Accounting in ecommerce comes with peculiar challenges – from tracking sales across multiple platforms to navigating sales tax regulations – requiring an approach different from more traditional accounting. Undoubtedly, accounting software can streamline basic bookkeeping and help handle your accounting for Shopify, for example, more efficiently. With functions like expense tracking in Shopify, it can automate most of the daily bookkeeping duties, including:

- Producing real-time P&L reports;

- Compiling every sales channel in one place;

- Managing your inventory from a single dashboard.

However, you might fancy a deeper level of expertise that an ecommerce accountant can provide. With specialized knowledge and strategic insight, they offer tailored solutions to address the unique financial needs of online businesses.

Let’s look at how a business can leverage this knowledge and expertise and find the answer to whether you need an ecommerce accountant.

Contents:

1. What is ecommerce accounting?

- How do we define accounting for ecommerce?

- What is the difference between ecommerce and traditional accounting?

2. How do you maintain ecommerce accounting (with accounting software)?

3. Do I need an accountant (CPA) for my ecommerce business?

4. How do ecommerce accountants address common challenges in online business?

Key takeaways

- Ecommerce accounting has evolved into a strategic tool for business growth through technology integration and proactive insights.

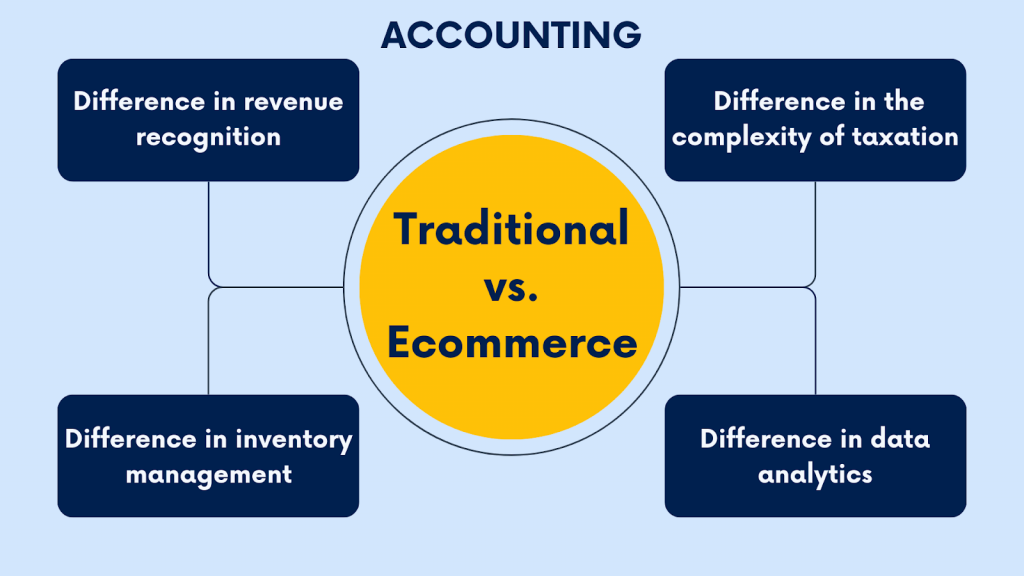

- Ecommerce accounting differs from traditional methods due to unique revenue recognition, inventory management, taxation complexity, and data analytics challenges.

- Ecommerce accountants play a pivotal role in business growth by leveraging technology and industry knowledge to provide insights, optimize strategies, facilitate tax compliance, and guide decision-making.

What is ecommerce accounting?

Ecommerce has firmly entrenched itself as a serious force in the global economy. With the increasing prevalence of smartphones, widespread internet access, and secure online payment systems, buying and selling goods and services over the internet have become commonplace. As a result, ecommerce sales consistently grow year over year, claiming a larger share of total retail sales. Businesses increasingly prioritize their online presence to remain competitive in today’s markets. This trend has led to the development of specialized tools, platforms, and ecommerce accounting practices tailored to the unique demands of online commerce.

So what’s ecommerce accounting, and why do we speak about it as a specific branch of accounting?

How do we define accounting for ecommerce?

By definition, ecommerce accounting is a specialized area within accounting that focuses on managing financial transactions and reporting obligations specific to ecommerce enterprises. Its responsibilities include monitoring revenue streams, tracking expenses, handling inventory, assessing liabilities, and addressing the unique financial challenges typical for online business models.

What is the difference between ecommerce and traditional accounting?

Traditional and ecommerce accounting share fundamental principles but, due to the distinct nature of the business models they serve, differ in their focus, processes, and considerations.

#1 – Difference in revenue recognition

One key difference is how they handle revenue. Traditional businesses recognize revenue when they physically sell (in-store) or deliver a product to the customer. Ecommerce businesses may recognize revenue right when the sale happens (not waiting for the delivery) or upon downloading a digital product. Besides, there are cases with service subscriptions, requiring a different accounting approach.

#2 – Difference in inventory management

Another big difference is how they manage inventory. Traditional businesses usually deal with inventory stored in their shop or a warehouse nearby. Ecommerce businesses often sell not only through their online stores but also several ecommerce marketplaces and manage inventory distributed across various inventory hubs and fulfillment centers in multiple states or even countries if selling globally. So, they must track stock levels across these online platforms and inventory hubs to be sure they align and reflect the real-time status of in and out-of-stock items.

#3 – Difference in the complexity of taxation

Taxes also vary between traditional and ecommerce accounting. Ecommerce businesses deal with complex online sales tax rules, cross-border transactions, and taxes on digital goods, which means ecommerce accountants need to stay updated on changing tax laws and control sales and transaction amount thresholds and tax sourcing rules not to miss hitting tax obligations in this or that state. (Like, it’s quite a chunk!)

#4 – Difference in data analytics

Ecommerce accounting involves real-time analysis of a lot of data from online sales, customer interactions, and digital marketing to help businesses make the right, weighed, and timely decisions (as things change rapidly in ecommerce). Traditional accounting may focus more on reporting and analyzing historical financial data.

As you can see, all the above creates unique challenges for ecommerce accounting, justifying the necessity to distinguish it as a separate accounting branch.

How do you maintain ecommerce accounting (with accounting software)?

Let’s not forget that ecommerce usually involves dealing with large transaction volumes (in addition to everything listed above). At this point, maintaining ecommerce accounting requires software, as manually doing it is super time-consuming and error-prone (and, have some mercy to your accountant, it’s a literal pain in the neck).

The biggest virtue of accounting software is the ability to connect with ecommerce platforms, payment systems, ecommerce marketplaces, and some other sales channels to fetch and record sales, expenses, and inventory details (and often, customer behavior data) automatically and often in real-time.

It helps reduce errors and save time compared to manual data entry, quite obviously. But that’s the bare minimum. With all the necessary and accurate data put together, accounting software aids in financial reporting and accounts reconciliation, successfully handling both with minimal human interaction. Many accounting solutions also allow for creating and sending invoices automatically and applying payments to open invoices, closing them, and categorizing these transactions under corresponding accounts. So, it basically covers up many routine bookkeeping and accounting tasks, leaving a business owner or an accountant space for deeper analytics and decision-making.

Let’s break it down.

Automatic ecommerce transaction compilations

Traditionally, ecommerce businesses would need to compile each transaction, which is a laborious task that could take hours (particularly if you have a large number of sales and expenses). Manual bookkeeping is time-consuming and vulnerable to human error.

An accounting app for ecommerce with in-built integration functionality can match each transaction in seconds with 100% accuracy, so you can free up time, spend less on your financial management, and ultimately boost your profits.

Overall, it’s a safer, faster, and more efficient way to manage your finances. You’ll need to invest significantly less in hiring an accountant, as your bookkeeping will be continually updated and under control.

Managing diverse ecommerce sales platforms

With thousands of retail platforms and payment processing providers, we often hear clients complain about juggling dozens of systems. If you sell on different platforms and have varying payment streams, you have an app for each one, including:

- Etsy,

- Amazon,

- eBay,

- Stripe,

- Shopify,

- PayPal, etc.

Multiple points of sale mean multiple sales income ledgers, platform fees, tax deductions, admin and shipping costs, and compliance regulations.

Ecommerce accounting software draws those revenue centers and payment processing functions together, collating all your data in one place to give you accurate insights into business performance. This way, you can review overall sales from your website, app, and other retail channels, consolidating everything from your customer reports to inventory management.

Capturing your data in one place helps you evaluate performance, schedule stock fulfilments, report overall figures, and calculate profitability – with user-friendly reports and one-click data analysis. The benefits include substantial administrative burden reductions, better revenue insights, and enhanced accounting management.

Want to learn more about managing ecommece accounting? Book your seat at our Weekly Public Demo to see how you can do it with Synder, or explore it yourself with a 15-day all-inclusive free trial.

With all the above in mind, does this mean that you can go without an accountant? Absolutely not. You might need an accountant to prepare and file your taxes, analyze your business’s well-being through financial statements, and help you understand what your business numbers mean and how you can affect them. But should you go with an ecommerce accountant specifically? We’ll find out just a little further.

Do I need an accountant (CPA) for my ecommerce business?

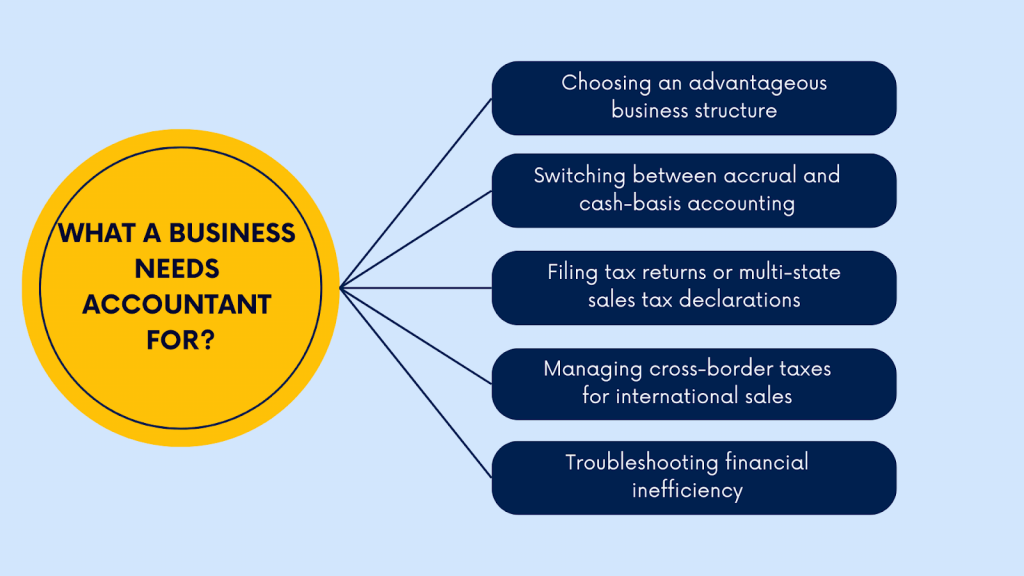

Meanwhile, let’s look at the cases where a business might need an accountant a hundred percent. Here are a few scenarios in which you probably need advice from an accountant:

#1 – Choosing an advantageous business structure as a startup

When starting a new business, selecting the correct trading structure – a sole proprietorship, partnership, limited liability company (LLC), or corporation – can have significant implications for taxes, liability, and operations. An accountant can help evaluate the pros and cons of each structure based on your specific circumstances and goals. For instance, they might recommend an LLC for its flexibility and liability protection for small businesses.

#2 – Switching between accrual and cash-basis accounting systems

Accrual accounting records revenue and expenses when incurred, regardless of when cash changes hands, while cash-basis accounting records transactions only when cash is received or paid. Switching between these methods can impact financial reporting and tax obligations. An accountant can advise on the best accounting method based on your business model and financial needs.

#3 – Filing complex tax returns or multi-state sales tax declarations

Business growth might result in more complex tax compliance, especially when operating in multiple states or countries. Accountants specialize in navigating intricate tax laws and regulations, ensuring accurate and timely filing of tax returns and sales tax declarations to avoid penalties and audits.

#4 – Managing cross-border taxes for international sales

Selling products or services internationally introduces additional tax considerations, including value-added tax (VAT), customs duties, and withholding taxes. An accountant with expertise in international taxation can help businesses navigate these complexities, optimize tax planning strategies, and ensure compliance with foreign tax laws.

#5 – Troubleshooting financial inefficiency

Identifying and addressing cost inefficiencies is essential for optimizing profitability and sustainability. Accountants can conduct financial analysis to pinpoint areas of excessive spending, inefficiencies in operations, or opportunities for cost-saving measures. For example, they might analyze inventory turnover ratios to identify slow-moving products or review overhead expenses to uncover potential savings.

If you’re an established ecommerce company, it might seem you don’t necessarily need to pay for accountancy services outside of your year-end expenses and hire an ecommerce accountant. Integrating an advanced ecommerce accounting software with your Shopify (or Wix, or you name it) account can help you to take care of your day-to-day finances and deliver up-to-date reports, so you know where you stand to some extent. But will it be the same as business grows? Or will you be able to tackle every aspect of your business accounting on your own?

What can an ecommerce accountant do for your business in this scenario?

How do ecommerce accountants address common challenges in online business?

We started by mentioning the peculiar challenges of ecommerce business and how you might need a different approach to accounting for an ecommerce company. At this point, you might want your accountant to be on the same page with you — to understand how ecommerce business works, be aware of all its peculiarities, and use this expertise to manage your business finances to help you grow.

Here’s how an ecommerce accountant can benefit your company.

Benefit #1 – Bringing ecommerce expertise to the table

As an ecommerce business owner, you know how managing sales data from multiple channels is a common challenge. From your online store to payment processors and marketplaces like Amazon’s Seller Central, eBay, or Shopify, — each has peculiarities to consider. Ecommerce accountants know how online selling works in general and through each platform. They know what to watch out for, what data to analyze, what metrics to track, and more.

Let’s break it down.

Multi-channel inventory management

One key aspect that ecommerce accountants focus on is inventory management. They help businesses track inventory flows across different channels, ensuring adequate stock levels to meet customer demand while minimizing excess inventory costs. Sales trends and inventory turnover rates analysis can help you optimize inventory levels and replenishment strategies to enhance efficiency and profitability.

Accounting for payment and marketplace fees

Another critical area of expertise for ecommerce accountants is accounting for service fees. Different platforms can charge various fees, including listing, referral, payment processing fees, and others (depending on the platform).

An accountant with ecommerce expertise knows how to track these expenses and incorporate them into financial records to assess the cost of sales and calculate profitability across your sales channels. They can help you understand where these expenses eat up your margins and find the solution (like tweaking pricing, for example, or cutting unnecessary services), and so on.

Handling sales taxes

Understanding sales tax obligations is another vital aspect of ecommerce accounting. An ecommerce accountant typically knows which ecommerce platform or marketplace gathers and remits sales taxes for you and where you need to do it yourself. With the complexity of state and local sales tax laws and regulations, especially for online transactions, ecommerce accountants help businesses mitigate risks of tax underpayments due to overlooking hitting a tax nexus and often substantial associated fines. (We’ll get to it in more detail a bit further.)

Analyzing data beyond pure finances

Ecommerce accountants know that each transaction detail matters and analyze things beyond financial statements (such as customer behavior and product performance), proactively identifying cost-saving opportunities and revenue-generating strategies for online businesses. This analysis and performance reviews help them uncover inefficiencies in operations, identify areas for improvement, and recommend actionable solutions to drive growth and profitability.

For example, an ecommerce accountant may analyze sales data to identify best-selling products and high-margin items, helping businesses focus marketing efforts and inventory management resources accordingly. They may also evaluate the effectiveness of advertising campaigns and promotional activities, providing insights into customer acquisition costs and return on investment.

Benefit #2 – Setting up a comprehensive accounting system

As ecommerce accountants leverage technology to do their job, they might be more savvy than traditional accountants in handling the technical aspects of your online business. It includes setting up your accounting system, if needed, and ensuring it works smoothly, accurately fetching financial records to reflect the transactions and activities across different platforms.

Accounting software selection

Ecommerce accountants can assist in selecting the most suitable accounting software tailored to the needs of your online business. They consider factors such as the volume of transactions, integration capabilities with ecommerce platforms, and scalability for future growth.

Integration with ecommerce platforms

Ecommerce accountants can help set up integration between accounting software and your ecommerce platforms, such as Shopify, WooCommerce, or Magento, as they might already know how to do it efficiently. This integration can automate the transfer of sales data, expenses, and inventory information, eliminating the need for manual data entry and reducing the risk of errors.

Benefit #3 – Managing taxes and compliance efficiently

Ecommerce businesses face multiple tax obligations, including sales taxes that vary by jurisdiction. Accountants who deal with ecommerce know all the potential risks and pitfalls of sales taxes, ensuring compliance, and optimizing tax strategies.

Here’s how they assist in managing sales taxes for ecommerce businesses.

Defining tax nexuses and sourcing rules

Ecommerce accountants help businesses understand the concept of tax nexuses, which determine the geographical locations where a business collects and remits sales taxes. They analyze physical presence, economic activity, and sales thresholds to identify potential tax nexuses in various jurisdictions. Additionally, accountants interpret sales tax sourcing rules to determine the appropriate tax rates and jurisdictions for each transaction.

Tracking revenue and transactions by sources and locations

Ecommerce accountants implement systems and processes to track revenue and transactions accurately, categorizing sales by sources (e.g., website, marketplace) and locations (e.g., state, county, city). By maintaining detailed records of sales activities, accountants ensure compliance with sales tax reporting requirements and mitigate the risk of overlooking potential tax obligations in specific jurisdictions.

Identifying economic tax nexus

Ecommerce accountants monitor sales activities and revenue thresholds to identify instances where businesses may trigger economic tax nexus thresholds in certain jurisdictions. They analyze sales data and revenue trends to proactively assess the possibility of exceeding nexus thresholds. It helps businesses take preemptive measures to comply with sales tax obligations in additional jurisdictions.

Understanding platform and marketplace sales tax responsibilities

Ecommerce accountants advise businesses on the sales tax responsibilities of ecommerce platforms and marketplaces. While some platforms may collect and remit sales taxes on behalf of sellers, others may require businesses to handle sales tax obligations independently. Accountants help understand the sales tax policies of each platform and ensure compliance with platform-specific requirements.

Guiding sales tax optimization

Ecommerce accountants can offer you strategic guidance on sales tax optimization strategies to minimize tax liabilities and maximize tax savings. They evaluate available exemptions, deductions, and credits applicable to ecommerce businesses, helping businesses leverage tax incentives and diminish the impact of sales taxes on profitability.

Benefit #4 – Helping your marketing through financial insights

Ecommerce accountants can play a significant role in helping your marketing efforts by leveraging financial data to provide valuable insights and strategic recommendations.

Let’s see how they can assist in optimizing your marketing strategies.

Improving customer segmentation

Ecommerce accountants can analyze sales data to identify customer segments based on purchasing behavior, demographics, geographic location, and other relevant factors. Understanding the characteristics and preferences of various customer groups helps marketers tailor their messaging, promotions, and product offerings to target and engage specific segments based on insights backed with financial data.

Analyzing customer lifetime value

Ecommerce accountants can use historical transaction data to calculate and analyze customer lifetime value (CLV). CLV represents the total revenue a customer potentially generates over the whole period of being a customer. By understanding the CLV of different customer segments, marketers can prioritize their marketing efforts and allocate resources more effectively to acquire and retain high-value customers.

Breaking down campaign performance

Ecommerce accountants can evaluate the performance of marketing campaigns by tracking key performance indicators (KPIs) such as return on investment (ROI), cost per acquisition (CPA), conversion rates, and revenue generated per campaign. By analyzing campaign metrics and financial data, marketers can identify which marketing channels, campaigns, and messaging resonate most with their target audience and drive the highest return on investment.

Analyzing profitability

Ecommerce accountants can conduct profitability analysis to assess the financial impact of marketing initiatives and promotions. They can compare the costs of marketing campaigns against the revenue generated, helping marketers evaluate the profitability of different channels and tactics. Such analysis enables businesses to make data-driven decisions about where to allocate their marketing budgets for maximum impact and ROI.

Forecasting and planning

Ecommerce accountants can use financial data and historical trends to forecast future sales, revenue, and customer acquisition metrics. By providing insights into future demand and market trends, accountants enable marketers to develop strategic marketing plans, set realistic targets, and allocate resources effectively to achieve their business objectives.

Aligning inventory with marketing efforts

Effective marketing campaigns can drive product demand spikes, impacting inventory levels and supply chain operations. Ecommerce accountants can work closely with marketers and inventory managers to ensure adequate stock levels, optimize inventory turnover, and minimize stockouts or overstock situations. By aligning marketing efforts with inventory management strategies, businesses can enhance customer satisfaction and maximize sales opportunities.

Benefit #5 – Facilitating business growth

It’s worth saying that ecommerce owners seek proactive partnerships, valuing accountants who anticipate challenges, identify opportunities, and navigate the complexities of online markets.

Ecommerce accountants make your accounting not about numbers but what’s behind those numbers, offering strategic insights and fostering business growth. This evolution stems from the integration of technology and the demand for swift decision-making in the ecommerce industry. Traditionally viewed as post-factum analysts, accountants now respond to the real-time demands of online commerce, providing proactive guidance based on immediate data.

With advanced tools and software, ecommerce accountants access and analyze financial data, offering timely recommendations for business decisions. They uncover valuable insights into customer behavior, market shifts, and operational efficiencies, empowering businesses to make informed choices that drive profitability and sustainable growth.

Drawing from their expertise in ecommerce platforms and market dynamics, accountants guide businesses toward strategic initiatives and investment prospects. They assist in optimizing pricing strategies, streamlining operations, and capitalizing on emerging trends to maintain a competitive edge. As ecommerce evolves, accountants remain essential growth advisors, shaping financial strategies and fostering success.

TL;DR

- Ecommerce accounting is custom-made for online businesses, covering financial transactions, revenue, expenses, inventory, and taxes unique to online commerce.

- Ecommerce accounting differs from traditional methods in several ways, including revenue recognition, inventory management, taxation, and real-time data analytics for quick decision-making.

- Ecommerce accounting software offers several benefits. Firstly, it automates daily tasks such as tracking expenses and managing inventory, saving time and effort. Secondly, it gathers sales data from various channels and platforms, organizing it into a single location for easy access and analysis. Lastly, it provides real-time insights and financial reports, allowing businesses to make informed decisions quickly.

- An accountant can be beneficial in various situations, including establishing a business structure, transitioning accounting systems, managing complex taxes, dealing with multi-state or international sales taxes, identifying financial inefficiencies, or improving profitability.

- Ecommerce accountants are essential for managing online businesses. They handle sales data, set up accounting systems, and integrate the software with ecommerce platforms. They efficiently manage taxes, track revenue, and offer insights for marketing efforts. Moreover, they provide proactive guidance for business growth based on real-time data.

Bottom line: Is hiring an ecommerce accountant worth it?

So, do you need an ecommerce accountant for your business? Let’s try to finally answer this question.

Accounting software offers significant automation benefits for bookkeeping and accounting tasks, there’s no doubt. However, it can’t replace the expertise and insights a qualified accountant can provide, especially for ecommerce businesses.

Opting for an accountant specializing in ecommerce can be advantageous as they possess a deep understanding of the specificities of online sales and multichannel platforms. Such professionals can assist in setting up accounting systems that comprehensively integrate all sales channels and financial data sources, providing a unified view of business performance. Beyond mere numbers, ecommerce accountants offer valuable insights into the underlying factors driving profitability and growth. Therefore, hiring an ecommerce accountant can be wise in leveraging financial data to enhance business outcomes and achieve sustainable growth.

Share your thoughts

Are you an ecommerce business owner? How do you handle your accounting? Do you believe an ecommerce accountant is a necessity for your business? Share your thoughts in the comment section below, we appreciate good discussion.

Thanks for sharing such great information. It is really helpful to me. I always search to read quality content and finally I found your post. Keep it up, and keep posting!

I like that you talked about a cohesive accounting application that you can use to put every channel in the same place which means that data is automatically streamed to the program to have everything you need on time with great accuracy. I can imagine how it will be more effective if you also hire retail accounting professionals who know different types of software they can recommend for the type of business you have. Because there might be a specific program that will be more useful or beneficial for the kind of sales or inventory you have.

Hi Mia, thank you for your thoughtful comment! You’re absolutely right; combining a cohesive accounting application with the expertise of retail accounting professionals can significantly enhance business operations. Tailoring software recommendations to fit the specific needs of a business, considering its sales patterns and inventory types, is a smart approach. This synergy not only ensures accuracy and timeliness but also optimizes financial management to support business growth. Great insight!

Very informative article… Thanks for providing such important and necessary information.

Appreciate the work you are doing.

Nicely done! It’s a remarkable piece of writing, beneficial for all internet users. I’m sure they will appreciate it. Cheers 🙂