Every year, as the tax season looms over, taxes become our buzzword (or scareword). While taxes come in different shapes and sizes, other deductions are happening in the background before the paycheck even hits your pocket. And today, we’ll look at one type of such deductions, namely pre-tax deductions.

Want to properly get ready for tax season? Simplify your accounting with Synder! It integrates seamlessly with your payment platforms, ensuring accurate bookkeeping for your online payments and subscriptions. Stay compliant, save time, and focus on growing your business. Try Synder today for hassle-free tax management!

This article has been prepared for informational purposes only and gives a general overview of pre-tax deductions. It’s not intended to provide any tax advice. It’s highly recommended to consult with a tax professional to ensure that taxes are properly calculated and reported.

Contents:

1. What are pre-tax deductions?

- Are pre-tax deductions just different types of taxes?

- Are pre-tax deductions the same as payroll deductions?

- Are pre-tax deductions tax-free?

- How do pre-tax deductions affect Social Security benefits?

2. Why do pre-tax deductions matter?

- Pre-tax deductions can reduce your taxable income

- Pre-tax deduction lowers payroll taxes for employers

3. Types of pre-tax deductions

- Employer-sponsored health plans

- Health Reimbursement Arrangements (HRAs)

- Health Savings Accounts (HSAs)

7. Pre-tax disability insurance

8. Employer-paid life insurance

9. How to calculate pre-tax deductions

10. Pre-tax deductions example

11. What employers need to know about pre-tax deductions

12. Common mistakes to avoid when utilizing pre-tax deductions

13. Alternative ways to save for retirement and healthcare expenses

What are pre-tax deductions?

Pre-tax deductions are deductions that are taken out of your paycheck before taxes are calculated. This means that the money you contribute to these accounts isn’t included in your taxable income, which can lower your overall tax bill.

Let’s now answer some common questions and address misconceptions about pre-tax deductions.

Are pre-tax deductions just different types of taxes?

The answer is: no. While having money deducted from your paycheck does certainly sound like some form of tax, pre-tax deductions are not taxes. Taxes are mandatory charges imposed by the government on income, property, or other activities, and they fund government services and initiatives. Pre-tax deductions, on the other hand, are usually voluntary and go towards specific benefits chosen by the employee, such as retirement plans, health insurance, and others.

Are pre-tax deductions the same as payroll deductions?

Here, there’s no short answer. Pre-tax deductions are indeed a type of payroll deductions but they aren’t actually the same. Payroll deductions refer to all those deductions that are made to the employees’ wages both on a pre-tax and a post-tax basis.

In other words, all pre-tax deductions are essentially payroll deductions but not all payroll deductions are pre-tax.

Are pre-tax deductions tax-free?

For the most part, yes, but there are exceptions. While these deductions reduce taxable income for the purpose of income tax, they aren’t always exempt from other taxes like Social Security and Medicare (FICA taxes).

Some people believe that reducing taxable income through pre-tax deductions will lower their subsequent Social Security benefits. However, Social Security benefits are calculated based on your highest 35 years of earnings, and pre-tax contributions to retirement accounts like 401(k)s are still included in these earnings calculations.

Why do pre-tax deductions matter?

If both employees and employers opt for pre-tax deductions, they must be giving them some benefits. Let’s look at the most important ones.

Pre-tax deductions can reduce your taxable income

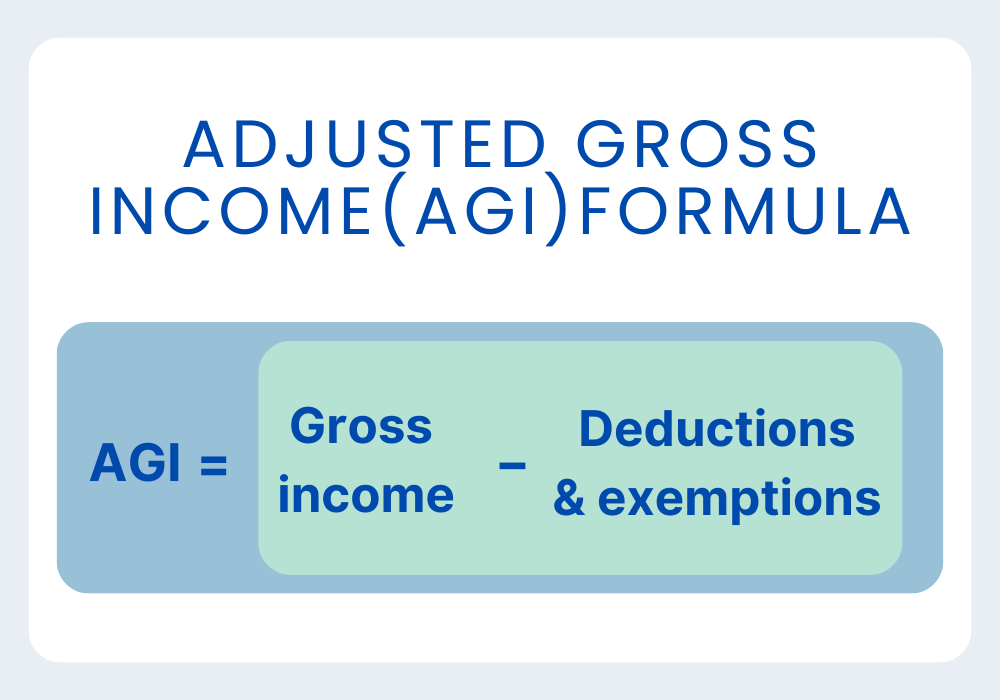

As can be understood from the definition of a pre-tax deduction, this type of contribution can reduce your taxable income by lowering your adjusted gross income (AGI). Your AGI is your gross income minus any deductions or exemptions you are eligible for. By contributing to pre-tax accounts, you can lower your AGI and your tax bill.

Pre-tax deduction lowers payroll taxes for employers

Since pre-tax deductions reduce an employee’s taxable income, employers also benefit as they pay lower payroll taxes (like FICA and FUTA taxes) on this reduced income.

Types of pre-tax deductions

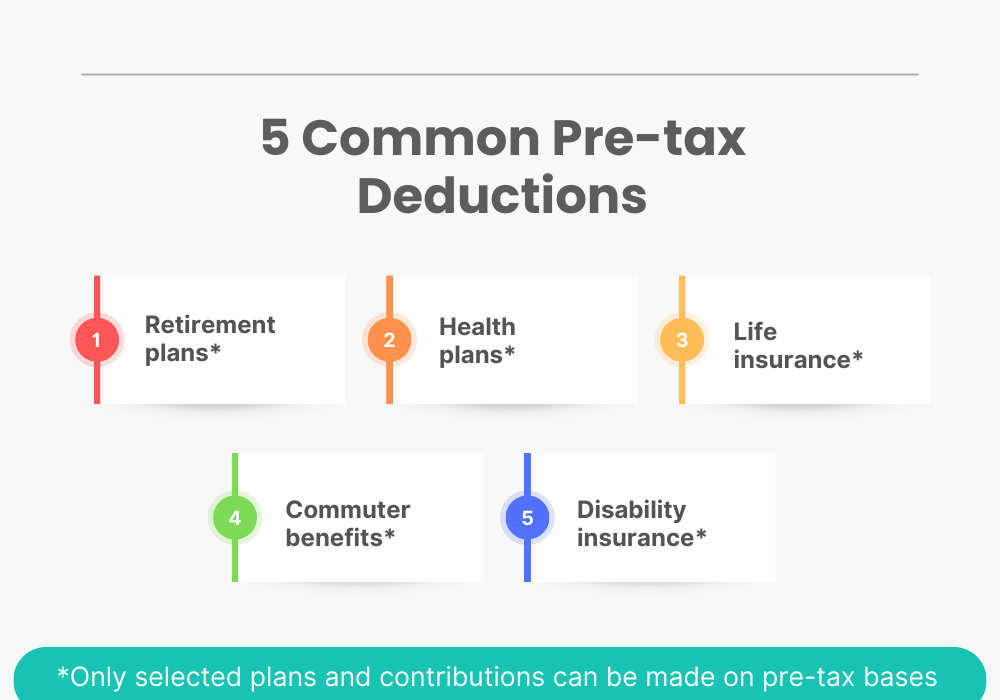

There are many types of pre-tax deductions. The most prominent ones include:

- Retirement contributions;

- Healthcare contributions;

- Disability insurance;

- Commuter benefits;

- Life insurance.

This doesn’t however mean that every retirement plan (or other deduction from the above list) is by definition a pre-tax deduction. For example, contributions to a Roth 401(k) or Roth IRA are made with after-tax dollars. So it’s important to remember that among the various payroll benefits, you can find both pre-tax and post-tax contributions.

Pre-tax retirement plans

Most traditional IRA plans, 403(b) plans, Thrift Savings Plan, and various 401(k) plans are pre-tax, which means that every dollar that’s put into them will lower an employee’s taxable income by the same amount. Nonetheless, there are yearly contribution limits to these plans, and depending on the plan, taxes usually have to be paid upon retirement when you withdraw the funds.

Remember that although these saving plans are exempted from income tax, they’re still subject to Social Security and FICA taxes.

Pre-tax health plans

Pre-tax health insurance plans are a commonly used employee benefit. An employer-sponsored health plan refers to health coverage purchased by an employer for their employees and dependents, with the cost of premiums often split between the employer and employee on a pre-tax basis. These plans may include group health insurance, dental insurance, vision insurance, or a health reimbursement arrangement (HRA).

Employer-sponsored health plans

These plans typically involve health coverage purchased by an employer for their employees and dependents. The cost of premiums is often shared between the employer and employee, with the employee’s portion usually deducted on a pre-tax basis. This can include group health, dental, and vision insurance plans.

Health Reimbursement Arrangements (HRAs)

HRAs are employer-funded programs that reimburse employees for qualified medical expenses, including insurance premiums. Contributions made by employers to an HRA are indeed pre-tax and exempt from payroll taxes. For employees, reimbursements are tax-free as long as their insurance policy meets minimum essential coverage (MEC) standards.

Some insurance companies employ generative AI to streamline the administration of these plans, leveraging algorithms to optimize cost distribution between employers and employees on a pre-tax basis.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a powerful tool for managing healthcare costs. In addition to the pre-tax contribution benefits and tax-free withdrawals for qualified medical expenses, HSAs offer portability (they remain with you even if you change jobs) and the funds roll over annually without forfeiture. Plus, the account balance can grow through investment, and this growth is also tax-free. It’s important to note that HSAs are only available to individuals with a high-deductible health plan (HDHP) and have annual contribution limits set by the IRS.

FSAs vs. HSAs

It’s key to distinguish between HSAs and Flexible Spending Accounts (FSAs). FSAs also allow for pre-tax contributions for medical expenses, but they typically have a “use it or lose it” policy, meaning any unused funds at the end of the plan year may be forfeited, unlike HSAs, which allow fund rollover.

Pre-tax commuter benefits

Pre-tax commuter benefits are a practical way for companies to support their employees, particularly in areas with high commuting costs. They can be a valuable part of an employer’s benefits package, helping attract and retain talent.

This arrangement reduces an employee’s taxable income, leading to potential tax savings and effectively increasing their net income.

For 2024, the amount you can set aside each month for things like bus passes and parking for work has gone up to $315. That’s $15 more than last year’s limit.

Employers also benefit from offering pre-tax commuter benefits. By reducing the taxable income of their employees, employers can save on payroll taxes. For example, a company can save an average of $40 per month for each participating employee, which can add up to significant savings annually for businesses with multiple employees.

Pre-tax disability insurance

Employer-sponsored disability insurance can be a valuable part of your financial safety net. It’s one of those things you hope to never need, but it’s really reassuring to have.

There are two main types: short-term and long-term disability insurance. Short-term disability insurance typically covers a portion of the employee’s salary if they’re temporarily unable to work due to an illness, injury, or childbirth. Long-term disability insurance kicks in for more extended periods of disability, potentially lasting for several years or even until retirement age.

If you pay your disability insurance premiums with pre-tax dollars, any benefits you receive from the insurance in the future are typically taxable. On the flip side, if you pay your premiums with after-tax dollars, the benefits are usually tax-free.

Employer-paid life insurance

This is a type of life insurance where the employer provides a life insurance policy for their employees, typically as a part of the overall benefits package.

The pre-tax status of these premiums set by the IRS applies only up to $50,000. While pre-tax deductions reduce taxable income before taxes are applied, the taxable benefit of life insurance (over $50,000) is treated as additional income after the employer pays the premiums. So the value of life insurance above $50,000 is added to your income and taxed accordingly, affecting the net take-home pay.

How to calculate pre-tax deductions

Want to know how pre-tax deductions are calculated? Here’s a simple breakdown of a few steps needed to calculate these deductions:

- Step 1. Identify eligible pre-tax deductions

Determine which deductions are eligible for pre-tax treatment (e.g., 401(k) contributions, health insurance premiums).

- Step 2. Determine deduction amounts

Decide on the amount to contribute or deduct for each eligible item.

- Step 3. Subtract deductions from gross income

Deduct these amounts from the employee’s gross income.

Pre-tax deductions example

Now let’s put the above steps into practice. For example, if an employee earns $3,000 per month and contributes $200 to a 401(k) and $100 to a health insurance premium, you need to subtract these from the gross income. This looks as follows:

$3,000 (Gross Income) – $200 (401(k)) – $100 (Health Insurance) = $2,700 (Taxable Income)

The resulting figure is the taxable income used for calculating income taxes.

What employers need to know about pre-tax deductions

If you’re an employer who’s also in charge of payroll or if you have an in-house HR team or even outsourced payroll and HR services, it’s always good to know the basics of pre-tax deductions. Let’s look at the most important points:

- Understand the types: Familiarize yourself with various pre-tax deductions such as 401(k) for retirement, HSA for health expenses, FSA for healthcare or dependent care expenses, etc.

- Check eligibility: Determine which employees are eligible for specific pre-tax benefits, as not all benefits apply to every employee.

- Explain benefits: Clearly communicate the benefits and advantages of pre-tax deductions to employees, highlighting how these can reduce taxable income. Educate employees about how pre-tax deductions impact their taxes and take-home pay.

- Stay updated: Keep up-to-date with the IRS regulations, including changes in contribution limits and tax implications.

- Accurate deductions: Ensure that the correct amounts are deducted from employee paychecks and properly reported to the IRS.

- Compliance: Adhere to all legal requirements and timely filings related to pre-tax deductions.

- Integration with payroll: Make sure payroll systems are set up to accurately manage and track these deductions. Payroll software can be very helpful here as it automatically tracks and calculates payroll deductions.

Check out more articles related to How to file taxes for ecommerce , tax tips for small business , and small business tax deductions.

Common mistakes to avoid when utilizing pre-tax deductions

While pre-tax deductions can be a great way to save money on taxes, there are some common mistakes to avoid. Proper financial planning and management can help you steer clear of those pitfalls.

Overlooking eligibility

Not every employee is eligible for all types of pre-tax deductions. The benefit of pre-tax deductions can vary based on an individual’s overall financial situation, tax bracket, and future tax rates. It’s essential to understand your specific benefits package to know which deductions you can utilize.

Misunderstanding tax implications

While pre-tax deductions can lower your income tax, they may not always reduce other taxes like FICA, for example. Also, a pre-tax deduction for retirement savings plans defers taxes rather than eliminates them. Taxes will be owed upon withdrawal in retirement for traditional 401(k) and IRA plans. Hence, it’s important to recognize the full tax implications of these deductions and if in doubt, contact your tax advisor.

If you are looking for a tax specialist, check out Synder Accountants Directory.

Ignoring limits

Pre-tax deductions have annual contribution limits. Exceeding these limits can lead to complex tax issues, so it’s important to be aware of these caps.

There’s sometimes confusion about who’s eligible for certain pre-tax deductions and the limits on how much can be contributed. For instance, there are annual contribution limits for 401(k) plans and HSAs set by the IRS, and not everyone may be eligible for certain accounts like HSAs.

Forgetting future taxation

Contributions to pre-tax retirement plans are taxed upon withdrawal. Remember this future tax obligation when planning for retirement and managing your finances.

It’s crucial to note, that if you were to withdraw money from your IRA retirement account before age 59 ½, you may be subject to tax penalties. It’s always best to consult your financial advisor for guidance.

Alternative ways to save for retirement and healthcare expenses

While pre-tax deductions are a great way to save for retirement and healthcare expenses, there are other options to consider as well. For example, Roth IRAs – Individual Retirement Accounts, allow you to save money for retirement after taxes are paid, which means your contributions grow tax-free.

Additionally, taxable brokerage accounts allow you to invest in stocks, mutual funds, and bonds, so they can be a good option if you want to save money for other things, like buying property or launching your own business. These accounts don’t have the same tax advantages as Roth IRAs but offer more flexibility in terms of investment and withdrawal options.

For healthcare expenses, a high-deductible health plan (HDHP) paired with an HSA offers an interesting combination. HDHPs have lower monthly premiums but higher deductibles, which means you pay more out of pocket before insurance kicks in. However, paired with an HSA, you can save money tax-free for healthcare expenses and potentially earn investment returns.

Final thoughts

Pre-tax deductions are a powerful tool for saving money on taxes and planning for your financial future. By contributing to retirement accounts, health savings accounts, and other pre-tax options, you can reduce your taxable income and save money in the long run. However, it’s important to understand the rules and limitations of pre-tax deductions and to avoid common mistakes. With some knowledge and planning, you can maximize your pre-tax deductions and stay on top of your finances.

Curious about how others are leveraging pre-tax deductions? Join the conversation in our comments section and share your own experiences or tips!

And if you want to take more control of taxes during tax season, you could try out Synder Sync, which will streamline your workflow and spare you more time for this crucial period. Integrating with the most popular ecommerce sales and payment channels like Amazon, Etsy, eBay, Stripe, PayPal, and many more, Synder acts like a bridge between them and your books. It unites everything into one ecosystem, automatically transferring all sales transactions from the connected platforms together with taxes, fees, shipping costs, and other related details to your accounting software. It also checks that there are no duplicates, hence eliminating the risk of data errors.

The most prominent features of the solution offered by Synder include (but aren’t limited to):

- Two sync modes: Per-Transaction or Daily Summary

- Smart Rules

- Rollback

- Unlimited import of historical data

Eager to learn more about this top-notch accounting solution? Book a slot at our Weekly Public Demo to learn more about Synder’s functionalities or sign up for a free 15-day trial.

It’s interesting to know that we’d maximize our pre-tax deduction to save money. Recently, my cousin said she has some questions about filing her taxes now that she’ll be the owner of a shop. I’ll share your insight with my cousin to help her lower her tax bill and retirement costs.

Thank you Barbara for explaining pre tax deductions and how it can help us save money in the long run. Tax is a bit complicated thing to understand. Your article was helpful!