What are the steps necessary to reconcile a bank statement? Why is it important to reconcile your bank statements? Find the answers in this helpful article!

Overview:

Reconciliation process by Synder

In this guide, you can find out how to reconcile Square in QuickBooks with the help of Synder.

Our customers who process Square accounting have found that the most accurate way to record all Square sales, fees, and refunds is to sync everything into a Square (required for Synder) account in QuickBooks Chart of Accounts and enable payouts processing for reconciliation ready matches between Square payouts and withdrawals made to your checking. So you basically reconcile Square deposits on your Checking account with the help of Square QuickBooks Online integration.

Customizing Your Synder Settings

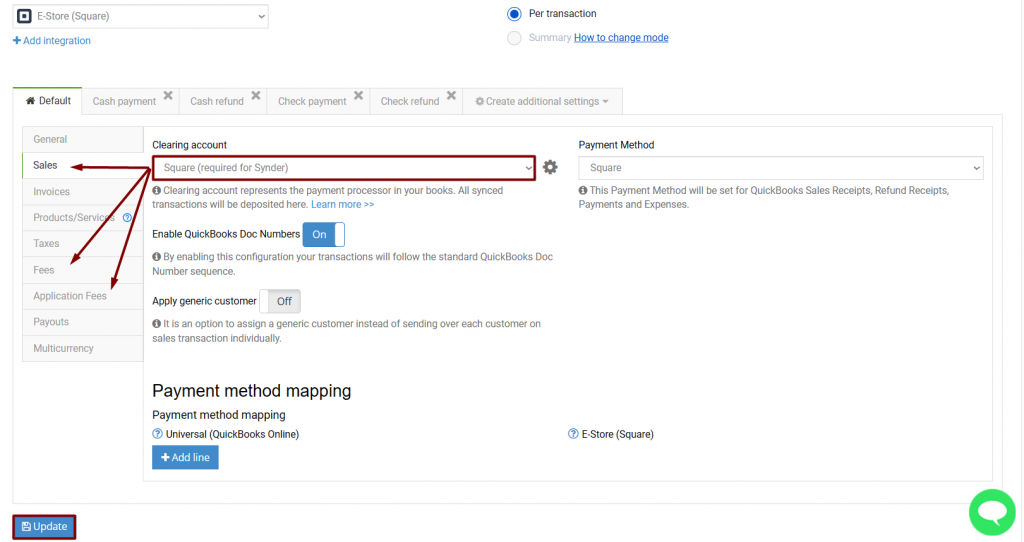

First, go to Settings in Synder and select Square in the Integration dropdown to make sure all the accounts are selected correctly.

Make sure you have the clearing (Square (required for Synder) account) account selected as a Clearing account in the Sales, Fees and Application fees tabs.

In case you don’t have an account with “Square” in it, the system will auto-create it. Check your Synder settings to make sure you have that account selected as Bank account in Sales, Fees and Application fees.

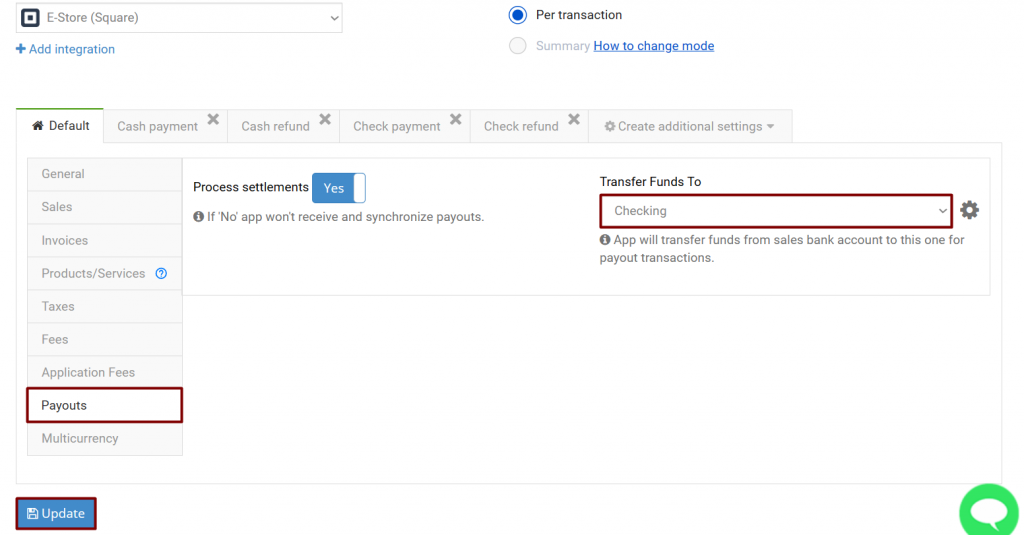

Enable the payouts feature and select your Checking account into which you deposit actual funds from Square in Transfer Funds To in order to automate the matching process to reconcile.

Synchronize Square transactions with QuickBooks automatically or turn on the manual mode.

NB!: this will work for newly appearing transactions, historical ones are to be synchronized manually if that is needed. See how to import historical transactions into your accounting platform to reconcile in your accounting company.

How to reconcile in QuickBooks

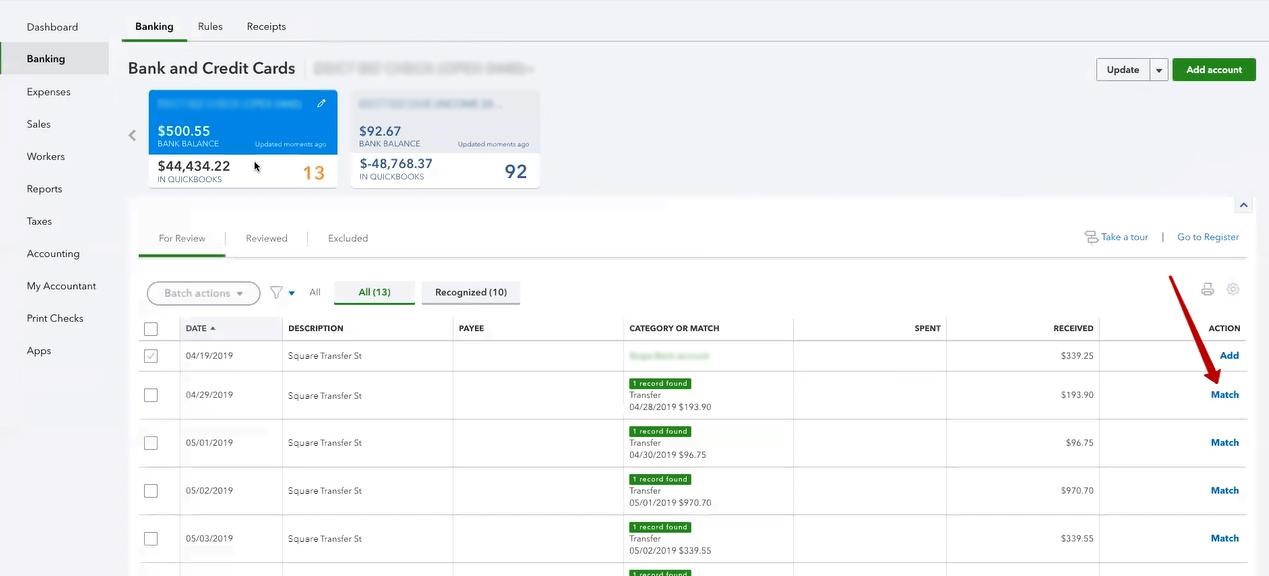

Open For Review list in QuickBooks Banking and click on match next to Square withdrawals.

*Keep in mind that according to the way you set up your Square, in most cases real funds from Square are transferred to your checking reconcile account 3–7 days after the actual payment took place.

Congratulations! You have successfully pulled in all Square data and can easily reconcile your checking account now avoiding manual data entry and having recorded all sales, fees, expenses, and refunds. Reconcile your account with Synder in one click!

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!

Do people typically reconcile their Square Bank account in Quickbooks? If so, what is an easy way to see the running balance in Synder so I can reconcile?

Hello Zech! Yes, in most cases, our customers reconcile their Square Bank account in QuickBooks. To check the running balance on Synder’s side, please navigate to the Reporting tab, select Balance Sheet, choose the date you want to review the balance for, and click on Run. For more details and to check which transactions are included in the report, it’s better to run a report directly in QuickBooks. I hope this helps!