Starting a new business brings a multitude of responsibilities, and one of them is tackling the scary task of filing Form 1120, also known as the U.S. Corporate Income Tax Return. This six-page form requires meticulous attention to detail as it involves providing a wealth of financial information, and making a mistake leads to hefty penalties.

Want to know exactly what to expect and what pitfalls to avoid? Dive into our article where we explore Form 1120, its various sections, and key considerations for filing. We’ll help you navigate the complexities of this form, making the process smoother and more understandable.

Disclaimer: Please be aware that this article is meant to offer a broad overview and is not intended to provide tailored tax advice. Tax laws and regulations are intricate and can differ depending on individual situations. If you or your business need guidance with the 1120 tax form or have specific tax-related questions, it’s advisable to seek assistance from a qualified tax professional. It is not recommended to solely rely on the information presented here for tax preparation or decision-making.

What is Form 1120 and what is it used for?

Form 1120, which is known as the U.S. Corporation Income Tax Return, is used to report a corporation’s income, gains, losses, deductions, and credits, and to calculate how much income tax the corporation owes.

This form is quite substantial, spanning six pages and comprising seven sections. In comparison to personal tax forms like the W-2 and 1099, it’s notably longer.

IRS Form 1120 comes in various versions tailored to specific business types. While most corporations complete the standard Form 1120, certain industries have specialized versions of the form. These include:

- Form 1120-C: Designed for cooperatives, including farmers’ cooperatives.

- Form 1120-F: Intended for foreign corporations.

- Form 1120-FSC: Applicable to foreign sales corporations.

- Form 1120-H: Specifically for condominium management, residential real estate management, or timeshare associations opting for HOA treatment.

- Form 1120-L: Tailored for life insurance companies.

- Form 1120-ND: Created for funds established to cover nuclear decommissioning expenses.

- Form 1120-PC: Geared towards property and casualty insurance companies.

- Form 1120-POL: Suited for political organizations.

- Form 1120-REIT: Designed for real estate investment trusts.

- Form 1120-RIC: Intended for regulated investment companies.

- Form 1120-S: For S corporations.

- Form 1120-SF: Meant for settlement funds.

Dive into our article on corporate taxes.

Who must file Form 1120?

When it comes to filing corporate tax returns in the United States, different rules apply to different entities. Here’s a breakdown of who needs to file Form 1120:

1. Domestic corporations

In general, all domestic corporations are required to file an income tax return unless they fall under an exemption in section 501. Most domestic corporations use Form 1120 for this purpose, unless they have specific reasons to use a different special return.

2. Domestic entities choosing corporate taxation

If a domestic entity opts to be classified as an association taxable as a corporation, it should typically use Form 1120 for filing, unless a special return applies to its situation.

3. Limited liability companies (LLCs)

LLCs with multiple owners are usually treated as partnerships for federal income tax purposes and file Form 1065, known as the U.S. Return of Partnership Income. However, if an LLC has only one owner, it is often disregarded as a separate entity, and the owner reports income and deductions on their personal federal income tax return. An LLC can use Form 1120, but only if it has previously filed Form 8832 to elect corporate taxation.

4. Corporations engaged in farming

Corporations involved in farming activities, excluding subchapter T cooperatives, should utilize Form 1120 to report their income or losses arising from these agricultural pursuits.

5. Ownership interest in FASITs

Special rules apply for FASITs. For Financial Asset Securitization Investment Trusts (FASITs) that existed on or before October 22, 2004, and specifically concerning regular interests issued before that date, special rules apply. Corporations holding an ownership interest in such FASITs covered by these rules must report all income, gains, deductions, losses, and credits on their income tax return, with exceptions noted in section 860H.

6. Foreign-owned domestic disregarded entities (DEs)

DEs wholly owned by foreign persons, including foreign corporations, are considered separate domestic corporations for certain requirements under section 6038A, applicable to 25% foreign-owned domestic corporations. Although DEs are not obliged to file a U.S. income tax return, those subject to these rules must submit a pro forma Form 1120 with Form 5472 attached by the return’s due date, including extensions.

7. Certified qualified opportunity funds (QOFs)

To qualify as a certified QOF, a corporation must file Form 1120 and attach Form 8996, even if it had no income or expenses to report.

8. Qualified opportunity investments

Corporations that held qualified investments in a QOF during the year must include Form 8997 with their return.

Understanding these filing requirements is crucial for corporations to meet their tax obligations effectively.

Is 1120 a form for S Corp or C Corp?

Both C and S corporations must file a federal income tax return. C corporations use Form 1120 to calculate their taxes due. S corporations use Form 1120S as an information return. S corporations must also prepare a form 10 K-1 for each shareholder to include with their individual returns.

Is Form 1120 for LLC?

As stated by the IRS, if your LLC is set up as a corporation, it has to follow the regular corporate tax rules, and you’ll need to file a Form 1120, which is called the U.S. Corporation Income Tax Return. When you file a 1120, it’s essentially the income tax return for C corporations, and there are no pass-through items that go onto an individual 1040 or 1040-SR from a C corporation return.

Now, if your LLC qualifies and has elected to be treated as an S Corporation, the tax rules change. In this case, you should file a Form 1120-S, known as the U.S. Income Tax Return for an S Corporation. S corporation laws then apply to your LLC. Each owner or shareholder reports their proportionate share of the corporate income, credits, and deductions on a document called Schedule K-1, which is part of Form 1120-S.

Do nonprofits file Form 1120?

If your nonprofit’s tax-exempt status has been revoked, you may be required to file Form 1120. This may happen if you fail to file IRS Form 990s for three consecutive years. This is the way many organizations continue to automatically lose their tax-exempt status.

Corporation Income Tax Return: How to complete and file Form 1120

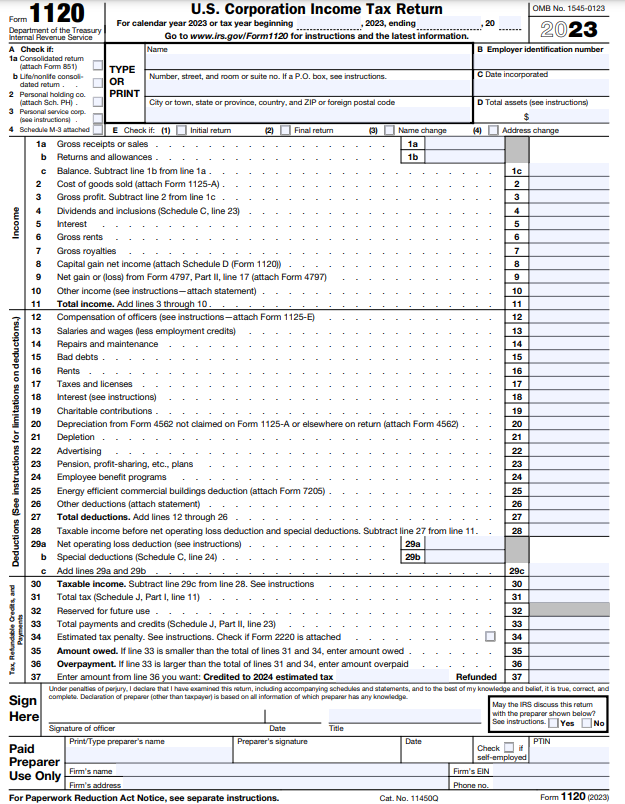

Form 1120 is a document that spans six pages. The initial page encompasses four primary sections, including essential corporate details, income, deductions, tax, refundable credits, and payments.

The subsequent five pages delve into more intricate information, covering aspects such as dividends, specific deductions, balance sheets, and various accounting details.

Before submitting Form 1120, remember to sign and date the bottom of the first page to ensure its completeness.

Now you’re ready to explore the steps you’ll need to complete to fill out Form 1120 correctly.

Step 1. Gather the necessary information to complete your tax return

Here’s a rundown of the crucial details you should gather:

- Your Employer Identification Number (EIN): Your corporation’s unique identifier recognized by the IRS.

- Incorporation date: The date on which your corporation was officially incorporated.

- Total assets: An inventory of all assets held by your corporation, including both tangible and intangible assets.

- Total income: The overall income generated by your corporation, encompassing all revenue sources.

- Gross receipts: The total revenue before any deductions or expenses are considered.

- Cost of Goods Sold (COGS): The expenses directly associated with the production of goods or services.

- Dividends earned: Income received from investments and holdings in other entities.

- Interest earned: Income generated from interest-bearing accounts or investments.

- Royalties earned: Income obtained from the use of intellectual property or licensing agreements.

- Capital gains: Profits realized from the sale of assets or investments.

- Tax deductions: An array of deductions that can vary based on your company’s specific circumstances. These deductions can significantly impact your tax liability.

- Business tax credits: Any tax credits your corporation intends to apply for, which can help offset tax liabilities and lower your overall tax burden.

Gathering the necessary financial information automatically

Don’t have all the necessary information? It’s time to start using accounting automation! With Synder, you’ll have all the necessary accounting records tax season-ready at all times. All you need to do is connect all the channels in use and your accounting system to Synder. Once you do that, the tool will start recording transaction info in real time and allow you to import years of historical data to your books for hassle-free reconciliation. No duplicates, no mess. With the help of Synder, you’ll have accurate info on total income, gross receipts, COGS and tax deductions (in your accounting software), which will greatly streamline filling out your Form 1120.

Ready to experience the incredible impact Synder can have on your accounting processes? You can get started by signing up for our all-inclusive 15-day free trial to see the benefits firsthand. If you’d like a more personal touch, you’re welcome to reserve a spot at our Weekly Product Demo. This way, you can witness the magic of smart accounting software in action and explore how it can make your life easier.

Step 2. Fill out Page 1 of Form 1120

Use the information you gathered to fill out the first page of Form 1120.

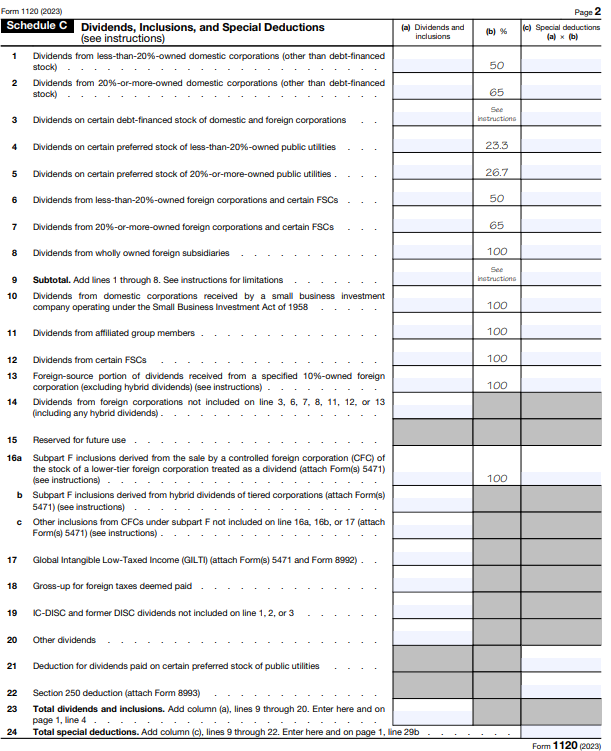

Step 3. Fill out Page 2 Schedule C of Form 1120: Dividends, Inclusions, and Special Deductions

In Schedule C of Form 1120, C corporations have to report the dividends they’ve received, whether from foreign or domestic subsidiaries. This includes income from things like debt-financed stock and public utility stock, as well as earnings from affiliates and other entities. It’s also where they report any less common types of income.

To sum it up, all the dividends and similar income go on Line 23, and any special deductions related to this income are listed on Line 24. Similar to individuals, C corporations can invest in other companies’ stocks, and they need to report the dividend income they receive from these investments every year through Schedule C.

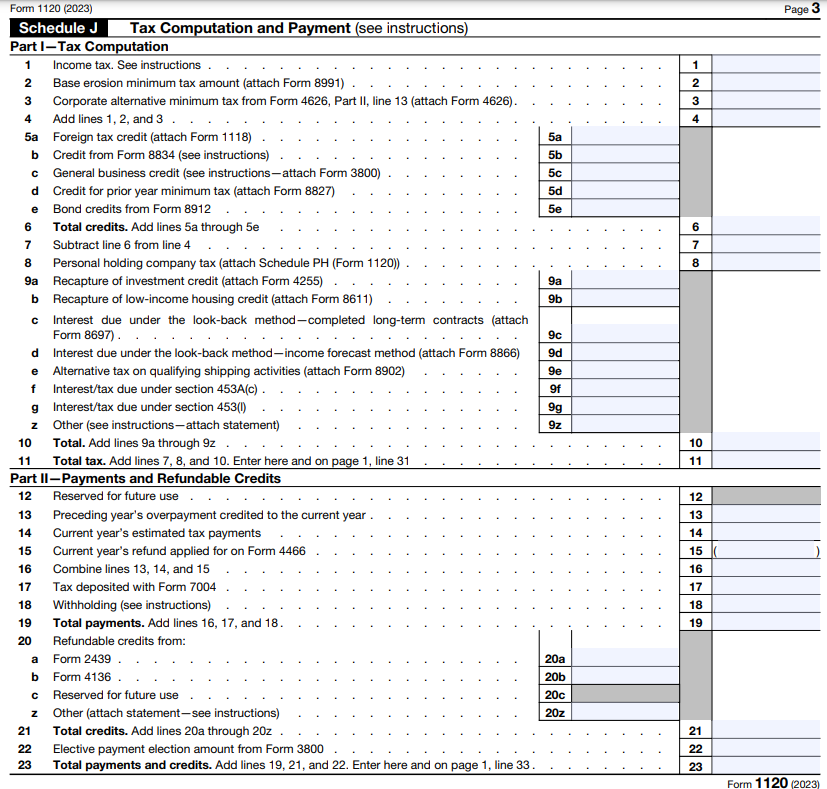

Step 4. Fill out Page 3 Schedule J: Tax Computation and Payment

Schedule J calculates your tax liabilities by considering your business tax credits and estimated tax payments. Tax credits directly reduce your tax liability dollar-for-dollar.

Part I: Tax Computation

- Check if your corporation is part of a controlled group and include Schedule O if applicable.

- Calculate the income tax due and add any base erosion minimum tax from Form 8991.

- Include various tax credits like foreign tax credits from Form 1118, credits from Form 8834, general business credits from Form 3800, and others.

- Subtract these credits from the total tax.

Part II: Payments and Refundable Credits

- Record any overpayment carried over from the previous year, estimated tax payments made during the current year, and refunds applied for using Form 4466.

- Combine these figures with any tax deposited with Form 7004.

- Report withholdings and tally up all payments, including refundable credits from forms such as Form 2439 and Form 4136, to determine the total payments and credits for the year.

- Leave the line “Reserved for future use” empty for any updates or tax code changes.

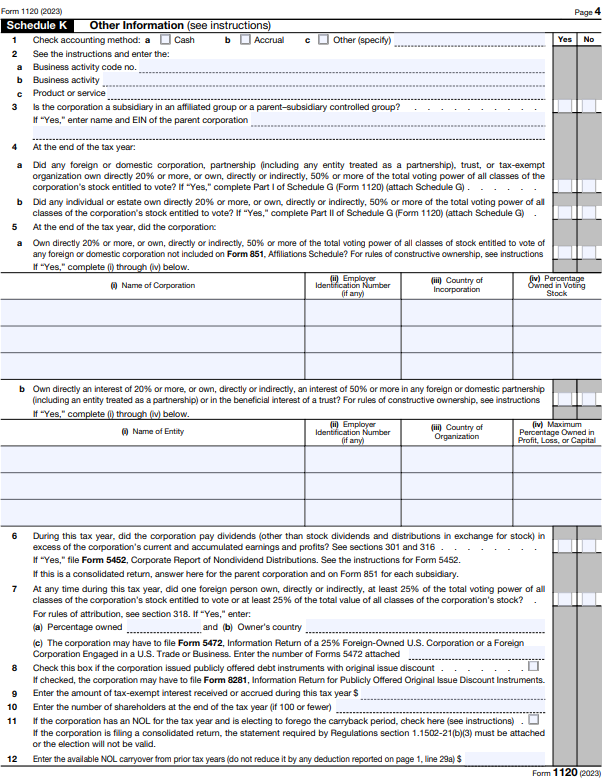

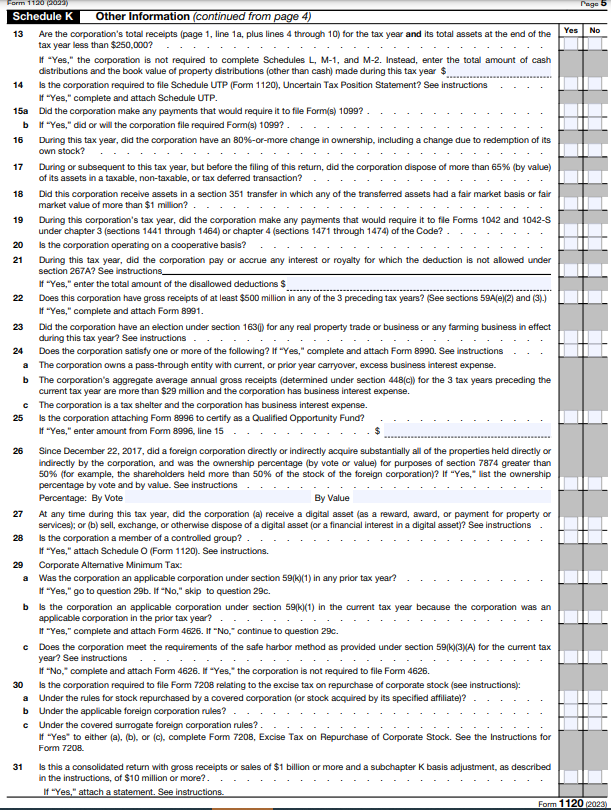

Step 5. Fill out Pages 4 & 5 Schedule K: Other Information

In Schedule K, you’ll be asked to provide more information about the owners and their investments in other companies. Complete this section if your corporation’s total income and end-of-year assets go beyond $250,000. It’s important to double-check that the information you provide matches the official records of your corporation.

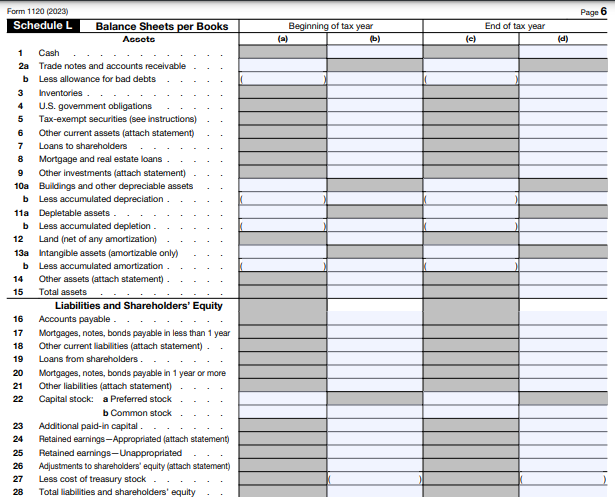

Step 6. Fill out Page 6 Schedule L: Balance Sheets per Books

Schedule L is where you’ll re-create your company’s year-end balance sheet based on your accounting records. You can simply access your accounting software, such as Synder, to obtain the necessary information to complete this section.

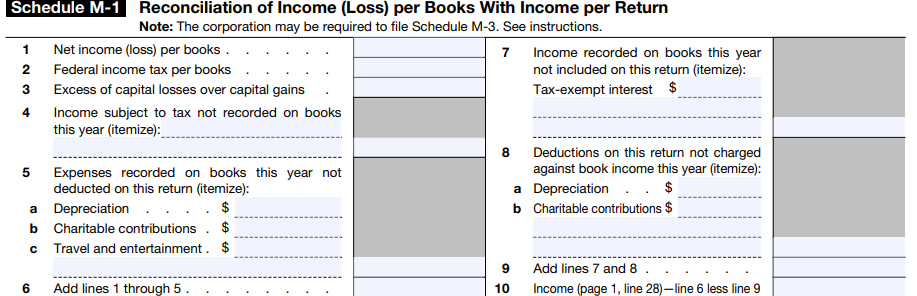

Step 7. Fill out Page 6 Schedule M-1: Reconciliation of Income (Loss) per Books With Income per Return

Schedule M-1 serves as a tool to align your financial records with your tax return. Essentially, it’s a way to make sure the net income in your accounting books matches the income reported on your tax return. This involves accounting for non-tax-related items by either adding or subtracting them. To perform a book-to-tax reconciliation successfully, you’ll need to identify the income and deduction items that vary between your financial records and the tax return.

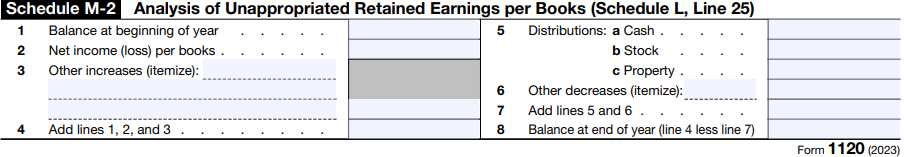

Step 8. Fill out Page 6 Schedule M-2: Analysis of Unappropriated Retained Earnings per Books (Schedule L, Line 25)

Schedule M-2 focuses on the retained earnings that haven’t been designated for any specific use in your company’s financial records. This information is significant for businesses because it indicates the amount of money available that hasn’t been earmarked for any particular purpose.

Check out our article on payroll forms.

Who needs to sign Form 1120?

To make sure the tax return is properly handled, it should be signed and dated by someone authorized within the corporation. This includes the president, vice president, treasurer, assistant treasurer, chief accounting officer, or any other corporate officer with authority.

If the return is being filed by a receiver, trustee, or assignee on behalf of the corporation, the fiduciary (receiver, trustee, or assignee) must sign instead of a corporate officer. This requires including a court order or specific instructions that grant the fiduciary the authority to sign on behalf of the corporation, especially in bankruptcy situations.

If you delegate the preparation of your taxes, tax preparers need to sign the return in the designated preparer’s signature area, and include their Preparer Tax Identification Number (PTIN) along with their signature. It’s important to provide a copy of the completed return to the taxpayer.

In addition, if the corporation wants to grant the IRS permission to discuss its 2022 tax return with the tax preparer, they should check the “Yes” box in the signature area. This authorization applies specifically to the individual preparer, allowing them to assist with tasks such as providing missing information, checking on the return’s processing status, and responding to certain IRS notices on behalf of the corporation.

When is Form 1120 due?

Form 1120 must be submitted by April 15, following the end of tax year. Failure to meet this deadline, even with extensions, may result in penalties and accrued interest.

How to file Form 1120?

When it comes to filing Form 1120, you have two options: you can either file it online or send it in by mail. While both methods are available, usually businesses choose going the online route. It’s not only faster and more convenient but also reduces the paperwork involved. Additionally, it’s worth noting that if your corporation reports assets of $10 million or more, online filing is mandatory.

If you choose to mail your Form 1120, check the mailing address on the IRS website.

Need info on other forms? Check out our article on Form 1096.

Conclusion

Form 1120 is a cornerstone of corporate tax compliance in the United States. It’s essential for corporations to understand not only their obligation to file but also how to accurately complete the form to meet their tax obligations effectively.

Managing your taxes can become an extra weight on your day-to-day business operations. Missing even a single form submission can result in IRS penalties. Moreover, dedicating your current resources to handle this task can disrupt your productivity and efficiency, especially during the busy tax season. That’s why we recommend using automated accounting software, such as Synder, and consulting with a tax professional.

What’s your experience with completing and filing Form 1120? Share in the comments below!

.png)