An SMB owner often has to wear many hats. But while it might be fine at the early stage of a business, strategic delegation is crucial when a small business starts to grow. Meanwhile, neglecting financial tasks, like bookkeeping, can lead to consequences. While accounting software helps, a professional bookkeeper adds expertise and a human touch. Moreover, without delegation, owners risk burnout and compromised decisions.

Let’s talk about whether hiring a bookkeeper is worth it today. Putting it short, it is. And below, we’ll find out why.

Understanding bookkeeping and the role of a bookkeeper

Let’s start with breaking down bookkeeping and its place in business management.

What’s bookkeeping?

In a nutshell, bookkeeping is the systematic recording and organization of a business’s financial transactions. It involves keeping track of income, expenses, and other activities to create a clear picture of the company’s financial health. This process forms the foundation for informed decision-making and regulatory compliance.

How does it differ from accountinng?

Bookkeeping and accounting are closely related yet distinct financial functions within a business.

Bookkeeping involves the day-to-day recording of financial transactions, such as sales and expenses, and maintaining organized financial records. As mentioned, it lays the foundation by creating a clear and accurate financial trail.

On the other hand, accounting is a broader process that includes interpreting, analyzing, and summarizing the financial data provided by bookkeepers. Accountants use this information to generate reports, make financial projections, and offer strategic insights. While bookkeeping focuses on the details of transactions, accounting zooms out to provide a comprehensive understanding of a company’s financial health and performance.

Long story short, bookkeeping is the practical recording, and accounting is the analytical interpretation of financial data.

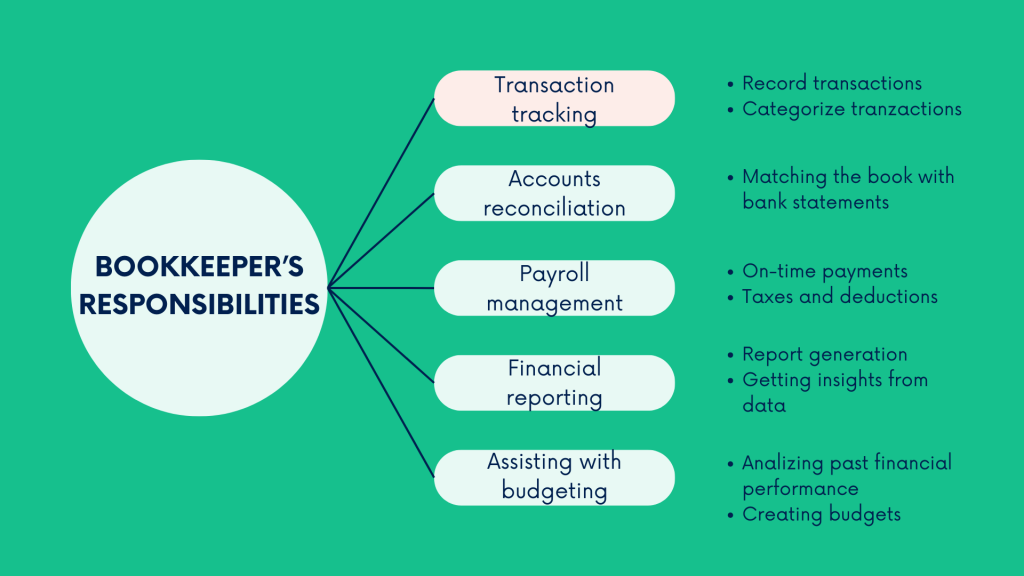

Bookkeeper’s responsibilities

While it may seem that bookkeepers are mostly into accurate data entry, their role is so much more than that.

A bookkeeper takes on various responsibilities critical to a company’s financial well-being. Bookkeepers’ and accountants’ roles often overlap, as bookkeepers participate in financial reporting, analytics, and some financial planning. It’s worth adding that it’s not rare when bookkeepers also help with tax preparation. However, filing taxes is mostly a CPA’s or tax professional’s responsibility.

So, we’ll look at the most typical bookkeeper’s activities.

Transaction tracking

One key bookkeeper’s task is tracking transactions – they keep an eye on the money coming in and going out. They record every financial transaction, from sales and purchases to expenses and receipts. It involves coding each transaction accurately and categorizing them to maintain a clear and organized financial record.

Accounts reconciliation

Another essential duty is reconciling accounts, which means matching the company’s records with bank statements to ensure everything aligns. Bookkeepers should do it regularly to catch discrepancies or errors, keeping the financial picture accurate.

Related:

What Is Reconciliation in Accounting: The Basics of Reconciling Accounts

Payroll management

Managing payroll is another crucial aspect of a bookkeeper’s role. They ensure employees get paid accurately and on time, handling deductions, taxes, and other related matters. This way, they keep the team fairly compensated and help the company comply with payroll regulations.

Related:

Payroll Management for SMBs: A Simple Guide for Improving the Management of Payroll System

Financial report generation

Generating financial reports is where a bookkeeper transforms data into meaningful insights. They compile information to create reports that provide a snapshot of the company’s financial health. These reports are valuable tools for decision-making, helping business owners understand trends, identify areas for improvement, and plan for the future.

Related:

P&L Template: Understanding the Profit and Loss Statement (Plus a Template to Download)

Assisting with budgeting

Collaborating with management, bookkeepers actively help create and maintain financial budgets. They provide valuable insights into past financial performance to assist in setting realistic and achievable financial goals.

Related:

Strategic Financial Planning: Aligning Business Goals With Financial Reality

As you can see, the attention to detail maintained by a bookkeeper is instrumental in preventing costly errors and legal complications. Yes, bookkeepers contribute significantly to the smooth functioning of a business, keeping the financial records accurate and up-to-date. But they also help wiser decision-making based on correct business data.

Is hiring a bookkeeper worth it: why might you want to delegate financial tasks?

We started with business owners wearing multiple hats. One of which is often bookkeeping. There are various reasons behind that (we’ll touch upon those a bit further). Also, with the development of accounting software, automating a big deal of bookkeeping tasks, it might seem that business owners can do the bookkeeping themselves. Should they, though? Is it worth hiring a bookkeeper? Let’s find out.

Why would SMB owners do bookkeepers jobs?

Many SMB owners, especially in the early stages of their ventures, often choose to handle bookkeeping tasks themselves. The reasons behind this decision can vary, but the most typical might include:

- Cost concerns

Hiring a professional bookkeeper is an additional expense, especially for startups or small businesses with limited budgets. Owners may opt to save money by taking on these responsibilities themselves. - Hands-on control

Some entrepreneurs prefer to have direct control over their financial records. Handling bookkeeping allows them to stay intimately involved in the day-to-day financial affairs of the business. - Limited resources

In the early stages of a business, owners may wear multiple hats due to limited resources. Bookkeeping might seem like a task the owner can manage until the business grows and financial complexities increase. - Technology utilization

The availability of user-friendly accounting software has empowered business owners to manage their bookkeeping to a certain extent. Automated tools can streamline some processes, making it more feasible for owners to handle basic financial tasks. - Initial learning curve

Some business owners may choose to do their bookkeeping initially due to the perceived simplicity of the task. Handling accounting software and managing the most basic financial entries might seem achievable without professional assistance.

As you can see, these reasons pretty much make sense. However, it’s important to note that as businesses grow and financial complexities increase, there is often a shift towards outsourcing bookkeeping or hiring dedicated specialists. That’s to say, the decision to handle bookkeeping personally is often temporary, driven by the unique circumstances and needs of the business at its current stage.

Can you find the needed help in accounting software?

Accounting software has undoubtedly changed bookkeeping by automating and streamlining many tasks and simplifying this process for businesses. It helps organize financial data, generate reports, and ensure accuracy. Here’s how accounting software assists with bookkeeping.

- Accounting software automates repetitive tasks such as data entry, categorization, and transaction recording, saving time and reducing errors. It can integrate with various payment processors, marketplaces, and ecommerce platforms to fetch the data directly from there.

- The software provides instant access to real-time financial data, allowing quick decision-making based on up-to-date information.

- Accounting software generates detailed financial reports, including income statements and balance sheets, offering insights into the business’s financial health.

- Invoicing and expense tracking become more straightforward with accounting software, enhancing efficiency in managing cash flow.

- Many accounting software solutions facilitate tax compliance by tracking deductible expenses and generating reports needed for tax filings.

- Integration with bank accounts enables automatic reconciliation, ensuring that financial records match bank statements accurately.

However, the software’s effectiveness depends on proper setup, data input, and interpretation, areas where a bookkeeper plays a crucial role. And that brings us to whether you need a bookkeeper even if you have smart accounting software.

Why you might want to hire a bookkeeper?

So, we get it. With time, business financial management needs outgrow a business owner’s bookkeeping hat (one of the many, remind you). Accounting software might become a solution, with its automation magic and things. But here’s the catch.

While accounting software is helpful, it’s important to note that its effectiveness depends on the person using it. Setting up an accounting system or adjusting it to fit the business’s changing needs requires a deep understanding of financial details. A professional bookkeeper not only knows how to use the software but also understands the specific financial aspects of a business. This human touch is crucial.

Despite knowing their industry well, business owners may lack the detailed financial knowledge that a seasoned professional possesses. And it’s where a professional bookkeeper’s expertise becomes valuable, bringing insight and adaptability beyond what any software can offer.

How to hire a bookkeeper to fit your particular needs?

Delegating bookkeeping to a professional offers several advantages. It frees up your time, ensures accurate financial records, and provides timely insights for informed decision-making. A skilled bookkeeper enhances financial transparency, helping you manage expenses and cash flow and growth plan. Going with a qualified bookkeeper is an investment in your business’s efficiency and success. At this point, you might want to approach the search for a professional wisely.

Below are some recommendations to help you hire the right bookkeeper for your business needs.

#1 – Qualifications and experience

When looking for a bookkeeper, it’s crucial to consider their qualifications and experience. Seek someone with a degree or certification in accounting, finance, or a related field. These credentials show they have a solid understanding of financial principles.

But it’s not just about qualifications – practical experience matters too. A candidate with a proven history of handling finances in your industry brings valuable insights. They understand the specific challenges of your business, like industry regulations and accounting standards, making them better equipped to manage your financial transactions effectively.

In simple terms,your successfull candidates (the ones you’re most likely to hire) should not only know the theory but also have real-world experience applying that knowledge to the specific needs of your business. This combination can help maintain accurate and industry-appropriate financial practices, ultimately contributing to the success of your business.

#2 – Software proficiency (QuickBooks, Xero, Insperity, you name it)

As utilizing accounting software has become common, you might want your bookkeeper to know how to use the accounting software your business uses or plans to use. It’s helpful if they’re familiar with popular tools like QuickBooks, Xero, or others specific to your industry, making it easier for them to fit into your existing financial processes.

Also, consider if the candidates are comfortable using other business tools, not just accounting software. For example, if your small business uses HR, payroll, or other business software, having a bookkeeper who knows how to handle these tools can be useful. This broader knowledge of business tools means the bookkeeper can efficiently manage various financial and administrative tasks, making them a valuable addition to your team.

Attention to detail

A bookkeeper pays close attention to every detail in financial records, ensuring the accuracy necessary for effective financial management services. This skill is crucial because errors or discrepancies can lead to costly mistakes in financial management.

During the hiring process, assess the candidate’s attention to detail by asking about their experience in identifying and correcting financial discrepancies. You might also present a task that requires being careful around financial data to check their precision and accuracy in delivering bookkeeping services.

Communication skills

Effective communication is vital for a bookkeeper providing their service. They should be capable of explaining complex financial information in a digestible way for non-financially savvy stakeholders. During interviews, assess their ability to speak finances without jargon.

Additionally, inquire about their experience communicating with various parties, including team members, ensuring they can articulate financial insights and information clearly. Responsive communication is also crucial, so ask about their approach to timely and effective correspondence in the context of delivering bookkeeping services.

References and reviews

Checking references and reviews helps learn about the bookkeeper’s reliability and work ethic. When requesting references, you might want to ask about their experiences with previous employers or clients, focusing on the bookkeeper’s ability to meet deadlines, handle confidential information, and work collaboratively.

Online reviews or testimonials offer an external perspective, highlighting the bookkeeper’s reputation in the industry. Look for patterns of positive feedback, reliability, and the ability to work effectively with others, ensuring you’re hiring someone with a track record of being a valuable asset to businesses like yours.

Do you need accountant for ecommerce?

It largely depends on the scale and complexity of your operations. For small businesses with straightforward transactions, modern ecommerce accounting software may suffice, automating much of the routine bookkeeping and tax preparation.

However, as your business grows, dealing with complex financial transactions, navigating tax regulations across different jurisdictions, and strategic financial planning become more challenging. In such cases, the expertise of a professional accountant can be invaluable, not just for ensuring compliance and accuracy in your financial reporting, but also for providing strategic advice to help your business thrive and expand.

Bottom line

Well, to hire or not to hire, that’s the question.

The advent of advanced accounting software has undoubtedly streamlined many aspects of bookkeeping for business owners who find themselves taking the bookkeepers’jobs for some reason. However, relying solely on automation may leave critical financial tasks unattended, because a bookkeeper job is more than that. Delegating bookkeeping responsibilities to a professional (be it an on-site or a freelance bookkeeper) not only frees up valuable time for business owners but also brings forth a myriad of benefits.

One of the key advantages is the expertise that a professional bookkeeper brings to the table. Their in-depth knowledge of financial regulations, tax codes, and industry-specific nuances ensures accurate and compliant record-keeping. Moreover, a professional provides that indispensable human touch that software inherently lacks. They can interpret financial data, identify trends, and offer strategic insights contributing to informed decision-making.

While automation handles repetitive tasks efficiently, a skilled bookkeeper ensures the software is set up for the specific business needs. They act as the conductor of a financial orchestra, making various elements work together smoothly and efficiently.

%20(1).png)