Form 1042 is an important document when it comes to reporting income paid to nonresidents or entities that are subject to United States income taxes. This is a crucial tool for ensuring that businesses and organizations accurately report payments made to foreign recipients in accordance with tax laws.

Contents:

2. Understanding U.S. sourced income

3. Key components of form 1042

- Section 1: Record of federal tax liability

- Section 2: Reconciliation of payments of U.S. source FDAP income

- Section 3: Potential section 871(m) transactions

- Section 4: Dividend equivalent payments by a qualified derivatives dealer (QDD)

5. The role of withholding agents

7. FAQs

What is a 1042 form?

Form 1042 is a tax form used by businesses and institutions in the United States to report the taxes they withhold on payments made to foreign individuals or entities. Essentially, it tells the government how much money it’s withheld to pay taxes on payments to foreigners.

This form helps ensure that all participants comply with tax rules on income earned in the United States and paid to people or entities outside the country. Understanding the key details of form 1042 is essential for those involved in transactions with foreign parties and will help prepare for tax season.

Along with form 1042, there is usually another form called form 1042-S. It provides more detailed information about payments made to foreigners and helps confirm the information reported on form 1042. Together, these forms ensure that the correct amount of tax is withheld and reported correctly on income earned in the United States by foreign individuals.

Who needs to file form 1042?

Form 1042 is used to report any income earned in the U.S. by:

- non-U.S. citizens;

- foreign partnerships, corporations, estates, or trusts.

This form helps ensure that they pay the correct amount of tax on that income, following U.S. tax rules. Even if there’s a tax treaty or some other exception to paying taxes, the IRS still needs form 1042 to be filled out. It’s basically a way for the IRS to keep track of income earned in the U.S. by foreign entities and ensure they’re following the tax laws properly.

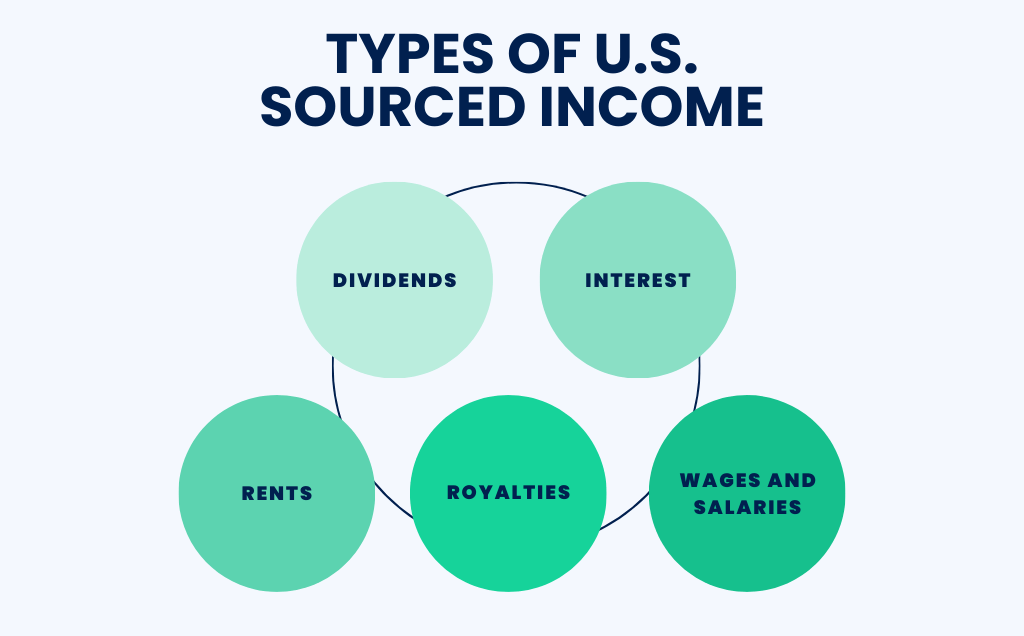

Understanding U.S. sourced income

As mentioned above, form 1042 is based on the concept of income earned in the United States. This income may encompass dividends, interest, rents, royalties, and other types of income generated within the boundaries of the United States. Identifying and classifying this income correctly is fundamental to fulfilling form 1042’s reporting requirements.

Types of U.S. sourced income

1. Dividends

Dividends are similar to rewards that companies pay to people who own their shares. When a company makes a profit, it may share some of that profit with its shareholders in the form of dividends. These payments are usually made regularly, such as every few months or once a year.

For people who invest in the stock market, dividends can be important because they provide a stable income beyond the money received from selling shares. Plus, you can use the dividends you receive to buy more shares, which could mean even more money in the future. Overall, dividends are an important part of how people make money investing in U.S. companies.

2. Interest

Interest is like a bonus you get when you let someone borrow your money, usually by putting it in savings accounts or buying bonds in the U.S. Banks or government entities pay you interest for using your money. This extra money, called interest income, is pretty important, especially if you’re focused on saving or investing.

For instance, if you have money saved in a bank account, the interest you earn adds to your savings over time, helping them grow. Similarly, when you invest in bonds, the interest payments you receive provide a steady income stream.

Interest income is particularly significant for people with savings or investment portfolios because it’s a reliable way to earn extra money. Unlike other investments like stocks, interest income is usually more stable and predictable, which makes it essential for building wealth and planning finances effectively.

3. Rents

Rent is the money you make when you let someone use your property and they pay you for it. In the U.S., this usually means leasing or renting out different kinds of real estate, like homes, shops, offices, or even land.

If you own property and rent it out to someone, you get rental income. This could be from people living in apartments or houses, or from businesses using office spaces or shops. Sometimes, landowners rent out land for farming, recreation, or other purposes.

Rent is a big deal for property owners because it’s a regular source of income that helps them make money from their investments. It’s an important part of how people manage their real estate and make financial plans.

4. Royalties

Royalties are payments people or businesses get when others use their ideas or natural resources in the U.S. This could be for things like patents, copyrights, trademarks, or letting companies extract minerals, oil, or gas from their land.

For example, if you invent something and a company wants to use it, they pay you royalties. Or if you own land with oil or gas reserves, companies might pay you royalties to drill there.

Royalties are a way for creators, inventors, and landowners to make money from their creations or resources without selling them outright. It’s like getting paid for letting someone else use what you own.

5. Wages and salaries

Wages and salaries are the money you earn from your job or the services you provide in the U.S. Whether you work in an office, offer services like consulting or gardening, or have a job in a store, the money you get paid for your work is your wages or salary. And your employer also pays taxes on your salary, called payroll taxes.

It’s basically the main way people make money, and it’s what helps them pay for things like rent, groceries, and other expenses. Plus, when people have money to spend, it keeps the economy going strong.

Key components of form 1042

Filling out this form isn’t difficult, especially if you follow the instructions. Let’s take a look at this process.

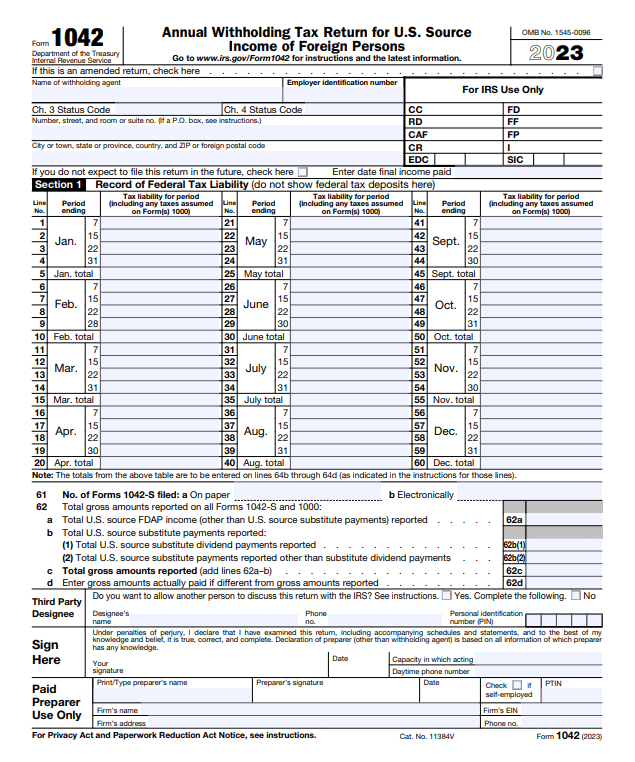

Section 1: Record of federal tax liability

- Lines 1 through 60: Display the withholding agent’s federal tax liability record for each quarter‐monthly period, totaling liabilities for specific periods on lines 64b through 64d.

- Line 61: Input the number of forms 1042-S filed, whether on paper or electronically.

- Lines 62a through 62c: Enter amounts reported on all forms 1042-S and forms 1000 for the calendar year, ensuring reconciliation to avoid IRS correspondence.

- Lines 63a through 63e: Input amounts reported on all forms 1042-S and forms 1000, regardless of filing method.

- Line 64: Include adjustments to total tax liability (64a), sums of liabilities under chapters 3 and 4 (64b and 64c), liabilities for specified federal procurement payments (64d), and the total sum (64e).

- Line 65: Report total tax deposits for the year, including extensions, separating those made in the same year as withheld tax (65a) and those made in the following year (65b).

- Line 66: Enter any overpayment from the 2022 form 1042 applied as a credit on the 2023 form 1042.

- Line 67: Deduct taxes withheld by other agents from total tax liability on lines 64b and 64c, such as taxes withheld by a U.S. agent under chapter 3.

- Lines 70a and 70b: Record excess payments related to withheld taxes (70a) and the excise tax on specific federal procurement payments (70b), excluding overpayments from amounts withheld directly from the beneficial owner.

- Line 71: Choose between requesting a refund or credit for any extra amount (70a and 70b), with a credit potentially reducing tax deposits for 2024. If you reimbursed overwithheld amounts after 2023, mark for a credit for 2024 on line 71.

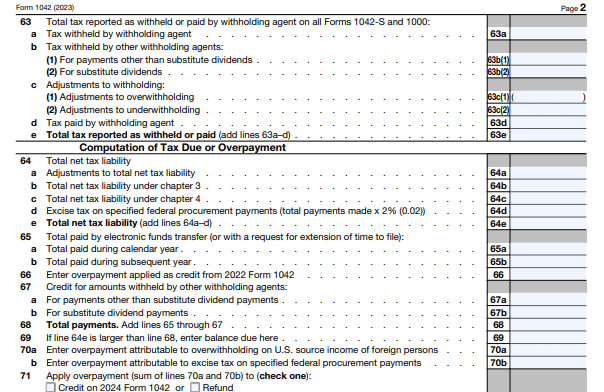

Section 2: Reconciliation of payments of U.S. source FDAP income

- Line 1: Enter the amount of U.S. source FDAP income that needs to be withheld under chapter 4, including any withheld amounts pending deposit under an escrow process.

- Line 2: Input U.S. source FDAP income not subject to withholding under chapter 4, categorized by specific exceptions for each payment reported on form 1042-S. Line 2e should be the total of lines 2a through 2d.

- Line 3: Enter total amount of U.S. source FDAP income mentioned in lines 1 and 2e.

- Line 4: Record the total U.S. source FDAP income payments listed in box 2 of form 1042-S, covering both chapter 3 and chapter 4 amounts, matching the sum of gross amounts reported on line 62c.

- Line 5: Calculate the difference between the total reported on line 4 and the total on line 3, representing U.S. source FDAP income subject to reporting under chapter 4.

- Line 6: If there’s a variance on line 5, explain it here. Attach additional sheets to form 1042 if more space is needed to detail the difference.

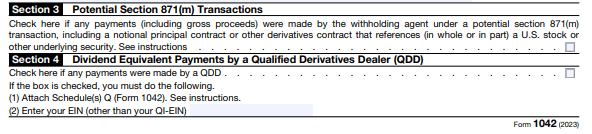

Section 3: Potential section 871(m) transactions

Check the box if you’re a withholding agent who makes payments linked to possible 871(m) transactions during the year. These transactions may involve contracts like notional principal or derivative contracts that relate to a U.S. stock or underlying security. For more details on what qualifies as a potential 871(m) transaction, see Regulations section 1.871-15(a)(12). If you need specifics on payments associated with these transactions, refer to Regulations section 1.871-15(i).

Section 4: Dividend equivalent payments by a qualified derivatives dealer (QDD)

If any qualified iIntermediary (QI), including its main office or any branch, acted as a qualified derivatives dealer (QDD) during the tax year, check the box. Enter the regular Employer Identification Number (EIN) of the QI (not the QI-EIN) and attach a Schedule(s) Q (form 1042) for each QDD. Even if a QDD doesn’t owe taxes, you still need to fill out and attach Schedule(s) Q (form 1042).

Reporting requirements

Starting from the tax year 2023, there are some new requirements for form 1042, which is filed in 2024. If you’re a partnership with more than 100 partners, you’ll have to file form 1042 electronically.

Another change is that starting in tax year 2023, withholding agents who act as brokers for the transfer of publicly traded partnership interests must withhold tax as per Internal Revenue Code Section 1446(f) and report it on form 1042.

Additionally, there’s a new Qualified Intermediary (QI) agreement, outlined in Revenue Procedure 2022-43, which comes into effect from January 1, 2023. This replaces the previous QI agreement from Revenue Procedure 2017-15. Under this new agreement, any qualified intermediary considered a “qualified derivatives dealer” (QDD) or having a QDD branch during the tax year must complete Schedule Q (form 1042).

Even with these changes, the 2023 form 1042 itself remains largely similar to the previous year’s version.

Deadlines for form 1042

You have to submit forms 1042, 1042-S, and 1042-T by March 15 of the year after you paid the income that needs to be reported. So, for example, if you made payments that need to be reported in 2023, you must file these forms by March 15, 2024. It’s essential to meet this deadline to report income accurately to the IRS and avoid any potential penalties.

Penalties for late submission

If you don’t file form 1042 on time, including related forms, 1042-S and 1042-T, you may face penalties.

The penalty amounts from 5% to 25% of the unpaid tax for each month or partial month that the return is overdue.

This penalty can accumulate over time, but it won’t exceed 25% of the unpaid tax. So, the longer the delay, the more you may owe in penalties, potentially up to a quarter of the unpaid tax amount. It’s crucial to file your form 1042 promptly to avoid these penalties and ensure compliance with tax regulations.

The role of withholding agents

Who is a withholding agent?

A withholding agent is essentially any person or organization responsible for deducting and holding back a portion of tax from payments made to foreign individuals or entities. This role ensures that the correct amount of tax is paid to the government by non-residents earning income from U.S. sources.

Withholding agents can include individuals, businesses, financial institutions, or any other entity involved in financial transactions with non-residents. Their duty is to follow U.S. tax laws regarding tax deduction and reporting accurately.

Responsibilities of a withholding agent

1. Identifying withholdable payments

Withholding agents have to recognize which payments require tax withholding under U.S. tax laws. These could include payments of incomes from U.S. sources going to foreign individuals or entities.

2. Withholding tax

Deduct the right amount of tax from these payments to foreign recipients. The withholding rate depends on factors like the type of income and the recipient’s tax status.

3. Reporting

Report the withheld tax to the IRS using specific forms like form 1042 and form 1042-S.

4. Compliance

It’s important to follow all relevant tax laws and regulations. This means ensuring accurate withholding, reporting, and sending the withheld taxes to the IRS on time, and keeping proper records.

5. Documentation and record-keeping

Keep thorough records of payments to foreign individuals or entities, the amounts withheld, and all related paperwork.

Common mistakes

Inaccurate information

Providing incorrect information is a common mistake to avoid. This includes errors in details such as the payer’s or recipient’s information, as well as inaccuracies in payment amounts or types. These mistakes can lead to problems with tax reporting, potential audits, and delays in processing.

For instance, if you enter the wrong taxpayer identification number (TIN) for a recipient, the IRS may not match the income reported with their tax return. Similarly, mistakes in payment amounts or types can cause income to be misreported or classified incorrectly.

To prevent these errors, it’s important to verify all information thoroughly before submission. This involves double-checking details like names, addresses, TINs, and payment amounts to ensure accuracy. By doing so, you can avoid unnecessary complications and maintain compliance with tax regulations.

Failure to report all income

Another crucial error to avoid is failing to report all income that is subject to tax withholding. This means not properly documenting certain types of income or neglecting to report payments made to foreign individuals or entities. Such oversights can result in inaccurate tax filings, leading to potential penalties or legal consequences.

For example, if a business forgets to report payments made to foreign contractors for their services, it could mean that income isn’t accurately reported, resulting in non-compliance with tax laws. Similarly, overlooking specific types of income, like dividends or royalties, in tax filings can lead to inaccuracies and possible audit complications.

It’s essential to keep thorough records of all income transactions and ensure that every relevant income source is correctly reported to the appropriate tax authorities. By accurately reporting all income subject to tax withholding, individuals and businesses can steer clear of penalties and stay compliant with tax regulations.

How to avoid these mistakes?

Of course, when you run a business, it’s crucial to keep accurate and compliant records of your online sales. However, manually managing these records can be a time-consuming task.

But, this problem can be easily resolved if you use Synder Sync for your business accounting. Synder helps businesses carefully organize their transactions, covering various aspects such as sales, fees, taxes and more, all customized to their unique preferences.

Thanks to this, you can ensure your business’s reporting is correct and tax-season ready

Simplify your bookkeeping with automation. Attend Synder’s Weekly Public Demo to learn more, or sign up for a free account to try it by yourself.

Conclusion

Knowledge of form 1042 and its requirements is critical for businesses with international operations. From determining taxable payments to accurately reporting income and staying compliant with tax rules, understanding form 1042 ensures compliance and helps avoid penalties. To effectively meet your obligations, you must stay up to date with new filing requirements and reporting changes. By understanding the key aspects of form 1042 and meeting filing deadlines, businesses can manage their taxes well in a global economy.

Disclaimer: This article serves as a general overview and doesn’t provide personalized tax advice. Tax laws are intricate and can differ based on individual situations. If you or your business need help with filing form 1042 or have specific tax questions, it’s advisable to seek guidance from a qualified tax professional. Depending solely on the information presented here for tax preparation or decision-making isn’t advisable.

FAQs

Is form 1042 required to be filed electronically?

For the tax year 2023, any withholding agent classified as a financial institution is mandated to electronically submit form 1042.

Who is the withholding agent on form 1042?

A withholding agent can be any entity, such as an individual, corporation, partnership, trust, or association. This includes foreign intermediaries, foreign partnerships, or U.S. branches of specific foreign banks and insurance firms.

How do I pay 1042 withholding tax?

The tax payment needs to be made electronically using the Electronic Federal Tax Payment System (EFTPS) from a U.S. bank. The EFTPS system is user-friendly and easy to navigate.

Can form 1042 be extended?

A qualified intermediary (QI) has the option to ask for extra time to submit form 1042, 1042-S, 1099, and, if necessary, 8966. This request for an extension must be submitted before the original due date of the return.

Share your thoughts

Have you encountered any obstacles or triumphs while dealing with form 1042? Perhaps you have helpful tips or stories that you can share with others facing similar challenges. Feel free to leave your experiences, questions or tips in the comments below.

%20(1).png)