Net income (net profit or net earnings) is one of a business’s critical profitability metrics. It reflects how much money you make during a specific period, like a month, quarter, or year. In simple terms, it’s what’s left over for the company after paying all its bills and costs.

Usually, net income appears on the company income statement as its bottom line. However, in some cases, you might want to analyze your company’s profitability change month over month or year over year. At this point, you can calculate your net income from a balance sheet.

Sounds complicated? Let’s still figure out how you can do it.

Key takeaways

- Net income, derived from the income statement, is a critical metric for assessing a company’s profitability, revealing the bottom-line profit or loss generated over a specific period.

- While the income statement and balance sheet are vital financial statements, they offer distinct perspectives on a company’s finances; the income statement shows performance over time, while the balance sheet displays the financial position at a specific moment.

- Retained earnings represent the cumulative net income that a company has kept instead of distributing as dividends to shareholders. This is where you can find net income on a balance sheet.

💡 From static Excel sheets to dynamic insights. Move beyond static balance sheets and embrace the dynamic financial insights made possible with Synder!

What is net income?

For starters, let’s define net income.

So, net income is the money a company has left after subtracting all its expenses from its total revenue.

This metric shows how much profit a company has made. You might want to subtract expenses such as wages, rent, and taxes from the money you earned through sales or services (your revenue) to determine the net income. The resulting net income figure provides a clear picture of your company’s profitability.

However, it’s important to note that this figure doesn’t necessarily reflect the exact amount of cash you have on hand. You might plan to reinvest your profits into the business for growth or allocate them towards paying off debts. So, while net income indicates profitability, it doesn’t always correlate directly with the cash readily available to the company.

Net income or net profit?

You might’ve met the term net profit instead of net income. It makes sense, as both terms mean and express the same thing, so they are used interchangeably in most contexts.

Occasionally, you might encounter a subtle nuance in how these terms are used. For instance, net income might be used more commonly in financial statements and reports. Net profit could be favored in discussions or informal settings.

As mentioned, both terms essentially mean the bottom-line profit a company earns after deducting all expenses from its total revenue, your net earnings. So, in terms of practical use, you can choose any you like better.

The difference between net income and gross income

Often, people may confuse net income and gross income. Yes, both metrics are about your income, but they focus on different things.

Gross income, also known as gross earnings or gross profits, is the money you make from your sales or services minus the direct expenses of producing those goods or services.

Net income is what you have after subtracting all expenses, not just the direct ones like COGS.

In simple terms, it’s like comparing the money you make before paying any bills (gross income) to what you have left after paying all your expenses (net income).

The difference between net income and net operating income

Another popular metric net income can be confused with is net operating income (or just operating income). There’s no wonder, as both terms are so very close, except for a nuance.

To get total net income, you take all the money a company earns and extract all the expenses it incurs.

Operating income is a bit different story, as it zooms in on the profit generated solely from a company’s primary business activities, excluding certain non-operational costs, such as taxes, interest, and others.

So, to get net operating income (or operating income, if you will), you subtract purely operating expenses, such as wages, rent, and utilities, from total revenue.

How to calculate net income: net income formula

Let’s look at how you normally calculate net income .

It means using the income statement (or, if you will, the profit and loss statement). The income statement usually contains information about a company’s revenues and expenses that you need to perform the calculation.

There are several formulas you can utilize and we’ll look at them all.

#1 – Using total revenues and expenses

The most straightforward and simplified way to calculate net income is to subtract all your company’s expenses from the revenue.

The formula, at this point, looks as follows:

Net income = Total revenue – Total expenses

Now, let’s break down the components.

- Total revenue is the money a company earns from its primary business activities. It includes sales of products or services, interest income, and other earnings.

To get the total revenue, you usually go to the top of a company’s income statement, where it’s listed. - Total Expenses are all the costs involved in generating revenue and running the business. Expenses encompass various categories such as cost of goods sold (COGS), operating expenses, interest expenses, and taxes. They include everything from raw materials and labor costs to rent, utilities, and administrative expenses.

You can locate these expenses in the income statement below the revenue section.

#2 – Using gross profit and COGS

Another way to calculate net income provides a different perspective on how net income is derived, focusing on the difference between gross income (or gross profit) from primary business activities and total expenses incurred by the company.

We’ll be using the following formula:

Net income = Gross income − Expenses

Let’s break it down real quick.

- Gross income is derived by subtracting the cost of goods sold (COGS) from total revenue. It represents a company’s profit from its core business activities before deducting operating expenses.

Gross income = Total revenue−Cost of Goods Sold (COGS) - Cost of Goods Sold (COGS) is the direct cost of producing the goods or services a company sells. It encompasses expenses like raw materials, direct labor, and manufacturing overhead.

- Expenses here represent the costs incurred by the company in its day-to-day operations besides COGS. These include operating expenses, interest expenses, and taxes.

You can find all the necessary components for this calculation in the different sections of the income statement.

COGS is found below the revenue section, reflecting direct production costs. Operating expenses, including salaries, rent, utilities, and marketing expenses, are listed further down, detailing day-to-day operational costs. Interest expenses, such as costs of borrowing, typically appear below operating expenses. Taxes are usually listed towards the bottom.

#3 – Conservative net income calculation

As mentioned, net income is connected with other profitability metrics – gross income (gross profit) and operating income. All these finance metrics look at profitability from different angles. However, if we take the most conservative way of calculating net income, we’ll see them all included in the calculation.

Let’s look at how it all builds up.

You remember gross income being what you have after deducting the cost of producing your goods or services. You calculate gross income by subtracting COGS from total revenue.

Gross profit = Revenues – COGS

We also touched upon operating income – the profit you get exclusively from your company’s core operations. Its calculation doesn’t consider outside expenses, like interest, taxes, amortization, and depreciation. Instead, it includes operating expenses, which are the costs of running a business other than production.

Operating income = Revenues – COGS – Operating expenses

Finally, if you introduce non-operating expenses to the calculation, you’ll get to the net income.

Net income = Revenues – COGS – Operating expenses – Non-operating expenses

And that makes the most reliable calculation of profitability, allowing you to better understand what affects it the most.

Let’s quickly break down operating and non-operating expenses and where to find them in your financial statements.

- Operating expenses are the costs directly related to running a company’s core business activities, such as salaries, rent, utilities, and marketing. These expenses are linked to day-to-day operations. Operating expenses appear listed below the gross profit line on the income statement.

- Non-operating expenses are spending from activities outside the company’s primary business operations, like interest on loans, losses from currency exchange, or impairments of assets. They’re usually listed separately after operating expenses on the income statement.

And that’s how you calculate your net income using the income statement. But we want to know whether it’s possible to figure out net income from a balance sheet. So, let’s get to it.

A quick look at the balance sheet and P&L statement

First thing, let’s see how they differ.

You know that the income statement and the balance sheet are major accounting reports that allow you to analyze a company’s financial position. However, they serve distinct purposes and provide different types of information.

Sign up for a 15-day free trial today or spare a spot at our Weekly Public Demo to learn more about how you can always have accurate financial statements automatically generated with Synder.

Financial statements: What can the P&L statement say about your business?

The income, or profit and loss, statement focuses on a company’s performance over a specific period – a quarter, year, etc. This financial statement outlines the company’s revenues and expenses. In other words, the money earned from sales of goods or services and how much it took the company to earn this money. The purpose of the income statement is to analyze a company’s operation and the ability to make a profit.

At this point, the income statement is the primary source of truth about your company’s profitability. So, it’s logical to figure out your net income and other profitability metrics from this report.

Financial statements: What has the balance sheet to say about your business?

Now, the balance sheet is a different story. It’s also a fundamental financial statement, but it looks at your business at a different perspective.

First, it analyzes a company’s finances at a specific moment, showing what it has, in terms of finances, at this point. Typically, it’s the end of a reporting period, the end of a year, for example.

The balance sheet comprises three main sections – assets, liabilities, and equity.

- Assets represent what the company owns or controls, such as cash, inventory, property, and equipment.

- Liabilities are the company’s obligations or debts, including loans, accounts payable, and accrued expenses.

- Equity, or net worth, is the difference between assets and liabilities and represents the company’s ownership interest.

All these strategic components, ideally, should be in balance (hence the name balance sheet), following the fundamental accounting equation:

Assets = Liabilities + Equity.

As the balance sheet overviews a company’s financial resources and obligations, it helps assess its stability and liquidity.

Read more about balance sheet account reconciliation.

As you can see, the income statement and balance sheet analyze a company’s finances but look at those from different angles, focusing on different aspects.

They don’t seem to have much in common. So, is it possible to calculate or find the same metric from such different reports? Apparently, it is.

Determining net income from the balance sheet

Finally, we’re getting there.

Though the income statement and balance sheet, as mentioned, seem not to intersect, there’s one point at which they do. Let’s look at retained earnings.

Understanding retained earnings

Retained earnings on a balance sheet represent the accumulated profits of a company that have not been distributed to shareholders as dividends. These earnings are carried over from previous periods and are reported under shareholders’ equity.

Simply put, retained earnings are like a company’s savings account, where it keeps a portion of its profit earned over time, which it hasn’t paid out to its shareholders as dividends. Instead, the company keeps it for its own use, like investing in the business, paying off debts, or funding future projects.

They measure the company’s financial health and ability to grow over time.

But what does it have to do with net income?

Retained earnings are closely connected with net income, being the portion of the said net income that a company keeps to itself. Let’s look at the retained earnings calculation.

To calculate them, businesses start with the beginning balance of retained earnings, add the net income for the period, and then subtract any dividends paid to shareholders.

Retained earnings = Beginning retained earnings + Net Income – Dividends

This way, businesses get to the ending balance of retained earnings, which is reported on the balance sheet.

How to get to net income from retained earnings?

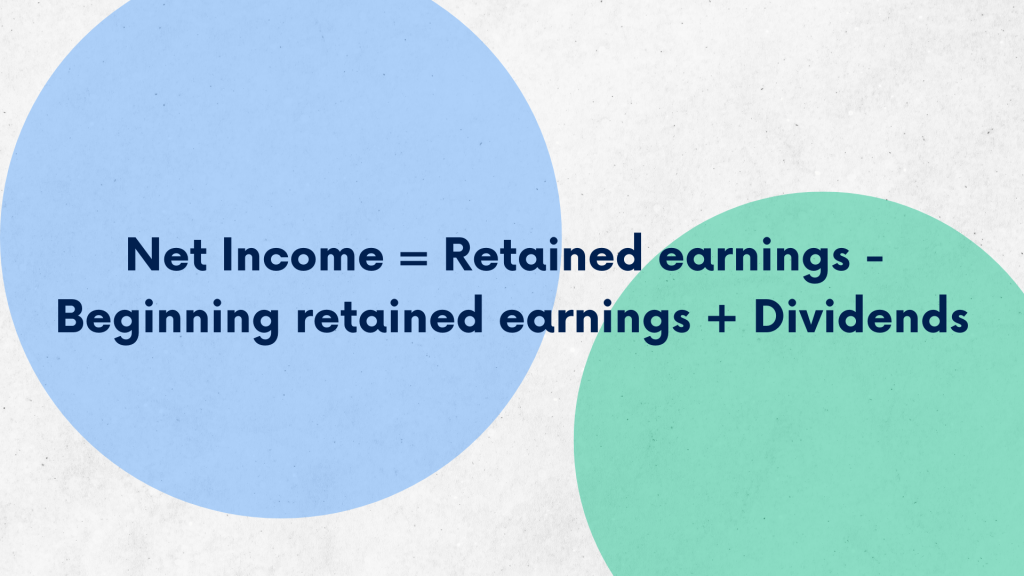

Since we know how retained earnings are calculated, we can determine net income for the period in interest from there.

We have the equation for retained earnings that contains net income. All we need is to isolate it from this equation. This way, we’ll obtain the desired number.

To do so, you can subtract the beginning retained earnings and add dividends to both sides. You are left with:

Net Income = Retained earnings – Beginning retained earnings + Dividends

Let’s break it down.

- Retained earnings are (as we know by now) the cumulative profits that the company has kept over time instead of distributing them to shareholders as dividends. To have the retained earnings value for the calculation period, you look at the shareholders’ equity section of the balance sheet.

- Beginning retained earnings is the balance of retained earnings at the beginning of the period under consideration. It can be found in the shareholders’ equity section of the previous period’s balance sheet.

- Dividends are payments made to shareholders as a distribution of profits. Dividends reduce the amount of retained earnings available to the company. Dividends paid during the period can usually be found in the cash flow statement or disclosed in the notes to the financial statements.

Calculating net income: Bottom line

So, while traditionally, net income (net profit) is calculated from the income statement, you may face scenarios where extracting it from the balance sheet becomes necessary.

One such scenario is when historical data is required to analyze a company’s performance over multiple periods and understand its cumulative profitability. At this point, you might want to retrieve net income from the balance sheet.

In cases where the income statement is unavailable or unreliable, such as during restructuring, acquisitions, or other complex financial transactions, the balance sheet can calculate net income. This strategic reliance on the balance sheet ensures a more accurate representation of a company’s financial health should the income statement be distorted by extraordinary events.

Breaking down retain earnings, net income can be calculated by adding the beginning retained earnings to the dividends and subtracting this sum from the ending retained earnings, providing a straightforward method to ascertain the company’s profitability for the period.

Share your thoughts

Sharing is caring! Share your thoughts and opinions in the comments section below. We’re always up to a good discussion.

Great article, easy to understand. I learned a lot. Thank you Volha.