Every person who’s managing a business knows that payment processes can either make or break the day. If you’re looking for a simple way to accept payments offline, it’s easy to get overwhelmed by all the payment processing devices available.

Most likely, the showdown between the Square Terminal and the Square Reader has already caught your eye. These devices are part of the Square ecosystem, and offer different functionalities to cater to various needs. So, if your head is spinning and you’re wondering which of the two to choose, let’s break both of them down.

Key takeaways:

- The Square Reader is a payment processing device that fits in your pocket and pairs with your phone, while the Square Terminal offers an all-in-one payment solution without the need for additional devices.

- The Square Reader is a budget-friendly option at just $49, while the Square Terminal, priced at $299, offers more advanced features.

- Both devices are compatible with other Square products such as Square Stand, Square Register, Square Appointments, and the Sale App.

Contents:

1. What’s the deal with Square?

2. What’s the difference between Square Reader and Square Terminal?

3. When to go for Square Reader

4. When to opt for Square Terminal

5. Comparing the features: Which suits your needs?

7. What more do you need for Square payments?

8. Boost your business efficiency with Synder

What’s the deal with Square?

First off, let’s give a quick shout-out to Square. The services being offered by this company have really helped business people to accept payments anywhere. As with Square, you don’t need large equipment or confusing tools and devices. They have a range of products such as Square Stand, Square Register, and Square Appointments but today we’ll be focusing on the Square Terminal and the Square Reader.

What’s the difference between Square Reader and Square Terminal?

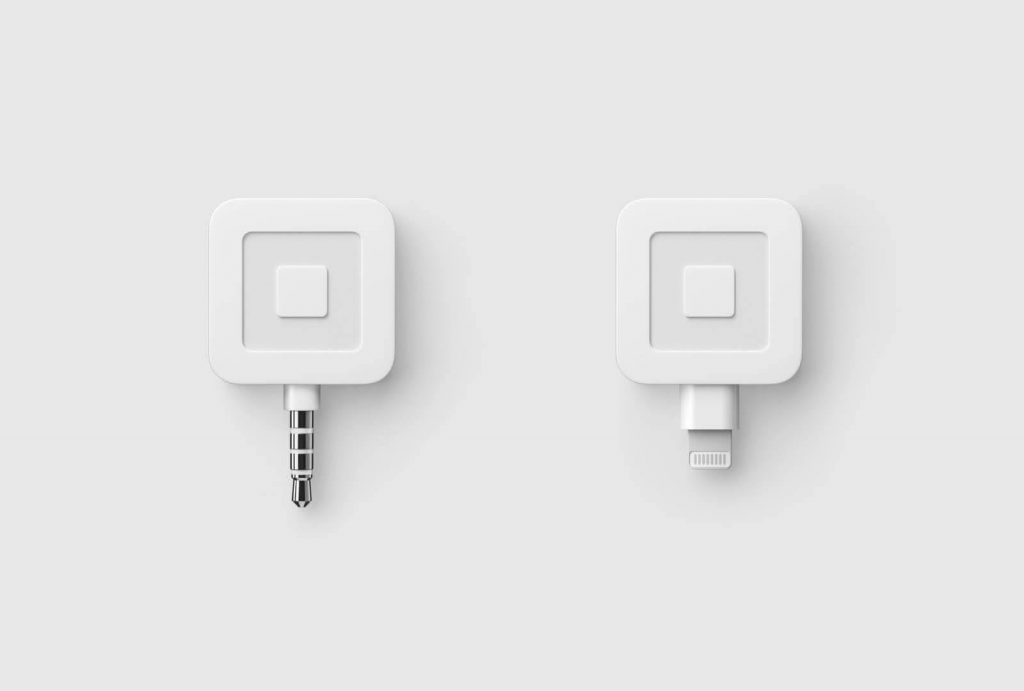

Let’s kick things off. The Square Reader is a small device that can easily be carried around in your pocket and primarily designed for mobile payment processing. It syncs with your phone or tablet through the headphones jack, Bluetooth, or even the lightning connector and enables businesses to accept credit cards on the move.

On the other hand, the Square Terminal can be described as a middle ground between a fixed POS system and a mobile card reader. It has its own built-in screen and receipt printer. It’s a bit larger but offers more features and can handle a broader range of transactions. It’s perfect for businesses that need a complete countertop solution with more functionality and a professional look.

When to go for Square Reader

Square Reader

Imagine you’re at a farmer’s market, a pop-up shop, or even a food truck. The Square Reader slips into your pocket, ready to whip out whenever you make a sale. It’s as easy as pie.

The Square Reader is perfect if you:

- Are always on the go and need something ultra-portable.

- Have a tight budget and want to keep costs low.

- Don’t mind using your phone or tablet to process payments.

- Want a simple solution for quick transactions.

When to opt for Square Terminal

Square Terminal

The Square Terminal is your go-to if you:

- Run a more established business with a physical location.

- Need a more professional-looking setup.

- Want an all-in-one device without relying on your phone or tablet.

- Appreciate having a built-in receipt printer for customers.

Comparing the features: Which suits your needs?

When it comes to comparing Square Reader and Square Terminal, it’s all about what your business requires.

1. Design and mobility

When comparing the Square Reader and Square Terminal in terms of design and mobility, the Square Reader bests the competition for its compact and minimalist design, making it extremely portable and easy to carry in a pocket. It connects to a smartphone or tablet via a headphone jack, Bluetooth, or lightning connector, allowing businesses to accept credit cards payments anywhere.

On the other hand, the Square Terminal, while it’s not something you’d carry in your pocket and designed as a standalone device with an integrated touchscreen and receipt printer, it still remains relatively compact to move around your store or take with you to events. Its built-in battery allows you to move it around easily within your business, although it is less suited for truly mobile operations compared to the Square Reader. Also, it has an integrated screen, so you don’t have to worry about using another device for your transactions. A key benefit of both devices is that Square accepts a variety of credit cards, including Visa, Mastercard, American Express, Discover, JCB, and UnionPay, allowing you to serve a wide range of customers.

2. Ease of use

Both devices are designed to be easy to use, but the Square Terminal might have a slight edge here. It has a touch screen interface and a simple installation process. All you have to do is plug it in, switch it on, connect it to Wi-Fi and you’re ready to go.

The Square Reader, while simple, requires a bit more setup. You’ll need to pair it with your phone or tablet and download the sale app. But once you’re all set, it’s smooth sailing.

3. Payment methods

Both devices also support contactless payments such as Apple Pay, Google Wallet, and other NFC payments which have become essential in today’s tap-and-go society.

The Square Reader comes in two versions: one that reads magnetic stripe cards and another that handles chip cards and contactless payments. The latter is often referred to as the Square Reader for contactless and chip.

The Square Terminal, on the other hand, is a mini command center. It can take chip cards, swipe cards, and contactless payments. Also, it comes with a touch screen that makes the transactions to be very easy. Another advantage of the Terminal is that it can process integrated payments, which means that it can process payments, control stock, and store customer information. This makes it a great fit for businesses that need a bit more than just a way to swipe cards.

4. 2nd generation models

Both devices have undergone significant upgrades with their 2nd generation models. The 2nd generation Square Terminal is a notable step up from the 1st generation model. It provides better connectivity and shorter response time. The 2nd generation model is a refined version of the 1st generation and removes some of the creases that are present in the first version and makes transactions extremely fluid and cuts down on the possibilities of glitches during payments.

In the same way, the 2nd generation of the Square Reader has also experienced improvements in design and features, for example, improved chip reader capabilities and stronger connection with mobile devices.

Breaking down the costs

Square Reader: $49;

Square Terminal: $229.

As you can see, the Square Reader is a more budget-friendly option. You can get a basic model for free, or choose the version with contactless payments and chip card acceptance for $49. There are no monthly fees; you only pay a small fee for each transaction. If you ever need to make changes to your payment setup, like removing a bank account from Square, you can easily do this through the Square dashboard, ensuring smooth financial management for your business.

The Square Terminal is slightly more expensive. However, it’s an all-in-one device with a built-in receipt printer and touch screen, making it a valuable investment.

What more do you need for Square payments?

If you’re exploring payment solutions beyond the Square Terminal and Reader, you might want to consider the Square Stand and Square Register.

Square Stand

Square Stand

The Square Stand is a great choice that turns your iPad into a powerful point-of-sale system. It’s perfect if you already have an iPad and want a more stationary setup. Just slap your iPad onto the Square Stand and hook up your Square Reader via Bluetooth or the lightning connector. This setup lets you enjoy the bigger screen for easy navigation through the Square Point of Sale app while swiping, dipping, or tapping away with the Square Reader. It’s suitable for companies that require something more long-term but still would like the ability to accept payments at different locations.

Square Register

Square Register

For a complete and integrated POS experience, the Square Register might be the way to go. It features dual displays—one for you and one for your customers—and includes all essential components like a card reader, receipt printer, etc. Although it’s a bit pricier, it provides a comprehensive solution for managing high-volume transactions.

Tip 1. Even though the Square Register has built-in card readers, having a Square Reader around can be handy. For example, if you have more than one selling location in your store, the Square Reader can be your mobile backup or used for outdoor, temporary sales. This way, all your transactions sync up in the Square Point of Sale system without a hitch.

Tip 2. The Square Terminal can team up with the Square Register to handle payments during busy times or special promos. It also helps reduce customer waiting time and ensures that your customers are always satisfied. Moreover, the Square Terminal can take care of tasks like processing Square Appointments.

Square Point

The Square Point system ties all your sales data together, managing your business behind the scenes. It doesn’t process transactions itself, but it works with your Square hardware to offer a complete solution for managing your business. It enables you to perform the activities of transaction processing, inventory control, and sales reporting. But there’s more to the story.

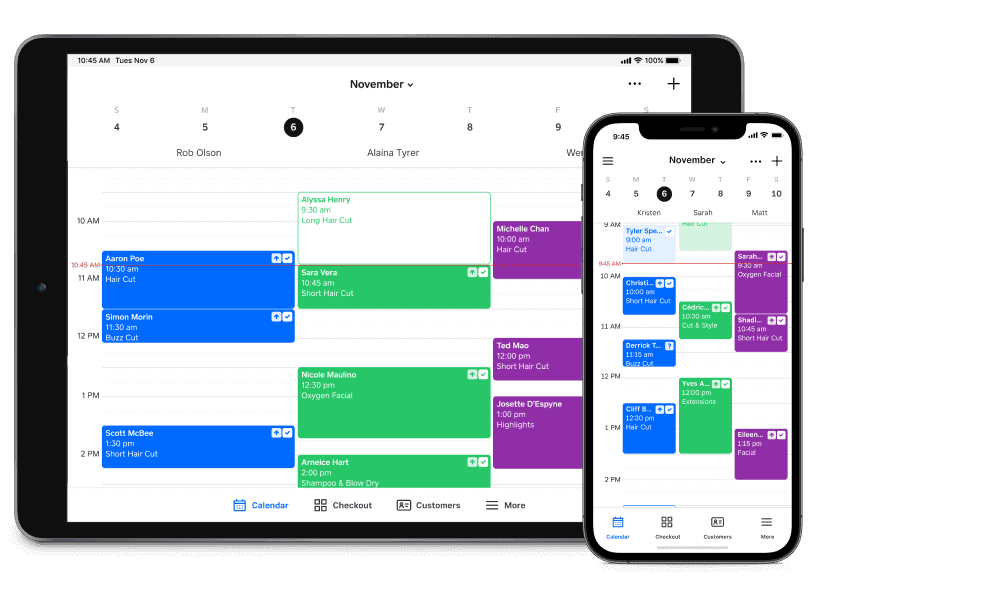

Square Appointments

Square Appointments

If you run a business that requires booking time slots, Square Appointments is a must-have. It’s an app, but you can also use it through a web browser with a full set of tools. It lets you sync with your calendar, schedule appointments, send reminders to clients, and even let them book appointments at their convenience through the website. You won’t have to worry about double-booking, as everything’s organized in one place.

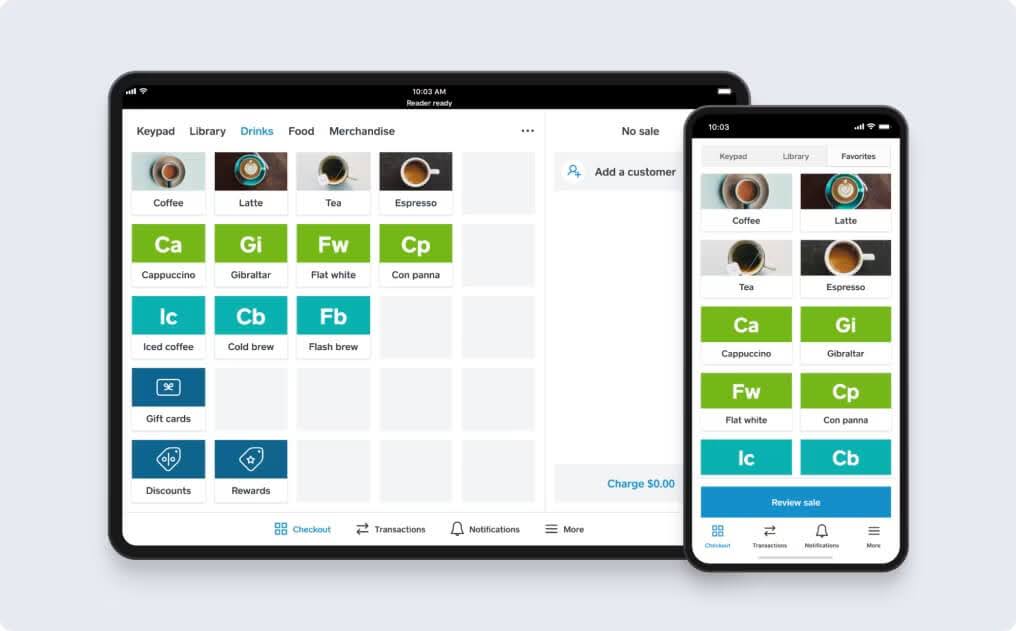

Square Point of Sale App

Square Point of Sale App

Now let us discuss the Square Sale App for managing sales on the go. The Sale App, available on both iOS and Android, is a mobile app designed to work with your Square Reader and Square Terminal to facilitate sales on the go. This app lets you track every sale, manage your inventory, and keep tabs on your earnings. It also supports various payment methods, including contactless payments, chip cards, and traditional credit cards.

USB hardware

Don’t forget the extras! When it comes to setting up your Square system, USB hardware is the glue that holds everything together. From cash drawers, keyboards to barcode scanners, these accessories help you build a customized point-of-sale system that fits your needs. Connecting USB hardware to your Square Stand or Square Register is a piece of cake. Just plug it in, and you’re ready to go. This flexibility makes it easy to expand your setup as your business grows. Whether you need a receipt printer for quick transactions or a cash drawer for secure storage, Square has you covered.

Boost your business efficiency with Synder

Now, let’s talk about automation because, let’s face it, who doesn’t love making life easier? While you’re busy figuring out the best way to accept payments, you also need to keep your data in sync with your accounting system. Discover Synder, the app that transfers your sales, fees, expenses, and refunds from over 30 ecommerce platforms like Stripe, PayPal, and Shopify to accounting systems like QuickBooks, Xero, and Sage Intacct, making sure you’re covered no matter how your customers pay.

Imagine a seamless Square QuickBooks Online integration via Synder Sync. Synder ensures that all your data is integrated with all the details—products, customers, taxes, etc. This app also takes care of categorizing and classifying your data, so everything’s organized and easy to find. And when it comes to reconciliation, once everything’s connected and set up, Synder’s got your back, making sure everything adds up perfectly.

Final thoughts

So, what’s the bottom line? Choosing between the Square Terminal and the Square Reader boils down to your business needs and operational style. Both payment processing devices have their unique strengths, making them suitable for different types of businesses.

If you’re looking for a simple, budget-friendly solution that offers mobility and ease of use, the Square Reader is your best option. However, if you require a more complex solution that can accommodate a broad range of functions, then the Square Terminal is a great fit.

Also, think about how you might want to grow and integrate with other Square products. Both the Square Reader and Square Terminal can connect with Square’s ecosystem, like the Square Stand, Square Register, and software solutions like Square Appointments, etc. These extras can make your business run even smoother, improve customer service, and simplify your payment processes. And finally, your decision should match your business goals, how many transactions you handle, and how mobile you need to be.

Share your thoughts

Have you used the Square Reader or the Square Terminal for your business? Which device worked best for your needs, and why? Share your experiences in the comments below!