Are you having trouble managing retail inventory costs and keeping your business running smoothly? Learning and using the right retail accounting techniques may be the solution you need.

While you can handle many of these tasks yourself, some aspects of retail accounting require a qualified specialist, so you may want to delegate them to a professional. As a business owner, you need to at least know the basics of retail accounting to navigate it. It’s time to start learning if you want to take charge of your finances!

Key takeaways:

- Retail accounting is very important as it helps control the main costs of inventory and gives information about sales and purchases of the goods.

- Retailers have several methods to manage inventory costs, including the weighted average, FIFO (First In, First Out), and LIFO (Last In, First Out).

- Good inventory management is supported by accounting software that automates the tracking of goods.

What is retail accounting?

In simple terms, retail accounting involves calculating the cost of inventory in relation to its selling price.

More specifically, in retail accounting, you’ve got to value all of your inventory at retail value and then subtract your sales to estimate your remaining inventory. This will also help you determine the markup on your items, which can be used to calculate how much inventory you have left after the sale.

Retail accounting helps you track inventory. You can do it manually, but it will be very time consuming, or it can be done using specialized software, making it easier to identify loss, damage, or theft.

Methods to account for inventory costs

Since inventory is a critical retail component, choosing an inventory costing method that fits your business and the items you sell is important. There are 3 main ways how retailers can track inventory and calculate inventory costs:

- Weighted average method;

- First in, First out (FIFO);

- Last in, Last out (LIFO);

Let’s discover each method and see how they may be used:

Weighted average method

The weighted average method for valuing inventory is often used for items like hardware supplies, where individual items have different purchase prices but are hard to track separately.

Want an example? Imagine a bin of screws. Some were bought for $0.05 each, while others cost $0.08 per item. Tracking the price of each screw individually is tough. So, the retailer figures out the average cost and applies it to all the screws in stock. This way, retailers greatly simplify the way they track items, saving loads of valuable time in the process.

First in, first out (FIFO) accounting method

First-in, first-out is a method used to count ending inventory costs that focus on cost flow. The FIFO accounting method assumes that the inventory purchase costs will also be recognized first and the value of your total inventory will decrease. The FIFO method is especially useful for perishable items and is popular among food retailers because of its practical advantages.

Here’s an example of how inventory costs are counted using the FIFO accounting method:

If 50 apples were originally purchased for $5, and then another 50 apples were purchased (or produced) for a total cost of $7.50, FIFO would assign a price of $5 to the first resold item. After selling 50 apples, the new cost of the fruit will be $7.5, since it’s assumed that the oldest item is sold first. By using FIFO, retailers can streamline the sales process and avoid wastage of items that perish quickly.

Last in, first out (LIFO) accounting method

The LIFO (Last In, First Out) accounting method considers the last items purchased as the first ones sold, making it the opposite of the FIFO (First In, First Out) method. Therefore, the cost of sales is determined by the price of items purchased most recently.

Let’s get back to the example above:

If retailers sell 50 pens that were initially purchased for $5, and then another 50 pens are purchased for $7.50, the LIFO method would assign a value of $7.50 to the original items sold. This retail accounting strategy will be the best option for start-up organizations, offering a new approach to inventory management and cost estimation.

Retail inventory method

The retail method works well when there’s a clear relationship between wholesale purchasing prices and retail selling prices.

For example, if a grocery store consistently marks up items by 50% of the wholesale price, this method is effective. However, if the markup percentage varies greatly, such as 10%, 25% or 40%, then it’s more difficult to use the retail method accurately.

The retail method calculates the value of ending inventory by adding beginning inventory and any new purchases. Total sales are then subtracted from this amount. The difference is then multiplied by the cost to retail price ratio, which tells you what percentage of the retail price is the cost.

For instance, if a pair of shoes costs $40 to manufacture and retailers sell them for $100 each, the cost-to-retail ratio is 40% (or $40/$100) when expressed as a percentage.

How does retail accounting work?

The retail method of accounting is a key method that allows retailers to avoid taking physical inventories and determine the value of their inventory, potentially improving their accounting practices over time. Let’s look at how this works.

For instance, you have a jewelry retail business. Every product, be it fasteners or a set of decorative stones, carries a constant 50% markup. At the beginning of the quarter, you restated your inventory, valued at its original cost of $100,000.

During the quarter, your sales recorded through our point of sale system reached $40,000. In addition, during this period you invested US$15,000 in replenishing your stock of fixtures and accessories.

Want to know your numbers? Let’s count:

Starting inventory (cost basis): $100,000

Additional inventory acquired (cost basis): $15,000

Total inventory available for sale (cost basis): $115,000

Quarterly sales (retail price): $40,000

Now, let’s count, but remember, to add your numbers in this formula:

$40,000 * 50% = $20,000

Here you’ll also need to add your numbers, as it’s just an example:

$115,000 – $20,000 = $95,000

How do I keep track of the inventory on hand?

Unlike inventory costing, tracking inventory on hand is relatively easy. Essentially, the goal is to keep track of the amount of inventory you have in stock at any given time. This information is vital from the retail accounting perspective as it will provide you with accurate cost and forecast information.

Keeping accurate inventory records will also help save time while preparing your tax statements.

Unless you prefer to calculate inventory manually, the best way to track the inventory in stock is with the perpetual method. This method allows you to keep track of the items you sell as changes occur with a fully integrated point-of-sale (POS) system.

If you sell online using PayPal, Stripe, or Square, you might not need a separate POS. Instead, you can set up a smart auto-tracker in the background to instantly enter all changes into your ecommerce accounting software after a sale.

If you sell offline, you’ll have to acquire a POS system where each item will be assigned a barcode. When the item is sold and you scan its barcode, the numbers in your inventory will update automatically.

💡 You’re on your way to mastering retail accounting. Continue your journey by learning how to account for sales transactions and track COGS efficiently.

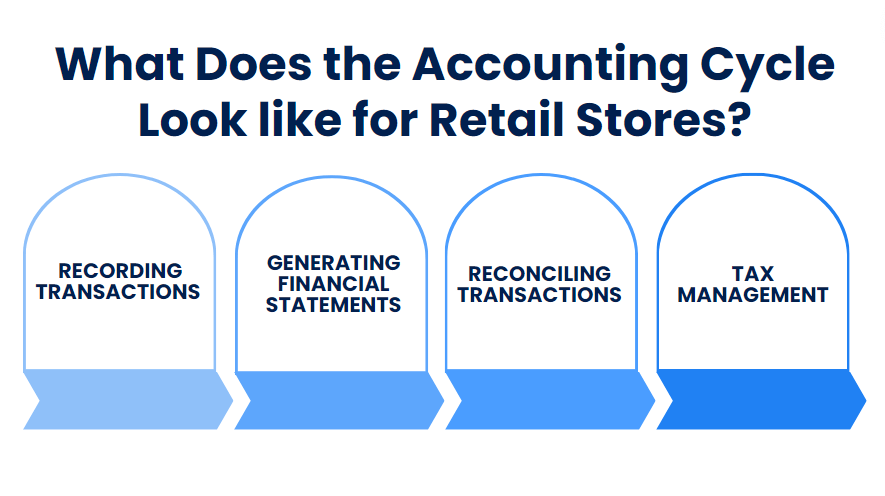

What does the accounting cycle look like for retail stores?

Once you’ve chosen an inventory costing method and set up a smart system to keep track of inventory on hand, it’s time to focus on fine-tuning the accounting cycle. For retail stores, the accounting cycle consists of the following milestones:

1. Recording transactions

Recording all income and expense transactions accurately is essential for accounting. This means keeping detailed records of sales, invoices, payments, refunds, and other transactions. You should track information like customer names, amounts, discounts, products sold, taxes, payment methods, and subscription details if relevant. Using an automated accounting system can make this process more precise and manageable.

2. Generating financial statements

As you move through the retail accounting cycle, there are three financial statements you’ll want to look at — income statement, balance sheet, and cash flow statement. These financial statements provide crucial information that will help you make important business decisions.

3. Reconciling transactions

The final step in the accounting cycle for a retail store is balancing the books. This step is usually performed monthly and helps to reconcile your records with the actual balance on your business accounts. During reconciliation, if any discrepancies, errors, or unauthorized expenses are found, you should make the appropriate adjustments and mark them in your general ledger.

4. Tax management

Efficient tax management is imperative for retail businesses to meet their tax obligations and optimize tax liabilities. This includes accurately calculating taxes, preparing tax returns, and ensuring compliance with tax regulations. Accounting automation tools play a key role in tax management by automating calculations, generating necessary tax reports, and providing timely reminders for tax deadlines.

How can Synder help automate my retail accounting?

Managing accounting in retail business can be quite time-consuming. Automated accounting software like Synder will be of great help for you and your accountant, plus, it will save you a lot of time. You can face a lot of challenges, but Synder will help you cope with them. With Synder, you’ll get:

1. Automated data sync

Synder lets you automatically synchronize multichannel data into accounting platforms like QuickBooks Online, QuickBooks Desktop, Sage Intacct, and Xero. You can choose to sync this data either as daily journal entries or in detailed transactions.

Synder simplifies the process of recording transactions, ensuring that each transaction is accurately logged with details about the cost, client, and product. It synchronizes transactions and imports comprehensive data, including taxes, product details, and customer information.

3. Accurate tax calculating

Synder simplifies sales tax calculations for ecommerce businesses by leveraging transaction data from all your sales channels like Shopify and Amazon, as well as integrated payment processors like Stripe, Square, and PayPal. It calculates taxes based on total sales and specific tax rates, then matches those calculations with tax codes in your linked QuickBooks, Xero or Sage Intacct accounts.

4. Automated reconciliation

Synder simplifies the reconciliation process, making sure all your financial data matches up correctly. You won’t need to check every detail for errors. Synder automates these tasks, making your workflow more efficient.

5. Detailed Profit & Loss report

When it comes to P&L reporting, Synder gathers transactions in great detail—from payment processing fees to extensive customer and product data like names, locations, and SKUs. This detailed collection contributes to the precision of the P&L reports, making them highly informative.

Synder provides you with the tools to manage your own accounting and helps simplify the entire retail accounting process. By automatically generating accurate P&Ls, reconciliation, and routine tasks, you have all the necessary information to make important business decisions in minutes.

Try Synder’s free trial to see how it can improve your business accounting, and join our informative Weekly Public Demo for additional insights and advice.

Retail vs. cost accounting

Cost accounting method is another method that retail stores can use, but it’s slightly different from retail accounting and has its own advantages. While retail accounting tracks inventory based on sales price, cost accounting tracks each item based on its total acquisition cost. Cost accounting is often more complex because it involves tracking factors such as shipping, manufacturing, overhead, and development costs.

Although cost accounting method can provide better accuracy, it usually requires more complex calculations. The main advantage of retail accounting is how easily it sets inventory prices to match what customers pay. However, cost accounting can be challenging because it involves many factors that store owners can’t control.

Advantages and disadvantages of retail accounting

Advantages of retail accounting

The benefits of retail accounting are many, but here are the top 3 we think you should know:

- Simplified inventory management

Retail inventory removes the need for manual counting, which is great for different retail stores.

- Easy estimation

Store owners can estimate current inventory based on sales figures, making it simpler, particularly for stores with large inventories.

- Tax advantages

Methods like FIFO, LIFO, or weighted average can offer tax advantages. Variances in inventory or sales volumes from these methods may be deductible, providing potential tax benefits.

Disadvantages of retail accounting

Despite all the pros, there are always some cons. Even if they aren’t so critical, it’s important to mention them:

- Lack of accuracy in some cases

Retail accounting may give wrong results if you sell items with vastly different prices, as the methods may not reflect the true inventory value.

- Inconsistency and estimation

The system may be inconsistent and only provide estimates. While it saves time by avoiding manual counting, retail accounting may offer less precise numbers compared to manual methods. Also, since it’s an estimate, it’s hard to give an exact figure using this technique.

Conclusion

Now, let’s review what we’ve said about retail accounting. First of all, it’s important for running a retail business effectively. Knowing different methods for tracking inventory costs and managing sales can improve workflow and help salespeople tackle a variety of tasks. Second, it allows accountants to spend less time on routine tasks and more time analyzing problems and advising on business growth.

What’s more, the advantages of retail accounting, such as easier inventory tracking, direct assessment of inventory levels based on sales data, and potential tax advantages through methods such as FIFO, help maintain financial health. This frees up more time to develop your business.

FAQs

What is the FIFO accounting method?

FIFO, which stands for “First-In, First-Out,” is a retail accounting method based on the assumption that the oldest items in your inventory are the first to be sold. This method is frequently employed by retail businesses dealing with time-sensitive products, like trendy fashion items or perishable goods typically found in convenience stores.

What does an accountant do in a retail store?

Accountants in a retail store can offer inventory management systems that help track stock levels, analyze sales trends, and prompt timely restocking to maintain smooth operations.

What is the accounting formula for inventory?

The formula for determining ending inventory is straightforward:

Beginning Inventory + Net Purchases – Cost of Goods Sold (COGS) = Ending Inventory.

Beginning inventory refers to the inventory at the end of the previous period. Net purchases include the items purchased and added to your inventory count during the current period.

What inventory method do retail stores use?

Some common methods for valuing and counting inventory are First In, First Out (FIFO); Last In, First Out (LIFO); and Weighted Average Cost.

Share your thoughts

How do you manage inventory and accounting in your retail store? Are there any specific challenges you’ve encountered with the methods discussed, such as FIFO, LIFO, or the weighted average method? Share your thoughts with us!

Hi there I am so excited I found your site, I really

found you by accident, while I was researching on Google for something

else, Regardless I am here now and would just like to say cheers for a incredible post and a all round thrilling blog (I also love the theme/design), I

don’t have time to go through it all at the minute but

I have book-marked it and also added in your RSS feeds, so

when I have time I will be back to read a great deal more, Please do keep up the fantastic work.

Thanks for the interesting article. Apart from accounting, you can do a lot more analysis in a store, like competitive analysis. You can succeed or stay caught up in the market. It’s up to you.