In the rapidly evolving landscape of e-commerce and online business, payment processing platforms play a pivotal role in ensuring smooth transactions and customer satisfaction. One such platform that has gained immense popularity is Stripe. Offering a range of benefits and opportunities, it has empowered businesses to accept payments from across the globe seamlessly. However, as circumstances change, businesses might find themselves needing to part ways with this platform.

Let’sl delve into the world of Stripe, explore its advantages and disadvantages, discuss the scenarios that might prompt the need to delete a Stripe account, and provide a step-by-step guide to make the process as seamless as possible.

Understanding Stripe – benefits and drawbacks

Stripe has emerged as a preferred choice for businesses seeking a robust and user-friendly payment processing solution. Its benefits are multifaceted, making it an attractive option for startups, SMEs, and large enterprises alike.

Stripe benefits

One of the standout advantages of Stripe is its easy setup and integration. With well-documented APIs and developer-friendly tools, businesses can integrate Stripe into their websites and applications with minimal technical barriers. This simplifies the process of accepting Stripe payments online, enhancing the user experience.

Furthermore, Stripe’s extensive range of payment options makes it highly versatile. From credit and debit cards to digital wallets and localized payment methods, it accommodates a wide array of customer preferences. This is crucial for businesses with a global customer base.

Security is a top priority for any online transaction, and Stripe excels in this aspect. It provides advanced security features, including encryption, tokenization, and two-factor authentication, ensuring that customer data remains secure throughout the payment process.

Stripe’s global reach and multi-currency support are additional advantages that cater to businesses eyeing international expansion. This feature eliminates the complexity of managing various currencies, making cross-border transactions hassle-free.

For businesses that rely on subscription models, Stripe’s subscription and recurring payment capabilities are a game-changer. It enables automated billing, reducing administrative overhead and improving cash flow predictability.

Stripe drawbacks

However, as with any platform, there are drawbacks to consider. Transaction fees, while a standard practice in the payment processing industry, can eat into a business’s profitability, especially for high-volume transactions. Additionally, Stripe’s automated risk assessment system can sometimes lead to account holds or disputes, impacting a business’s ability to access funds.

Another notable drawback is the limited customer service options provided by Stripe. While they offer support via email and chat, some businesses might prefer more immediate and personalized assistance, which might not always be readily available.

Reasons for deleting a Stripe account

Despite its advantages, there are scenarios in which a business might choose to delete its Stripe account. These reasons can range from strategic shifts in business models to regulatory or legal considerations.

Changing business models or opting for different payment processors can be a compelling reason to bid farewell to Stripe. As a business evolves, its payment processing needs might change, leading to the exploration of alternatives better suited to the new direction.

Dissatisfaction with Stripe’s fees or services is another trigger. Some businesses might find that the transaction fees erode their profit margins, or they might desire a more comprehensive suite of services that Stripe doesn’t provide.

In unfortunate instances, a business might face closure or suspension due to unforeseen circumstances. Deleting the Stripe account becomes a necessary step in the winding-down process.

Legal or regulatory reasons can also play a role. If a business encounters compliance issues or changes in regulations that conflict with Stripe’s capabilities, deletion might be the only viable solution.

Lastly, simplification of payment processing systems can motivate businesses to consolidate their payment methods, leading to the deletion of Stripe accounts.

Considerations before deleting your Stripe account

Before proceeding with the account deletion process, certain precautions and preparations are essential.

Backing up transaction data and customer information is critical for record-keeping and potential future audits. This ensures that historical data remains accessible even after the account is deleted.

Communicating with customers about payment changes is equally crucial. Abruptly discontinuing Stripe payments without prior communication can lead to customer dissatisfaction and loss of trust. Inform them of the transition and provide alternative payment methods.

Additionally, make sure to have an alternative payment processing solution in place before deleting your Stripe account. This ensures uninterrupted cash flow and customer convenience.

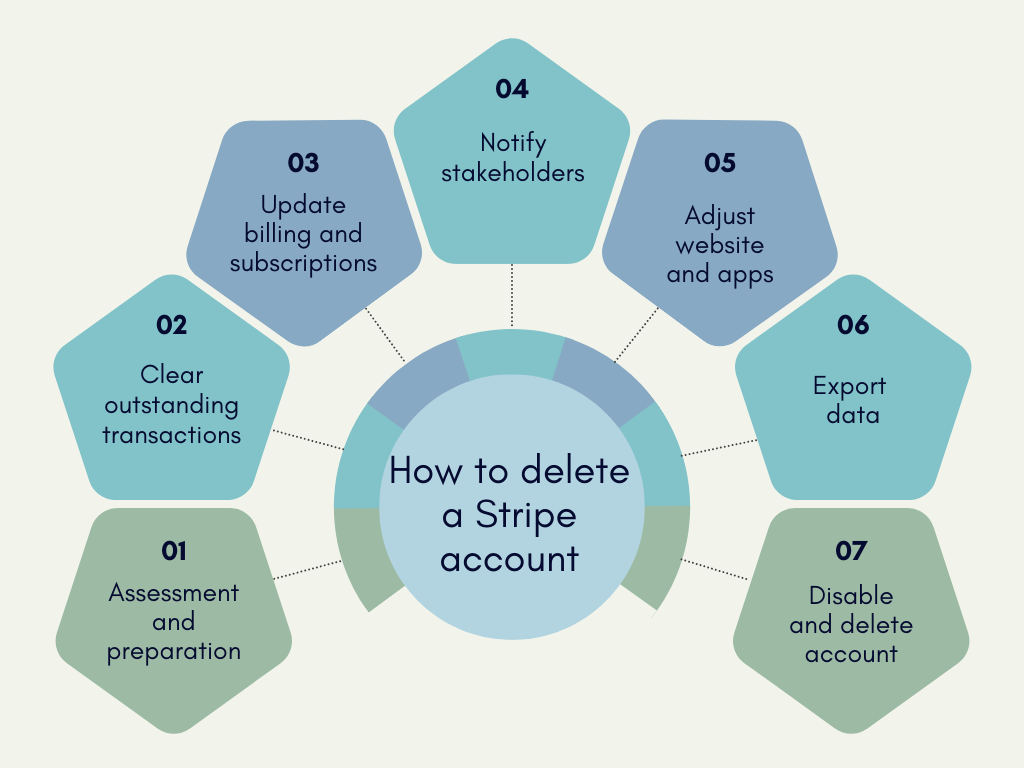

Step-by-Step Guide to deleting your Stripe account

Assessment and preparation

Begin by evaluating your reasons for deleting the Stripe account. Ensure that your decision aligns with your business’s goals and requirements. Also, confirm that you have a suitable alternative payment solution in mind.

Back up essential transaction data and customer information. This includes invoices, payment history, and customer contact details. Export this data and store it securely for future reference.

Clear outstanding transactions

Before you proceed with the account deletion, it’s vital to settle any pending or failed transactions. Refund customers for any payments that are pending or unsuccessful, ensuring a clean slate.

Notify customers about the upcoming changes. Explain that you’re discontinuing Stripe payments and provide them with alternative payment methods they can use.

Update billing and subscriptions

If your business operates on a subscription model, make sure to cancel any active subscriptions on Stripe. Inform your subscribers about the change and advise them to switch to the new payment method.

Notify stakeholders

Notify relevant stakeholders about your decision to delete the Stripe account. This might include your team, investors, and partners. Share details of the alternative payment solution you’re adopting to ensure a smooth transition.

Adjust website and apps

Remove any Stripe integration from your website or applications. Update your checkout pages to reflect the new payment options you’re offering.

Export data

Go to your Stripe dashboard and export all historical transaction data. This data can be useful for accounting purposes, reporting, and future analysis.

Disable and delete account

Log in to your Stripe account and navigate to the account settings. Find the option to disable your account. This might involve completing certain steps, verifying your identity, or settling any outstanding fees.

Once your account is disabled, follow the steps to delete it. Keep in mind that the process may vary, so follow the instructions provided by Stripe.

Final communications

Before the account deletion is finalized, send out a final communication to your customers. Inform them of the account closure and provide a clear timeline for the transition. Assure them of your continued support for any payment-related issues during this period.

Post-deletion actions and considerations

After deleting your Stripe account, a few additional steps can help ensure a seamless transition:

Double-check that your Stripe account has been deactivated. This involves ensuring that you’re no longer able to log in or access any account-related features.

Monitor your bank account for any residual transactions that might still be processing through Stripe. This will help you identify any unexpected payments that need attention.

Archive all documentation related to your Stripe account. This includes invoices, communication with customers, and any correspondence with Stripe’s support team. This documentation can be valuable for reference in the future.

Conclusion

Deciding to delete your Stripe account is a significant step that requires careful consideration and planning. As a versatile and widely used payment processing platform, Stripe offers a range of benefits, but it’s important to weigh them against your business’s specific needs and circumstances. Whether you’re pivoting your business model, seeking more cost-effective options, or navigating regulatory challenges, the process of deleting a Stripe account can be made smoother by following the step-by-step guide provided above. By backing up data, communicating effectively with stakeholders and customers, and ensuring a seamless transition to an alternative payment solution, you can minimize disruptions and uphold customer trust even as you bid farewell to Stripe.

Read more about How does Stripe work.