At its core, disbursement represents an act of paying out money, a fundamental process that keeps the wheels of economic activities turning. This article delves into the realm of that process, aiming to demystify its mechanisms, highlight its significance in different sectors, and explore the various forms it takes.

From the disbursement of loans to the allocation of grants and salaries, understanding this process is essential for anyone navigating the financial landscapes of the modern world. And we’re here to help you!

What is disbursement?

The word disbursement refers to the act of paying out or distributing money, means transferring it from one account to another. It’s a term commonly used in financial and business contexts. It can take various forms, such as cash payments, checks, electronic funds transfers, or other methods of payment.

What is a disbursement fee?

A disbursement fee is a charge that may be associated with the release of money. These fees can arise in various scenarios, such as during the processing of loans, legal transactions, or in the administration of estates or trusts. The nature and purpose of those fees can vary, but they generally cover the costs associated with handling and transferring funds. The key aspects of these fees are:

- Loan disbursements. In the context of loans, especially mortgages or student loans, a disbursement fee might be charged to cover the cost of processing the loan and releasing the money to the borrower or to the institution (in the case of student loans).

- Legal transactions. Lawyers or law firms often incur costs on behalf of clients for items such as court filing fees, payment for obtaining reports or records, and other expenses related to a legal matter. These costs are then passed on to the client as fees.

- Estate or trust administration. Executors or trustees may incur various expenses in the process of administering an estate or trust. The fees charged to cover these costs, including payments made to third parties for services, are also considered disbursement fees.

- Real estate transactions. In real estate, these fees can be part of the closing costs, covering expenses like wire transfer fees, courier charges, or other administrative costs associated with the transfer of property.

- Banking and financial services. Banks and other financial institutions may charge such fees for services like issuing bankers’ drafts, wire transfers, or processing certain transactions.

How does disbursement work?

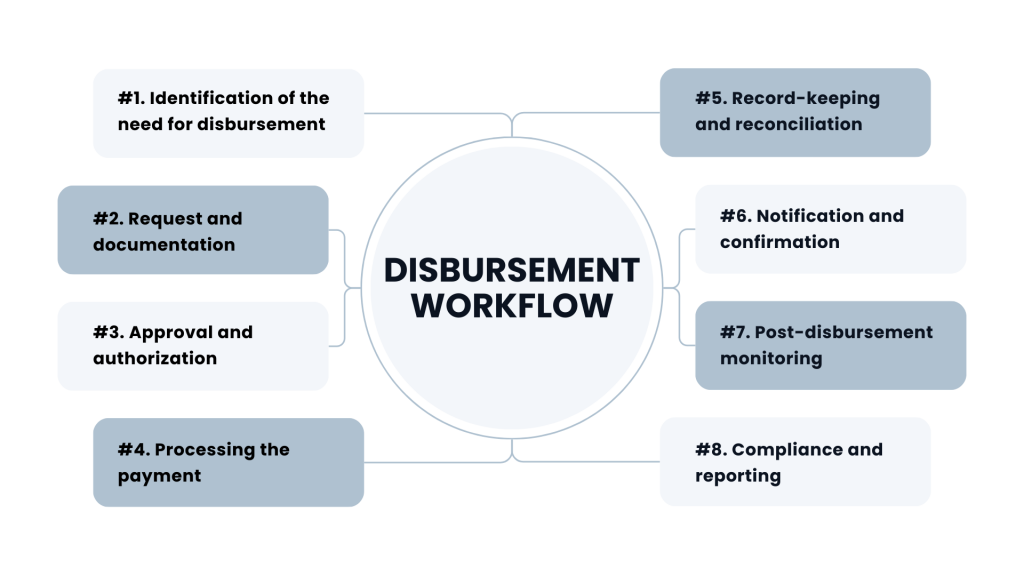

The process can vary depending on the context (such as business operations, loans, grants, etc.), but generally follows a structured pathway.

Step #1. Identification of the need for disbursement

This step involves recognizing the requirement for a payment. It could be a recurring need, like payroll, or a specific occasion, such as a vendor invoice, a loan payment, or a grant award.

Step #2. Request and documentation

The next step is typically a formal request for disbursement. This request is often accompanied by supporting documentation, such as invoices, purchase orders, loan agreements, or other relevant paperwork. This documentation serves as proof of the legitimacy and necessity of the payment.

Step #3. Approval and authorization

The payment must be authorized. This involves reviewing the request and its supporting documents to ensure everything is in order and complies with the organization’s policies or the terms of an agreement. In many organizations, this step might require one or more approvals, depending on the size and nature of the transaction.

Step #4. Processing the payment

After approval, the payment is processed. This can involve different methods, such as electronic funds transfers, checks, or digital payment platforms. The method chosen usually depends on the organization’s practices, the nature of the transaction, and the preferences or requirements of the recipient.

Step #5. Record-keeping and reconciliation

This is a crucial step for maintaining accurate financial records. The disbursement is recorded in the financial system, reflecting a decrease in the payer’s cash balance or an increase in their liabilities. Later, reconciliation is done to ensure that the recorded transaction matches the actual amount of money that left the account.

Step #6. Notification and confirmation

In many cases, both the payer and the payee will receive notifications confirming the transaction. This ensures transparency and allows both parties to update their records accordingly.

Step #7. Post-disbursement monitoring

For certain types of payments, such as loans or grants, there may be a need for ongoing monitoring to ensure that the money are used for their intended purpose. This can involve periodic reporting or audits.

Step #8. Compliance and reporting

Finally, especially in the case of large or regulated entities, there might be a need to report the payment in financial statements or to regulatory bodies, ensuring compliance with financial regulations and standards.

Example of disbursement

Example: Business Loan Disbursement for a Manufacturing Company

- Company: XYZ Manufacturing Inc.

- Purpose of Loan: Expansion of production line

- Loan Amount: $500,000

- Lender: Main Street Bank

- Loan Approval Date: January 10, 2025

- Scheduled Disbursement Date: February 1, 2025

1. Pre-disbursement preparation (January 11-31, 2025)

XYZ Manufacturing Inc. provides all necessary documentation to Main Street Bank, including business plans, cost estimates for the expansion, and bank account details. Main Street Bank reviews the documentation for completeness and accuracy.

2. Loan disbursement authorization (January 31, 2025)

The bank completes its final review and authorizes the payment. XYZ Manufacturing Inc. receives a notification about the upcoming disbursement.

3. Actual disbursement (February 1, 2025)

Main Street Bank transfers $500,000 to XYZ Manufacturing’s designated bank account via electronic funds transfer. The bank sends a disbursement notice to XYZ Manufacturing, detailing the loan amount, transfer details, and terms of repayment.

4. Post-disbursement activities (February 2025 onwards)

XYZ Manufacturing Inc. starts using the funds for the expansion project, purchasing new equipment and hiring additional staff as planned. The company maintains records of all expenditures related to the loan for accountability and auditing purposes. Interest on the loan starts accruing from the date of disbursement.

5. Repayment phase (Starting March 2025)

According to the loan agreement, XYZ Manufacturing begins monthly repayments of the principal and interest, as scheduled with Main Street Bank. Regular statements are exchanged between XYZ Manufacturing and the bank, ensuring both parties keep accurate records of the repayments.

Types of disbursement

Disbursement can occur in various forms depending on the context and purpose.

Type #1. Operational disbursements

These are crucial for maintaining the day-to-day functionality of a business. They include routine payments like office supplies, utility bills, and rent. Efficient management of operational disbursements is essential for good cash flow management.

Type #2. Payroll payments

This is a critical function in human resource management. Payroll disbursements not only include salaries and wages but also encompass bonuses, commissions, and other forms of employee compensation. Accuracy and timeliness are vital in payroll payments to maintain employee satisfaction and comply with labor laws.

Type #3. Loan disbursements

When disbursing loans, lenders often follow specific protocols, including credit checks, approval processes, and disbursement schedules. For instance, student loan funds might be disbursed directly to the educational institution, while a mortgage loan would be disbursed to the seller or borrower in a real estate transaction.

Type #4. Dividend disbursements

These are a form of profit sharing and depend on the company’s earnings and dividend policies. Dividend disbursements can be a significant factor for investors when choosing which stocks to invest in.

Type #5. Vendor or supplier payments

These disbursements require careful management, as delayed payments can affect the supply chain and business operations. Businesses often set up accounts payable systems to manage these payments efficiently.

Type #6. Tax disbursements

These are legally mandated and vary based on jurisdiction. For businesses, timely tax disbursements are essential to avoid penalties expense and legal complications.

Type #7. Insurance payments

In the insurance industry, the disbursement process involves assessing claims to ensure they are legitimate and comply with the terms of the insurance policy.

Type #8. Governmental disbursements

These cover a wide range of payments, from social welfare programs to government employee salaries. They are funded by taxpayer money and thus are subject to public scrutiny and regulatory compliance.

Type #9. Reimbursements

This type of disbursement is unique because it involves repaying someone for expenses they’ve already incurred. It’s common in corporate settings where employees travel or incur expenses on behalf of the company.

What is a loan disbursement?

A loan disbursement refers to the process by which the lender releases the borrowed money to the borrower. This is a key phase in the loan process, particularly in contexts such as education, housing, or business loans. Here’s a detailed breakdown of what it entails.

1. Approval and agreement

Initially, the loan must be approved by the lender. Following approval, the borrower and lender enter into an agreement, setting the terms and conditions of the loan, including the interest rate, repayment schedule, and any other relevant details.

2. Release of funds

Once the loan agreement is signed, the lender disburses the funds. The mode of transaction can vary. For instance, in a student loan, the money might be sent directly to the educational institution to cover tuition fees, while in a home loan, the funds might be transferred to the borrower’s account or directly to the seller or contractor.

3. Timing and phases

Some loans are disbursed in a lump sum, while others may be disbursed in phases. For example, construction loans are often disbursed in installments based on the completion of different stages of the construction project.

4. Documentation

The disbursement is typically accompanied by documentation outlining the details of the transaction. This might include payment schedules, loan statements, and other relevant financial information.

5. Interest accrual

Depending on the loan terms, interest may start accruing on the principal amount from the date of payment. This is particularly significant in the case of student loans, where interest might accrue while the student is still in school.

6. Use of funds

Generally, the use of the disbursed funds is intended for a specific purpose, such as paying tuition fees, purchasing property, or financing a business venture. Misuse of these funds can lead to penalties or legal consequences.

7. Repayment

Following disbursement, the borrower is typically required to start repaying the loan after a certain period, as per the terms agreed upon. This includes both the principal amount and the accrued interest.

Learn more about backorder.

Conclusion

As we conclude our journey through the intricate world of disbursement, it becomes evident that this process is not just a mere financial transaction but an important element in the efficient functioning of businesses, governments, and financial institutions. The way funds are disbursed can significantly impact financial health, compliance with regulations, and the overall success of financial plans and projects.

.png)