Struggling with product shipment and stumbled upon the term FOB as a potential solution? It might just be the answer you’re looking for. But it’s still important to understand the whole point of FOB and the major differences between FOB shipping point and FOB destination before implementing it into the workflow.

Why does this matter? Because these terms define who is responsible for the goods at different stages of their journey. Understanding this can help you avoid unexpected surprises, especially in terms of costs and risks.

Keep reading to learn the details, as today, we’ll uncover who is responsible for the costs under each term and how it impacts your transaction recording.

Key takeaways:

- FOB defines the point at which ownership and responsibility for goods transfer from the seller to the buyer during the shipping process.

- Under FOB Shipping Point, the buyer handles ownership and responsibility for the goods as soon as they’re shipped from the seller’s location.

- In FOB Destination, the seller retains ownership and responsibility until the goods arrive at the buyer’s specified location.

Contents:

What is FOB?

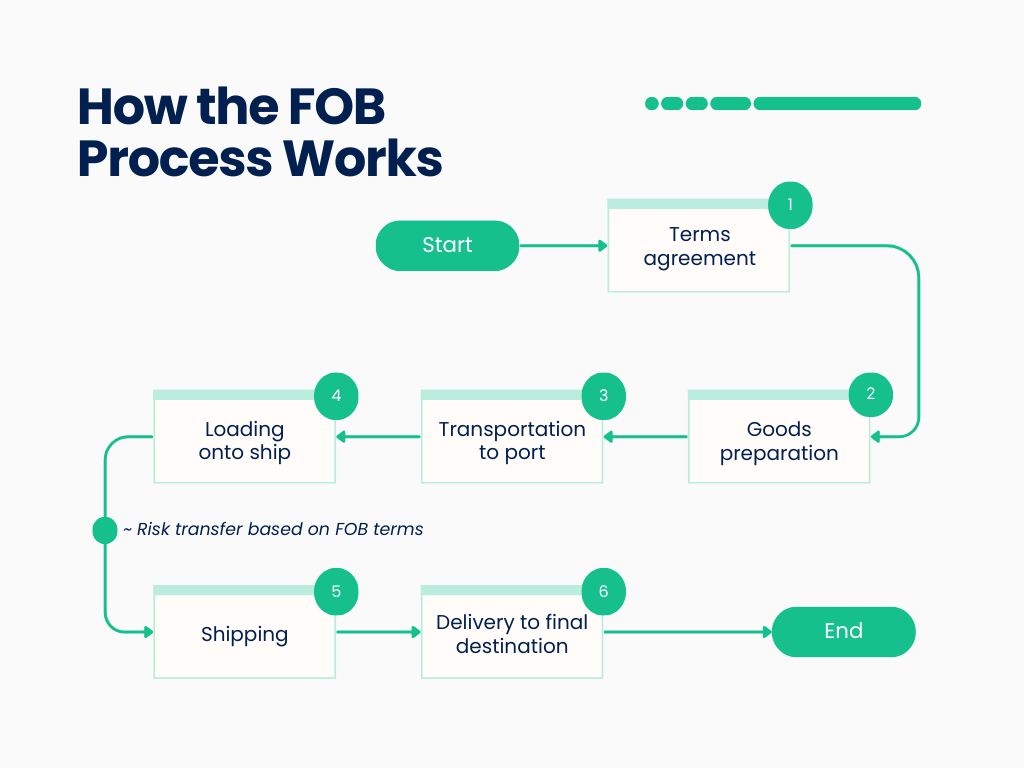

FOB, or “Free on Board,” is a common term in international shipping, particularly for sea freight. As explained by the International Chamber of Commerce (ICC), FOB defines the moment when responsibility and the associated risks shift from the seller to the buyer during the shipping process.

The costs associated with FOB include:

- Transporting the goods to the port of shipment;

- Loading the goods onto the shipping vessel;

- Freight transport across the sea;

- Insurance during transit;

- Unloading and transporting the goods from the destination port to the final location.

Under FOB terms, the division of responsibilities—covering costs, handling losses, or managing damages—is clearly outlined in the sale contract or purchase order. This ensures both parties know exactly what they’re accountable for from the moment the goods are shipped to when they reach their final destination.

| To ensure smooth shipping of items globally, the International Chamber of Commerce (ICC) published a set of 11 Incoterms (international commercial terms) that specify the responsibilities of sellers and buyers. Incoterms 2020 is the latest edition that’s still in effect. |

Why should you care about FOB terms?

Understanding FOB means knowing who holds the responsibility when things go wrong during shipping. FOB terms clearly outline who’s responsible for costs and who must take action if goods are damaged or lost during transit.

Consider this scenario: As a seller, you’ve agreed to the FOB destination, which means (spoiler) it’s you who retains responsibility for the goods until they arrive safely at the buyer’s location. If the shipment arrives at the buyer’s receiving dock with visible damage, under FOB destination terms, it’s your responsibility to address the issue.

Note: FOB establishes when the goods become an asset on the balance sheet. This gets especially important at the end of a calendar or fiscal year because transactions around that time can determine in what accounting period the goods are recorded.

| Want to take the hassle out of bookkeeping? Synder is an accounting automation software that integrates with your sales channels, payment platforms, and even POS systems, keeping detailed records of every transaction. The result? Easily manageable books and stress-free accounting. Curious? Explore the workflow on our Weekly Public Demo or test it yourself with a 15-day free trial. |

As we’ve already touched upon FOB destination, let’s move to the main part of the whole article: What’s the real difference between a FOB shipping point and a FOB destination?

FOB shipping point vs. FOB destination

If you’re only starting to learn the difference between these two terms, here’s a small cheat sheet on FOB shipping point vs. FOB destination:

| Aspect | FOB shipping point | FOB destination |

| Ownership | Transfers to the buyer as soon as the goods leave the seller’s shipping point. | Transfers to the buyer when the goods reach the buyer’s location. |

| Risk responsibility | Buyer assumes risk once goods are loaded onto the carrier. | Seller retains risk until goods reach the buyer’s destination. |

| Shipping costs | Buyer is responsible for shipping costs from the shipping point onward. | Seller covers shipping costs until the goods reach the destination. |

| Insurance requirements | Buyer typically arranges insurance for transit. | Seller may cover insurance until delivery to the destination. |

| Accounting recognition | Seller records the sale once goods are dispatched. | Seller records the sale when goods are delivered to the buyer. |

Let’s get into more detail about the responsibility, accounting rules, and costs associated with each term, as these are the most important aspects.

Difference #1. Responsibility

The main difference between FOB shipping point and FOB destination lies in when ownership and responsibility for the goods transfer from the seller to the buyer.

In FOB shipping point, the buyer assumes responsibility for the goods as soon as they leave the seller’s shipping location. From that moment, any risk including any damage, loss, or any mishap during transit, rests on the buyer’s shoulders. This means that if something happens to the goods during the transit, the buyer can’t hold the seller accountable.

In contrast, with FOB destination, the seller remains in charge until the goods reach the buyer’s doorstep. The seller bears all the risks during transit. If the goods are damaged or lost before they arrive, it’s up to the seller to make it deal with this problem, whether that means replacing the items or offering a refund.

Difference #2. Accounting rules

When it comes to accounting, timing is everything. The moment a sale is recognized in the seller’s and buyer’s books can have a significant impact on financial reporting, influencing revenue and inventory levels.

For FOB shipping point, the seller records the sale in their books as soon as the goods are shipped, even though the buyer hasn’t yet received them. This early recognition means that the seller’s inventory decreases and accounts receivable increases. It’s a quick boost to revenue but shifts the inventory burden to the buyer instantly.

With FOB destination, the seller holds onto the goods and the responsibility until they reach the buyer’s location. The sale isn’t recorded until delivery is confirmed, meaning the seller’s inventory remains unchanged until the goods arrive. This delay in recognizing revenue can slow down financial reporting but ensures the seller retains control over the goods until they safely get to the buyer’s hands.

Difference #3. Shipment costs

When it comes to the transportation bill, the specific FOB term determines who’s picking up the tab.

Under FOB shipping point, the buyer is responsible for all transportation costs from the point of shipment onwards. This includes everything from freight charges and customs duties to any other costs that arise during transit. The buyer might also need to arrange and pay for insurance to protect the goods while they’re on the move.

With FOB destination, the seller carries the financial load covering all transportation costs until the goods safely arrive at the buyer’s location.

Now that we’ve explored the key differences between FOB shipping point and FOB destination, let’s check some simple examples for each term to understand better how they work individually.

FOB shipping point: Example

Let’s pretend you’re an American furniture manufacturer, and you’ve just secured a big order online from an Italian retailer. The deal is set up under FOB shipping point terms. As soon as you load the products onto the ship, your responsibility ends there.

Now, boom! The ship hits rough seas, and some of that furniture gets damaged. The good news? It’s no longer your responsibility. Under FOB shipping point, the moment the goods are loaded onto the ship, the risk transfers to the buyer. You’ve done your part—getting the furniture safely onto the ship—beyond this, it’s the buyer’s responsibility.

So, what’s the takeaway? Does FOB shipping point strike gold for any seller?

Not really.

While FOB shipping point can be advantageous for online sellers, it’s not without its drawbacks. If something goes wrong during transit, even though the responsibility isn’t yours, the buyer might not be thrilled, which could strain future business relationships. Plus, If the buyer faces issues with customs or transit, it might delay the final payment or cause complications, which, again, can impact the seller’s financial statement.

How seller should record transactions under FOB shipping point terms

There are some specific implications for how the seller records the transaction when delivering products on FOB shipping point terms.

1. Revenue recognition

The seller recognizes the revenue as soon as the goods are shipped, since the transfer of ownership occurs at that moment. The sale is recorded immediately, regardless of when the buyer actually receives the goods.

Note: As a seller, you have to record any shipping or freight costs in the Delivery Expense account as a debit.

2. Inventory and COGS

At the time of shipment, the seller will reduce their inventory and record the Cost of Goods Sold (COGS) simultaneously with recognizing the revenue. This ensures that the sale is accurately reflected in the financial statements as of the shipping date.

3. Shipping costs

In the case of FOB shipping point, the buyer typically covers the shipping cost. However, if the seller initially pays the shipping costs and then bills the buyer, the seller will record this as a receivable or add it to the sale price.

FOB destination: Example

This time, you’ll be an ecommerce seller from Canada specializing in handmade ceramics, and you’ve just received an order from Japan. The deal is set up under FOB destination terms, meaning you’re responsible for the goods all the way until they safely reach the buyer’s door in Japan.

It’s always good to be prepared for a bad-case scenario, so let’s add some drama here as well – rough seas again. We love consistency. Not the natural disasters, obviously.

As the seller, the pressure’s still on you. If anything goes wrong during transit, it’s your job to make it right. You have several options to send replacements, fill out an insurance claim, or cover the cost of the damage. Either way, you’re on the hook until the goods are delivered in perfect condition.

The final thought on this case?

You, as a seller, maintain control over the shipping process, which can ensure better handling of the goods. Yet, any damage or loss during transit is your problem to solve, potentially leading to additional costs or delays.

How seller should record transactions under FOB destination terms

The process for recording transactions under FOB destination slightly differs from that of FOB shipping point.

1. Revenue recognition

The seller doesn’t recognize the sale immediately when the goods are shipped. Instead, revenue is recognized only when the goods are delivered to the buyer’s location and the risk of loss transfers to the buyer.

2. Inventory and COGS

Until the goods are delivered, they remain part of the seller’s inventory. Once the goods arrive at the destination, the seller will reduce their inventory and record the COGS at the same time they recognize the sale. This dual entry ensures that both the reduction in inventory and the recognition of revenue happen simultaneously.

3. Shipping costs

Since the seller is responsible for the goods until they reach the buyer, any shipping costs incurred should be recorded as an expense in the seller’s accounting records. This expense is usually categorized under “Freight-Out” or “Delivery Expense.”

Additional international commercial terms (Intercoms) to know

Even though FOB is one of the most commonly used Incoterms accounting for around 70% of international trade agreements between buyers and sellers, there are several other Incoterms that provide additional flexibility. Knowing these terms can help you offer better solutions to your customers and choose the best terms for your business.

Here are several of them:

| FAS (Free Alongside Ship) | The seller is responsible for delivering the goods to a designated port and placing them alongside the buyer’s vessel. Once the goods are alongside, the buyer takes on all risks and costs, including loading, shipping, and insurance. This term is ideal for maritime shipments where the buyer has control over the shipping process. |

| CIF (Cost, Insurance, and Freight) | The seller covers the costs of transportation and insurance up to the destination port. However, the risk transfers to the buyer once the goods are on board the ship. |

| DDP (Delivered Duty Paid) | The seller takes full responsibility for delivering the goods to the buyer’s specified location, including covering all costs and risks throughout the journey. The seller also handles import duties, taxes, and customs clearance. Essentially, DDP places maximum responsibility on the seller, with the buyer simply receiving the goods without having to deal with any of the logistics. |

| CPT (Carriage Paid To) | The seller pays for the carriage of goods to the named destination, but the risk transfers to the buyer as soon as the goods are handed over to the first carrier. The seller’s responsibility includes paying for transportation up to the destination, but the buyer must manage insurance and any additional risks once the goods are in transit. |

| EXW (Ex Works) | This term places the least responsibility on the seller. The seller’s only obligation is to make the goods available at their premises (factory, warehouse, etc.). The buyer assumes all risks and costs associated with transporting the goods from the seller’s location to their final destination, including loading the goods, transportation, export duties, and insurance. |

As you can see, each of these terms has its strengths and weaknesses, and the best choice often depends on what you’re shipping and where it’s headed.

For instance, DDP might not be ideal for high-value goods like electronics or jewelry, where customs duties can be significant. On the other hand, CIF or CPT might be more suitable for managing risks during international transit without overwhelming the seller.

Wrapping up

So, yes, it’s important to understand the FOB functionality before implementing it into the workflow. Whether you opt for FOB shipping point or FOB destination, the right choice depends on your specific needs and how much control you want over the shipping process.

But here’s the kicker: no matter which FOB term you go with, keeping a close eye on all associated expenses is a must. Track every cost, including shipping fees, insurance, and customs duties, to avoid any unpleasant surprises when it’s time to balance the books at the end of the accounting period. You don’t want hidden expenses catching you off guard, right?

Make your choice wisely and keep those financial records sharp—your bottom line will thank you!

Share your thoughts

Have you worked with FOB terms before? Got insights or tips for fellow sellers when it comes to these shipping options? Share your experience in the comment section below.

nice article.

Wonderful