As a small business owner, you might prefer to use a Mac over a PC to run your business. For many people, Apple computers look more attractive due to their in-built security features and simplicity of use. However, when managing business finances, Mac users could face difficulties finding accounting software compatible with their operating system. Although the market for accounting and bookkeeping software for PCs is still much wider, it doesn’t mean accounting solutions for Macs are a rare finding today.

In this article, we’ll review the ten best Mac accounting solutions available on the market that small businesses might want to consider. We’ll also show the benefits and challenges of using Macs for business accounting and explain which features should be considered when choosing Mac-compatible accounting software.

Here’s what you’ll learn about Mac accounting software:

1. Top 10 best Mac accounting software for a small business

- Synder

- QuickBooks Online

- Xero

- Zoho Books

- FreshBooks

- AccountEdge Pro

- Kashoo

- FreeAgent

- Wave Accounting

- Connected Accounting and ERP

2. Why might small businesses choose Mac?

3. Is all accounting software Mac supported?

4. The challenges of choosing user-friendly accounting software for Macs

5. Various types of Mac accounting software

6. What factors should mac users consider when choosing accounting software for small businesses?

Without further ado, let’s dive into Mac accounting software!

Top 10 best Mac accounting software for a small business

Let’s look at some great accounting software that can suit Mac users. We tried to pick solutions featuring different pricing and deployment and more than just basic accounting. Moreover, we also include software that can integrate with other business tools and apps.

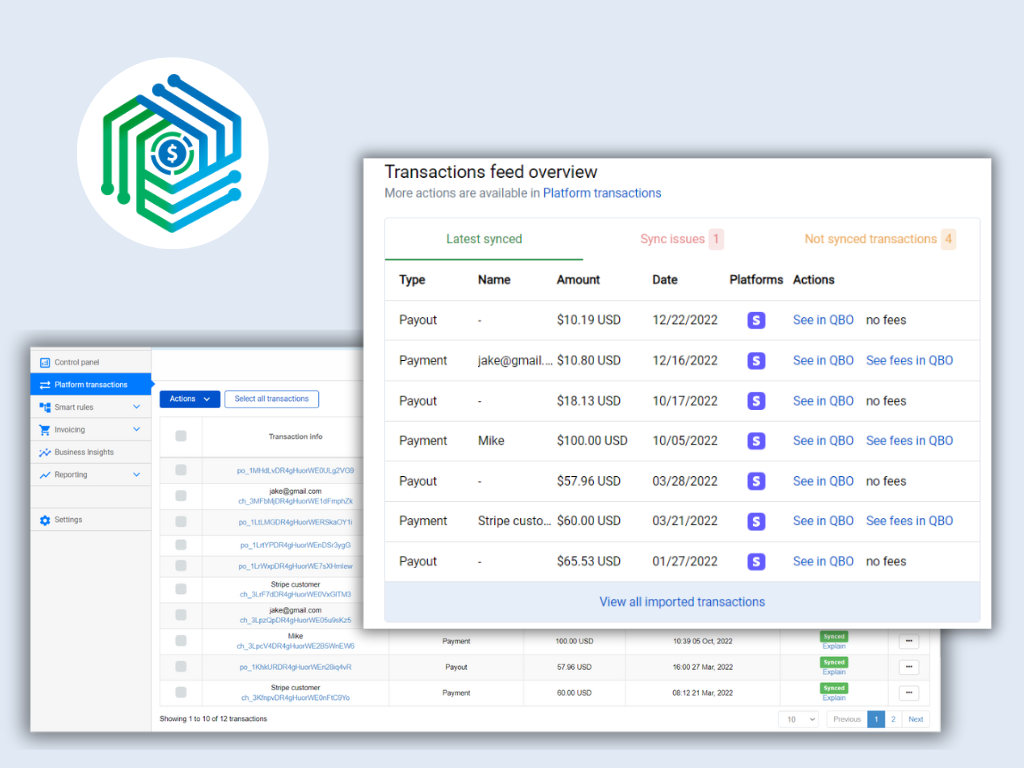

Synder – accounting software for Mac with instant business insights

Synder is an e-commerce accounting and analytics software that allows businesses to integrate all their sales and payment platforms in a single ecosystem with accounting. Synder connects 25+ payment processors and e-commerce platforms to the most popular accounting software, such as QuickBooks Online, QuickBooks Desktop, and Xero, and its own accounting, Synder Books. Synder users can benefit from accounting automation at its most. Combined with powerful sales analytics and instant business insights, it gives business owners a comprehensive overview of their finances and profitability.

Business types:

Synder is the best choice for e-commerce businesses, online merchants, SaaS, and other subscription-based businesses as well as services with high volumes of transactions.

Synder’s most prominent features:

- General accounting;

- Financial statements;

- Accounting automation (daily summaries or per transaction synchronization);

- Accounts reconciliation;

- Multicurrency;

- 25+ integrations (Shopify, Amazon, Stripe, PayPal, QuickBooks, Xero, and more);

- Business analytics;

- Invoicing;

- Payment links (easily accept online payments from inside emails, social media, etc.);

- Inventory management;

- Smart workflow automation rules (product mapping, categorizations, notifications, automatic emails, applying of taxes, etc.);

- 24/7 support (email, phone, live chat), free online demo.

Pricing:

Synder offers a variety of subscription plans. A 15-day free trial is available. Paid plans consist of the Basic plan ($13/month), the Small plan ($28/month), the Medium plan ($55/month), the Scale plan ($99/month), and the Large plan ($355/month). By paying yearly, you can save 20%.

Why not learn about the benefits of Synder for your business from a seasoned professional? Delve into this overview by Kelly Gonsalves, a Top 50 cloud accountant in North America, a member of the Intuit Trainer/Writer Network, and Insightful Accountant’s Top 100 ProAdvisor, to understand why Synder’s automation is essential for online businesses.

QuickBooks Online – cloud-based accounting software for Mac

QuickBooks Online is cloud-based accounting helping small businesses manage their finances, including income, expenses, payroll, and more. QuickBooks integrates with multiple payment processors and sales platforms directly or via third-party solutions available on their app marketplace to automate bookkeeping and financial reporting.

A quick note: you might want to know that apart from the online version, QuickBooks also comes as a desktop solution compatible with Mac.

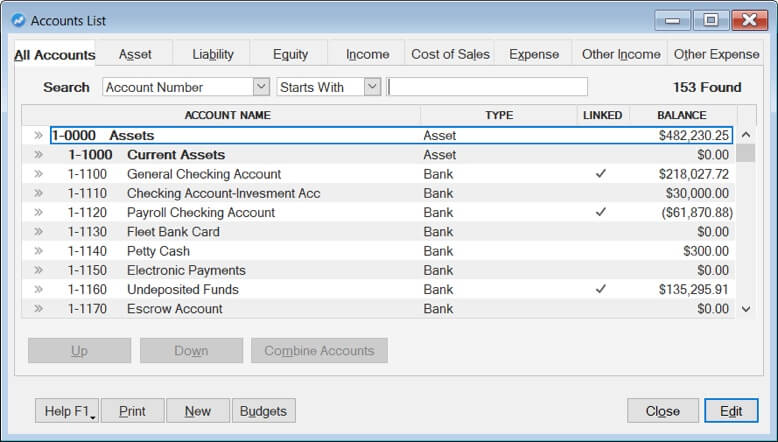

Source: quickbooks.intuit.com

Business types:

QuickBooks accounting can be a great choice for small and medium-sized businesses that need accounting with payroll.

Most prominent features of QuickBooks Online:

- General accounting;

- Integration with payment platforms;

- Invoicing;

- Capturing receipts;

- Accepting payments;

- Financial reporting;

- Payroll management;

- Inventory;

- Contractor management;

- Mobile app;

- Tax preparation.

Pricing:

QuickBooks offers various subscription plans that businesses might choose from considering their particular needs. QuickBooks plans offer discounts for its clients for the first 3 months. The plans consist of the Self-Employed plan ($7.50 per month for the first three months, then $15/month), the Simple Start plan ($15 for the first three months, then $30/month), the Essentials plan ($27.50 per month for the first three months, then $55/month), the Plus plan ($42.50 per month for the first three months, then $85/month), and the Advanced plan ($100 per month for the first three months, then $200/month). With QuickBooks Online, a free 30-day trial is available.

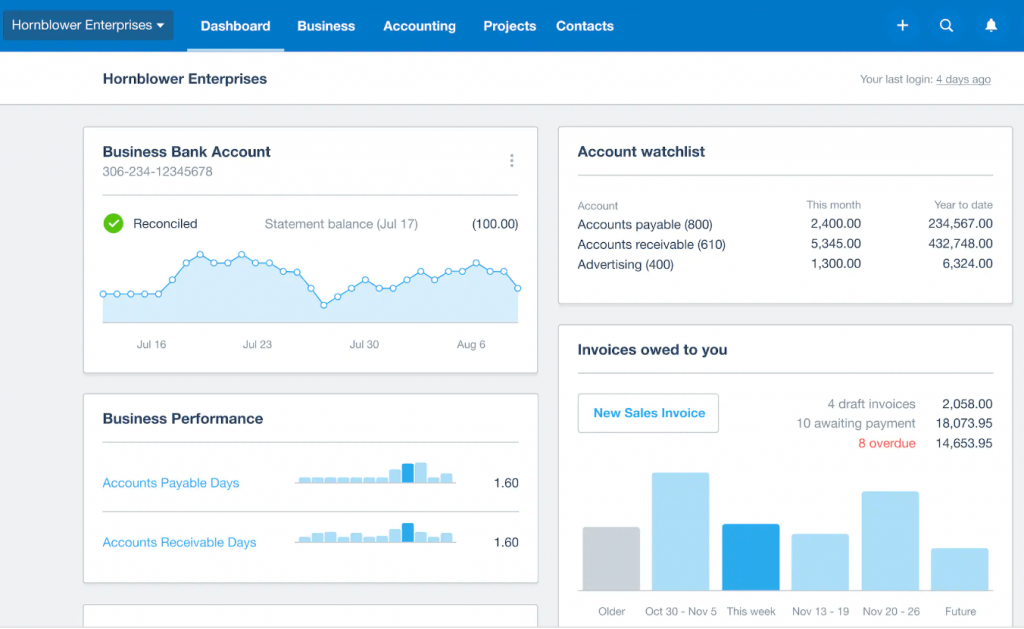

Xero – accounting software for small and medium-sized businesses

Xero is a cloud-based accounting software tailored for small and medium-sized businesses. It helps automate bookkeeping, invoicing, and payroll management. You can easily connect Xero to your bank and reconcile your accounts. Whichever your accounting method is – cash-based or accrual – Xero works well for both. It also features tired access for multiple users. At this point, a business owner can decide what level of access to give to an accountant or a CPA firm helping with accounting and taxation. Xero accounting can integrate with other business software. It possesses a great app marketplace, so whenever users need to extend their Xero functionality, they have a wide choice of apps that come to help.

Source: xero.com

Business types:

Xero can be a wonderful choice for small and medium-sized businesses.

Most prominent Xero’s features:

- Cash-based and accrual accounting;

- Real-time cash flow;

- Inventory management;

- Automatic import and coding of your bank transactions;

- Automated invoicing;

- Spend management and billing payments in bulk to creditors;

- Optional add-on for Gusto payroll app;

- Instant, up-to-date reporting with quick links to all the original transactions.

Pricing:

Xero offers three subscription plans that might suit businesses at different stages. Plans consist of the Early plan ($12 per month), the Growing plan ($34 per month), and the Established plan ($65 per month). Xero users can avail of a free trial of 30 days.

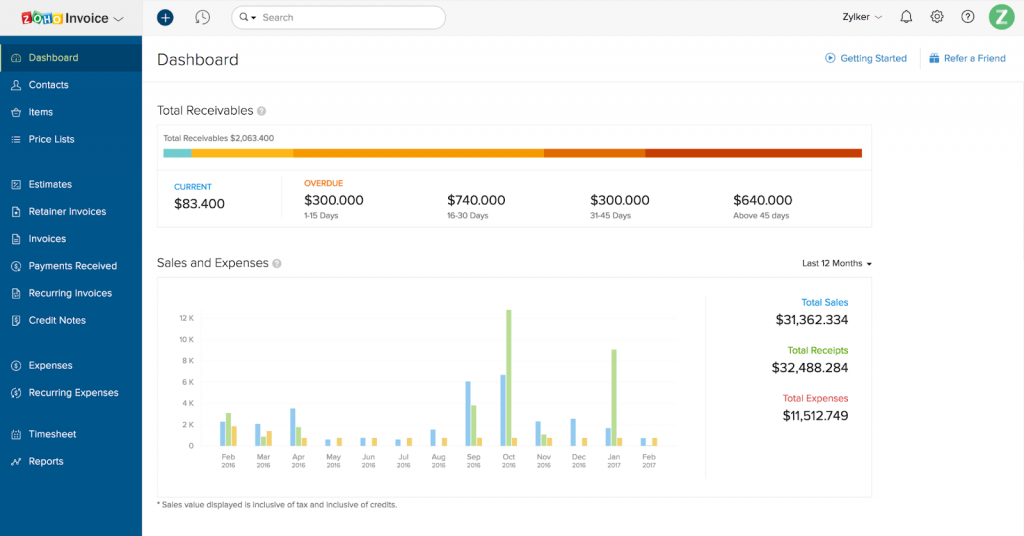

Zoho Books – accounting software for Mac suited for freelancers and startups

Zoho Books is an accounting platform that helps businesses do bookkeeping easily, manage accounting tasks, and neatly organize their transactions. The platform features convenient billing and invoicing, accounts reconciliation, financial statements, cash flow control, and more.

Source: zoho.com

Business types:

Zoho Books is specifically tailored for Mac users. It’s designed to work with Apple products and even has an app for the Apple Watch. Zoho Books was primarily designed to simplify accounting for small businesses. Besides, it can suit freelancers and startups.

Most prominent features of Zoho Books:

- Customizable invoice templates, online payments, and transaction approval;

- Recurring expenses, vendor credits, and landed cost;

- Inventory tracking, price lists, and inventory adjustment;

- Automated bank feeds, transaction matching, and reconciliation;

- Scheduled and customized reports;

- iOS app for mobile devices;

- Multiple project management, timesheet.

Pricing:

Zoho Books comes with a bunch of subscription plans, allowing for a monthly or annual commitment. Users can choose the best fit according to their needs. A free plan is available for businesses with up to $50K annual revenue. Zoho’s’ paid plans consist of the Standard plan ($20 per organization/month), the Professional plan ($50 per organization/month), the Premium plan ($70 per organization/month), the Elite plan ($150 per organization/month), and the Ultimate plan ($275 per organization/month). By choosing a yearly option users can avail of discounts on the above plans. A 14-day free trial is available for Zoho Books.

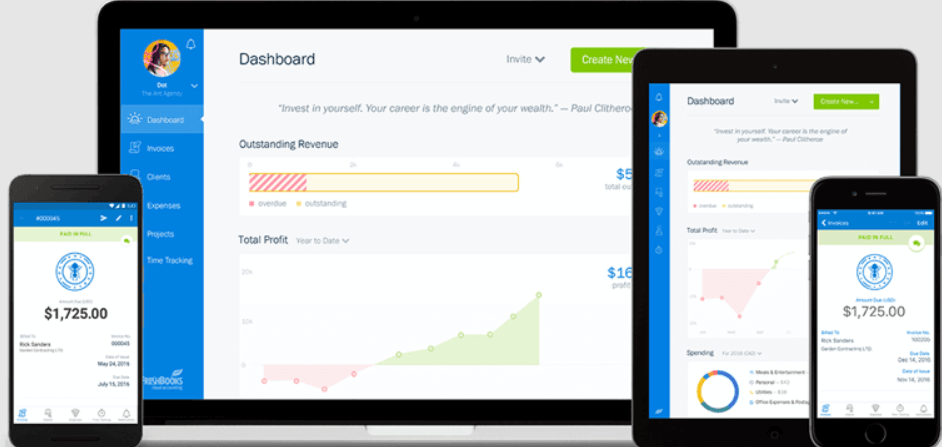

FreshBooks – accounting software for Mac with financial management features

FreshBooks is one of the great cloud accounting apps created primarily for small and medium-sized businesses. Tailored to help companies securely and accurately handle their finances, FreshBooks offers efficient tools for automating the accounting process, expense management, invoicing, business reporting, and time-track features. It’s a cross-platform and cross-device app that perfectly fits Mac users.

Source: freshbooks.com

Business types:

FreshBooks can be a good fit for small and medium-sized businesses.

Most prominent FreshBooks features:

- Online accounting and bookkeeping;

- Expense and receipt tracking;

- Estimates and invoicing;

- Accepting payments;

- Client management;

- Payroll management with Gusto integration;

- Time tracking.

Pricing:

FreshBooks offers a selection of subscription plans that might suit various businesses depending on their needs. Monthly and annual subscriptions are available, with the annual FreshBooks offer providing discounts for its users. As of March 2023, there is a limited-time offer that can give FreshBooks’ clients 60% off for the first 6 months. The plans consist of the Lite plan ($6.80 per month for the first 6 months, then $17 per month), the Plus plan ($12 per month for the first 6 months, then $30 per month), and the Premium plan ($22 per month for the first 6 months, then $55 per month). There’s also a Custom plan that can be agreed upon between a client and the FreshBooks team. There is a free 30-day trial available.

AccountEdge Pro – desktop accounting software for Mac

AccountEdge Pro is a desktop accounting software suitable for Mac, tailored primarily for small and growing businesses. In addition, it allows remote access for those who might need to perform tasks outside the office by opting in for the AccountEdge Pro Hosted version. AccountEdge Pro offers both self-service and full-service payroll options. It also offers the Shopify Connector and UPS integration for online merchants.

Source: accountedge.com

Business types:

AccountingEdge Pro can be a wise choice for small businesses at the stage of growth. It can perfectly fit Mac users and business owners who prefer desktop solutions.

Most prominent AccountEdge Pro features:

- Chart of accounts;

- Creating and tracking sales and purchases;

- Budgeting, planning, and forecasting;

- Customer relationship management;

- Job cost;

- Order entry;

- Project management;

- Time and billing.

Pricing:

AccountEdge Pro comes with a one-time fee of $499 to get started. User licenses are charged separately. A free 30-day trial is available.

Kashoo – small business accounting software for Mac

Kashoo is a cloud accounting software solution designed for small businesses to simplify bookkeeping for business owners, giving them more control over the books and the possibility to manage them themselves. Thanks to the simplicity of use and intuitive interface, Kashoo offers small business owners a smooth experience in controlling and managing their transactions. It includes a bunch of helpful accounting features: from financial reporting to creating and sending invoices and accepting payments. The software also integrates with some other accounting, payment, and payroll management systems.

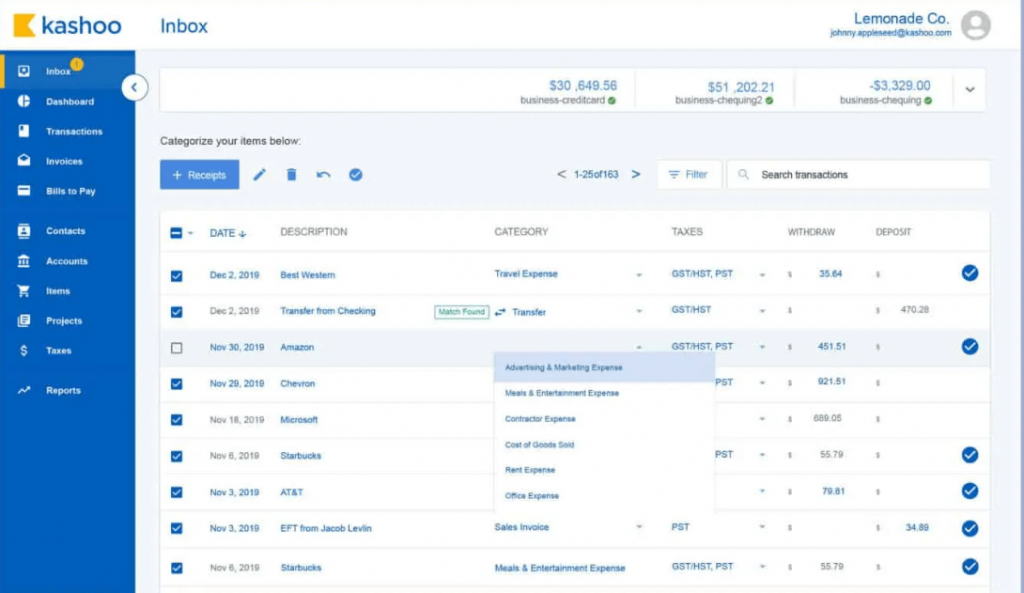

Source: kashoo.com

Business types:

Kashoo can suit small business owners who prefer or have to do the bookkeeping themselves.

Kashoo’s most prominent features:

- Connection to bank accounts;

- Income and expense tracking;

- Invoicing and accepting payments;

- Standard and customized financial reporting;

- Clients and suppliers management;

- Project management;

- Multi-user account management.

Pricing:

They offer subscriptions with the possibility to pay monthly or annually. There’s currently a time-limited offer for new users on their 2 accounting plans namely, the Trulysmall. accounting plan ($1/first year) and the Kashoo plan ($2/first year).You can avail of a free trial for 14 days. Additional fees can be charged for online payment processing, adding more businesses to the account, and payroll management.

FreeAgent – accounting software for Mac for efficient management

FreeAgent is an online accounting software solution designed to help small business owners, freelancers, and financial specialists, such as bookkeepers and accountants working with small businesses. It automates accounting, helps business owners understand and control their cash flow, and allows for efficient management of everyday financial routines.

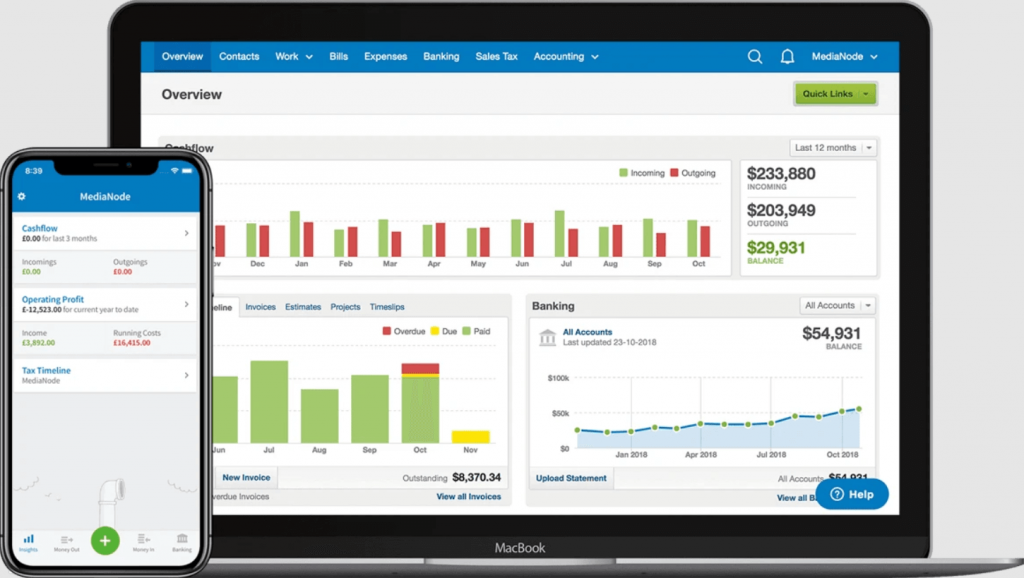

Source: freeagent.com

Business types:

FreeAgent can be a great fit for small businesses, freelancers, accountants, and bookkeepers.

Most prominent features of FreeAgent:

- Accounting and bank feeds;

- Automated categorization of transactions;

- Sales tax reporting;

- Multi-currency invoicing;

- Estimate templates;

- Multi-language and multi-currency estimates;

- Project and time-tracking.

Pricing:

FreeAgent is a subscription-based accounting software. They offer a single pricing plan with a 50% discount for the first six months of use for new subscribers ($10 for the first 6 months, then $20 per month). A 30-day free trial is also available.

Wave Accounting – free accounting software for Mac

Wave Accounting is a free web-based accounting software tailored to cover the needs of small businesses and businesses at the beginning level. Wave helps business owners manage the most basic accounting processes, such as bookkeeping, invoicing, and financial reporting, in one place through a few internal integrations.

Wave software features several add-ons, allowing it to extend the functionality to comprise payroll and payments. It comes with a user-friendly interface and a comprehensive dashboard giving an overview of business performance at a glance. Only self-service customer support is available, which might be a drawback for a non-tech-savvy person. It means you’ll need to browse Wave’s knowledge base or communicate with a chatbot to find a solution to your issue, should it occur.

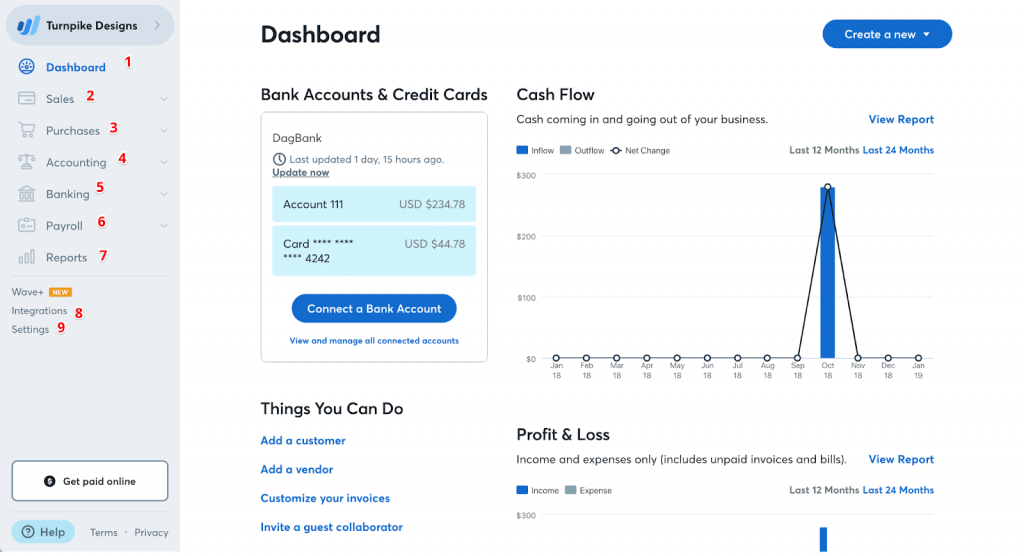

Source: waveapps.com

Business types:

Wave can fit the bill for small businesses, startups, micro-businesses, or sole proprietors that need simple basic accounting and invoicing.

Most prominent Wave accounting features:

- Banking with built-in bookkeeping;

- Accounting with income and expense tracking;

- Basic accounting reports;

- Automated invoicing;

- Recurring invoicing;

- Accepting payments online;

- Payroll management;

- Advisor help.

Pricing:

The basic feature set in Wave accounting is free. However, additional features, such as payroll, online payments, and advisor help, come with separate charges each.

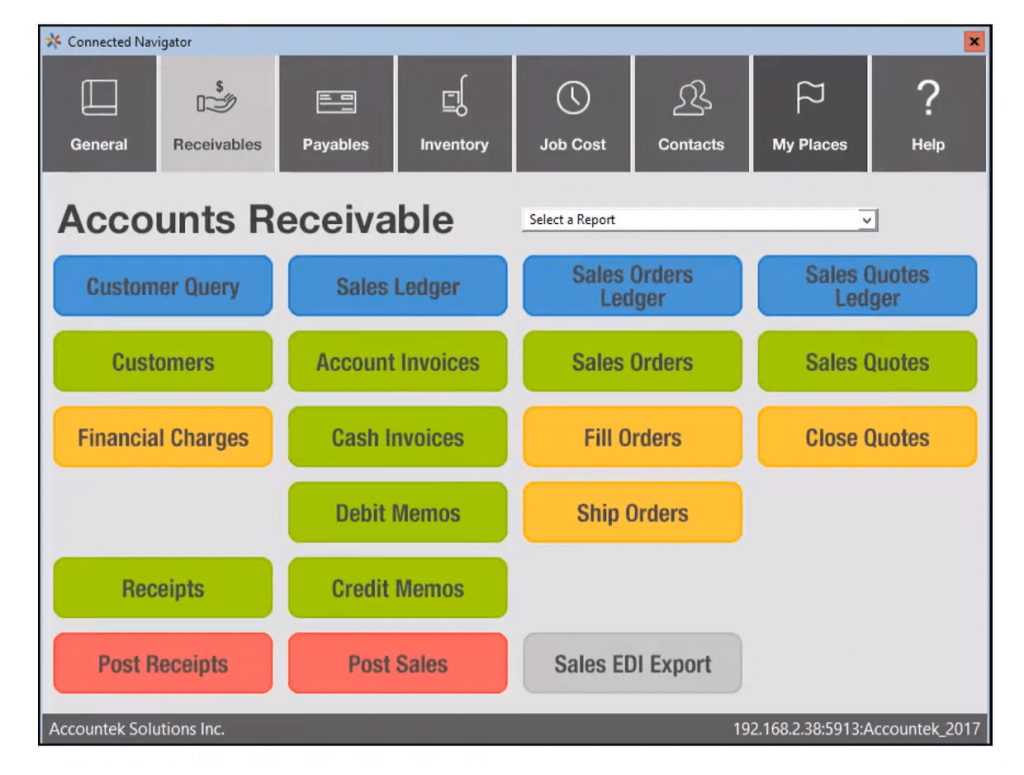

Connected Accounting and ERP – customizable accounting software for Mac

Connected Accounting & ERP is accounting software available as both desktop (for Mac and PC) and cloud-based solutions. The Core Accounting product helps small businesses manage their finances, accounts receivable, and payable, and delivers standard reports such as income and cash flow statements, inventory, sales tax summaries, and 1099 forms—empowering businesses with tools for ERP optimization.

Several integrations with partner services allow businesses to accept and process payments, manage payroll, and customize the program to address the specific needs of a business.

Source: accountek.com

Business types:

Connected Accounting & ERP might suit small businesses that prefer desktop solutions to securely do their accounting.

Most prominent features of Connected Accounting and ERP:

- General Ledger, accounts receivable, and accounts payable;

- Inventory control;

- Support of multi-currency;

- Accepting payments;

- Managing payroll;

- On-demand customization.

Pricing:

The desktop version of Connected Core Accounting comes with a one-time charge for a perpetual license (starting from $1,499). The cloud-based version, Connected on Demand, is offered as a SaaS with a monthly subscription. For a price quote, you need to contact Connected Accounting & ERP.

Why might small businesses choose Mac?

It’s a common belief that Mac computers are a more frequent choice in the creative niche. It’s partially true, thanks to many in-built tools and a wide selection of Mac software, making life easier for designers and other creative professionals. However, Apple computers may also suit various types of small businesses. Just like other PCs, running a business using Mac can have its benefits and some hardships when it comes to business software, including accounting software programs, and we’ll look at both.

But let’s start with the features that make Apple computers stand out from other PCs.

The simplicity of use. macOS (the Apple operating system) is user-friendly. It makes everyday office work a breeze. Mac doesn’t suppose the users should necessarily be tech-savvy to make full use of macOS.

Regular updates. Apple consistently improves macOS with new features and security fixes. The latest release, macOS Tahoe beta, continues that tradition. You can compare macOS Tahoe vs Sequoia to decide which version aligns better with your needs.

Focus on creativity. It’s true that a lot of specific software aimed at designers and other creative professionals was initially created for macOS, which makes them sometimes fiercely loyal to the brand.

Security. Mac computers feature solid in-built protection measures, making them harder to hack. So if a business deals with sensitive information, like financial data, for example, choosing Mac can be a smart decision.

Maintenance. Being, most often, a more expensive solution compared to devices of the same class from other brands, Macs feature lower maintenance, better reliability, and simpler troubleshooting, when your Mac is working slow or shows errors.

Is all accounting software Mac supported?

That’s a perfectly valid question that some users might have. So is all accounting software Mac supported? The short answer is no. The long answer is, many of the leading software companies offer Mac-supported versions of their accounting software but they don’t always provide the same range of features that their Windows counterparts do. On the other hand, some software like Zoho, for example, offers Mac-specific features. That’s why it’s always best to review various options and compare their features.

Additionally, if you like to have access to your accounting software when you’re on the go, some providers offer iOS apps that you can use on mobile devices. These don’t always mirror the features offered in the non-mobile version so make sure to read detailed descriptions of a mobile app for a better understanding of its functionality.

The challenges of choosing user-friendly accounting software for Macs

The biggest difficulty in using Mac computers is probably the limitations in the software you can use. Compared to the software created for other PCs, the choice is narrower, and since you need to stick to the macOS software, it can sometimes be an issue.

Still, it’s worth making a small remark: most of these limitations relate to desktop programs. Today, many software vendors either strive to make their software cross-platform or offer cloud-based solutions. The latter eliminates these limitations connected with using this or that operating system. Moreover, it allows businesses to use the computers they (and their employees) are more comfortable with without worrying about compatibility.

We’ll still review the hardships you might face having to stick to desktop solutions, including small business accounting software.

Limited features

The sad truth about PC software adjusted for Mac is that it used to provide limited features compared to the PC version. For example, you could have the basic functionality, but some additional features (that could be quite helpful) could be unavailable.

Excessive functionality

This is the other side of the same coin. Your Mac-version software might have too many features, some of which you might never need to use. While at first, they might seem great to have, in reality, they create too much clutter, making it difficult to use the software.

Compatibility

Even if you have a complete Mac working environment, it can be different for your external partners, such as accountants or tax advisors. In the worst-case scenario, they won’t be able to open and use the documents you give them access to, because their format isn’t supported by the operating system or accounting software they use. In the best case scenario, they’ll need much more time to adjust to working with you.

Still, such adjustments bear a high risk of inaccuracy due to switching data from one format to another. To make things worse, the adjustments might stop working after the software gets updated.

Poor business software integration

This one is very close to the issue described above. Many business software can be PC-centric. So, if you’re using different computers to run your business (like with macOS, Windows, etc.), it can be challenging or impossible to integrate your business software across various operating systems. This way, you’ll burden yourself (or your employees) with the tedious tasks of copying data between apps. In the case of bookkeeping, it can be extremely error-prone and time-consuming (and you can spend a fortune on a bookkeeper, especially if they charge you per hour).

Though, as previously mentioned, plenty of cloud-based solutions are available on the market, including various business software, you still might want to know about these hardships. Switching to new software can be hard for many people. So if your accountant used to work with desktop accounting software (like QuickBooks Desktop, for example), you might need to find some way to organize your work.

Various types of Mac accounting software

Let’s look at the types of Mac accounting software and what you should pay attention to in choosing the perfect one.

Types of accounting software for Mac: Deployment

Based on deployment, accounting software for Mac can be divided into desktop, cloud-based, and web-based. Let’s review each type to assist you in making the best buy for your business.

Desktop accounting software

Desktop software is usually the one licensed for use locally on desktops, laptop computers, or related local area network servers. To start working, a user needs to install the software on their computer. Desktop software solutions score highly on security metrics, as they run locally, so there’s no access to the data from outside the network. However, it can be costly, as you usually pay for such software per license. There can also be compatibility issues (we’ve touched upon them earlier).

Cloud-based accounting software

Cloud-based software usually refers to software that’s hosted and operates in the cloud server and that you access and use via a web browser, a dedicated desktop client, or an API that integrates with your desktop or mobile operating system. Usually, cloud-based software is provided under a SaaS model, which means you pay to access the software functionality, and in most cases, the pricing is subscription-based.

Web-based accounting software

Web-based software usually operates on a server connected to the internet, and users access it from their computers using an internet browser. Examples of web-based software include online stores, social media sites, e-mail services, and various business software, including accounting, CRMs, team collaboration tools, and more.

Types of accounting software for Mac: Pricing

Pricing types for accounting software comprise free, one-time-charge, and subscription-based solutions.

One-time-charge accounting software

One-time-charge pricing means that you pay once for the use of the software. Depending on the provider, software updates and technical support might be included in this price, or you’ll have to pay for them separately. Basic on-premise (desktop) Mac accounting systems may cost around $200 – $400 for limited user licenses. It can be a one-time expense, giving value for a longer duration. The one-time charge can help avoid frequent payments and outflow of cash.

Free accounting software

Sometimes, vendors can offer the software free of charge. It often comes as one of the pricing plans. The free plan usually provides only basic features. Examples of companies that provide completely free plans are Zoho and Wave.

Using free accounting software for Mac is more typical for smaller companies that have the most basic accounting needs. But it’ll always be a compromise between functionality and sticking to the budget. So as a company grows, it might be more profitable to choose paid accounting software and enjoy wider functionality.

Another way you can use software for free is during the trial period. Depending on the vendor, it can last from a couple of days to a month. That usually gives you the ability to compare different apps, software, and their fit for your business needs.

Subscription-based accounting software

Subscription-based pricing is a payment model that allows customers to split the payment for software or services for the period they’re going to use it. Usually, a subscription is paid monthly or annually. This flexibility in the level of commitment can be a great advantage. Thus, the per-month subscription allows you to painlessly cancel it after using the software for several months and understanding it’s not a good fit for you. An annual subscription, on the other hand, usually proves to be a cheaper option in the long run.

What factors should Mac users consider when choosing accounting software for small businesses?

Though pricing and type of deployment matter, there are even more important factors one needs to consider when choosing accounting software for Mac. Just like with any business software, there’s no one-fit-for-all solution. There are many things to consider and they usually depend on the business and its particular needs. Hence, we’ll now go through the factors that might influence the choice of software for small businesses.

Usability

Ease of use is probably the primary requirement for any solution, not only accounting software. After all, all those great features the software might offer don’t matter if you don’t understand how to find and use them. Sometimes, you can find it hard to set up the solution, navigate it, or understand the names of its different features. Even one such flaw can scare users away, prompting them to ultimately stop using the app or software.

For tools, such as business accounting software, it’s critical to be user-friendly. After all, people use them to solve pretty complicated tasks. So why add more complications? Ideally, accounting software should be straightforward, intuitive, and comprehensible (and prepare your morning coffee, but that’s optional).

Integrability

Accounting is an integral part of the management of your business. At this point, you might want your accounting software to integrate with the other business software that you use. Depending on the character of your business and what data you want to have in accounting, these may be customer relationship management software (CRMs), inventory management systems, payment systems, e-commerce platforms, and more.

Apart from the most obvious virtue – automated import of the data from your various business software and other sources into accounting – such integration can help manage your business in a single ecosystem, preventing data loss and inaccuracies, and giving you a more comprehensive overview of your business.

Security

As a business, you deal with highly sensitive information, such as your financial data, customer details, etc. You want to make sure that the type of software or app you use handles all that data in a secure manner and according to law and your internal policies.

It’s a common practice for small businesses to outsource their accounting to a third party. At this point, sharing access to your accounting, you need to be sure your sensitive data is protected.

Learn more about accounting cybersecurity, common cyber threats for accountants and how to avoid them.

Feature set

How to neither miss out on anything nor overpay for accounting software features that you might never use? The answer is to learn what features accounting software offers and put them in the context of your business needs.

In general, you might want your accounting software to help you with accurate bookkeeping, accounts reconciliation, financial reporting, and help with taxation. Then, you ask what you might need to fulfill all these. Do you need your accounting software to provide invoicing so that you can automatically send invoices and apply payments to open invoices once they’re paid? Do you need your customer data transferred to your accounting? Do you operate abroad and need multicurrency support? Answering such questions may give you more insights into what features you need in your accounting software and what can be unnecessary.

Inventory management

Some software comes with inventory management features that let you adequately deal with your stock. They assist you in maintaining the right amount of stock without overstocking your items but also not running too low. Inventory control features let you track not only the levels of inventory but often the movement of items as they leave or enter the storage facility.

Each business is different, so some very advanced inventory management features might only be supplied by specialist apps. Then it’s best to research whether the accounting software of your choice will be able to integrate with the inventory management app. It’s a good idea to read clients’ reviews to get a better grasp of the day-to-day use of such apps. It’s also important to clear system storage on Mac if you use one. There are various ways how to effectively get rid of unnecessary files on your device.

Payroll management

If you’re dealing with payroll, it’s desirable to have that feature as a part of the software or app you’re using. However, if you’re already using a payroll app that you’re happy with, make sure your chosen Mac accounting software gives you the possibility to seamlessly integrate the two.

Scalability

Your business will grow, and your needs might evolve with the growth. At this point, you might want your accounting software to have the capacity to adjust. Does the accounting software for Mac that you’re looking at have any limitations to the volume of transactions it can record? Does it allow several users to access the same accounting campaign? Providing for scalability in advance might save your business substantial time and money in the future, as you won’t need to change your software once your business grows and go through the choice and adaptation to new software once again.

Support

Customer support immensely impacts your experience with accounting software. Nothing is perfect, and flaws can occur, such as downtimes, updates, maintenance, and failed integrations – anything that can happen will happen sooner or later. And in this situation, you better get all the help possible. In that respect, customer reviews are one of the best ways to understand if a software vendor cares about customers or if customer support is just on paper. If many people complain about their inquiries remaining unanswered or getting answered a year after the issue took place (and it’s not even a joke, you might find plenty of such horror stories), it’s a bad sign. You definitely don’t want to remain without any help during the tax season, for example.

Brief recap

This isn’t the exhaustive list of factors you might want to consider when choosing accounting software. However, they’re probably the most important, like the basics to start your research with.

As you can see, pricing isn’t even on the list. Usually, when you’ve shortlisted the solutions that answer your basic requirements, pricing can be one of those small details that help make the final decision.

Another great tool that might help you make the right choice is to read customer ratings and reviews. Though many business owners neglect this sort of information, the way customers rate software and what they share about it can hint at whether your experience will be smooth or bumpy.

Find out more about the best business process automation software for your business.

Choosing Mac accounting software: key takeaways

Running a small business using Mac doesn’t mean you have a limited choice of accounting software options. There’s a wide range of cloud-based and web-based small business software for Mac available on the market that is also compatible with other PCs. It enables small businesses to seamlessly integrate all their parts into a single environment, notwithstanding the operating systems.

This way, when choosing accounting software for Macs, you might want to focus primarily on your business needs. So, when looking at the provided features, you’ll be putting them into the context of your business requirements. You might want to consider the type of your business, the volumes of your business transactions, and what data you need to have in accounting and reflect in financial statements. The kind of relations you have with your accounting specialists may also influence your choice of accounting software. Do you have a full-time in-house accountant? Do you prefer to do your bookkeeping in-house and turn to a CPA for financial consulting and tax filing? Do you outsource your accounting to a CPA firm (it’s a common case for small businesses)? Answering these questions might hint at what Mac accounting software will fit the bill for your business.

Nice informartion.

Nice article

Thanks for commenting!

Which one offers check writing & which one runs on the new Apple chip. For example, AccountEdge Pro does not & has declared they have decided not to.

Hey Michael, thanks for stopping by and for the heads up about AccountEdge Pro.

As for check writing, I believe QBO should do it. As for Synder, we currently can sync your check payments from payment systems, however can’t yet create them from scratch.

This was very helpful