When you sell on Shopify, you must declare your tax liabilities, including corporation tax, income tax, sales tax, and any potential overseas taxes if you sell internationally.

Luckily, Shopify itself helps with submitting a 1099-K Form to the IRS, which is already reducing a part of the work needed to be done. But do all Shopify sellers receive this form? What are the requirements? And is it possible to track all the cash flow from different channels within one app? Keep reading to learn the answers to all these questions!

Key takeaways:

- Shopify provides its sellers with a 1099-K Form if they meet certain requirements.

- Shopify 1099-K Form reports income only, not expenses.

- Alongside a 1099-K Form, sellers also need to submit Schedule C and Schedule SE to the IRS.

- Shopify business owners still need to collect their sales taxes manually, Shopify doesn’t do this.

Contents:

2. Does Shopify provide sellers with a 1099-K Form?

3. Shopify 1099-K requirements

4. How to get the 1099-K Form from Shopify

5. How to file taxes with Shopify 1099-K Form

6. Can a Shopify accounting app automate the tax filing?

What is a 1099-K Form?

First, let’s quickly explain the 1099-K Form so we can understand what it is and what’s reported on it.

1099-K is sent to freelancers, independent contractors, or any unincorporated business entity paid more than $600 from another business annually via:

- Credit, debit, or stored value cards such as gift cards;

- Payment apps or online marketplaces.

So, when selling on Shopify, your 1099-K Form details the total revenue you brought in with Shopify Payments the previous tax year. Keep in mind that the form reports total gross income with no adjustment for credits, refunds, fees, or shipping.

Who needs to fill out Form 1099-K?

Payment card companies, payment apps, and online marketplaces are required to fill out Form 1099-K and send it to the IRS each year. Since Shopify falls into this category, it follows the same reporting requirements.

Note: Whether or not you receive a Form 1099-K, you must still report any income on your tax return.

Does Shopify provide sellers with a 1099-K Form?

Yes. It means that you, as a Shopify business owner, aren’t responsible for submitting your 1099-K Form.

By January 31 of each year, if you accept payments through Shopify Payments and meet certain criteria (which we’ll discuss shortly), Shopify will send the 1099-K Form to the IRS and provide you with a copy so you can use it with other tax records for income tax return filing.

If you need to change the 1099-K Form, the updates can be backdated to your original request date.

Now that you understand what the 1099-K Form is, you might be wondering: What about sales tax?

Does Shopify collect sales tax?

Shopify doesn’t file or remit sales taxes on your behalf.

To be more specific, Shopify isn’t required to collect sales tax from users, as the platform doesn’t fall under the IRS marketplace facilitator requirements, unlike eBay or Amazon.

→ Learn about the accounting tasks provided by Shopify.

Shopify 1099-K requirements

Now, moving on to the Shopify requirements we’ve mentioned above. As already stated, Shopify Payments isn’t the only requirement to receive a 1099-K Form. The criteria might change from year to year, however, for the 2023 calendar year, they were the following:

- You need to receive more than $20,000 in gross payments and have more than 200 transactions;

- You need to meet your state’s individual threshold.

How to get the 1099-K Form from Shopify

If your Shopify store qualifies for a 1099-K Form, you’ll receive an email once it’s available for download. When ready, you can view it in your Shopify account:

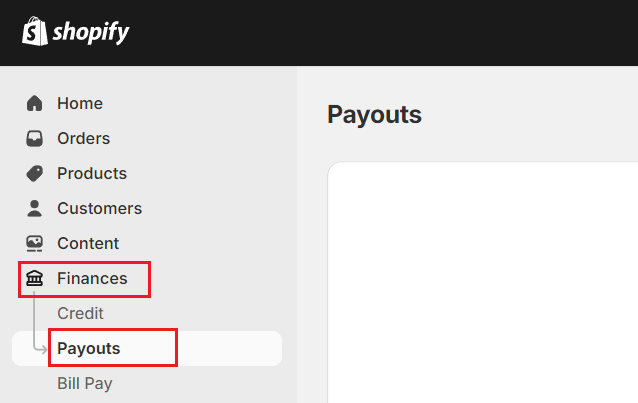

Go to the Finances → Payouts. There you’ll find all your transactions.

Select the option “Export 1099-K transactions” and specify the start and end dates. The form can be exported in the following formats:

- CSV for Excel, Numbers, or other spreadsheet program;

- Plain CSV file.

Note: If you own multiple online stores and make at least $20,000 per store, you’ll get a separate 1099-K for each one.

How to file taxes with Shopify 1099-K Form

As previously mentioned, Shopify does the major part of sending the Form to the IRS. However, you can file your Shopify taxes even without the 1099-K Form. You can simply use the data in your Shopify reports to fill out your tax forms.

Still, you’ll need to file certain forms along with your Shopify 1099-K Form, so let’s focus on them.

Note: Shopify doesn’t report every merchant’s transactions to the IRS.

Can a Shopify accounting app automate the tax filing?

To an extent, yes. At least, it greatly facilitates the process. An accounting software solution like Synder Sync, specialized in accounting automation, can integrate with Shopify to extract essential transaction data. This data can then be used to reconcile your QuickBooks Online records with your actual bank account, ensuring that the records match and there are no errors or duplicates.

Accurate tax filing requires year-round record-keeping, not just a last-minute scramble. That’s why Synder Sync is an invaluable partner for any business owner. The tool supports the integration with 30+ platforms and is able to:

- Categorize transactions to the correct accounts in your accounting system;

- Store both ongoing and historical transactions;

- Record all data from payment platforms, including fees and tax amounts*;

- Prepare for an error-free reconciliation process and more.

* – This is especially important for a Shopify business owner since Shopify 1099-K Form only reports the income with no expenses. However, you still need accurate expense records for tax filing.

Connect your Shopify store and test all the features available with a 15-day free trial or book a spot at the Weekly Public Demo with Synder’s experts to learn more about its accounting automation capabilities.

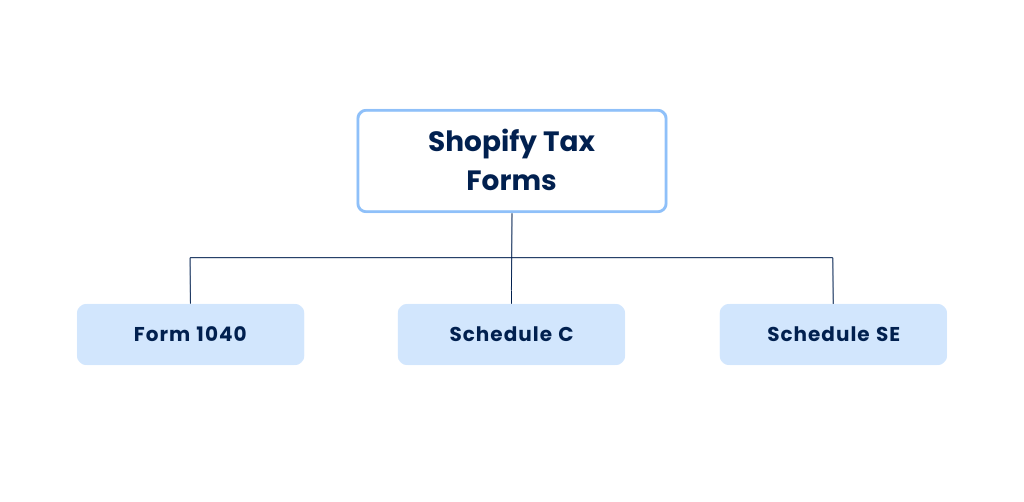

What other Shopify tax forms do you need?

⭐️ We’d like to remind you that while you can download the forms from Shopify, it’s also recommended to consult a tax professional and use accounting software to manage larger tasks like calculating total income, expenses, and overall tax liabilities.

Overall, you’ll usually need the following forms:

- Form 1040 which reports your taxable income and calculates your overall taxes.

- Schedule C which reports your business expenses and gross business income.

- Schedule SE which helps to figure the tax due on net earnings from self-employment.

Note: In order to fill out the Schedule C Form, you’re going to need to include all of your other business expenses as well as your COGS.

While Shopify will produce the 1099-K, you must still verify whether the information is correct, as this needs to match your tax return. Shopify issues the report to both the IRS and you, but it isn’t responsible for filing your tax returns–it’s more of a backup to ensure online retailers aren’t under-declaring.

Conclusion

All in all, as a Shopify seller, you need to have a clear understanding of the 1099-K Form and utilize the right tools. It’s true, that Shopify provides good assistance by issuing the 1099-K Form for qualifying sellers, however, it’s important to remember that this form only reports income and not expenses. Sellers must still manage their sales taxes and financial records to ensure a smooth tax filing season. Integrating an accounting software solution like Synder Sync can significantly simplify this process by automating transaction categorization and ensuring accurate record-keeping. For those seeking further guidance, consulting with a tax professional is always a prudent step.

Share your experience

Tell us about your experience with the Shopify 1099-K Form! Did you face any challenges? Do you have any tips for other business owners? Leave your comments below!

FAQs

Does Shopify report to the IRS?

Yes. If you meet the required transaction threshold, Shopify will issue a 1099-K form to both you and the IRS. This ensures that your income from Shopify sales is accurately reported for tax purposes.

What is the threshold for 1099?

The threshold for receiving a 1099-K form from Shopify is $20,000 in gross payments and 200 transactions in a calendar year. If you meet or exceed this threshold, Shopify is required to report your earnings to the IRS.

Who qualifies for a 1099-K?

The 1099-K form is sent to freelancers, independent contractors, or any unincorporated business entity that receives more than $600 annually from another business via credit cards, debit cards, stored value cards like gift cards, or through payment apps and online marketplaces.

For Shopify, there are specific requirements, such as the threshold, which we mentioned in the previous answer.

How do I view my 1099-K on Shopify?

To view your 1099-K on Shopify, log into your Shopify account. Then, go to Finances → Payouts. From there, you can access and download your yearly 1099-K Form by specifying the start and end dates.

Does Shopify file sales tax returns?

No. While Shopify provides tools to help you calculate and collect sales tax, it remains your responsibility to file and remit the taxes to the appropriate state and local tax authorities.

Does Shopify 1099 include PayPal?

No, the 1099-K form issued by Shopify includes only the transactions processed through Shopify Payments. PayPal will issue its own 1099-K form for transactions processed through its platform, so you’ll need to review both forms for complete reporting.

Is a Shopify 1099-K reliable and accurate?

It’s important to keep in mind that the reports you download from Shopify are generally accurate but only include transactions made through your Shopify account. You’ll still need to track transactions made on other platforms manually or with the help of specialized accounting automation software.

It’s also important to manage your settings, because tax rates vary between locations and automatic tax calculations are only as accurate as the specified rules. The easiest approach to declaring your income and matching your revenue with multiple 1099 forms is to combine them using one accounting package.

.png)