The Profit and Loss (P&L) statement is a pivotal gauge of financial performance. Bringing together a company’s revenues, costs, and expenses, P&L speaks of profitability and shapes strategic decisions. However, it only works if done correctly. And here’s where a well-crafted P&L template emerges as a vital tool, simplifying the process of creating accurate and insightful financial reports and guiding businesses toward wiser financial management and growth.

Let’s look at what makes a good Profit and Loss statement and how to create, customize and utilize P&L templates in managing your business finances.

Contents:

1. What’s a Profit and Loss statement?

- The role of a P&L statement in managing a small business

- What an analyst can learn from a P&L statement

- Factors that impact the accuracy of a P&L statement

2. Why do you need a Profit and Loss template?

3. How to create and customize a Profit and Loss template?

4. Automated Profit and Loss – a wise approach to a P&L statement

What’s a Profit and Loss statement?

But let’s start with some fundamentals and look at a Profit and Loss statement.

By definition, a Profit and Loss statement is a fundamental financial report that provides a snapshot of a business’s financial performance over a specific period, usually a fiscal quarter or year. It presents a clear overview of the company’s revenues, costs, and expenses, ultimately revealing whether the business has generated a profit or incurred a loss during the specified time frame.

Usually, the P&L statement is structured to highlight the company’s top-line revenue, followed by various categories of expenses, such as cost of goods sold, operating expenses, and interest expenses. The difference between total revenue and expenses yields the net income or net profit, representing the residual earnings after accounting for all costs. Conversely, if expenses exceed revenue, a net loss is indicated.

Often they call the P&L statement an income statement, so you can choose whichever name you like more.

The role of a P&L statement in managing a small business

This financial document is critical for assessing a company’s financial health, efficiency, and profitability. It aids in internal decision-making, allowing management to pinpoint areas for cost reduction or revenue enhancement. It also helps communicate the company’s financial performance to external stakeholders, such as investors, creditors, and regulatory authorities, influencing their perceptions and investment decisions.

Let’s break it down.

Performance evaluation

The P&L statement brings together a business’s revenues, expenses and compares them to picture resulting profits or losses. Tracking these figures over different periods usually helps business managers assess the effectiveness of their strategies, marketing initiatives, and cost management efforts and identify successful ventures and areas that require adjustment.

Cost control and efficiency

The breakdown of expenses in the P&L statement enables businesses to identify specific cost drivers. This visibility empowers managers to identify inefficiencies, allocate resources more effectively, and implement cost-saving measures, thus enhancing profitability.

Strategic decision-making

With insights from the P&L statement at hand, business leaders can make better decisions regarding expansion, investment opportunities, product development, and pricing strategies. Understanding how changes in revenue and expenses affect the bottom line assists in weighing potential risks and rewards.

Budgeting and forecasting

The historical data provided by the P&L statement is invaluable for constructing accurate budgets and forecasts. These projections serve as roadmaps for financial planning, aiding in setting realistic goals and tracking progress toward achieving them.

Investor relations

A well-prepared P&L statement builds trust and credibility with investors and shareholders by demonstrating financial transparency. Investors use this report to assess a company’s financial health, growth prospects, and overall stability, influencing their decisions to buy, hold, or sell company shares.

Loan applications and creditworthiness

Lenders and creditors often rely on the P&L statement to evaluate a business’s creditworthiness. A strong profit margin and positive net income can enhance a company’s ability to secure financing at favorable terms.

Performance benchmarking

The P&L statement enables businesses to compare their financial performance against industry peers, competitors, or historical data. This benchmarking facilitates a deeper understanding of relative strengths and weaknesses, driving initiatives to improve and stay competitive.

What an analyst can learn from a P&L statement

Usually, it’s an analyst’s work to interpret the figures in a P&L report into more digestible information for business owners and stakeholders. A company’s accountant most typically puts on this analytical hat (but in the case of smaller businesses, a business owner might wear it as well). They’d look through those numbers, analyze those trends, and based on those, would tell, simply put, how well a business is doing, answering critical questions about it. Like, does a company make a profit? Where does the money come from, and what eats it up? Is a business likely to grow or shrink? Is it ready to grow, does it have capacity? How does it perform against competitors? And many more.

In other words, P&L reports are like chapters of a book a company’s writing in real time. Those capable of reading it (analysts, for example) can predict potential plot twists and offer the writer better solutions.

Factors that impact the accuracy of a P&L statement

With all the above in mind, it’s also worth noting that the value of the P&L statement emerges only when its numbers accurately reflect a company’s financial reality. Otherwise, the consequences might range from leading to bad choices to making investors worried to steering the business in the wrong direction (and more).

Multiple factors can impact the accuracy of the P&L statement, and we’ll look at the most common and critical ones.

- Recording of transactions

The accuracy of a P&L statement depends on the precise recording of all financial transactions. Errors or omissions in recording revenue, expenses, and other activities can distort the overall picture.

Want to learn more about how Synder can help your business? Book a seat at our free webinar to have your questions answered, or sign up for a free trial to explore Synder yourself.

- Expense classification

Properly categorizing expenses is crucial. Misclassifying costs results in wrongly calculating gross profit, net profit, and various expense ratios.

- Timing of revenue and expenses

Accurate timing of recognizing revenue and expenses is essential. Recognizing revenue too early or delaying the recording of spending can lead to inaccurate profit figures for a specific period.

- Accrual vs. cash basis accounting

The choice between accrual and cash basis accounting affects when revenue and expenses are recognized. Accrual accounting records revenue when earned and expenses when incurred, while cash basis records them when cash changes hands.

- Depreciation and amortization

Accounting for depreciation and amortization of assets properly is crucial. Errors in calculating these values can impact the expenses reported and the overall profit.

- Inventory valuation

For businesses that sell products, inventory valuation methods (FIFO, LIFO, etc.) influence the cost of goods sold, thus affecting gross profit.

- Non-recurring items

Including one-time or non-recurring items can distort the accuracy of ongoing operations. These items should be clearly disclosed and separated from regular expenses.

- Adjustments and corrections

Regularly reviewing and making necessary adjustments ensures the timely correction of errors so the P&L statement accurately reflects the financial reality.

- Currency exchange and translation

For international companies, fluctuations in currency exchange rates and translation of foreign financial data can impact the accuracy of reported revenues and expenses.

- Financial restatements

Errors found in previous periods may require restating historical financial statements, affecting the accuracy and comparability of the P&L statement.

- Disclosure and transparency

Clear and transparent disclosure of accounting policies, notes, and footnotes helps users of financial statements understand the context and the story told by the reported numbers.

As you can see, the accuracy of a P&L statement requires attention to detail, adherence to accounting principles, consistency in accounting practices, and thorough review processes. At this point, having a P&L template looks like a viable solution, helping to answer many potential issues. And we’re getting to it right away.

Why do you need a Profit and Loss template?

So, what’s a P&L template, and what makes it a thing?

Naturally, it’s a pre-made Profit and Loss statement framework, if you will, tailored to your specific needs.

It means the template considers your industry, particular revenue streams, and expense categories, ensuring the accurate tracking of your financial performance. Usually, a P&L template includes the necessary formulas to calculate critical financial metrics automatically, saving you time and effort. Besides, your template might enhance visual representation through charts and graphs, enabling quick identification of trends. As your business grows, you can customize the template to accommodate scalability, keeping your financial reporting relevant.

The biggest virtue of a P&L template is the organized and systematic approach to financial reporting, helping to keep integrity and consistency from report to report with no business-critical data omitted. This way, you can accurately track your progress over time and localize any unexpected changes and anomalies faster (so you can react accordingly).

Now, let’s go and see how you can create an effective Profit and Loss template for your business.

How to create and customize a Profit and Loss template?

To create your P&L template, you have a couple of options. You can build it from scratch, review and adjust your usual P&L statement, or, which is way easier, download the P&L template we offer in this article to use it as your starting point.

Major components of a Profit and Loss statement

Starting from scratch when creating a Profit and Loss template can be daunting. So breaking down the major elements of a P&L statement might be a good idea to simplify the process and ensure you capture crucial financial insights accurately. As you know, a P&L report contains various sections that come in a logical order one after another, ending with a bottom line, usually your profit. Let’s go through those one by one.

Revenue (Sales)

This section is pretty straightforward. It encompasses all sources of income your business generates. It might include product sales, service fees, subscription revenue, etc. – whatever you sell that brings you money. Usually, you can obtain the necessary data for this section from your sales records and invoices.

Cost of Goods Sold (COGS)

COGS includes direct costs of producing your goods or services, including raw materials, labor, manufacturing expenses, and packaging costs. You can calculate your COGS with the following simple formula:

COGS = Opening Inventory + Purchases – Closing Inventory

If we break it down, we can see the following:

- Opening Inventory is the value of inventory at the beginning of the accounting period. You can find the opening inventory value by referring to the balance sheet of the previous accounting period. Specifically, you’ll look for the closing inventory value from the prior period, which now serves as the opening inventory value for the current period’s COGS calculation.

- Purchases are the total cost of additional inventory purchased during the accounting period.

- Closing Inventory is the value of inventory at the end of the accounting period.

Gross Profit

You get the Gross Profit value by subtracting COGS from your total revenue. It represents the money your business earns after covering direct production costs. The data for this section comes from the Revenue and COGS sections.

Here’s the formula for calculating gross profit:

Gross Profit = Total Revenue – Cost of Goods Sold (COGS)

Operating Expenses

Operating Expenses include various costs necessary to run your business day-to-day. It can encompass marketing, rent, utilities, salaries, and administrative costs. You can get the needed information on operating expenses from invoices, receipts, and payroll records.

Operating Income (Operating Profit)

Operating Income is the result of subtracting operating expenses from gross profit. It reflects your business’s profitability before accounting for interest and taxes. The data is taken from the Gross Profit and Operating Expenses sections.

Other Income and Expenses

This section covers non-operating items such as interest income, interest expenses, and gains/losses from asset sales. It affects your overall profitability and financial position. Data is collected from various financial transactions and records.

Net Income (Net Profit/Loss)

Net Income represents your business’s overall profit or loss after all relevant costs and revenues. Basically, it’s your bottom line. You can consolidate the elements to calculate it from all previous sections of the P&L statement.

There are both simple and extended formulas for calculating net income.

Simple formula:

Net Income = Total Revenue – Total Expenses

Extended formula:

Net Income = Gross Profit – Operating Expenses + Other Income – Other Expenses – Taxes

The extended formula provides a more detailed breakdown of the components that contribute to the calculation of net income. Apart from the core revenue and expenses, it considers other income sources, additional expenses, and income taxes.

Creating templates in Google Sheet / Excel

One of the most popular tools for P&L template creation is Google Sheets or Excel, depending on what you prefer (they are pretty much interchangeable). Here, we’ll be having Google Sheets as an example. If you’re familiar with it, you know that you can insert formulas there for automatic calculations. Also, you can grant access to the document to everyone involved, which is convenient.

Back to the template. Needless to say that before you start, you need to have the necessary data at hand to fetch your numbers. Then you can start creating your template following several steps, and we’ll look at them to have a general idea. Please note that we’re describing the basic steps, and you can adjust the process to cater to your business case.

Step #1 – Set up your Spreadsheet

- Open Excel or Google Sheets.

- Create a new spreadsheet or open an existing one you want to turn into the P&L template.

Step #2 – Label your sections

Next, you create the two major sections of the template, namely Revenue and Expenses. For each section, you’ll have two columns that you label with the following headers:

- Description. This column will contain the names of the revenue and expense categories.

- Amount. This column will contain the corresponding values for each category.

Step #3 – Input your categories

- List your revenue categories (e.g., Sales, Services) in the Description column under the Revenue section.

- List your expense categories (e.g., COGS, marketing, rent) in the Description column under the Expenses section.

Step #4 – Add formulas for calculations

- In the Amount column next to each revenue category, input your revenue figures for the period.

- In the Amount column next to each expense category, input your expense figures for the period.

Step #5 – Calculate gross profit

- Create a cell below your revenue and expense entries and label it Gross Profit.

- In the cell next to it, input the formula: =SUM(Amount of Revenue Categories) – SUM(Amount of Expense Categories). This way, you’ll calculate your gross profit.

Step #6 – Add operating expenses

- Create a cell for Operating Expenses.

- Input your operating expense figures.

- Below the operating expenses, calculate Operating Income by subtracting the Operating Expenses from Gross Profit. For example, if your Gross Profit is in cell B10 and your Operating Expenses are in cell B11, the calculation formula you input into the cell for the Operating Income value will look like this: =B10 – B11

Step #7 – Incorporate other income and expenses

- Create cells for Other Income and Other Expenses.

- Input any additional income and expense figures.

- Calculate Net Operating Income by adding Other Income and subtracting Other Expenses from Operating Income.

For example:

- Cell B12 contains the value of Operating Income.

- Cell B14 contains the value of Other Income.

- Cell B15 contains the value of Other Expenses.

In an empty cell where you want to display Net Operating Income, you can use this formula: =B12 + B14 – B15

Step #8 – Include tax expenses

- Create a cell for Tax Expenses.

- Input your tax expense figure.

- Calculate Net Income by subtracting Tax Expenses from Net Operating Income.

Step #9 – Format your template

Apply formatting to make your P&L template visually appealing.

Use borders, shading, and font styles to differentiate sections and make data stand out.

Step #10 – Name and save

Give your template a meaningful name for future use (you might want to save it if working in Excel).

Remember that Excel and Google Sheets offer various formatting and customization options, so feel free to experiment and make your P&L template as informative and user-friendly as possible. You can add sections for your company name, name of the person owing the P&L report, add the comments section, etc. You can also add graphs and charts to visualize your data for better perception.

Automated profit and loss – a wise approach to P&L reporting

With all the possibilities Google Sheets provides for P&L reporting, you still have quite a chunk of manual data entry. And it’s a drawback as it takes time, and there’s a high risk of errors. Meanwhile, many accounting software solutions possess in-built reporting, including P&L and other financial statements, saving you time and effort. Behind it, there’s a good deal of automation freeing your hands from daunting data entry and eliminating the possibility of errors, ensuring your P&L statements are always neat and accurate. At this point, automating your P&L reporting seems a wiser approach.

Let me show you how it works (real quick) on the example of Synder.

Synder is a comprehensive accounting solution for online businesses, helping them handle a substantial portion of financial management with automation, providing high data accuracy, and liberating you from the burdens of manual labor. The platform allows businesses to join multiple payment gateways (such as Stripe, PayPal, and Square), online marketplaces (including eBay, Etsy, Amazon, and Shopify), as well as accounting software options (like QuickBooks Online, Xero, QuickBooks Desktop, or Synder Books) into a single financial ecosystem to seamlessly integrate business transaction data, efficiently categorize it, and have it ready for accurate reconciliation, financial reporting, and tax filing.

Now, getting to P&L reporting, Synder fetches transactions with a high level of detail: from payment processing fees to various customer and product data (such as names, locations, SKUs, etc.). All these invest in the accuracy of P&L reports and make them super informative.

Synder features an in-built customizable P&L template, allowing for tracking your profit and loss in multiple dimensions, depending on what you want to find out. Thus, you can set up your template in Synder to show your profit and loss for a certain period, like for a year, month by month, to identify certain trends. You can also break it down by products, location, ecommerce store, etc., for a more granular look at the best and worst performing revenue sources to adjust your strategies accordingly.

Now, let’s see how it works in Synder.

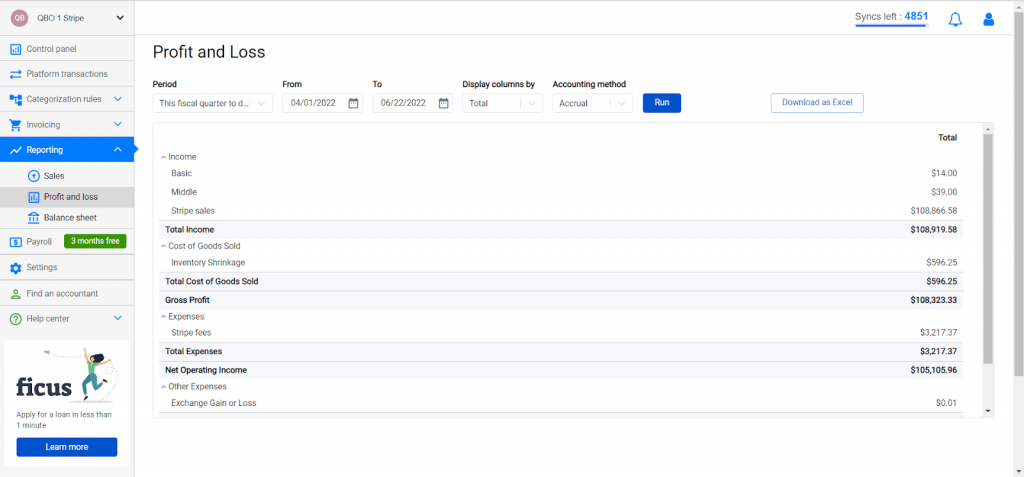

Upon logging in to your Synder account, you get to the main Dashboard.

Here, on the menu on your left, you can click on Reporting and choose the report you want to generate. In our case, it’s Profit and loss.

There, you need to set up the report by selecting options on the drop-down menus, such as:

- Period – this month to date, last month, this year to date, or you can choose a custom interval;

- Display columns by – location, contact, ecommerce stores, product, tags, tax, payment processor, or month;

- Accounting method – cash or accrual.

Once you’re done with the settings, click the Run button, and that’s basically it.

Here’s what your P&L report for a certain period might look like:

As mentioned above, you can create custom P&L statements depending on what you need to track. You can also download them as Excel files to use outside of Synder.

Bottom line

To cut a long story short, the Profit and Loss statement is a vital measure of a business’s financial health, providing insights into profitability and driving strategic decisions. Crafting a well-designed P&L template streamlines reporting by automating calculations and ensuring data accuracy. While manual templates are an option, leveraging software offers a wiser approach, automating data entry and enabling deeper financial analysis, ultimately enhancing business growth.

I really appreciate how the blog explains profit and loss statements in simple terms. Thanks, author, for breaking down finance jargon for us. This makes managing my business much easier!

Thank you so much! I am glad you like how we explained the P&L statement. Best of luck in your business endeavors!