Reconciling your Square transactions in Xero shouldn’t eat up your valuable time or leave you scratching your head. With Synder, your Square sales, fees, taxes, and payouts can flow smoothly into Xero without manual entry.

Common challenges in Square Xero reconciliation

Many businesses don’t realize how tricky reconciling Square payments in Xero can be until they’re knee-deep in mismatched numbers. Since Square combines sales, refunds, fees, and tips into one lump payout, it’s easy for things to get out of sync if you’re not following a clear process. This often leads to errors, wasted time, and confusion.

Here’s where most sellers tend to hit roadblocks:

- Manual work and time wasted

Every single transaction, fee, refund, and payout from Square needs to be individually entered and verified in Xero, which quickly leads to errors and inefficiencies. As your sales increase, this manual process turns into a major hurdle.

- Mismatched payouts, fees, and discounts

One of the biggest headaches in Square Xero reconciliation comes from mismatched payouts. Square combines multiple sales, refunds, and its own processing fees into a single lump sum deposited into your bank. Without clear visibility into these individual components, it’s incredibly challenging to accurately perform Square payouts bank reconciliation in Xero. This can lead to your Xero bank balance not aligning with your actual bank statements.

- Duplicate entries

This often occurs when businesses try to manually import data, or if their setup isn’t perfectly configured to prevent overlapping records. Duplicate transactions in Xero inflate your sales figures or expenses, leading to inaccurate financial statements and making your Square Xero reconciliation much more complex and time-consuming.

- Incorrect tax mapping

Square transactions often include different tax rates, such as sales tax or VAT, depending on the product and region. If these aren’t properly mapped in Xero, your financial reports can quickly become unreliable. This in turn leads to underreporting or overreporting tax, which is especially risky during tax season or an audit.

A guide to Square Xero reconciliation

This is what you need to do:

- Connect Square and Xero in Synder

- Choose how you want to sync transactions

- Map Square payments to the right Xero accounts

- Customize the settings to match your needs

Step 1. Connect Square and Xero in Synder

Xero and Square don’t communicate easily, so to sync your Square transactions with Xero, you need a connector. Synder serves as the link between the two platforms, letting your sales, fees, taxes, and payouts transfer smoothly into your accounting system.

To connect the Square integration, follow these steps:

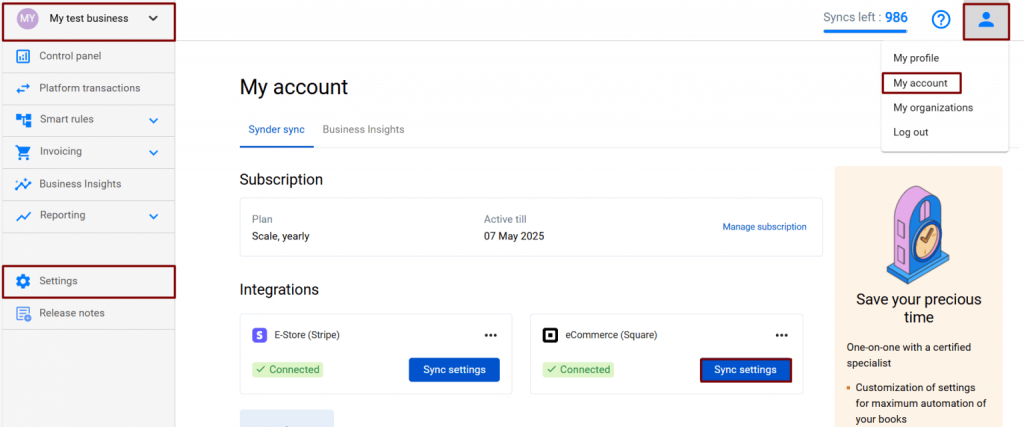

- Switch to the needed Organization in the top-left corner of the Synder page.

- Click on the Person icon in the upper-right corner and select Organization settings.

- In the Integrations section, click Add integration. Then choose Square from the dropdown menu and click Connect Square account.

Repeat the same steps to connect your Xero account. Once both platforms are connected, Synder will begin pulling in your Square data and syncing it directly to Xero.

Step 2. Choose how you want to sync transactions

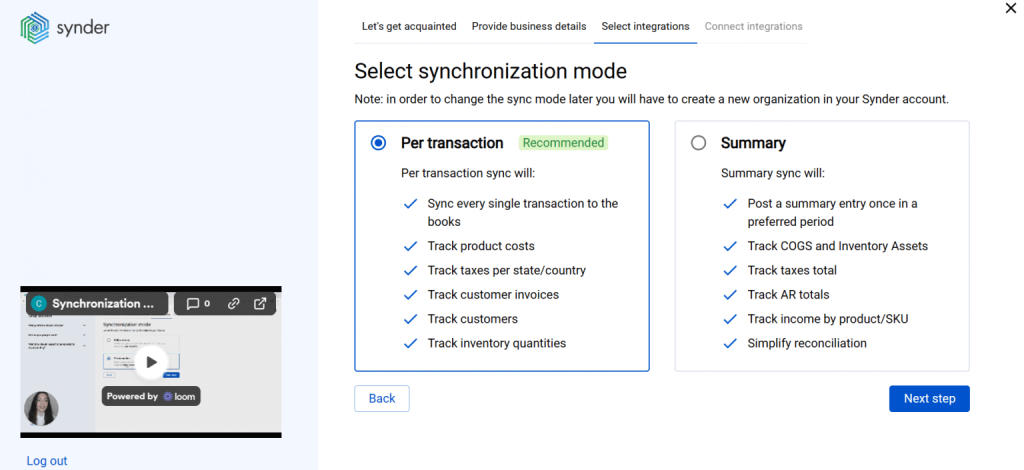

While setting up an accounting software like Xero, you’ll be asked to choose a specific sync mode. Here are your options:

- Per-Transaction Sync records each individual transaction in detail in your accounting software, giving you full transparency and granular reporting;

- Summary Sync groups daily transactions into a single summarized entry per day, simplifying your books and speeding up reconciliation.

Step 3. Map Square payments to the right Xero accounts

Now you can map Square transactions to the right income, expense, and tax accounts in Xero for cleaner books.

To map product names from Square to Xero:

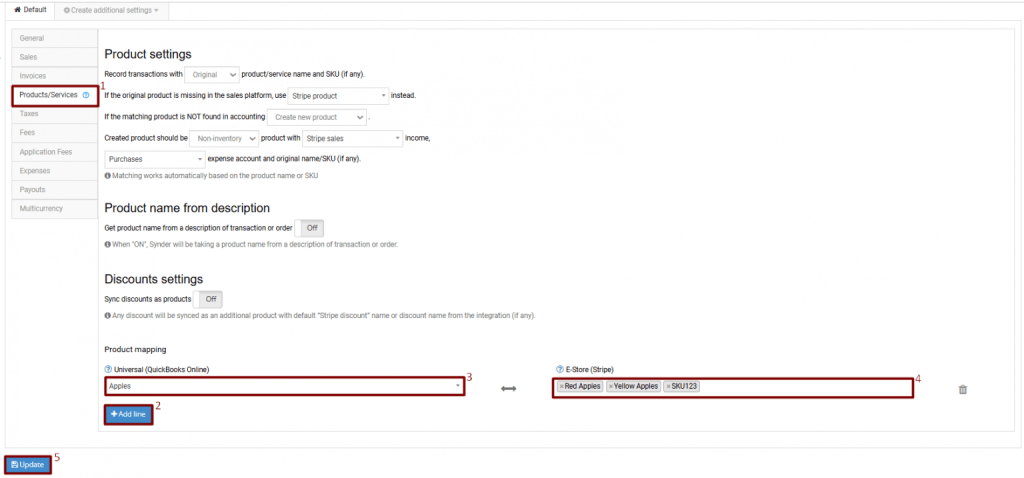

- Go to Synder settings → Products and services tab.

- Click Add line to add a new line for mapping products.

- Select your Xero products from the dropdown (the left field).

- Fill in the product names from your Square account in the right field. Remember that the names you type in the Integration field must be absolutely identical to the names you have on your payment platform side (yes, those colons and underscores matter, too, so better copy and paste the name you need). You can match more than one name from Square to one product in Xero.

- Click Update to save the settings.

- Synchronize your transactions to check the results in Xero.

Step 4. Customize the settings to match your needs

Synder offers a variety of settings that let you tailor your Square Xero reconciliation to your company’s preferences. These settings help you customize everything from how sales and invoices are recorded to how taxes, fees, and payouts are handled, giving you full control over your accounting data and making sure everything stays accurate and organized.

To start configuring settings for your Square Xero integration, select the organization needed at the top left of the page → Settings button on the left menu of Synder → choose the Square integration from the dropdown.

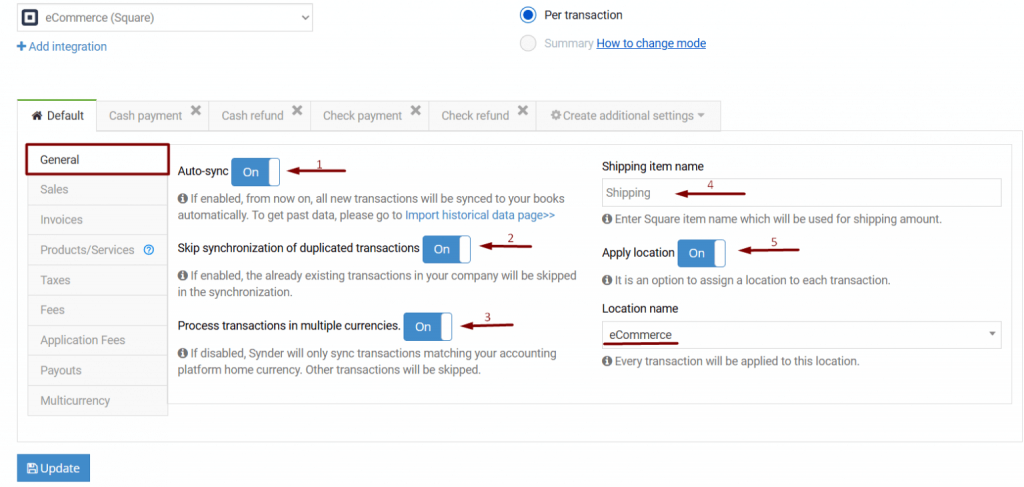

Synder’s General Settings give you a few key options to control how your Square data syncs to Xero:

- Auto-sync: Automatically syncs new Square transactions as they come in, so you don’t have to do it manually. If you prefer to review transactions first, you can keep this off and sync only when you’re ready.

- Skip synchronization for duplicated transactions: Prevents double entries by ignoring any transactions that already exist in your Xero account.

- Process transactions in multiple currencies: Depending on your setup, Synder will create transactions in the original foreign currency in Xero or convert them to your home currency according to the exchange rate provided by your payment processor.

- Shipping item name: Helps Synder recognize shipping charges on invoices and account for them correctly using the item name you specify.

- Apply location: Adds location tracking to your synced transactions, as long as location tracking is turned on in your Xero settings. This is useful for tracking sales by store, region, or team.

Beyond the General Settings, Synder lets you fine-tune every little detail of how your Square data syncs to Xero. You can decide how sales and invoices get recorded, keep track of Square fees and payouts and even make sure the right tax codes are automatically applied. These options give you full control, so your data ends up in the right places in Xero, helping keep your books neat and accurate.

Why businesses use Synder for Square Xero integration

Business owners choose Synder for Square Xero integration because it helps them streamline accounting, maintain accuracy, and scale their practice, without sacrificing control.

Here’s why leaders choose Synder:

- Significant time savings: By automating the data flow between Square and Xero, Synder saves hours of manual work. Stape, a thriving SaaS business, for example, saved over 180 hours a year by automating month-end reviews in Xero.

- Error prevention and rollback: Built-in duplicate detection and rollback features let you fix mistakes easily, making Synder ideal for fast-moving businesses, who can’t afford delays caused by bookkeeping mistakes.

- Historical data import: You can easily pull in past Square transactions without a time limit. It’s a perfect solution for onboarding new clients or catching up on backlog. This feature comes with a fee on Basic and Essential plans. The Pro plan includes 3 months of history for free, while the Premium plan offers unlimited historical import at no extra cost.

- All-in-one platform: With Synder, you can manage multiple clients and integrations in one dashboard with consistent workflows across 30+ platforms.

Ready to simplify your Square Xero reconciliation and save hours on manual work? Book a free demo with Synder to see how it can change your business.

FAQ

Can I import historical Square payouts into Xero?

Yes, Synder allows you to import historical Square payouts into Xero. You can synchronize past transactions starting from a specific date, depending on your Synder plan and the integration’s API limitations. Once imported, you can sync these transactions to Xero, ensuring your financial records are complete and up-to-date. Included for free on the Premium plan, 3 months free on Pro, and available for a fee on Basic and Essential.

How does Synder handle Square fees, taxes, and tips?

Synder automatically handles Square fees, taxes, and tips to keep your books accurate. Once mapped, it records Square fees as expenses in the right Xero accounts, applies the correct tax codes to sales, and includes tips as part of your sales transactions. You can also customize these settings to fit your specific accounting needs, making it even easier to simplify your bookkeeping and ensure everything is properly tracked in Xero.

Will Square refunds and chargebacks sync automatically?

Yes, by default, Synder deducts refunded amounts from your income for the related product. However, if you prefer to track refunds separately, you can easily set this up in Synder.

Is it possible to reconcile multicurrency Square payouts?

Yes, reconciling multicurrency Square payouts in Synder is simple. Just ensure that the option to process transactions in multiple currencies is turned on in Synder’s General Settings. Don’t forget to enable multicurrency in your Xero account as well for everything to sync smoothly.