Financial statements provide a snapshot of business performance and give an accurate overview of a company’s financial management, profitability, solvency, and liquidity. However, they can only do good when you reconcile the accounts properly.

Reconciliations involve comparing daily transactions with bank statements. If a record is lost, you’re in trouble because fixing it can take time and effort. So, businesses rely on professionals to take care of account reconciliation.

Now, let’s get into more details and find out exactly what this mysterious reconciliation is.

Contents:

1. What is account reconciliation?

- Bank reconciliation

- Accounts receivable reconciliation

- Accounts payable reconciliation

- General ledger reconciliation

- Tax reconciliation

- Intercompany reconciliation

- Credit card reconciliation

3. How does reconciliation work?

4. What is QuickBooks reconciliation?

5. What is the easiest way to reconcile a bank statement?

6. How do you reconcile a balance sheet?

7. Example of a good balance sheet reconciliation

8. How do you reconcile expenses?

9. FAQ

Key takeaways:

- Reconciliation involves comparing internal accounting records against external financial statements or bank statements to verify that the figures are correct and balanced.

- Regular reconciliation is not just an occasional requirement but a regular necessity, particularly for larger companies.

- Effective reconciliation involves systematic steps from verifying general ledger accuracy to posting necessary journal entries to correct any discrepancies.

- While reconciliation can be complex and time-consuming, leveraging modern accounting software and adhering to a systematic process can simplify and streamline this essential task.

What is account reconciliation?

Account reconciliation is a process of comparing financial records with an actual bank balance to ensure the figures are fully balanced.

Source: Investopedia

Checking account reconciliation requires two pieces of data to match. The first is the business owner’s records (the books), and the second is a third party, such as a bank (bank statement). If you match up these two reports, you should see zero difference between the two documents—it means they have the same value on a specific date.

Account reconciliations are inevitable for any business. The only difference is in the frequency. Usually, the bigger the company, the more frequently you need to reconcile the books with your bank statement—monthly, weekly, or even daily. Smaller businesses can go through the process every month or even every six months.

Usually, you reconcile your books at the end of the accounting period to ensure the general ledger balance is complete and accurate. → To fully understand the whole accounting process inside one’s business, read our article on the AR basics to get a thorough understanding of the topic.

What is the purpose of reconciliation?

In accounting, reconciliation ensures that two sets of records (usually the balances of two accounts) are in agreement, meaning that the money leaving an account matches the actual money spent.

In more detail, the primary purposes of reconciliation are:

- Accuracy of financial records.

Reconciliation helps verify that the balances in an organization’s accounting records (such as the ledger) match the corresponding information in external records (such as bank statements).

- Internal control.

Reconciliation acts as an internal control mechanism that ensures financial transactions are properly authorized and recorded.

- Compliance with regulations.

Many regulatory bodies require companies to perform regular reconciliations to comply with accounting standards and legal requirements.

- Preparing for audits.

Regular reconciliations make the audit process smoother and more efficient, as they ensure that the accounts are accurate and up-to-date.

Good to know: According to the survey, up to 59% of financial department resources can be spent on managing transactions. Shockingly, up to 95% of this energy is spent on transactions that already match. This is explained by the fact that the manual accounts reconciliation process is slow in identifying transactions that actually require special attention.

Types of reconciliation

To avoid overwhelming you with hard-to-understand information and terminology, let’s review the most common types of account reconciliations. We’ll provide a small example for each so you’ll definitely grasp the main point!

#1. Bank reconciliation

This type of reconciliation helps businesses identify transactions recorded in their bank statements that have not yet been entered in the business’s own financial records. Common discrepancies include bank fees, direct debits, or deposits in transit (i.e., amounts received but not yet cleared by the bank).

Example:

Suppose a business notices a difference between its cash account balance in the ledger and the balance shown in the bank statement. Upon reviewing the statement, it may find a bank service charge of $50 and a deposit of $500 that has not yet cleared. The reconciliation will involve adjusting the cash account to reflect these transactions.

→ Learn more about bank reconciliation and how you can automate it.

#2. Accounts receivable reconciliation

This type of reconciliation ensures that the amounts recorded in the accounts receivable ledger accurately reflect all outstanding invoices due from customers and match the total reported on the balance sheet. It also involves verifying that all payments received have been properly accounted for and that any discrepancies due to returns, allowances, or write-offs are correctly recorded.

Example:

A company’s accounts receivable ledger shows a total of $20,000, but the balance sheet shows $19,500. On reconciliation, it’s found that a recent payment of $500 was received but not posted to the accounts receivable ledger. The adjustment would be made to reflect this payment, aligning the ledger with the balance sheet.

#3. Accounts payable reconciliation

This type ensures that all amounts the company owes to suppliers and other creditors are accurately recorded in the accounts payable ledger and match the corresponding entries on the balance sheet.

Example:

The accounts payable ledger of a business shows liabilities totaling $15,000, whereas the balance sheet indicates $16,000. Reconciliation reveals an invoice for $1,000 that was received and not yet entered into the accounts payable system. The ledger is then updated to include this outstanding invoice.

→ Check an ultimate guide to the full cycle AP process in 2024.

#4. General ledger reconciliation

This involves ensuring that all entries in the general ledger are complete and accurate, and that the ledger balances reconcile with subsidiary ledgers and other financial reports.

Example:

During the reconciliation of the general ledger, it’s noticed that the total sales recorded do not match the sales tax collected. Upon investigation, it is found that sales totaling $2,000 were recorded without adding sales tax. Corrections are made to include the tax, thus aligning the sales records with tax liabilities.

#5. Tax reconciliation

Tax reconciliation involves ensuring that all tax-related entries in the financial records match the amounts actually paid or to be paid as per tax returns. This includes verifying tax liabilities, credits, and deductions.

Example:

A company’s records show that $50,000 was paid in corporate taxes, but the tax return prepared indicates a liability of $48,000 due to an additional deduction that was not initially recorded. The reconciliation process would involve adjusting the financial records to reflect this deduction, ensuring that the records match the actual tax liability and purchases.

#6. Intercompany reconciliation

In companies with multiple departments or entities, this reconciliation ensures all transactions between these entities are recorded consistently in all relevant ledgers.

Example:

Company A sells inventory to its subsidiary, Company B, for $10,000. Reconciliation ensures that Company A records this as revenue and Company B as an expense and that the transaction is eliminated during consolidation to prevent double-counting of revenue.

#7. Credit card reconciliation

This involves verifying credit card statements against purchase receipts and payment records in the business’s books.

Example:

A review of a company credit card statement reveals a charge of $300 for office supplies. Reconciliation involves ensuring there is a corresponding receipt and that the expense was recorded under the correct account.

How does reconciliation work?

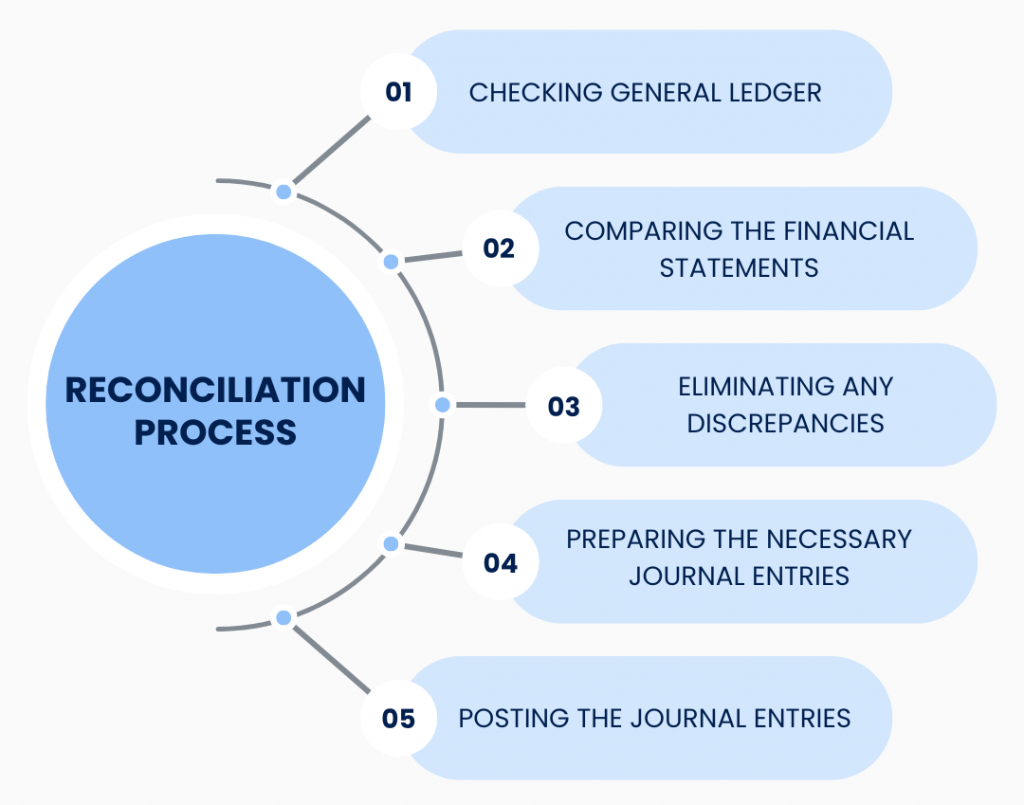

Step #1: Checking general ledger

Accurate records are one of the most important steps that affect future reconciliations. Neglecting this essential step leaves your company’s finances open to manipulation and potential fraud. Even the smallest businesses need a system that reduces accounting errors and simplifies bookkeeping procedures.

So first things first. For an accurate account reconciliation, an accountant needs to go through all the general ledger accounts to verify that there are no missing transactions and that the balance is right.

Step #2: Comparing the financial statements

Then, for correct account reconciliation, the specialist has to compare the balance in the general ledger with data from independent third-party systems or other supporting documentation (bank or credit card statements). This can be a reconciliation of bank statements and balance sheets.

Reconciliation between the bank statement and the general ledger allows both statements to complement each other. Errors and omissions in the books are easily detected and rectified.

Step #3: Getting rid of balance discrepancies if such appear

Next, a professional studies the acquired information and takes appropriate corrective actions to eliminate any discrepancies in both the general ledger and bank statement.

Reconciliation tasks include checking balances, identifying duplicate entries, and correcting mistakes where necessary. These routines may seem like a lot of work, but they help keep the accounts neat so that a business owner can see clearly how the business performs.

Step #4: Preparing the necessary journal entries

It’s time to double-check your ledger and all the noted discrepancies. If discrepancies have been detected in the previous step of account reconciliation, balance errors should be corrected and marked in special journal entries.

Step #5: Posting the journal entries

And that’s it! Now, the journal entries are ready to be posted.

When a discrepancy between the two accounts is found — for example, because an amount was entered in one ledger but not in another or because both books show different values for a single transaction — a “secondary entry” has to be posted to correct it. Only by posting all necessary secondary entries can you achieve accurate reconciliation. After this step, the general ledger is updated for the reconciliation period.

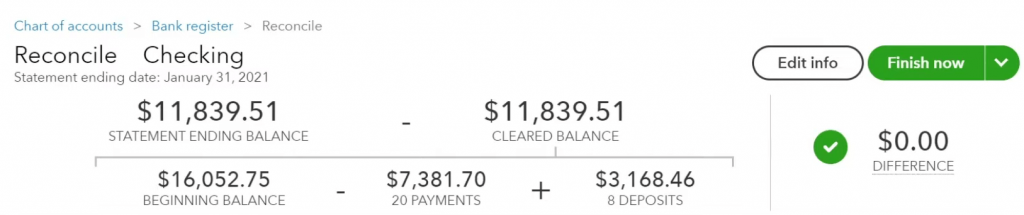

What is QuickBooks reconciliation?

QuickBooks reconciliation is a specific feature and process within the QuickBooks accounting software. This form of reconciliation typically involves comparing the transactions recorded in QuickBooks against external financial statements, such as bank statements or credit card statements.

The primary purpose of reconciling accounts in QuickBooks is to verify that the account balances in QuickBooks match those reported by the bank or credit card companies.

Source: Intuit QuickBooks

How do I reconcile in QuickBooks?

Step 1: Prepare for reconciliation

Before you start, ensure you have your most recent bank statement handy. You need this statement to compare the transactions listed with those recorded in QuickBooks.

Navigate to the Banking menu or the Accounting tab on the dashboard → Select Reconcile → Select the Account.

Select the account you want to reconcile from the drop-down menu. This could be a bank account, credit card account, or other account.

Step 2: Enter statement information

Input the ending balance as per your bank statement for the period you’re reconciling. Enter the date of the bank statement you are reconciling against.

Step 3: Match and verify transactions

QuickBooks will display a list of transactions for the period. Manually check off each transaction that matches your bank statement.

This includes all deposits, withdrawals, fees, and other charges.

If there is a difference between your statement balance and the QuickBooks balance, look for transactions that might have been missed, duplicated, or misrecorded. If transactions on your bank statement are not recorded in QuickBooks, you’ll need to add these manually.

Note: Sometimes, you might need to create an adjustment due to bank errors or accounting mistakes. You can do this directly from the reconciliation window in QuickBooks.

Step 4: Finalize the reconciliation

Once the balances match and all transactions are accounted for, finish the reconciliation. QuickBooks will offer to generate a reconciliation report.

After completing the reconciliation, it’s good to review the reconciliation summary and detail reports to ensure everything was captured accurately.

What is the easiest way to reconcile a bank statement?

Reconciling accounts can be done manually, but it takes time and requires specialized knowledge. Furthermore, if you make any mistakes in reconciling, it’s hard to undo your work, and it usually takes a lot of time. That’s why many financial professionals use accounting software to avoid such complications.

We’ll use Synder Sync as an example of accounting software that ensures flawless reconciliation.

Step 1: Connect your bank accounts

If you already use QuickBooks, Xero, or Sage Intacct, you can easily connect your bank accounts to get a regularly updated, live picture of your current account balance.

This way, you’ve got half of your accounts reconciliation process covered.

Step 2: Connect sales + payments channels, and accounting software

Most accounting software solutions don’t have detailed native integrations with all the payment platforms you might be using. Synder provides you with such an option and helps you cover the other half of account reconciliation. Use Synder to connect your payment platforms, such as Stripe, Square, or PayPal, among others, with your accounting software.

→ Read how to connect Stripe to QuickBooks to get a better understanding.

Step 3: Reconcile

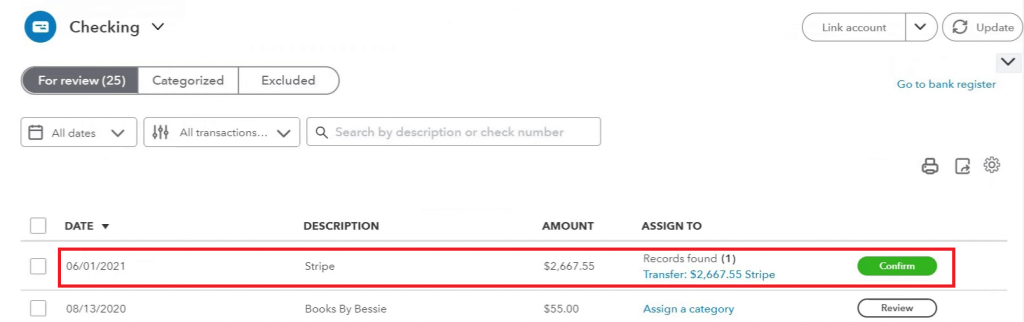

Since we’ve already mentioned Stripe and QuickBooks Online integration, let’s keep it as an example.

After the connection, Synder will first create a “Stripe” account in QuickBooks (“Clearing” account). Once your Stripe withdraws money to your bank, Synder will record a transfer from your Stripe account to your Checking account, showing you the actual money flow when funds first hit your Stripe account and then are transferred to the bank checking account with the help of Stripe QuickBooks Online integration.

QuickBooks “pre-matches” the transfer from the “Clearing” account to the “Checking” account for the same amount of the bank statement line. At this step, QuickBooks guesses which of the bank statement lines corresponds to a particular transaction created in the “Checking account”.

Note: You can’t create transactions in the Banking Tab when reconciling, as they may cause an error. Each transaction will be added only when it’s been approved by the bank.

To reconcile in QuickBooks Online, open the For Review list in QuickBooks Banking and click “Confirm” next to Stripe withdrawals.

Source: Synder Knowledge Base

Get a zero difference after matching all the transactions needed to prove that your accounting is correct with Synder! Create an account and reconcile last month of your online sales for free, or visit a Weekly Public Demo to get more insights.

How do you reconcile a balance sheet?

A balance sheet reconciliation can show the accuracy of the figures reported on a company’s balance sheet, which lists its assets, liabilities, and equity. This process involves comparing the account balances on the balance sheet with the information in the underlying financial records and supporting documentation, such as bank statements, invoices, and contracts.

The typical steps for performing a balance sheet reconciliation include:

Step 1: Gather financial documents

Collect all relevant financial documents that affect the balance sheet, such as bank statements, invoices, loan agreements, and previous balance sheets. These documents provide the necessary details for verifying the accounts on the balance sheet.

Step 2: Review balance sheet accounts

Each account on the balance sheet needs to be individually reviewed. This includes:

- Assets: Checking cash and bank balances against bank statements, reconciling accounts receivable with customer balances, and verifying inventory levels and fixed assets with physical counts and depreciation schedules.

- Liabilities: Comparing accounts payable balances with supplier statements, confirming loan balances with amortization schedules and lender statements, and verifying other accrued liabilities.

- Equity: Ensuring that equity transactions, such as issued shares, dividends, or retained earnings, are recorded correctly.

Step 3: Identify discrepancies

During the review, note any discrepancies between the account records and the supporting documents. Differences could be due to errors in data entry, unrecorded transactions, or timing differences between when transactions are recorded and when they occur.

For each discrepancy:

- Investigate the cause: Determine why the discrepancy exists. This may involve tracing transactions through journals and ledgers, reviewing transaction dates, or checking calculations.

- Resolve differences: Correct any errors found, record any missing transactions, and adjust entries for timing differences. This may involve making journal entries to correct balances.

Make the necessary journal entries if errors are found or adjustments are needed to reflect correct information.

Step 4: Verify and finalize

After adjustments, verify that all accounts now align with the supporting documentation and that the total assets equal the sum of total liabilities and equity.

Keep a record of the process, including details of the investigations and the adjustments made. This documentation is essential for audits and future reconciliations.

Regularly review and reconcile the balance sheet, typically as part of the monthly or annual closing process.

→ Read more about balance sheet reconciliation and how it works.

What is a good balance sheet reconciliation?

A good balance sheet reconciliation is a thorough and accurate process that ensures the financial information presented on the balance sheet accurately reflects the company’s financial status.

The key characteristics that define a good balance sheet reconciliation are:

#1. Comprehensive coverage

A good reconciliation covers all accounts on the balance sheet. This includes not only the major accounts, such as cash, receivables, payables, and debt, but also other accounts that might sometimes be overlooked, such as prepaid expenses, accrued liabilities, and deferred revenue.

#2. Detailed documentation

Every step of the reconciliation process should be well-documented. This includes maintaining detailed records of the review process, discrepancies found, the investigations undertaken to resolve discrepancies, and the adjustments made.

#3. Timeliness

Reconciliation should be performed regularly and promptly after the end of the accounting period. Timely reconciliation helps quickly identify and rectify errors and ensures that financial reporting is relevant and provides useful information.

#4. Use of supporting evidence

Good reconciliation practices involve cross-verifying balance sheet accounts with external and internal documentation. This can include matching bank balances with bank statements, confirming receivables and payables with respective statements, and checking fixed assets with physical inventory counts and valuation reports.

#5. Consistency

Applying consistent methods for reconciliation ensures that changes in the financial statements reflect real changes in the business rather than changes in accounting methods.

#6. Problem solving and analysis

A good reconciliation process is proactive in solving problems. It involves matching figures and analyzing discrepancies to understand their root causes. This analysis can lead to improvements in the internal controls, reducing the likelihood of similar discrepancies in the future.

Example of a good balance sheet reconciliation

Below is an example of a good balance sheet reconciliation for a hypothetical company, illustrating how to reconcile the Cash and Accounts Receivable accounts.

Here’s a balance sheet reconciliation example for XYZ Corporation as of December 31, 2023.

Step 1: Gather financial documents

These include:

- Bank statement ending December 31, 2023;

- Accounts receivable aging report as of December 31, 2023;

- General ledger accounts for Cash and Accounts Receivable.

a. Cash account reconciliation:

| Description | General Ledger | Bank statement | Difference | Adjustment needed |

| Ending balance | $25,000 | $24,700 | $300 | None |

| Outstanding checks | -$250 | – | $250 | Add back |

| Bank errors | – | -$50 | $50 | Deduct error |

Reconciled cash balance: $24,700

Explanation:

The general ledger shows $25,000, but the bank statement shows $24,700. The difference of $300 is due to outstanding checks ($250) not yet cleared by the bank and a bank error of $50 incorrectly deducted.

b. Accounts Receivable reconciliation

| Customer | Ledger Balance | Statement balance | Difference | Adjustment needed |

| Customer A | $5,000 | $5,000 | $0 | None |

| Customer B | $3,000 | $2,800 | $200 | Correct ledger |

| Customer C | $2,500 | $2,500 | $0 | None |

| Unrecorded payment | – | – | $200 | Record payment |

Reconciled accounts receivable balance: $10,300

Explanation:

The total in the ledger initially shows $10,500, while the total from customer statements shows $10,300. The discrepancy with Customer B is due to a payment of $200 received but not recorded in the general ledger.

Step 2: Investigate and resolve differences

- For Cash account: Adjust the general ledger to reflect the bank error and verify when outstanding checks are cleared. Make an adjustment entry to account for the bank error.

- For AR account: Update the ledger to reflect the received payment from Customer B. Record the missing $200 payment to correct the accounts receivable balance.

Ensure all adjustments are reflected in the general ledger. Confirm that reconciled balances match the corrected ledger and supporting documentation.

Step 3: Document the process

Document all findings, adjustments, and verification steps in the reconciliation report.

Note: Have the reconciliation reviewed and approved by the financial controller to ensure accuracy and completeness.

How do you reconcile expenses?

Step 1: Gather financial documents

Start by collecting all relevant financial documents related to expenses. This typically includes:

- Bank statements;

- Credit card statements;

- Receipts;

- Invoices;

- Purchase orders;

- Expense reports.

Step 2: Record all expenses in the accounting system

Ensure that every expense has been properly recorded. This involves:

- Logging each expense from receipts and invoices into the appropriate expense accounts.

- Ensuring that the date, amount, and nature of the expense are accurately recorded.

Step 3: Match recorded expenses

Compare the expenses recorded in your accounting system to those listed on your bank and credit card statements. Check each transaction to ensure it matches in terms of amount, date, and payee.

Step 4: Identify discrepancies

As you compare your recorded expenses with bank statements, identify any discrepancies. Common issues might include:

- Expenses that appear on the bank statement but are not recorded in the accounting system.

- Expenses recorded in the accounting system that don’t match the amounts charged as per bank statements (e.g., due to bank fees or errors).

- Duplicate entries where an expense might have been recorded more than once.

For each discrepancy, investigate the cause and make necessary adjustments to correct errors such as missing entries, incorrect amounts, or duplicate transactions.

Step 6: Reconcile expense reports

If your organization uses expense reports (for employee reimbursements, for example), verify that receipts support each item on the expense report and match the entries in your accounting system. Ensure that expense reports have been approved according to your company’s policy.

After resolving all discrepancies and ensuring all transactions are accurate, make any necessary journal entries to adjust the balances in your expense accounts. This could involve:

- Adding missing expenses.

- Correcting misclassified expenses.

- Removing duplicate transactions.

Step 7: Review and finalize

After making adjustments, review the expenses again to ensure that everything now matches the bank and credit card statements accurately. Once confirmed, finalize the reconciliation for the period.

Set up a regular schedule for reconciling expenses (monthly is typical) to catch and correct errors promptly and maintain accurate financial records.

Bottom line

As you can see, reconciliation determines the accuracy of financial statements. By methodically comparing internal accounting records against external financial statements or other corroborating documents, businesses can maintain consistent and reliable financial reports.

While the task is complicated, it’s possible to establish a simple, straightforward two-click routine for an accurate account reconciliation process within the automation software.

Share your thoughts

If you have insights, experiences, or tips about reconciliation, we’d love to hear from you in the comments below. What methods have you found effective? Have you encountered any specific challenges? Share your thoughts with the community!

FAQ

What is reconciliation, in simple words?

Reconciliation is the process of comparing two sets of records to ensure they match. It’s like checking your homework answers with a solution guide to make sure they’re correct.

Why do you reconcile accounts?

The account reconciliation process keeps your business on track with its finances and different regulatory requirements. You might want to know where your money is going, how much you have left, and what to do with it.

Reconciliations of accounts help you verify that your financial records are accurate. If they’re not, you may need to adjust them. This way, you’ll ensure having the most recent and up-to-date information on your company’s financial status.

What are the golden rules of accounting?

The golden rules of the accounting process are basic principles that guide how financial transactions are recorded:

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit all expenses and losses, and credit all incomes and gains.

What are the basic steps to reconciliation?

The basic steps to reconciliation include:

- Collecting all relevant financial statements and records.

- Comparing the transactions in your records to those on the external statements.

- Finding any differences between the two sets of records.

- Looking into why discrepancies exist and correct them.

- Finalizing the reconciliation process.

How do you solve an out of balance reconciliation?

To solve an out of balance reconciliation:

- Check each transaction for accuracy, ensuring that all entries have been recorded and match the corresponding documents.

- Ensure no transactions were missed or recorded twice.

- Make sure all totals add up and that transactions are recorded under the correct dates.

- Make adjustments for any overlooked fees, incorrect entries, or mathematical errors.

Can you reconcile an expense account?

Yes, you can reconcile an expense account. This involves:

- Ensuring all expenses recorded in the account match the actual money spent, as shown in receipts, invoices, and bank statements.

- Reviewing the classifications and amounts of expenses to ensure they are recorded in the appropriate categories and amounts.

- Finding and correcting any inaccuracies, such as misclassifications, duplicate entries, or missing transactions.

Disclaimer: This article provides a general overview of reconciliation and is intended for informational purposes only. It’s not intended as professional advice. Accounting practices and regulations can vary widely, so it’s important to consult a qualified accounting professional who can provide advice tailored to your specific circumstances and ensure compliance with applicable laws and standards.

Excellent article! Thanks for explaining how to reconcile transactions.

Thank you very much, David! We’re glad you found the article helpful.