In today’s business environment, the flow of goods and services often involves a series of transactions that require documentation. One such critical document is an invoice. Understanding invoice payment is crucial for both businesses and individuals to ensure smooth financial operations. In this comprehensive guide, we’ll delve into the ins and outs of invoice payments.

What is an invoice payment?

Invoice payment refers to the monetary transactions made in response to an invoice issued by a seller or service provider to a buyer. The invoice, which acts as a formal request for payment, details the goods or services provided, their cost, payment terms, and other relevant information. Once the buyer agrees upon the invoice, they proceed with the payment as stipulated.

The process of invoice payment ensures a systematic and transparent method of documenting and settling financial transactions between businesses and their clients or between businesses themselves. It not only provides a record of sales and services rendered but also establishes the expectations for payment, ensuring both parties have clarity on the financial aspects of their relationship.

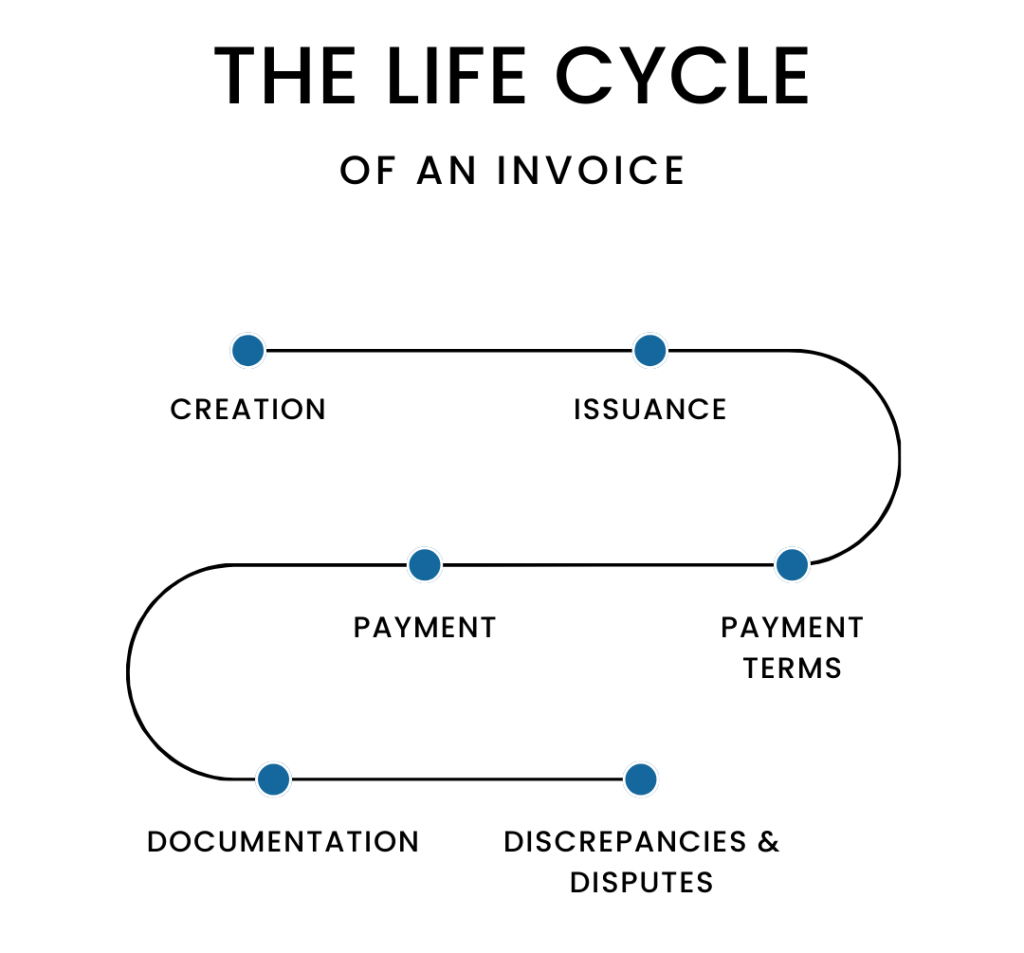

The life cycle of an invoice

- Creation. When a product is sold, or a service is rendered, the seller or service provider creates an invoice. This document will detail the items or services, their prices, quantities, taxes, discounts, total amount due, and payment terms.

- Issuance. Once created, the invoice is sent to the buyer. This can be done in various ways, such as by email, postal mail, or through an electronic billing system.

- Payment terms. Invoices typically come with payment terms. These are guidelines indicating when the payment should be made. Common terms include:

- Due on receipt: Payment is due as soon as the invoice is received.

- Net 30: Payment is due within 30 days of the invoice date.

- Net 60: Payment is due within 60 days of the invoice date.

Other terms might include early payment discounts or late payment penalties.

- Payment. The buyer reviews the invoice and, if everything is in order, makes the payment using one of the methods specified on the invoice.

- Documentation. Once the payment is received, the seller should document the transaction, marking the invoice as “paid” and updating their accounting records. This helps in keeping track of revenue and is essential for tax and audit purposes.

- Discrepancies & disputes. If there are issues with the invoice (e.g., wrong amounts, incorrect items), the buyer can raise disputes. The seller and buyer will then need to resolve these discrepancies before payment is made.

Types of invoices

Invoices come in various types, each tailored to specific business situations and transaction requirements. The primary types of invoices are:

- Standard invoices: The most common type, detailing what the buyer owes the seller.

Recurring invoices: Used for ongoing services, billed at regular intervals (e.g., monthly). - Proforma invoices: Preliminary bills of sale, often sent before the final product is delivered or the service is completed.

- Credit invoices: Indicate a refund or rebate due to the buyer, perhaps because of returns or overpayment.

- Debit invoices: Indicate an additional amount owed by the buyer, usually because of changes in the order or miscalculations in the original invoice.

- Commercial invoices: Used in international trade, detailing products being shipped and their value, serving as a customs declaration.

Transform your accounting experience with Synder! Track and record your invoices seamlessly directly to your accounting system (QuickBooks Online/ Desktop or Xero). Moreover, you can create and schedule a recurring invoice in Synder! No more human errors in bookkeeping and accounting, no more wasted hours. Synder software ensures that every financial detail is accurately captured, letting you focus on what you do best—running your business. Embrace automation, reduce errors, and focus on what truly matters for your business.

Book a seat on a Weekly Product Demo to learn more about recording the invoices with Synder and ask your questions—our software experts will share all the features and capabilities of the software.

Components of an invoice payment process

An invoice is a critical document in the business world, serving as both a record of a transaction and a formal payment request. While the specific details included can vary based on the nature of the transaction and local regulations, there are common components that are generally found in most invoices.

Invoice header

The header usually contains the word “Invoice” in a prominent font to clearly identify the nature of the document. It distinguishes the document from other transactional documents like receipts, quotations, or purchase orders.

Sender’s details

This section provides information about the seller or service provider. It typically includes:

- Business name;

- Address;

- Contact number;

- Email address;

- Business logo (optional, but adds a professional touch).

Recipient’s details

This section provides information about the buyer or client and can include:

- Client’s or customer’s name;

- Address;

- Contact number;

- Email address.

Invoice number

A unique identification number for the invoice. It’s crucial for tracking, record-keeping, and referencing in future communications. This number should be unique to avoid any confusion or overlap with other transactions.

Date information

| Invoice issue date | The date when the invoice is generated and sent. |

| Invoice due date | The date by which the payment should be made. It helps the recipient know the deadline for the payment. |

Description of goods/services

A detailed breakdown of the products or services provided. This section may include:

- Item name or service description;

- Quantity;

- Unit price;

- Total price for the number of units.

Amount due

This section specifies the total amount the recipient owes. It often includes:

- Subtotal (before any tax or discounts);

- Discounts (if applicable);

- Taxes (e.g., VAT, sales tax, GST, depending on the region);

- Shipping or delivery charges (if applicable);

- Grand total (the final amount due).

Payment terms

This section outlines the conditions and preferred methods for payment. For example:

- Upfront payment requirements;

- Interest charges for late payments;

- Preferred payment method (bank transfer, cheque, credit card, etc.).

Bank or payment details

Information necessary for the client to make the payment:

- Bank account number;

- Bank name and address;

- SWIFT code or IBAN number (for international transactions);

- Payment portal details (for online payments).

Notes or comments

This optional section can provide additional information or clarifications related to the transaction. For instance:

- Shipping details;

- Warranty information;

- A thank-you note or a reminder for prompt payment.

Terms and conditions

Outlines any legal considerations, return policies, warranty details, or other essential terms associated with the transaction.

Invoice footer

This section might include confidentiality notes, disclaimers, or any other relevant footnotes. Some businesses also put their tax identification number or business registration details here.

Methods of invoice payments

The methods available for making invoice payment have evolved dramatically over the past few decades. Both businesses and consumers now have a variety of options when it comes to settling an invoice. Below is an exploration of popular methods for such payments:

1. Bank transfers

Funds are electronically transferred from one bank account to another.

Pros: Secure, directly deposited, quick once set up, suitable for both domestic and international transactions.

Cons: Might involve fees, especially for international transfers; requires sharing bank details.

Learn what you need to open your business bank account.

2. Credit/debit card payments

Payment made using a credit or debit card, often facilitated online or via phone.

Pros: Convenient, instant, widely accepted, offers possible rewards or cashbacks on cards.

Cons: Transaction fees may apply; risk of card data theft.

3. Cheques (or checks)

A written document instructing a bank to pay a specified amount from the drawer’s account.

Pros: Can be post-dated, provides a paper trail, can be stopped if necessary.

Cons: Takes time to clear, the possibility of bouncing if insufficient funds, becoming less common in many regions.

4. Cryptocurrencies

Digital or virtual currencies (e.g., Bitcoin, Ethereum) used as a medium of exchange.

Pros: Decentralized, can be used for international transactions without traditional banking fees or exchange rates, potential for anonymity.

Cons: Volatile value, not universally accepted, regulatory concerns in some regions.

5. Direct debit (or automatic debit)

An arrangement where a business is authorized to automatically withdraw funds from a customer’s bank account on agreed-upon dates.

Pros: Streamlines recurring payments (e.g., monthly subscriptions), ensures timely payments.

Cons: Requires trust and authorization; issues can arise if the account has insufficient funds.

6. Online payment gateways

Web-based systems (e.g., Stripe, Square, Braintree) that process payments for online merchants.

Pros: Secure, supports a variety of payment methods (cards, wallets), integrates with many e-commerce platforms.

Cons: Transaction fees apply; may require technical setup.

7. Point of Sale (POS) systems

Physical systems located at retail locations, which can process card, mobile, and sometimes even check payments.

Pros: Suitable for brick-and-mortar stores, integrates with inventory systems, provides sales analytics.

Cons: Hardware costs, transaction fees.

8. Installment payments (or “Buy Now, Pay Later”)

Allows customers to purchase goods or services and pay in installments over time.

Pros: Increases purchasing power, often comes with low or no interest for a promotional period.

Cons: Can lead to overspending; missed payments can incur fees or interest.

Importance of invoices

Invoices play a pivotal role in the business and financial world. Their importance spans across several domains, including legal, financial, operational, and relational aspects of a business. Here are some of the primary reasons why invoices are essential:

Legal evidence of a transaction

An invoice acts as a legal record of the sale of goods or provision of services. It is proof that a transaction occurred between two parties. In the case of disputes or misunderstandings, an invoice can be used as evidence in legal proceedings.

Financial record keeping

Invoices help businesses track their revenue and identify outstanding debts. They provide a basis for financial reporting, helping businesses understand their profitability, manage their cash flow, and make informed financial decisions.

Tax documentation

Invoices are crucial for tax reporting and compliance. They detail the taxable amounts for goods and services sold. They help businesses claim input tax credits (in regions with Value Added Tax or Goods and Services Tax) and are often required during tax audits.

Professionalism and credibility

Issuing detailed and clear invoices reflects a company’s professionalism. It assures clients and customers that they’re dealing with a legitimate and organized business entity. A well-structured invoice can improve a company’s brand image and reputation.

Clear communication and transparency

Invoices clearly outline the terms of a transaction, ensuring both parties understand what has been agreed upon, from product details to payment terms. They prevent ambiguities and misunderstandings, as everything is documented.

Cash flow management

Regular and timely invoicing ensures a consistent inflow of cash, which is vital for the operational and financial health of a business. Invoices with clear due dates and payment terms can reduce delays and encourage prompt payments from customers.

Enforcing payment obligations

Invoices formally request payment from clients, setting the expectation for remuneration. They often include payment terms, penalties for late payment, and interest charges, giving businesses a tool to enforce timely payments.

Streamlining operations

Invoicing systems, especially digital ones, help automate and streamline business operations, saving time and reducing manual errors. They can integrate with other business systems like inventory management, CRM, and accounting software for efficient operations.

Conclusion

Invoice payment process is the lifeblood of many business transactions. Understanding the intricacies of invoice payments can help streamline financial operations, build trust, and foster long-lasting business relationships. As technological advancements continue, it’s also crucial to stay updated on the latest payment methods and security practices to ensure seamless and safe transactions.