With your company and accounts connected, you can start customizing the Stripe–QuickBooks Online integration settings. These settings determine how QuickBooks Online records transactions, invoices, fees, expenses, and payouts.

Stripe settings are organized in the following sections:

Plan availability:

- * Available from the Essential plan and higher

- ** Premium feature available only on Pro and Premium plans

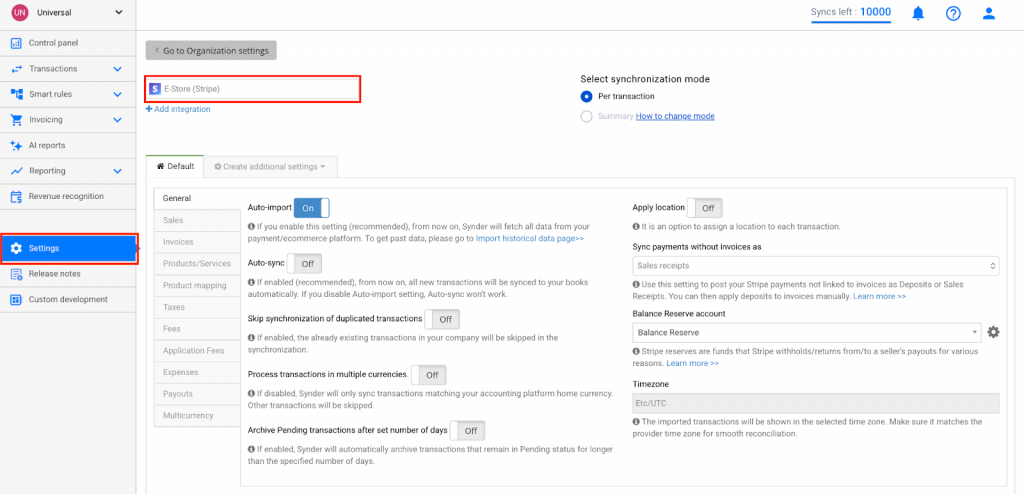

How to Access Stripe Settings

To access your Stripe settings in Synder:

Option 1: From the main menu

- Select the appropriate organization from the top-left corner

- Click Settings in the left-hand menu

- Choose Stripe from the dropdown list

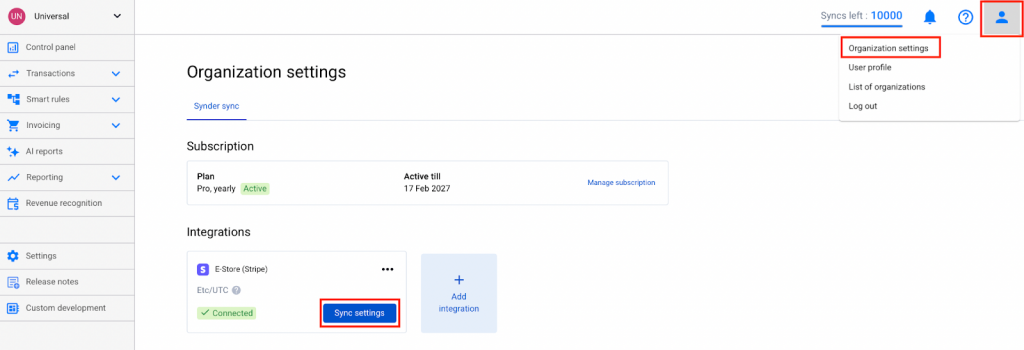

Option 2: From Organization Settings

- Click the person icon in the upper-right corner

- Select Organization settings

- Click Sync settings under Stripe

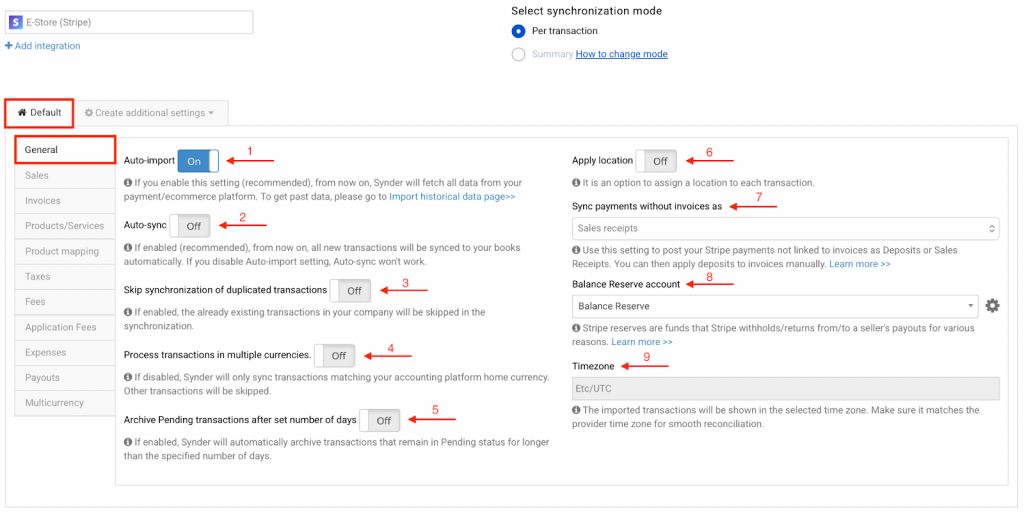

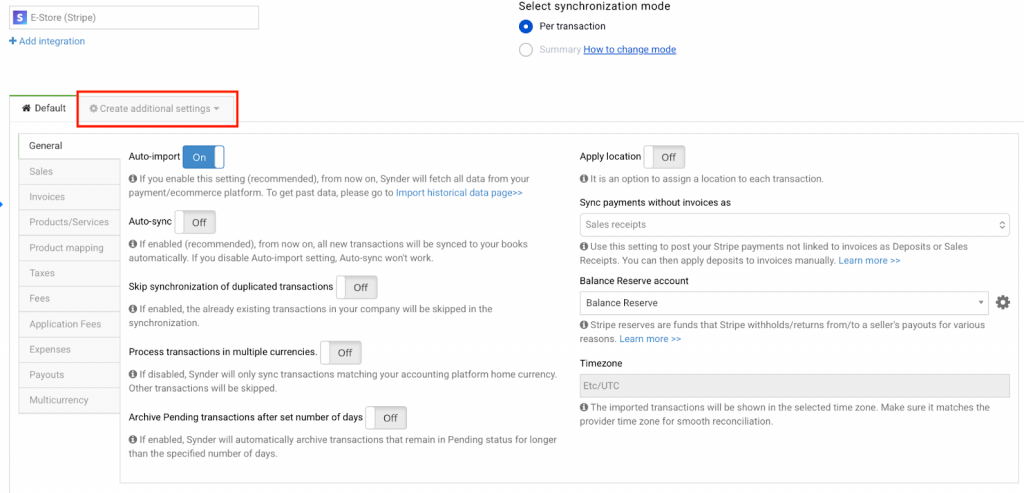

1. General settings

- Auto-Import – When ON, Synder automatically imports transactions from your Stripe integration without affecting your sync balance or syncing them to QuickBooks Online. When OFF, import transactions manually.

- Auto-sync – When ON, Synder automatically syncs transactions after import. When OFF, select transactions to sync manually.

- Skip synchronization for duplicated transactions * – When enabled, Synder skips transactions that already exist in QuickBooks, preventing duplicates.

- Process transactions in multiple currencies – When enabled, Synder syncs all transactions regardless of currency. When disabled, Synder syncs only transactions in your home currency.

- Automatically Archive Pending Transactions – When enabled, Synder automatically removes pending Stripe transactions that were never finalized, keeping your Synder dashboard clean. To manually archive a transaction, go to the Platform Transaction tab, locate the transaction, click the three dots next to it, and select Archive.

- Apply location ** – When ON, select a QuickBooks Online location to assign to synced transactions.

- Sync payments without invoices as Sales Receipts or Deposits *– Choose whether payments without invoices are synced as Sales Receipts or as Deposits. For more details, see the guide Syncing Stripe Payments as Deposits/Overpayments in Synder.

- Balance reserve account – Select a liability account in QuickBooks Online to record Stripe reserves before release.

- Timezone – Displays your Stripe account’s timezone to help match dates between Stripe and QuickBooks Online.

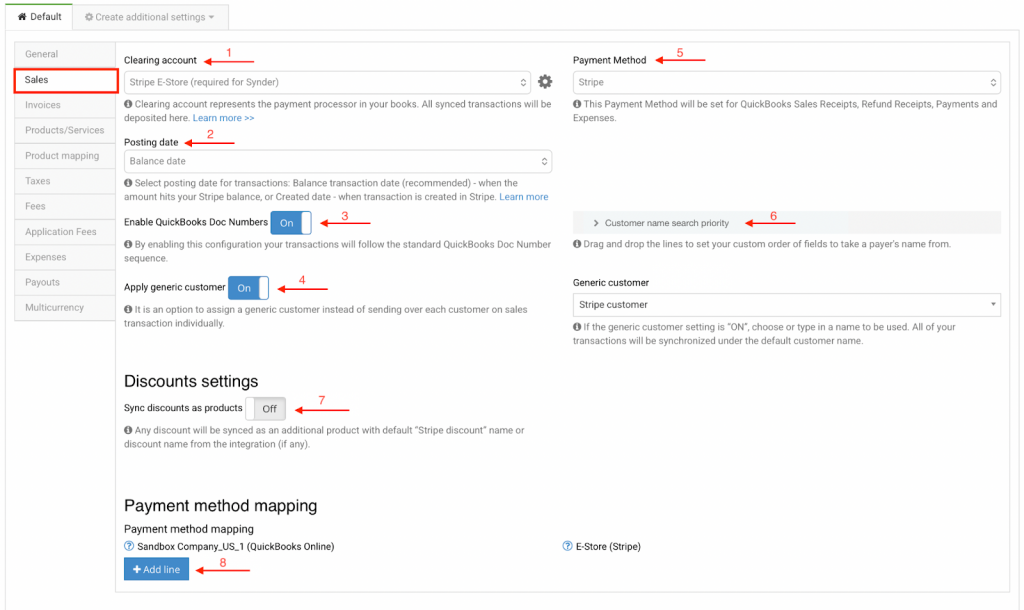

2. Sales

- Clearing account – A temporary holding account where sales receipts, refund receipts, and payments are deposited before being cleared out by your payout.

- Posting date – Choose the source of the accounting document date: either the creation date or the balance date of the sales transaction. For more details, see the guide Stripe Posting Date Setting.

- Enable QuickBooks Doc Numbers – When ON, transactions follow the standard QuickBooks document numbering sequence. When OFF, Synder assigns the DocNumber using the number from your payment processor.

- Apply generic customer * – When enabled, Synder assigns a generic customer name to all transactions to keep your QuickBooks Online customer list organized. Choose or enter a default name (for example, “Stripe Customer”) to apply to all transactions.

- Payment Method – Select the default payment method (Cash, Check, Credit Card, or Stripe) used for sales receipts, refund receipts, payments, and expenses.

- Customer Name Search Priority* – Choose which field Synder checks first to get the customer name. See our guide for more details Customer Name search priority.

- Sync discounts as products ** – Sync discounts as separate products (for example, “Stripe Discount”) for detailed tracking.

- Payment method mapping* – Synder retrieves the payment method used in Stripe and includes it in the transaction description. You can use this information to map the payment method in QuickBooks Online.

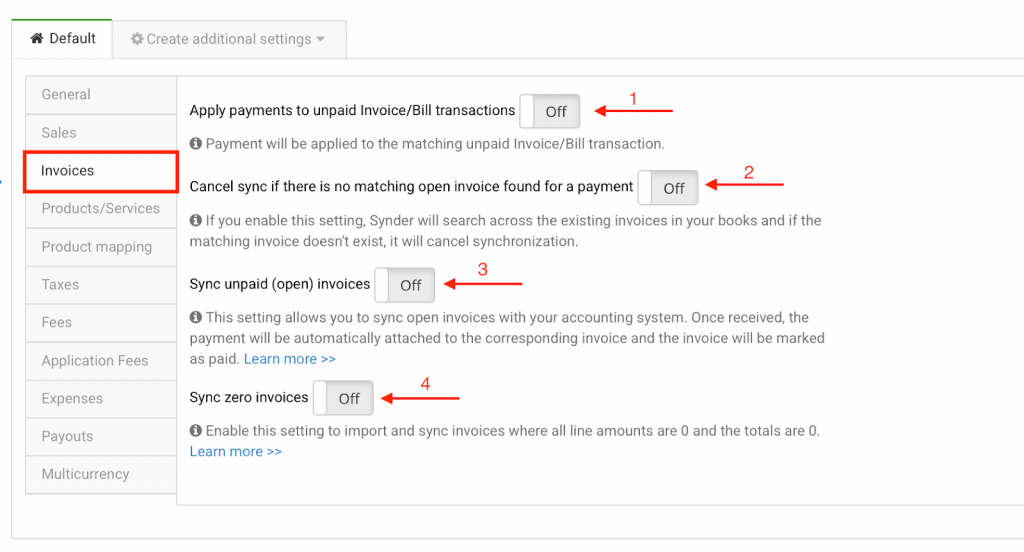

3. Invoices

- Apply payments to unpaid Invoice/Bill transactions * – When enabled, Synder automatically applies payments that match unpaid invoices or bills, ensuring they are closed correctly.

- Cancel sync if there is no matching open invoice found for a payment* – If a payment doesn’t match any open invoice, it won’t sync, preventing incorrect entries.

- Sync unpaid (open) invoices * – When enabled, Synder syncs open invoices with QuickBooks Online. Incoming payments are automatically applied to the correct invoice and marked as paid in your books when Apply payments to unpaid invoices is enabled.

- Sync zero invoices* – When enabled, invoices with zero line amounts or total amounts are imported and synced.

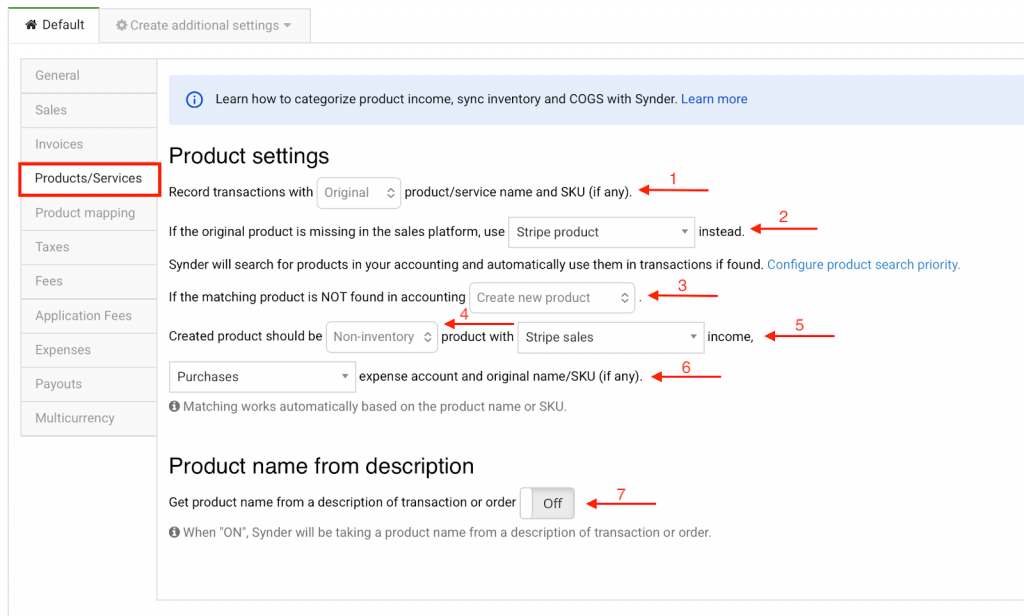

4. Products and Services

- Record transactions with Original/Common product/service name and SKU – Choose whether Synder records transactions using the original product name or a common product name. Synder matches original names to existing products by name or SKU, or creates a new product if a match is not found. Common product names help standardize future transactions.

- If original product is missing – If the original product is missing in the sales platform, Synder will use the item or SKU. Configure product search priority – Allows you to define whether Synder searches by SKU or product name first when matching products between Stripe and QuickBooks Online. See our guide for more details Product Search Priority.

- If the matching product is not found,* – If the matching product doesn’t exist in QuickBooks Online, Synder either creates a new product or cancels the transaction sync.

- Assign product type – Select the product type for newly created items: Non-inventory, Inventory, or Service. See more details about inventory below.

- Assign income account – Select the income account that will be used for this product.

- Assign expense account – Select the expense account that will be used for this product.

- Get product name from transaction or order description – When enabled, Synder pulls the product name from the transaction or order description, such as Stripe charge details, ensuring accurate product mapping.

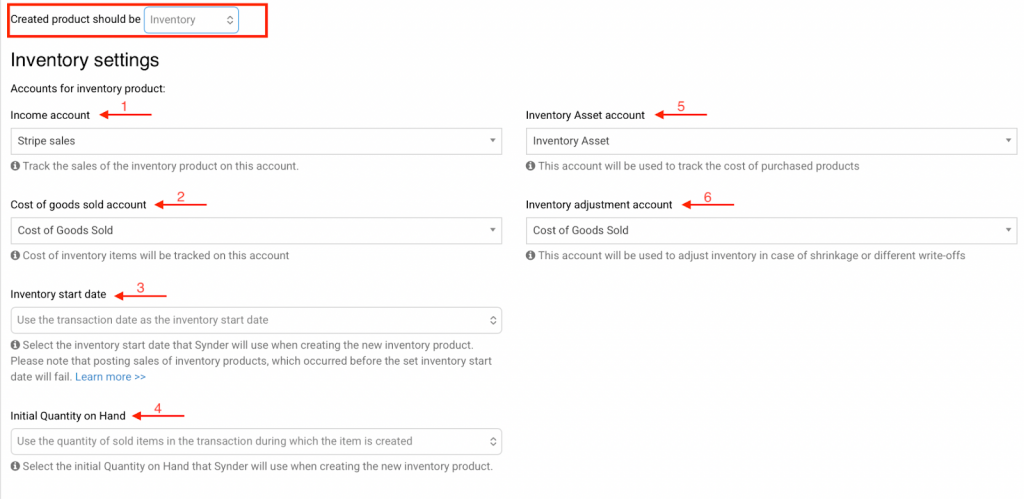

Synder supports inventory tracking, but inventory items must already exist in QuickBooks Online, and their names must exactly match the names in your payment processor. Synder cannot create inventory items because QuickBooks requires a Quantity on Hand (starting stock level), which Synder cannot access. Existing inventory items will sync correctly, and QuickBooks will automatically update their stock levels. See our guide for more details Managing Products and Services with Synder – Per Transaction Sync.

- Select an income account to track sales for the inventory product.

- Select a Cost of Goods Sold account to track the cost for the inventory product.

- Select the inventory start date that Synder will use when creating the new inventory product. Please note that posting sales of inventory products, which occurred before the set inventory start date, will fail.

- Select the initial Quantity on Hand that Synder will use when creating the new inventory product.

- Select an inventory Asset account to track the cost of purchased products.

- Select an inventory adjustment account to track shrinkage or different write-offs.

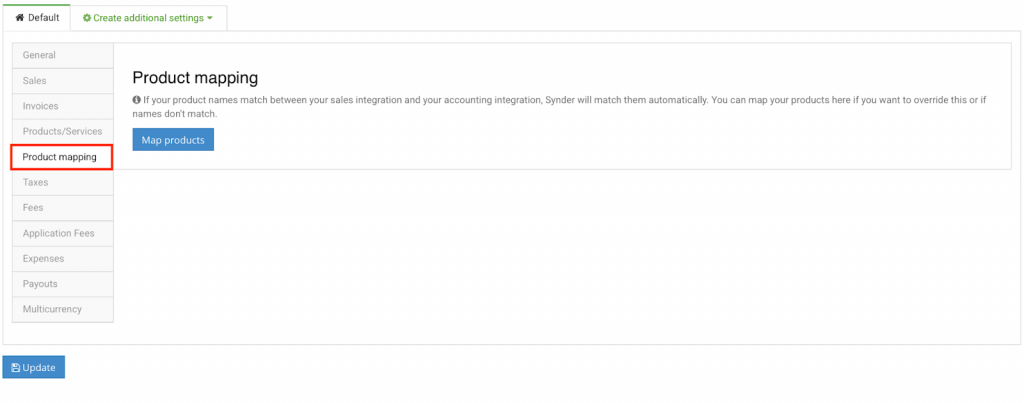

5. Product mapping *

Synder can identify existing products in your accounting company and apply them to transactions. If product names in your payment system and accounting company don’t match 100%, fill in the product names from your payment platform in the right field to map them to product names from your QuickBooks Online in the left field. Check out an additional guide about Product mapping feature.

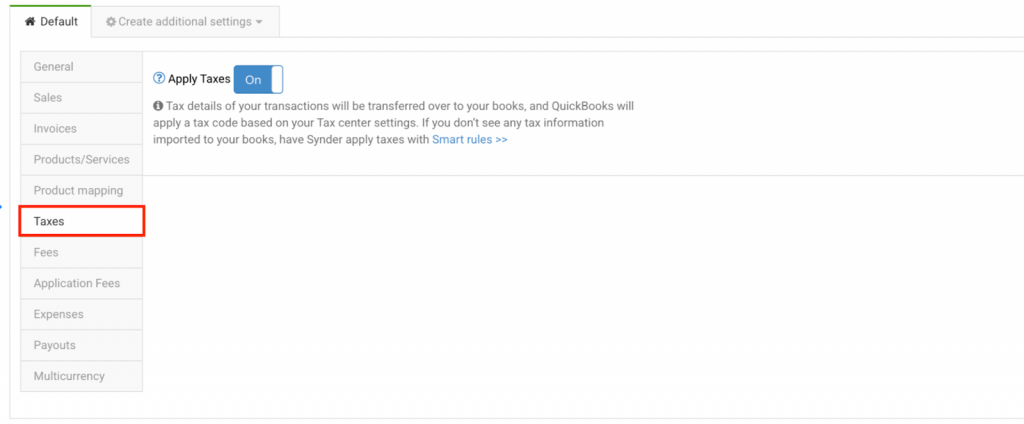

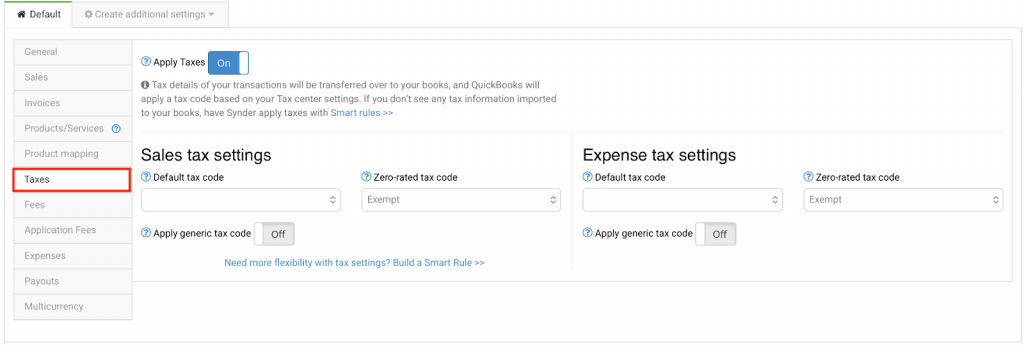

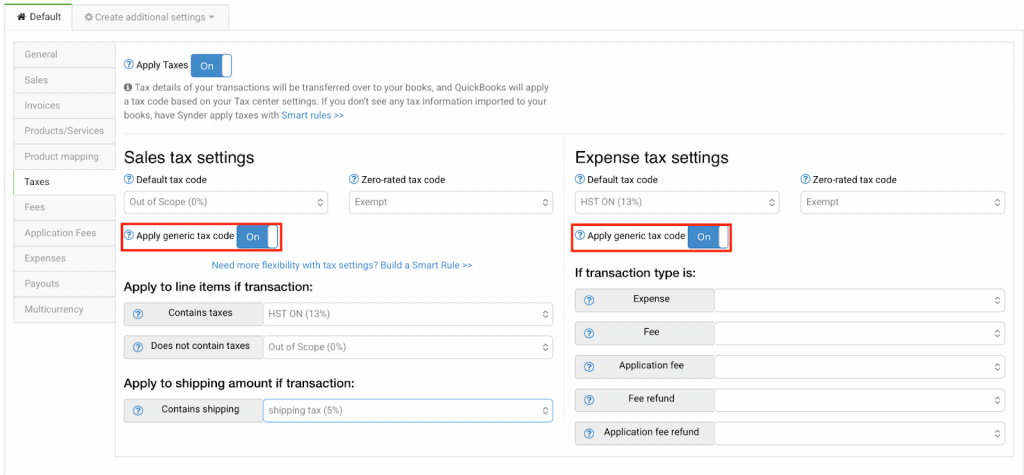

6. Taxes tab settings

Sales taxes settings for US-based QuickBooks Online companies

Most QuickBooks Online users in the U.S. use Automated Sales Tax, which allows QuickBooks Online to apply sales tax automatically based on the sale or company address. QuickBooks Online calculates the tax rate automatically.

To have Synder record taxes in the tax field for accurate reporting, enable this setting as shown below. If you prefer the tax to be recorded as a line item, leave this feature disabled.

Sales taxes settings for Non-US-based QuickBooks companies

When your payment processor calculates taxes, Synder automatically records them in QuickBooks Online. If your payment processor (such as Stripe, Square, or PayPal) does not calculate taxes, use Synder tax settings to apply and record taxes in QuickBooks Online. Check out more about How sales tax works in Synder.

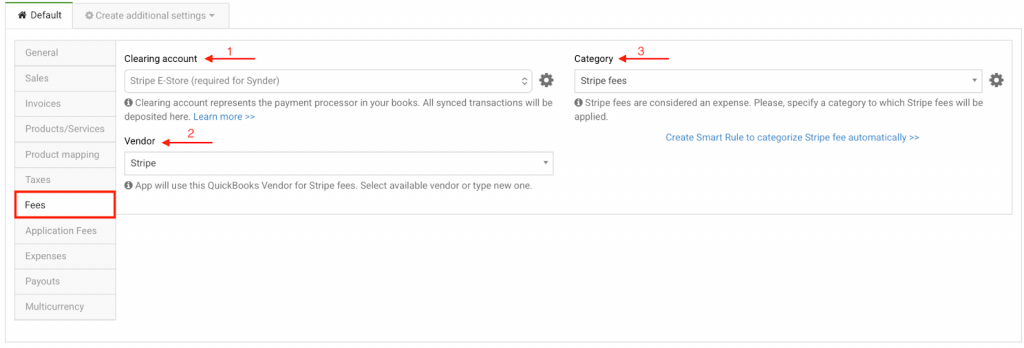

7. Fees

- Clearing account – Select the clearing account where Stripe fees are recorded. Use the same account as the Sales clearing account to keep all related transactions consistent.

- Vendor – Select a QuickBooks Online vendor to assign Stripe fees. Choose an existing vendor or enter a custom name to group all Stripe fees under one vendor.

- Category – Select the expense category in QuickBooks Online for Stripe fees to track and report processing costs accurately.

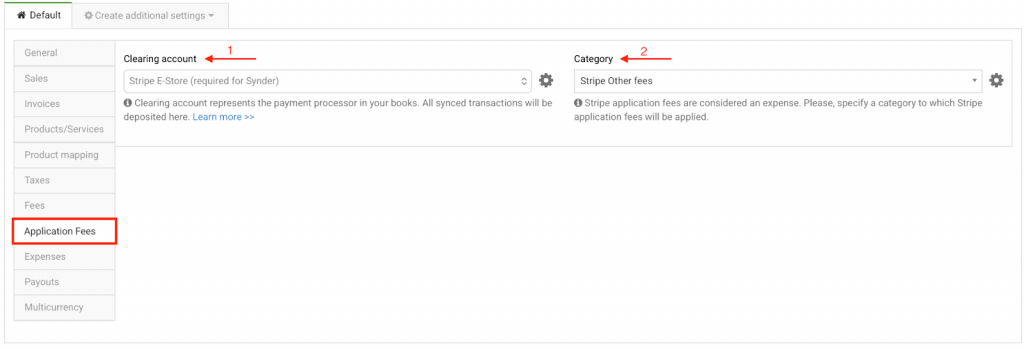

8. Application Fees

Application fees are expenses for your customers when they use a third-party app to pay on your platform. For example, if you process a $40 payment through Stripe and a third-party app charges a 0.5% fee ($0.20), and Stripe takes its fee (e.g., $1.46), the net amount is $38.34.

- Clearing account – Select the clearing account where application fees are recorded. Use the same account as the Sales clearing account to keep records consistent.

- Category – Select the expense category in QuickBooks Online for application fees to track and report platform-related charges accurately.

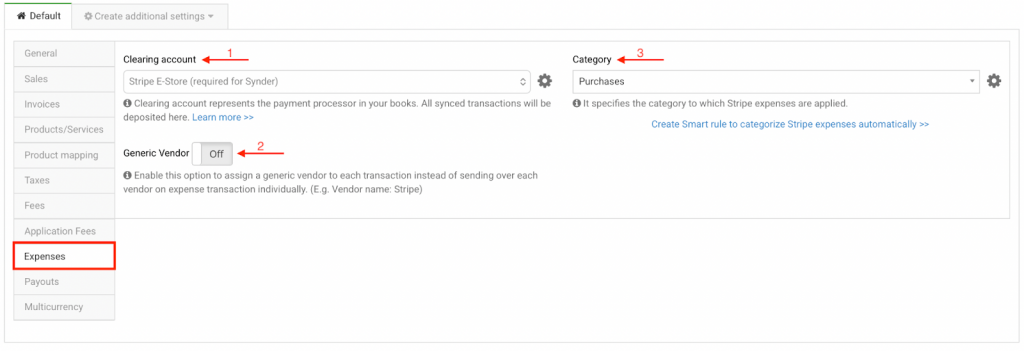

9. Expenses

- Clearing account – Allows the selection of the clearing account where expenses are recorded in your books. Use the same account as the Sales clearing account to keep your records consistent.

- Generic Vendor – When ON, all expenses are assigned to a default vendor instead of creating a new vendor for each transaction. Choose an existing vendor or enter a custom name.

- Category – Select the expense category in QuickBooks for these transactions to track and report expenses accurately.

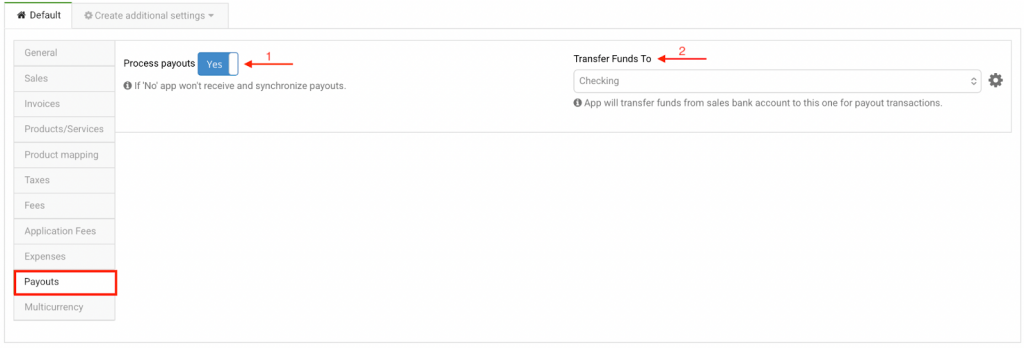

10. Payouts

The Payouts tab tracks Stripe payouts—bulk transfers from your payment processor to your bank (daily, weekly, monthly, etc.). Synder records these as transfers from the clearing account to your checking account. Syncing payouts with sales and expenses helps reflect actual cash flow and simplifies reconciliation.

- Process payouts – When enabled, Synder tracks Stripe payouts and creates transfers to your checking account. When deactivated, payouts are not synced to your books, and the clearing account won’t be cleared automatically by payouts.

- Transfer Funds To – Select the QuickBooks Online checking account where the Stripe payouts are deposited.

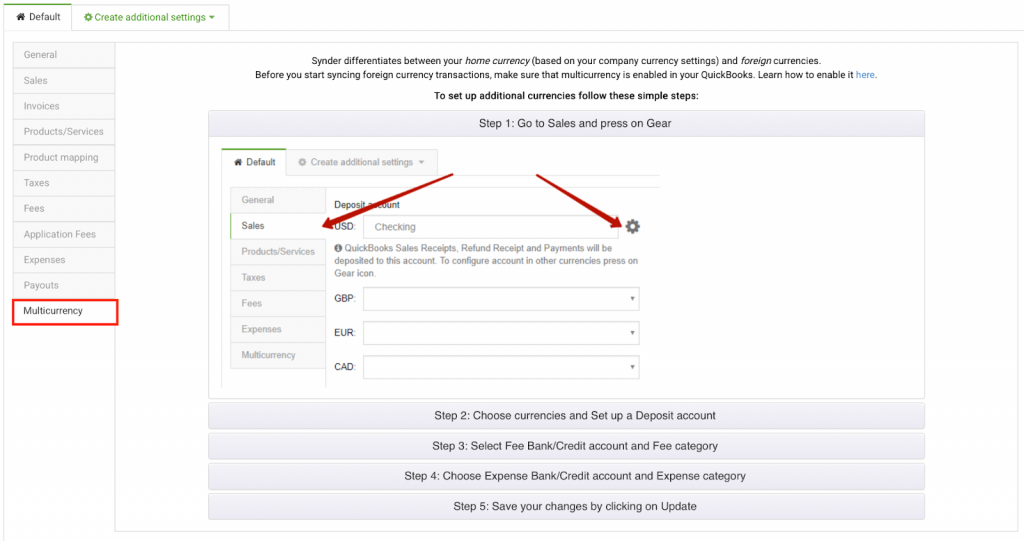

11. Multicurrency

Synder supports multicurrency. While Synder doesn’t perform currency conversions itself, it transfers conversion rates from your payment processor to QuickBooks Online to avoid discrepancies. Conversion rates can differ between QuickBooks Online and Stripe on the same day, so recording the rate from the source is important.

Note: If the conversion rate is not available from the integration, we will use the rates available on the accounting software

Set up your accounts to reflect real-world money flow—for example, use separate checking accounts if payouts are in different currencies. Typically, payouts are in a single currency, while sales can occur in multiple currencies.

You can find how to customize Multiple Currencies here in the Multicurrency tab. Check how to Synchronize Multicurrency Transactions in QuickBooks Correctly.

Additional Settings

Use “Create additional settings” only if you need to treat some transaction types differently. In most cases, it isn’t necessary and may cause confusion if you forget to configure a setting for a specific transaction type.

Reach out to Synder Team via online support chat or email with any questions you have – we are always happy to help you!