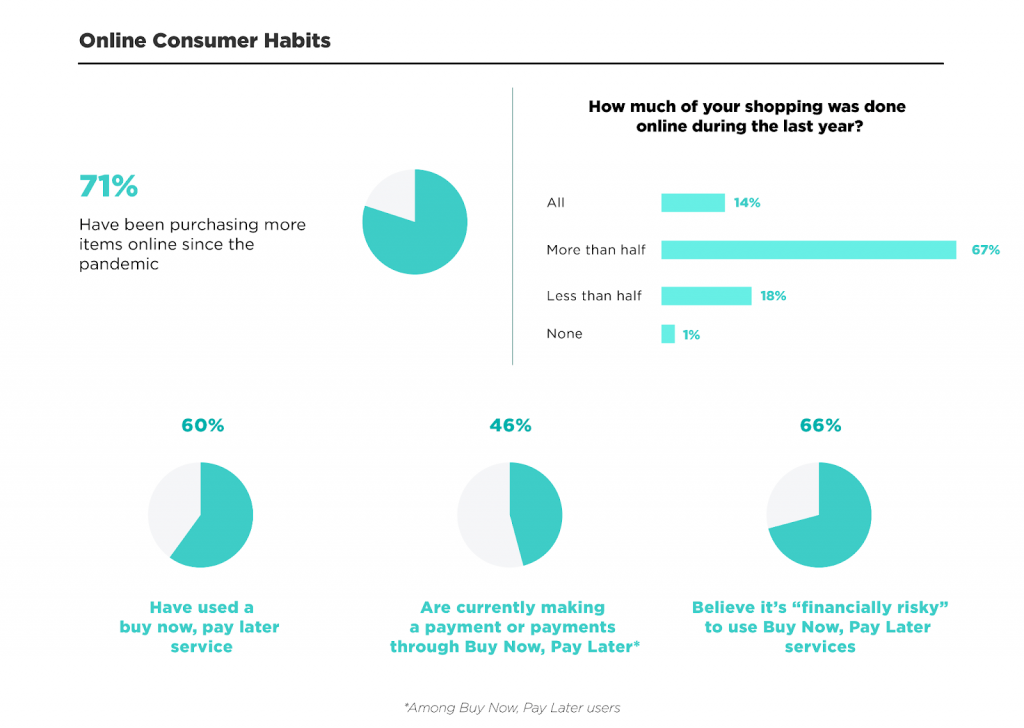

You may be familiar with Buy Now, Pay Later as a concept. Perhaps you saw it the last time you were in a mattress store, or when you were browsing your favorite online clothing store from where you and your colleagues were working in silos. More and more ecommerce businesses are offering Buy Now, Pay Later as a payment option and it’s a popular choice amongst shoppers with 60% of people having used BNPL.

Let’s delve into what Buy Now, Pay Later is, top reasons why it should be included in your finance team’s ecommerce strategy, and some popular BNPL options on the market.

Contents:

1. What is Buy Now, Pay Later (BNPL)?

2. Why customers love online shopping with Buy Now, Pay Later

3. Popular ecommerce Buy Now, Pay Later options

What is Buy Now, Pay Later (BNPL)?

What exactly is Buy Now Pay Later? Simply put, it’s an interest-free payment you can make over several installments, that’s why it acts as a type of an installment loan.

Unlike credit cards, which allow you to spend money before you have it and then pay back the credit card company with interest, Buy Now Pay Later services allow consumers to pay for their items in smaller amounts spaced out over the course of a few weeks or months. They also get to receive the item they’ve ordered up front with zero interest fees.

Why customers love online shopping with Buy Now, Pay Later

1. People can’t afford as much as they used to

With the cost of living going up but salaries staying the same or even stagnating, people just don’t have as much spending power as they did before. Global instability and widening inequalities mean that the average person can’t splash out on luxury items as easily.

We’re increasingly seeing people turn to second-hand items and stores to make ends meet, as well as item sharing and borrowing apps, food waste-avoidance apps, and other ingenious methods for helping the planet and surviving with less money.

Offering a Buy Now, Pay Later system allows people who may in the past have used similar systems to pay for a car or a house to pay for more basic necessities like clothing, or a couch. The cost of living has simply gone up for the average person, and Buy Now, Pay Later is one financial system that customers are turning to in order to purchase things that their incomes might not otherwise allow.

2. Buy Now, Pay Later is a more attractive payment option than using credit cards

People are tired of being in constant credit card debt, so BNPL offers people a way around that by removing the interest rates that credit cards have, but still allowing people to make purchases they don’t have the upfront funds for.

Instead of amassing debt, flexible payments allow people a little more peace of mind. So how do BNPL companies make money? Are there any fees? Well, quite often the price of items will be marginally hiked up for all consumers in order to turn a profit for the BNPL company.

An item that might have originally been listed at, say, $188, will be listed at perhaps $196. Whether you pay in one lump sum or over a period of time makes no difference to you as a consumer (in terms of how much money you ultimately pay), but choosing BNPL means that the BNPL company will still turn a profit.

Ultimately, the consumer knows exactly how much they’ll have to pay overall, and BNPL feels like a zero-risk option compared to credit cards. Buy Now, Pay Later seems like a good financing solution.

3. Buy Now, Pay Later options are convenient: Easy purchases and easy payments

If you’re staring at a near-empty bank account, it’s convenient to have the option of BNPL because it allows you to continue with your purchases without having to wait until your next paycheck rolls in, and without using credit cards. Basically, you can shop now.

Services like Clearpay allow you to easily create an account and make 4 payments, one every 2 weeks or so. So you can buy that Bridesmaid’s dress for your best friend’s wedding without having to borrow money from your parents or getting into debt (or even worse: missing your friend’s wedding altogether).

A lot of people can find themselves in dire straits at a moment’s notice; a relationship breakdown, job loss, theft, home burnt down, you name it. Life can be very unsteady, and having the option to Buy Now, Pay Later can make things a little easier for people who might not have funds up front, or who might not have a great credit score. BNPL is a good way to make sound financing decisions and make those payments.

4. BNPL payment methods lead to increased sales and AOV: More purchases, more revenue

Because of the convenience of BNPL services, companies tend to make more sales when they offer BNPL as an option, and the average order value of the sales also goes up. Why? Because now people have the freedom to purchase things that they otherwise would have to abandon. You might wonder what a good bounce rate is, and how BNPL can make a difference.

Many people abandon their shopping carts when BNPL isn’t available, so having this option removes a big pain point for shoppers. 48% of responders for a survey by Cardify.ai said that BNPL allows them to spend at least 10% – 20% more than if they were using a credit card. As you can see, adopting BNPL might be a good solution for your problems.

5. BNPL makes customers more loyal

Being able to make more purchases from your ecommerce business can lead to greater customer loyalty as people become more familiar with you and amass more positive experiences with your products and your company. They see you as a reliable partner who’s got their back. Along with things like pre-call planning to generate greater sales, offering Buy Now, Pay Later services makes it easier for more people to stay with you, and that ease in itself is likely to make people want to buy from you again.

So, encouraging greater customer loyalty relies on 2 things:

- Ease – people like to have an easy time when they’re shopping for anything.

- Familiarity – making it easier for people to shop from you helps to create familiarity with your ecommerce business and products, which then is likely to lead to greater customer loyalty.

6. BNPL lets you gain competitive advantage

A lot of things can give us a competitive advantage in business. Cold calling scripts are a popular choice for ecommerce businesses wanting to garner greater interest in their products, for example. Buy Now Pay Later is another financial tool for getting a leg up over the competition.

With more and more businesses now offering Buy Now Pay Later options on their ecommerce sites, it makes sense to do the same in order to stay competitive online, along with things like streamlining your team’s efforts for greater productivity. People will often choose the path of least resistance, just like rainfall traveling from mountaintops to the sea will find the easiest way down.

The easier you make it for people to shop from you, the more likely they’re to do so. And if other companies are making it easier for them to get what they need with BNPL, they might jump ship. So to stay competitive in any market, offering people multiple payment options is very important. Nobody wants to be late in adopting new payment options as it may cost you your ecommerce business.

7. BNPL payment options help you build trust

Offering Buy Now, Pay Later payments options helps build trust in 2 ways:

- People are likely to feel that they’re being trusted to pay the money they owe, which in itself can foster trust in the business. Being trusted creates trust and generates interest in your products.

- Repeated transactions build trust. By offering BNPL, you’re opening the door to more consumers who otherwise wouldn’t be able to afford your product, and as a result, building trust with more people.

Why is trust important? Well, trust is currency. The more people trust you, the more likely they’re to buy from you repeatedly and to refer other people to your brand. That’s what brands may use for reputation purposes.

Now that the concept of BNPL as a financing mechanism is clear, let’s explore repayment options, and pay special attention to the way these payment methods work.

Popular ecommerce Buy Now, Pay Later options: Choosing a BNPL provider to make your ecommerce venture more appealing to customers

The demand for flexible financing is at an all time high. With lots of payment providers and ecommerce BNPL options available, it might be hard to decide which one you really need. Let’s check out some of the most popular interest-free BNPL solutions on the market today and see why these methods are so appealing to customers.

Affirm

Affirm, one of the most popular BNPL platforms, is actually a credit line that allows you to shop online at your favorite brands and make payments over a period of up to 60 months. With no hidden fees and interest rates that start as low as 0% (but can reach 36% for big-ticket items), Affirm is one of the providers that give you the ability to make high-ticket purchases like furniture, home appliances, and electronics without having to pay for them up front. By lending you the money, Affirm’s BNPL gives you the flexibility to pay off your purchases over time, which is especially helpful if you’re saving up for a large purchase or dealing with fluctuating monthly income.

How does Affirm Buy Now, Pay Later work?

Affirm’s BNPL option allows you to purchase items from major retailers and online stores, and the payments are split up into smaller, more affordable installments.

You can apply for an account online, and if approved, you can shop and purchase items from a wide variety of stores, such as Amazon, Samsung, Walmart, Target, etc. What’s more, you can select a payment plan that works well for your financial situation.

Pay in 4 with Affirm

Affirm’s Pay in 4 is a convenient payment method designed especially for routine purchases. You can split your payment into four manageable, interest-free installments, scheduled every two weeks. The best part? This approach comes with zero added fees. Plus, opting for ‘Pay in 4’ will have no impact on your credit score. For added convenience, customers can set up straightforward, automatic payments and enjoy a hassle-free shopping experience.

Let’s say your cart amounts to $80. Your initial payment would be $20, either immediately at checkout or two weeks later. Following that, you’d have three subsequent payments, all of $20, spread out over the next six weeks.

For all your Affirm purchases on Affirm.com or within the Affirm mobile app, you can opt to use a debit card, a checking account, or an Affirm Savings account. For certain purchases, using a credit card is also an option.

Monthly Installments with Affirm

Thinking of investing in a big-ticket item? Affirm’s Monthly Installments are tailored just for that. Opt for a payment structure that gives you the flexibility to pay over time, without the stress of hidden fees.

Affirm offers extended payment plans that span from three to 60 months. The annual percentage rate (APR) for these plans can be anywhere from 0% to 36%. Monthly payments are required, with the first one due a month after your purchase gets processed. If you aren’t eligible for the complete loan amount, an upfront payment at checkout might be needed.

During checkout, Affirm will show you all the repayment options available. These terms can differ based on the merchant, the total purchase amount, and your existing credit status. Remember, while a longer repayment term might seem attractive due to smaller monthly payments, it could mean shelling out more in interest over time.

With Affirm, transparency is key; the amount you see at checkout is the exact amount you’ll pay. For an effortless payment experience, you can also set up simple, automatic payments, ensuring your focus remains on enjoying your purchase rather than the payment process.

How to pay with Affirm

Paying for purchases with Affirm is easy:

Step 1: Start shopping. Whether you’re browsing online or in-store, you can opt for Affirm to pay later. At the checkout point, look for Affirm, or generate a virtual card using the Affirm app for easy payment.

Step 2: Select your preferred payment plan. Tailor your payment strategy. Whether you prefer 4 interest-free bi-weekly payments or monthly installments, the choice is yours.

Step 3: Make your payments. With the Affirm app or online platform, stay on top of your payments. Activate AutoPay to ensure punctuality. And don’t stress about missed payments – there are no hidden fees.

As you can see, with Affirm BNPL, you can make your payments on time and get the items you need without breaking the bank and any interest involved. In case you’re late with your payments, there are no late fees.

Afterpay

Afterpay, a BNPL provider often mentioned with Affirm, is a form of deferred payment where a customer can pay off their items in three or four installments, depending on the amount of the purchase.

The customer typically pays fortnightly, but can opt for monthly payments as well. Note that Afterpay doesn’t approve all orders. They aim to promote responsible spending and thus take into account the following approval factors: sufficient funds for the first installment, your history with Afterpay, the amount you owe, the value of your current order, the number of active orders you have.

How does Buy Now Pay Later with Afterpay work?

Paying fortnightly

With Afterpay, you can split your purchase into four equal parts, paying one part every two weeks. So, if you buy something for $100, you pay $25 at the time of purchase and then the same amount every two weeks until you’ve paid the full price.

The best part? The money is automatically taken from the debit or credit card you used. You can also link your bank account for this. Sometimes, for bigger buys, your first payment might be a bit more than the others. But don’t worry, Afterpay will give you all the details before you finalize your purchase.

There’s no interest on this four-payment plan, but be on time with your payments to avoid late fees, which may be as high as $8.

Paying monthly

For pricier items, Afterpay has a monthly payment option for either six or twelve months. Interest might apply to these plans, going up to 35.99% annual rate, although there are 0% interest offers too. Just remember, this monthly plan is for specific online shops and for purchases over $400.

How to pay with Afterpay

Paying with Afterpay is just as easy as paying with Affirm:

Step 1. Find a store & shop. Start by shopping at your favorite stores that are listed in the Afterpay Shop Directory.

Step 2. Choose Afterpay at checkout. Once you’re ready to buy, select Afterpay as your preferred payment option.

Step 3. Sign up or log in. New users will have to create an Afterpay account (they’ll receive an instant approval decision). Returning users should simply log in to proceed.

There are also some differences depending on the way you shop. If you’re shopping online, once you’ve checked out, the retailer will ship your order. If you’re shopping in-store, download the Afterpay mobile app and follow the in-app instructions and complete eligibility checks. If you’re eligible, set up the Afterpay Card and then use the Afterpay Card with Apple Pay or Google Pay for a contactless payment at the store’s checkout.

Step 4. Manage your payments. Log in to your Afterpay account anytime to view your payment schedule. You can make a payment before its due date if you wish. If you don’t, Afterpay will automatically charge your linked debit or credit card on the scheduled dates.

Afterpay BNPL offers a flexible financing plan that lets a customer tailor their payments to their budget and individual needs. They can pay in full or increase their monthly payment amount at any time. Either way, this provider allows you to shop at the most popular stores and retailers with no interest and establishment fees.

NB! Are you interested in Afterpay? Read our guide on ‘How to Add Afterpay to Shopify’.

Klarna

Klarna Buy Now, Pay Later is a payment service that enables customers to pay for their purchases over time when shopping at their favorite stores and retailers, such as Adidas, Shein, Abercrombie & Fitch, GoDaddy, Macy’s and many more. This service can be used for purchases made online or in-store, and it provides a payment plan for shoppers who choose to pay for their items in installments, rather than paying the full amount all at once. However, longer financing options are also available.

How does Buy Now, Pay Later work with Klarna?

Before you shop with Klarna, make sure you have an active bank account and that you’ve verified your identity by providing a photo ID and proof of address. Once you’ve done so, you can start shopping with Klarna and paying for your purchases over time.

When you checkout online and select Klarna BNPL as your payment option, you’ll be asked to enter your credit card information. Once your order is verified and approved, Klarna will deposit the amount of your purchase into your bank account. You can then make one monthly payment for your purchases or set up a payment plan to pay off your purchase in installments. What plans does Klarna offer?

Klarna’s Pay-in-Four

With Klarna, you can divide your total into four equal payments that are due every two weeks. When you make a purchase, the first payment is required at checkout; then you’ll have three more equal payments charged automatically every fortnight.

Klarna’s Pay in Full

With the Pay Later option, you can receive your items first and have the convenience of paying for them within 30 days after they’re shipped. It provides the advantage of trying out products before making any payment, all while enjoying this service without any interest charges.

Klarna’s Monthly Financing

With Monthly Financing, you have the flexibility to spread your payments over a period ranging from six months to two years. However, it’s essential to note that these extended payment plans could carry an interest rate of up to 29.99% APR.

How to pay with Klarna

When you’d like to pay with Klarna, follow these steps:

Step 1. Browse your favorite shops—within the Klarna app, at your local mall, or on any online site.

Step 2. Select the items you want to purchase.

Step 3. At checkout, choose Klarna as your payment option.

To shop with Klarna in a brick-and-mortar store, first log into the Klarna app and select “In-store” from the main screen. From there, pick the store you’re interested in and follow the instructions to create a digital card. Once created, add this card to your digital wallet. At the checkout counter, simply access your Klarna in-store digital card within your wallet and tap your phone against the card reader to process the payment.

Klarna allows payments via debit cards, credit cards, or bank accounts. All Klarna installments are interest-free, but if your payment is 10 days overdue, the company starts to charge late fees – either $7 or 25%. If you miss two consecutive payments, Klarna temporarily freezes your account. Note that a service fee might be applied when using a one-time card at a retailer that isn’t a partner.

PayPal

Due to its worldwide availability, PayPal is one of the most popular payment providers (along with Stripe). Loved by brands, companies, retailers and consumers alike, they developed their own BNPL feature for their customers.

PayPal’s Buy Now Pay Later feature allows customers to purchase items online and pay later, through a new or existing PayPal account. This feature eases the payment process for customers, as the payment is made through their existing PayPal account. It also makes it easy for customers to manage their payments by allowing them to view their payments, create and track payment schedules, and adjust the amount of payment in the app.

This feature is primarily designed for customers who have a good payment history and a track record of timely payment with the provider. This makes the PayPal payment terms more flexible, allowing customers to make payments according to their financial situation and available funds. PayPal is also one of the most trusted payment providers on the market which acts as a great selling point for your customers.

How does Buy Now, Pay Later with PayPal work?

PayPal’s Pay in 4

PayPal’s Pay in 4 is a flexible payment solution that allows you to spread the cost of a purchase into four equal installments. Here’s how it works: when you make a purchase, you’ll pay the first quarter of the total at checkout. The remaining 3 equal payments will be automatically debited from your chosen payment method every two weeks. Whether you choose a debit card, credit card, bank account, or even your PayPal balance, the process is seamless and interest-free. Additionally, there are no extra fees involved.

PayPal’s Pay Monthly

For bigger-ticket items up to $10,000, PayPal offers extended monthly payment plans with durations of 6, 12, or 24 months. However, these come with interest rates ranging from as low as 4.99% to as high as 35.99% APR. You can pay with your debit card or confirmed bank account, plus this plan impacts your credit score.

How to buy now, pay later with PayPal

Paying with PayPal involves three easy steps:

Step 1. Select “PayPal” when you’re checking out.

Step 2. Receive an instant decision.

Step 3. Finalize the subsequent payments either in the app or online, and set up autopay for hassle-free transactions.

NB! Check out our guides on PayPal alternatives and Stripe vs PayPal.

Sezzle

Sezzle BNPL allows consumers to split their purchases into four smaller payments that are spread out over six weeks. This makes it easier to manage their financing, as the consumers don’t need to worry about paying a huge amount of money all at once.

How does Sezzle Buy Now, Pay Later work?

With Sezzle, you’ve got three options.

Sezzle’s Pay in 4

Sezzle lets you split your purchase into four equal payments. When you make a purchase, you’ll pay the first quarter upfront and then the rest in three payments, spaced two weeks apart. The payments will automatically come from the debit or credit card you provided, or straight from your bank account if you prefer. While Sezzle doesn’t charge interest on its four-payment plan, there might be some fees, like card payment, account reactivation, or rescheduling fees, to watch out for.

Sezzle’s Pay in 2

With Sezzle’s Pay in 2 option, you divide your purchase into two equal parts: the first payment is made during checkout, and the second is scheduled two weeks after.

Sezzle’s Pay Monthly

Sezzle provides monthly financing options that span from three months up to four years. These extended payment plans might come with interest rates between 5.99% and 34.99% APR.

How to pay with Sezzle

If you’d like to pay with Sezzle online, follow these steps:

Step 1. Choose the item you’d like to buy.

Step 2. Select the option “Pay with Sezzle” when you check out.

Step 3. Choose the payment plan that works best for you.

Step 4. Complete the purchase.

If you’re shopping in-store, the steps are a little different:

Step 1. Start by downloading the Sezzle app.

Step 2. After you download the app, activate your Sezzle virtual card.

Step 3. Open your digital wallet (Apple or Google) and add the virtual card.

Step 4. Use your digital wallet as usual to complete the purchase.

Shop Pay Installments

Shopify, one of the most popular ecommerce platforms, has its own version of BNPL – Shop Pay Installments, established in partnership with Affirm. At its most basic level, Shopify Shop Pay Installment Plan is similar to a credit card payment plan. Customers can use this payment plan to make a purchase of $50-$3,000, set up a payment schedule, and make monthly payments to complete the purchase. Shop Pay Installment Plan allows customers to buy what they want on Shopify, when they want it. It also allows ecommerce business owners to sell more with the help of Expert Magento development services.

This functionality is accessible to U.S. businesses utilizing both Shopify Payments and Shop Pay, but not all businesses qualify.

How does the Shop Pay Installment Plan work?

The following customer payment options are available:

Interest-free payments with Shop Pay Installments

If you’re shopping for smaller items and the order doesn’t exceed $999.99, you can opt for four payments every two weeks. No interest.

Monthly payments with Shop Pay Installments

If you’ve got a bigger order between $150 and $17,500, you can use monthly payments (over three, six or twelve months depending on the amount) with a 10% to 36% APR. At the end of each payment period, the payment plan will automatically renew unless the customer cancels it. It’s important to note that each payment is non-refundable.

A premium option is also available to eligible merchants and allows for interest-free payments and longer repayment terms.

Generally, the business pays a fee of 5% to 6% for each BNPL transaction, based on various business factors and Affirm’s underwriting.

How to pay with Shop Pay Installments

With Shopify’s Shop Pay Installment Plan, customers should do the following:

Step 1. Place your desired items in the shopping cart.

Step 2. Proceed to checkout using Shop Pay.

Step 3. Opt for your preferred payment method: either ‘Pay in 4’ or ‘Pay Monthly’.

After this, depending on your plan of choice, the scenario may slightly differ. If you choose Pay in 4, then, after making an initial payment during purchase, the following three payments will be auto-charged every two weeks to your saved card on Shop Pay. You’ll receive email reminders before each installment. If you select Pay Monthly, following your initial payment at purchase, the next 11 payments will be auto-charged monthly to your saved card on Shop Pay. You’ll receive email reminders ahead of each payment.

NB! Are you using Shopify as an ecommerce platform? Read our article on ‘22 Shopify Tips and Tricks: How To Quickly Grow Your Online Store’ to ace your Shopify business.

Check out our guides on how to add Stripe to Shopify and how to do bookkeeping for Shopify.

With this short guide on the most popular BNPL providers, you’ve got an opportunity to weigh the pros and cons of each solution, as well as choose the best option for your ecommerce business.

Closing thoughts on BNPL in ecommerce and BNPL providers

Offering Buy Now, Pay Later payment options opens the door of your ecommerce business to a greater number of customers, whether you’re in the business of fashion, caller ID service providers, or other type of software company, or anything in between. People who might not be able to afford the cost of your products upfront are now able to pay in installments over the course of a few weeks or months. You get the full payment for your items and the customer gets the item they want in a way that doesn’t break the bank.

The average value of the sales your ecommerce business makes also goes up when you offer BNPL as people are suddenly able to buy more from you in one go. So it’s not just new customers you can attract. You’re now able to make more sales with the existing customers who would have spent less in your store otherwise. Don’t be late in adopting new payment methods!

All of this means that your ecommerce business gets fewer abandoned shopping carts, in other words, more orders. Offering flexible payment options like BNPL is attractive for customers who love online shopping but either don’t want to get a credit card, or who are unable to do so.

And finally, what all of the above results in is a longer customer-business relationship, higher order values and more orders for your ecommerce business.