BAS statements hold significant importance for Australian businesses, but the process of completing them can often evoke anxiety, particularly for those who haven’t allocated sufficient funds. In this guide, we delve into BAS (Business Activity Statement) and GST (Goods and Services Tax) to simplify these essential aspects for Australian business owners. Join us as we explore how to complete and lodge BAS, and what you should be mindful of as you approach the payment phase.

Disclaimer: Please note that this article is not intended to offer accounting, tax, business, or legal advice. It is presented solely for informational purposes. Prior to making any decisions or taking any actions related to the content discussed, we strongly recommend seeking guidance from your own professional advisors who can provide advice tailored to your specific business needs.

What is a BAS statement?

The acronym BAS stands for Business Activity Statement, a crucial document for Australian businesses registered for Goods and Services Tax (GST). Businesses must submit BAS statements either monthly, quarterly, or annually, depending on their size and turnover. The primary purpose of a BAS statement is to report the money collected and paid out by the business to the government.

What’s GST?

GST (Goods and Services Tax) is a value-added tax that applies to most goods and services sold for consumption within a country on a domestic scale. Consumers are the ultimate payers of GST, but it is the responsibility of businesses selling these goods and services to remit the tax to the government. GST is included in the final price of goods purchased by consumers and is paid at the point of sale. It operates as an indirect consumption tax and is levied on specific goods and services.

One of the key purposes of the GST system is to simplify taxation by replacing various state-based consumption taxes, such as sales tax, service tax, and excise duty tax, with a single tax known collectively as GST. The federal government collects GST and subsequently distributes the revenue to the respective states. In essence, GST serves as a mechanism for generating government revenue while streamlining the tax collection process.

What kind of payments does BAS cover?

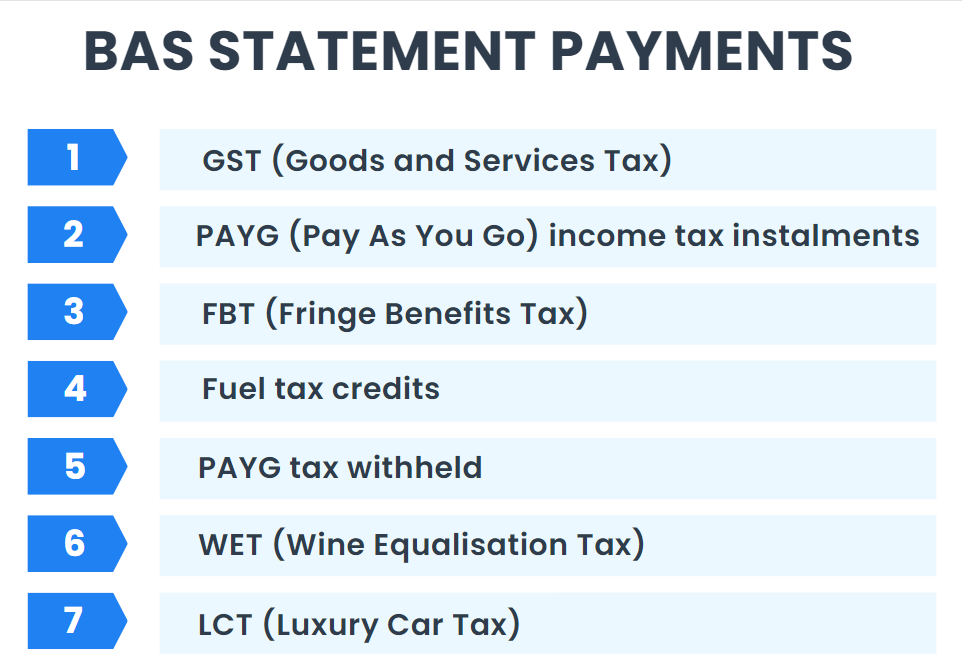

BAS statements encompass a wide range of payments, including but not limited to:

- GST (Goods and Services Tax)

- PAYG (Pay As You Go) income tax instalments

- FBT (Fringe Benefits Tax)

- Fuel tax credits

- PAYG tax withheld

- WET (Wine Equalisation Tax)

- LCT (Luxury Car Tax)

What is the purpose of a BAS statement?

The Australian Taxation Office (ATO) uses the information provided in BAS statements to calculate GST refunds or liabilities for the business. Additionally, BAS data is used for determining business income tax (for those in the pay-as-you-go system), employee income tax, fringe benefits tax, luxury car tax, wine equalisation tax, and fuel tax credits. Accurate and timely submission of BAS statements is essential for businesses to meet their tax obligations in Australia.

What information should be included in BAS?

When it’s time to file your BAS for your business, it’s crucial to have accurate and comprehensive financial records readily accessible. The Australian Tax Office (ATO) strongly advises maintaining detailed records encompassing sales, fees, expenses, wages, and other business-related expenditures. Additionally, it’s prudent to retain other pertinent records such as logbooks and stocktake documentation.

Many businesses choose to delegate their bookkeeping responsibilities to professionals because of the intricate and time-consuming nature of record-keeping. Outsourcing bookkeeping is a prevalent strategy among small and medium-sized enterprises seeking efficient scalability.

For your BAS submission, you’ll need information pertaining to the following elements:

- Total sales for the reporting period

- GST collected on those sales

- GST paid on business-related expenses

- Wages disbursed to employees

- Income tax withheld from employee wages (PAYG Withholding)

If your business participates in the PAYG Instalment system, some of this information might already be pre-populated.

It’s important to recognize that you can only claim GST credits for the portion of your purchases directly related to your business activities. Private expenses, such as entertainment or food, are not eligible for GST credits. When an item serves both business and personal purposes, you are only permitted to claim the portion associated with your business operations.

While you aren’t required to submit tax invoices when lodging your BAS, it’s essential to have them readily available, as the ATO may request them for verification purposes. Additionally, since your BAS may serve other tax-related functions, you might need to provide supplementary information regarding your business, its income, and your workforce during the reporting process.

Making sure you’ve got accurate information for your BAS

Want to streamline your tax filing process and ensure the accuracy of your BAS? Synder offers a seamless solution!

Connect all your sales channels and platforms to your accounting system using Synder, ensuring that crucial information is constantly at your fingertips. When you integrate your platforms, Synder Sync will automatically synchronize data with your accounting, providing you with a comprehensive overview of your total sales, GST collected, fees, and more whenever you need it. Say goodbye to manual data entry and embrace the benefits of intelligent automation!

Why not give Synder a try yourself? Sign up for a 15-day free trial and see how the tool works firsthand. Or, if you prefer, join our Weekly Public Demo and dive into Synder’s capabilities with the guidance of an expert. It’s all about making your work smoother and more efficient!

How to complete BAS: BAS tips you need

Tip 1. Use whole dollar amounts

Ensure that all amounts entered on the BAS are in whole dollars. Do not round up to the next dollar; simply omit any cents.

Tip 2. Single entry

Each invoice or transaction should be entered only once to maintain accuracy and prevent duplicate entries.

Tip 3. Cash accounting

For businesses employing cash accounting for GST, it’s essential to ensure that both sales and expenses are recorded in the same reporting period as the payment was received. This aligns with the principles of cash accounting.

Read about the differences between accrual and cash accounting.

Tip 4. Exclude irrelevant fields

The BAS form may have multiple fields, but you should only fill out those that are relevant to your business. If a particular field doesn’t apply to you, enter zero in that field to indicate that you have nothing to report.

Tip 5. Check calculations

Meticulous attention to detail is essential when manually completing the BAS. Careful calculation and double-checking of figures help minimize errors, which is of utmost importance in tax reporting.

Tip 6. Correct mistakes

Understand that you can go back and correct any mistakes made on previous BAS submissions. It’s important to rectify errors promptly.

Tip 7. Consider getting professional help

To simplify the BAS completion process and ensure compliance with tax regulations, businesses may consider using accounting software. Alternatively, seeking assistance from experienced professionals, such as tax agents or BAS agents, can provide valuable expertise in navigating the complexities of tax reporting. These professionals can offer guidance and support to make the process more manageable.

Want to have a bigger picture? Learn how to file taxes for ecommerce.

How to lodge your BAS statement

The method you choose to lodge your BAS statement can depend on your business structure, preferences, and the tools or software you have in place. Let’s have a look at the methods.

Method 1. Lodge online

When lodging online, you’ve got two options:

- You can complete and submit your BAS statement online through the Australian Taxation Office’s Business Portal. This method is suitable for businesses of various sizes.

- If you are a sole trader, you have the option to lodge your BAS through myGov, which is a secure online platform provided by the Australian government.

Method 2. Lodge through software

If you use accounting, payroll, or financial software that integrates with Standard Business Reporting (SBR)-enabled software (like QuickBooks or Xero), you can file your BAS directly from that software portal. This streamlined approach can save time and reduce the chances of errors.

Make sure your QuickBooks or Xero has all the necessary information.

Not sure what accounting software to choose? We’ve got you covered – read our comparison of QuickBooks and Xero.

Method 3. Lodge with the help of tax or BAS agent

If you have a registered tax or BAS agent, they can handle the lodgment and payment process on your behalf. Tax and BAS agents, typically accountants or bookkeepers, can efficiently manage your BAS requirements, ensuring accuracy and compliance with tax regulations.

Method 4. Lodge by mail

While less efficient and generally subject to earlier due dates, you can request a paper BAS and a pre-addressed envelope. However, this method may require you to pay the ATO earlier, affecting your cash flow cycle.

Method 5. Lodge a ‘nil BAS’

If you have no transactions or activities to report for a specific BAS reporting period, you can still fulfill your reporting obligations by lodging a ‘nil BAS.’ This can be done over the phone or online, indicating that there are no taxable transactions to report.

Learn more about lodging your BAS.

What are the due dates for BAS reporting?

Here are the BAS (Business Activity Statement) due dates for reporting based on different reporting cycles:

Monthly reporting

Monthly BAS statements are due on the 21st day of the month following the end of the taxable period. For example, if you have a July monthly BAS, it is due on 21 August.

Note: If your GST turnover exceeds $20 million annually, you are typically required to lodge and pay GST on a monthly basis. Monthly reporting is the more frequent reporting cycle and is mandated for businesses with higher annual turnovers to ensure more regular and detailed reporting of their GST activities.

Quarterly reporting

Quarterly BAS statements have the following due dates for each quarter:

- For the quarter of July, August, and September, the due date is 28 October.

- For the quarter of October, November, and December, the due date is 28 February of the following year.

- For the quarter of January, February, and March, the due date is 28 April.

- For the quarter of April, May, and June, the due date is 28 July.

Note: To be eligible for quarterly reporting for your BAS, your GST turnover should be less than $20 million annually. If your annual turnover is at or below this threshold, you can opt for the less frequent quarterly reporting cycle, which provides businesses with a bit more time between reporting periods compared to monthly reporting.

Annual reporting

The due date for lodging and paying your annual GST return is 31 October. However, if you are not required to lodge a tax return, the due date is 28 February following the annual tax period.

Note: To be eligible for annual reporting for your BAS, your GST turnover should be under $75,000 per year for standard businesses or $150,000 per year for not-for-profit organizations. If your turnover exceeds these thresholds, you would typically be required to report and pay GST on a monthly or quarterly basis, depending on the size of your turnover. Annual reporting provides a simplified reporting option for businesses with lower turnover levels.

It’s important to adhere to these due dates to avoid penalties and ensure compliance with your tax reporting obligations. Additionally, different due dates may apply if you use a registered tax or BAS agent for assistance.

When do you pay GST?

If your BAS indicates that you have a GST payment owing, it’s typically expected that you make the payment on the same day. You have the option to make this payment online, via mail, or in person at an Australia Post office.

However, if you find that you can’t afford to pay the GST amount owed, there may still be a way to avoid fines. You can do this by ensuring you lodge your BAS on time and then collaborating with the Australian Taxation Office (ATO) to establish a suitable payment plan.

Can you get a GST refund?

When you’ve paid more GST than you’ve collected, the Australian Taxation Office (ATO) will owe you a refund. This refund will be directly deposited into your designated bank account.

BAS statement: Conclusion

Filling out a BAS might seem overwhelming, but with proper preparation, it can be manageable. Keeping your records updated and reconciled, as well as maintaining sufficient funds in your business account, and sticking to due dates are crucial steps to simplify the process. Maintaining a comprehensive record of your income and expenses will also provide a clear financial overview, preventing unexpected issues when it’s time to submit your BAS.

%20(1).png)