Ever thought about the dollars behind the scenes that keep our schools running and roads paved? Welcome to the world of corporate taxes, a financial puzzle that shapes the way businesses operate and impacts our daily lives.

In this guide, we’re taking a quick look at corporate taxation, explaining why companies pay taxes on their profits and why it’s essential for the functioning of society.

Let’s find out!

Key takeaways

- Corporate taxes, derived from a company’s profits, are used for funding public services and infrastructure, thereby supporting societal functions.

- Businesses benefit from corporate tax deductions, which can enhance employee welfare, provide financial resilience, and support strategic reinvestments, though they also face complexities like double taxation and compliance challenges.

- Corporate taxes significantly influence a country’s GDP by contributing to government revenue, supporting economic growth through public investments, and reflecting the overall health and productivity of the business sector.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

Grasping corporate tax fundamentals

Let’s talk about corporate taxes—basically, the money businesses kick back to the government from their profits. But it’s not as simple as it sounds. So, let’s break it down.

What’s a corporation, by the way?

Before we get to corporate taxes, let’s define what to consider a corporation (because the tax in question is connected to this type of entity).

A corporation is a legal entity established by a group of individuals for the purpose of conducting business. Recognized by the government as an independent entity, a corporation possesses distinct legal attributes, enabling it to engage in contractual agreements, own assets, and assume legal responsibilities in its own right.

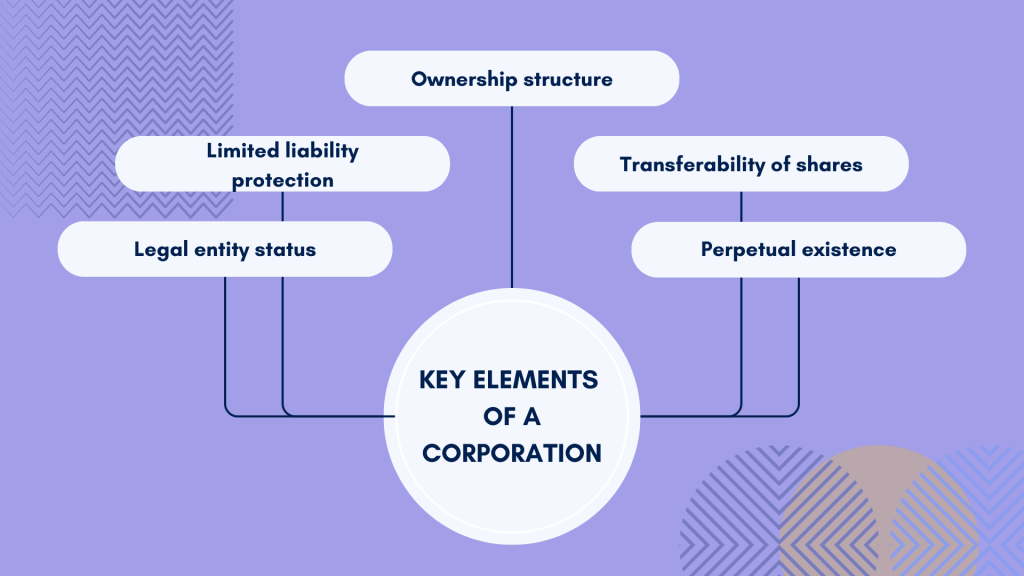

Let’s look at the key elements of a corporation.

#1 – Legal entity status

Acknowledged as a legal entity separate from its owners, a corporation is vested with the capacity to execute legal obligations, acquire property, and participate in legal proceedings independently.

#2 – Limited liability protection

One of the principal advantages of a corporation is the principle of limited liability. Shareholders, the proprietors of the corporation, are typically shielded from personal liability for the company’s debts, restricted to their financial investments in the corporation.

#3 – Ownership structure

Shareholders, akin to stakeholders in the corporation, collectively participate in decision-making processes through the election of a board of directors. This governance structure ensures effective management and strategic decision-making.

#4 – Transferability of shares

Shares, representing ownership interests, are often transferable. This facilitates the buying and selling of ownership stakes without unduly impacting the ongoing operations of the corporation.

You might also consider reading about equity financing.

#5 – Perpetual existence

A distinctive characteristic of corporations is their perpetual existence, irrespective of changes in ownership or leadership. Unlike partnerships or sole proprietorships, corporations can endure transitions seamlessly.

So, a corporation is basically a business entity with legal powers, making teamwork smoother and keeping things in order.

Corporate tax definition

Back to the corporate tax.

At its core, it’s the government’s way of getting a slice of the financial pie from businesses. When a company turns a profit, a portion of that moolah is set aside to be handed over to the tax collector. It’s like a contribution businesses make for the privilege of operating in a country’s economic playground.

Simply put, corporate tax is a percentage of a company’s profits that goes to the government. This way, businesses play a part in funding public services, infrastructure, and all the things that keep a nation ticking. So, when we talk about corporate tax, we’re basically discussing the government’s cut from the profits businesses make.

What does the government use corporate taxes for?

Corporate tax funds form a critical component of government revenue, contributing to a spectrum of essential public initiatives. Here’s a practical breakdown of how these funds are typically allocated:

- Public services support

A substantial portion of corporate tax revenue goes towards underpinning crucial public services, including healthcare, education, and law enforcement. This ensures citizens have access to essential services that enhance their overall well-being. - Infrastructure investment

Governments leverage corporate tax revenue to finance infrastructure projects, such as building and maintaining roads, bridges, and public transportation systems. These investments contribute to economic development and improved quality of life. - Education and research funding

Corporate tax funds are often channeled into education and research initiatives. This encompasses support for schools, universities, and research institutions, fostering innovation and skill development within the workforce. - Social welfare programs

Addressing the needs of vulnerable populations, corporate tax revenue supports social welfare programs. This may include provisions for unemployment benefits, housing assistance, and food aid. - National defense and security

A portion of corporate tax revenue is allocated to bolster national defense capabilities, ensuring security and readiness in the face of challenges or emergencies. - Debt management

Governments utilize corporate tax funds to manage debts, covering interest payments and principal amounts on loans or bonds issued to finance previous expenditures. - Economic stimulus measures

During economic downturns, governments deploy corporate tax revenue strategically. This can involve economic stimulus measures, including tax incentives, subsidies, and financial support to businesses, fostering economic activity. - Environmental and regulatory initiatives

Corporate tax contributions play a role in supporting environmental and regulatory endeavors. This may involve investments in sustainable practices, environmental conservation, and the enforcement of corporate responsibility regulations.

Related:

Why Did I Get a IRS Treas 310 Tax Ref: Tax Refund Unveiled

Payroll Taxes for an Employer: How Is Payroll Tax Calculated?

How do you calculate corporate tax?

Calculating corporate taxes requires several steps and might be challenging for a non-accounting-savvy one. While it’s usually an accountant’s piece of bread, a buisness owner might want to at least understand where the numbers come from and thus, better understand their finances. So let’s break down the corporate tax calculation process real quick.

- Determine taxable income

Usually, you start with the company’s total revenue and subtract the cost of goods sold (COGS), operating expenses, and other allowable deductions. This gives you the taxable income, which is the basis for calculating corporate tax. - Apply the corporate tax rate

Identify the applicable corporate tax rate. Corporate tax rates can vary, so consult the relevant tax laws or regulations to determine the rate that applies to the company’s taxable income. - Calculate gross corporate tax

Multiply the taxable income by the corporate tax rate. This gives you the gross corporate tax liability before any adjustments. - Consider tax credits and incentives

Factor in any tax credits or incentives that the company is eligible for. These can include credits for research and development, investment, or other activities that qualify for special tax treatment. - Account for deductions

Deduct any additional allowable deductions, such as depreciation, charitable contributions, or other deductions outlined in tax laws. This reduces the taxable income and, consequently, the corporate tax liability. - Calculate net corporate tax

After factoring in credits and deductions, recalculate the corporate tax liability. This final figure represents the net corporate tax, reflecting adjustments made for credits and deductions. - Consider local taxes

Be aware of any additional local or state corporate taxes that may apply. Some jurisdictions impose additional taxes on corporate income, so ensure compliance with all applicable tax regulations.

As you can see, corporate taxation can be comples. At this point, businesses might want to consider seeking advice from tax professionals or accountants (which is a common recommendation). They can provide insights, ensure compliance, and optimize the company’s tax position.

Breaking down corporate taxable income

As corporate taxable income is the starting point for calculating corporate taxes, we suggest giving it more attention. Let’s open the hood and look at the components that make up this financial recipe in more detail.

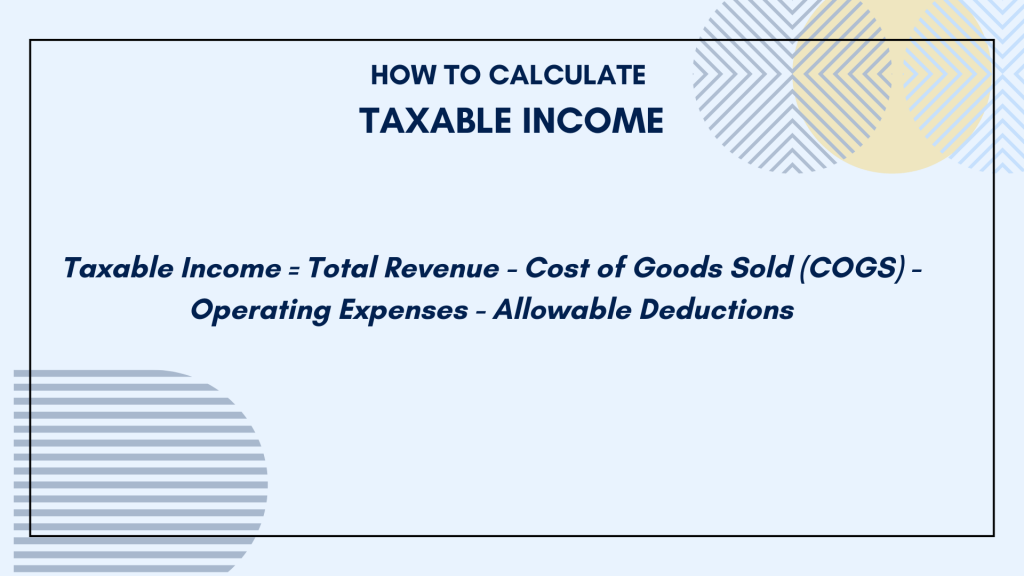

The formula to calculate taxable income for a corporation is generally as follows:

Taxable Income = Total Revenue − Cost of Goods Sold (COGS) − Operating Expenses − Allowable Deductions

Here’s a breakdown of each component.

- Total Revenue is the total income generated by the corporation from its business operations. It includes sales, services, and any other sources of income.

- Cost of Goods Sold (COGS) represents the direct costs associated with producing goods or services sold by the corporation. This includes raw materials, labor, and manufacturing overhead.

- Operating Expensesinclude general and administrative expenses, selling and marketing expenses, research and development costs, and other day-to-day operational costs.

- Allowable deductions are specific expenses allowed by tax laws to be subtracted from the total revenue to arrive at taxable income. These can include depreciation, certain employee benefits, interest payments, charitable contributions, and other eligible expenses.

The resulting figure represents the taxable income, which is the basis for calculating the corporate tax liability. As previously mentioned, the appropriate corporate tax rate is then applied to this taxable income to determine the gross corporate tax liability. Subsequently, tax credits and further deductions are considered to arrive at the final net corporate tax liability.

Corporate taxes are tightly linked to a company’s accounting practices. How a company reports income, deducts expenses, and employs accounting methods significantly impacts its taxable income and, consequently, the amount owed in corporate taxes. Strategic financial management, including aggressive tax planning, can lower the effective tax rate. Accounting decisions related to depreciation, inventory valuation, and revenue recognition play a pivotal role in shaping taxable income.

In this context, the use of accounting software becomes indispensable, streamlining financial processes, ensuring accurate reporting, and aiding in optimal tax management.

Global taxes variability

Now, imagine this on a global scale. Every country’s got its own rulebook for corporate taxes. Some places, like those mysterious tax havens, make it super easy for businesses with jaw-droppingly low tax rates. Why? Well, that depends on a bunch of things—how the country’s economy works, politics, and the fierce competition to get businesses to set up camp. So, when companies decide where to call home, it’s not just about the weather; it’s about navigating the wild world of global corporate tax rates.

Effective corporate tax rates

But wait, there’s more. The rate you see on paper, the one they call the statutory tax rate, isn’t exactly what businesses end up forking over. Welcome to the effective corporate tax rate, where deductions, subsidies, and tax loopholes come into play. These financial tricks can seriously slash the real tax bill a company pays, making the actual rate a lot less than what’s officially stated. Understanding this difference is key. It’s not just about what’s written in the rulebook; it’s about decoding the secret language of corporate finances that determines what hits the government’s pockets.

Below, we’ll look at how corporation taxes work in the USA, and break down tax rates and what determines them.

Introducing tax rate (corporate): how corporations handle corporate taxes in the USA

The historical evolution of the U.S. corporate tax rate narrates a story marked by legislative milestones, none more impactful than the Tax Cuts and Jobs Act.

The Tax Cuts and Jobs Act (TCJA), enacted on December 22, 2017, was a sweeping overhaul of the U.S. tax system with the primary goals of stimulating economic growth and simplifying the tax code.

Notable changes included a significant reduction in the corporate tax rate from 35% to a flat 21%, adjustments to individual tax brackets and rates, an increase in the standard deduction, and modifications to various deductions, including the state and local tax deduction. The TCJA also introduced a new deduction for certain pass-through businesses, altered the taxation of multinational corporations, and doubled the estate tax exemption.

While proponents lauded the legislation for its potential economic benefits, critics raised concerns about its impact on income inequality and the federal deficit, making the TCJA a focal point in discussions about U.S. tax policy and economic strategies.

This way, as of today, the corporate tax rate is set to 21%. This strategic recalibration aimed to bolster global competitiveness and position the United States as a magnet for corporate investments.

A quick look at corporate tax filing

The U.S. corporate tax filing process involves several key steps, with specific deadlines and options for extensions.

Corporations are required to report their income and calculate their tax liability using Form 1120. The standard deadline for filing corporate tax returns is the 15th day of the fourth month following the end of the corporation’s tax year, which typically falls on April 15th for calendar-year filers. However, corporations can request a six-month extension, moving the filing deadline to September 15th. This extension provides additional time for companies to gather necessary financial information and complete the filing process accurately.

Form 1120 serves as the official document for reporting corporate income taxes. It includes sections for detailing the corporation’s income, deductions, credits, and ultimately calculating the net tax liability. Notably, corporations with assets exceeding $10 million are required to file their tax returns electronically, emphasizing the move towards modernization and efficiency in tax administration.

Online filing requirements align with the broader trend in digital transformation, streamlining the submission process and enhancing accuracy in reporting. This shift to electronic filing not only reduces paperwork but also facilitates faster processing and communication between corporations and the Internal Revenue Service (IRS). In summary, the U.S. corporate tax filing process involves adherence to specific deadlines, the use of Form 1120 for comprehensive reporting, and a growing emphasis on electronic filing for corporations with substantial assets.

State-level tax rate: adding up to corporate tax complexity

State-level corporate income taxes in the U.S. contribute to the overall complexity of the tax landscape, with individual states wielding autonomy in setting their tax rates. The variations in these rates can significantly impact the overall tax burden on corporations.

Here’s a breakdown of state-level corporate income taxes and examples of varying state tax rates

State autonomy

Each U.S. state has the authority to impose its own corporate income tax rate. This autonomy leads to a diverse range of tax structures, creating a patchwork of rates across the country.

Varying state tax rates

States employ different tax rate structures, ranging from flat rates to progressive systems. For instance:

- North Carolina

As of the last available information, North Carolina employs a flat corporate income tax rate, providing simplicity for businesses operating in the state. - New Jersey

In contrast, New Jersey implements a progressive tax structure with multiple brackets, resulting in higher rates for corporations with higher taxable incomes.

Marginal rates and tax brackets

Some states use a tiered or bracketed approach, where corporations are taxed at different rates based on their taxable income. These marginal rates can vary widely between states, influencing the overall tax liability.

Special deductions and credits

States may offer specific deductions, credits, or incentives to attract businesses or encourage certain activities. The availability and generosity of these provisions can impact the effective tax rate for corporations.

Combined state and federal rates

It’s essential to consider the combined impact of state and federal corporate income tax rates. Corporations operating in states with higher tax rates may experience a more substantial overall tax burden when federal and state rates are combined.

Understanding the state-level corporate income tax landscape is crucial for businesses to make informed decisions about their operations and tax planning strategies.

Corporate tax deductions: how can one increase tax efficiency

As mentioned above, your taxable income serves as a basis for corporate tax calculation. Understanding and strategically utilizing deductions can significantly impact a company’s bottom line. Permissible deductions for corporations extend beyond mere financial transactions, encompassing a spectrum of operational expenses that can be leveraged to reduce taxable income. From employee salaries and benefits to travel expenses and other necessary operational costs, corporations have a palette of deductions to paint a more favorable tax picture.

Examples: from salaries to travel prices

Zooming in on the specifics, the corporate tax landscape allows deductions for a range of expenditures essential for business operations.

- Employee salaries, a cornerstone of any workforce, can be deducted.

- Benefits such as health benefits, tuition reimbursement, and bonuses further add to the deduction arsenal.

- Travel expenses, often incurred in the pursuit of business opportunities, also find a place in the deduction playbook.

- Additionally, insurance premiums, interest payments, sales taxes, and advertising costs contribute to the mosaic of deductions, enabling corporations to optimize their taxable income.

Corporate tax advantages for businesses

the payment of corporate taxes transcends routine fiscal responsibilities, presenting distinct advantages for astute business owners. Let’s decipher these advantages in pragmatic terms, elucidating why navigating the intricacies of corporate taxes is a strategic imperative for your business.

Employee well-being and competitive edge

Corporate tax returns offer a pragmatic avenue for enhancing your workforce’s well-being. The deduction of medical insurance for employee families not only signifies a commitment to staff welfare but also positions your business competitively in talent acquisition. Extending to encompass retirement plans and tax-deferred trusts, these benefits become not just perks but strategic tools for attracting and retaining top talent.

Resilience through loss deductions

In the face of financial setbacks, corporations enjoy a pragmatic advantage in the deduction of losses. The ability to deduct the entire loss amount becomes a fiscal buffer, providing resilience during economic downturns. This streamlined process contrasts with the more intricate procedures sole proprietors face, showcasing the business-like efficiency of corporations in managing their financial stability.

Retained profits for strategic deployment

Retaining profits within the business is not just a financial strategy; it’s a business tactic with far-reaching implications. This pragmatic advantage allows for strategic tax planning and potential future benefits. The ability to reinvest retained profits for business expansion, research and development, or other strategic initiatives positions your business as a proactive player in the market.

Streamlined operations through simpler deductions

When it comes to the deduction of losses, corporations benefit from a streamlined process, avoiding the need for extensive proof of profit intent. This business-like efficiency simplifies tax management, allowing for more straightforward financial planning and tax liability management.

As you can see, corporate taxes are not just an obligation but can be a tactical advantage contributing to your business’s strategic success.

Challenges of corporate taxes for businesses

However, we can’t leave aside the fact that corporate taxation often poses significant challenges for businesses, with double taxation standing out as a formidable hurdle. Understanding and addressing these challenges is essential for corporations aiming to optimize their financial standing.

What’s double taxation and how it impacts corporate finances

One of the primary challenges businesses face in the realm of corporate taxation is the specter of double taxation. This occurs when a corporation is taxed on its profits, and then shareholders face taxes on the dividends received from those profits. This double layer of taxation erodes the overall income available for distribution and can be a significant deterrent for corporations. The impact is particularly pronounced in C corporations, where profits are first taxed at the corporate level before reaching individual shareholders. This challenge not only reduces the after-tax income for shareholders but also complicates the financial planning landscape for corporations.

S corporations: an alternative path

In response to the double taxation conundrum, some businesses opt for the S corporation structure. S corporations, unlike their C corporation counterparts, do not face corporate-level taxation. Instead, income passes through to the shareholders who report it on their individual tax returns. This alternative structure mitigates the challenge of double taxation, offering a more straightforward path for small to mid-sized businesses. However, S corporations have certain eligibility criteria and restrictions, and their applicability depends on the specific circumstances and goals of the business.

Complexity of tax code and compliance burden

Beyond double taxation, the sheer complexity of the tax code poses an ongoing challenge for businesses. Navigating regulations, deductions, and compliance requirements demands significant resources in terms of time, expertise, and financial investment. Small and medium-sized enterprises, in particular, may find it burdensome to stay abreast of the evolving tax landscape and ensure compliance with the myriad regulations.

Global taxes and multinational corporations

For multinational corporations, the challenge extends beyond domestic tax considerations. The global nature of business operations introduces complexities related to international tax laws, transfer pricing, and the coordination of tax strategies across multiple jurisdictions. The need for a cohesive global tax strategy becomes imperative to manage the tax implications of cross-border operations effectively.

The role of corporate taxes in GDP

Corporate taxes play a significant role in the Gross Domestic Product (GDP) of a country as they contribute to government revenue, which, in turn, influences the overall economic health. Here’s how corporate taxes intersect with GDP:

- Government revenue contribution

Corporate taxes are a major source of revenue for governments. As businesses generate profits, a portion of these profits is taxed by the government. The revenue collected from corporate taxes is then utilized to fund various public services, infrastructure projects, and government programs. The magnitude of corporate tax contributions shapes the government’s fiscal policy and its ability to undertake initiatives that impact economic development. - Economic output and business performance

The profits generated by businesses, subject to corporate taxation, are reflective of economic activity. Higher profits indicate robust business performance and increased economic output. As a component of GDP, corporate profits contribute to the calculation of the overall value of goods and services produced within a country. The relationship between corporate profits and GDP reflects the business sector’s role in driving economic growth. - Employment and income generation

Corporate taxes are intricately linked to employment and income generation. When businesses thrive and generate profits, they are more likely to expand and create job opportunities. The wages and salaries paid by corporations to their employees contribute to the overall income earned by individuals, influencing consumer spending—a key driver of economic activity that contributes to GDP. - Investment and capital formation

The revenue collected through corporate taxes can be channeled back into the economy through government spending, contributing to investment in public infrastructure and services. Additionally, businesses may choose to reinvest their profits for capital formation, such as expanding operations, investing in technology, or engaging in research and development. These investments enhance productivity and efficiency, contributing to economic growth as reflected in GDP. - International perspective

In the context of multinational corporations, corporate taxes contribute to the global standing of a country. A competitive corporate tax environment can attract foreign direct investment and promote a favorable business climate, positively influencing the country’s economic position within the global marketplace. - Tax-to-GDP ratio

The ratio of total tax revenue, including corporate taxes, to GDP is a crucial economic indicator. It provides insights into the overall tax burden on the economy. Changes in this ratio can signal shifts in government fiscal policy and have implications for economic growth and development.

So, as you can see, the relationship between corporate taxes and GDP underscores the interconnectedness of government finances and economic well-being.

Conclusion

Long story short, corporate taxes are more than just a financial responsibility – they’re a toolkit for businesses. From understanding taxable income components to navigating global tax rate variations, businesses are in a constant dance of optimizing their tax strategies. The U.S. corporate tax system, with its history, filing intricacies, and state-level impacts, adds layers to this dynamic.

The perks of corporate taxes, like simplified loss deductions, profit retention, and fringe benefits, become practical tools for businesses aiming not just to comply but to strategically thrive. As these taxes intersect with GDP, their impact on government revenue, economic output, and employment becomes clear.

Continue reading: What is a chart of accounts?

Share your thoughts

Feel free to comment in the section below to ask your question or share experience with corporate taxes. We’d love to hear from you!

%20(1).png)