Whether you’re a small business or a medium to large enterprise, managing your cash flow is important for your success just like any other business involved with finances. Research shows that as much as 60% of small businesses deal with cash flow issues due to late payments alone.

That’s when payment terms like 2/10 Net 30 usually pop up. It can incentivize early payments making more of your customers and even partners pay promptly, ultimately saving your business from dealing with the woes of obstructions and delays in your incoming cash flow.

Wondering what this term 2/10 Net 30 really means, how you can calculate it, and what are some of its pros and cons? Read along for a complete understanding.

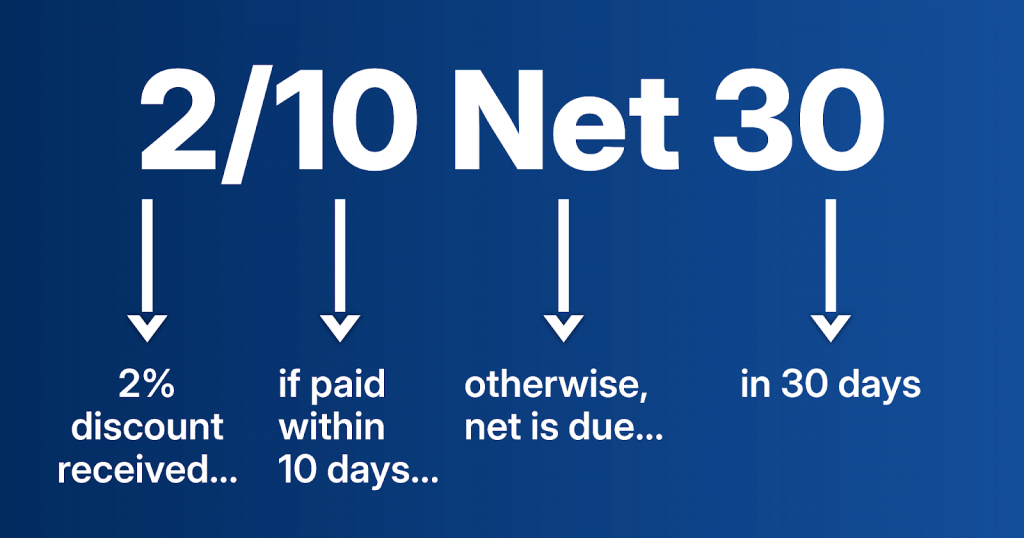

First up, what is 2/10 Net 30?

The term 2/10 Net 30 refers to a payment discount offered to buyers. It means that if the buyer pays within 10 calendar days, they receive a 2% discount on the total invoice amount. If they don’t take advantage of this discount, the full invoice amount is due within 30 calendar days from the invoice date.

This payment term is commonly used in corporate finance and can be particularly beneficial for managing cash flow, especially in industries where cash flow issues are prevalent like B2B services, transportation, manufacturing, restaurant and legal industry. Let’s quickly see when you can use this.

When to use 2/10 Net 30 discounts?

You can use 2/10 Net 30 discounts if:

- You have a strong cash flow and can afford to offer discounts without impacting your profitability.

- Your industry typically experiences long payment cycles where encouraging prompt payment can significantly benefit your cash flow management like construction businesses in which projects have lengthy timelines and wholesale distribution businesses in which founders rely on prompt payments to maintain liquidity.

- You want to improve relationships with customers who may be hesitant to pay quickly. Offering a discount can encourage them to prioritize their payments to you over other vendors.

This strategy works best in industries where maintaining liquidity is essential for operations and where competition for customer loyalty is high like wholesale distribution, manufacturing, construction, professional services, and retail.

How can you calculate 2/10 Net 30?

Calculating the 2/10 Net 30 discount is straightforward. Here’s how you can do it step-by-step.

Suppose your business purchases $800 worth of goods or services on July 5th. You’ve entered a credit agreement with the seller: if you pay the net amount between July 5th and July 15th, you’ll receive a 2% discount, which will bring your total down to $784.

Step-by-step calculation

- Invoice full amount: $800

- Invoice date: July 5

- Invoice due date: August 4 (30 days after the invoice date)

- Payment terms: 2/10 Net 30

- Discount period: 10 days (from July 5 to July 15)

Quick formula

To calculate the discounted amount, use this formula:

Discounted Amount = (100%−Discount) × Invoice Amount

For our example:

100% − 2% = 98%

Now apply it to the invoice amount:

0.98 × $800 = $784

Detailed formula breakdown

You can also express it as:

(Discount Rate) × (Invoice Amount) = Reduced Payment

Using our numbers:

(0.02) × (800) = 16 (This is the discount amount)

So, if you pay within the discount period, your total payment will be: $800 − $16 = $784

Quick table of payment terms

| Date of Invoice Payment | Number of Days Before Paying | Early Payment Discount % | Discount Amount | Payment Amount Due |

| July 5 through July 15 | 0 – 10 | 2% | $16 | $784 |

| July 16 through August 4 | 11 – 30 | 0% | $0 | $800 |

Want to see how you can do accounting using different approaches? Read ahead for the methods.

How to do accounting for discounts: Net method vs. gross method

Now when accounting for cash discount, you can use either the net method or the gross method:

Net method

With the net method, you record the sale at the discounted amount if you expect customers to take advantage of early payment discounts.

- Example:

- Total Invoice: $1,200

- Discount: $24

- Amount Recorded: $1,176

In your accounting records, you would show:

- Accounts Receivable: $1,176

- Revenue: $1,176

Gross method

With the gross method, you record the sale at the full invoice amount and adjust for discounts later if they’re taken.

- Example:

- Total Invoice: $1,200

- Amount Recorded: $1,200

If paid early, you would then record a credit memo for $24 when payment is received.

In your accounting records, you’d show:

- Accounts Receivable: $1,200

- Revenue: $1,200

- When payment is made:

- Cash: $1,176

- Accounts Receivable: $1,200

- Discounts Allowed (or Sales Discounts): $24

Using either method depends on your business’s accounting policies and how frequently customers take advantage of discounts.

For example, if you run a furniture store and 80% of your customers take the early payment discount, here’s what the calculation would be like:

- Total Invoice: $10,000

- Discount (2%): $200

- Amount Recorded: $9,800

Your records:

- Accounts Receivable: $9,800

- Revenue: $9,800

This method will give you a conservative view of revenue, reflecting expected cash inflow.

On the other hand, considering a gross method example, let’s say if you operate a software company where only 30% of customers utilize discounts, here’s what the numbers will be like:

- Total Invoice: $10,000

- Amount Recorded: $10,000

Your records:

- Accounts Receivable: $10,000

- Revenue: $10,000

When payments are made early:

- Cash Received: $9,800

- Discounts Allowed: $200

This method will give you a more optimistic view of revenue before applying discounts.

In short, go for the net method if most customers take discounts for a conservative approach, and opt for the gross method if fewer customers take advantage of discounts to reflect potential revenue. Now, let’s understand some pros and cons of 2/10 Net 30.

Pros of 2/10 Net 3

As a business owner, here are some pros of using 2/10 Net 30:

Encourages early payment

Offering a 2% discount for early payment incentivizes your customers to pay sooner. This can significantly improve your cash flow management.

Reduces bad debt risk

When customers pay faster, you lower the chances of late payments turning into bad debt. Businesses with effective credit management practices can reduce bad debt. This means fewer accounts receivable issues for you.

Improves relationships with customers

Offering early payment discounts enhances customer satisfaction and loyalty. Customers appreciate saving money, which makes them more likely to return for future purchases. This can strengthen your business relationships and lead to repeat sales.

Cons of 2/10 Net 30

On the other hand, here are some cons of suing 2/10 Net 30:

Reduced revenue

While discounts can encourage early payments, they can also decrease your overall revenue if many customers take advantage of them. As a business owner, you need to find the right balance between encouraging early payments and maintaining profitability.

Cash flow impact

If, as a business, you start taking advantage of this offer from your suppliers and consistently pay early without strategically managing your payments, this may impact your cash flow.

Complexity in accounting

Managing different invoice payment terms and discounts can complicate your accounting processes. You’ll need to ensure that your accounting system accurately reflects these transactions, which may require additional time and resources in your accounts payable process.

Final thoughts – Use Synder for your accounting needs!

Overall, understanding and implementing 2/10 Net 30 payment terms can significantly enhance your cash flow management. By incentivizing early payments and reducing accounts receivable aging, you can position your business for better financial health.

If you want to manage your invoices and accounts receivable easily, use Synder. Our promising accounting automation software can make recording and reconciling sales data a breeze for your business. And here’s more: it integrates seamlessly with 30+ popular platforms like QuickBooks, Xero, Sage Intacct, Stripe, PayPal, Amazon, Shopify, and many others. This means you can centralize your data across multiple sales channels and payment gateways in one user-friendly platform, eliminating manual errors and saving valuable time.

Ready to simplify your financial management? Sign up for Synder’s 15-day free trial or book a spot at a Weekly Public Demo to learn how Synder can address your specific business needs.