dashboard > Settings > Billing > Invoice

2. Set up payment methods

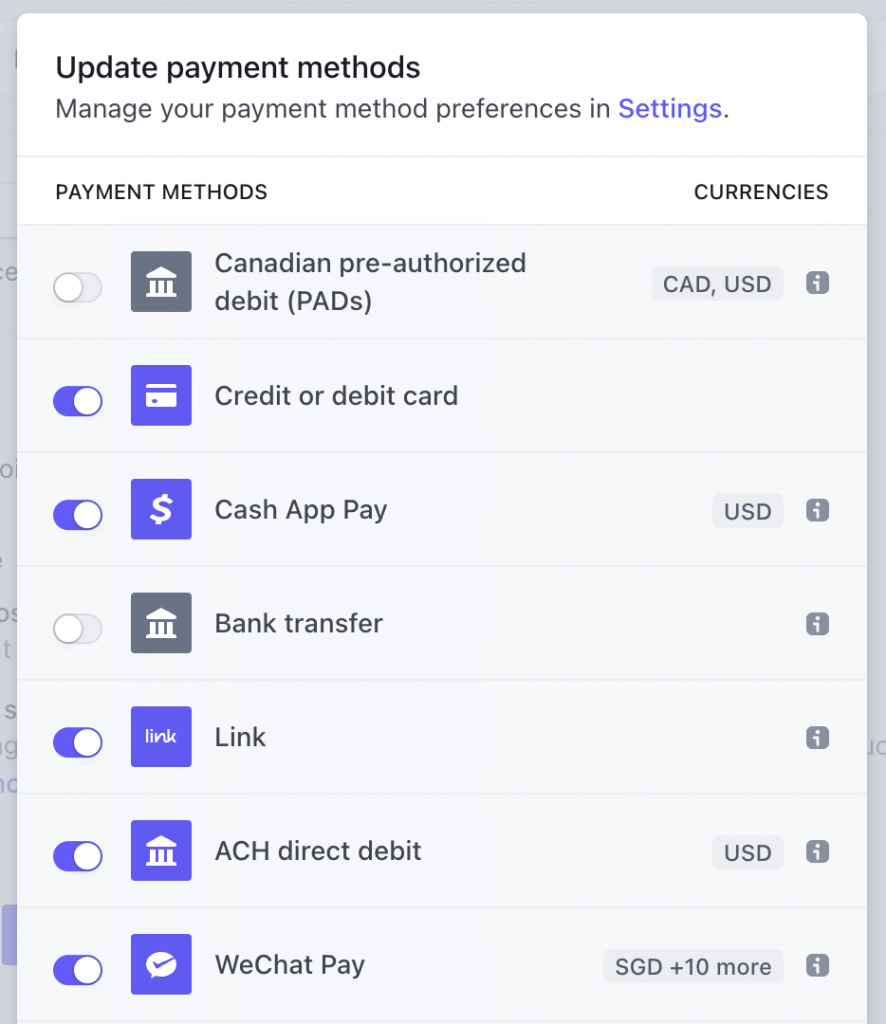

For new users, Stripe activates card, Link, bank transfers, Cash App Pay, and WeChat Pay payment methods by default. To add more payment options, you might want to access your Payment methods settings and activate them.

To do this, you need to go to your Dashboard > Settings > Payment methods.

Bear in mind that certain situations might restrict the use of payment methods for invoices. For example, a payment method might be limited to a specific currency or have maximum payment constraints. When such limitations arise, Stripe won’t automatically choose a payment method.

3. Create and send Stripe invoices to customers

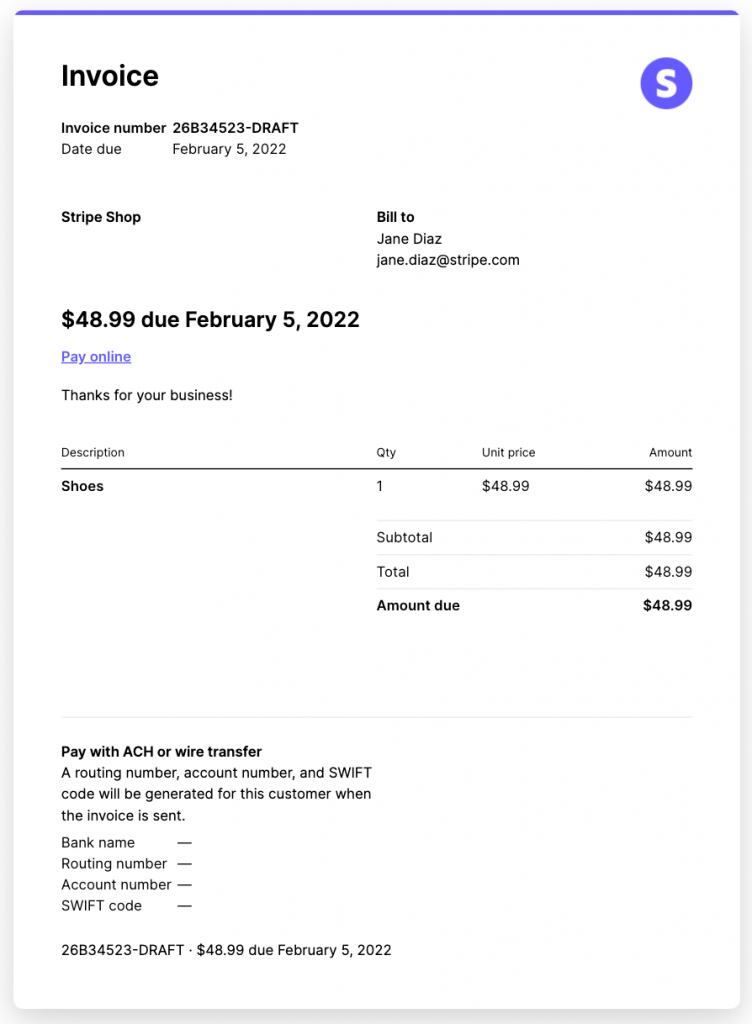

Now, it’s time to invoice a customer. In Stripe, you create and send invoices from your Dashboard that you’re typically directed to upon logging in. Here’re the steps to follow:

- Log in to your Dashboard.

Search for the customer you’re going to invoice. - Create the invoice from scratch or use your custom template.

- Send the invoice to your customer with or without a payment link included. In the first case, clicking on the link will send the customer to the Hosted invoice page where they can pay the invoice online. Sending an invoice without a payment link, a customer will receive just a PDF invoice, so they will need to pay it through the bank.

- Monitor the invoice payment status on your Stripe’s invoice page. You can find it by going to the Dashboard > Invoices.

- As soon as the customer pays, Stripe receives the payment and automatically sets the invoice status as Paid.

It’s worth mentioning that Stripe also offers a bunch of cool invoice management stuff like sending email notifications or reminders to your customers upon failed payment attempts, after Stripe finalizes an invoice, with receipts after invoices are paid, and more.

Invoice management for multi channel businesses

As you can see, Stripe helps a lot with invoicing. However, today businesses, especially online businesses, such as ecommerce and SaaS, often sell their products and services through multiple platforms and provide various payment options to cater to the needs of the wider audience. In other words, apart from Stripe, they can get paid through PayPal, Square, in-built payment options of various ecommerce platforms and marketplaces – choose what you like. At this point, managing invoices might become a pain in the neck. If you want a comprehensive view of all your invoices from different systems, you need a means to somehow put this data together. How can you do this? There are some ways.

Google Sheets

Google Sheets are electronic spreadsheets allowing to consolidate and manage data from different sources. It’s worth noting, though, that Google Sheets are more of a manual entry story or are about using third-party software to import data into it. In light of this, managing multi-channel invoicing using Google Sheets can be a viable solution for smaller businesses that need a simple and cost-effective way to handle invoicing from various sources. Still, it’s an option, so let’s look at its benefits and drawbacks.

Benefits of managing multi-channel invoicing with Google Sheets might include:

- Accessibility and collaboration

Google Sheets is cloud-based, allowing authorized users to access and collaborate on the same spreadsheet from anywhere with an internet connection. It can be particularly useful if your invoicing team is distributed or you need to share information with clients or suppliers.

- Customization

Google Sheets provides basic spreadsheet functionality, enabling you to customize your invoice templates to match your branding and requirements. You can set up formulas to automate calculations like taxes, discounts, and totals.

- Integration with other Google services: Google Sheets can be easily integrated with other Google services, such as Google Forms for order submissions or Google Drive for document storage. This integration can streamline your invoicing process by automating data input.

- Cost-effectiveness

Google Sheets is part of the Google Workspace suite, which offers a free version with limited features and a paid version with more advanced capabilities. It can be a more budget-friendly option compared to dedicated invoicing software.

- Real-time updates

Multiple users can work on the same spreadsheet simultaneously, and changes are reflected in real-time. It can reduce confusion and ensure everyone is working with the most up-to-date information.

Now, the Google Sheets option comes up with drawbacks, such as:

- Limited automation

While Google Sheets offers basic automation through formulas and simple scripts, it lacks the advanced automation capabilities of dedicated invoicing software, which might become a limitation as your business grows and your invoicing needs become more complex.

- Data Entry Errors

Manual data entry increases the risk of errors, especially when dealing with large amounts of data from different channels. Mistakes in calculations or data input can lead to inaccuracies in your invoices.

- Scalability

Google Sheets can become less efficient as your invoicing volume increases. Large spreadsheets with extensive data and complex calculations might slow down or become unwieldy to manage.

- Security concerns

While Google provides security measures for its cloud services, storing sensitive financial information on a cloud-based platform could be a concern for some businesses.

- Lack of advanced features

Google Sheets lacks specialized features that dedicated invoicing software offers, such as automated reminders, integrated payment gateways, and in-depth reporting. These features can significantly improve efficiency and customer experience.

As you can see, using Google Sheets for multi-channel invoicing can be a good starting point for smaller businesses with relatively simple invoicing needs. However, as your business grows and your invoicing processes become more complex, you might fancy more advanced features and scalability.

Managing multi-channel invoicing with Synder

For online businesses operating across multiple sales channels and featuring large volumes of transactions, the process of managing invoices can quickly become overwhelming. Each platform may have its own unique invoicing system, making it challenging to keep track of payments, reconcile accounts, and ensure a cohesive financial overview. This fragmentation can lead to errors, delays, and missed opportunities for growth. Partly manual solutions (like the above mentionedGoogle Sheets) are not the option due to the amount of data to handle.

Synder is a financial management tool designed to simplify and streamline the processes of invoicing, accounting, and payment reconciliation for businesses operating across multiple sales channels. It acts as a bridge between various e-commerce platforms, marketplaces, and payment gateways, centralizing transaction data and providing a unified interface for financial operations.

Synder offers a comprehensive suite of features that cater specifically to multi-channel businesses:

- Centralized business management

Synder acts as a bridge between various sales and payment platforms, ensuring that all transaction data gets integrated into one streamlined interface. It can drastically simplify financial reporting and enhance transparency and accuracy in record-keeping. - Automated invoicing

Creating and sending invoices can be time-consuming, particularly when dealing with numerous channels. Synder leverages automation to generate invoices seamlessly, making the invoicing process efficient and error-free. - Stripe-powered payment links

Synder goes beyond traditional invoicing by integrating with Stripe to offer payment links within invoices. This integration empowers customers with easy checkout options, improving the overall payment experience. - Real-time reconciliation

Synder’s real-time synchronization ensures that transaction data is up-to-date across all channels, minimizing discrepancies and enabling businesses to reconcile accounts with precision. - Payment tracking and closing

One of the standout features of Synder is its ability to automatically close invoices in the accounting system upon payment receipt. This feature streamlines the reconciliation process and provides a clear overview of outstanding payments.

Should you believe Synder can be the solution you’re looking for, don’t hesitate to book a seat at our webinar or sign up for a free trial to learn more about how it can help your particular business.

As you can see, invoicing can be a labyrinth for businesses, especially when operating across multiple channels. Stripe steps in as the guiding light, simplifying this complexity. It not only eases payment processes but also handles invoices seamlessly. Templates and automation streamline the process, while insights maintain clarity on transactions. For multi-channel ventures, Stripe’s potential expands further when integrated into systems like Synder. This synergy unifies data from different channels, erasing the hassle of scattered invoices, so businesses can concentrate on growth, customer satisfaction, and financial equilibrium.

Want to learn more? Read an article about Stripe business loan or our guide How to delete Stripe account.