Nonprofits face unique challenges in managing their finances. With hundreds of billions of dollars Americans donate yearly, nonprofits must adhere to strict guidelines set by the Financial Accounting Standards Board (FASB) that require control on gathering and spending donated funds. It sets complexities to accounting for donations, with many nuances to consider.

At this point, using accounting software tailored for nonprofits is a wise approach nonprofit organizations can take. The software helps streamline tasks, maintain accurate records, and meet reporting standards, empowering them to optimize financial management processes and drive mission-driven impact.

Let’s look, then, at accounting software for nonprofits.

Key takeaways

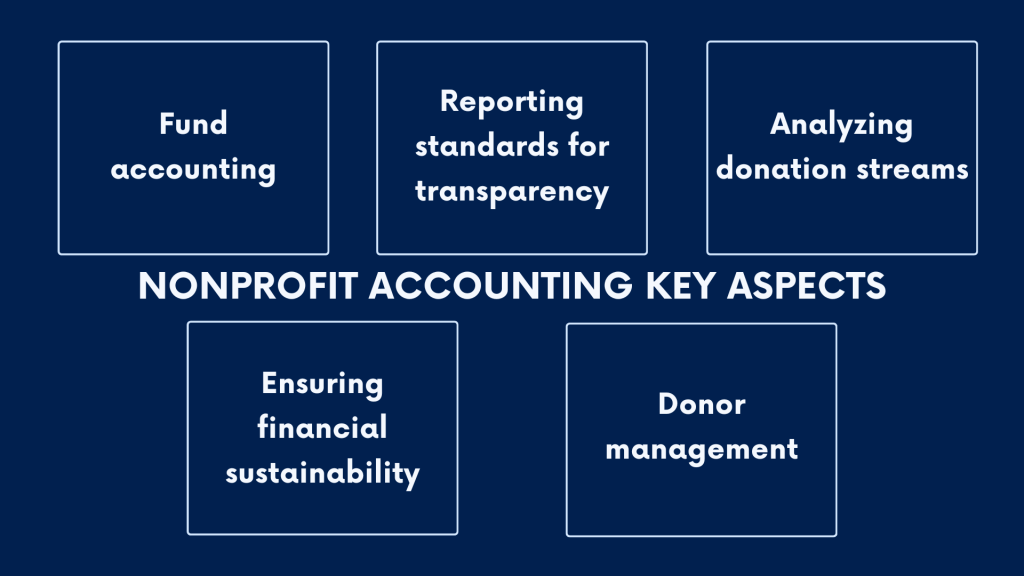

- Nonprofit organizations must adhere to unique financial management and reporting practices, including fund accounting and maintaining transparency and accountability to manage donations, grants, and expenses.

- Accounting software tailored for nonprofits streamlines financial processes, supports compliance with regulatory standards, and enhances donor management by providing tools for accurate tracking, reporting, and analysis of financial data.

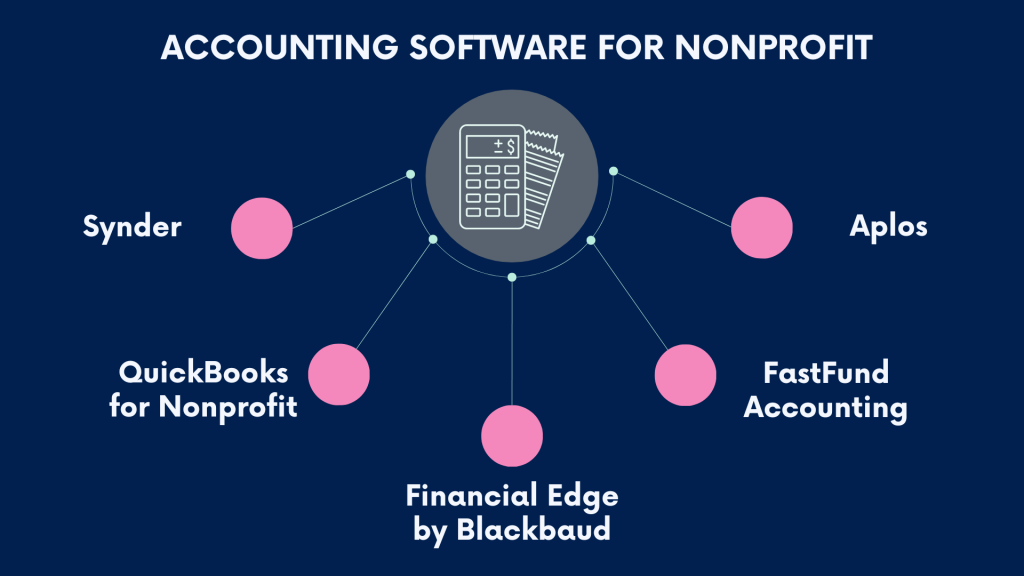

- Selecting the right accounting software is crucial for nonprofits, with solutions like Synder, QuickBooks for Nonprofits, Financial Edge by Blackbaud, FastFund Accounting, and Aplos offering specialized features to meet diverse organizational needs and ensure financial integrity and sustainability.

Understanding nonprofit accounting

Nonprofit organizations operate within unique financial grounds that demand a specialized approach to accounting. Unlike their for-profit counterparts, nonprofits’ mission is to serve their communities rather than generate profits for shareholders. In fact, just in 2023, total giving reached $557.2 billion.

Nonprofit accounting refers to the specialized financial management and reporting practices employed by organizations that operate for purposes other than profit-making. It involves tracking and reporting on financial activities, donations, grants, and expenses in accordance with regulatory standards and donor restrictions.

Transparency and accountability are key in nonprofit accounting. Donors rely on nonprofits to manage funds responsibly. Detailed financial reports provide insights and accountability.

Nonprofits must adhere to regulatory requirements and handle funds according to donor restrictions. Stewardship reflects responsible resource management, with internal controls and audits ensuring accuracy and compliance.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

Nonprofit financial records management and reporting – important aspects

From tracking donations to allocating funds for various programs and grants, nonprofit accounting demands attention to detail and adherence to industry-specific standards.

Let’s break dow some important aspects of nonprofit accounting.

#1 – Fund accounting – tracking funds separately

One of the distinctive features of nonprofit accounting is the practice of fund accounting. Unlike traditional accounting methods for-profit entities use, fund accounting requires nonprofits to track funds separately for different programs, projects, and grants.

Each fund represents a separate pool of resources designated for specific purposes, such as supporting community initiatives, conducting research, or delivering services to underserved populations.

For example, a nonprofit organization focused on environmental conservation may establish separate funds for land preservation, wildlife rehabilitation, and public education campaigns.

Tracking expenditures and revenues associated with each fund in such a way allows nonprofits to demonstrate accountability and transparency in utilizing donor contributions and achieving anticipated outcomes. And as we mentioned, extreme transparency is a fundamental requirement for nonprofits.

And now, we’re getting to how they maintain that level of transparency through reporting.

#2 – Nonprofit reporting standards for transparency and accountability

Nonprofit organizations should hold to high standards of transparency and accountability in their financial reporting practices.

Maintaining accurate financia data

Stakeholders, including donors, grantors, regulators, and the public, rely on accurate and comprehensive financial information to assess the organization’s financial health, stewardship of funds, and impact on the community.

Reporting standards in nonprofit accounting prioritize disclosure of financial activities, giving stakeholders access to relevant information to make informed decisions.

That’s why nonprofit organizations should maintain very detailed reporting. And breaking down funds into separate accounts, the fund accounting we mentioned previously, allows them to do that.

Having detailed reporting

In terms of financial statements, nonprofits generate standard financial reports – the statement of financial position (balance sheet), statement of activities (income statement), and statement of cash flows. The difference is that they will include more items in each section to accommodate that detailed accounts breakdown.

For instance, the statement of activities provides a breakdown of revenues and expenses by program or functional area, offering insights into how the organization allocates resources to support its mission.

Organizing reporting this way helps nonprofits maintain accountability and build trust with stakeholders (which is a primary driver of a nonprofit’s operation).

#3 – Analyzing donation streams across multiple sources

As nonprofits receive donations through a wide range of payment methods and channels, including online platforms, credit card transactions, direct bank transfers, checks, and even cryptocurrency donations, in some cases, they need robust accounting systems that can accommodate and accurately record donations from diverse sources.

Analyzing donation streams across multiple sources is crucial for nonprofits to understand their funding sources, identify trends, and make informed decisions about resource allocation and fundraising strategies. Besides, they can evaluate the effectiveness of different fundraising campaigns, assess donor preferences, and optimize their fundraising efforts to maximize impact.

Moreover, the ability to account for donations across various payment gateways ensures nonprofits can reconcile financial records accurately and maintain transparency in their financial reporting. This comprehensive approach to donation management enables nonprofits to build stronger relationships with donors and drive sustainable growth and impact in their communities.

#4 – Ensuring financial sustainability and integrity

Nonprofit organizations should uphold principles of sustainability and integrity.

Achieving financial sustainability involves balancing revenues and expenses to ensure long-term viability and resilience. Nonprofits rely on diverse funding sources, including individual donations, grants, sponsorships, and earned income, to support their operations and initiatives.

Maintaining financial integrity requires adherence to ethical principles, compliance with regulatory requirements, and actionable internal controls.

Nonprofits implement robust financial management practices, such as budgeting, cash flow management, and risk assessment, to mitigate financial risks and safeguard organizational assets.

#5 – Donor management

Donor management is vital in ensuring financial transparency, accountability, and sustainability. Nonprofits rely on donor contributions to support their mission-driven activities, and effective donor management practices help organizations track and steward these contributions responsibly.

Nonprofit accounting standards guide the handling and disclosure of donor funds, ensuring that organizations uphold their fiduciary responsibilities and steward donor resources effectively.

Overall, integrating donor management with nonprofit accounting processes enables organizations to optimize fundraising efforts, strengthen donor relationships, and fulfill their mission-driven objectives.

What are the potential pitfalls and risks nonprofit organization face in accounting?

Nonprofit organizations operate within a complex financial landscape, facing unique challenges and risks in their accounting practices. While effective financial management is essential for achieving the organization’s mission and sustaining operations, nonprofits must navigate potential pitfalls and mitigate risks to maintain financial health and accountability.

Risk #1 – Compliance failure

Nonprofit accounting should follow many regulatory requirements imposed by governmental agencies, such as the Internal Revenue Service (IRS) and the Financial Accounting Standards Board (FASB). Failure to comply with these regulations can result in penalties, loss of tax-exempt status, and damage to the organization’s reputation.

For example, nonprofits must adhere to IRS guidelines for maintaining tax-exempt status, including restrictions on political activities, lobbying, and unrelated business income. Additionally, nonprofits must comply with FASB standards for financial reporting, revenue recognition, and asset management to ensure transparency and accuracy in their financial statements.

Risk #2 – Misallocation of funds

One of the most significant risks in nonprofit accounting is the misallocation of funds, where resources are not used in accordance with donor restrictions, grant requirements, or organizational priorities. Misallocation can occur due to poor financial oversight, inadequate internal controls, or lack of understanding of donor intent.

For instance, if a nonprofit organization uses restricted funds designated for a specific program to cover general operating expenses, it may face legal and ethical implications, including potential lawsuits, loss of donor trust, and damage to its reputation. Nonprofits must establish robust financial management policies and procedures to ensure that funds are allocated appropriately and in alignment with organizational objectives.

Risk #3 – Financial insustainability

Maintaining financial sustainability is a constant challenge for nonprofits, particularly in the face of economic uncertainty, fluctuating revenue streams, and increasing competition for funding. Nonprofits rely on diverse sources of revenue, including individual donations, grants, sponsorships, and earned income, to support their operations and programs.

However, overreliance on a single funding source or insufficient diversification of revenue streams can pose significant risks to the organization’s financial stability.

For example, a nonprofit might depend heavily on government grants that are subject to budget cuts or changes in funding priorities. In this case, it may struggle to sustain its programs and services over the long term.

#4 – Fraud and mismanagement

Nonprofit organizations are not immune to the risk of fraud, mismanagement, and financial impropriety. Fraudulent activities, such as embezzlement, misappropriation of funds, and falsification of financial records, can undermine the organization’s credibility, erode donor trust, and jeopardize its mission.

To mitigate the risk of fraud and mismanagement, nonprofits must implement internal controls, segregation of duties, and regular financial audits to detect and prevent fraudulent activities. Moreover, fostering a culture of transparency, accountability, and ethical behavior among staff, board members, and volunteers is essential for maintaining the organization’s integrity and reputation.

How can accounting software help manage accounting for nonprofits?

As you can see, nonprofits have a lot on their accounting plates – all those distinct financial structures, reporting requirements, and operational complexities. Manual accounting doesn’t work here, and, as a nonprofit organization, you need accounting software.

Accounting software can help tackle many of these pitfalls and streamline the accounting processes for nonprofits. Here’s an integrated overview of how such software offers comprehensive solutions:

- Streamlining fund accounting

Nonprofit entities deal with various funding sources, each possessing various restrictions and reporting standards. A well-structured chart of accounts plays a key role in this process by helping categorize transactions clearly and supporting accurate financial reporting aligned with nonprofit standards. Accounting software automates fund tracking and ensures compliance, crucially supporting fund accounting by accurately recording and allocating transactions against specific funds. - Tracking restricted funds

A major challenge for nonprofits is managing restricted funds designated for specific purposes by donors. Accounting software provides tools to categorize and segregate these funds, enabling organizations to monitor their usage and ensure compliance with donor requirements. - Enhancing donor management

Managing donor information alongside financial data is critical. Accounting software aids by integrating donor databases with financial systems, improving donor relations through the automated generation of receipts and acknowledgments, and ensuring accurate reporting. - Generating accurate financial statements

Nonprofits must adhere to accounting standards like GAAP or FASB guidelines. Accounting software automates financial statement generation, ensuring accuracy, consistency, and compliance across reporting periods. - Managing grant accounting

The software simplifies grant accounting by tracking multiple funding sources, matching expenditures to specific grants, and adhering to reporting requirements. This streamlines the management of grant revenues, expenditures, and deadlines. - Handling donation and pledge management

Accounting software offers tools for recording and tracking donations, pledges, and donor information, which is crucial for maintaining donor relations, facilitating accurate reporting, and ensuring compliance. - Facilitating collaboration and transparency

By providing secure, role-based access to financial data and reports, accounting software enhances accountability, decision-making, and stakeholder trust among board members, volunteers, and donors. - Streamlining audit processes

Software streamlines audits by maintaining accurate and organized financial records, providing audit trails, and enabling easy access to documentation, ensuring transparency and compliance with regulations. - Improving budget management

Accounting software supports effective budget management by offering real-time budget monitoring and forecasting capabilities, crucial for managing limited resources and planning future budgets accurately. - Enhancing budgeting and forecasting

Tools for creating and monitoring budgets, forecasting future revenues and expenses, and analyzing variances between actual and budgeted figures help nonprofits manage their resources effectively. - Simplifying financial operations

Automating routine tasks and enhancing data security, accounting software simplifies day-to-day financial operations, allowing nonprofits to focus on mission-critical activities. - Ensuring scalability

As nonprofits grow, accounting software can scale to handle increased data volumes and adapt to new financial standards, ensuring continued compliance and efficient management.

5 nonprofit accounting software to look at

Nonprofit organizations require specialized accounting software to meet their unique financial management needs. Here are five software solutions tailored for nonprofit accounting you might want to look at as a nonprofit organization.

#1 – Synder

Synder is a comprehensive accounting solution that automates bookkeeping and finance management for small businesses and nonprofits. It offers seamless integration with various payment systems and e-commerce platforms.

Synder simplifies the tracking of donations, grants, and expenses across multiple sources, categorizing them appropriately for easy reporting. It also offers real-time financial reports and insights, helping nonprofits stay compliant and make informed decisions.

Synder offers a free trial to test its features. Pricing plans are structured into several tiers, catering to different sizes and needs of organizations, though specific nonprofit pricing requires contacting their sales team for a customized package.

#2 – QuickBooks for Nonprofits

QuickBooks is a widely recognized accounting software that offers a specific version tailored for nonprofits. It’s designed to handle accounting tasks such as tracking donations, grants, and expenses.

QuickBooks for Nonprofits provides features like fund and program tracking, donation and grant management, and financial reporting customized to nonprofit needs. It also supports budgeting and forecasting to aid in financial planning.

QuickBooks offers a 30-day free trial. While it doesn’t have a free version, it does provide various paid plans. Nonprofits might qualify for discounts through TechSoup, a service offering software solutions to nonprofits at reduced rates.

#3 – Financial Edge by Blackbaud

Financial Edge NXT is a cloud-based accounting software developed by Blackbaud, specifically designed for the unique needs of nonprofit organizations, offering sophisticated fund accounting, grant management, and reporting capabilities.

This solution excels in handling complex nonprofit financial requirements, including fund accounting, grant and endowment management, and financial transparency. It offers advanced reporting tools for accurately tracking and reporting on financial data.

Blackbaud does not publicly list Financial Edge NXT’s pricing, requiring potential users to contact them for a customized quote. Information regarding a free trial is not typically available, as Blackbaud prefers to provide personalized demos.

#4 – FastFund Accounting

FastFund Accounting is designed by Araize specifically for nonprofit organizations. It’s a comprehensive system that combines fund accounting, fundraising, and payroll solutions in one platform.

FastFund Accounting offers true fund accounting capabilities, enabling nonprofits to track and report on different funds and grants. It supports budget management, financial reporting, and compliance with nonprofit accounting standards.

FastFund Accounting offers a free trial for its software. Its pricing structure includes several tiers, based on the number of users and the functionalities needed, with both monthly and annual subscription options available.

#5 – Aplos

Aplos is specialized accounting software designed for nonprofits and churches, focusing on fund accounting, donations management, and financial reporting.

Aplos provides robust fund accounting features, allowing for easy tracking and management of designated funds, donations, and grants. It offers detailed financial reporting, budgeting tools, and donation tracking to simplify financial management for nonprofits.

Aplos offers a 15-day free trial to explore its features. The pricing is structured into various tiers, depending on the size of the organization and the range of functionalities required, with monthly and annual billing options.

As you can see, each solution offers features and pricing structures tailored to the nonprofit sector, ensuring that organizations can find a software solution that best fits their specific accounting needs and budget constraints.

It’s not the full list of options available on the market. It only proves that nonprofit organizations have the flexibility to choose software that can address their particular needs.

Bottom line

As you can see, nonprofit accounting comes with its characteristic nuances and challenges, just like bookkeeping for e-commerce or accounting for SaaS, etc., that accounting software should address. The distinct financial management and reporting practices specific to nonprofit organizations, such as fund accounting and the critical emphasis on transparency and accountability, necessitate specialized tools. Tailored accounting software not only simplifies these complex processes but also ensures compliance with regulatory standards and effective handling of donations, grants, and expenses, which are pivotal for maintaining trust and driving mission-focused outcomes.

Choosing the right accounting software is crucial for the operational efficiency and sustainability of nonprofit organizations. By providing functionalities that automate fund tracking, enhance donor management, and facilitate accurate financial reporting, such software solutions help nonprofits navigate their unique challenges. This support not only aids in upholding principles of sustainability and integrity but also empowers organizations to optimize their financial management practices. As a result, they are better equipped to serve their communities effectively, demonstrating the significant impact well-chosen accounting software can have on the nonprofit sector.

Continue reading: All you need to know about inventory management database.

Share your thoughts

Are you a non-profit organization? What accounting software do you use, and whay do you like it? Please, share your thoughts in the comments!