If you’ve ever tried to reconcile WooCommerce payments in Xero manually, you already know how messy it can get. Sales, refunds, fees, shipping, discounts, and taxes don’t always line up neatly with your bank feed, leaving you with discrepancies and extra hours of detective work.

The easiest way to fix this is to use an accounting automation tool like Synder. It automates the sync between WooCommerce and Xero, making reconciliation faster and more accurate.

Why WooCommerce payouts often don’t match the bank feed in Xero

WooCommerce itself doesn’t send payouts to your bank, but your payment processors (Stripe, PayPal, Authorize.Net, etc.) do. Each of these adds its own complexity:

- Fees: Payment gateways deduct fees before sending money to your bank.

- Refunds and chargebacks: These often hit your account separately, not tied to the original sale.

- Shipping & discounts: Unless mapped correctly, these won’t reflect in the right places in Xero.

- Taxes (including marketplace facilitator tax): Sales tax may be collected and remitted by the processor, meaning you never see the cash.

- Timing differences: Today’s sale may only reach your bank account a few days later.

All this explains why what you see in WooCommerce reports may not match the deposit that hits your Xero bank feed.

Reconciling WooCommerce payments in Xero via Synder

Step 1: Create a Synder account and connect integrations

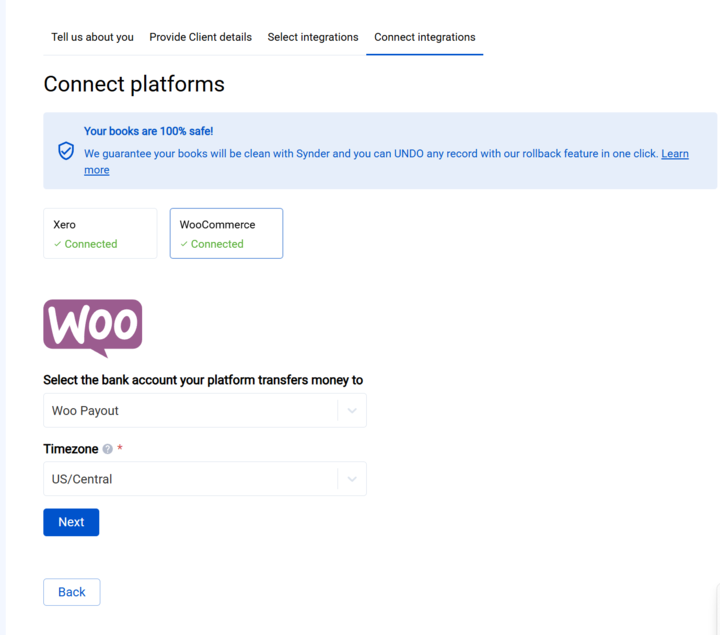

Sign up for a Synder account and connect WooCommerce and Xero. This establishes the link between your store and your accounting system. At this stage, you’re only connecting the platforms – no data is moving yet.

Note: Before syncing, set up your Xero chart of accounts with clearing accounts for WooCommerce payouts and other WooCommerce transactions, like sales, refunds, and fees. Use one clearing account per payment processor (e.g., Stripe, PayPal). In Synder, map each processor to its clearing account and link your real bank account for deposits. This way, payouts align with your Xero bank feed.

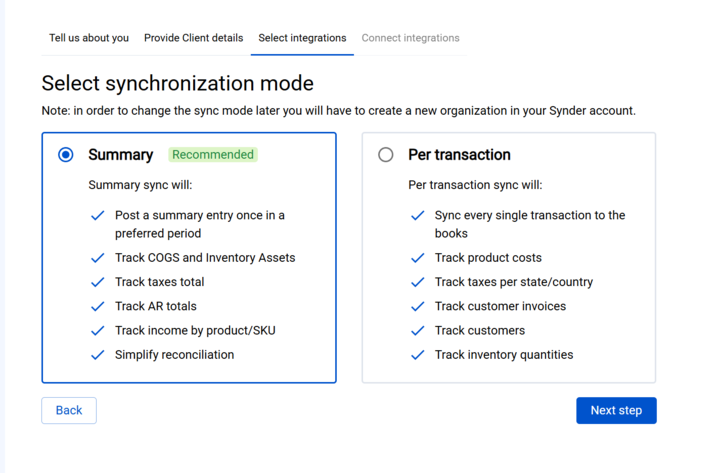

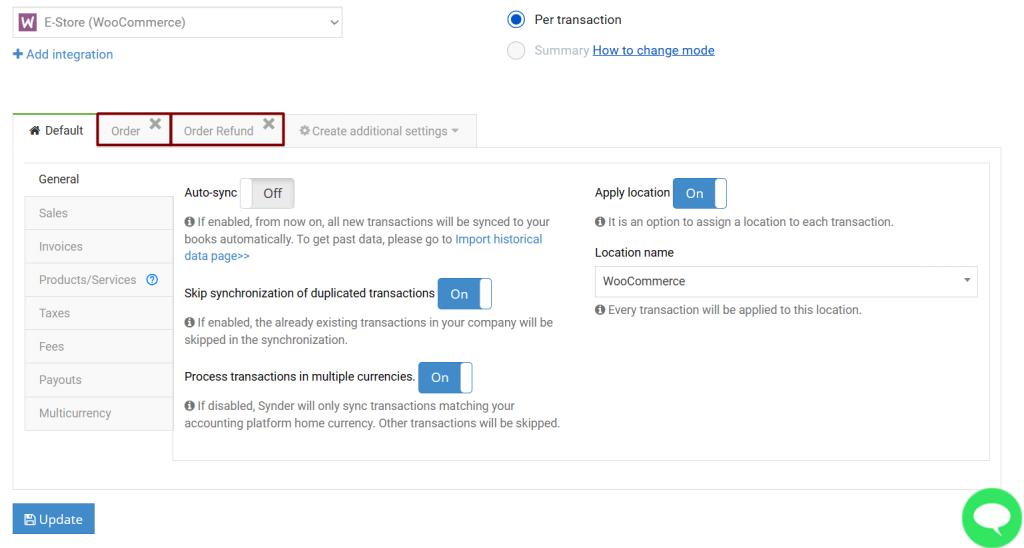

During the connection process, you’ll also be prompted to select a sync mode. Choose Per Transaction if you need detailed records and quantity-on-hand tracking. For cleaner books, tracking of inventory assents and COGS totals, Summary Sync is the simpler option.

Step 2: Configure mapping

With the integrations connected, go into Synder’s settings to choose how data should be posted in Xero. Map sales, shipping, discounts, taxes, fees, and refunds to the right Xero accounts so everything lands in the correct place automatically.

Step 3: Enable sync and import transactions

Once mapping is complete, turn on the sync. Synder will start importing WooCommerce orders and related data — including line items, shipping, discounts, and taxes. In Per Transaction mode, all line items are synced individually, but you can also use the Group by SKU option to track totals for each product.

At the same time, connected payment processors like Stripe or PayPal will feed in fees, refunds, and payout information. From this point on, Synder continuously records new transactions into your Xero clearing accounts using the rules you set up in Step 2.

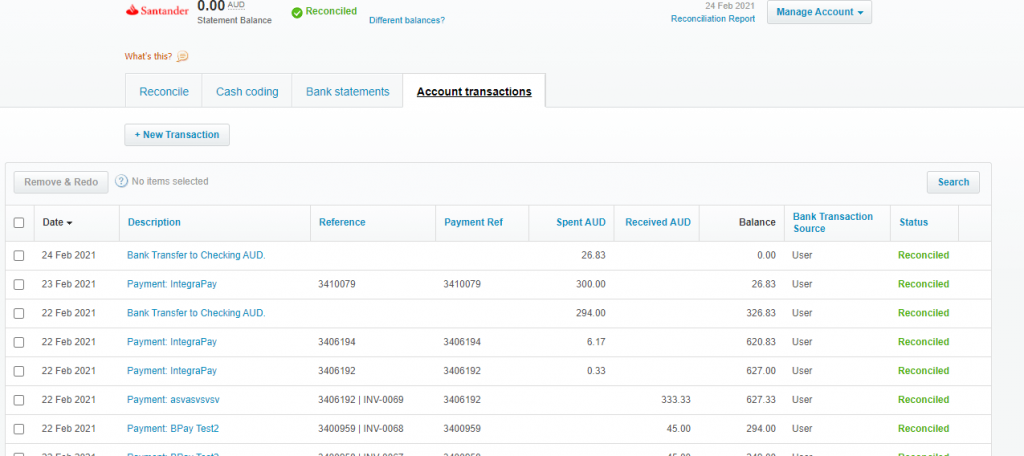

Step 4: Reconcile the clearing account against payouts

When your payment processor issues a payout, Synder creates a transfer in Xero that moves the payout amount from the clearing account to your checking account. This reduces the clearing account balance to zero, or to the same amount as the ending balance in your payment platform, ensuring the account can be fully reconciled.

When the deposit later shows in your Xero bank feed, you only need to match that transfer, not reconcile dozens of transactions one by one. This is the essence of Synder’s reconciliation flow and is what ensures your books align in just a click.

Step 5: Handle refunds, returns, and adjustments

Refunds and returns flow through the clearing account just like sales but as negative transactions tied back to the original order. This keeps your revenue, tax balances, and cost of goods sold accurate without extra steps.

Importing historical WooCommerce transactions

Keeping past periods accurate is just as important as staying current. Synder allows you to bring in historical WooCommerce data so your books reflect the full picture, not just new sales. With historical sync enabled:

- Older WooCommerce sales, refunds, fees, and payouts are imported and posted into the same clearing account workflow you use for current transactions.

- Transfers tied to those historical payouts are created automatically, allowing you to match them against deposits that already exist in your Xero bank feed.

- Books remain accurate not only for the present but also for past reporting periods, giving you reliable P&L and balance sheet numbers across the board.

- You can import as much WooCommerce history as the platform allows, with no limits from Synder, ensuring no gaps when you start automating.

Note: Importing history is free on Synder’s Premium plan, includes 3 months for free on the Pro plan, and is a paid feature on Basic and Essential plans.

Inventory & COGS tracking

Tracking inventory and COGS properly is a major reason to choose itemized sync with Synder. Without it, many merchants end up doing month-end adjustments or guessing. With correct setup:

- Each product sale triggers a reduction in stock in Xero in the Per Transaction Sync mode.

- The cost associated with that sale is recognized immediately in COGS.

- Returns and refunds reverse both the sale and the cost entry, preserving gross margin accuracy.

- If you use variants or bundles, Synder can handle those complexities (depending on settings).

Fee mapping & marketplace tax setup

Because payment gateways deduct their fees before depositing, your bank deposit is always net. To keep things aligned:

- Synder records the gross sale in the clearing account with all components (tax, shipping, discount).

- It also records the fee separately as an expense (or to a merchant fee account). In the Per Transaction mode, the fee is reflected as a bill and payment, while in the Summary mode, it appears as a payment and credit note.

- Then it posts the net transfer to the checking account in Xero.

- For marketplace facilitator tax (e.g. marketplaces remitting tax on your behalf), you can map those taxes to a liability account so you don’t overstate your remittable sales.

This structure ensures your deposit matches the bank feed exactly, while still capturing full detail.

Matching WooCommerce payouts to bank deposits

Because every payout is recorded as a transfer from the clearing account, when the deposit appears in your Xero bank feed, you don’t need to reconcile line by line. You just match or confirm the deposit with that transfer record. This significantly reduces manual reconciliation work and ensures your bank balance, clearing balance, and sales records stay in harmony.

FAQ

Why don’t my WooCommerce payouts match what I see in Xero?

Because the deposit is net of fees, refunds, taxes, and possibly withheld marketplace tax, while WooCommerce reports often show gross amounts. Without an integration to break those parts out, you’ll always see a gap.

How do I map taxes, shipping, and discounts from WooCommerce to the correct Xero accounts?

In Summary mode, you map each component, such as tax, shipping, and discounts, to specific Xero accounts (e.g., revenue, liability, contra-revenue). In Per Transaction mode, these settings are defined in Synder, but some categories (like fees) can be assigned manually, while income accounts are determined by the product’s income account in Xero. This ensures recording is granular and automated.

Should I use daily summary or itemized posting?

If you need accurate inventory tracking, COGS, or customer details, including closing open invoices with payments, choose the itemized Per Transaction Sync. For smaller stores not tracking stock, the Summary mode may be sufficient. But the itemized sync gives you better traceability.

How are fees recorded so deposits match my Xero bank feed?

Synder records the full (gross) sale, posts the fee as a separate expense, and then applies the net transfer. In the Per Transaction mode, the fee is reflected as a bill and payment, while in Summary mode, it’s recorded as a payment and credit note. The deposit in your bank matches that net transfer. So instead of reconciling dozens of lines, you match one transfer.

Can Xero update inventory and COGS automatically when WooCommerce items sell or are returned?

Yes, when Per Transaction Sync is enabled, every sale adjusts inventory and recognizes COGS. Returns reverse the process automatically.