We all know PayPal—it’s a go-to name in online payments. But are you aware of ALL the costs associated with it?

If you’re here to get a grip on these fees and discover how to run your business smarter, keep reading! Spoiler alert: Getting a clear view of PayPal’s seller fees can completely transform your pricing strategy.

And, let’s face it, getting those fees properly recorded in your books from the get-go is what your future self will really thank you for. As experts in accounting automation, we can confirm: tracking your PayPal fees accurately isn’t a nice-to-have—it’s a must-have for your business’s financial health.

But hey, let’s not jump too far ahead. Let’s get back to the basics and start where it all begins.

Key takeaways:

- PayPal typically charges 1.9% to 3.5% per transaction, plus a fixed fee up to $0.49. Extra fees may apply for currency conversion and international transactions.

- PayPal fees vary based on the country and currency of the payments, so stay informed about the specific rates for your region.

- Implementing accounting automation tools like Synder Sync can save time by automatically tracking and recording transaction data, reducing errors and simplifying reconciliation.

Contents:

- PayPal merchant fees: How much does PayPal charge in fees?

- PayPal fee structure explained: Types of rates and fees PayPal charges its users

- 1. PayPal transaction fees: Fees related to accepting payments from customers

- 2. Resolution & risk-management fees: Fees related to disputes and currency management

- 3. Gateway & processing fees: Fees for payment gateways and payout services

- 4. Other operational fees: Miscellaneous fees for specific situations

- How to keep a record of your PayPal fees with Synder Sync as a seller

PayPal merchant fees: How much does PayPal charge in fees?

PayPal seller fees—yep, we all know they’re a thing. But how much is PayPal really taking?

On average, expect to shell out 1.9% to 3.5% of each transaction, plus a fixed fee ranging from $0.05 to $0.49. Not too bad, right? Well, but here’s where it all just begins. Tack on an extra 1.5% for international transactions plus 3-4% more for currency conversion fees, and suddenly, the costs start to stack up!

In short, when you use PayPal, it eats a bite of every sale in exchange for being your payment processor.

PayPal fee structure explained: Types of rates and fees PayPal charges its users

We could dive into endless examples of PayPal fee calculations, but here’s the deal: the percentage depends on the type of transaction. So first, let’s get familiar with the main PayPal fees and when they apply.

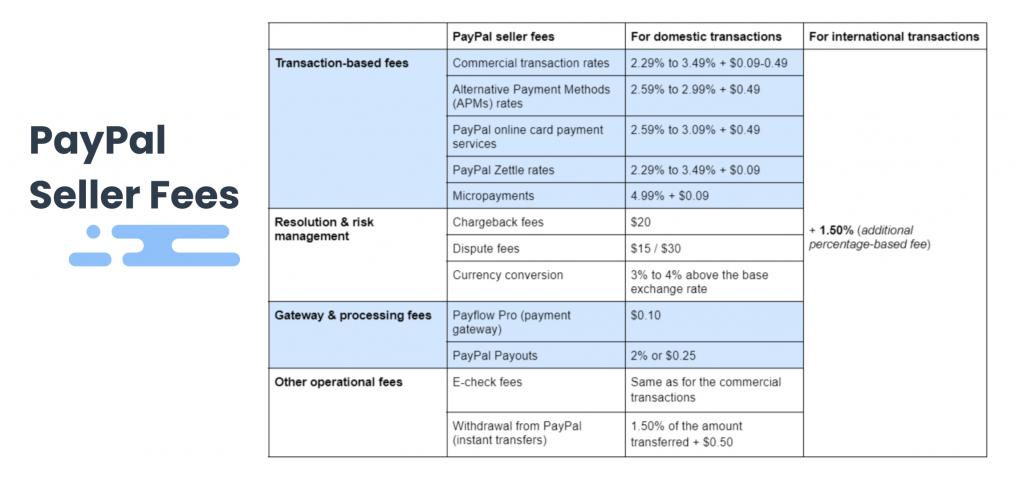

PayPal fees generally fall into four categories:

- Transaction-based fees: Commercial transaction rates, APMs, PayPal online card payment services, PayPal Zettle rates, micropayments;

- Resolution & risk management: Chargeback fees; dispute fees, currency conversion;

- Gateway & processing fees: Payflow Pro, PayPal Payouts;

- Other operational fees: E-check fees, withdrawal from PayPal.

Now, let’s break them down one by one.

Disclaimer: Fixed fees vary by country and are charged in the local currency. For the purpose of this guide, we’ll focus on U.S. merchant fees in USD. For specific rates in your country, check PayPal’s official guide.

1. PayPal transaction fees: Fees related to accepting payments from customers

Commercial transaction rates

Fees for receiving payments for goods and services.

| Payment type: | PayPal fee for domestic transactions: | PayPal fee for international transactions: |

| PayPal checkout | 3.49% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| QR code transactions | 2.29% + $0.09 | + 1.50% (additional percentage-based fee) |

| QR code transactions through third-party integrator | 2.29% + $0.09 | + 1.50% (additional percentage-based fee) |

| Pay with Venmo | 3.49% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| Send/receive money for goods and services | 2.99% | + 1.50% (additional percentage-based fee) |

| Standard debit and credit card payments | 2.99% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| All other commercial transactions | 3.49% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

Fee per transaction

These rates apply to businesses that use PayPal for processing payments online or through invoicing. If your business handles a large volume of transactions, PayPal might offer custom rates. The commercial transaction rate covers basic payment processing and ensures businesses can accept payments from credit/debit cards, PayPal balances, and other supported methods.

Alternative Payment Methods (APMs) rates

Fees for accepting payments through various non-traditional methods.

| Payment type: | PayPal fee for domestic transactions: | PayPal fee for international transactions: |

| APM | 2.59% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| APM through Invoicing | 2.99% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| APM through Pay Links and Buttons | 2.99% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

Fee per transaction

APMs allow customers to pay using their preferred local banking systems or other regional payment services. These methods include options like Apple Pay Web, Google Pay, and some real time bank transfers like BLIK, EPS, iDEAL, and others that vary by region and customer preference.

Note: You must accept the terms of the APM agreement before receiving APM payments.

PayPal online card payment services

Fees for receiving payments made with debit or credit cards through PayPal’s system.

| Payment type: | PayPal fee for domestic transactions: | PayPal fee for international transactions: |

| Advanced credit and debit card payments | 2.59% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| Payments advanced | 2.89% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| Payments Pro | 2.89% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

| Virtual terminal | 3.09% + $0.49 (fixed fee) | + 1.50% (additional percentage-based fee) |

Fee per transaction

This PayPal service lets you accept a wide range of cards, including Visa, Mastercard, Discover, and American Express, either through seamless online checkout or via manual entry through PayPal’s virtual terminal. The fees for this service cover the convenience of processing card transactions directly and securely via PayPal.

PayPal Zettle rates

Rates for in-person payments using PayPal’s point-of-sale system.

| Payment type: | Standard rate: |

| Card present transactions (e.g., chip, tap, swipe) | 2.29% + 0.09$ |

| Manual card entry transactions | 3.49% + 0.09$ |

| QR code transactions | 2.29% + 0.09$ |

Fee per transaction

This PayPal service is designed for businesses that accept payments via card readers or mobile devices in physical locations.

PayPal charges no monthly fees, and businesses only pay for transactions processed via Zettle. These rates apply to a wide range of card types, including Visa, Mastercard, and American Express.

Micropayments

Special rates for receiving smaller transactions.

| PayPal fee for domestic transactions: | PayPal fee for international transactions: |

| 4.99% + $0.09 (fixed fee) | + 1.50% (additional percentage-based fee) |

Fee per transaction

PayPal micropayments are designed for businesses that handle low-value transactions, typically under $10. This specialized fee structure helps merchants avoid losing too much revenue to standard PayPal transaction fees, which can be disproportionately high for small payments.

The higher percentage fee is balanced by a lower fixed fee, making it ideal for sellers of digital goods, such as e-books, downloads, or other small-scale purchases.

| DID YOU KNOW? Tracking PayPal fees doesn’t have to be a headache—automation makes it effortless! With the right accounting automation tool, you can seamlessly sync your PayPal fees into your QuickBooks Online account, ensuring everything is recorded accurately without lifting a finger. |

2. Resolution & risk-management fees: Fees related to disputes and currency management

Chargeback fees

Fees applied when a customer disputes a charge and files a chargeback.

PayPal fee amount: $20.

This fee is on top of the refunded amount unless you’re covered by PayPal’s Chargeback Protection, which waives the fee for eligible merchants (though it comes with a small additional cost per transaction). The chargeback fee makes up for the administrative work involved in processing and resolving these disputes—a standard practice across most payment platforms including PayPal.

And if the PayPal chargeback isn’t processed through a buyer’s PayPal account or guest checkout, PayPal adds a settlement fee to cover the additional handling for credit and debit card disputes.

Dispute fees

Fees for handling non-chargeback disputes through PayPal’s resolution process.

| Standard dispute fee: | High volume dispute fee: |

| $15 | $30 |

Fee per transaction

These expenses kick in when a buyer opens a non-chargeback dispute in PayPal’s Resolution Center, typically due to dissatisfaction with a product or service. The fee covers the administrative work of resolving the dispute and applies no matter which party wins the case.

Merchant fee currency conversion

Costs applied when converting payments into different currencies.

Fee amount: Varies between 3% and 4% above the base exchange rate.

This fee comes into play when converting payments between different currencies, making PayPal international transactions a bit more costly. The exact cost depends on the currency, but be ready that PayPal discloses the exchange rate at the time of the transaction.

3. Gateway & processing fees: Fees for payment gateways and payout services

Payflow Pro (payment gateway)

Monthly and per-transaction fees for using PayPal’s custom payment gateway.

| Payment type: | PayPal fee: |

| Payflow Pro transaction | $0.10 per transaction |

| Payflow Link transaction | $0.10 per transaction |

Fee per transaction

With Payflow Pro, you get the flexibility to design a checkout page that matches your brand’s look and feel. But if you need a faster solution, Payflow Link offers a ready-made template you can embed directly into your site’s checkout page.

Note: Advanced features like fraud protection and recurring billing are available for additional monthly fees.

| UpGuard gave PayPal an “A” rating (820/950) regarding the platform’s security as of 2024. |

PayPal Payouts

Costs for sending mass payments, such as payroll or affiliate payments.

| Payment type: | PayPal fee: |

| U.S. transactions | 2% of total transaction amount (capped at $1) |

| U.S. transactions when using the Payouts API | $0.25 (flat rate) |

| International PayPal payouts | 2% of total transaction amount (capped at $20) |

Fee per transaction

It’s a PayPal service designed for businesses that need to send bulk payments to multiple recipients, such as payroll, affiliate commissions, or rewards either to PayPal accounts or directly to bank accounts. PayPal Payouts integrates seamlessly with your existing systems through the Payouts API, making it a flexible solution for automating your mass payments, especially when selling online.

The fee is based on the PayPal type of payment and the currency received.

4. Other operational fees: Miscellaneous fees for specific situations

E-check fees

Fees applied for payments made via electronic checks, which take longer to process.

Rate: Same as for the commercial transactions.

Maximum fee cap for e-checks: $300.

While the fees are similar to PayPal standard payments, the slower processing time can delay access to funds. International transactions or currency conversions may tack on additional PayPal fees, but once the e-check clears, PayPal deducts its portion, just like with any other transaction.

Withdrawal from PayPal

Costs for withdrawing funds from your PayPal account to your bank.

| Transfer type: | PayPal fee: |

| Instant transfer to cards/bank account | 1.50% of the amount transferred, with a minimum fee of $0.50 per transaction |

| Standard withdrawal (to bank account) | Free (takes 1-3 business days to process) |

While PayPal standard transfers are free of charge but take a little time, instant transfers give you near-immediate access to your business funds—but at a cost. Both options have transfer limits:

Instant transfer for bank: $25,000 per transaction.

Standard and instant transfers for cards:

- Per transactions: $50,000;

- Per day: $100,000;

- Per week: $250,000;

- Per month: $500,000.

Note: Keep in mind, if currency conversion is involved, PayPal may apply an additional merchant fee based on current exchange rates.

How to keep a record of your PayPal fees with Synder Sync as a seller

One of the most common headaches for businesses using PayPal is tracking transaction fees in accounting software like QuickBooks or Xero. PayPal deducts fees automatically, and if these aren’t accounted for properly, your sales won’t match the payouts to your bank. This creates discrepancies and frustration when trying to reconcile your accounts.

Here’s the game-changer: Synder Sync—a verified Intuit partner. No more manual tracking, no more missed expenses. With Synder, all your PayPal fees are automatically categorized and recorded, so your books are always in sync.

Why manual tracking is problematic

Without automation, tracking PayPal fees becomes time-consuming and error-prone. PayPal deducts transaction fees automatically, and these deductions vary based on transaction type (domestic, international, micropayments, etc.).

If you don’t have a system that accurately reflects these deductions in your accounting software, you’ll constantly be dealing with discrepancies.

How Synder Sync solves the problem

We’ve already mentioned the connection between PayPal and accounting systems, but what about the features?

- Automated fee recording: Every PayPal sales transaction is synced, with fees automatically recorded as a separate expense, ensuring no fee is missed.

- Customizable categories: By default, fees are placed under the “Expenses – Commissions and Fees – PayPal fees” category in your QuickBooks chart of accounts. Want to use a different category? No problem—Synder lets you customize it.

- Flawless reconciliation: No more manual data entry! Synder creates both a sales receipt and an expense for the fee, ensuring your gross sales and fees are always in perfect harmony.

→ Learn more about how Synder records fees right into the QuickBooks Online account.

On the whole, Synder tracks all types of PayPal transactions, including PayPal payments, processing fees, expenses, PayPal refunds, and deposits, and reflects them inside QuickBooks, Xero, or Sage Intacct.

Moreover, Synder Sync isn’t limited to PayPal alone. It supports integration with 30+ platforms, including Shopify, eBay, Amazon, and other payment systems like Stripe and Square. This means that as long as a platform or payment provider is connected to your business, Synder tracks every transaction, fee, refund, and deposit. With its robust multi-channel support, Synder Sync ensures you get a complete picture of your business’s financial health in one place.

Automate your PayPal fee tracking with Synder Sync and eliminate the hassle from your bookkeeping! Visit our Weekly Webinar to learn more insights or test the features yourself with a 15-day free trial.

Wrapping up

Now that you’re familiar with the ins and outs of how PayPal charges fees, you’re better equipped to handle the costs of processing payments through the platform. While it’s impossible to avoid dealing with fees entirely, the great news is you can optimize how they’re recorded and tracked. Why spend hours manually tracking every transaction when you can streamline the process?

Synder Sync takes the hassle out of tracking PayPal expenses, ensuring every seller fee is automatically categorized, tracked, and reconciled in your accounting software. Save time, avoid costly errors, and stay focused on what matters most—growing your business.

I purchased 1/4 side of beef from seller and they said I should have sent payment by friends and family option. I told him we are not friends or family so I chose the other option. He refuses to pay the fee that PayPal states seller will be charged. I question how he can get away with refusing to pay the seller’s fee.

Hi Teressa, it’s important to use the “Goods and Services” option for transactions like yours to ensure you’re covered by PayPal’s buyer protection. The seller is expected to cover any fees associated with this service as part of doing business. If a seller insists on using “Friends and Family” to avoid fees, it’s a red flag since this method offers no protection for the buyer in case of disputes or fraud. You did the right thing by prioritizing the security of your transaction.

If you’re unable to resolve the issue with the seller, consider contacting PayPal’s customer service for advice. They can provide guidance on how to handle the situation and explain the protections available to you as a buyer.

If you suspect that the seller’s insistence on using “Friends and Family” is part of a scam or fraudulent activity, you can report this to PayPal. PayPal takes such reports seriously as part of their efforts to maintain a safe and trustworthy platform.